Executive Summary

- Buoyant markets pass $1.1T: crypto soars amid banking crisis

- BTC, ETH outperform every stock market, all commodities

- Fed restarts QE by stealth: Bitcoin, gold benefit

- Citi: Billions of users, trillions in blockchain value by 2030

- Miners gain as hashprice, Ordinals soar

- Just weeks until Ethereum unstaking problem is solved

- Binance hit by CFTC regulatory bombshell; US splits from Europe

1. Overview

With the first quarter of the year now drawn to a close, there has been a huge amount of upheaval for investors to parse. But after a torrid and troubling 2022, it is clear that - in crypto markets at least - bullish sentiment has returned in force.

March was a particularly positive month for crypto and blockchain markets. There was the US banking crisis to digest, with seismic central bank decisions ripping through global markets, sending Bitcoin to $28k and beyond and pulling the total crypto market cap to the edge of $1.2 trillion, its highest point since June 2022.

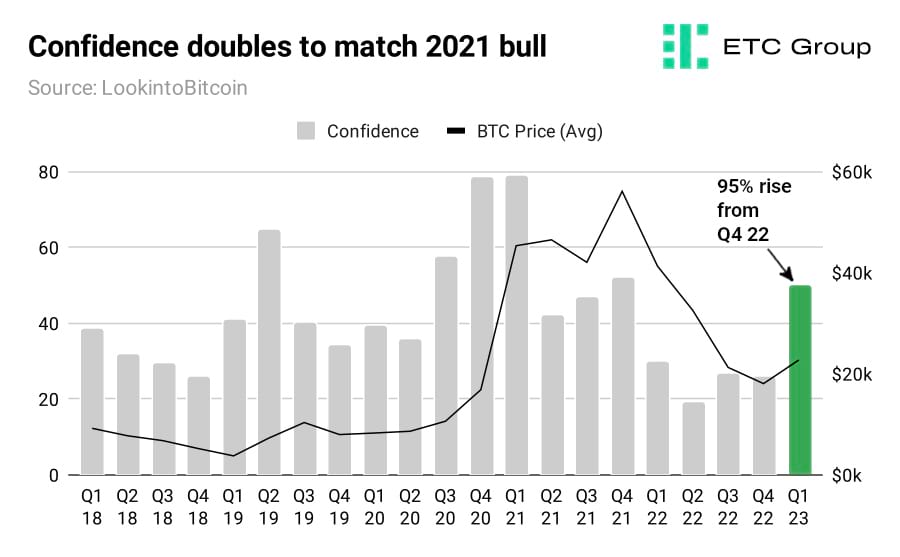

Data gathered and aggregated by ETC Group since 2018 reveals one particularly intriguing statistic.

We take the Fear and Greed Index as a proxy for confidence in Bitcoin markets and note that there was a 95% rise between Q4 2022 and Q1 2023. This metric apes the classic Warren Buffett quote that contrarian investors can make their best gains by being “fearful when others are greedy, and greedy when others are fearful”.

It uses asset volatility, relative 30-day and 90-day price momentum, social media and search sentiment along with Bitcoin market dominance to assign a score as to whether investors are relatively fearful or ready to deploy capital into crypto.

With the aggregate F/G score now over 50, these are levels not seen since the bull run of 2021, which saw Bitcoin reach its all time high of $69k.

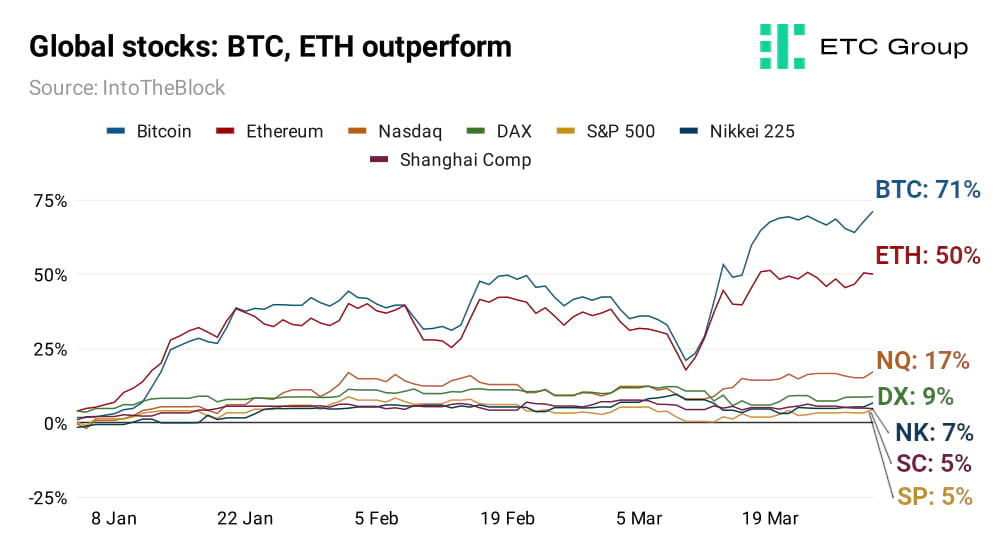

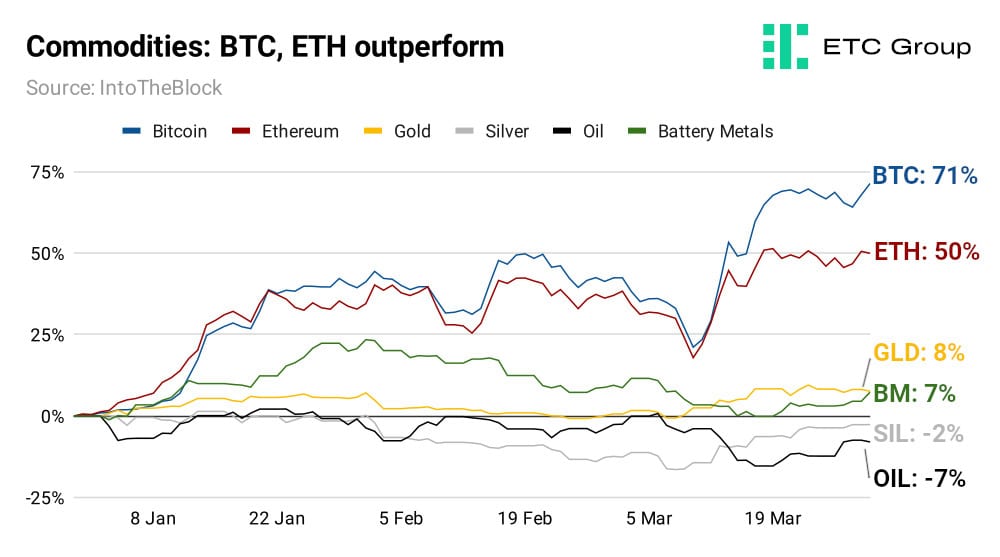

Bitcoin and crypto do not exist in a vacuum. So it is additionally useful for investors to see how blue-chip cryptoassets performed against other standard portfolio diversifiers and alternative assets.

Between 1 January and 31 March 2023, both Bitcoin and Ethereum outperformed the S&P 500, Germany's DAX 40, the Nasdaq, the Shanghai Composite and the Nikkei 225 by a factor of between three and 10.

Similarly, since the turn of 2023 the two largest cryptoassets have produced returns far in excess of gold, silver, oil (using the US oil fund as a proxy) and battery metals (using the Global X Lithium & Battery Tech ETF as a proxy).

Gold returned 8% across the period, while silver produced minus 2% returns. Ethereum saw gains of 50.5%, while Bitcoin led the pack with a gargantuan 71% increase.

Bitcoin's performance in Q1 2023, with its market cap now standing at $542bn, represents the asset's best quarterly performance in two years. One of the most significant drivers behind the rally is the expectation that central banks will be forced to reverse their historically-aggressive rate hikes with recession looming, a theory backed by the downfall of three US banks in particularly short order.

Investors are now facing a unique macroeconomic environment characterised by tightened monetary and financial conditions, exceedingly high volatility and inflation fears still in the background.

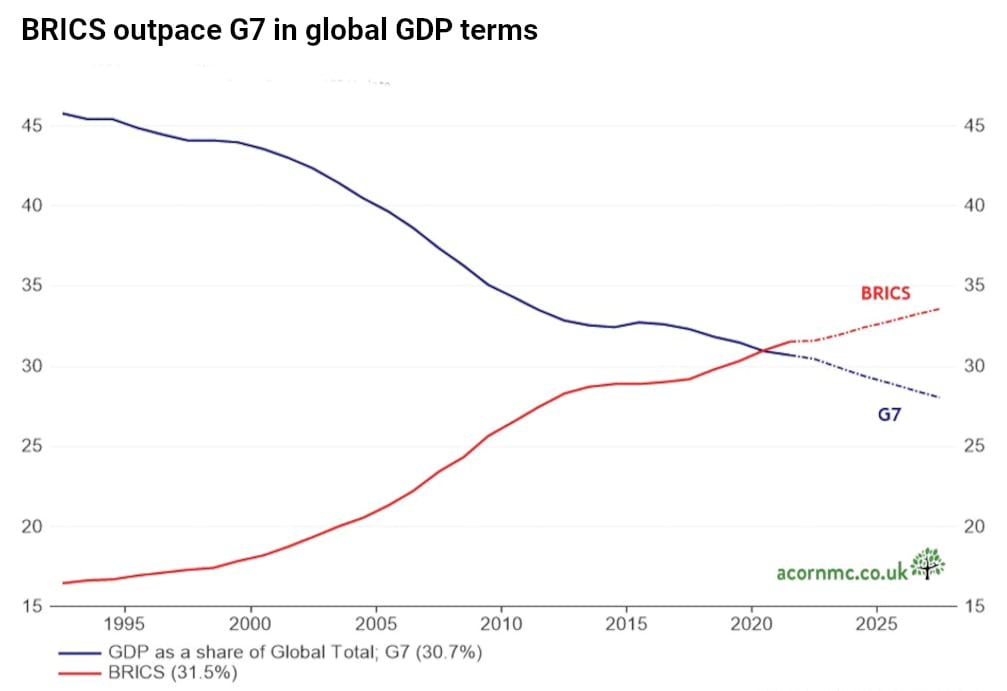

On a wider scale it is becoming increasingly common to see the argument that there is both a changing market order, and a changing world order for investors to grapple with.

