On a total return basis, as well as a risk-adjusted basis, Bitcoin crushed every other asset into the dust in January 2023.

Bitcoin’s January return of 39.63% was its second-best start to a year since 2013, years before the asset became widely-known and at least half a decade before it was widely traded by institutions.

It is clear that institutional confidence in crypto returned in force in January, followed by a healthy dose of FOMO, or Fear of Missing Out, by retail participants shocked into action by soaring prices.

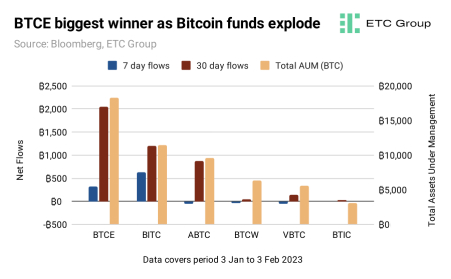

And ETC Group’s BTCE was the biggest winner of the recent pick up in institutional interest in cryptoassets.

2,044.1 BTC flooded into the 100% physically-backed ETC Group Physical Bitcoin (Ticker: BTCE) in the 30 days to 3 February 2023, the largest amount entering a Bitcoin exchange traded product (ETP) in Europe across the period.

That shift spiked the ETP’s total assets under management (AUM) by $154.8m to $432.1m. In native units, BTCE has an AUM of 18,281.3 BTC.

It now makes BTCE the largest physically-backed Bitcoin investment product in Europe by AUM. If synthetic notes like CoinShares’s COINXBT are included in the calculation, BTCE is Europe’s second-largest by AUM and just 2,117 bitcoins would stand between BTCE becoming the region’s largest Bitcoin ETP.

Additionally, In the seven days to 3 February, another 316.7 BTC flowed into BTCE, the largest amount among physically-backed European Bitcoin funds.

Synthetic vs Physical

Physical ETPs like BTCE replicate the price performance of Bitcoin by physically holding BTC with a third party custodian in cold storage. Synthetic ETPs instead rely on derivatives called swap agreements with counterparties — for example crypto asset lending platforms — to do the same thing.

In the seven days to 3 February, physically-backed Bitcoin ETPs were the biggest winners in terms of inflows, while synthetic ETPs underperformed the market.

The two lowest-performing European funds, with net outflows of 38 BTC (€805k) and 26 BTC (€551k) respectively, are both synthetic Bitcoin ETPs: Bitcoin Tracker One and Bitcoin Tracker Euro.

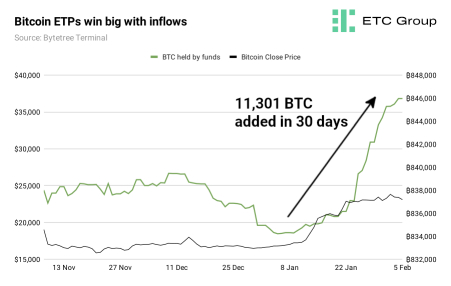

In total, according to Bytetree data, global Bitcoin investment products saw a total of 11,301 BTC of net inflows, worth $260m, between 3 January and 3 February.

The basis trade is back on

The closest thing to a risk-free trade in Bitcoin — trading the basis with futures — also spurred flows over recent weeks, according to data surveyed by ETC Group.

This popular arbitrage strategy sees traders buy spot Bitcoin (or a highly liquid associated product like BTCE), while simultaneously selling long-dated Bitcoin futures, collecting ‘risk-free’ premium.

Because of its liquidity profile, BTCE has become the instrument of choice for hedge funds and other institutions making this type of trade.

The latest available data from Deutsche Borse XETRA, one of the seven European stock exchanges on which BTCE trades, shows that the physically-backed Bitcoin ETP was the third-most traded exchange-traded product among across December 2022, with an order book turnover more than three times larger than the next crypto product.

Only WisdomTree’s daily leveraged and short NASDAQ funds traded more volume on XETRA across the month.

Crypto ETPs are still opening despite bear market

The number of crypto ETPs rocketed by 50% in 2022, showing a market of growing depth and interest even as the price of Bitcoin dropped by 66% and the total market cap of all cryptoassets dived from a high of $3 trillion to under $1 trillion.

162 crypto ETPs were available as of 31 December 2022, compared to 109 on 1 January 2022. From a market structure perspective this is one of the most bullish long-term trends to note.

But not every Bitcoin ETP is equal. Far from it. As suggested in ETC Group’s recent report Why Structure Matters in Crypto ETPs, investors are opening themselves up to potential hidden risks if they buy uncollateralised or synthetic products, or those that allow their products to lend out Bitcoin or other cryptoassets as part of the package.

Despite the growth of the Bitcoin ETP market, the structure of some of these products exposes investors to concealed risks. These include increased counterparty risk in those products that allow lending or ‘sweating’ of assets, as well as market risk from those products that are synthetic, rather than physically-backed.

BTCE’s structure does not allow the fund to lend out its underlying assets, and investors have a legal claim to the Bitcoin backing it, should the issuer go out of business.

BTCE’s structure also differs from Grayscale’s GBTC Bitcoin Trust. That is a closed-ended fund.

Because of this structure. $14.5bn in Bitcoin is unable to leave GBTC, and the US market regulator, the SEC, has repeatedly denied the company’s attempts to convert the fund into an ETF. As of 6 February 2023 the Net Asset Value (NAV) of GBTC shares are now worth 43.06% less than the Bitcoin in the fund.

By contrast, BTCE and other open-ended funds allow for creation and redemption of shares, which allows Bitcoin to both leave and enter and keeps the NAV tightly tracking the actual price of Bitcoin.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.