Introduction

The biggest software upgrade in the history of cryptocurrency is coming.

This is The Merge: the end of Proof of Work on Ethereum and the introduction of Proof of Stake.

This means the end of mining on Ethereum and the introduction of the newer consensus mechanism, whereby users stake ETH in order to support the network and receive yield on their tokens as a reward.

Ethereum is by far the largest blockchain ecosystem for decentralised apps and a key infrastructural building block for Web3.

It introduced smart contracts - self-executing programs written on the blockchain - when it launched in 2015 and as a result created the vast new crypto verticals of decentralised lending and borrowing (DeFi) and NFTs.

But it has been a victim of its own success: the millions of people and programs competing to use its services mean that fees have regularly soared to extortionately high levels and the processing speed of the network has suffered.

Ethereum co-creator Vitalik Buterin, and its de facto figurehead, originally scheduled the switch to Proof of Stake as early as mid-2016, making this perhaps the most overdue and highly-anticipated upgrade of its type in history.

At the time[1], Buterin quoted Hofstadter's Law, a somewhat joking adage often cited by programmers that describes the difficulty of accurately estimating how long it takes to implement tasks of substantial complexity.

It goes[2]: “It always takes longer than you expect, even when you take into account Hofstadter's Law.”

With Ethereum creating upwards of ten billion dollars[3] of revenue per year through transaction fees for the thousands of apps vying to use its platform, the wholesale switch to a new consensus mechanism is a risky business, akin to rebuilding an aeroplane while it is still in flight.

Given the number of apps and services that use Ethereum, the Merge is set to have large ripple effects on the crypto market as a whole.

Why Proof of Stake?

Ethereum is essentially a distributed global database of nodes: computers that each host a copy of the entire Ethereum blockchain and its ledger of transactions, and that run software to verify blocks and the transaction data they contain.

To reach consensus, and to organise who owns what on the network, a majority of nodes have to agree on the golden copy of this ledger. Consensus mechanisms like Proof of Work and Proof of Stake are the methods by which nodes reach agreement.

When Ethereum moves to Proof of Stake, the network will no longer rely on mining machines processing billions of complex calculations in order to be in with a chance of verifying blocks of transactions. Instead it will rely on validators to add new blocks to the never-ending chain. Validators will be picked at random to add new blocks. To be eligible for selection, validators must post collateral of at least 32 ETH (around $53,000 at time of writing).

This figure is meant to weed out malicious actors and ensure that participants have a reasonable economic stake in the network succeeding, and to give them an incentive to run the most recent software updates.

Validators can be punished for behaving maliciously or inappropriately. The most common punishment is ‘slashing', where validators can lose some or all of their 32 ETH stake.

Anyone who wants to be a validator will be added to an activation queue that limits the rate of new validators who can join the network. When they have been activated, validators will then be allowed to review and approve new blocks, and earn ETH as a reward for doing so.

Most end-users do not have $50,000-worth of ETH to stake, and so turn to centralised staking services like Coinbase in order to earn a percentage of the yield on offer. Still, the number of validators has climbed rapidly from 300,000 in February 2022[4] to over 417,000 as of late-August 2022.

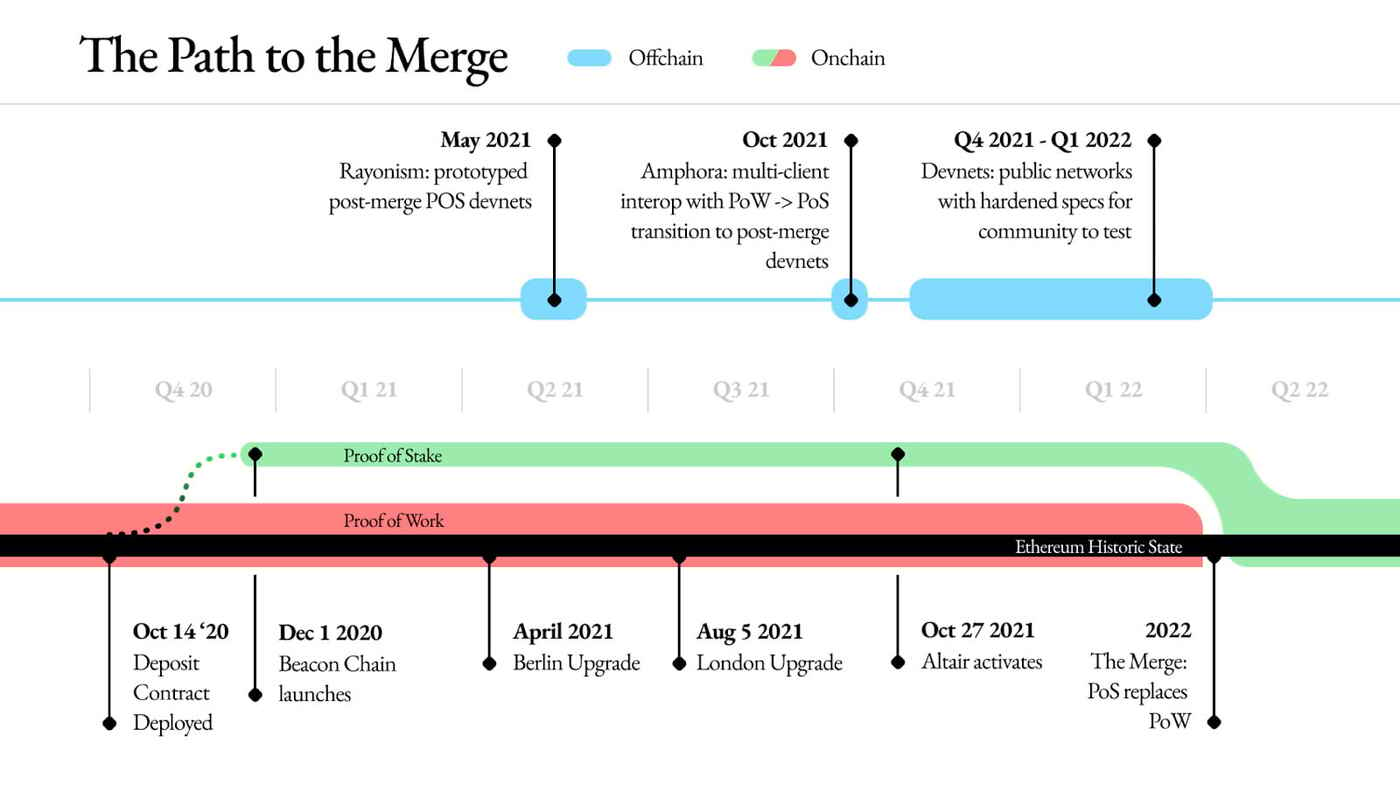

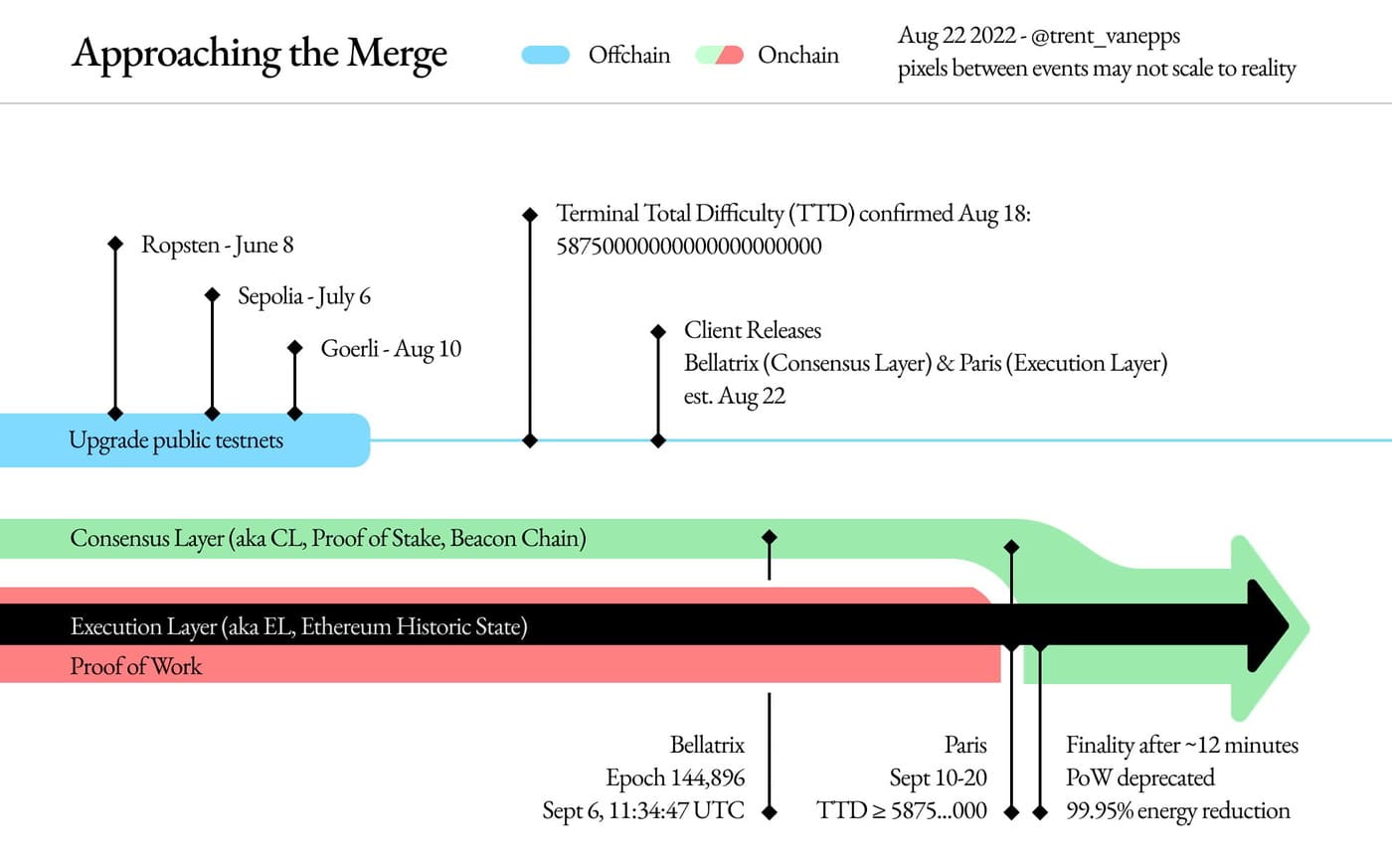

The good news is that several testnets (testing environments that mimic the blockchain's working without affecting it) have enacted Proof of Stake successfully[5]. As in the below image, Ropsten completed the feat on 8 June, followed by Sepolia on 6 July, and finally Goerli on 10 August. Each marks a stepping stone to seeing the Merge go live.