One chart posted on Twitter from Acorn Capital Management suggested that in late March 2023 BRICS countries (Brazil, Russia, India, China and South Africa) finally overtook the G7 (Canada, France, Germany, Italy, Japan, United Kingdom, and the United States) in terms of their share of world GDP.

BRICS countries now contribute 31.5% of global GDP, compared to the G7's 30.7%, the research suggests.

This is a generational shift that columnists have long feared. It speaks to the desire by the United States to contain crypto innovation rather than to support it, and is perhaps why companies like Coinbase have been so fervently courting growth markets in Europe, Brazil and elsewhere.

Trillions of value in blockchain: Citi

In other news, Citi released their widely-covered ‘Money, Tokens and Games' report suggesting an 80x increase in the market value of tokenised securities over the next seven years.

“We forecast $4 trillion to $5 trillion of tokenised digital securities and $1 trillion of distributed ledger technology-based trade finance volumes,” analysts wrote.

“Unlike automobiles or more recent innovations like ChatGPT or the Metaverse, blockchain is a back-end infrastructure technology without a prominent consumer interface, making it harder to visibly see how it could be innovative. But we believe we are approaching an inflection point, where the promised potential of blockchain will be realised and be measured in billions of users and trillions of dollars in value [our emphasis]”.

This tallies with ETC Group's long-running prediction that there will be broad abstraction of blockchain: that we expect to see more projects and products released where the end-user does not necessarily know that there are digital assets and blockchains running in the background.

The first sign of this was the corporate integration of Ethereum NFTs in 2022 by the likes of Reddit and Starbucks that never once mention non-fungible tokens.

Bitcoin miners gain as fees climb 128%

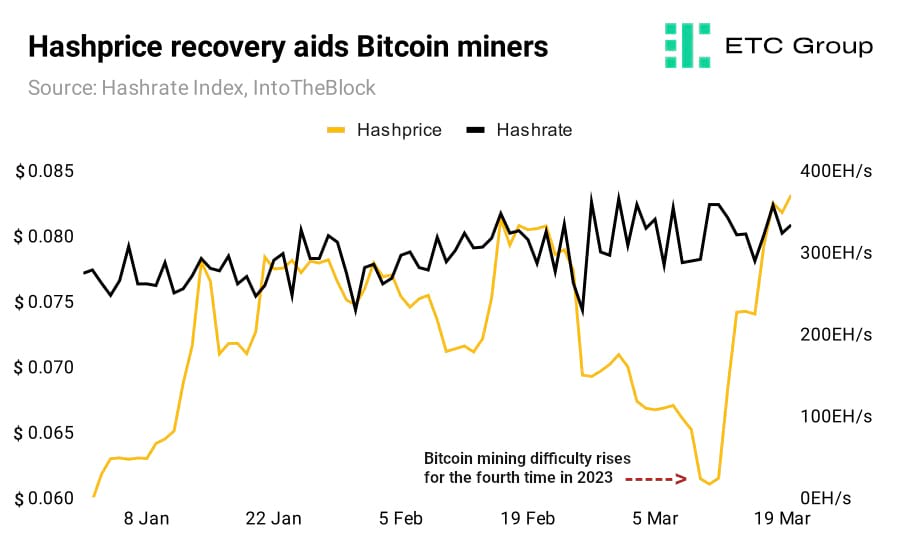

Bitcoin miners are back in profit after a long, cold Crypto Winter. Miners have benefited from rising prices for their underlying commodity and the commensurate spike in stock prices, while at the same time making gains from the 40% year-to-date increase in hashprice.

Hashprice is defined as the revenue that Bitcoin miners can earn for every unit of energy spent on processing blocks of transactions. The metric climbed from $0.059 per terahash at the start of 2023 to $0.083 per terahash as of the end of March.

At the same time, the price of 1 bitcoin rose by more than 70%, from $16,605 to over $28,000, offering much improved profit margins for those selling BTC into open markets.

The cost of miners' BTC production depends on three main variables: the speed of their hardware, the Bitcoin network's mining difficulty (which automatically adjusts up or down depending on how many machines are mining), and the cost of electricity.

The effect of climbing prices has added much-needed support to one of the sections of the crypto market that has struggled the most in recent months. The two largest publicly-traded Bitcoin miners by market cap, Marathon Digital Holdings (NASDAQ:MARA) and Riot (NASDAQ:RIOT) have seen their share prices rocket by 150% and 130% in the year to date.

The current market cycle has resulted in the bankruptcies of big name miners and hosting providers, including Core Scientific and Compute North, as well as many companies facing painful debt restructuring plans. Some miners which managed to cling onto their mined BTC throughout the 2022 Crypto Winter are now having to cash in, given rising opex costs, rising interest rates and turmoil in the banking sector.

In light of this, Bitcoin miners that maintained a 100% HODL strategy - where they attempt to sell zero bitcoin mined - are finding it difficult to keep to this philosophical aim. Hut 8 (NASDAQ:HUT) became one of the last holdouts to yield to market pressures when it sold 188 BTC in February.

With Bitcoin's hashrate 27% higher year to date - hitting an all time high of 400 exahash per second (EH/s) in late March - mining difficulty is also more challenging than ever before. Bitcoin network difficulty refers to how hard it is (and therefore how long it takes) for miners to solve block puzzles by directing energy towards the process. Difficulty has jumped by 23% in 2023 so far, heaping additional pressure on miners.

So the addition of new and extra revenue sources for miners have come as welcome relief.

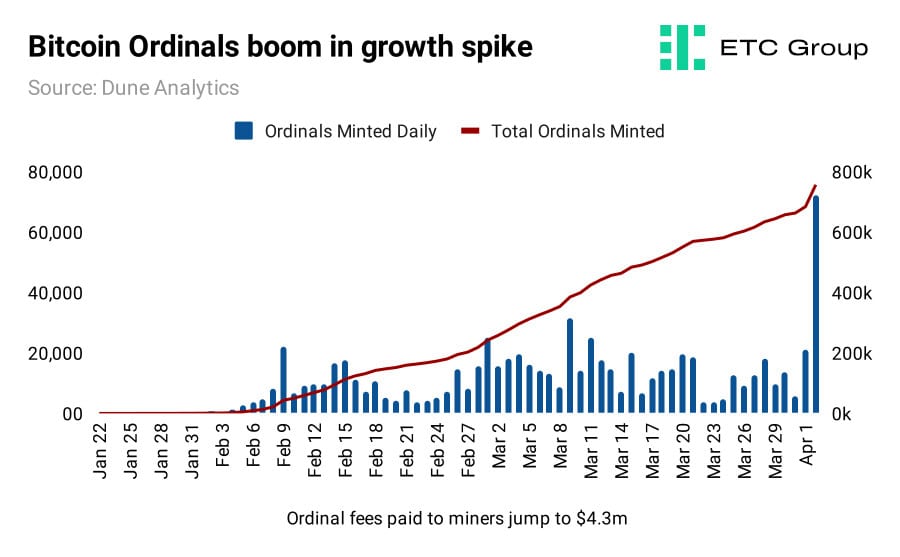

Bitcoin Ordinals are the blockchain's own version of NFTs, and are a new asset type previously thought impossible to produce on the original blockchain due to its data structure and limits in its scripting language.

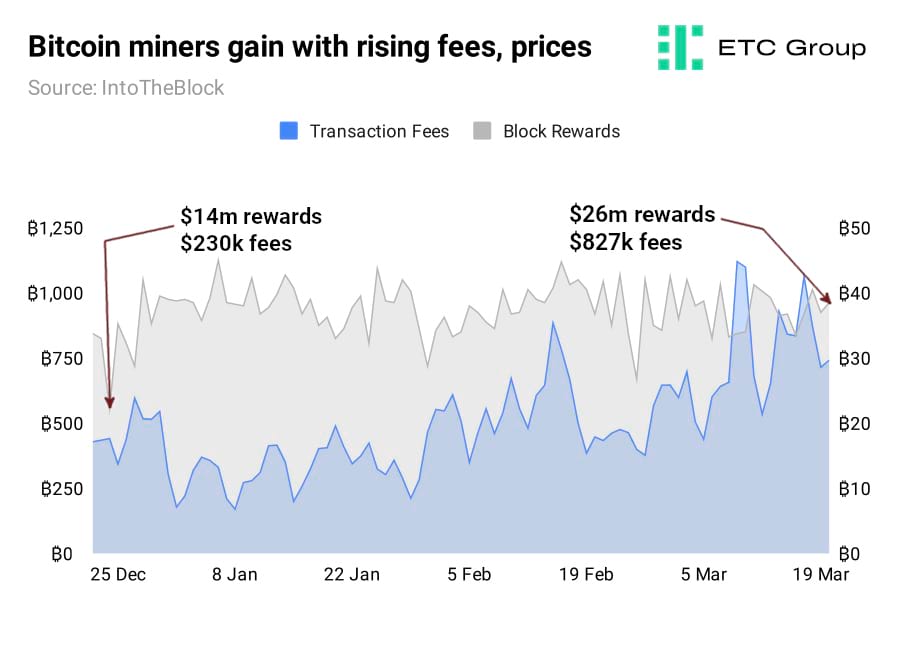

Since their creation in January 2023, there has been a marked increase in transaction fees paid to miners. As a snapshot, a review of the data shows that Bitcoin users paid $230,210 to miners in fees as of the end of December 2022, compared to $827,050 as of 20 March 2023.

