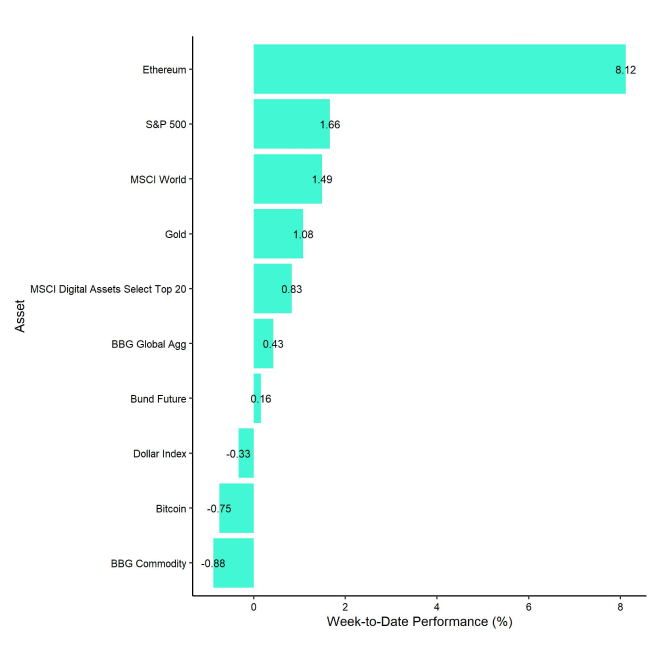

- Last week, cryptoassets slightly underperformed traditional assets like equities although performance dispersion was very wide among individual cryptoassets

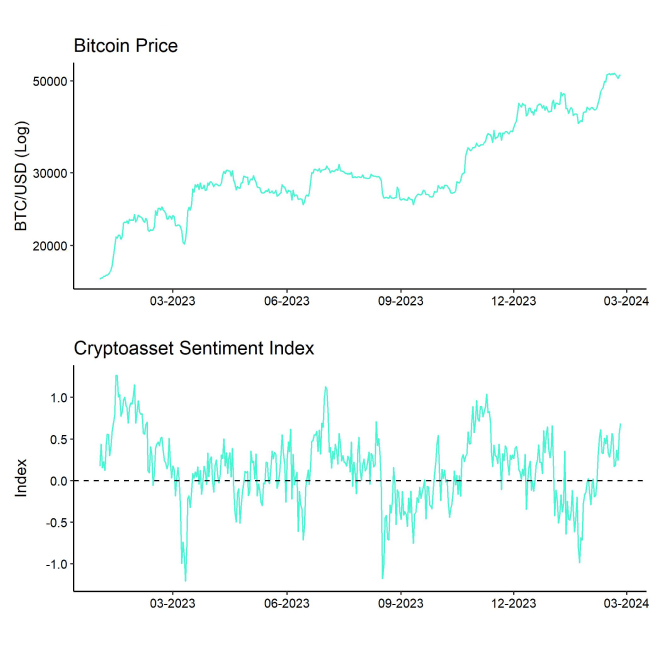

- Our in-house “Cryptoasset Sentiment Index” has continued to increase and still signals bullish sentiment - highest level since mid-December 2023