Readers and investors should be prepared to read and ingest a series of Ethereum-specific naming conventions that may not make much sense outside of this context. The Merge consists of a sequence of two upgrades – Bellatrix on the consensus layer followed by Paris on the execution layer. Bellatrix will be enacted at 11:34am UTC on 6 September. Once this is live, it kickstarts the countdown towards Total Terminal Difficulty (see below) and the Paris hard fork.

Despite their preference for obscure and opaque naming conventions, Ethereum developers are nothing if not methodical. The transition from Proof of Work to Proof of Stake is the culmination of years of testing, re-testing and community co-ordination, and marks a major achievement of technical engineering.

As such, the Merge is one of the most-watched events in the history of the digital asset market.

When will the Merge happen?

If everything goes to plan, the date for Etherum's changeover from Proof of Work to Proof of Stake is set for around 15 September 2022.

Normally, the kinds of hard forks that create new sets of backwards-incompatible rules to upgrade a network happen at a particular block number. In blockchains, the block number is akin to an internal calendar: it is simply the number of blocks that have been successfully added to the chain, creating an ever-growing record and history of transactions.

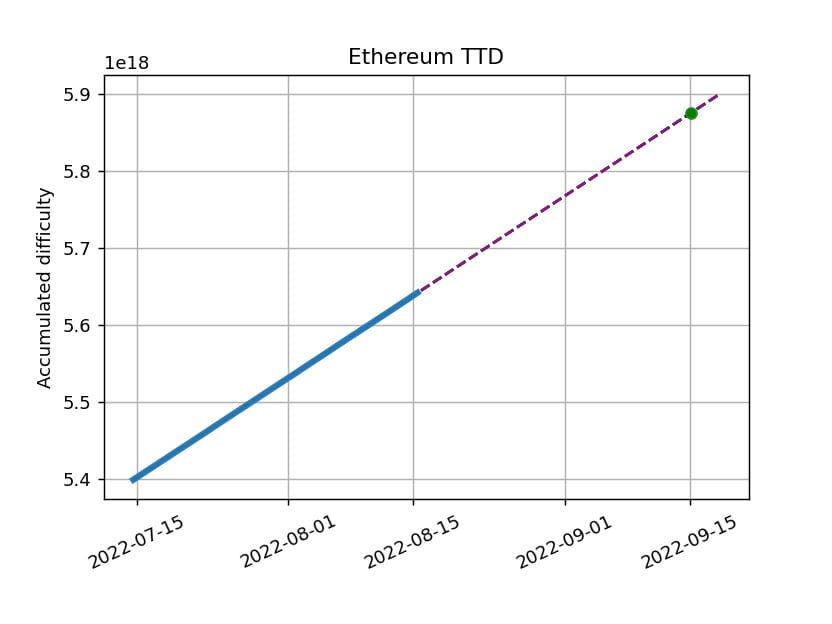

For the Merge, Ethereum is depending instead on a process called Total Terminal Difficulty (TTD).

TTD is the total difficulty required for the final Proof of Work block to be mined before the transition to Proof of Stake.

Using TTD instead of a specific block number does one very important thing: it sidesteps an ever-present risk: that a malicious fork could be enacted backed by a minority of Ethereum miners voting with their hashing power. There is more on the potential for Ethereum forks later in this research paper.

Data site bordel.wtf[6] is keeping a live record of TTD where users can see an exact time and date for the Merge.

On 12 August 2022 Vitalik Buterin endorsed[7] lead Merge developer Tim Beiko's suggested 15 September date for the Merge, while noting that the exact timing depended on Ethereum's hashrate.

Fixing the finite number of hashes left until Proof of Stake happens adds a level of certainty that no participant has had to date, and sets in stone a definitive switch-off for Proof of Work Ethereum.

As of 24 August 2022, there remain only around 130,000 blocks left to mine on the Proof of Work Ethereum chain.

At the time of the publication of this report, the estimated time and date of the Merge is 1.56am UTC on 15 September 2022[8].

How have markets responded?

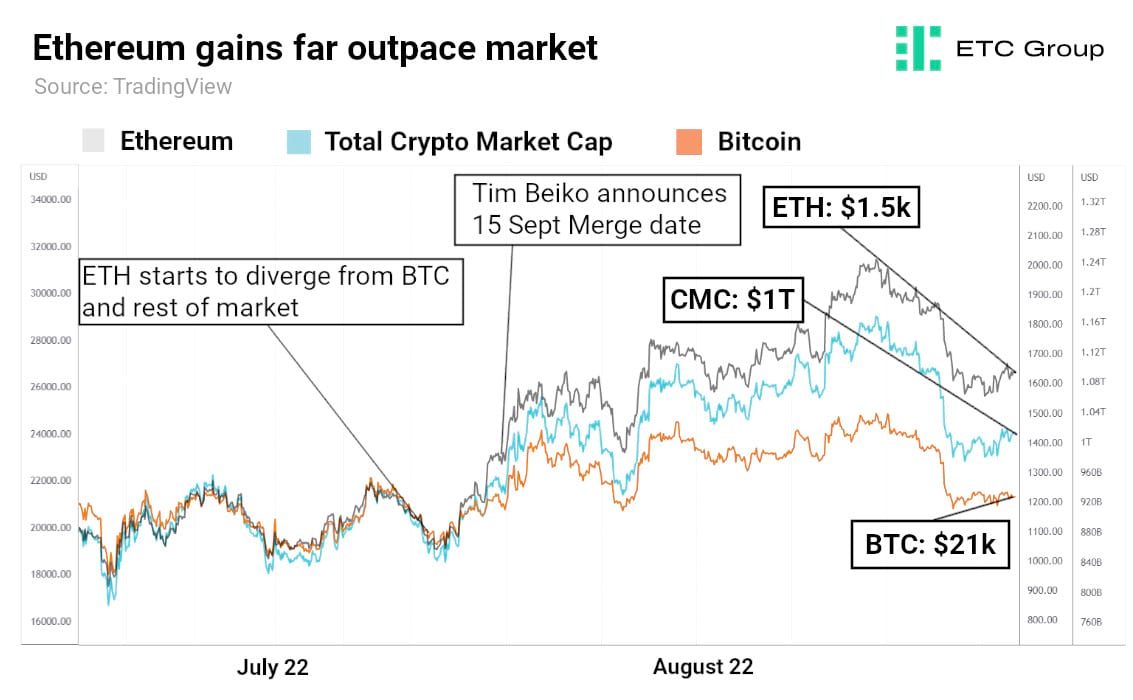

When on 15 July 2022, Tim Beiko offered an approximate date for the software upgrade of 15 September 2022, ETH began to diverge strongly from Bitcoin and the total crypto market cap.

Certainty is always a boon to investor sentiment, no matter the asset under consideration. Rumours that Beiko would announce a nailed-down date for The Merge created an obvious positive shift in the weeks running up to the announcement.

In the period after the local market bottom of 18 June, Ethereum was moving largely in tandem with Bitcoin and the total crypto market cap. Such a state of affairs rarely comes as a surprise, because as the two largest assets in the ecosystem, Bitcoin and Ethereum tend to have an outsized effect.

In the 31 days after Beiko offered a definite date in a developer call[9], the price of the Ethereum token ETH shot up by 60%.

While the announcement did come at a particularly bullish time, when crypto markets as a whole were recovering from the post-Terra/crypto lending contagion crash, over the same period Bitcoin only managed a 15% rise[10], while the total crypto market cap climbed 24%, from $924bn to $1.15trn.

Because Ethereum is a foundational piece of technology with millions of users and supporters, spread across multiple markets and use cases, that means there are many moving parts to consider, any of which could shift dramatically on a week-to-week basis.

Potential price action post-Merge

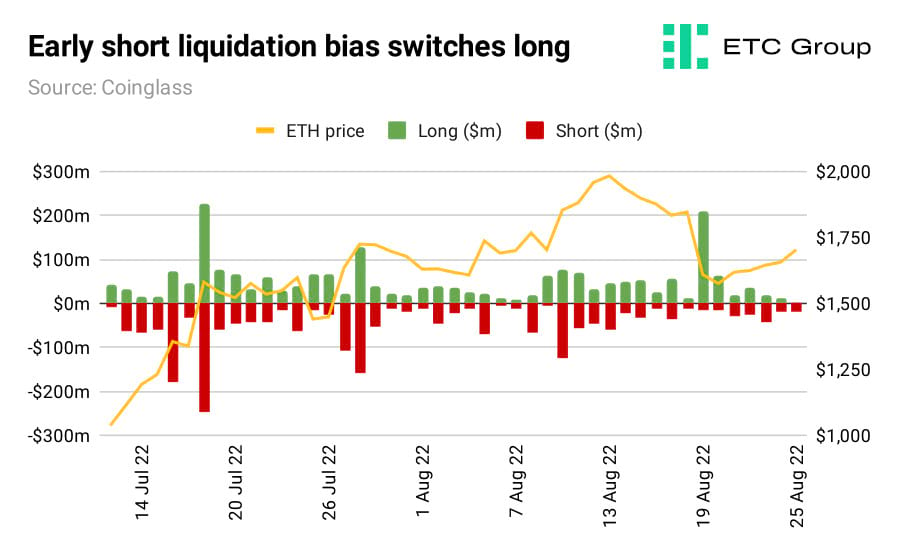

Looking further ahead: on an aggregate basis, traders are clearly biased towards long ETH[11], but this has become an exceedingly crowded trade of late.