And the average fees paid to miners jumped by 128% from 12.97 BTC in January to 29.7 BTC in March, ETC Group analysis shows.

The introduction of NFT-like assets on the Bitcoin blockchain has not only enthused a new wave of developers but also brought forward an enticing new revenue stream for miners hyper-focused on block rewards.

Data from Dune Analytics shows that more than 750,000 Ordinals have been created as of 3 April 2023, producing more than $4.3m (₿155) in new revenue for Bitcoin miners.

Ordinals have also taken another growth leap forward since the February 2023 publication of the Digital Assets and Metaverse Monthly Review.

The expansion rate of the new asset type has ballooned and Ordinals are on a fast track to 1 million inscriptions. Over 70,000 Ordinals were created in one 24-hour period at the end of March, more than double the highest number yet minted.

The Bitcoin hashrate hit 400 EH/s (400 million TH/s) for the first time in March, a new record all time high, and a signal that miners are coming back online amid higher prices for the commodity.

And after much fear and heightened M&A attempts, Bitcoin miners like Stronghold are now lifting their guidance for the end of the year.

As Dylan LeClair and Sam Rule point out for Bitcoin Magazine Pro: “Hashrate has been following the surge in price, which is the likely result of more machines coming online at a more profitable price point. In 2022 there was a lot of unused, newer inventory of ASICs that sat idle at lower bitcoin prices and have now made their way onto the network…most notably in companies like Marathon Digital Holdings and Riot.

Surging hashrate is likely due to the result of capex decisions made months ago which are now materialising after a time lag, the analysts write. Research by Miner Mag also suggests that US crypto mining companies have been drastically expanding the import of machines since January which is contributing to higher hashrate and a more secure Bitcoin network.

Altcoins get buzzy

Some interesting data is starting to come through in the area beyond the top two digital assets by market cap.

While Bitcoin and Ethereum account for nearly 65% of the total crypto market cap, this does not mean by any stretch that there is a lack of interest or innovation happening further down the market cap tree.

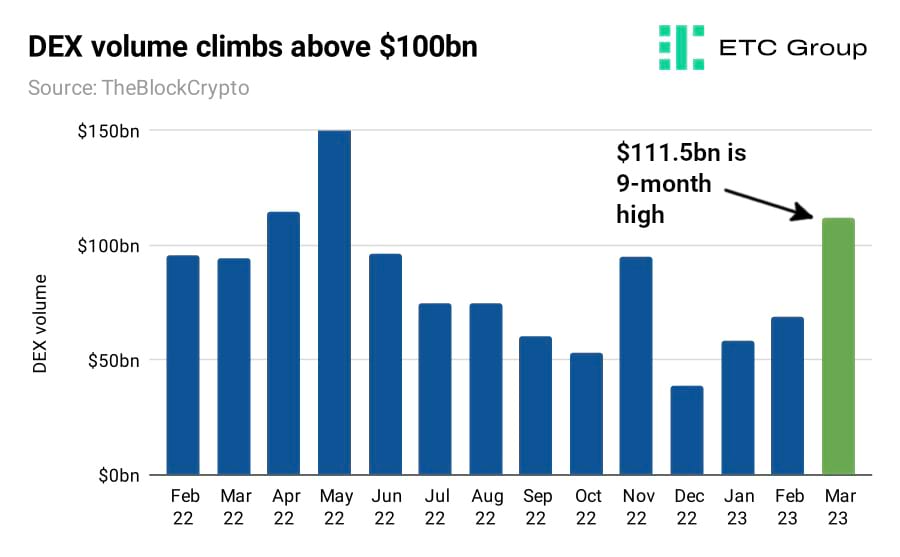

This recent trend is most easily represented by the growth of decentralised exchange volume to over $100bn for the first time since June 2022.

Decentralised exchanges (DEXs) allow users to swap digital assets without the need for a market maker offering both sides of a trade, nor a centralised order book. Decentralised exchanges do not hold or custody user assets, unlike centralised digital asset exchanges.

Volume across all decentralised exchanges hit a nine-month high in March 2023, with Uniswap again emerging as the largest player. Uniswap has its own governance token UNI which allows users to vote on who should receive trading fees, and in what proportion.

UNI is currently the 20th largest digital asset, with a fully diluted market cap of $6bn.

In every crypto market cycle to date, capital has flooded into Bitcoin and Ethereum before those assets find a pause level, after which capital rotates into altcoins further down the market cap list. As such, and with the top two coins finding stability at $28k and $1.8k, we would expect coins in the top 20 to start receiving some new flows with more upside at hand.

Basket products are often the best way to gain cross-asset exposure in stocks, bonds, and commodities. The same applies to cryptocurrencies. To this end, ETC Group is launching the first ever digital asset ETP based on an MSCI Index.

The index comprises the top 20 digital assets by market cap; excluding stablecoins, memecoins, privacy coins, and exchange tokens. It includes leading cryptocurrencies like BItcoin, Ethereum, Avalanche, Polygon and Solana. Each asset is capped at a maximum of 30% so that no one digital asset dominates the index.

Institutional digital asset fund flows

A rush for quality collateral in the face of liquidity concerns aided institutional netflows into digital asset investment products in March 2023.

Trust has been at a premium in both TradFi and crypto markets in the last month. The rapid collapse of Silicon Valley Bank and the Credit Suisse takeover in Switzerland have added to growing anxieties about the health of the global banking system.

But what became increasingly clear was that not all investment products are equal.

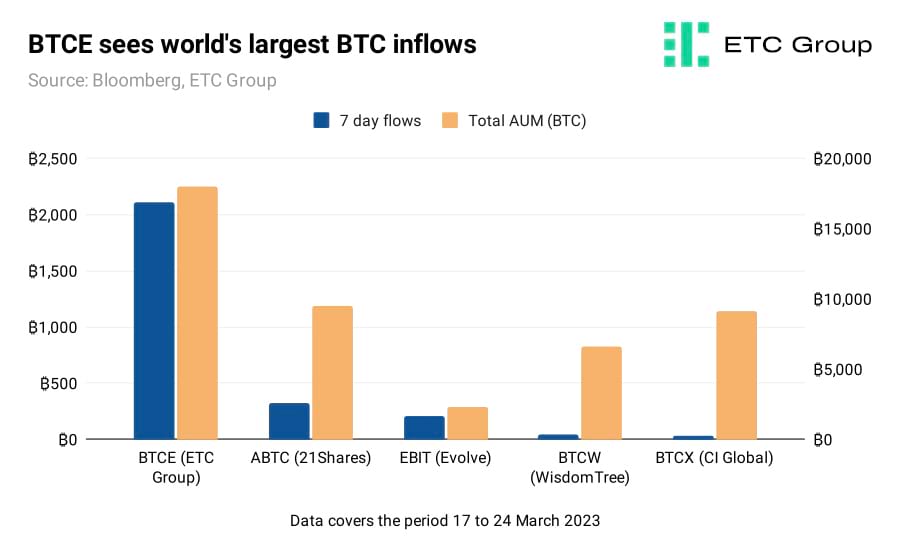

Data from Bloomberg across the month showed that ETC Group's BTCE extended its position as the largest physically-backed Bitcoin investment product in the world.

In the week from 17 March to 24 March, 2114.9 BTC ($58.6m) flowed into BTCE, according to Bloomberg data.

BTCE's gains across the week were six times larger in BTC terms than any other Bitcoin investment product.

This 7-day increase in assets under management was so large that it beat ETC Group's biggest 30-day inflow of 2023, recorded between 3 January and 3 February.

The addition swelled the fund's total assets under management to more than half a billion dollars ($503.21m), making BTCE the biggest winner of the rapid increase in institutional allocation to cryptoassets.

In native units, BTCE now has an AUM of 17,957.6 BTC.

This means BTCE extends its position as the largest physically-backed Bitcoin investment product not just in Europe, but globally.

2. Macro Signals

Central banks found themselves in unpleasant territory in March 2023. Inflation started to drop sharply in the Eurozone, tagging 6.9% in the final days of the month. Analysts have been warning since at least the second half of 2022 that there would be more deflationary than inflationary risks to markets in 2023, a position which would be made exponentially worse by increased interest rate hikes and tightening liquidity conditions.

On 16 March The European Central Bank Governing Council raised its three key interest rates by 50 basis points in a bid to bring inflation down to its medium-term target of 2%.

Investors will have to wait until 3 May to hear the Federal Reserve's next interest rate decision. Traders are already pricing in the higher possibility of a hold at a target rate of 4.75 - 5.00%, with two-thirds betting that the Fed will neither increase nor decrease rates at the next FOMC meeting.

The extreme tensions engulfing the banking sector have been laid bare for all to see.

The scale of unrealised losses on bank balance sheets, combined with substantial fears of depositor flight, has put the entire global banking system on watch.

Andrew Bailey, governor of the Bank of England, said as much in testimony to the UK Parliament on 29 March, noting that the British central bank was “on heightened alert” to further turmoil after the collapse of Silicon Valley Bank (SVB).

Alternative stores of value such as Bitcoin and gold have been clear beneficiaries of the plummeting faith in banks.

Additionally, the US Federal Reserve's decision to enact a new emergency liquidity programme, the Bank Term Funding Programme (BTFP) amidst bank collapses and liquidity scares have also been of benefit to Bitcoin. The Federal Reserve has long claimed it has all the tools necessary to combat inflation, so it may have come as a surprise to some to see a new tool unveiled post-SVB.

