- Cryptoassets outperformed last week on account of ongoing optimism surrounding a final spot Bitcoin ETF approval in the US

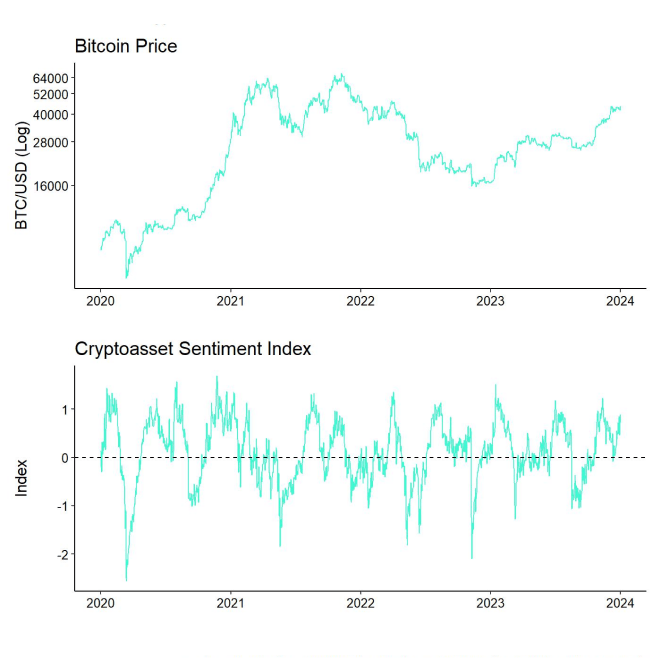

- Our in-house “Cryptoasset Sentiment Index” has increased again and signals positive sentiment