When every trader in a market is moving in one direction, it introduces significant fragility. If almost everyone is long ETH, at the first sign of trouble there is a lot of asymmetric downside because a very large number of long positions will close out and short traders will pile in.

Consider leveraged liquidations in ETH since the Merge date was announced, as recorded by data site Coinglass.

In the weeks after Tim Beiko's announcement, traders short ETH saw the largest numbers of liquidations as the bullish news filtered through the market. But as potential edge cases started to emerge and gain traction - notably that of a potential fork in the chain to continue Ethereum as Proof of Work, those largest leveraged liquidations switched over to long positions.

On 19 August, more than $208m of long positions in ETH were liquidated when the spot price fell from $1,845 to $1,603.

We can see more alternative pictures starting to emerge from derivatives markets.

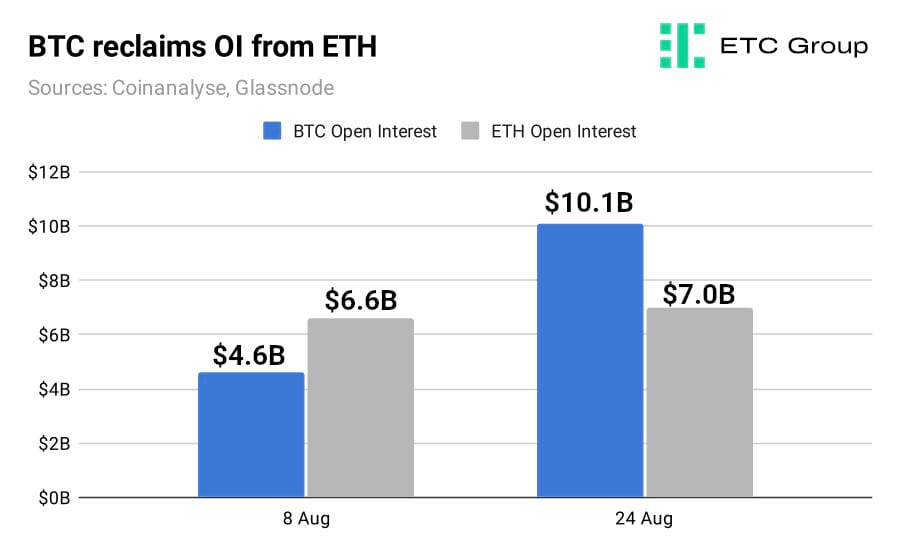

Ethereum options markets made history in the weeks following Beiko's announcement.

Ever since crypto derivatives became widely offered in 2020, the open interest in options contracts for Ethereum has never exceeded that of Bitcoin. That curve flipped in July, with ETH options interest rocketing 32% higher than BTC. And so for the first time ever in early August, ETH options open interest at $6.6bn exceeded BTC[12] at $4.8bn.

As of 24 August, the picture has shifted back in the opposite direction, with BTC reclaiming that number one spot in options open interest.

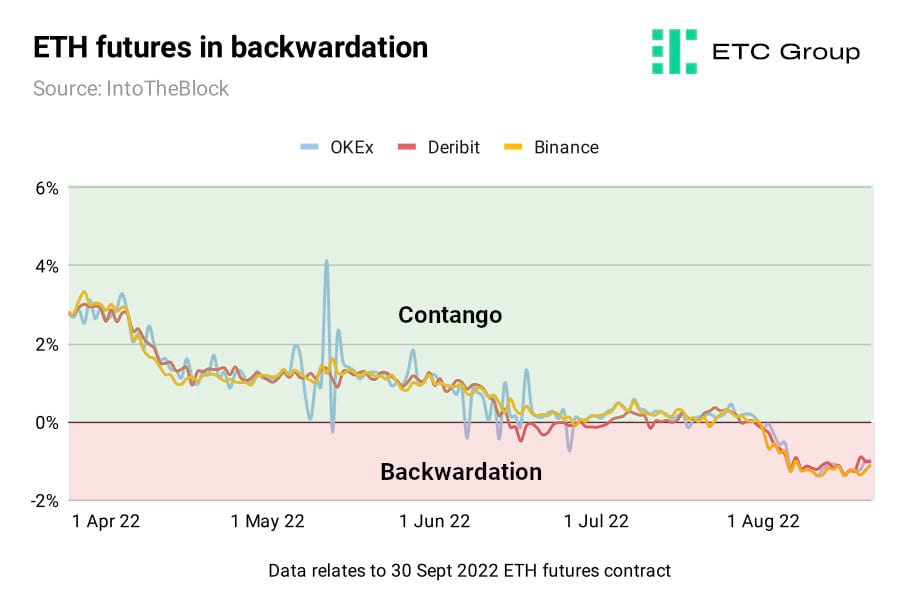

Futures traders are currently pricing Ethereum lower than the spot price, putting Ethereum in a state of backwardation.

Basis is the percentage difference of a futures contract price vs the underlying asset's spot price. An asset is said to be in contango when the basis is positive (green), i.e. when futures prices are at a premium to current prices. Backwardation is when the opposite is true: that the basis is negative, and when futures prices are lower than current prices.

As Glassnode has noted elsewhere, this suggests that traders are seeing The Merge as a ‘buy the rumour, sell the news' event, and are positioning themselves to expect lower ETH prices in the days and weeks post-Merge.

Ethereum is only 40% complete

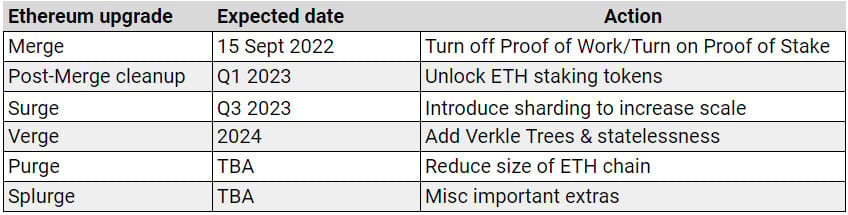

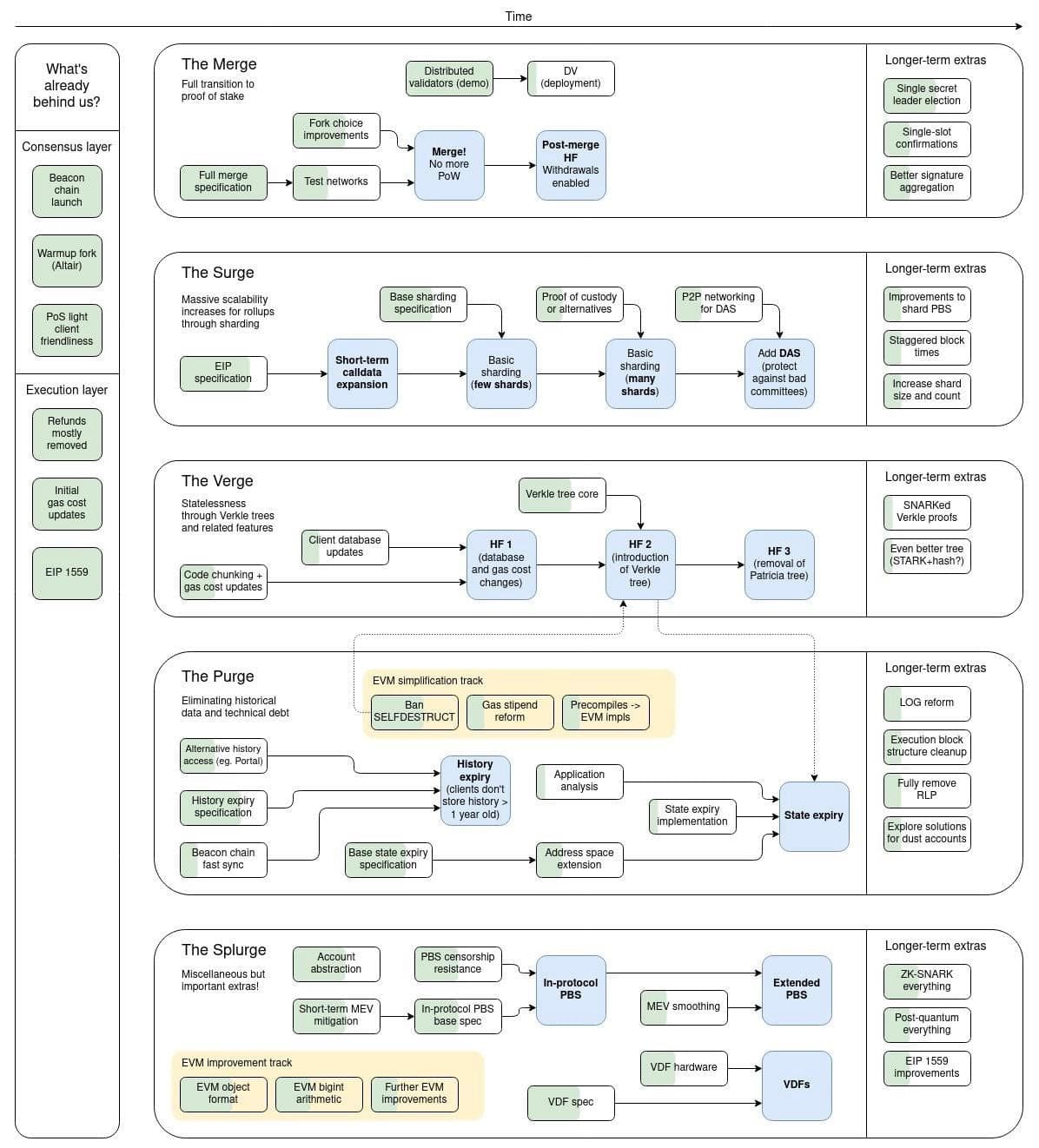

The Merge is not the beginning of the end for Ethereum development. It is not even the end of the beginning. In fact, the Merge is the starting point for a decade-long live upgrade schedule.