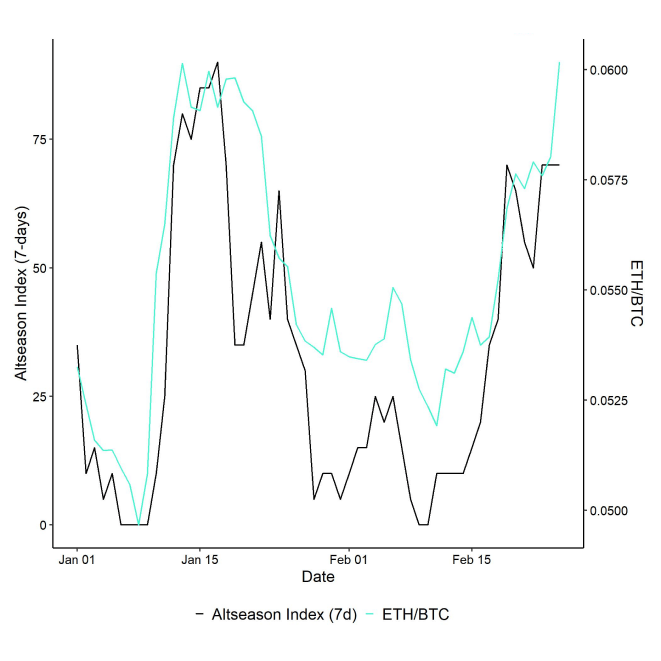

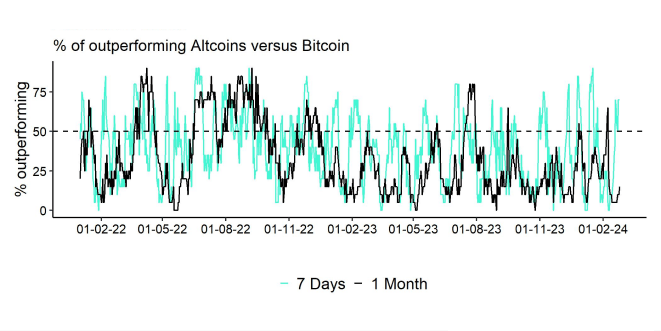

- Rising risk appetite in crypto markets is also visible in our “altseason index” which has increased in line with Ethereum’s outperformance against Bitcoin

Chart of the Week

Performance

Last week, cryptoassets slightly underperformed traditional assets like equities although performance dispersion was very wide among individual cryptoassets.

While Bitcoin's performance was rather flat last week, Ethereum managed to outperform Bitcoin by around 9%. Ethereum's outperformance was generally a signal for a broader outperformance of so-called “altcoins” which represent all other cryptoassets apart from Bitcoin.

This is also visible in our “altseason index” which has increased in line with Ethereum's outperformance against Bitcoin (Chart-of-the-Week ). More specifically, 70% of cryptoassets within our basket of tracked altcoins managed to outperform Bitcoin over the past 7 days – the highest outperformance since early January.

Ethereum's outperformance was also supported by improving network fundamentals relative Bitcoin and even relative to major ETH Layer 2s such as Polygon.

More specifically, While Ethereum's network activity based on active addresses and transfer count managed to increase by around +1% year-to-date, Bitcoin's network activity actually decreased by almost -20% this year, albeit from high levels.

In addition, there is increasing positive network momentum in ETH Layer 2s. For instance, following the token launch, StarkNet's Total Value Locked (TVL) increased to 1.31 bn USD, making it the fourth Ethereum L2 to exceed 1 bn USD in TVL.

Apart from increasing activity in altcoins, we saw many regulatory news that were net bullish for the development of cryptoassets in the US.

For instance, former US president Donald Trump indicated during a recent TV interview that he is no longer anti-Bitcoin and said that he “can live with it”.

Although he has abstained from giving a clear endorsement for Bitcoin or cryptoassets in general, this statement marks a clear shift in tone by him. The latest nationwide opinion polls for the 2024 United States presidential election indicate that Trump could be the next US president.

Another big news from the European regulatory side was the communiqué by the Luxembourg financial regulator to allow investments by Luxembourg-domiciled funds into virtual assets such as Bitcoin. This implies that another wave of institutional money could soon flow into this asset class.

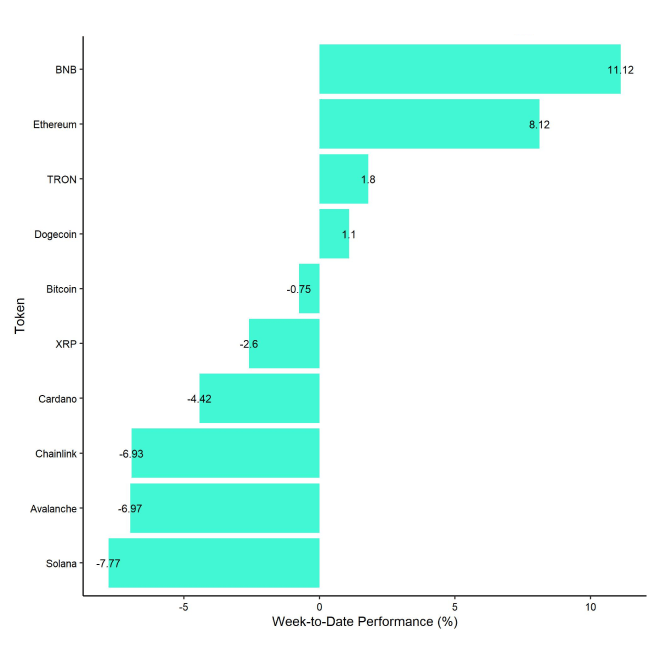

In general, among the top 10 crypto assets, Binance's BNB token, Ethereum, and TRON were the relative outperformers.

