After the Merge: What’s next for Ethereum and crypto markets?

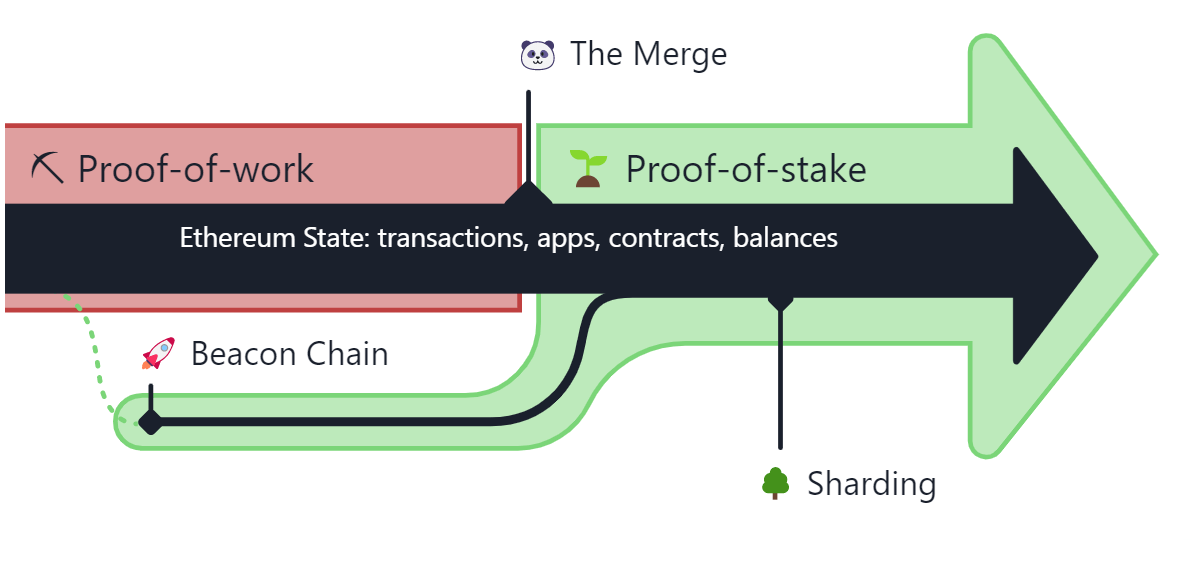

The world breathed a sigh of relief as the biggest technical overhaul in the history of crypto went off without a hitch. At 6.42am UTC on Thursday 15 September 2022, the Ethereum blockchain turned off Proof of Work and turned on Proof of Stake. 95% of validators switched over to the new system, far more than the 66% required, suggesting that Ethereum has perfected its yield-producing incentive system.

The frictionless Merge was something of an anticlimax after months of handwringing about the possible edge cases that could emerge. That’s testament to the years of testing, retesting and precision applied by Ethereum researchers and developers.

As predicted in ETC Group’s popular The State of Ethereum: The Merge report, this was a ‘buy the rumour, sell the news’ event. In the week following, ETH was down some 20%. This was expected, due to large-scale de-risking post-Merge, and the unwinding of positions across the DeFi spectrum.

Pre-Merge, traders had started to borrow significant amounts of ETH in the hope of receiving larger airdrops of ETHW, the Proof of Work continuation of the Ethereum chain. In line with its standard policy of allocating the proceeds of hard forks, investors who held the Ethereum ETP ZETH at the time of the Merge received a free 1:1 allocation of ZETW, the Ethereum Proof of Work ETP.

The successful Merge sets the stage for the upgrades that will improve throughput on Ethereum, reduce transaction fees and allow it to scale to many millions more users.

First up is the Shanghai hard fork which is expected at least six months from today (around the end of Q1 2023) and according to Ethereum’s Github planning page, is in its very early stages. Next to come will be sharding: where Ethereum’s computing load will be split horizontally across smaller ‘shard chains’, reducing fees and making the user experience on Ethereum much better. Sharding also makes Ethereum easier to access and more democratic. Instead of ever-more expensive PC hardware, sharding will make it possible to run Ethereum on a standard home laptop or mobile phone, according to the Ethereum Foundation.

