Litecoin adoption booms with massive new deal, cryptocurrency’s regulatory ‘Wild West’ is ending, and Square adds 16 million new Bitcoin users.

Square $29bn acquisition adds 16.2m new Bitcoin users

In mid-July 2021, Jack Dorsey’s payments giant Square (NASDAQ:SQ) said it was building a mainstream crypto wallet to bring Bitcoin to the next 100 million users. But with a $29bn acquisition of an Australian payments company on 2 August, it is already 15% of the way there.

In a shareholder letter released late Sunday, Square said its Cash App generated $2.72bn of bitcoin revenue, and $55m of bitcoin gross profit in Q2, each up approximately 3x year over year. Wolfie Zhao, Asia Editor, TheBlockCrypto

ASX-listed Afterpay (ASX:APT) owns an extremely popular ‘buy now, pay later’ checkout product called Clearpay, which has around 16.2 million customers. It is most commonly used by both millennials and Gen Z customers who are used to owning and using a product while paying off the cost in monthly installments.

The buyout figure came in at more than 30% higher than Afterpay’s closing price on Friday 30 July, and when completed will be Australia’s largest ever company takeover.

Square added in a press release that the buyout — which is expected to complete by Q1 2022 — would allow both firms to expand their offerings to more customers.

Afterpay has been seeking a way to grab more market share in the installments payments business in North America: this deal gives the business that chance.

Every merchant using Square will now be able to offer a ‘buy now, pay later’ option. But more important for Bitcoin is the other side of this coin: each of Afterpay’s 16.2 million retail customers, and all 100 million businesses registered on its platform, will be able to buy Bitcoin through the integrated Cash App.

Litecoin adoption booms with Newegg deal

Payments protocol Litecoin has picked up a significant win with computer hardware and gaming provider Newegg (NASDAQ:NEGG) adding LTC as a payment option across its online stores. The $6.3bn business was founded in 2001 and has outlets across North America, South America, Europe, Asia Pacific and the Middle East.

The 29 July announcements makes the consumer electronics retailer the first of its kind to accept Litecoin at checkout.

Customers shopping on Newegg.com will have the option of paying with Litecoin using the BitPay wallet app. To complete an order, users can select Bitpay at checkout, then use Litecoin held in their digital wallet.

Q2 2021 results for Litecoin, produced by ETC Group, show that the number of companies accepting LTC as a payment method grew 73% year on year.

The reason why Litecoin makes for a good payment option for merchants worldwide is the speed of its confirmations and its extremely low fees.

While Litcoin uses the same Proof of Work consensus algorithm as Bitcoin to secure its network, it differs in that it is set up to confirm blocks of transactions once every 2.5 minutes, compared to Bitcoin’s 10 minutes.

And the fees that consumers have to pay to confirm their transactions have barely changed in the last 12 months, even as the price of a single Litecoin has grown from $56 to around $150. As of August 2021, the average fee paid by a user to confirm a Litecoin transaction is less than $0.01.

As the enthusiasm and excitement around the use of cryptocurrency continue to grow, Newegg demonstrates once again that it’s committed to making it easy for customers to shop their way with a growing array of payment options that also cater to crypto fans. Stephen Pair, CEO, Bitpay

As of 31 December 2020, Newegg has over 4 million unique active users, each spending an average of $301 per purchase. 2020 was its first profitable full year.

Delivering a better online shopping experience isn’t only about price and selection – it’s also important to let people shop however they want, and that extends to offering flexible payment options. We’re thrilled to accept Litecoin, as we believe that convenient payment options improve the overall shopping experience for all our customers. Andrew Choi, Senior Brand Manager, Newegg

The end of Wild West Crypto?

In a 30 July announcement Binance said it would end the ability for people in Germany, Italy and the Netherlands to take out futures and derivatives positions in cryptocurrencies.

Binance will wind down its futures and derivatives products offerings in Germany, Italy, and the Netherlands. With immediate effect, users from these countries will not be able to open new futures or derivatives products accounts. With effect from a later date to be announced in a further notice, users from these countries will have 90 days to close their open positions. Binance Support, 30 July 2021

As reported in the Wall Street Journal, Binance’s move comes off the back of crackdowns by regulators worldwide against the trading venue.

Separately, Malaysia’s securities commission on Friday reprimanded Binance and its chief executive, Changpeng Zhao, for operating illegally in the country, despite a previous warning. It ordered Binance to disable its main website and mobile applications in Malaysia within 14 business days, and immediately cease all media and marketing activities in the country. Caitlin Ostoff, markets reporter, WSJ

It appears regulators are no longer content to sit back and watch while unregulated cryptoexchanges build market share in legal grey areas.

Cryptocurrency lender BlockFi is another venue that has come under the watchful eye of regulators in the US. The New Jersey-headquartered firm has been hit with a cease and desist from Texas regulators, and in the past few weeks its 7.5% APY interest-bearing accounts have been deemed unregistered securities by five states.