Testament to this fact is that by its own co-creator's estimation, Ethereum as a piece of technology today is only around 40% complete..

Speaking to the Ethereum developers' ETHCC conference[13] in Paris between 19 and 21 July 2022, Buterin said that after the Merge, Ethereum would be around 55% complete.

While short-term market fluctuations are interesting to watch, it must be noted that these have little bearing on long-term outlooks for Ethereum.

Layer 1 rivals like Solana and Avalanche have managed to grab a little of Ethereum's market share, but not much.

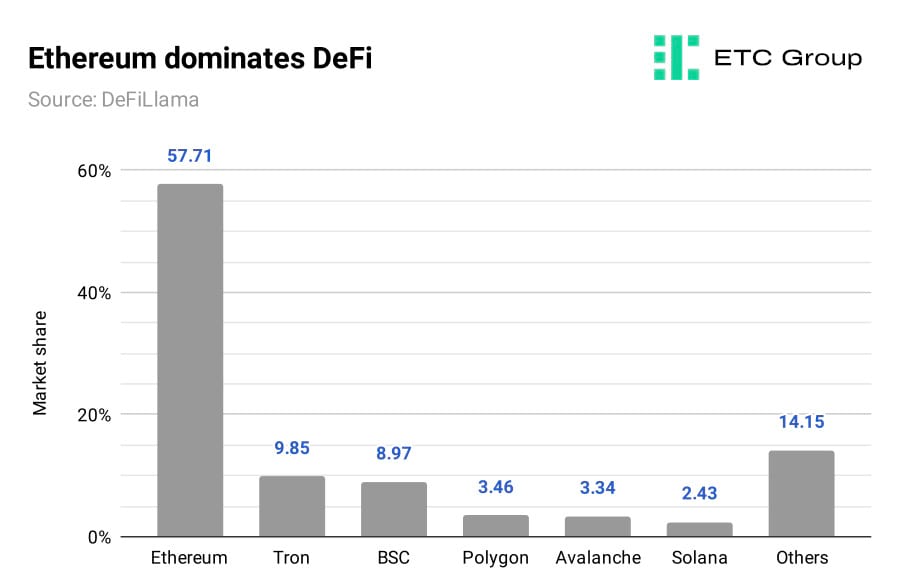

Despite its much-publicised problems, Ethereum attracts and retains the best blockchain developer talent, has the strongest and most battle-tested security of any blockchain on the market, controls 57% of the DeFi market (in terms of the total value locked in smart contracts) while its closest rival has 6%, and is home to many thousands of applications.

If Ethereum can implement the latter portions of its roadmap in a reasonable timeframe then there seems little reason why it should not continue to dominate the decentralised lending and borrowing markets, and the decentralised app space as a whole.

What the Merge will and won't do

There remains much discussion over what The Merge will and will not do for Ethereum.

The Merge will immediately

- Turn off Proof of Work and end mining on Ethereum

- Introduce Proof of Stake

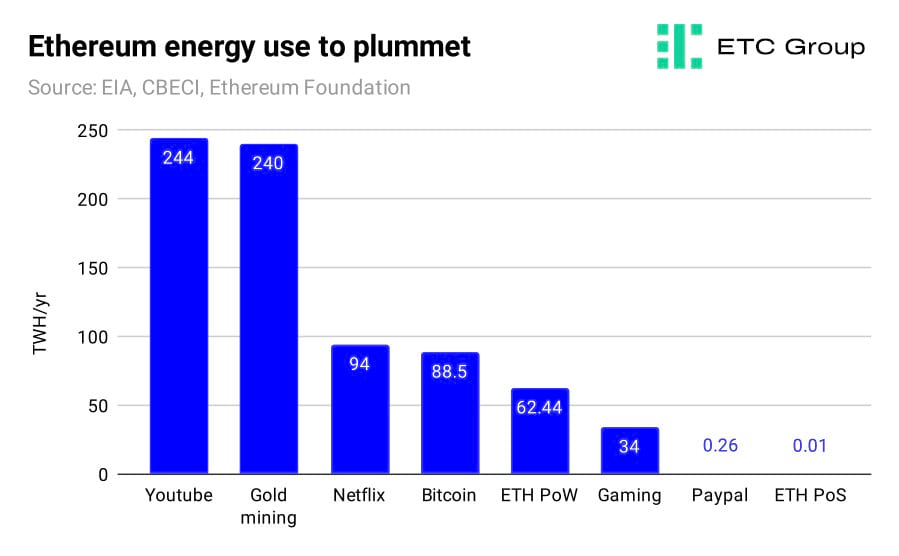

- Make the Ethereum network up to 99.95% more energy efficient

The Merge will not immediately

- Reduce transaction fees

- Improve Ethereum scalability and reduce congestion

- Create faster transaction processing

- Unlock ETH staking tokens

Some industry commentators remain somewhat confused as to exactly what will and won't be included in the Merge, so it is of little surprise that the public is too.

Overcoming performance bottlenecks in the Ethereum ecosystem is already a multi-billion dollar business, hence the dramatic rise of rollups and sidechains like Polygon. But for NFT and DeFi users to see lower fees, they will have to wait for the sharding upgrade slated for the ‘Surge' part of the long-term Ethereum roadmap, which will split Ethereum's network compute load horizontally, and won't be affected by the Merge.

Some have even conflated the Merge with the general long-term roadmap for Ethereum. The typical end user, whether NFT traders or DeFi participants will likely find much disappointment if, as expected, they are forced to pay the same high gas fees to compete for Ethereum's valuable blockspace as pre-Merge.

As Buterin wrote in a 2021 blog post[14]: “Sharding is the future of Ethereum scalability, and it will be key to helping the ecosystem support many thousands of transactions per second and allowing large portions of the world to regularly use the platform at an affordable cost.”

“Ethereum including rollups, including sharding, is going to be able to process 100,000 transactions a second,” he added at the recent Paris developer conference.

So Proof of Stake as a whole will increase throughput capacity from Ethereum's current ~15 transactions per second (TPS), as well as lowering transaction fees. But these elements will not be immediately addressed by the Merge on 15 September 2022.

Sharding is not scheduled to be implemented on Ethereum until the Surge: the next development phase after the Merge. Given that it took six years longer than anticipated for Proof of Stake Ethereum to get a definitive date, it is easier to forgive the more pessimistic analysts who suggest that a Q3 2023 estimation for sharding to be rolled out across the Ethereum network is somewhat optimistic.

The Roadmap: Merge-Surge-Verge-Purge-Splurge

Sharing the below image, Buterin said: “The Ethereum protocol today is undergoing a long and complicated transition toward becoming a much more robust and powerful system.”

After all five stages are completed, Buterin has said that Ethereum blockchain should far exceed Visa-levels of payment processing (~24,000 transactions per second)[15].

Clearly this will be to the benefit of the industries and verticals that have come to rely heavily on Ethereum.

The research enacted by Ethereum in its roadmap is highly likely to be adopted by and to benefit its competitors like Solana, Avalanche and Tezos - such is the nature of open source development.

Will unstaked ETH flood the market post-Merge?

Staked ETH that is currently locked in smart contracts on the Beacon Chain will be unlocked in a separate hard fork following The Merge. In a recent interview[16], Buterin explained that a second hard fork would take place “realistically six months” following The Merge.

This has been widely referred to as the “post-Merge cleanup”, but officially is called the Shanghai hard fork.

Given that digital assets tend to function on a supply and demand basis, a large influx of supply via exchanges onto the market in the wake of the Merge would cause severe downward pressure on the ETH price.

But Ethereum developers see this happening in a much more orderly fashion than some market commentators have suggested. There are code rules in place to stop unstaked ETH from exiting the Proof of Stake Ethereum chain all at once, which is a help.

In the same way as there is a queue to join the Beacon Chain, there will be a hardcoded queue to exit the chain.

So as noted validators will not be able to withdraw staked ETH immediately after the Merge.

Instead, withdrawing staked ETH is expected to be allowed in EIP-4895[17], which will likely be included as part of the Shanghai hard fork.

Currently four validators can be activated per epoch, with each epoch occurring once every six and a half minutes. When Proof of Stake Ethereum reaches 327,680 active validators, the activation rate will increase to five validators per epoch.

One additional validator per epoch will be added for every 65,536 additional validators activated.

Before validators enter the validator queue, they need to be voted in by other active validators. This occurs every 4 hours.

Why Ethereum is important (a brief history)

Five years after Bitcoin's public release, Vitalik Buterin debuted the Ethereum whitepaper[18], which laid out the case for ‘A Next Generation Smart Contract and Decentralised Application Platform'.

The paper was incredibly prophetic. In its first paragraph it named a swathe of innovations that Ethereum could help to make real, nearly all of which have come to pass.