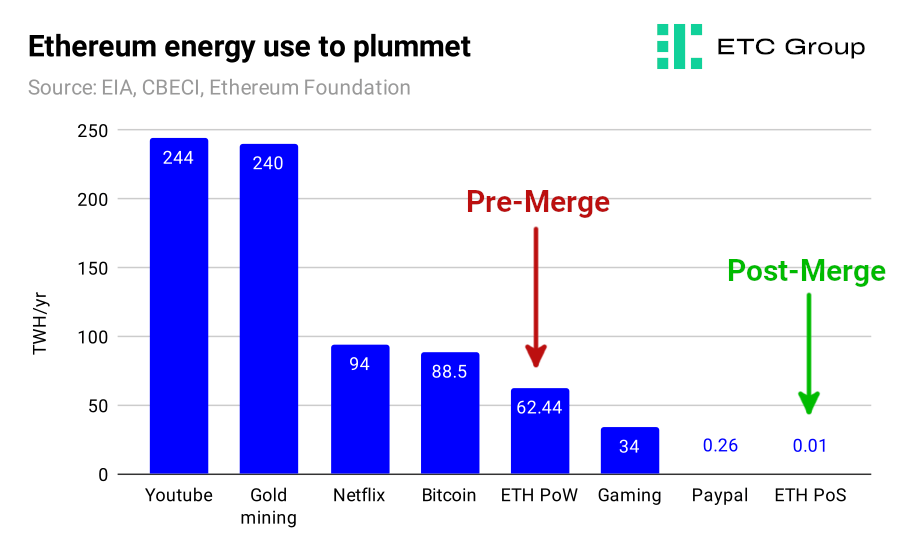

The bull case for post-Merge Ethereum is quite clear: the asset that powers the ecosystem turned deflationary, yield-bearing (like a dividend stock) and ESG-friendly — with 99.95% lower energy use — all on the same day. The Merge to Proof of Stake will reduce worldwide energy consumption by 0.2%, according to Ethereum co-creator Vitalik Buterin, and brings its annual energy use in line with the likes of PayPal.

To an extent, this heaps the political and regulatory pressure on Bitcoin as a Proof of Work operation. Ethereum has proved that such an incredible technical overhaul is possible (albeit with wide-scale support and seven years of solid work). Greenpeace is among the lobbying actors attempting to pressure US institutional investors including Fidelity to support Proof of Stake Bitcoin with a $1m ad campaign. For such a wholesale switch to occur, 95% of Bitcoin supporters would need to agree, creating an incredibly high bar to reach.

But such a move would ignore the disinformation and misinformation that still surrounds the energy use of Bitcoin. As displayed in the chart above, YouTube uses almost three times the amount of electricity per year as the world’s largest cryptocurrency: so where is the environmental campaign to ban YouTube?

Where is the recognition that Bitcoin mining actually improves decarbonisation in the United States through utilising flared gas that would otherwise be burned off from oil fields? Even the White House Office of Science and Technology Policy accepted this fact in their 8 September climate paper to support President Biden’s Executive Order on Digital Assets.

Central banks unload historic hikes as macro risk shifts

The Federal Reserve moved to up US Interest rates by 75 basis points (bps) on 21 September 2022 and the Bank of England is expected to do the same a day later.

It’s a tricky situation for risk assets like equities — and store of value cryptos like Bitcoin. Bond markets are pricing in US interest rates reaching at least 4.25% by the end of 2022.

The Rijksbank, Sweden’s central bank, just unloaded its first ever 100 basis point (bps) rate hike just enacted the largest rate hike in 30 years.

Even Japan (!) which has seen consumer price deflation since its hot property and stock market imploded in the 1990s, saw its highest inflationary reading in eight years, of 2.8%.

