- Bitcoin has declined more than -20% from its recent all-time high; altcoins have declined by an average of -32.6%

- Declining capital flows into major cryptoassets, increasing selling pressure from Bitcoin whales as well as miners coupled with increasing macro risks are the main catalysts behind the latest market rout

- We think that the short-term risk/reward has become increasingly asymmetric and that further downside risks are relatively limited

What’s behind the most recent crash?

Crypto markets have come under pressure recently as several factors have weighed on market sentiment. Bitcoin has already retraced more than -20% from its most recent all-time high in March and other altcoins have taken an even harder beating with the global altcoin market cap ex Ethereum being down an average of -32.6% from the recent high according to data provided by Coinmarketcap.

In general, capital flows into cryptoassets have significantly decelerated compared to the levels seen in the aftermath of the spot Bitcoin ETF launch in the US.

For instance, on-chain flows into major cryptoassets like Bitcoin and Ethereum had decelerated from approximately 100 bn USD per month in March to only 20 bn USD per month from April onwards. This coincided with a pause in the current bull market which is also one of the reasons the market failed to climb to new all-time highs again. Global crypto ETP flows and US Bitcoin ETF flows more specifically also decelerated significantly following the market peak in March.

More specifically, outflows from US spot Bitcoin ETFs have recently accelerated, with 7 trading days of consecutive outflows totalling USD -1.13 billion across all 10 US issuers.

Furthermore, we have seen increasing selling pressure on major Bitcoin spot exchanges mostly emanating from large short-term investors (“whales”). This is evident in increased whale exchange transfers which has increased overall selling pressure on exchanges.

As a result, intraday net buying volumes (buying minus selling volumes) on Bitcoin spot exchanges has turned negative which tends to be a headwind for prices. More specifically, we saw around -1.2 bn USD in net buying volumes on BTC spot exchanges over the past 7 days.

There are several catalysts behind this shift in market sentiment and risk appetite.

Bitcoin miners have come under significant economic pressure more recently as BTC mining revenues have declined by -50% in BTC-terms following the latest Bitcoin Halving on the 20 th of April. As a result, some Bitcoin miners were forced to shut off inefficient mining hardware and sell into their BTC reserves to cover expenses.

The Bitcoin hash rate has declined almost -10% from its recent peak which also supports this view. Besides, Bitcoin miners sold more than 30,000 BTC (~$2 billion) in June, the most this year, sending reserves to a 14-year low, according to data provided by CryptoQuant. However, it appears as if the market has mostly digested this level of selling so far.

Another important factor that has contributed to the most recent decline is the shift in global macro sentiment.

Traditional financial markets have recently started to “price out” benign global growth expectations. A key factor in the downward revision of global growth expectations is the consistent disappointment in U.S. economic data relative to forecasts.

The Bloomberg US ECO Surprise Index, which tracks deviations in crucial macroeconomic data from expectations, has fallen to its lowest since 2019, reflecting a broader recognition of the deteriorating macroeconomic climate.

While top equity indexes like the S&P 500 remain relatively robust, other indicators such as the AUD/JPY exchange rate, U.S. cyclical versus defensive stock sectors, and the copper/gold ratio are already indicating a weaker outlook for global growth. The recent decline in lumber prices also spells trouble for US housing and the overall economy more broadly.

Additionally, a surge in perceived sovereign risks in France, amid political shifts, is adding to the macroeconomic uncertainty. The cost of insuring against a default by the French government through five-year Credit Default Swaps has soared to its highest point since May 2020, as markets increasingly anticipate the potential for France's exit from the EU and Eurozone.

This has also weakened the Euro and strengthened the US Dollar which tends to be a headwind for Bitcoin and cryptoassets.

