Trump has likely won the US election.

What does it mean for Bitcoin & Cryptoassets?

What does it mean for Bitcoin & Cryptoassets?

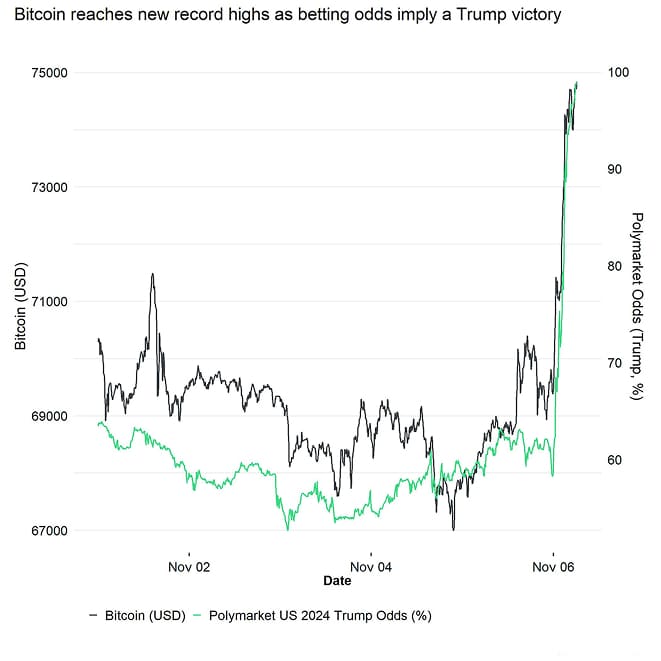

At the time of writing this report, Bitcoin has reached new all-time highs and crypto markets are rallying across the board in anticipation of a more pro-crypto regulatory environment in the US.

Trump is likely to win the electoral college majority as well as the popular vote in the recent US presidential election. At the time of writing the report, Polymarket odds already show a 99% chance and the New York Times estimates a probability of around 93% of Trump winning the presidency.

What is more is that there is a high probability for a so-called “Republican sweep” that includes the presidency, as well as the majority in both the House and the Senate. According to the latest odds provided by Polymarket, this probability currently sits at 92%. Republicans have already officially secured the majority in the senate.

It is quite likely that the final election results will already be called today.

The latest US election results imply that the political sentiment has significantly shifted towards a pro-crypto stance in the US and will likely accelerate the mainstream adoption of cryptoassets as outlined here.

For instance, in the Ohio senate race Bernie Moreno (R) defeated Sherrod Brown (D). Before the elections, Moreno publicly stated that he will defend the crypto industry in the senate and fight Senator Warren’s “war on crypto”. Meanwhile, Brown voted against the repeal of SAB121 earlier this year and has been openly anti-crypto.

At the time of writing this report, the vast majority of elected congressmen and senators in the house and senate are pro-crypto according to data provided by https://www.standwithcrypto.org/races.

Although both presidential candidates – Trump and Harris – have made pro-crypto statements before the election, Trump has made direct promises to the Bitcoin and crypto industry which have even been part of the official programme.

There are several reasons why this is relevant for cryptoassets:

Moreover, Trump has made several positive election promises, including the following:

Cryptoasset markets have already performed very well in anticipation of these developments.

Nonetheless, the decline in political uncertainty in the US could be the catalyst for a renewed bull run in Bitcoin and cryptoassets as outlined here.

We want to reiterate 2 key observations about US election cycles:

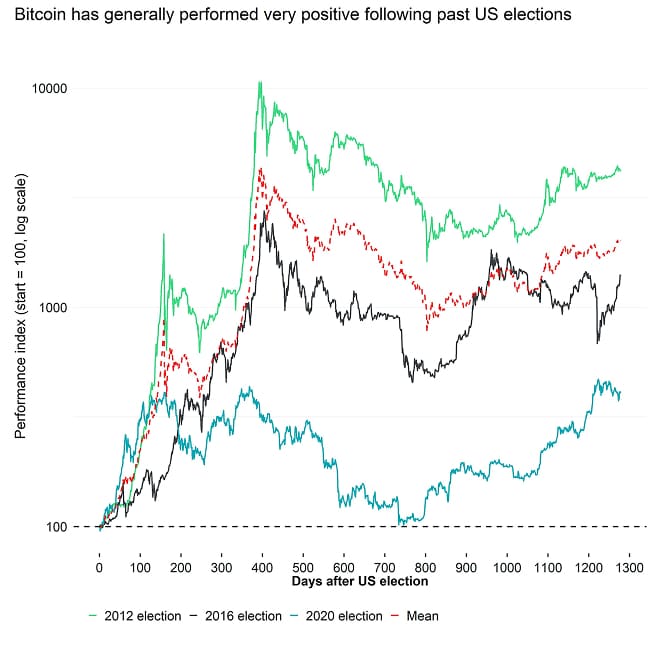

1st observation: Bitcoin has performed relatively well following past US presidential elections in 2012, 2016, 2020, regardless of the winning party.