The key thought process behind Ethereum was that it could improve on Bitcoin's application for blockchain as the basis for a secure and borderless digital currency by focusing on some of the other key applications for immutable online ledgers, including:

- custom currencies (which became ERC-20 tokens like Uniswap and Chainlink);

- the ownership of an underlying physical device, or smart property, which we have seen with the rise of tokenisation;

- non-fungible assets (such as domain names and NFTs);

- blockchain-based decentralised autonomous organisations (DAOs), which have become the de-facto way to organise new crypto projects, and of course;

- smart contracts, described in the paper as “more complex applications involving having digital assets being directly controlled by a piece of code implementing arbitrary rules”. This latter idea created and powered the entirety of the DeFi industry, along with multiple spin-out industries and concepts which perhaps did more to permanently alter the course of crypto from simple currencies to an entirely new asset class.

The platform has quickly become one the most influential and important not just in blockchain and cryptoassets, but in technology, networking and digital property at large.

Ethereum's recent history has not always been plain sailing and to claim otherwise would be revisionist at best.

Its main issue comes with marshalling a very large community of supporters, developers, miners and other disparate actors, each with their own personal priorities, power bases, support structures and ideas on how best to move Ethereum forward.

Testament to this point is the ongoing furore around the potential for a miner-supported fork to keep a Proof of Work version of Ethereum live and running after the Merge.

The reasoning is obvious: the switch to Proof of Stake will destroy their business models and make their expensive mining rigs entirely redundant. ETH supporters counter with the argument that miners have known for many years that the Merge was coming, and should not have made large capital expenditures on Ethereum mining equipment.

“The issue with ETH maximalists is that they don't see miners as real people with families to support,” said Kevin Zhou of Galois Capital on Laura Shin's Unchained podcast[19]. See more on ETHPoW fork and the potential outcomes below.

What to expect after The Merge

Higher volatility in Ethereum pricing should be expected in the days in and around 15 September. Uncertainty around the status of the Merge, its progress, and the state of the ETHPoW fork (see below) will contribute to higher volatility in spot markets. ETC Group analysts are watching this closely.

Coinbase said in a 16 August blog post[20] that it would “briefly pause” Ethereum and ERC-20 deposits and withdrawals “as a precautionary measure”.

“Although the Merge is expected to be seamless from a user perspective, this downtime allows us to ensure that the transition has been successfully reflected by our systems. We do not expect any other networks or currencies to be impacted and expect no impact to trading for ETH and ERC-20 tokens across our centralized trading products,” the post added.

Given the challenges of coordination when dealing with an ecosystem as large as Ethereum, it would be naive not to expect significant disruption in and around the Merge.

But there are other more long-term implications that the Merge brings most notably in terms of the tokenomics of the blockchain and who can profit from using it.

MEV

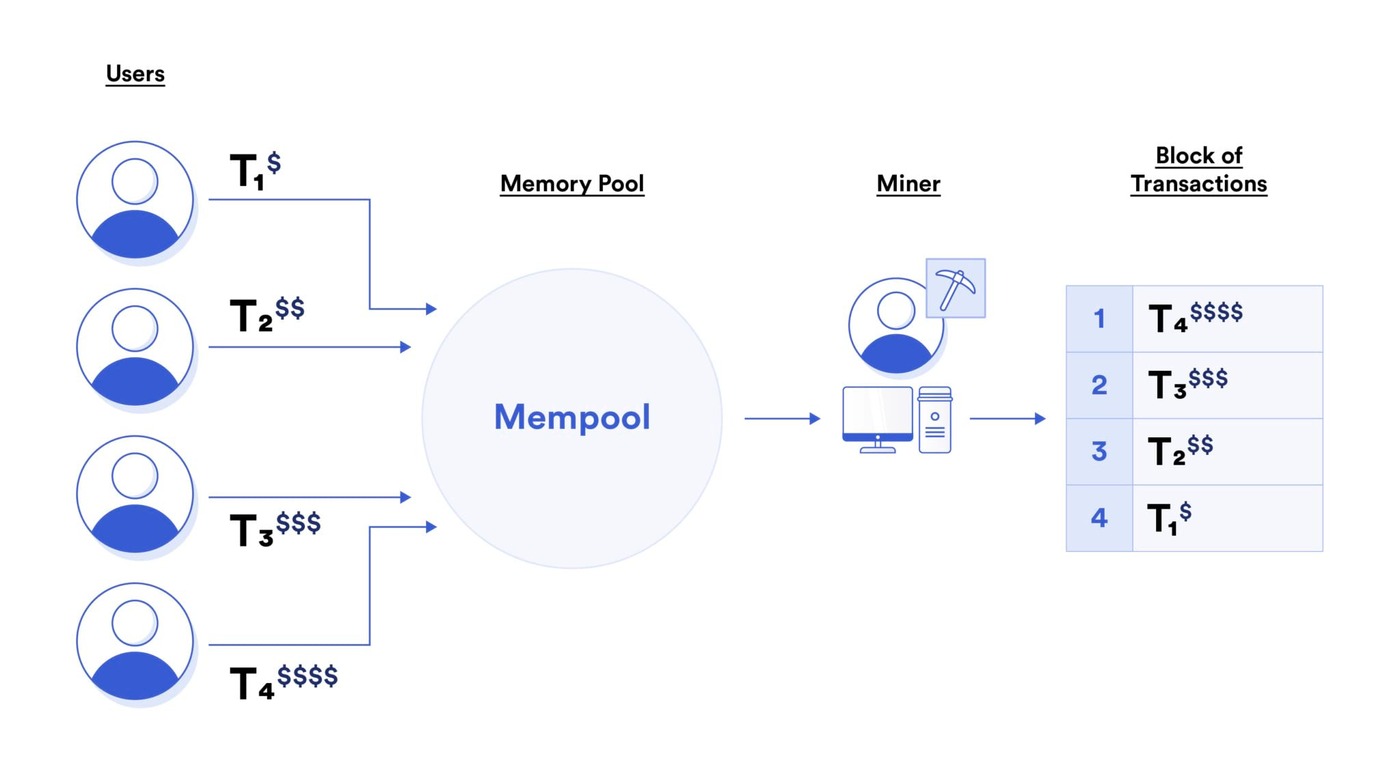

As Alex Obadia writes in one Flashbots Medium post[21], the architecture of the Ethereum blockchain creates substantial opportunities for profit, mainly through liquidations and arbitrage. Traders compete heavily to capture these opportunities as and when they occur.

Transactors who want to use the Ethereum blockchain express their willingness to have their transaction included in the next available block through their gas price: the transaction fee they are willing to pay to miners.

Proof of Stake has huge implications for ETH infrastructure providers as a whole: one key change is that the Merge will alter how Ethereum transactions are settled.

MEV has been a controversial topic in Ethereum's history. The concept was first introduced under Bitcoin's miner-supported Proof of Work system, and hence was termed ‘Miner Extractable Value', but is equally applicable in validator-supported Proof of Stake networks, and has since been widely renamed as ‘Maximum/Maximal Extractable Value'.

MEV relates to[23] the maximum total value that blockchain network supporters (miners or validators) can extract from producing blocks - over and above the standard block reward and transaction fees they might otherwise receive.

MEV operators can do two main things: include or exclude certain transactions in a block which pay higher transaction fees, or change the order of transactions in a block to reap larger payoffs.

And so, while block producers normally order transactions by the highest transaction fee in order to maximise profits, the network does not require them to do so. Block producers can extract additional profits from users by taking advantage of their ability to arbitrarily reorder transactions, creating what is known as MEV.

As one Ethereum community researcher has pointed out[24]: “The term MEV can be misleading as one would assume it is miners who are extracting this value. In reality, the MEV present on Ethereum today is predominantly captured by DeFi trades through structural arbitrage strategies. Miners indirectly profit from these traders' transaction fees.”

Extracting value from the Ethereum blockchain through MEV disproportionately favours traders and Ethereum miners, and introducing Proof of Stake, with its more egalitarian validator system, is one way to tip the balance back towards system stability and back in favour of Ethereum users.

And as economically rational actors, miners tend to choose the highest-profit opportunities: those transactions with the highest gas price attached, and then order these transactions by the gas spend in the block they are producing.

It is this ability for miners to arbitrarily include, exclude, or re-order transactions from the blocks they produce that grants them substantial profit opportunities.

Some examples of MEV include:

- DEX arbitrage

This is simplest and best known form of MEV, where arbitrageurs take advantage of mispricing on decentralised exchanges (DEXs) like Uniswap and Sushiswap. Traders buy the lower-priced token on one DEX and resell it at the higher price on the second DEX in a single atomic transaction. One example on Etherscan here[25] shows one user turning 1,000 ETH into 1,045 ETH by taking advantage of the differing pricing of Ethereum vs the DAI stablecoin.