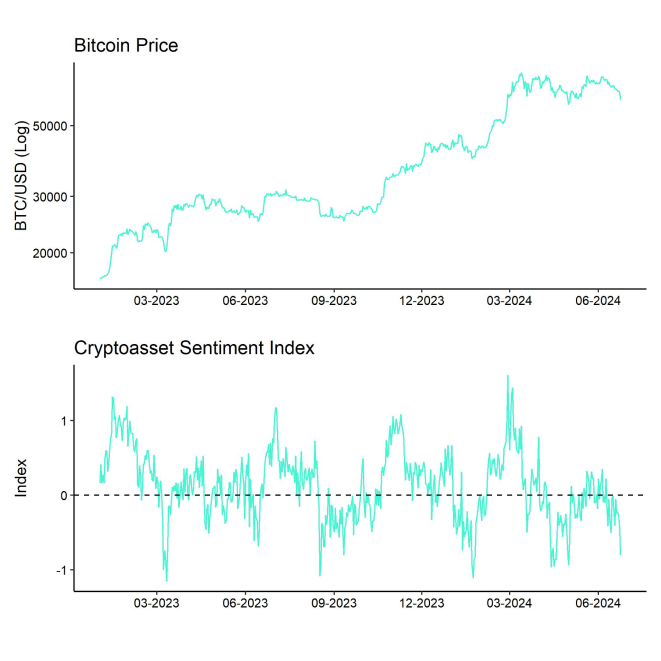

The ongoing downward adjustment in global growth forecasts, coupled with rising recession risks in the US, could continue to pose challenges for Bitcoin and other cryptoassets in the near term, as evidenced by the strong correlation between our Cryptoasset Sentiment Index and shifts in Global Growth Expectations shown here.

It is also crucial to note that changes in global growth expectations have been the most dominant macroeconomic driver in recent months, accounting for over 80% of Bitcoin's performance variability over the past 6 months.

All in all, declining capital flows into major cryptoassets, increasing selling pressure from Bitcoin whales as well as miners coupled with increasing macro risks are the main catalysts behind the latest market rout.

Is the Bottom In?

The public buys the most at the top and the least at the bottom. Bob Farrell

Wall Street wisdom assumes that the average individual investor is most bullish at market tops and most bearish at market bottoms. In theory, overly bullish sentiment signals a market top, while overly bearish sentiment signals a market bottom. In fact, one can observe similar behavioural traits in cryptoasset markets as well.

We think that several indicators already signal that positioning is lopsided, sentiment is bearish and “weak hands” have mostly exited the market.

Consider the following indicators:

- Crypto hedge fund's beta to Bitcoin has declined to a 4-year low

- Global crypto ETPs have seen the 2nd highest weekly net outflow on record

- Bitcoin long futures liquidations have spiked to the highest since April

- Bitcoin put-call volume ratios have increased to levels last seen during the rout in April

- The Crypto Fear & Greed Index has declined to “fear” levels

- Short-term holder spent output profit ratio (STH-SOPR) has declined to 0.96 signalling capitulation among “weak hands”

Therefore, we think the current market rout represents a good opportunity to increase exposure to Bitcoin & cryptoassets ahead of major events over the coming months:

Firstly, as we noted in one of our publications on Crypto Market Espresso, we still believe that the Bitcoin Halving will improve performance starting in the summer. More specifically, we estimate that the halving-induced supply shock will support a new equilibrium price for Bitcoin of slightly above 100k USD by the end of 2024 and around 172k USD by the end of 2025.

Thus, we think that the Halving effect is most likely not yet “priced in”.

Furthermore, according to Bloomberg analysts, US spot Ethereum ETFs are scheduled to launch earlier than anticipated in early July, which could result in more investment flows into cryptoassets as previously mentioned here. Large cryptocurrency investors like Pantera have already said that, once these new Ethereum products are released, they want to invest up to $100 million USD in them.

What is more is that we still think that we have only seen approximately 1/3 of potential net inflows into US Bitcoin ETFs that could be substituted from traditional risky assets such as equities into these new spot Bitcoin ETFs as outlined in our outlook report.

Moreover, as recently mentioned here, the SNB, ECB, and Bank of Canada's monetary policy actions indicate that the liquidity tide is already turning, which will surely be a significant tailwind for bitcoin and other cryptoassets in the medium to long run. In the case of a projected US recession, a reversal in the Fed's monetary policy is also very likely. We think that a US recession has become more likely over the past months as leading macro indicators have recently rolled over again.

Besides, in the context of rising French sovereign risks, Bitcoin is often considered a viable safeguard against sovereign default, being a decentralized network that is free from counterparty risk and resistant to censorship. This concept of Bitcoin as a hedge against sovereign default was detailed in our latest Bitcoin Investment Case report.

Lastly, the US presidential election is heating up to be very bullish for Bitcoin and cryptoassets as Trump has directly indicated to support Bitcoin mining in the US and enact more business-friendly crypto legislation. The latest opinion polls indicate a slight lead of Trump vis-à-vis incumbent president Biden.

All in all, the developments described above suggest that while the short-term picture may be bleak, the medium- to long-term outlook for bitcoin & cryptoassets remains very supportive.

Bottom Line

- Bitcoin has declined more than -20% from its recent all-time high; altcoins have declined by an average of -32.6%

- Declining capital flows into major cryptoassets, increasing selling pressure from Bitcoin whales as well as miners coupled with increasing macro risks are the main catalysts behind the latest market rout

- We think that the short-term risk/reward has become increasingly asymmetric and that further downside risks are relatively limited

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.