As mentioned above, overall altcoin outperformance vis-à-vis Bitcoin also picked up compared to the week prior, with 70% of our tracked altcoins managing to outperform Bitcoin on a weekly basis.

Sentiment

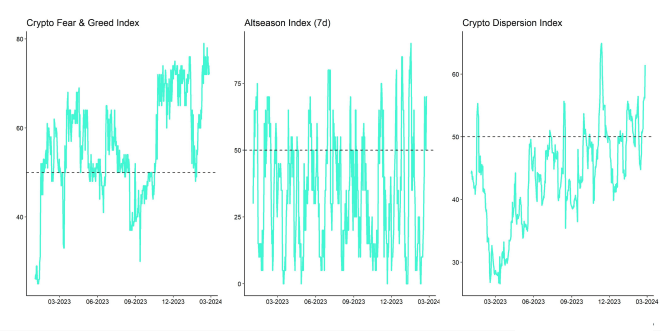

Our in-house “Cryptoasset Sentiment Index” has also continued to increase and still signals bullish sentiment. In fact, the index increased to the highest level since mid-December 2023.

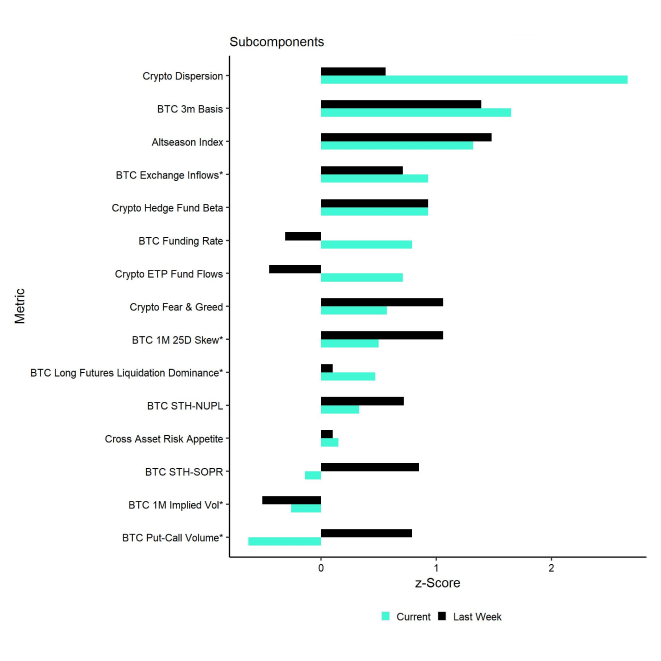

At the moment, 12 out of 15 indicators are above their short-term trend.