Those who have spent a little longer in the markets remain unmoved.

Central bank decisions are all about inspiring confidence and little about fixing the system that Bitcoin attempted to disrupt.

We might recall ex-Fed Chair Ben Bernanke here, who wrote in a post for the Brookings Institute in 2015: “When I was at the Federal Reserve, I occasionally observed that monetary policy is 98% and only 2% action. The ability to shape market expectations of future policy through public statements is one of the most powerful tools the Fed has.”

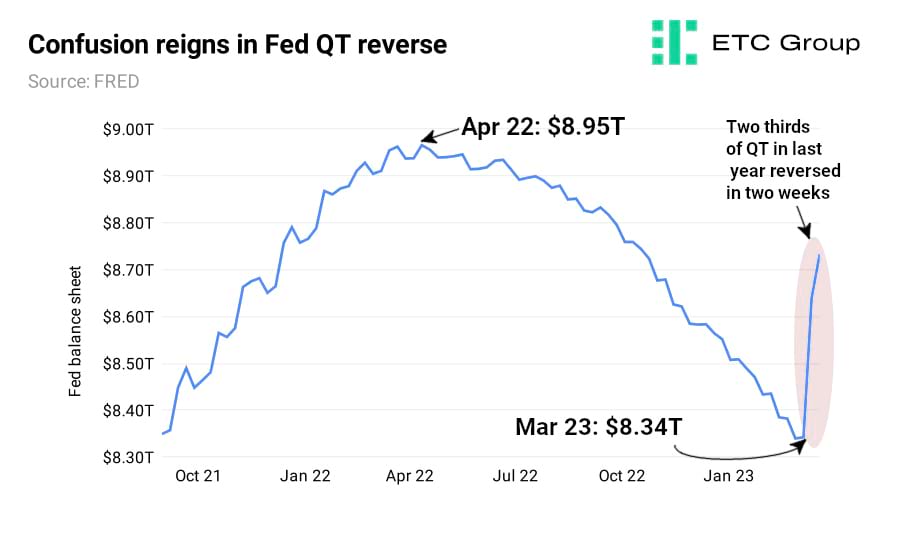

But if ever there was one chart to show the state of confusion at central banks, it is this. Over two weeks in March 2023, the Fed reversed two-thirds of the Quantitative Tightening (QT) enacted over the last year.

Are liquidity dumps just QE by stealth?

On 19 March, the other major central banks followed suit. In a joint statement the European Central Bank, the Bank of Japan, the Swiss National Bank, the Bank of England and the Bank of Canada said they would “enhance the provision of liquidity by offering US dollar swaps on a daily basis instead of weekly, These operations began on 20 March and would continue “at least until the end of April”, the statement said.

More Quantitative Easing (QE) is always required when central banks run out of ideas in fragile and brittle economies. As a case in point, look at the Bank of England, which which raising interest rates with one hand (QT) was forced to step in and buy £60bn of government bonds (QE) after the country's pension funds were within hours of collapse.

Three distinct themes have now emerged.

- Firstly, Bitcoin's utility as a decentralised, supply-capped store of value has been acquitted, live and in public.

- Secondly, the moves being made by central banks effectively lock in the near-immediate easing of monetary policy, providing a baseline for a crypto-friendly environment.

- Thirdly, more users are turning to crypto and alternative assets as faith in the banking system plummets.

BTC trading volumes recover

The fall of FTX took out one of crypto's largest market makers in the form of Alameda, and trading volume in BTC to USD - the largest trading pair for Bitcoin - crumbled towards the end of 2022.

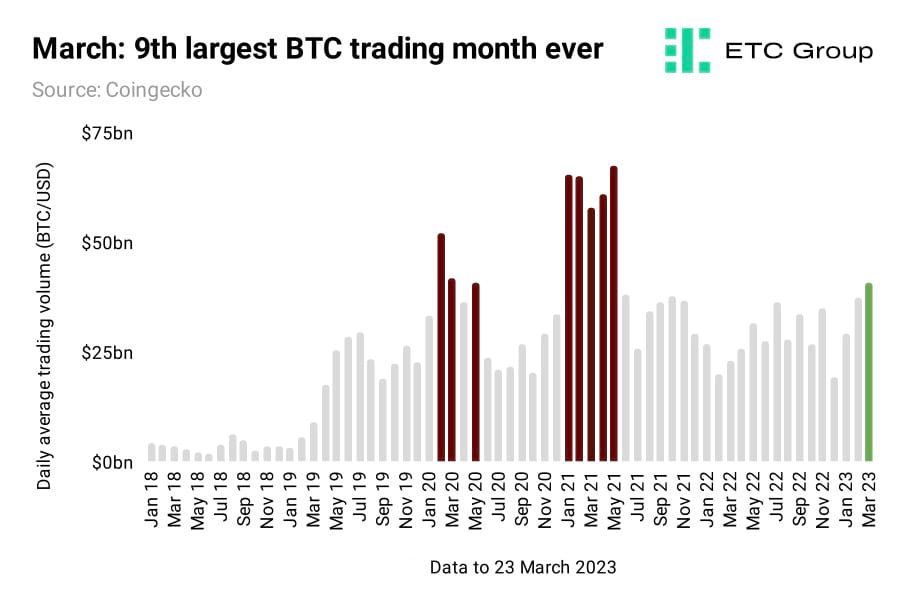

However, data compiled by ETC Group shows that March 2023 was the ninth-largest month on record for BTC/USD trading.

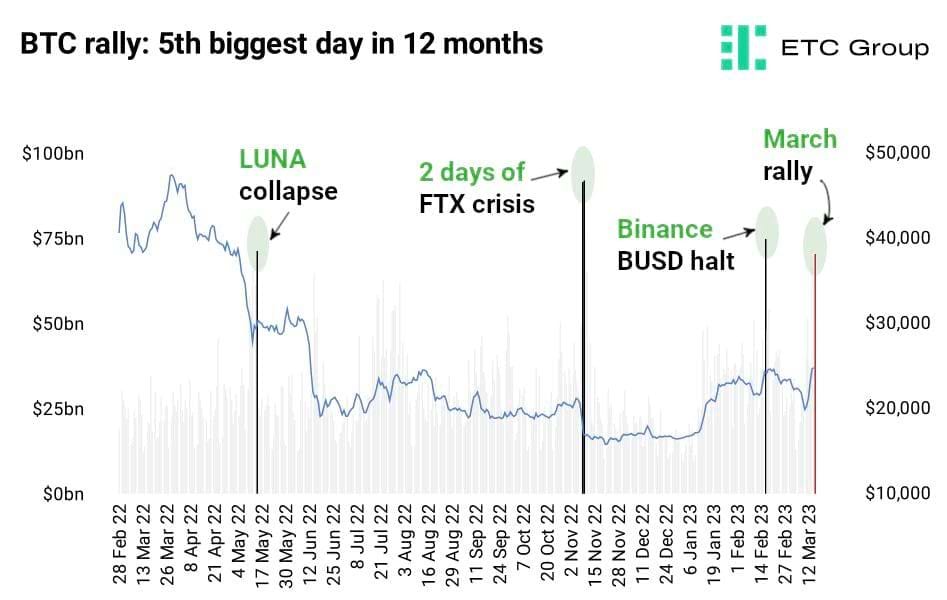

15 March was also the fifth largest trading day for BTC/USD in the last 12 months.

$70.7bn was traded across the major digital asset exchanges in this 24 hour period. This has only been exceeded by four events in the last year and it is notable that each previous time was a net negative for crypto in sentiment terms.

- 14 May 2022: Terra LUNA stablecoin implodes ($71.5bn)

- 8 November 2022: Reaction to FTX collapse ($91.7bn)

- 9 November 2022: Reaction to FTX collapse ($92.1bn)

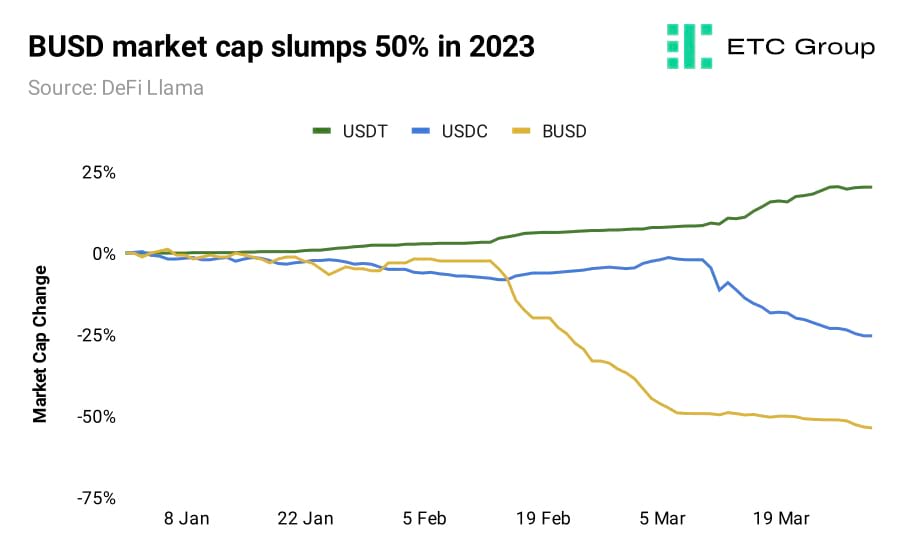

- 16 February 2023: Paxos forced to stop minting BUSD stablecoin ($75.2bn)

March's rally, by contrast, came at a point in time when fractional reserve banking was clearly under the microscope.

At a time when it is increasingly unclear that bank depositors will have the ability to access their money when required, Bitcoin has not only outperformed but its original philosophy as a counterparty risk-free asset is coming to the fore.

