- Bitcoin has performed relatively well following past US presidential elections in 2012, 2016, 2020, regardless of the winning party. However, this is the first presidential election where cryptoassets have been a part of the actual discussion which is why there are important nuances between both candidates.

- If the US elections were held today, a Trump win would imply a hypothetical performance of approximately +10.7% for Bitcoin (BTC) while a Harris win would imply a performance of around -10.5%, based on historical sensitivities of bitcoin's performance to these relative betting odds.

- Irrespective of the US election outcome, the very bullish confluence of the current Halving cycle and a renewed business cycle upturn induced by the latest monetary policy pivot is bound to provide a significant tailwind for Bitcoin and other cryptoassets over the coming months and well into 2025.

On the 5th of November, US voters will head to the ballot box to decide who will be the 47 th president of the United States. The US presidential election is one of the most important political events in the world, and for this election in particular, cryptoasset investors are increasingly interested in the potential impact of the election outcome on cryptoassets. In addition to the presidential election, US voters will also decide which party will end up in the majority in both houses of congress. This will also be a key factor impacting cryptoasset markets.

In this quantitative research piece, we will focus solely on the potential performance impacts of the US election on the cryptoasset markets.

In this context, here are the key historical observations with respect to the crypto markets:

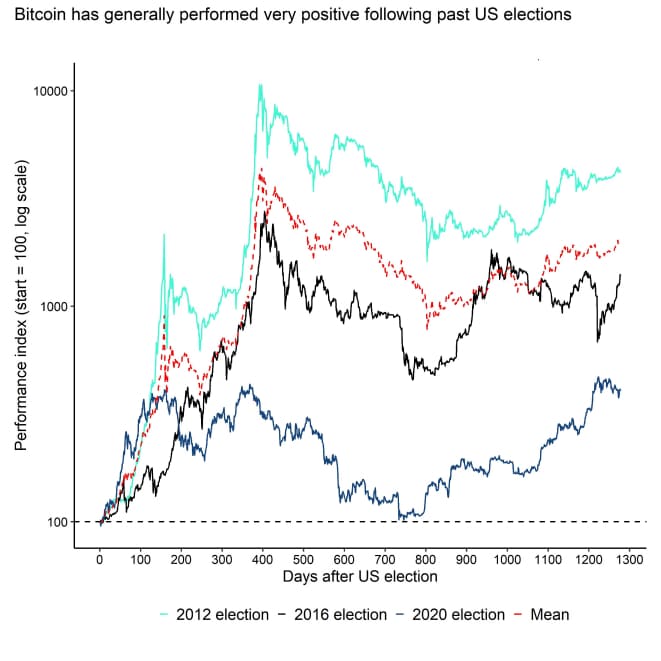

1st observation: Bitcoin has performed relatively well following past US presidential elections in 2012, 2016, 2020, regardless of the winning party.

Bitcoin has generally performed very well following past US presidential elections, regardless of the winning party. It is worth highlighting that bitcoin has exhibited diminishing returns over each of those past election cycles, for example, following the last US election in 2020 bitcoin exhibited a lower overall return in comparison to the previous US election in 2016.

However, on average, Bitcoin has increased by approximately +4,268% after 400 days of the election over the past 3 elections in 2012, 2016, and 2020 respectively.

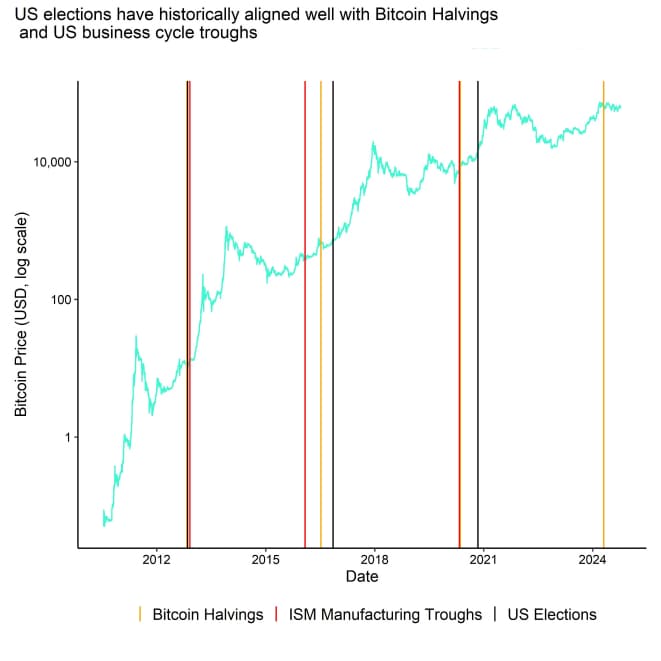

2nd observation: Past US election events have aligned well with both Bitcoin Halving events and US business cycle troughs, which are likely the main factors behind Bitcoin's stellar performance over the past 3 election cycles in 2012, 2016 and 2020. We have a similar alignment in this cycle.

It is also worth highlighting that Bitcoin's stellar performance in the past was most-likely not only related to the US election cycles alone but also probably more important macro and coin-specific factors.

