- Growing Mainstream Adoption of Digital Assets: Institutional investors and major asset managers are increasingly incorporating digital assets like Bitcoin into their portfolios, as evidenced by recent filings and the launch of Bitcoin ETFs in the U.S. Despite their current small market share, these investments reflect a broader trend towards mainstream acceptance

- Impact on Portfolio Performance: The inclusion of Bitcoin in portfolio optimizations, using strategies such as Maximum Sharpe Ratio and Risk Parity, has shown to improve the risk-adjusted returns compared to traditional portfolios. Portfolios optimized with Bitcoin not only offer higher returns for the additional risk taken but also present a wider range of efficient risk-return combinations

- Optimal Allocation Recommendations: Empirical studies suggest that even a small allocation to digital assets, specifically between 2% to 3% in broader asset mixes and up to 4% to 6% in more focused digital asset portfolios, significantly enhances portfolio performance without adversely impacting overall risk profiles

Gradually, then suddenly

Gradually, then suddenly, as they say, digital assets are becoming mainstream.

The biggest asset managers in the world have launched spot Bitcoin ETFs in the US this year and adoption among institutional investors is rising rapidly. Major financial institutions like Franklin Templeton themselves have just recently disclosed significant investments into Bitcoin ETFs via their latest 13F filings.

Institutional hedge funds that manage money for Ivy League university endowments have disclosed multi-million Dollar holdings. Stanford university's Blyth Fund has recently disclosed that they hold around 7% allocation in Bitcoin ETFs.

Nonetheless, at the time of writing, US Bitcoin ETFs only account for approximately 0.6% of the overall size of the US ETF market based on data provided by ICI.

In Europe, Bitcoin ETPs also only comprise a tiny fraction of the 11 trn EUR UCITS market of only 0.05%, according to our calculations based on Bloomberg data.

In general, we expect the relative size of digital assets to increase further as even small allocations to digital assets are bound to increase portfolio risk-adjusted returns significantly as demonstrated in our latest deep dive on Bitcoin.

But what is the optimal allocation to Bitcoin and digital assets in general?

What is the optimal allocation to digital assets?

Most empirical portfolio studies usually look at how a classical 60/40 portfolio comprising of 60% allocation in stocks and 40% allocation in bonds responds to a gradual increase in digital asset allocation.

In our previous digital asset study, we did a similar exercise by investigating the effect of increases in digital asset allocation on overall portfolio risk and return metrics.

Since digital assets generally exhibit a higher risk-adjusted return (“Sharpe Ratio”) than other traditional asset classes, a marginal increase in allocation usually leads to an increase in overall portfolio risk-adjusted returns.

However, most institutional asset managers don't employ a 60/40 portfolio in the first place because of high portfolio volatility and the dominance of the equity allocation for the whole portfolio's risk-return profile.

In fact, most institutional asset managers in practice allocate based on optimized risk metrics such as portfolio Sharpe Ratio or portfolio volatility which is why we perform a similar exercise here.

In a first step, we looked at optimized multiasset portfolios comprising of global stocks (MSCI World AC), global bonds (Bloomberg Global Aggregate USD-hedged), and commodities (Bloomberg Commodity Index).

More specifically, we optimized these portfolios based on the following approaches:

- Minimum Variance/Volatility

- Maximum Sharpe Ratio

- Equal risk contribution (Risk parity)

The Minimum Variance approach tries to minimize the average portfolio volatility. The Maximum Sharpe Ratio approach tries to maximize the ratio between average portfolio return (minus a risk-free return) and the corresponding average volatility. The Equal risk contribution or Risk Parity approach varies the respective portfolio weights until every asset has an identical relative contribution to the overall portfolio volatility.

In a second step, we added Bitcoin to the set of potential assets into the optimization. Our period of investigation (July 2010 – May 2024) was constrained by the fact that reliable market prices for Bitcoin only exist since 2010 as it is still a relatively young asset.