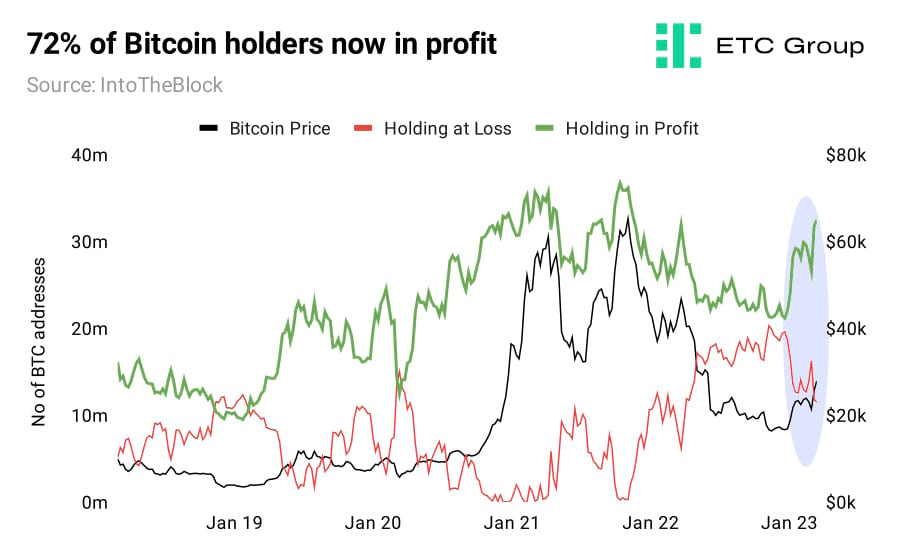

This regime change means that 72% of Bitcoin holders - some 32.5 million addresses - are now holding in profit at the current price of $28.5k. This is a huge shift from the start of 2023 where more than 50% of Bitcoin buyers were holding at a loss. Approximately 25% of Bitcoin holders, who purchased BTC in the euphoria of the last bull run, remain out of the money.

This level of Bitcoin holders being ‘in the money' is the highest point since November 2021. As such, the worst of Crypto Winter appears to be in the rearview mirror precisely at the point when traditional markets face their worst crisis of confidence since 2008 and macroeconomic and liquidity concerns are upending global allocations.

3. Regulatory Signals

The Nasdaq tech exchange announced plans to launch crypto custody services by the end of Q2 2023, joining the swathe of the largest traditional finance companies on earth - BNY Mellon and Fidelity spring to mind - attempting to grab crypto market share. Nasdaq will custody Bitcoin and Ether initially, before offering a litany of digital asset services including transaction execution for financial institutions.

Hong Kong's pivot to a more crypto-friendly stance is attracting companies far and wide to set up in the country.

OKX, one of the world's leading exchanges in terms of trading volume, recently announced that it intends on setting up an outlet in Hong Kong to provide clients with access to digital assets. The exchange is in the process of filing for a virtual asset provider (VASP) licence in Hong Kong at this stage.

Earlier in February, Hong Kong went ahead with new rules permitting retail investors to trade cryptocurrency. Bitcoin and Etheruem will become available for trading on licensed exchanges after being given the nod by Hong Kong Securities and Futures Commission.

The battle for hearts and minds in crypto and blockchain in the US continues to play out, with both the SEC and the CFTC on the front foot. In a 29 March House committee meeting, SEC chair Gary Gensler called for billions of dollars in extra resources and 500 additional staff to help it enact its role as “the cop on the beat” for digital assets in the United States.

But the regulator's demand for more firepower started to see pushback in Congress.

Nic Carter's widely-shared ‘Operation Chokepoint 2.0' blog, which recounts the attempt by the US government to cut off crypto banking rails - has moved out of the bounds of theory and into practice. The Castle Island VC, who famously championed Proof of Reserves for digital asset exchanges, has long argued that the US will fall to outside competition if it does not embrace the innovation that digital assets represent.

Elsewhere, influential law firm Cooper & Kirk, published a 37-page report addressed to US lawmakers citing regulatory overreach by the SEC and says crackdowns unfairly label crypto businesses as “a threat to the financial system, a source of fraud and misinformation and a risk to bank liquidity.”

Gary Gensler is due to appear before the House Financial Services Committee on 18 April to answer questions about the SEC's approach to crypto.

Binance hit by CFTC bombshell

The biggest regulatory news in crypto in March was undoubtedly the Commodity Futures Trading Commission (CFTC) and its lawsuit against Binance. The agency also claims oversight of digital assets (in direct opposition to the SEC) and this move has escalated the regulatory conflict between the agencies from pitched battles to open warfare.

The CFTC's suit names Binance founder Changpeng Zhao (CZ) specifically, alleging that his company knowingly offered unregistered crypto derivatives products to US customers against federal law.

It alleges that under CZ's leadership, Binance broadly directed its employees to turn a blind eye to customers using VPNs to conceal their locations while offering trades for digital assets including Bitcoin, Ethereum, and the stablecoins USDT and BUSD.

BUSD saw over $500 million in outflows in the first 24 hours after the lawsuit was filed.

This follows the enforced mid-February halt on minting new BUSD tokens by Paxos Trust Company, at the direction of the New York Department of Financial Services.

The lawsuit refers to each of these tokens as commodities, a direct challenge to the SEC which sees them as securities. Part of the suit also alleges that Binance, in a direct recall to FTX, has been counter-trading against its own customers.

The CFTC aims to charge Binance with violating a laundry list of laws, including:

- Illegally offering futures transactions and “off-exchange commodity options

- Failing to register as a futures commissions merchant

- Poor supervision of its main business model

- Not implementing Know-Your-Customer or Anti Money Laundering processes, and having a poor anti-fraud evasion program

CZ responded in a blog post, saying (among other refutations) that the complaint “appears to contain an incomplete recitation of the facts”. He defended the company's KYC procedures, claiming it uses “best-in-class” technology to ensure user compliance.

A Binance spokesperson added that the exchange now maintains "country blocks for anyone who is a resident of the United States and blocks "anyone who is identified as a US citizen regardless of where they live in the world." The exchange also blocks US cell phone providers and IP addresses, as well as US bank accounts, the spokesperson said.

In a statement by CFTC commissioner Kristin N Johnson, the regulator said that CZ and Chief Compliance Officer Samuel Lim had wilfully evaded oversight, and had been operating Binance “through a complex web of firms with the goal of using this operational infrastructure to shield Binance from complying with existing regulations in any of the jurisdictions where the firm operates.”

For now, the CFTC suit is a civil case, with no criminal charges filed. We will wait and see on that front.

This is bad news for Voyager Digital creditors too - the Canadian crypto brokerage was one of the most high-profile failures from the 2022 crypto winter along with lenders BlockFi and Celsius Network, filing for Chapter 11 bankruptcy in June 2022.

Voyager was set to be acquired for $1.3bn by Binance's US arm, but the acquisition was thrown into doubt by a block from the US Department of Justice's bankruptcy arm. Manhattan District Judge Jennifer Rearden placed a stay on the buyout, as reported on Twitter by advocacy group the Voyager Official Committee of Unsecured Creditors

In other crypto crime news, prosecutors unveiled a new indictment against FTX crypto exchange founder Sam Bankman-Fried (SBF) on 28 March. A bribery charge has been added to the 12 charges he already faces.

SBF is accused of attempting to bribe at least one and possibly more Chinese government officials as part of an effort to unfreeze certain accounts. Prosecutors allege that he directed $40 million in cryptocurrency to unfreeze accounts owned by FTX's sister trading firm Alameda Research.

Investigators in Montenegro said they had finally arrested Do Kwon, the on-the-run creator of TerraLUNA, the $60bn stablecoin failure that blew up markets in May 2022.

US Crypto: Commodity or Security?

By identifying so many major tokens (BTC, ETH, LTC) as commodities in the complaint against Binance, the CFTC is clearly staking its claim as the regulator responsible for crypto trading in the US.

The SEC has made its views clear; it believes most tokens are actually securities. Gary Gensler has said that every crypto other than Bitcoin seems to fit its definition of a security, but has remained largely silent on the details of the CFTC case.

The CFTC has maintained that stablecoins like USDT and BUSD are securities as well while the SEC previously suggested that BUSD is a security in its Wells Notice to Paxos.

CFTC chairman Rostin Benham said in February that his agency is gearing up for “precedent-setting” crypto enforcement cases. Last year, 20% of the CFTC's cases involved digital assets, showing its outsized interest in a sector that represents a small portion of the markets the CFTC oversees.

Europe, Asia, Middle East diverge from US on crypto regulation

American crypto companies are facing uncertainty and may move more operations offshore in the face of hostility from regulators. On 17 March, the leading US crypto company Coinbase disclosed it was in talks to set up a non-US digital asset exchange for its institutional clients. Coinbase went public in an April 2021 direct listing on the tech-focused NASDAQ exchange. Coinbase has aggressively expanded its operations in recent years, from 14 countries in 2014 to over 100 by this year. Those current platforms include Brazil, Singapore, Australia and Canada, however all trades are routed through its US venue.

Rival digital asset exchanges like Binance operate subsidiaries within the United States, but enjoy the protections of having most of their business running outside the jurisdiction of US regulators.

From a market structure perspective, US crypto companies do not even know who their regulator is, nor how to come into compliance, as there is no overarching federal framework for them to reference.

The securities regulator, the SEC, has long claimed jurisdiction over crypto markets, while the Commodity Futures Trading Commission - which oversees Bitcoin futures markets - has since 2015 classified Bitcoin as a commodity alongside gold and oil.

The SEC has ramped up enforcement actions in the past two years without providing any ability for companies to legally comply with regulations, as no regulations yet exist.

Trade bodies, including the American Securities Association, and the Financial Services Institute, have long campaigned against the SEC's regulation-by-enforcement stance.