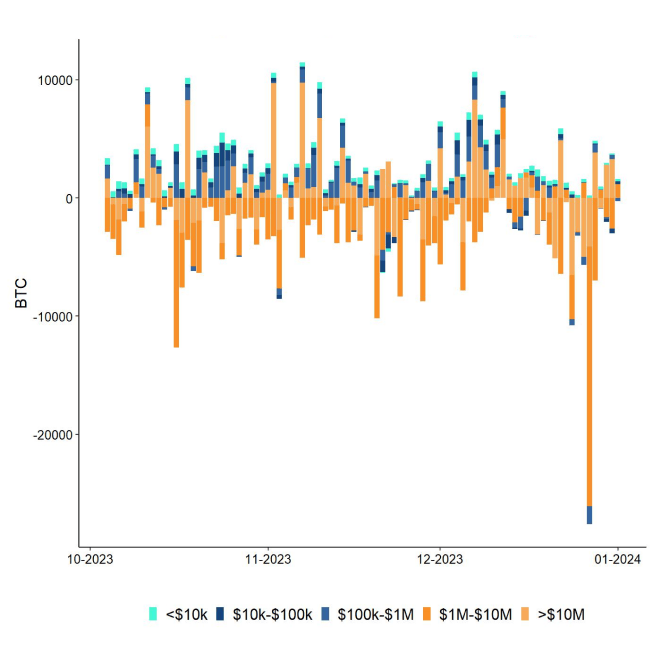

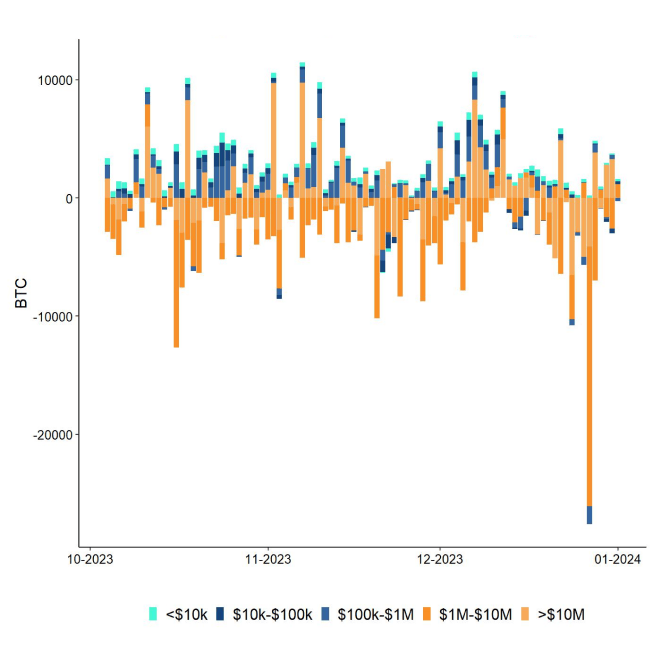

- Significant exchange outflows by large wallet sizes implies outsized institutional buying demand ahead of the likely approvals (Chart-of-the-Week).

Chart of the Week

Performance

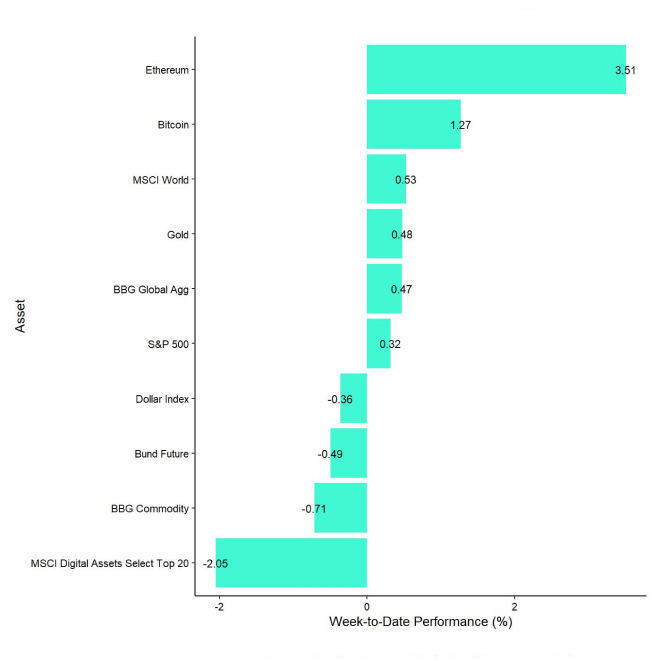

Last week, cryptoassets outperformed traditional assets on account of ongoing optimism surrounding a final spot Bitcoin ETF approval in the US.

Discussions between US ETF issuers and the SEC have recently reached a fever pitch as evidenced by a higher frequency of bilateral meetings between SEC officials and issuers as well as the flurry of last-minute filing amendments towards the end of the year.

By late Friday afternoon last week, a joint venture between Ark Investments and 21Shares, BlackRock Asset Management, VanEck, Valkyrie Investments, Bitwise Investment Advisers, Invesco Ltd., Fidelity, and WisdomTree Investments had all filed updated documents with regulators.

A final approval is generally expected this week as we approach the final deadline on the 10 th of January for the SEC to decide on the first filings. According to a recent article by Reuters, an approval could even happen as early as today or tomorrow.

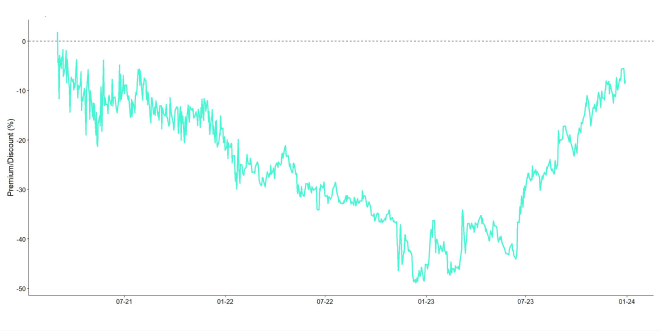

Recent actions by some market participants also implies that an approval is imminent. For instance, ARK Investments has recently offloaded its entire position in the Grayscale Bitcoin Trust (GBTC) before year-end. ARK's portfolio positions are usually published on a daily basis with one day lag. This was generally perceived as a sign that ARK is already preparing itself for the approval of its own product and substitution of the current GBTC position.