Bitcoin has generally performed very well following past US presidential elections, regardless of the winning party. It is worth highlighting that bitcoin has exhibited diminishing returns over each of those past election cycles, for example, following the last US election in 2020 bitcoin exhibited a lower overall return in comparison to the previous US election in 2016.

However, on average, Bitcoin has increased by approximately +4,268% after 400 days of the election over the past 3 elections in 2012, 2016, and 2020 respectively.

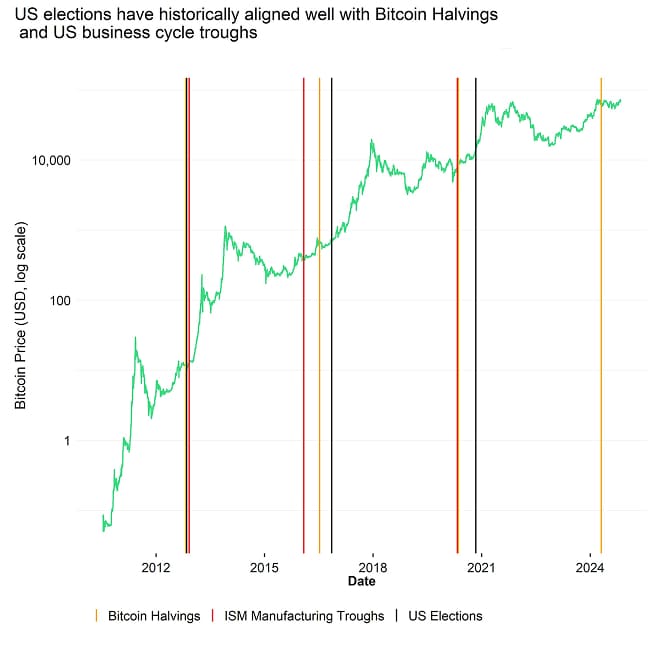

2nd observation: Past US election events have aligned well with both Bitcoin Halving events and US business cycle troughs, which are likely the main factors behind Bitcoin's stellar performance over the past 3 election cycles in 2012, 2016 and 2020. We have a similar alignment in this cycle.

It is also worth highlighting that Bitcoin’s stellar performance in the past was most-likely not only related to the US election cycles alone but also probably more important macro and coin-specific factors.

US election cycles have generally aligned well with both Bitcoin Halvings which happen pre-programmed approximately every 4 years and also US business cycle troughs shown here as troughs in the ISM Manufacturing Index.

In other words, both supply shocks from the Halving and business cycle recoveries that tend to go hand in hand with an increase in cross asset risk appetite have most-likely contributed to this remarkable performance in the past.

The good news is that we have a similar alignment around this US election event as the latest Bitcoin Halving just occurred on the 20th of April 2024 and the US business cycle also appears to be near its trough based on current readings of the ISM Manufacturing Index. Our previous analyses also imply that the positive effect from the Halving has just started to kick in around August this year and is now becoming an increasing tailwind for Bitcoin.

To put short, Bitcoin would have likely rallied regardless of the outcome of the US election over the coming months.

That being said, a Trump win is likely to accelerate the coming bull run in Bitcoin and cryptoassets.Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

Bitwise is one of the world’s leading crypto specialist asset managers. Thousands of financial advisors, family offices, and institutional investors across the globe have partnered with us to understand and access the opportunities in crypto. Since 2017, Bitwise has established a track record of excellence managing a broad suite of index and active solutions across ETPs, separately managed accounts, private funds, and hedge fund strategies—spanning both the U.S. and Europe.

In Europe, for the past four years Bitwise (previously ETC Group) has developed an extensive and innovative suite of crypto ETPs, including Europe’s largest and most liquid bitcoin ETP.

This family of crypto ETPs is domiciled in Germany and approved by BaFin. We exclusively partner with reputable entities from the traditional financial industry, ensuring that 100% of the assets are securely stored offline (cold storage) through regulated custodians.

Our European products comprise a collection of carefully designed financial instruments that seamlessly integrate into any professional portfolio, providing comprehensive exposure to crypto as an asset class. Access is straightforward via major European stock exchanges, with primary listings on Xetra, the most liquid exchange for ETF trading in Europe.

Retail investors benefit from easy access through numerous DIY/online brokers, coupled with our robust and secure physical ETP structure, which includes a redemption feature.