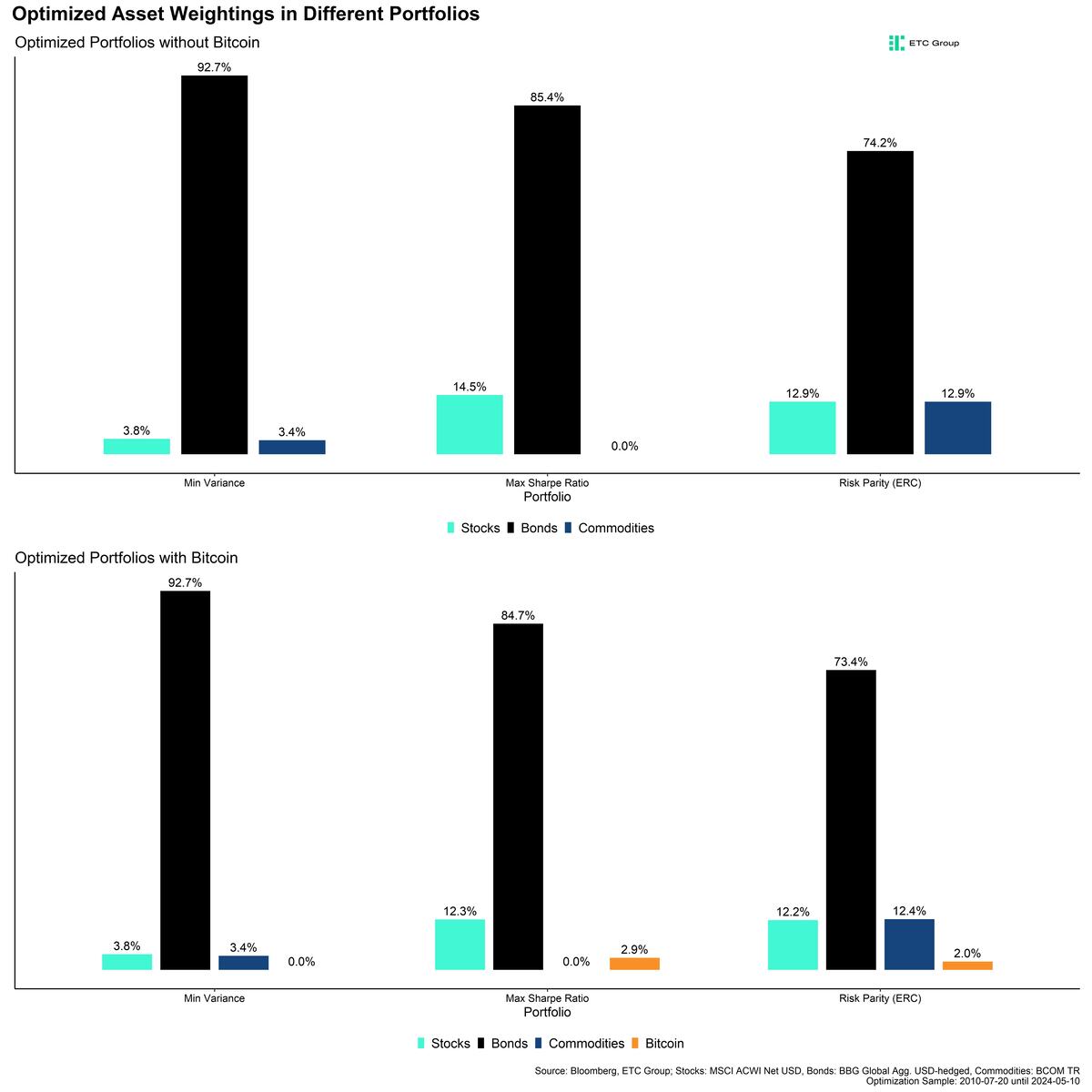

Here are the results for the different optimizations. The upper panel excludes Bitcoin while the lower panel includes Bitcoin in the optimization:

Several observations are in order:

Firstly, the minimum variance approach excludes Bitcoin completely since Bitcoin generally exhibits a higher level of volatility than the other assets.

Secondly, the maximum Sharpe Ratio approach excludes commodities in the traditional portfolio but includes Bitcoin in the new portfolio. The Bitcoin allocation is made largely at the expense of the stock allocation.

Lastly, the risk parity approach also includes Bitcoin at the expense of all other asset classes.