Moreover, we have recently seen very significant exchange outflows by large wallet sizes which implies outsized institutional buying activity (Chart-of-the-Week).

Most of these exchange outflows occurred on Coinbase. Coinbase is by far the most widely used custodian among the Bitcoin ETF issuers in the US and exchange outflows generally imply that coins are stored off-exchange in so-called “cold storage” for institutional investors.

It appears that the approval news is largely reflected in the market. Any type of postponement beyond this week would therefore certainly be negative at this point. Nonetheless, it is quite likely that we still see at least a minor positive short-term price reaction on the news judging by Grayscale's ongoing NAV discount that implies that an approval is not yet fully priced in.

At the time of writing, the NAV discount of Grayscale's Bitcoin Trust (GBTC) is still around -7.9% which only implies a probability of around 92% of an ETF approval. Grayscale has filed for a conversion of that trust into an ETF which would eradicate the discount completely in case of an approval.

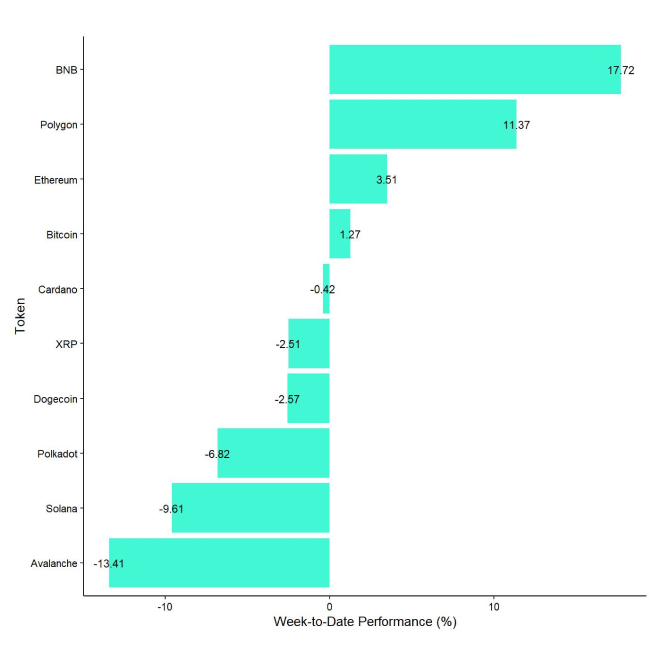

In general, among the top 10 crypto assets, BNB, Polygon, and Ethereum were the relative outperformers.

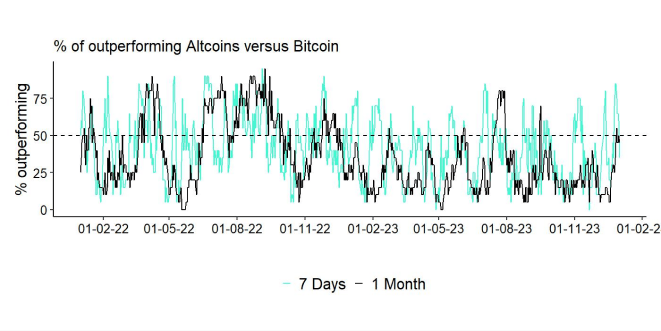

Altcoin outperformance vis-à-vis Bitcoin decreased compared to the week prior, with 35% of our tracked altcoins managing to outperform Bitcoin on a weekly basis. Altcoin outperformance had significantly picked up during the week before Christmas but has recently levelled off again.