Little effect on ETH holders/users: The fragmentation of DEXs and their price inefficiencies have relatively low impact on the rest of the ecosystem

- Sandwich trading

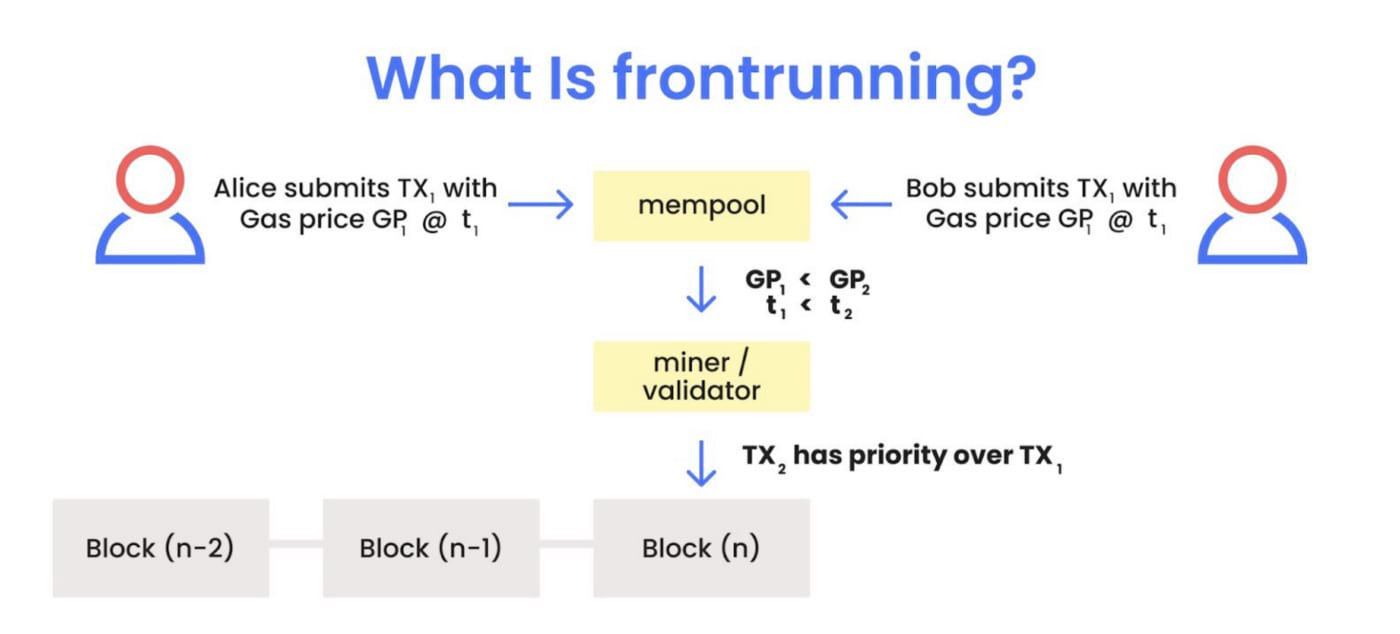

Also called frontrunning, sandwich trades are among the most malicious uses of blockchain transactions and the most controversial element of MEV. Due to the transparent nature of public blockchains (not just Ethereum), anyone can view pending transactions in the mempool, where transactions sit waiting to be picked up and processed by miners in Proof of Work systems and validators in Proof of Stake systems.

Large effect on ETH users/holders: Users who are sandwiched face larger slippage and poorer execution.

The end of sandwich trades?

Sandwich trades are a variation on frontrunning, which any reader will know is technically illegal in most jurisdictions. MEV traders can find pending transactions in the mempool and then attempt to surround the transaction by placing one order just before it, and one just after it - frontrunning followed by backrunning. Sandwich trades manipulate small changes in the price of Ethereum as a result of buying and selling the asset.

The transparency of blockchains like Ethereum, and the latency with which transactions are executed, make this strategy quite simple.

However, with the introduction of fixed block times, sandwich trades are likely to become more difficult.

Ethereum's Proof of Work system deploys variable block times, such that network participants can not be sure when exactly the next block will be confirmed. Post-Merge, under Proof of Stake, this changes. Instead blocks will be confirmed in ‘slots' every 12 seconds.

Every 32 of these slots make up a period called an epoch. At the start of this epoch, the validators who are randomly chosen to propose blocks are identified. Traders searching for MEV could theoretically structure their transactions based on the validators they know will be in charge of proposing a block.

Fixed block times will have wide-ranging effects: not least because MEV and profits for block producers have been so keenly focused on the specific order of transactions over time.

With fewer MEV opportunities on the table for arbitrageurs to profit from, and more competition due to the change in network architecture, this could lower gas fees and make Ethereum a more functional and less frustrating platform for the average end-user.

The precise repercussions of post-Merge MEV have not yet been established, but market participants are keeping a close eye on the outcomes.

Will ETH become deflationary after the Merge?

One of the most frequently-asked questions from the Ethereum Merge is whether the switchover will make ETH a deflationary currency.

One universal fact that almost every crypto market watcher will know is that Bitcoin is inherently deflationary. It has a fixed issuance schedule which is halved every four years and there is a hard cap of 21 million BTC that can ever exist. Ethereum is currently inflationary. There is no fixed cap on the number of ETH that can exist. New ETH are created every time a block is successfully mined, with the reward going to the miner.

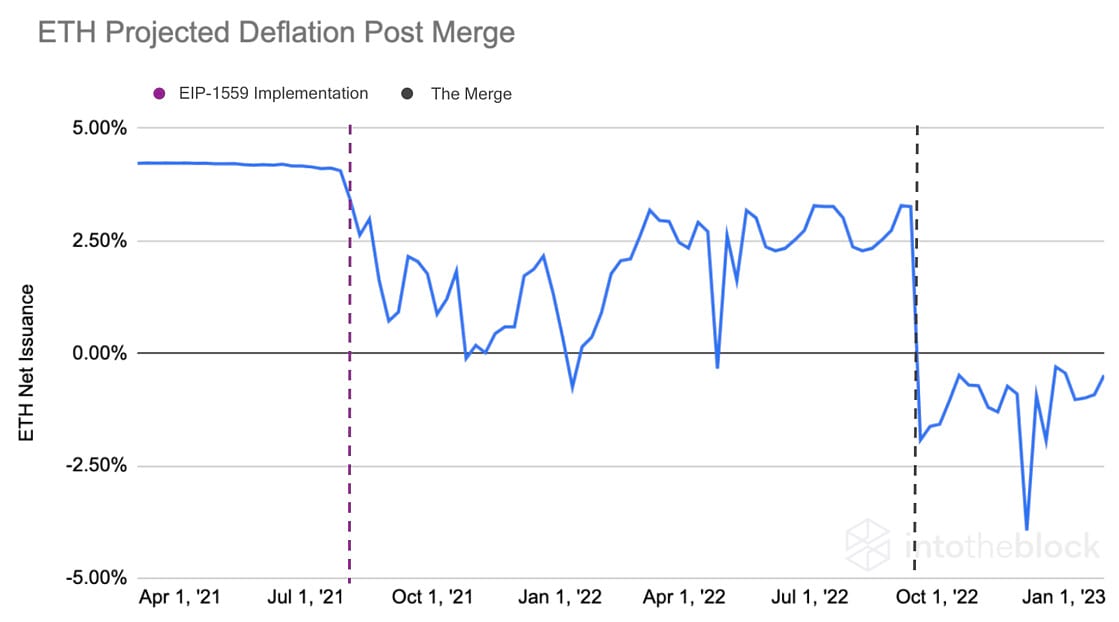

The decision to burn a portion of the ETH supply over time was introduced in EIP-1559, as part of the London hard fork.

This backwards-incompatible software update went live at Ethereum block 12,965,000, at around 1.15pm UTC on 5 August 2021.

The package of upgrades contained within the London hard fork made some major alterations to how the protocol calculated the transaction fees that should be paid to miners for mining blocks. Crucially, it smoothed out the fee volatility that has, at times, left the base layer incredibly congested.

London introduced a mechanism that programmatically ‘burns' (destroys) some of the base fees that are collected. When ETH is burned, it is removed from circulation permanently and effectively deleted from the ledger. Burning or destroying tokens is a format analogous to share buybacks in traditional equities.

Just as a public company might buy back its own shares, taking them out of the hands of market makers and thereby improving the price of the shares still left in public hands, blockchain protocols can set conditions where they burn, or automatically remove, tokens from their ecosystem.

How much ETH is being burned?

Every system that uses Ethereum also burns ETH whenever they perform an operation. That includes lending markets, decentralised exchanges, asset swaps, futures and derivatives markets, NFT traders or decentralised domain name services.

Just hours after London went live, the inventor of the Uniswap protocol, Hayden Adams, called EIP-1559 a “huge win”, and tweeted[26] that at current rates Uniswap alone would burn $1bn of ETH per year.

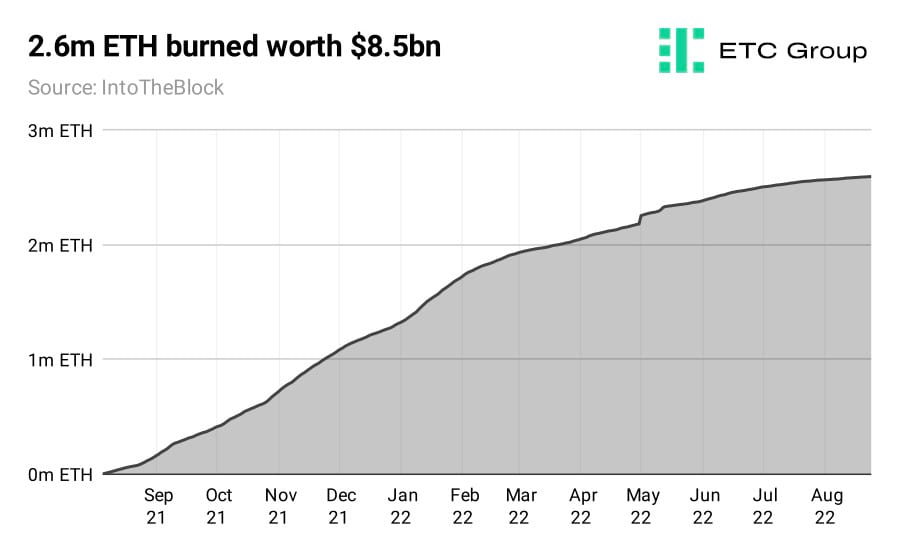

The total value of ETH removed from circulation reached $100m seven days after the hard fork and $500m within two weeks.

By mid-September, more than $1bn in ETH had been burned. These numbers are continuing to accelerate. In total to date more than 2.6 million ETH[27] worth $8.5bn has been excised from the Ethereum supply.

As of 25 August 2022, $15,300-worth of ETH is removed from circulation every minute, with more than 3.86% of the total ETH supply already burned through EIP-1559.

Using the blockchain explorer etherchain[28] we can see that as of 10 August 2021, 3.13 ETH (almost $10,000) was being burned every minute.

A year later, this figure had increased to 4.69 ETH per minute[29].