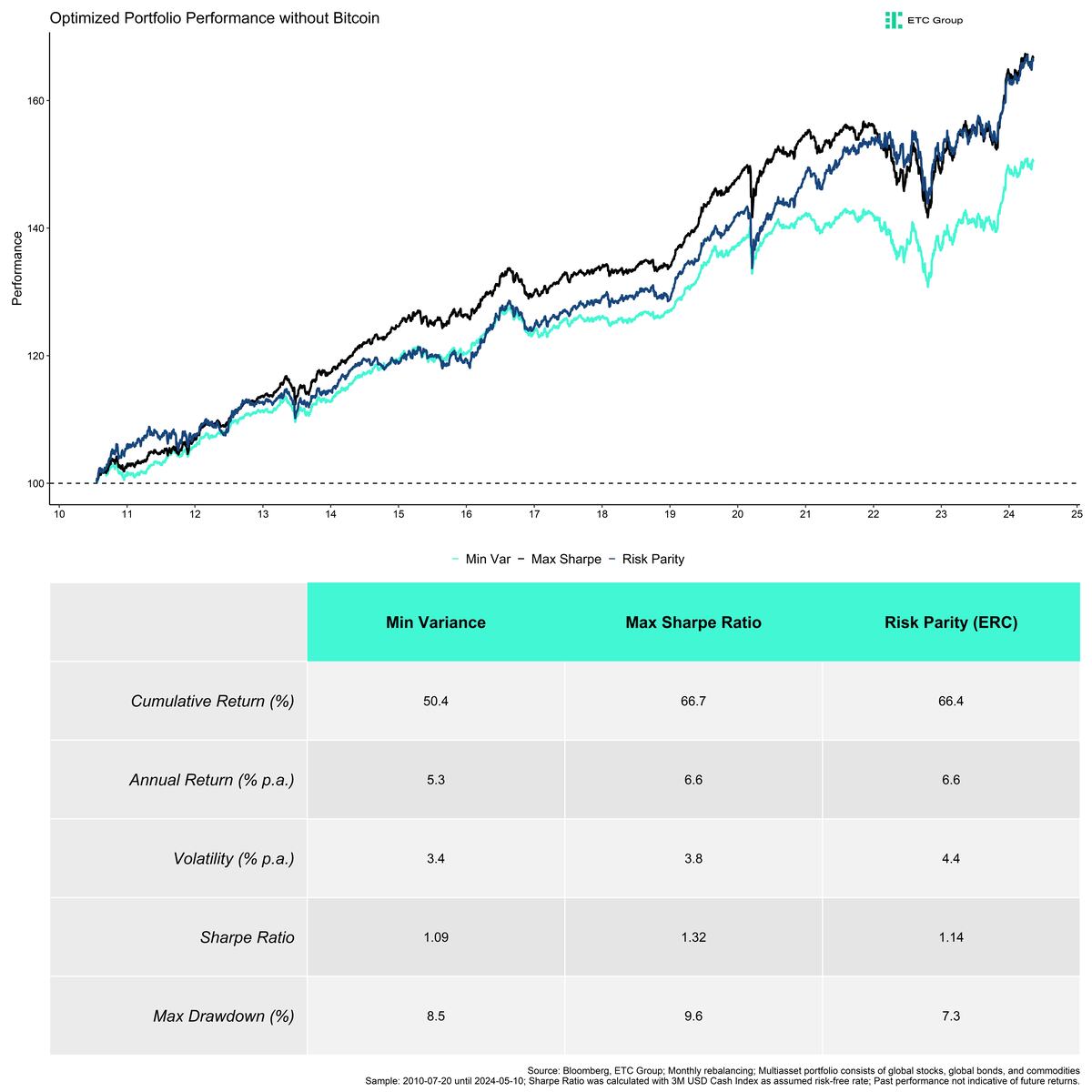

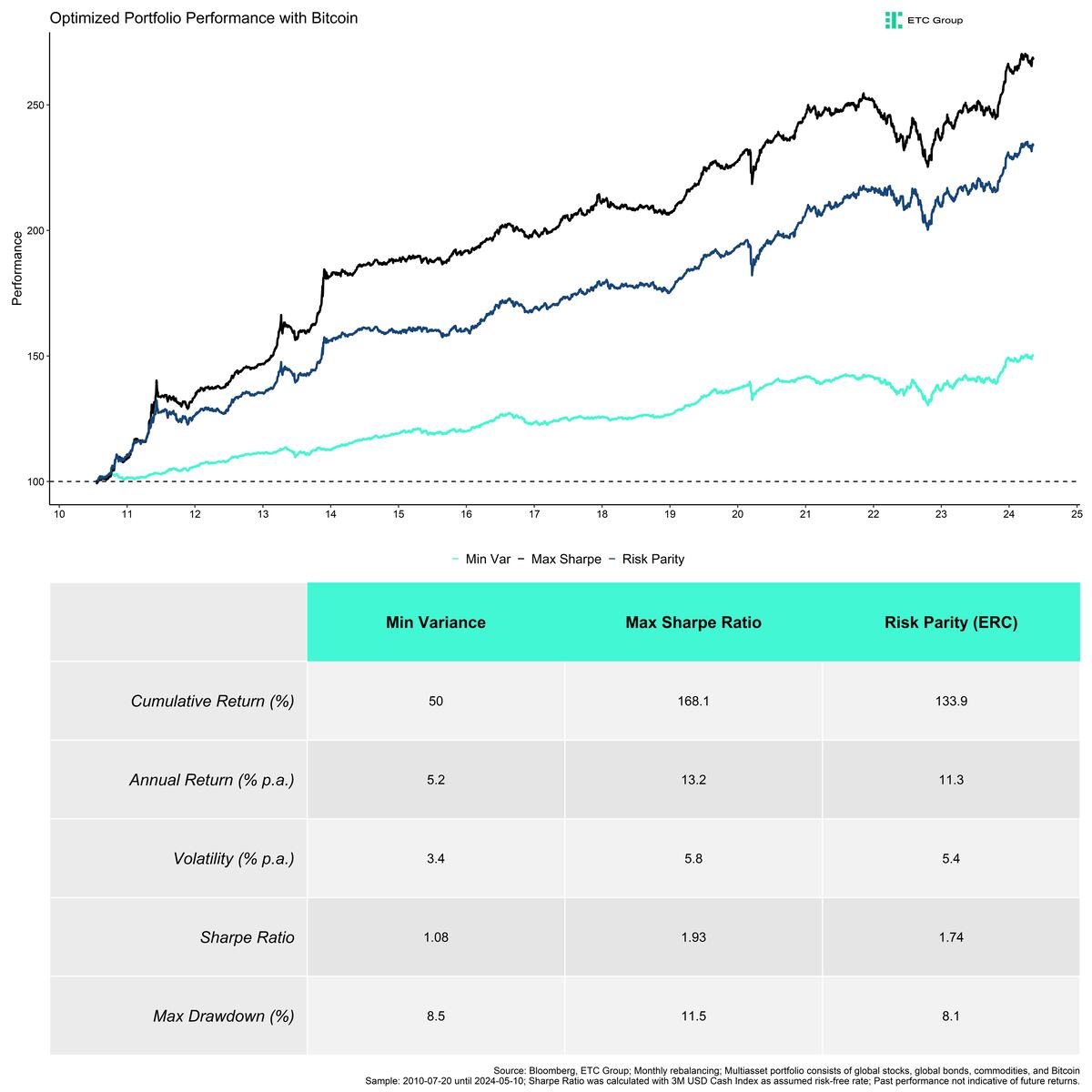

Furthermore, a comparison between the historical performances of the traditional portfolios that exclude Bitcoin and those that include Bitcoin reveals that the max Sharpe Ratio and the Risk Parity (ERC) portfolio were able to significantly outperform the Minimum Variance portfolio which didn't allocate to Bitcoin at all.

It is also important to highlight that the Risk Parity portfolio with Bitcoin even exhibited a smaller maximum drawdown than the Minimum Variance portfolio without Bitcoin. In other words, the increase in portfolio volatility was largely due to an increase in positive upside volatility.

Moreover, investors are over-proportionately rewarded with higher returns for unit of additional risk as the risk-adjusted returns (“Sharpe Ratio”) increase significantly by adding Bitcoin.

The Sharpe Ratios for optimized portfolios with Bitcoin are even significantly higher than for optimized portfolios without Bitcoin.