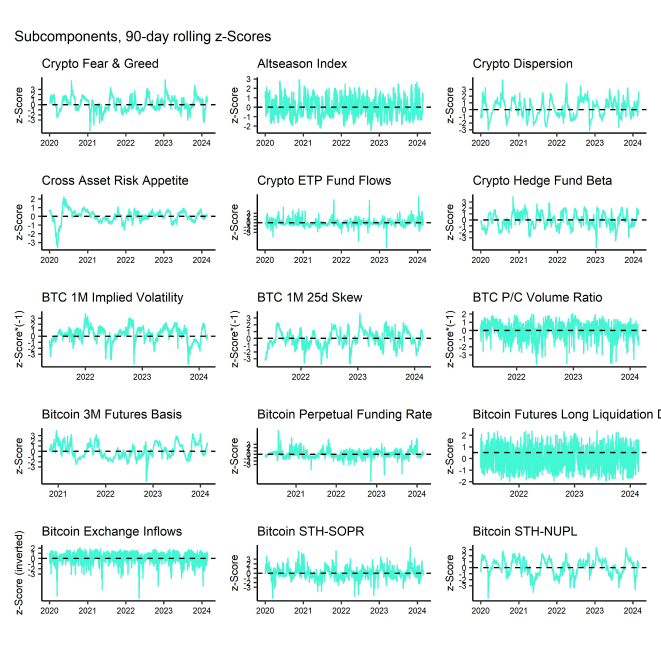

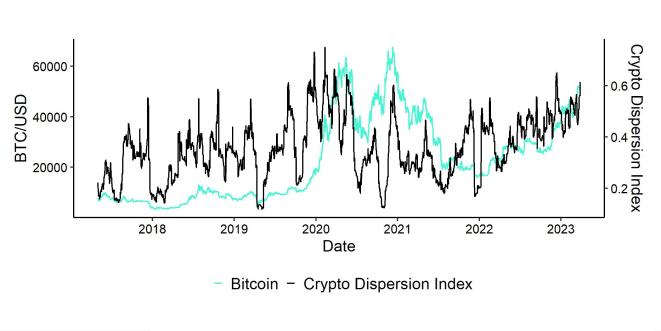

There are clear improvements in crypto dispersion visible which has contributed significantly to the latest upleg in the overall Cryptoasset Sentiment Index.

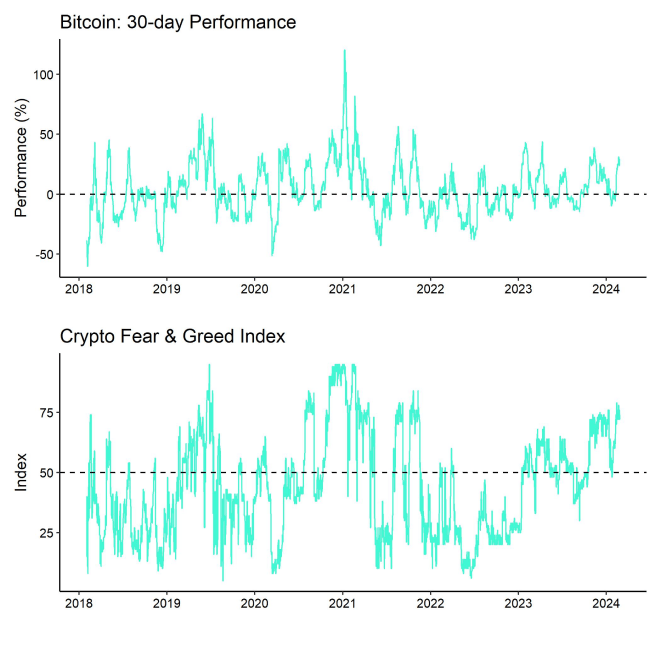

The Crypto Fear & Greed Index still remains in "Greed" territory as of this morning.

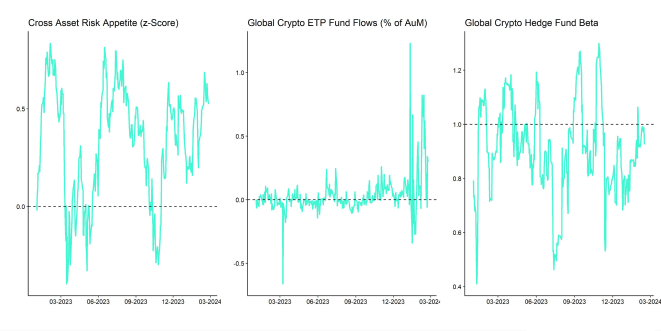

Meanwhile, our own measure of Cross Asset Risk Appetite (CARA) mostly went sideways throughout the week but is still signalling a positive sentiment in traditional financial markets.

As mentioned above, performance dispersion among cryptoassets has increased significantly to the highest reading since November 2023.

In general, high performance dispersion among cryptoassets implies that correlations among cryptoassets are low, which means that cryptoassets are trading more on coin-specific factors and that cryptoassets are increasingly decoupling from the performance of Bitcoin.

At the same time, altcoin outperformance vis-à-vis Bitcoin has also increased, with a clear outperformance of Ethereum vis-à-vis Bitcoin last week. Viewed more broadly, around 70% of our tracked altcoins have outperformed Bitcoin on a weekly basis.

In general, increasing altcoin outperformance tends to be a sign of increasing risk appetite within cryptoasset markets.

