- Bitcoin sold off more than -10% yesterday after a speculative research note suggested that the SEC might reject the ETFs in January

- Our in-house Cryptoasset Sentiment Index still remains elevated following yesterday’s sell-off

- However, the latest developments indicate no material change with respect to a potential approval of the spot Bitcoin ETFs in the US

Sentiment Check

Is the SEC rejecting the Bitcoin ETFs in January?

Bitcoin has sold off more than -10% during yesterday’s trading session. Market participants have attributed the most recent sell-off to a weekly research note

by Singapore-based crypto service provider Matrixport that suggested that the SEC might reject all ETF applications in January.

The curious thing about Matrixport’s research note is that Matrixport published a rather contradictory daily research note on the very same day that suggested that an ETF approval is imminent. Many pundits have therefore suggested that Matrixport may have tried to manipulate the market for unknown reasons.

Nonetheless, as a result, there were massive futures long liquidations in Bitcoin futures market which accelerated the decline in prices. According to data provided by Glassnode, yesterday saw more than 109 mn USD in futures long liquidations across major futures exchanges. Most of these liquidations happened on Binance which is mostly dominated by retail investors.

It is important to highlight that, despite the sharp spike in futures long liquidations yesterday, Bitcoin futures open interest on the Chicago Mercantile Exchange (CME), which is populated with institutional investors, hit a fresh all-time in BTC-terms.

So, institutional investors even appear to have increased their overall Bitcoin exposure into the most recent sell-off. CME is currently the biggest Bitcoin futures exchange based on open interest.

However, we still saw significant reversals in key on-chain and derivatives metrics yesterday:

Perpetual funding rates for Bitcoin perpetual contracts across major exchanges reached -1.3% on an intraday basis yesterday - one of the most negative readings ever recorded.

Bitcoin’s futures basis rate reversed sharply as well from an intraday high of above 22% p.a. to around 16% p.a., at the time of writing.

Futures long liquidations in Bitcoin futures spiked to 82 mn USD in a matter of only 10 minutes during yesterday’s sell-off.

Short-term holder spent output profit ratio (STH-SOPR) declined below 1 to the lowest reading since October 2023 suggesting that “weak hands” spent coins on average at a loss which is a sign of short-term capitulation.

We have certainly seen that movie before. The abovementioned metrics usually imply seller exhaustion in the short-term and therefore limited downside risk but there is more to it.

What’s next?

Although the Matrixport research note appears to be one of the major catalysts of the sell-off, the market was generally ripe for a correction as sentiment was elevated heading into the potential ETF approval by the SEC.

We have also highlighted this in our weekly research note published ahead of the Christmas holidays here.

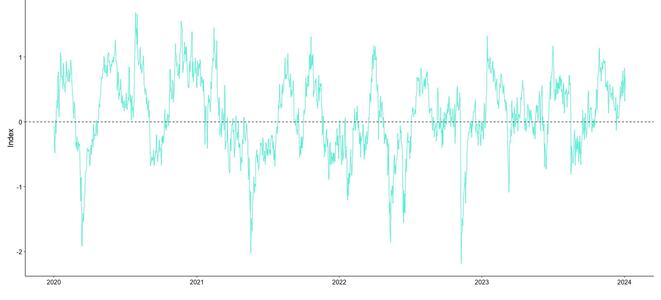

That being said, our in-house Cryptoasset Sentiment Index still remains elevated despite the most recent sell-off (see above).

The reason is that we have not seen clear capitulation in broader segments of the market such as low realized losses and many derivatives traders were quick in increasing their exposure massively after the sell-off again.

For instance, BTC perpetual funding rates have increased significantly following yesterday’s sell-off which implies an outsized imbalance between demand and supply for perpetual futures contracts on Bitcoin again.

All in all, the market still appears to be a bit frothy in the short-term based on our in-house Cryptoasset Sentiment Index.

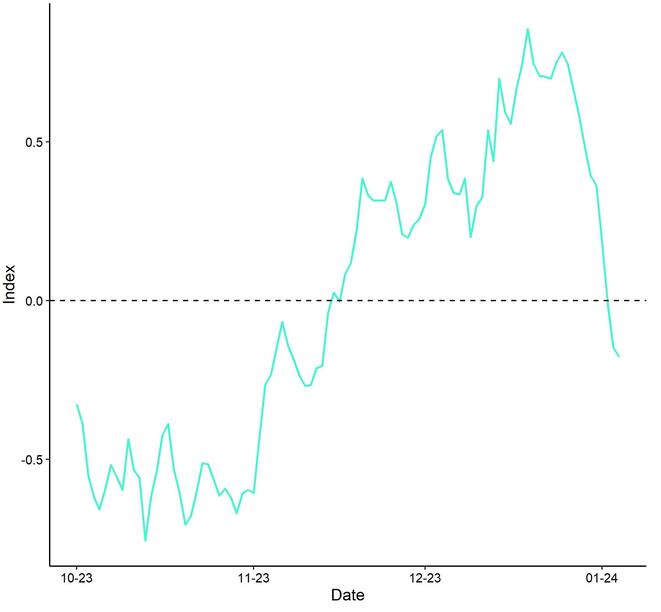

In the broader macro context, we have been observing a general decline in market sentiment in traditional financial markets that appears to have accelerated since the Christmas holidays. This can be seen in our Cross Asset Risk Appetite (CARA) index which measures traditional market sentiment across equities, bonds, commodities, and FX.

This general decline in TradFi market sentiment could also affect Bitcoin and cryptoassets negatively in the short term if correlations reassert itself. In general, changes in traditional cross asset risk appetite tend to be correlated with changes in cryptoasset performances.

That being said, any further weakness is potentially a good opportunity to increase exposure ahead of the ETF approvals and, above all, the Bitcoin Halving anticipated in April 2024.

We have formulated a fairly optimistic outlook for 2024 based on these factors and many others in our latest ETC Group 2024 Outlook as well.

Concerning the prospects of an ETF approval in the US, after yesterday’s sell-off, many ETF experts expressed that there was no material change in their expectation regarding an ETF approval in January.

To the contrary, we have even received more evidence throughout the day that point into that direction.

For instance, the SEC held meetings yesterday with the New York Stock Exchange, Nasdaq, and Cboe to finalize comments on spot Bitcoin ETFs. Moreover, Fidelity filed a registration of securities for its spot Bitcoin ETF with the SEC.

It is still assumed that the SEC might notify the applicants of an approval this Friday already.

Furthermore, Grayscale’s Bitcoin Trust (GBTC) is still trading at a NAV discount of only -8.1% per yesterday’s close which implies a probability of approval of around ~92%.

So, market participants have not adjusted their expectations of an ETF approval significantly either.

Bottom Line

- Bitcoin sold off more than -10% yesterday after a speculative research note suggested that the SEC might reject the ETFs in January

- Our in-house Cryptoasset Sentiment Index still remains elevated following yesterday’s sell-off

- However, the latest developments indicate no material change with respect to a potential approval of the spot Bitcoin ETFs in the US

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.