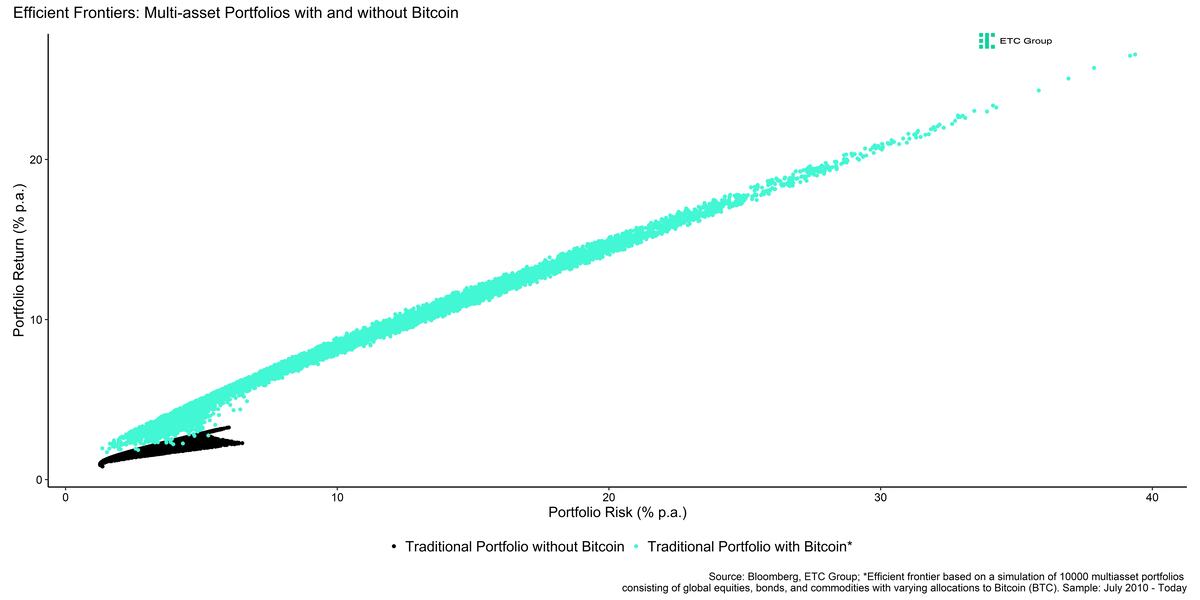

In fact, by including Bitcoin and digital assets into their portfolio optimization, the universe of potential multiasset portfolios increases vastly.

Asset managers are not only enabled to provide investors with more efficient portfolios, i.e. higher risk-adjusted returns, but also provide investors with a much larger set of risk-return combinations compared to traditional portfolios that only include stocks, bonds, and commodities.

So far so good. What about other digital assets?