On the opposite side of the globe, there is far more positivity. Hong Kong's move to legalise cryptocurrency trading for retail participants is a clear indication of Asian desire to access 24/7 crypto markets while still protecting investors.

In Europe, Germany's market regulator BaFin has long been a leader in defining rules for crypto companies - notably including crypto custody firms in the 2020 German Banking Act - while the Middle East continues its drive towards being a crypto-friendly region with concrete licensing regimes unveiled in March 2023.

The United States has a clear decision to make: allow crypto companies to come into compliance, or cripple innovation and push growth into the hands of its largest rivals.

Coinbase, Gemini target non-US futures launches

There is little doubt that US regulators going on the offensive with scant regard for the health of their domestic crypto industry is pushing innovation offshore.

In March it was revealed that US-domiciled exchanges Coinbase and Gemini were both (separately) pursuing plans for international derivatives exchanges to take advantage of the financial innovation that blockchain-based finance has brought to the table.

The Information reported on 29 March that the exchange founded by Tyler and Cameron Winklevoss was working with market makers and gearing up to launch an international cryptocurrency derivatives exchange in the wake of the collapse of FTX.

Gemini would pursue the launch of the wildly popular perpetual (perp) futures derivatives, which allow traders to make bets with high leverage. New York-based Gemini currently offers spot trading and staking in more than 60 countries, but its regulatory position - under the supervision of the New York State Department of Financial Services - means it cannot offer perp futures to US retail traders.

Bloomberg reported earlier this month that Coinbase was exploring plans for an overseas trading platform, while The Block reported that the digital asset exchange leader was considering offering perp futures.

And finally: Paris could legitimately claim the moniker of the newest crypto hub. In the last days of March the French capital saw outlets of US-based fast food chain Burger King start to accept cryptocurrency payments in the city.

4. On-chain Signals

Bitcoin

As suggested earlier in this report, bullishness has broadly returned to Bitcoin markets and with prices stabilising in the $28k region, more than 70% of holders are now in profit. Increased futures activity points to stronger support at these levels than we saw at $25k and indicates

The sudden increase in innovation in 2023, both with Ordinals and the expansion of the Lightning payments network, and the upcoming Bitcoin halving next year suggests Bitcoin has further upside for the rest of the year. However, with liquidity thinning, the next move upwards or downwards will be swift.

Liquidity Demand: Exchange Flows

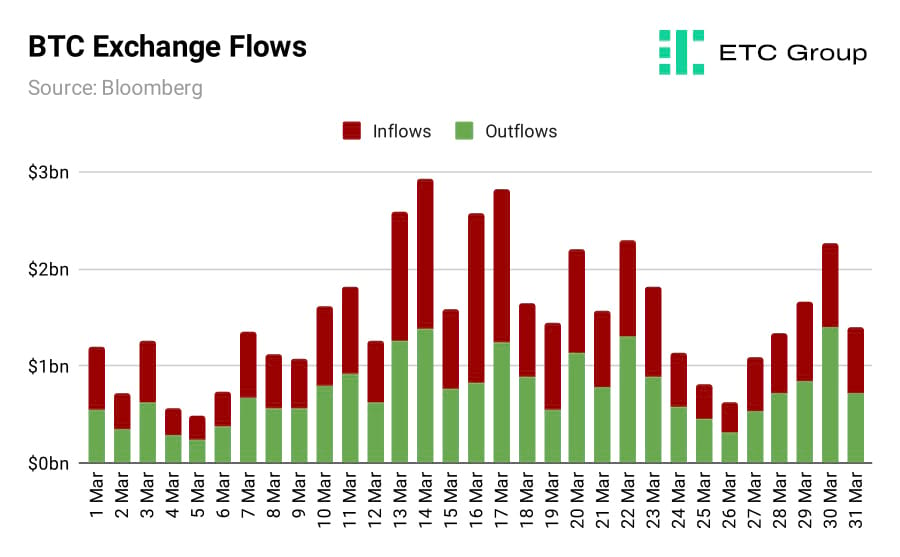

Bitcoin netflows were broadly flat in March, with outflows of $20.6 billion and inflows hitting $21.1 billion.

Outflows and inflows together came to $41.7 billion in March – a 52% increase from February. This reflects buoyant activity in March with traders moving large volumes of BTC onto and away from exchanges to adjust positions and enact trading strategies. Bullish Bitcoin

Futures Activity

Bitcoin futures activity surpassed $1 trillion for the first time since June 2022 in another sign that traders have regained confidence in the digital asset amid turmoil in the banking sector and persistent interest rate hikes. The $1.2 trillion in March equated to a 52% increase from February. Bullish Bitcoin.

Institutional Demand

In the 30 days to 24 March, net flows of $370 million entered Bitcoin investment products in the European market. This was a 225% rise from the $113.8 million added to Bitcoin ETPs in the 30 days leading to 24 February. Bullish Bitcoin.

Ethereum

On-chain signals were broadly bullish for Ethereum in March, and with unstaking coming through with the Shanghai hard fork on April 12, we see more potential upside for the second-largest cryptoasset.

Shanghai may turn out to be a ‘sell the news' event, but as we have suggested previously, there is unlikely to be large capital flight from Ethereum with staking withdrawals enabled. If anything, more corporations and institutions are likely to stake with ETH in the knowledge that they will be able to realise those gains.

ETH staking volumes have continued to rise ahead of the Shanghai upgrade, and in fact witnessed a large uptick in anticipation of being able to withdraw staking rewards.

Shanghai will be the first major update since the Merge that saw Ethereum transition from Proof of Work to Proof of Stake as its consensus mechanism in September. The Merge drastically reduced the network's energy usage and offered Ethereum holders the chance to earn interest in return for verifying transactions on the blockchain.

Releasing Ethereum locked up in the Beacon Chain has been a special priority for Ethereum developers, who have sacrificed other system upgrades in order to concentrate on this endeavour.

Liquidity Demand: Exchange Flows

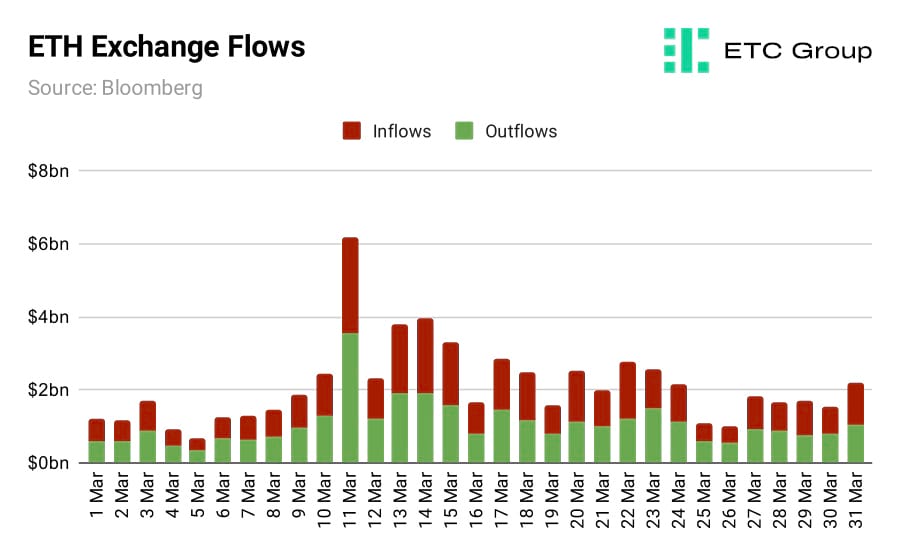

Ethereum netflows matched Bitcoin in March, with $32 billion in ETH exiting exchanges while $31 billion entered. In total, March's exchange flows of $63 billion were more than double the $26 billion of ETH that moved between exchanges and on-chain storage infrastructure. Bullish Ethereum

Futures Activity

$634 billion worth of Ethereum futures were traded in March. This represented a 20% increase from the figure recorded in February with derivatives trading predominantly taking place on Binance and OKX. Bullish Ethereum

Institutional Demand

Ethereum exchange-traded products saw positive inflows of $89 million in the 30 days to 24 March. This was 116% more than the $41.2 million that went toward Ethereum investment products in February. Bullish Ethereum

5. Digital Asset Equities

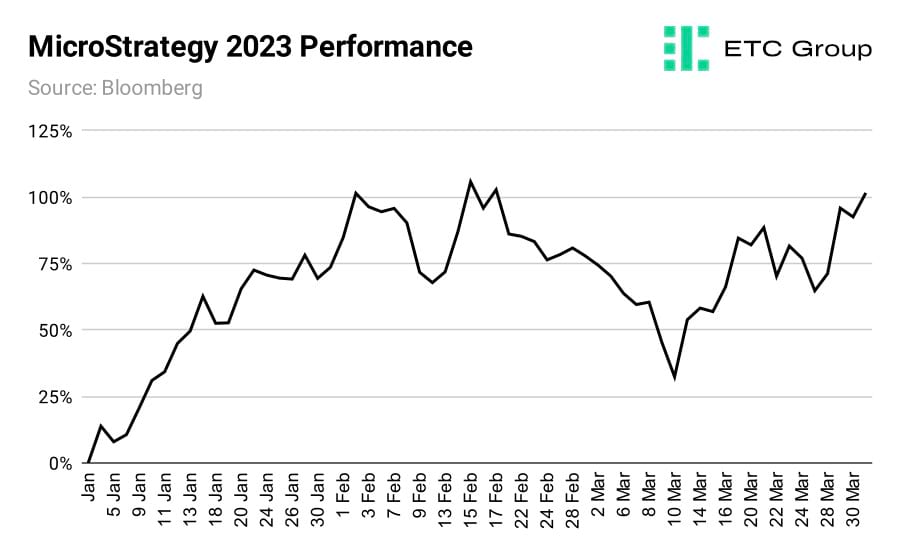

In a month where Michael Saylor's Microstrategy (NASDAQ:MSTR) paid off its $205m loan from the now-defunct Silvergate Bank, and bought another 6,455 BTC for $150m, digital asset equities recorded a positive upswing to extend their year-to-date gains.