Fund Flows

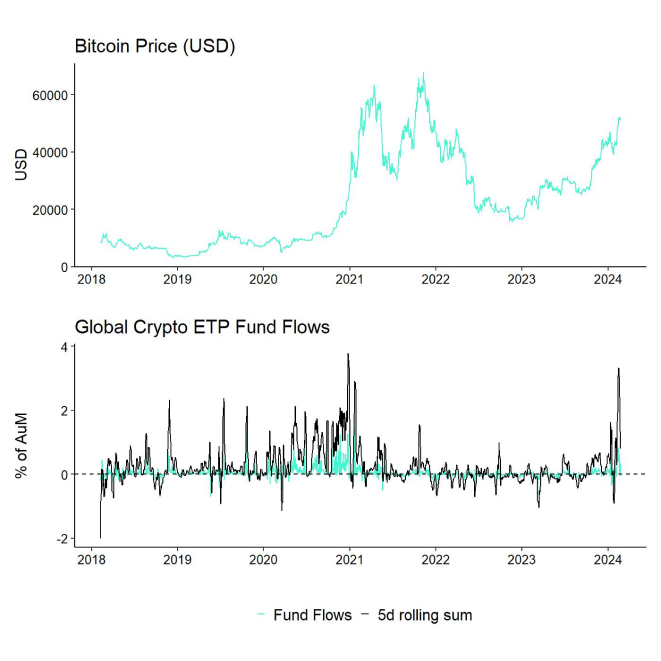

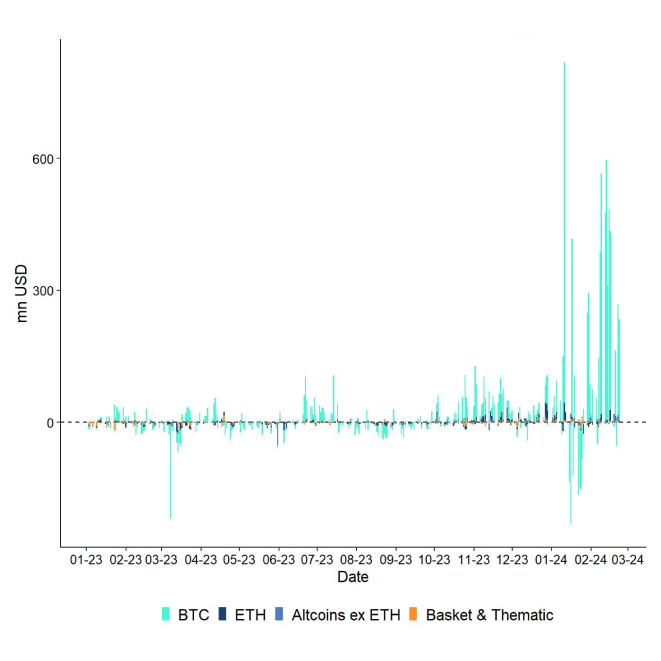

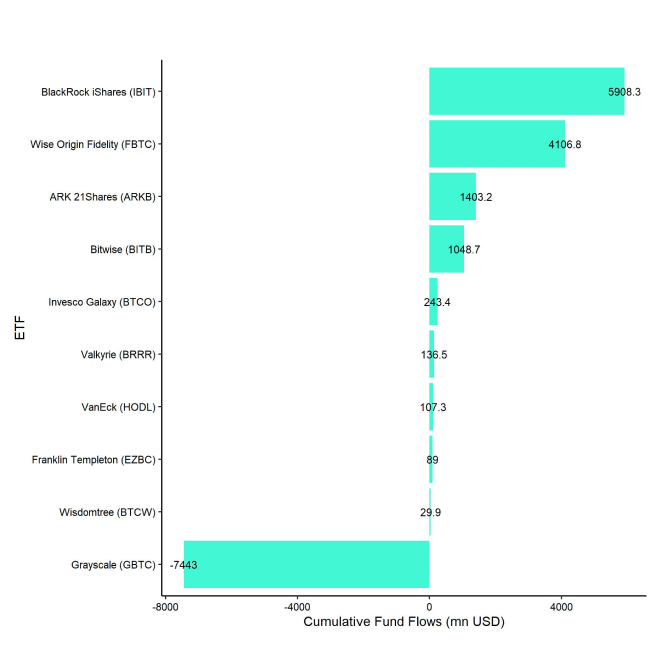

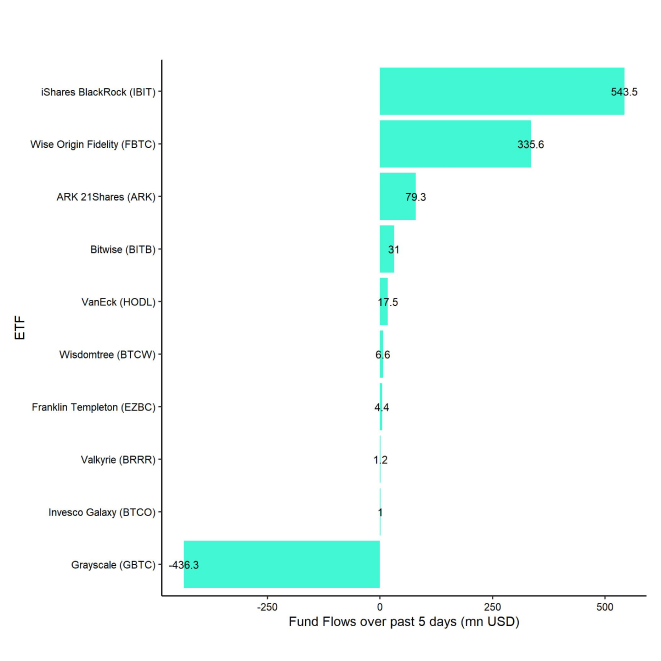

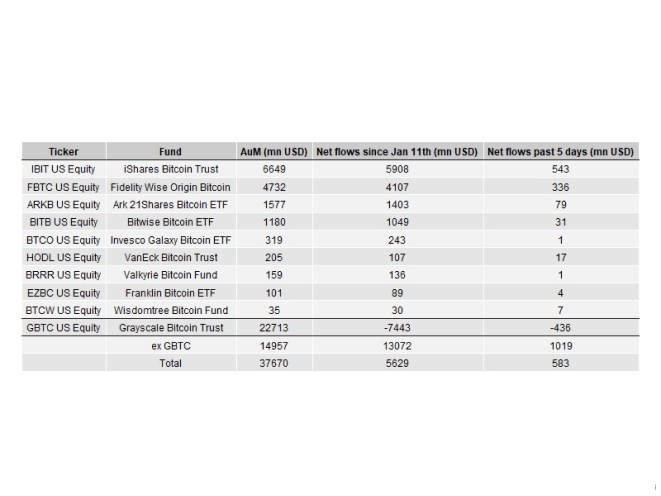

Overall, we saw another week of significant net fund inflows in the amount of +627.8 mn USD (week ending Friday) based on Bloomberg data across all types of cryptoassets.

However, the momentum of global fund flows has clearly decelerated from the very high levels we saw the week prior (above +2 bn USD).

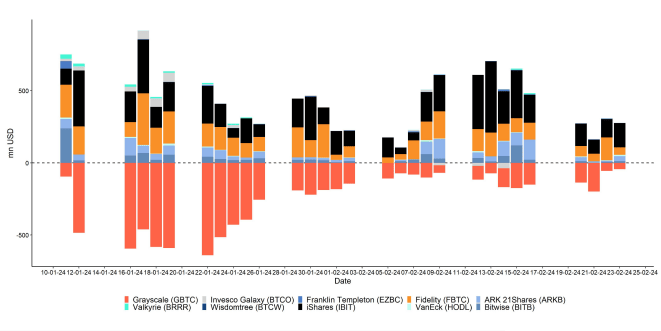

Global Bitcoin ETPs continued to see significant net inflows of +569.8 mn USD of which +543.5 mn (net) were related to US spot Bitcoin ETFs alone. The ETC Group Physical Bitcoin ETP (BTCE) saw net outflows equivalent to -9.4 mn USD last week.

The Grayscale Bitcoin Trust (GBTC) continued to see net outflows of around -436.2 mn USD last week which was again lower as the week prior. This was also more than offset by net inflows into other US spot Bitcoin ETFs which managed to attract +1019 bn USD (ex GBTC).

Note that some fund flows data for US major issuers are still lacking in the abovementioned numbers due to T+2 settlement.

Apart from Bitcoin, we saw comparatively small flows into other cryptoassets last week again.

Inflows into global Ethereum ETPs continued to be relatively high last week with around +19.1 mn USD. The ETC Group Physical Ethereum ETP (ZETH) also attracted +1.3 mn USD in inflows. Besides, Altcoin ETPs ex Ethereum that managed to attract +21.9 mn USD last week which is a clear acceleration compared to prior weeks.