Sentiment

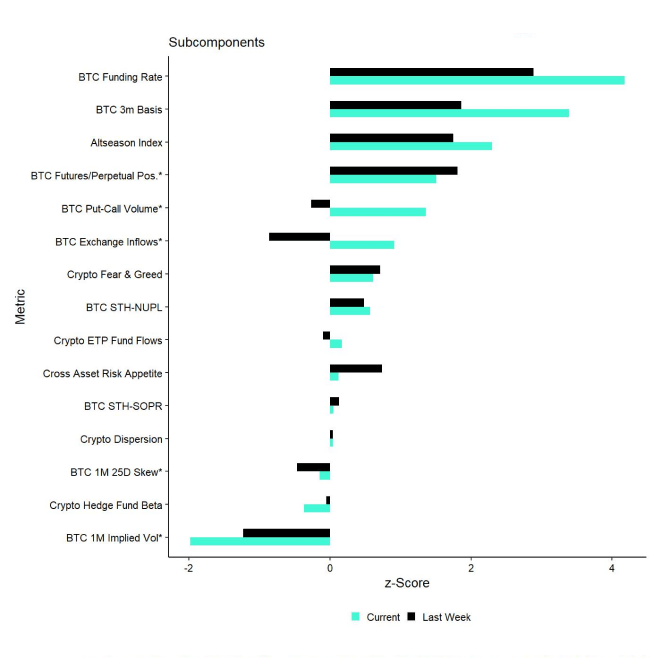

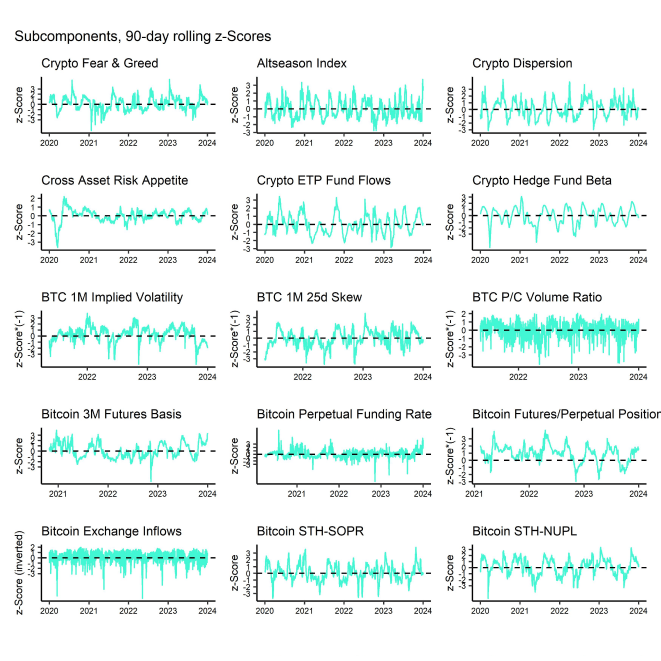

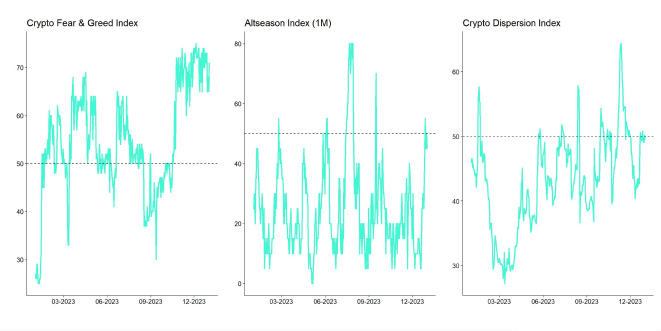

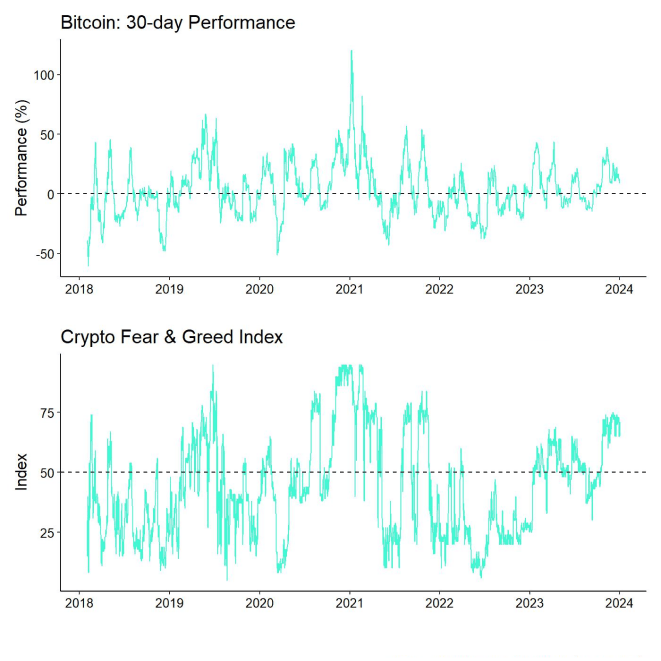

Our in-house Cryptoasset Sentiment Index has recently picked up again and currently signals a positive sentiment. At the moment, 12 out of 15 indicators are above their short-term trend.

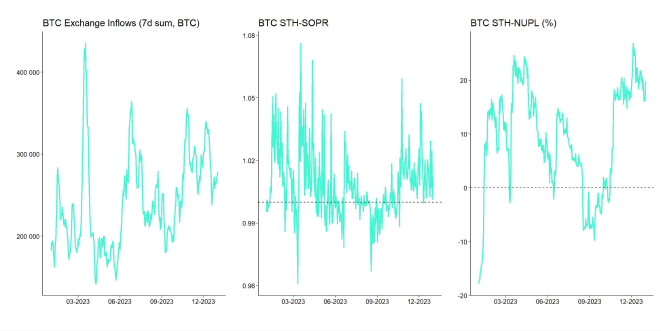

Compared to last week, we saw major reversals to the upside in BTC put-call volume ratio and BTC exchange inflows. Note that adecrease in exchange inflows leads to an increase in Cryptoasset Sentiment within our index.

The Crypto Fear & Greed Index still remains in "Greed" territory as of this morning.