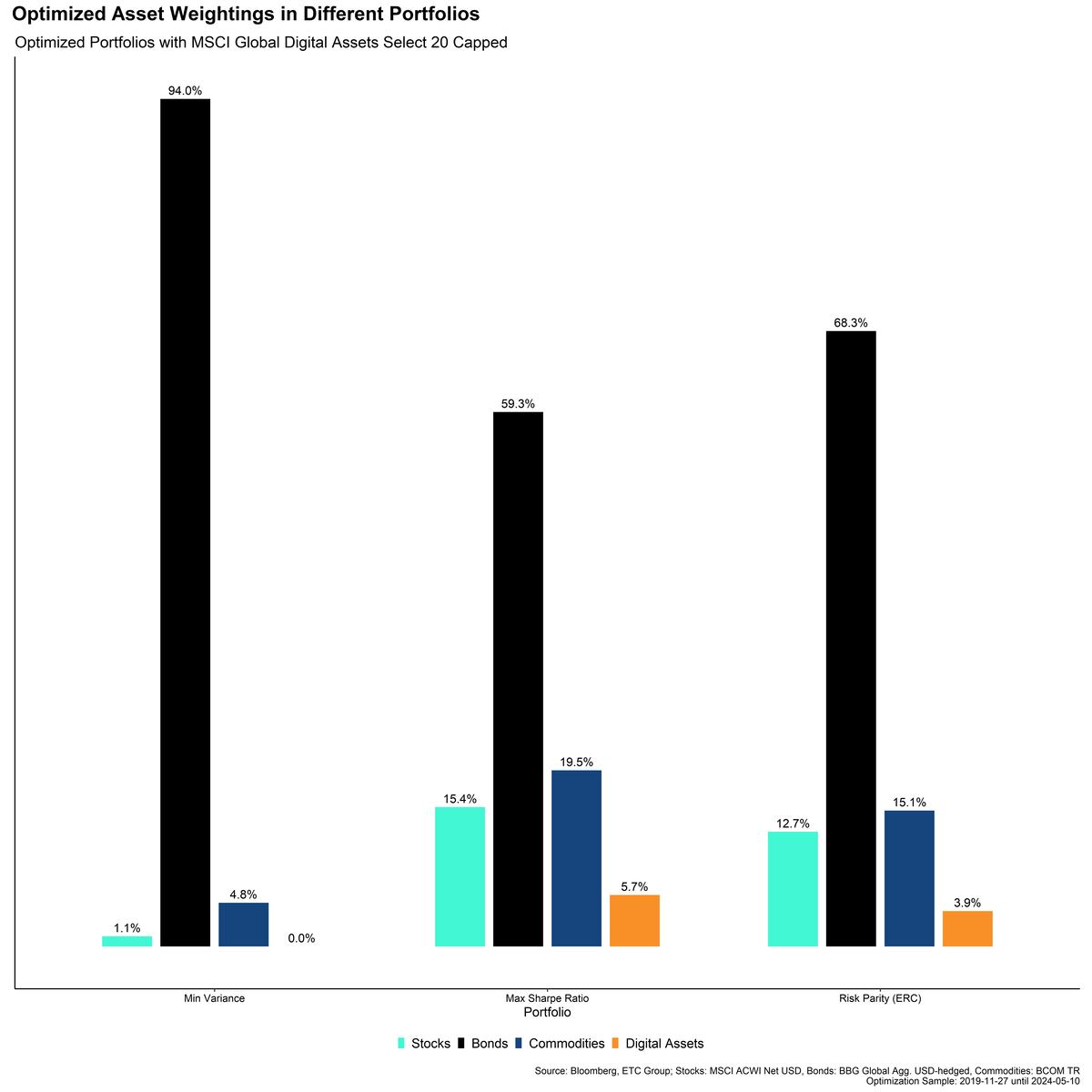

We also applied the same portfolio optimization approaches to a basket of the top 20 digital assets based on the MSCI Global Digital Assets Select 20 Capped Index.

→ The optimal % allocation is even higher in case of the Maximum Sharpe Ratio and Risk Parity portfolio optimization.

It is important to note that the period of investigation (November 2019 – May 2024) is much smaller due to the fact that younger digital assets within the top 20 digital assets like Solana or Ethereum have a smaller track record than Bitcoin.

All in all, the abovementioned results imply that even a small allocation to digital assets can have very positive effects on risk-adjusted returns without compromising the risk characteristics of the portfolios.

While highly risk-averse investors should probably avoid digital assets, the optimal allocation based on the Max Sharpe Ratio and Risk Parity approach appears to be between 2% and 3% for the full sample with bitcoin and between 4% and 6% for the smaller sample with a basket of the top 20 digital assets.

The results generally support our previous findings that we presented here.

Most portfolio optimization approaches also include digital assets within the optimal portfolio allocation which demonstrates that any modern portfolio approach that doesn't include digital assets like Bitcoin is probably sub-optimal.

We recommend that agile asset managers familiarise themselves with this emerging asset class for the benefit of their clients and to remain competitive.

Bottom Line

- Growing Mainstream Adoption of Digital Assets: Institutional investors and major asset managers are increasingly incorporating digital assets like Bitcoin into their portfolios, as evidenced by recent filings and the launch of Bitcoin ETFs in the U.S. Despite their current small market share, these investments reflect a broader trend towards mainstream acceptance

- Impact on Portfolio Performance: The inclusion of Bitcoin in portfolio optimizations, using strategies such as Maximum Sharpe Ratio and Risk Parity, has shown to improve the risk-adjusted returns compared to traditional portfolios. Portfolios optimized with Bitcoin not only offer higher returns for the additional risk taken but also present a wider range of efficient risk-return combinations

- Optimal Allocation Recommendations: Empirical studies suggest that even a small allocation to digital assets, specifically between 2% to 3% in broader asset mixes and up to 4% to 6% in more focused digital asset portfolios, significantly enhances portfolio performance without adversely impacting overall risk profiles

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

En

En  De

De