Thematic & basket crypto ETPs also experienced net inflows of +16.9 mn USD, based on our calculations. The ETC Group MSCI Digital Assets Select 20 ETP (DA20) also saw a slight pick-up in inflows last week. (+0.5 mn USD).

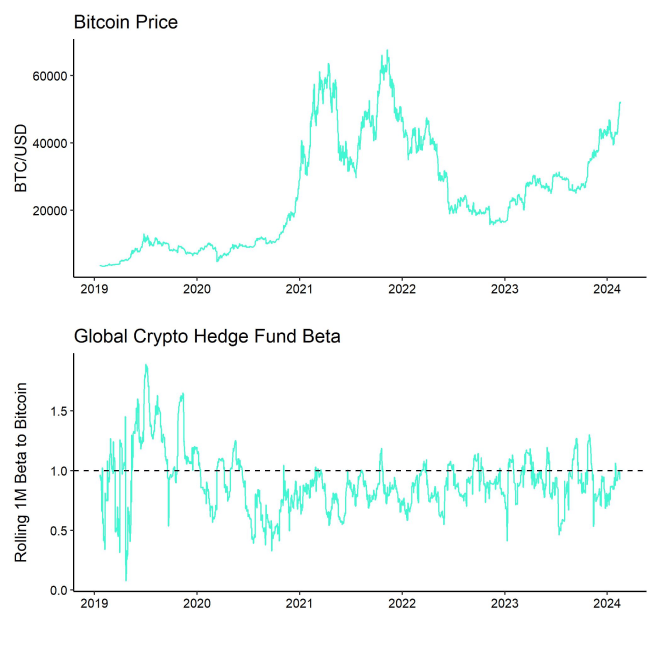

Besides, the beta of global crypto hedge funds to Bitcoin over the last 20 trading remained around 1.0 which implies that global crypto hedge funds are currently positioned neutral to Bitcoin market risks.

On-Chain Data

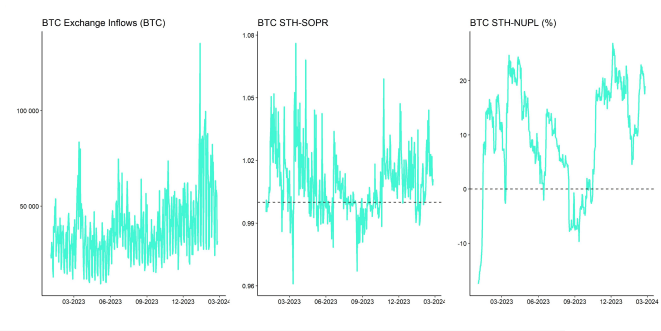

The shift in sentiment towards Ethereum and altcoins is generally also supported by improving network fundamentals relative to Bitcoin. But it is rather a weakness in Bitcoin than a strength in Ethereum's general network activity.

More specifically, While Ethereum's network activity based on active addresses and transfer count managed to increase by around +1% year-to-date, Bitcoin's network activity actually decreased by almost -20% this year, albeit from high levels. This is mostly due to a decline in inscription transaction count more recently which has become a significant driver of Bitcoin's on-chain activity.

Bitcoin's decline in network activity is also visible in the general reduction in transaction fees that have declined to the lowest level since November 2023.