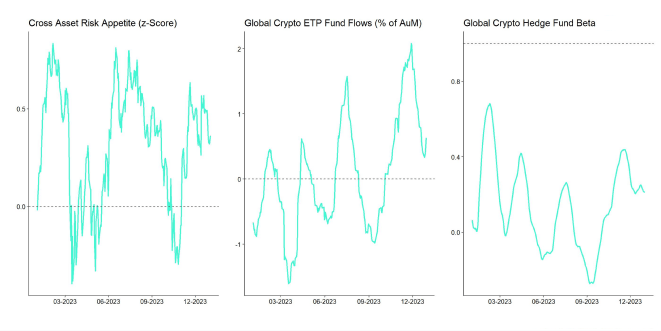

Meanwhile, our own measure of Cross Asset Risk Appetite (CARA) has recently decreased significantly heading into year-end, signalling a decline in risk appetite in traditional financial markets. That being said, the indicator remains slightly in positive territory overall.

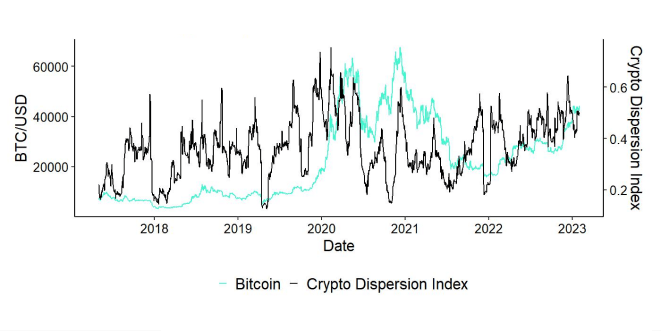

Performance dispersion among cryptoassets has mostly moved sideways last week but continues to be relatively high. In general, high-performance dispersion among cryptoassets implies that correlations among cryptoassets have decreased, which means that cryptoassets are trading more on coin-specific factors and that diversification among cryptoassets is high.