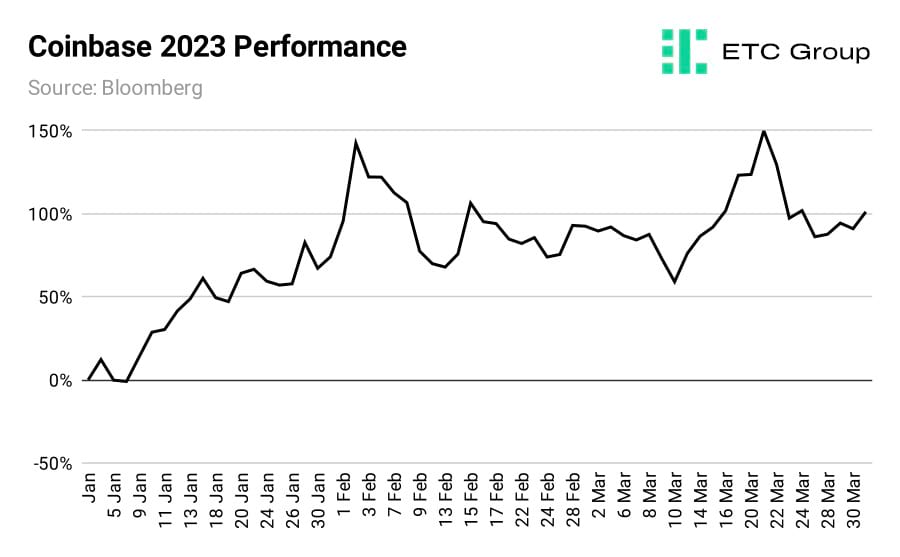

Coinbase (NASDAQ:COIN)

Coinbase's share price is up 101% year to date, with the leading digital asset exchange having benefited from healthier trading volumes in 2023, and the price of Bitcoin and the overall crypto market reaching nine-month highs.

Average trading volumes on-exchange have increased along with rising prices and confidence returning. Coinbase had a 24-hour trading volume of $686 million on 1 January, compared to trading volume of 842 million at the end of March, an increase of almost 23%.

Coinbase shares fell 13% on 23 March after the SEC warned it was considering potential enforcement action against the crypto exchange over possible securities laws violations.

Coinbase received a “Wells Notice” from the SEC, which warns companies they may face legal action. The regulator is looking at Coinbase's crypto staking business as well as investment and custody services, and part of its trading business.

Coinbase CEO Brian Armstrong retorted by saying they are “right on the law, confident in the facts, and welcome the opportunity for Coinbase (and by extension the broader crypto community) to get before a court”.

He added that “going forward the legal process will provide an open and public forum before an unbiased body where we will be able to make clear for all to see that the SEC simply has not been fair”.

Coinbase Chief Legal Officer Paul Grewal has argued that the company does not list or offer products to customers that are securities. More than 90% of digital assets reviewed by the company are not listed on the exchange because they meet this definition, Coinbase said.

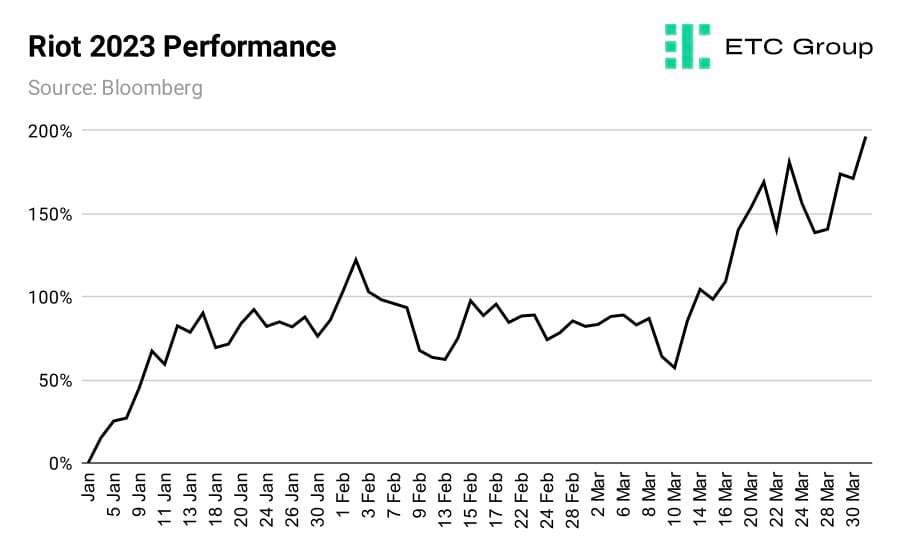

Riot (NASDAQ:RIOT)

Riot's stock price is 156% up this year and has gained more than 40% in March alone. This is the result of two factors: increased demand for Bitcoin accumulation and more transactions taking place on-chain.

Hashprice is effectively the amount that Bitcoin miners can earn per unit of energy they expend. As hashprice increases – with the symptomatic rise in the value of Bitcoin – profits have increased for miners and they are back in the green. Since 1 January, hashprice has jumped from $0.05939 TH/s to $0.07682 on 27 March – a rise of 29%. Hashprice reached a yearly high of $0.08487 on 22 March.

Riot currently holds 7,058 BTC according to its latest update and has strategically been selling part of the Bitcoin it produced over the course of the bear market to expand mining operations and make investments. In February, the company produced 675 Bitcoin and sold 600 BTC for proceeds of $14.2 million.

Riot expects their operational capacity to increase because of the excess liquidity they are welcoming. During the month of February, Riot deployed 4,608 S19-series miners.

Riot also had a total revenue of $259.2 million for the fiscal year ending on 31 December 2022 compared to $213.2 million for the same period in 2021.

It also produced 5,554 Bitcoin compared to 3,812 compared to the same twelve-month period in 2021 – a 46% increase.

MicroStrategy (NASDAQ:MSTR)

MicroStrategy stock has climbed 82% this year. The company is the world's largest corporate holder of Bitcoin. MicroStrategy executives said on an earnings call in February that the firm plans to continue its long-time strategy of buying and holding Bitcoin on its balance sheet.

In November, the company's unrealised losses amounted to nearly $2 billion when Bitcoin dropped below $16,000. But Bitcoin's rally in 2023 has worked to significantly cut these paper losses.

MicroStrategy has 132,500 BTC according to its latest earnings report, acquired for a total cost of $4 billion, or $30,137 per Bitcoin. So, MicroStrategy will be breakeven once the price of Bitcoin hits the next major round number level.

6. Into The Metaverse

While some early entrants, including Disney, pulled back on their metaverse ambitions in March, others ramped up their involvement. Nvidia in particular announced a move to bring industrial metaverse and generative AI applications to hundreds of millions of Microsoft users via Microsoft Azure. The move will connect Microsoft 365 programmes, including Teams, OneDrive and Sharepoint, with NVIDIA Omniverse, a platform for building and operating 3D industrial metaverse applications.

On 27 March the US concert sales giant Ticketmaster debuted NFT-gated ticket sales, allowing artists to offer extra concert experiences, presales or prime seats to fans that can only be unlocked with a specific NFT.

Token-gated sales are currently only compatible with Ethereum and can be stored in wallets including Metamask and Coinbase.

There were several interesting metaverse deals to note in March. Not least CCP Games, a startup building a blockchain-based game set in VR, Eve Universe, which raised a $40m round led by Andreessen Horowitz. Other investors included Makers Fund, Bitkraft and Kingsway Capital.

Blockchain social startup Op3n raised a $28m Series A round led by Animoca Brands. Other investors in the round, which valued the startup at $100m, included Dragonfly Capital, SuperScrypt and Creative Artists Agency.

Tilla, a Metaverse payments platform, secured strategic investment from J.P. Morgan and other investors, taking its total funding to $22 million. Tilla wants to make it easier for companies that need financial services in a digital economy world (inducing the Metaverse) to pay and transact with anyone in a regulated way. The company has built a payment platform intended for gaming platforms, virtual world publishers, mobile application developers and NFT providers.

On a national level, the Ministry of Science and ICT of South Korea approved investments of $51 million in various metaverse projects, doubling down on its bet for an AR/VR and Web3 future.

On 8 March, $30 million was allocated to a metaverse growth fund that will allow companies to develop virtual projects to get funding directly. Five days later, an additional $21 million was allocated to special metaverse initiatives in technology, industrials, and the public sector.

Since 2022, the Korean government has actively invested in the growth of its local metaverse industry, injecting millions in funds directly into companies in the field.

In May 2022, Lim Hye-sook, director of the Ministry of Science and ICT of South Korea, announced a package of $177 million set for metaverse companies, making the nation one of the first countries to direct funds into the burgeoning sector at that time.

On 27 March Gucci announced a partnership with Yuga Labs, the creators of the Bored Ape Yacht Club NFTs. The deal looks to expand Gucci's fashion label and entertainment services in the metaverse. The partnership will also extend to Otherside, the Bored Ape-themed virtual world and game.

Morgan Stanley has previously said that the digital fashion industry could reach $50 billion by 2030, adding new revenue streams from digital mediums for luxury brands. Luxury brands can provide customisable attire for in-world avatars or create virtual stores in which customers can try on clothes instead of visiting physical locations of stores, analysts wrote.