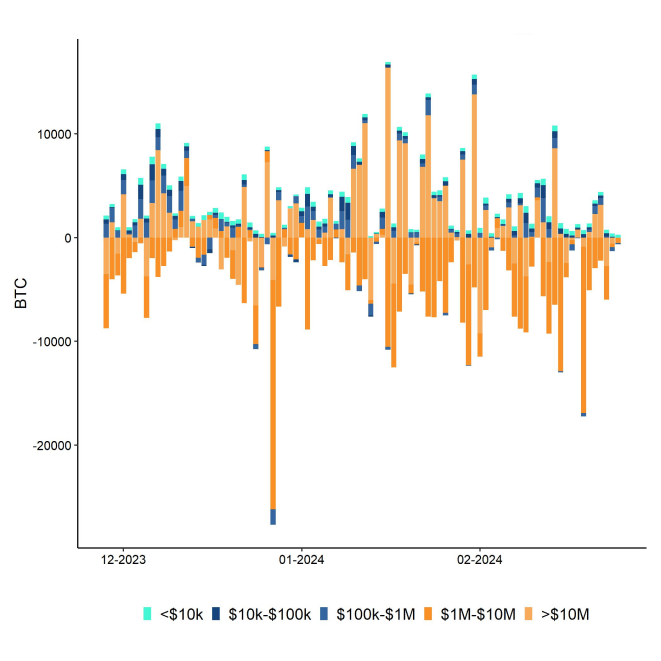

Apart from that, the development of exchange balances continue to be supportive of higher prices. BTC aggregate exchange balances have fallen to the lowest level since March 2018 and ETH exchange balances have fallen to the lowest level since July 2016. Decreasing on-exchange balances tend to be bullish for cryptoasset prices.

That being said, we did saw some increased BTC whale transfers from whales to exchanges but which were absorbed by demand from other entities. There is generally little BTC transfer volume to exchanges happening at the moment as the level of profit within wallets is relatively high. For instance, the Net Unrealized Profit/Loss metric (NUPL) is at 0.55 which implies that more than 50% of the current market cap of coins is in profit.

This means that less traders are willing to part with their bitcoins which implies low selling pressure on prices overall. This is usually also a necessary condition for a sustained bull market.

Another positive on-chain data point was the development of so-called accumulation wallet addresses. Bitcoin inflows into those accumulation addresses have reached an all-time high last week. Accumulation addresses are defined as addresses that have at least 2 incoming transfers and have never spent funds.

Futures, Options & Perpetuals

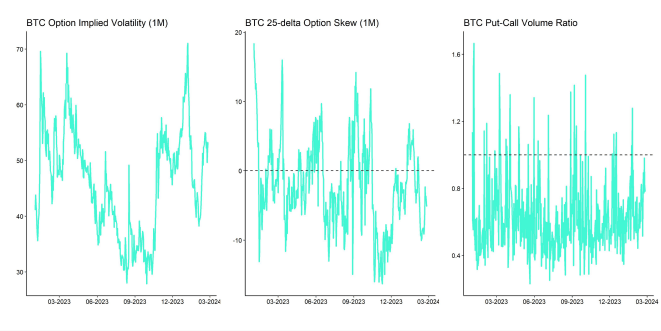

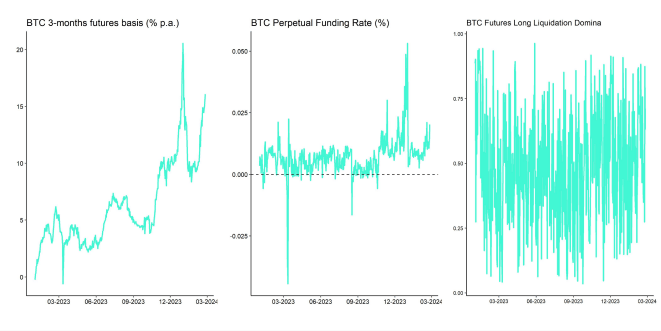

Aggregate BTC futures open interest has continued to move sideways over the past week. CME BTC futures open interest increased only slightly. BTC perpetual futures open interest has also moved sideways over the past week.

Besides, the 3-months annualized BTC futures basis continued to increase to around 16.1% p.a. which is the highest reading since early January.

BTC perpetual funding rate also remained relatively high indicating bullish sentiment on in BTC perpetual futures.

BTC options' open interest also decreased last week by around -68k BTC due to the expiry on Friday. At the same time, the Put-call open increased throughout the week, implying that option traders continued to build up downside protections. Put-call volume ratios were also somewhat elevated.

The 25-delta BTC option skew for 1-month, 3-months, and 6-months expiries also increased last week, following the increase in 1-week skew observed the week prior. This increase in option skew also implies a relatively higher demand for put options.

In contrast, BTC option implied volatilities remained fairly unchanged compared to the week prior while the realized volatility of Bitcoin continued to drift lower on a 1-month rolling basis.

Bottom Line

- Last week, cryptoassets slightly underperformed traditional assets like equities although performance dispersion was very wide among individual cryptoassets

- Our in-house “Cryptoasset Sentiment Index” has continued to increase and still signals bullish sentiment - highest level since mid-December 2023

- Rising risk appetite in crypto markets is also visible in our “altseason index” which has increased in line with Ethereum’s outperformance against Bitcoin

Appendix

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.