At the same time, altcoin outperformance has declined compared to the week prior, when we saw a pick-up in altcoin outperformance, with 35% of altcoins outperforming Bitcoin on a weekly basis. In general, low altcoin outperformance tends to be a sign of low risk appetite within cryptoasset markets.

Flows

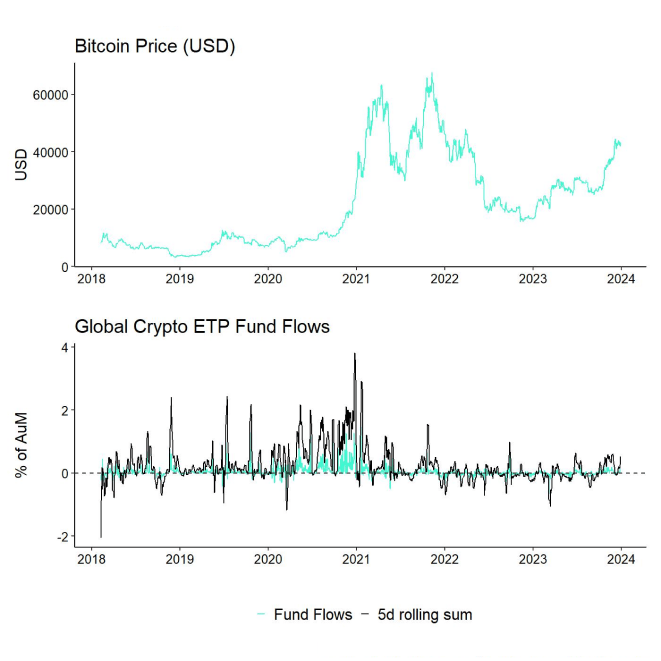

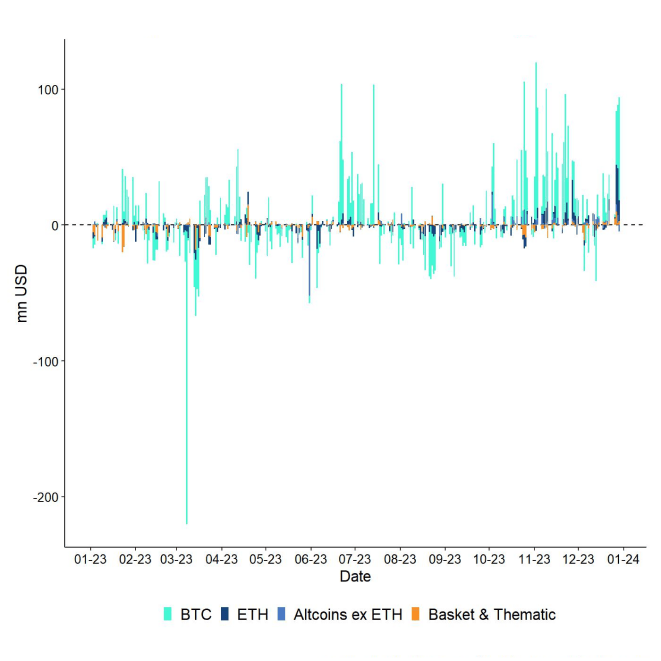

During the last week of the year 2023, we saw very significant net inflows into cryptoasset ETPs.

In aggregate, we saw net fund inflows in the amount of +269.1 mn USD (week ending Friday).