The fee market alteration idea[30] was first proposed by Vitalik Buterin and a five-strong team of developers back in April 2019. There followed over two years of intense trials on Ethereum's various testnet blockchains - effectively sandboxes for testing code changes in the wild - to ensure EIP-1559 would not have any unintended or unforeseen consequences.

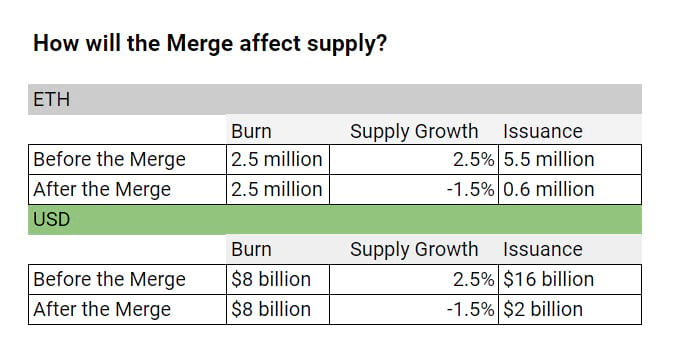

In this pre-Merge state, around 5.5 million ETH are scheduled to be issued each year, giving ETH an inflation rate or supply growth rate of around 2.5% per year.

Tracking data aggregator Ultrasound.money statistics[31], we can see that in a post-merge simulator, supply should fall to negative 1.5% annually post-Merge.

Issuance at that point - in theory - falls from 5.5 million ETH per year to just 0.6 million ETH per year. So yes, post-Merge, ETH should become deflationary.

There are of course other mechanisms that reduce the amount of ETH available to trade: staking is one of them.

13.3 million ETH now sit in the Ethereum staking deposit contract, providing investors with an unparalleled insight into the robust community support for Ethereum's switch to a Proof of Stake consensus mechanism. This smart contract is where users send their ETH to stake them on the network.

Post-Merge, Ethereum will become one of the largest deflationary currencies on earth. As such it provides a key narrative counterpoint to the rampant inflation consuming major economies.

- The amount of ETH issued post-Merge will drop by around 90%, as it will no longer be necessary to incentivise miners with ETH rewards to process blocks.

- More ETH will be burned than is issued, because more than 80% of transaction fees are burned and removed from circulation

- This suggests Ethereum inflation will fall to around -1.5% after the Merge is complete.

- Fees that are not burned will go to those staking ETH as validators, in order to encourage more validators to take part in securing the network. This makes it significantly more attractive to stake ETH than to not stake ETH.

It is difficult to understate the importance of the success of EIP-1559, or Ethereum Improvement Proposal.

This fee burn mechanism was intended to act as a counterpoint to Ethereum inflation, destroying the base fees paid for transactions to be included in the Ethereum ledger. So we see network effects writ large: the more Ethereum is used, the more useful it becomes.

Ethereum is no longer the only show in town, but it remains dominant among smart contract platforms.

Mid-Q4 2021 we heard from JP Morgan[32] that Ethereum could even be a better bet than Bitcoin in the long run, given that the blockchain is less susceptible to changes in central bank interest rates because it is not store-of-value focused.

“With Ethereum deriving its value from its applications, ranging from DeFi to gaming to NFTs and stablecoins, it appears less susceptible than bitcoin to higher [bond] yields,” analysts wrote.

Greener Ethereum

One of the key lines from the Ethereum Foundation which has entranced market-watchers is that Proof of Stake Ethereum will use approximately 99.95% less energy through its system of validators than it currently does with PoW miners.

How was this calculation made? Ethereum developer Carl Beekhuizen noted on the Ethereum Foundation blog in May 2021[33] that under Proof of Work, Ethereum daily energy use is around a third of Bitcoin's and under Proof of Stake it would fall to around 0.003GW per day.

The end of Proof of Work Ethereum means the end of the arms race for ever faster and more efficient mining machines. Instead, the task of validating transactions rests with those who have an economic stake in the network.

In effect, this means that PoS does not require extra computing power to prove trustworthiness, therefore reducing the overall energy consumption of the network substantially.

In Proof of Stake: nodes (also called validators) must show ownership of stake in the system to be able to add to the ledger of transactions.

In Proof of Work: nodes (also called miners) must solve computationally difficult tasks to gain the right to add to the ledger.

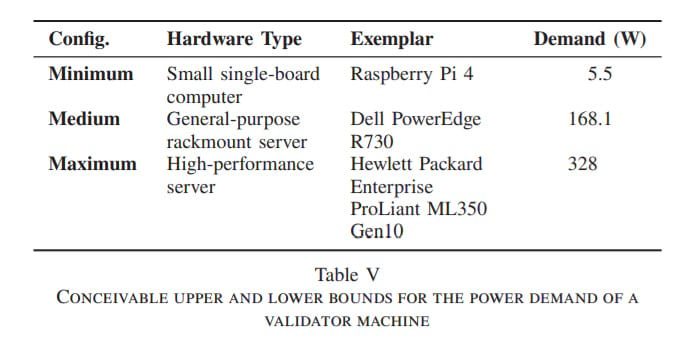

Research by UCL’s blockchain research centre[34] released in Q3 2021 suggests that because Proof of Stake tech allows a circumvention of the energy intensive problem-solving needed to mine Proof of Work blockchains, it is widely accepted that PoS chains require less energy consumption than PoW.

Also, “traditional blockchains with comparatively large numbers of validators running full nodes that verify every transaction, demand comparatively low-powered hardware.” So calculating Ethereum's post-Merge energy consumption will be a case of figuring out what the average hardware requirements are to stake on a particular chain.

ETHPoW Fork

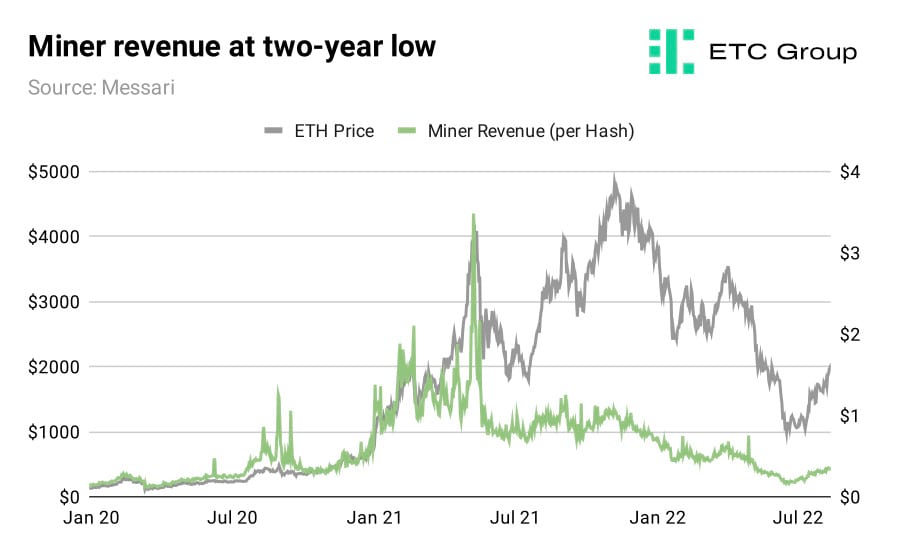

Mining ETH, just like mining Bitcoin, is big business, with more than 13,000 ETH[35] paid to miners every day. After the Merge, miners will be out of a job.

Vitalik Buterin always planned for Proof of Work to be turned off after the Merge. However, a wrench was thrown into the works by Chandler Guo, one of the world's largest and most powerful Ethereum miners.

Guo has led[36] efforts to create a Proof of Work fork of Ethereum that would be known as the ETHPoW chain. A cluster of exchanges like Poloniex[37], Huobi[38], and BitMEX[39] are supporting the proposed chain by listing derivatives tokens tied to it in the form of ETHW or ETHS futures.

To be clear: the ETHW token represents a potential stake in a blockchain that does not yet exist.

The economics of the situation become distinct when it is made clear that Tron co-founder Justin Sun[40] owns Poloniex. Tron is often called the “Chinese Ethereum” and is a logical competitor to the blockchain.

In a “Risk Alert” notice posted on Poloniex on 8 August, the exchange said: “The potential new chains arising from the uncertain Ethereum fork may not last long due to insufficient computing power or a possible lack of support from developers or community members. This may cause either of the forked futures tokens to lose value or be delisted from Poloniex.”

Major exchanges have not publicly expressed any willingness to list Ethereum fork tokens on their platforms.

It remains unclear how much grassroot support an ETHPoW chain has, or whether the flag bearers of this endeavour have the financial and technical aptitude to maintain it for the long-term. Vitalik Buterin has accused[41] exchanges listing forked products of “simply trying to make a quick buck” and underlined that the majority of the Ethereum community is in favour of the Merge.

It is important to remember that an ETHPoW network would divorce itself from Ethereum's thriving ecosystem of smart contracts, liquidity protocols, and decentralised applications. In effect, it is difficult to imagine Ethereum miners – underwater or otherwise – flocking en masse to a network devoid of any clear utility, value, or incentivisation structure.

GPU and ASIC-based mining computers set up to mine Ethereum can be used to support alternative chains, such as Ethereum Classic, Zilliqa, Ergo and Beam, but these chains are nowhere near as economically valuable as Ethereum.

Key network participants support Proof of Stake

The biggest mining pools, however, have recognised the Merge as a sign of the times and opted to evolve with the Ethereum blockchain. Ethermine and F2Pool will transform themselves from mining pools to Ethereum staking pools[42] that will serve the network's new Proof of Stake upgrade.