US election cycles have generally aligned well with both Bitcoin Halvings which happen pre-programmed approximately every 4 years and also US business cycle troughs shown here as troughs in the ISM Manufacturing Index.

In other words, both supply shocks from the Halving and business cycle recoveries that tend to go hand in hand with an increase in cross asset risk appetite have most-likely contributed to this remarkable performance in the past.

The good news is that we have a similar alignment around this US election event as the latest Bitcoin Halving just occurred on the 20 th of April 2024 and the US business cycle also appears to be near its trough based on current readings of the ISM Manufacturing Index. Our previous analyses also imply that the positive effect from the Halving has just started to kick in around August this year and is now becoming an increasing tailwind for Bitcoin.

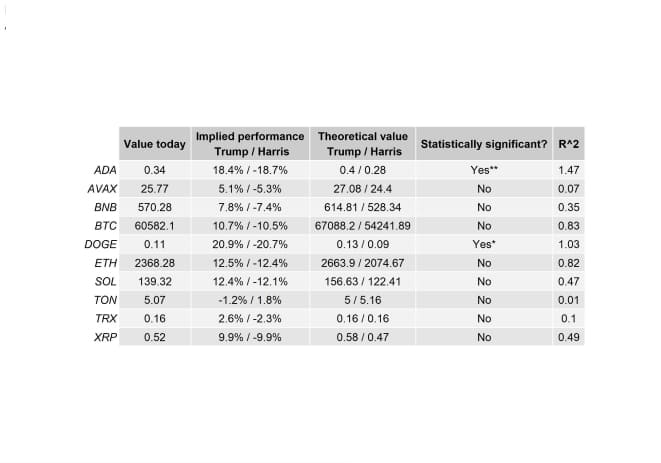

3rd observation: In general, major cryptoasset prices appear to be positively correlated with Trump's odds and inversely correlated with Harris' odds implying that the crypto market regards a Trump presidency as the preferred outcome. DOGE and ADA appear to be most sensitive to these potential outcomes, and are also statistically significant, therefore would likely be the best cryptoassets to "trade" this election.

To estimate the potential performance effects of the upcoming US election outcome, we have analysed the respective performance sensitivities to a change in relative betting odds between Trump and Harris.

Note: in our analysis we used an average of Polymarket and PredictIt betting odds to control for potential biases between those platforms. The results imply that the large majority of major cryptoassets appear to be positively correlated with a rise in Trump odds and inversely correlated with a rise in Harris odds (sole exception here would be TON).

Average of Predictlt & Polymarket Odds

*significant at the 10% level, **significant at the 5% level; data as of 09-10-2024

→ If the US elections were held today, a Trump win would imply a performance of approximately +10.7% for Bitcoin (BTC) while a Harris win would imply a performance of around -10.5%, based on historical sensitivities of bitcoin's performance to these relative betting odds.

4th observation: Most cryptoasset performances are still statistically insignificant but correlations of major cryptoassets to those betting odds have been rising structurally over the past weeks. Hypothesis: Crypto performances will become increasingly sensitive to those betting odds as we approach November 5th.

A caveat of the above results is that most major cryptoassets such as BTC or ETH do not appear to be statistically significant to those relative betting odds (see note above). Only the sensitivities of Cardano (ADA) and Dogecoin (DOGE) appear to be statistically significant and also the most sensitive from a pure performance perspective.

Another caveat is the relatively low R^2 across most major cryptoassets, which implies that other factors outside the US election appear to play a much larger role. In fact, our most recent analysis implies that Bitcoin's performance was explained most by macro factors such as US Dollar and monetary policy as well as coin-specific factors such as the Bitcoin Halving.

That being said, correlations of cryptoassets to those relative US election odds have been rising over the past few weeks. Our expectation is that these correlations will likely continue rising as we approach November 5th.

At the time of writing, average betting odds across multiple betting platforms have recently flipped in favour of Trump. However, the differences in national polling averages between both candidates are still within the margin-of-error which is why the US election outcome is still "too close to call" at this point.

However, irrespective of the US election outcome, the very bullish confluence of the current Bitcoin Halving cycle and a renewed business cycle upturn induced by the latest monetary policy pivot is bound to provide a significant tailwind for Bitcoin and other cryptoassets over the coming months and well into 2025.

Bottom Line

- Bitcoin has performed relatively well following past US presidential elections in 2012, 2016, 2020, regardless of the winning party. However, this is the first presidential election where cryptoassets have been a part of the actual discussion which is why there are important nuances between both candidates.

- If the US elections were held today, a Trump win would imply a hypothetical performance of approximately +10.7% for Bitcoin (BTC) while a Harris win would imply a performance of around -10.5%, based on historical sensitivities of bitcoin's performance to these relative betting odds.

- Irrespective of the US election outcome, the very bullish confluence of the current Halving cycle and a renewed business cycle upturn induced by the latest monetary policy pivot is bound to provide a significant tailwind for Bitcoin and other cryptoassets over the coming months and well into 2025.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.