Most of these inflows focused on Bitcoin ETPs (+163.6 mn USD) and Ethereum ETPs (+80.2 mn USD) but both Altcoin ex ETH ETPs and thematic & basket crypto ETPs also managed to attract net inflows of +6.1 mn USD and +19.2 mn USD, respectively, based on our calculations.

Meanwhile, the NAV discount of the biggest Bitcoin fund in the world - Grayscale Bitcoin Trust (GBTC) – has declined somewhat last week to around -7.9%. In other words, investors are assigning a probability of around 92% that the Trust will ultimately be converted into a Spot Bitcoin ETF.

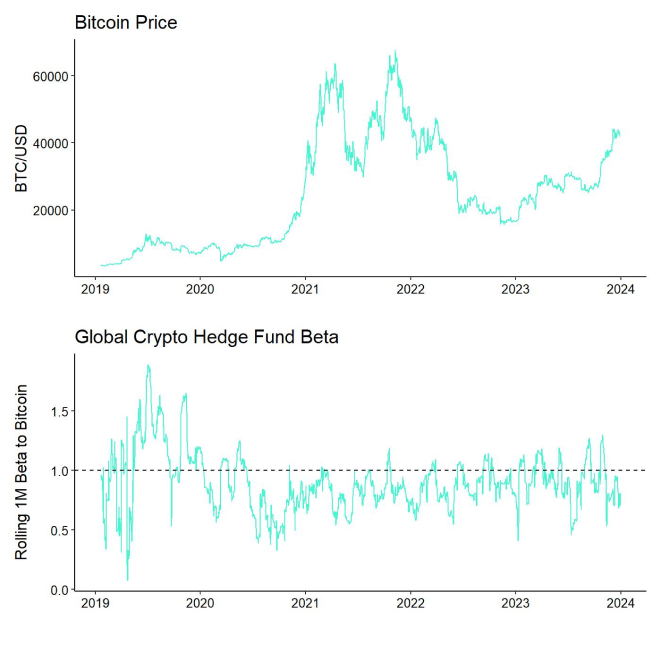

Besides, the beta of global crypto hedge funds to Bitcoin over the last 20 trading remains low at approximately 0.8, implying that global crypto hedge funds still remain under-exposed to Bitcoin market risks. However, global crypto hedge fund exposure seems to have started to increase recently, albeit from low levels.

On-Chain

Overall, on-chain activity was relatively muted during the holiday week with core network metrics like active addresses and new addresses hovering near year-to-date lows for Bitcoin. Nonetheless, the mempool remained relatively clogged with the mempool transaction count reaching the highest level since late August 2023. The mempool represents the queue of yet unconfirmed Bitcoin transactions. In fact, the number of daily transactions reached a new all-time high on the 31 st of December 2023 with over 731k transactions.

The abovementioned points imply that fewer entities are doing more transactions on the Bitcoin blockchain at the moment.

Meanwhile, mean and median fee levels also remain relatively elevated at the moment. This is still supporting BTC miner revenues significantly. In fact, the 30-day average miner revenue is at the highest level since January 2018 when the retail crypto frenzy led to the strongest demand for Bitcoin block space.

It is no surprise that BTC miners continue selling their revenues and also their previously accumulated reserves. Over the past 30 days, BTC miners have been selling around 124% of their daily revenues and overall BTC miner wallet balances have reached the lowest level since December 2022 according to data provided by Glassnode. All this happened as the aggregate network hash rate hit a fresh all-time high on Christmas Eve (24/12/23).

As we headed into year-end, we saw ongoing profit-taking but which was still dominated by short-term holders. Short-term holders are defined as investors with a maximum holding period of 155 days or less. In contrast, we saw relatively little profit-taking by long-term holders which is a positive sign.

We do not expect this to change any time soon until we reach new all-time highs based on historical observations that imply that long-term holders only start distributing coins significantly with new all-time highs.

Besides, we saw the highest net BTC exchange outflow last week on the 27 th of December since May 2023 with over -27k BTC aggregate net exchange outflow in a single day. The majority of these outflows occurred on Coinbase which accounted for -14.2k BTC. We generally saw the highest net exchange outflows from Coinbase since November 2022.