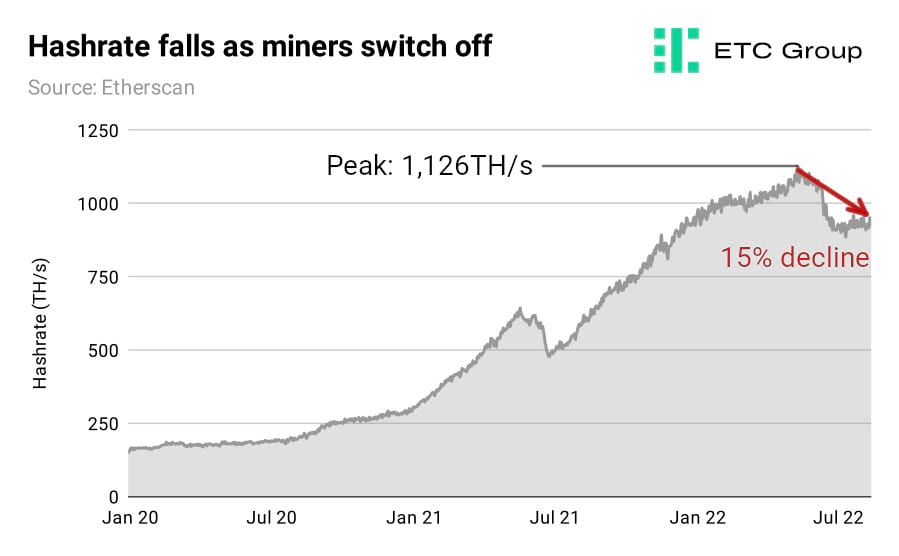

Ethermine is by far the largest Ethereum mining pool globally, with 228,000 miners using the service, generating over 260 TH/s: almost a third of all Ethereum Proof of Work hashrate. Hashrate is a measure of the computing power used to secure a blockchain.

Ethermine said it would not support any PoW forks of Ethereum, and that its pool would switch to “withdraw-only mode” after the Merge.

In a statement[43] the mining pool said: “After seven long years of research and development, the mining phase of Ethereum will come to an end. After this date it will no longer be possible to mine Ether on the Ethereum network using Graphics Cards (GPUs) or ASICs. As a consequence of this transition, the Ethermine Ethereum mining pool will switch to withdraw-only mode once the Proof of Work mining phase has ended. An accurate countdown timer will be available…You can continue to mine Ether until the countdown has reached zero.”

Chainlink, another key Ethereum service, has also said it will not support[44] any Proof of Work forks. Chainlink is a price oracle that provides real-time price data to smart contracts, ensuring that prices listed on decentralised exchanges are correct and up to date.

On 9 August Circle confirmed what most had suspected: it would not support ETH PoW forks.

Circle's USDC stablecoin, pegged 1:1 against the US dollar, is not only the largest dollar-backed stablecoin on Ethereum, but the largest ERC-20 asset overall, with a $45bn market cap.

As such it creates the kind of critical financial plumbing that keeps operations running smoothly on Ethereum and allows myriad services and decentralised exchanges to function correctly.

Tether, the issuer of USDT, the second largest US dollar stablecoin, said in a 9 August announcement[45] that it is “important that the transition to [Proof of Stake] is not weaponized to cause confusion and harm within the ecosystem. For this reason Tether will closely follow the progress and preparations for the event and will support PoS Ethereum in line with the official schedule.”

Reality is setting in, albeit slowly. From a peak hashrate of 1,126TH/s in May 2022, Ethereum hashrate has declined to 948TH/s, a drop of around 15.8%.

The Fate of Ethereum Miners

The Merge brings with it an existential crisis for Ethereum miners. They will no longer be needed to maintain the health of the Ethereum network. It is estimated that a million miners[46] will be impacted by the change that will leave them deprived of their primary or secondary sources of revenue.

Miners also face being saddled with expensive and potentially redundant mining equipment as Ethereum transitions away from Proof of Work. Ethereum miners have spent around $15 billion[47] on graphics processing units (GPUs). The hardware that allows them to earn rewards from validating transactions on Ethereum's blockchain.

This has already been a costly year for miners that have seen their balance sheets corrected by the steep incline in energy prices and crashing value of ETH. The slide in mining revenue has been compounded by a climbing hashrate – representing new miners joining the network and competing for profits.

The prospect of shutting down operations will distress new miners that have committed capital to large mining farms most as they will find it difficult to recover their investment.

Miners that choose to re-sell GPUs – but also auxiliary equipment like cabling, transformers, and coolers – will have to do so at a discount. Prices for mining equipment on the secondary market began to fall[48] shortly after representatives of the Ethereum Foundation announced tentative dates for the Merge. The influence of the news on the Ethereum network hashrate is already apparent.

Mining pools with vested interests in the sustained employment of GPUs and ASICs have looked to facilitate the crossover from Ethereum to Ethereum Classic[49]. The mining platform AntPool has earmarked $10 million[50] to invest in the Ethereum Classic ecosystem and ostensibly lure market participants toward it.

Why not just support Ethereum Classic?

There is already an alternative Proof of Work version of Ethereum live today. It is the original chain from Ethereum's 2016 hard fork, and is called Ethereum Classic.

Just as with Bitcoin and Bitcoin Cash in 2017, Ethereum split into two distinct chains in 2016 because of a major set of disagreements between core developers as to how the blockchain should be upgraded in the future.

There is no golden parachute planned for miners being ejected from the Ethereum network but there may be a soft landing for them yet. Ethereum mining is dominated by GPUs that can easily be reconfigured to mine less popular Proof of Work cryptoassets like Ethereum Classic (ETC), Ravencoin (RVN), or Ergo (ERG)[51].

But generating these digital assets in place of ETH is far less profitable for miners because of the limited user adoption and value synonymous with smaller cryptoassets. The market cap of Ethereum is 40 times that of Ethereum Classic[52] and 600 times the size of Ravencoin[53].

DeFi-focused news outlet The Defiant write[54]: “The Ethereum Classic token ETC has climbed in value by 174% since 13 July, as investors and traders speculate that the Merge will redirect a significant portion of hashing power to the Proof of Work chain, the path of least resistance.”

Critics suggest that development and dapps on Ethereum Classic are broadly lagging the rest of the market. The chain does not appear in Electric Capital's seminal annual Developer Report, which tracks the number of Web3 and decentralised app development ongoing throughout the blockchain sector.

Even Bloomberg call Ethereum Classic a “throwback token”[55], and a “desperate effort” to maintain a dying chain.

Nevertheless, Ethereum Classic could be one of the biggest winners from the Merge if it attracts even a portion of the mining community dedicated to the Ethereum network. Vitalik Buterin has advised[56] individuals with “pro-Proof of Work values and preferences” to migrate to Ethereum Classic because it has a “superior community and superior product.”

There is evidence that some miners have already moved over to Ethereum Classic. The network's hashrate has raced to a record high[57] of 42 hashes per second (H/s) – rising 50% since July. Ethereum Classic will become the second-largest Proof of Network network after Bitcoin once Ethereum completes the Merge.

There are some very powerful groups with a large economic incentive for Ethereum to continue as a Proof of Work blockchain: it remains a source of much consternation that miners may not just go quietly into the night, but instead fight for their claim on the future of Ethereum.

Post-Merge Outlook

It is one thing - in crypto and in business more broadly - to make bold promises, and quite another to deliver.

The bull case for Ethereum will be familiar to most readers: a massive reduction in issuance due to miner deprecation, plus staking continuing at its current levels and participants seeking stable yields, along with continued ETH burn via EIP-1559, making ETH one of the world's largest deflationary currencies post Merge.

The question for investors is: how much of the Merge has been priced in already?

Long ETH is a very crowded position and we can see from the kinds of leveraged liquidations there has been a general shift away from short liquidations to long liquidations in the past few weeks.

However, with Ethereum as the infrastructural base of Web3, plus the fact that it has by far the largest number of developers working on it, and by far the largest number of dapps and services connected to it, means the long-term value case for ETH has not changed.

20% of all active Web3 developers are working on Ethereum. So there remains significant potential for the revenue produced by Ethereum to rise far beyond today's $10bn figure. With staking enabled and both retail and institutional investors seeking yield, that makes Ethereum potentially the most secure blockchain on the market.

The bear case for Ethereum post-Merge is a question of how the chain differentiates itself from its Layer 1 competitors. We know that Solana, BNB Chain and Avalanche are snapping at Ethereum's heels, but each has a very long way to go to even come close to Ethereum's level of market penetration, or even to attract the number of developers willing to spend their time - mostly uncompensated - to work on improvements.

Proof of Stake is a system much more recognisable to Wall Street and to institutional investors than Proof of Work, with ETH as a viable yield-bearing asset akin to a dividend stock. The yield on staked ETH has remained steady at around 4% throughout the bear market, but traders are betting on that variable yield increasing to as much as 8%[58] post-Merge.

Institutions will have to weigh the illiquidity issue carefully: tokens will only be able to be unstaked with the Shanghai hard fork, coming around March 2023 by Vitalik Buterin's best guess. So the opportunity cost of parking funds in Ethereum for six months (while still earning yield) is a calculation going on at institutions around the world.

From its inception, Bitcoin took eight years to amass a $200bn market cap. Ethereum achieved that feat in less than six. With its mass-market applications experiencing rapid growth, upgrades creating a deflationary formula, and wider structural improvements just weeks away, the potential for Ethereum's market value to overtake that of Bitcoin seems closer than ever.

Ethereum today is much improved from where it was just a few short years ago. And yet by its own co-creator's estimation, the blockchain is only 40% complete. Post-Merge, the Ethereum blockchain will be around 55% complete, with four major research and development cycles still to come. In terms of its usability, scalability and internal economics, there is still much to do.

But investors are starting to consider Ethereum for what it really is. Not a static asset or simple currency, but a constantly evolving base layer upon which thousands of applications and services - both financial and non-financial - are built. It is here where Ethereum's true value and use case starts to become clear.

Notes

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

En

En  De

De