Kentucky is the latest.

— BlockFi (@BlockFi) July 30, 2021

In March 2021, BlockFi raised $350m in Series B funding, for a $3bn valuation. CEO Zak Prince told Coindesk at the time that the 500-employee service has $10bn in outstanding loans and $15bn in total assets.

All of these major moves come with a new crypto framework bill in Congress, which seeks to set up regulatory parameters for digital assets, currencies and stablecoins.

Representative Don Beyer’s 58-page Digital Asset Market Structure and Investor Protection Act covers several sectors in one. Among its aims are to direct regulators to define rules for the largely Ethereum-based DeFi markets, create a single standardised charter for cryptoexchanges to adhere to, and to define which cryptoassets may be considered securities and which may be commodities.

And as Decrypt reported this week, policymakers are seeking to tap US citizens for around $28bn through an exponential expansion of crypto-related taxation and reporting requirements.

The issue of securities-like investment structures in crypto markets, for example ICOs, have long grated with regulators. But without a regulatory framework to point to, watchdogs like the SEC have been forced to take risky individual actions. Joe Biden’s Democrats are taking huge leaps and bounds in the House and Senate — through banking and finance committees — to define cryptocurrencies once and for all in the largest financial market in the world.

Markets

BTC/USD

The slow descending wedge played out over the course of July has proved to be a jump-off point for more positivity in the Bitcoin price. After several downtrending weeks, Bitcoin began the session in the high-$36,000 range and it would prove its lowest point across the seven days. The cryptocurrency’s tentative climb above $42,500 — while rejected by traders — is an area that has not been tested since 20 May. Volatility also returned to BTC/USD in spades, with a 17.1% variance between its lowest trough and highest peak.

ETH/USD

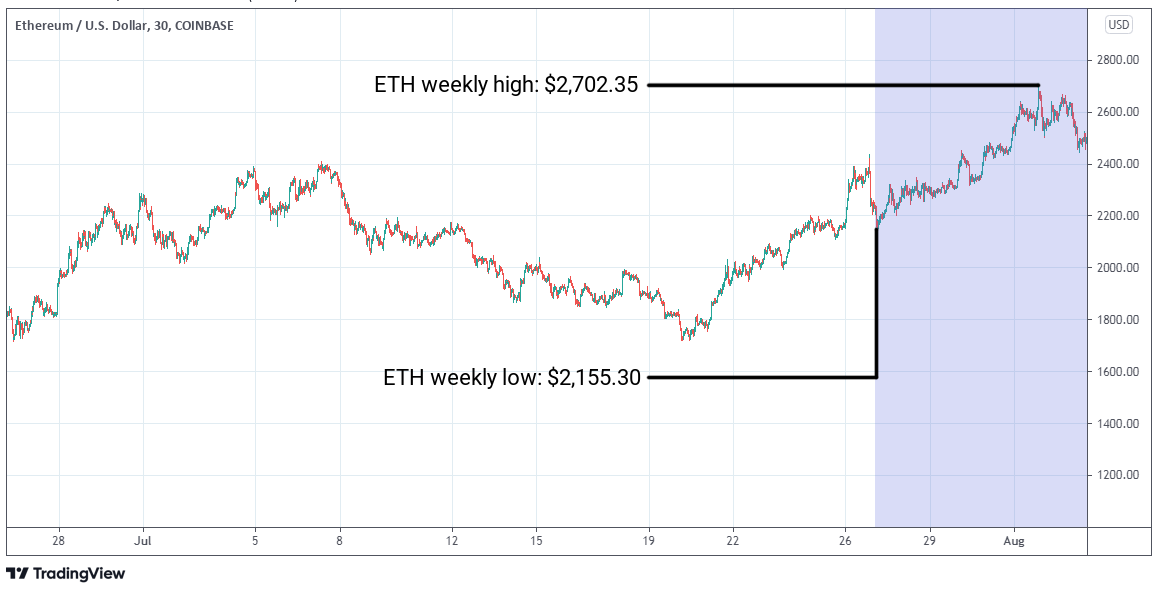

There was much more positivity on show in Ethereum this week, even more so than in Bitcoin. Traders had to go back to 7 June 2021 to find a comparative peak in the Ether price, as it hit more than $2,700 in late trading on 2 August. Bullish energy gripped the market, as the price dipped less than 0.2% from the week’s starting point, climbing strongly from $2,159.15 and maintaining clear distance above the psychologically-important $2,000 level. By the end of the seven-day trading session, Ether had moved 25% to the good, before backsliding 6.5% to finish the week at $2,525.14.

LTC/USD

In its best performance since 21 July, Litecoin tested $150 this week, climbing 16.8% from its starting point in much more bullish price action than we have seen in months. Litecoin showed a generalised decoupling from Bitcoin to track Ethereum more closely, with a peak much later in the trading week and a decline of less than 7% to finish at $139.75.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.