Metaverse Equities

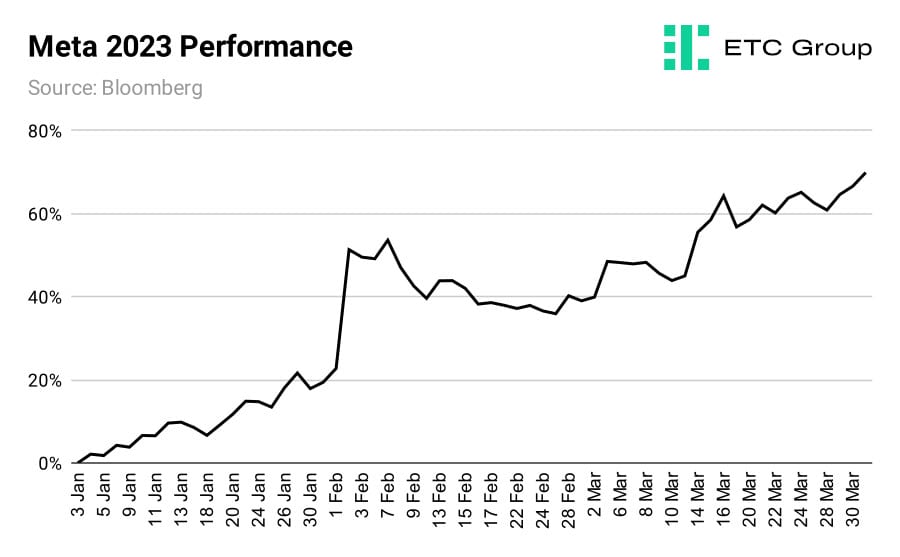

Meta (NASDAQ:META)

Meta's share price is up 65% despite the tech leader disclosing it will be cutting 10,000 jobs and eliminating 5,000 open roles this year.

Meta is testing what could become a foundational upgrade to its Quest VR headsets: a way for users tap and scroll on virtual elements with only their hands and no controllers required.

The new experimental feature is called Direct Touch, and is included with the Quest v50 software update. When hand tracking is on, the Quest 2 uses its external-facing cameras to complete the task. Inside the headset, users see them in VR as dark hand-like shadows.

In March, Meta launched its subscription service in the U.S. which allows Facebook and Instagram users to pay for verification.

The Meta Verified Service will give users a blue badge after they verify their accounts using a government ID and will cost $11.99 per month on the web or $14.99 a month on Apple's iOS system.

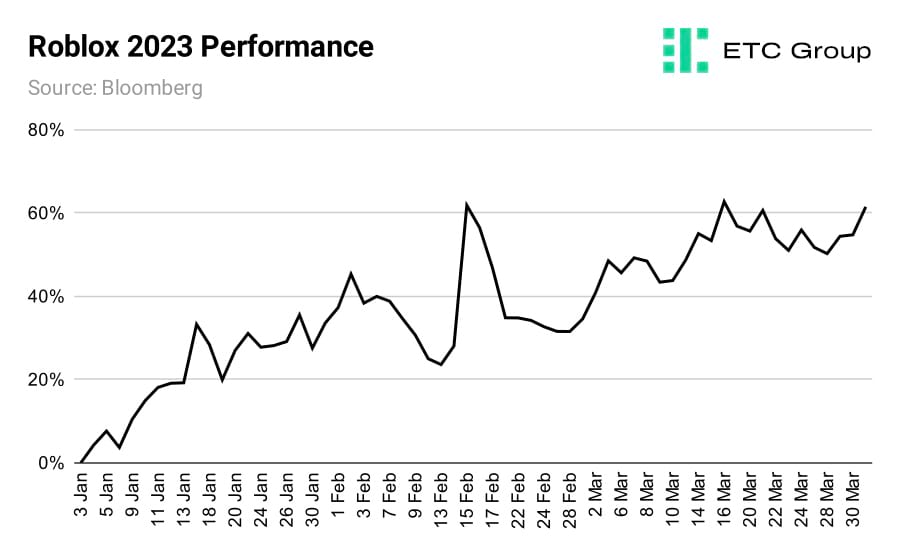

Roblox

Roblox has soared 57% this year. Investors had a scare last month when it emerged in a bank filing that Roblox held 5% ($150 million) of its $3 billion cash reserves at Silicon Valley Bank. But the panic was short-lived as the FDIC quickly stepped in to backstop all customer deposits in the U.S..

In February, Roblox outlined its vision for AI-assisted content creation, imagining a future where Generative AI could help users create code, 3D models and other content using the correct text prompts.

Roblox is now seriously trying to make its mission of turning users into creators a reality by launching its first AI tools: Code Assist and Material Generator. These tools are still in beta and can only generate code snippets and object texture based on short prompts for the time being.

7. Top 20 Brief

Polygon

Polygon, the Ethereum scaling solution, unveiled its effort to produce zero knowledge rollups with the beta launch of is zkEVM mainnet. Zero-knowledge proofs can significantly scale up transaction capacity on Ethereum without sacrificing security, a high priority for app developers. Some have compared the debut of ZK proofs to ChatGPT's impact on AI because it allows Ethereum transaction capacity to scale without disrupting user experience.

Vitalik Buterin joined the launch ceremony, sending a 0.005 ETH transaction along with a message referencing Neil Armstrong's first words on stepping onto the moon: “A few million constraints for man, unconstrained scalability for mankind.” He added: “I'm happy to see Ethereum Layer 2 scaling becoming fully real, not just something that's theoretical with these backdoors you're not supposed to talk about.”

Cosmos

Cosmos is appearing as the new blockchain home of choice for dapps frustrated by slow transaction speeds on Ethereum. While its token ATOM is only the 22nd largest on the market, investors have long considered its host chain to have potential as an Ethereum competitor alongside Avalanche (AVAX) and Solana (SOL).

By the end of September 2023 the decentralised exchange dYdX will be running on Cosmos. dYdX recently announced the launch of its private testnet taking a significant step towards the decentralised exchange leaving Ethereum. dYdX currently has $341 million in TVL.

Representatives at dYdX have cited lagging transaction speeds on Ethereum as the driver behind the move. They identified Cosmos as the best solution because of the faster throughput and its capacity to allow developers to customise blockchains to their own needs.

Cosmos allows developers teams to create their own native blockchains using the Cosmos Software Development Kit (SDK) according to their own preferences. Each Cosmos blockchain is distinct yet allows assets to move between chains, should developers enable this option.

This is the second major project in recent months to announce its migration from Ethereum to Cosmos. SushiSwap is making a similar move after it acquired the Cosmos-based trading platform Vortex Protocol in February.

In March Cosmos also got its own stablecoin, as Circle's US dollar-pegged USDC launched on the blockchain.

XRP

The trading volume of XRP exploded on South Korean venues as March closed out, Coindesk reported. The SEC vs Ripple is seen as a test case for the potential legal definition of cryptoassets as securities or commodities in the United States.

The summary judgement expected in the SEC's case against Ripple Labs will have huge consequences on XRP and other altcoins.

Between 20 March and 30 March, the price of XRP spiked more than 40% from $0.37 and $0.53 as traders flocked to the digital asset.

The token's recent rally reflects market sentiment that a favourable ruling is more likely than not, however our analysis sees this as broadly speculative for the moment. Ripple could win the case outright. On the other hand, a win for the SEC would mean that XRP and other altcoins are subject to stricter regulations as securities.

Ripple has been beset by the legal battle since 2020 when the regulatory agency charged it with selling XRP as an unregistered security.

The Ripple decision has the potential to provide long-anticipated clarity on whether the majority of cryptos outside Bitcoin and Ethereum are commodities or securities.

Solana

The popular NFT project y00ts has begun its move from Solana to the Polygon network. The project launched in September 2022 and is using a cross-chain bridge to take its 15,000-strong NFT collection to Polygon.

The floor price for y00ts is currently 148 SOL ($3,000) on Solana-based NFT marketplace Magic Eden and the collection's total sales volume exceeds 4 million SOL ($83 million).

But more than 10,000 y00ts have already been moved to the Polygon chain according to OpenSea.

The NFT collection's exit from Solana will be a loss to its NFT ecosystem as it will bring down trading volumes. This means the network will lose revenue on the fees it charges for these transactions.

Cardano

Cardano has released a new node version called v.1.35.6 which comes with a functionality called Dynamic peer-to-peer (P2P) networking. It will let network participants test automatic node communication without the need for static configurations.

By automating the peer selection process, Dynamic P2P enables enhanced communication between distributed nodes and simplifies the process of running a relay or a block-producing node.

There are two ways to configure a Carnado node – either as a block-producing node or as a relay node. A block-producing node is responsible for producing blocks on the blockchain, while a relay node communicates with other relays and broadcasts blocks from block-producing nodes.

The upgrade is intended to improve network uptime and stability.

8. Outlook

With the US facing severe ongoing risks from the failure of fractional reserve banking, and many banks fearful of unrealised losses and deposit flight, the stage has been set for a massive reversal in fortunes for Bitcoin.

BTC is already up 71% in 2023 so far, and the macroeconomic situation, along with fears of an extended and damaging banking crisis, will likely pull more capital into digital assets.

Multiple regulatory battles are honing into view as we pass the end of the first quarter of the year. The outcomes of these will be highly consequential for the crypto space at large.

Bitcoin's performance in Q1 2023, with its market cap now standing at almost $550bn, represents the asset's best quarterly return in two years.

One of the most significant drivers behind the rally is the expectation that central banks will be forced to reverse their historically aggressive rate hikes with the potential for economic slowdowns looming, a theory backed by the downfall of three US banks in particularly short order.

Investors are now facing a unique macroeconomic environment characterised by tightened monetary and financial conditions, heightened volatility and inflation fears still in the background.

Amid this maelstrom there is much increased potential for greater allocation to alternative assets including Bitcoin and Ethereum.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.