Most of these net outflows across all exchanges happened within large wallet sizes in excess of 1 mn USD in balances which also implies institutional demand (Chart-of-the-Week).

In this context, it is important to highlight that Coinbase is by far the most widely used custodian by the US ETF issuers. Some of the ETF issuers have already publicly announced their seeding investments such as Bitwise that have announced to seed their ETF with 200 mn USD. Bitwise also uses Coinbase as a custodian. Thus, a part of these exchange outflows could already be related to early seeding activities by these ETF issuers.

As a result, overall BTC exchange balances have reached their lowest level since April 2018. Coinbase's BTC exchange balance is at the lowest level since August 2015.

Ethereum exchange balances have also continued to drift lower with exchange balances hitting the lowest level since July 2016.

Overall, intensifying supply scarcity for both BTC and ETH ahead of the ETF approvals is very supportive at the moment.

Derivatives

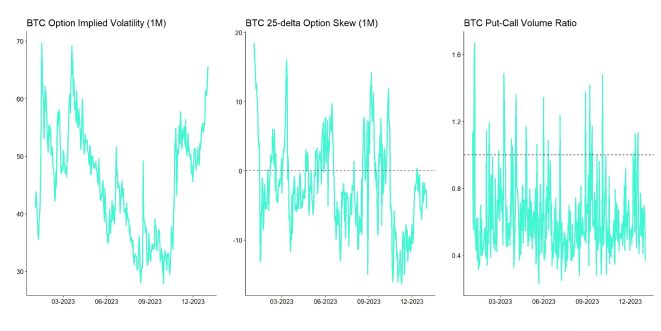

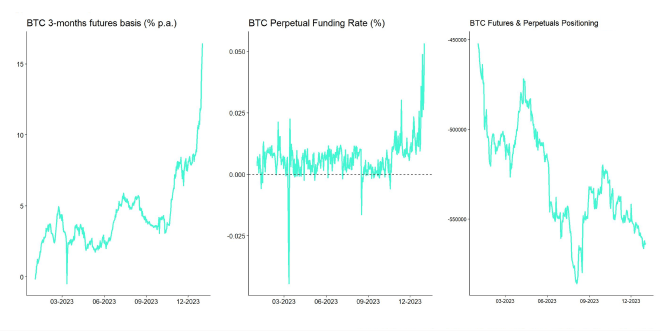

Both futures and perpetual open interest was relatively muted during the holiday week and there was generally a decline more recently due to futures short liquidations which increased to the highest level since early December.

Option open interest saw a very significant decline as the biggest options ever recorded expiry took place on the 29 th of December. On that day, approximately 174k BTC tied in option contracts expired across all major BTC options exchanges.

After this expiry, the BTC options market remains biased towards calls with a put-call open interest ratio at around ~0.42, at the time of writing. Put-call volume ratios have also declined significantly as we headed into year-end. The 1-month 25-delta BTC option skew has also declined in favour of calls and now sits at around -5.5%.

A significant development in the futures space was the steep increase in the futures curve contango and the resulting increase in the BTC 3-months annualized basis which increased to the highest reading since November 2021. The 3-months annualized basis currently sits at 16.4% p.a.

The sharp steepening in futures curve contango is definitely a sign for some euphoria and positive sentiment in the BTC futures market. In that same context, BTC perpetual funding rates have also increased to the highest level since November 2021 which is consistent with the previous observation.

Bottom Line

- Cryptoassets outperformed last week on account of ongoing optimism surrounding a final spot Bitcoin ETF approval in the US

- Our in-house “Cryptoasset Sentiment Index” has increased again and signals positive sentiment

- Significant exchange outflows by large wallet sizes implies outsized institutional buying demand ahead of the likely approvals (Chart-of-the-Week).

Appendix

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.