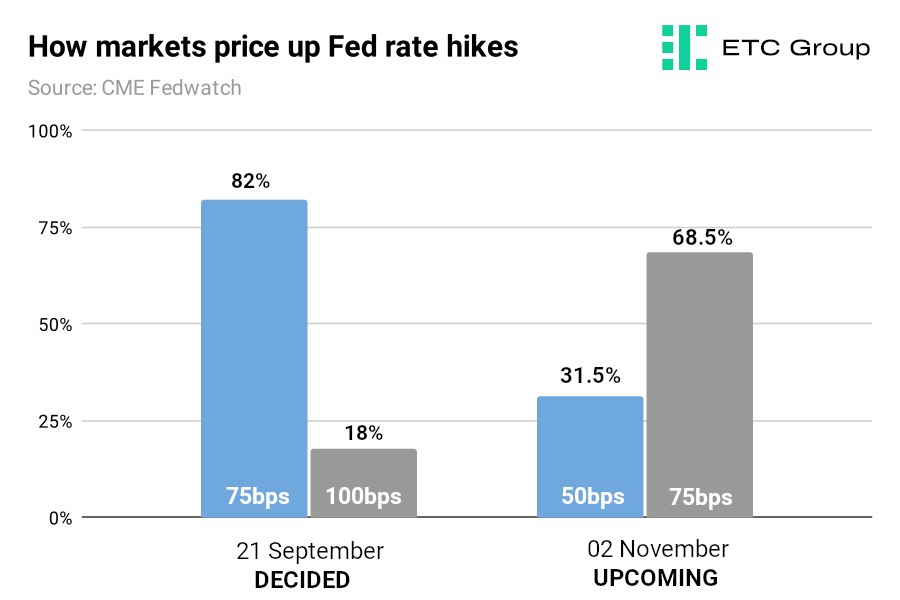

The Fed’s hike was a virtual certainty leading into the meeting, as the chart below shows. CME’s Fedwatch is a useful tool to gauge how bond markets and futures traders are positioning themselves ahead of any central bank moves.

For the 21 September meeting, 82% of traders expected a 75bps jump in interest rates, compared to 18% pricing in the chance of a 100bps move.

In the coming days, we expect higher chances of a rally in equities and crypto, simply because those 18% of positions expecting a higher hike have to be unwound. Ditto: if on 2 November the Fed pulls back to a 50bps hike, then the much larger number of positions expecting a 75bps hike will have to be unwound into the market, generating positive movement.

A widely shared report from Blackrock in the last few days on piled more bearish pressure. “For stock traders grappling with a hawkish Federal Reserve and a looming recession, the next shoe to drop will be on corporate earnings,” said the report.

“What we’re concerned about increasingly is earnings downgrades and we haven’t had that yet,” Nigel Bolton of BlackRock Fundamental Equities, which comprises active stock strategies, said in a 20 September Bloomberg interview. “The tone of management teams is already starting to change and we’re going to see pretty substantial reductions for 2023,” he said.

That posts a gloomy medium-term picture for risk assets like equities and crypto.

The reasons to be cheerful? Bitcoin is widely undervalued by any on-chain metric analysts care to share, from Network Value to Transaction Ratio (the price of Bitcoin compared to the ~$2.7bn of value being transacted on the blockchain daily) to the mining-centric Puell Multiple, to the Net Unrealised Profit and Loss metric, which displays the cost basis for Bitcoin investors in the market, all of which are flashing historically sound average-in entry points for long-term investors.

So, where will the next bullish narrative come from? The Merge is over, and the next Bitcoin Halving is still 18 months away. But the great thing about blockchain markets is that there is always the potential for a surprise around the corner. It is worth recalling that 2020’s DeFi summer and the NFT explosion startled even the most seasoned analysts.

Helium votes to close Layer 1 blockchain, join Solana

The Helium community has voted to shutter the decentralised wireless network’s own Layer 1 blockchain and shift its operations wholesale to Solana.

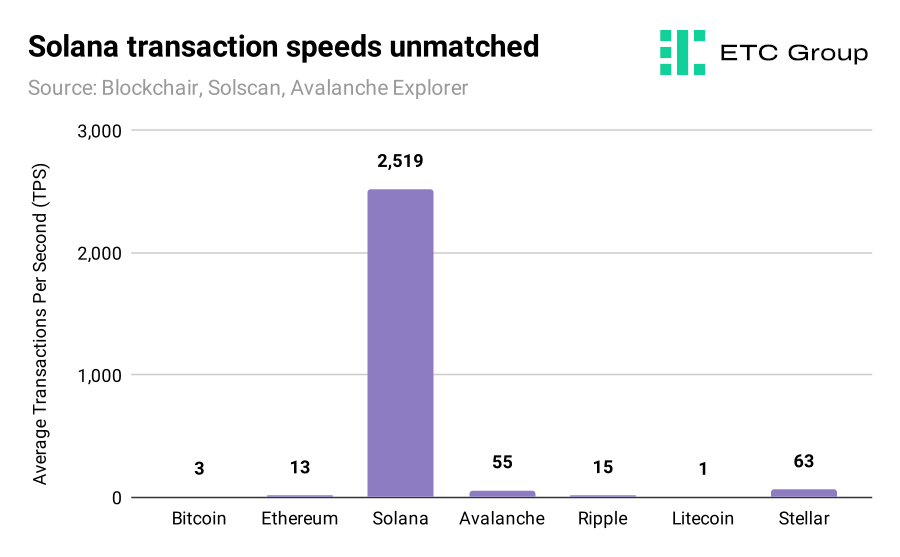

Solana was not the only Layer 1 blockchain considered. Development teams also considered Cosmos (ATOM), Polkadot (DOT), Ethereum (ETH), Avalanche (AVAX) and Algorand, eventually plumping for the 9th largest cryptoasset by market cap due to its extensive developer tooling, mobile stack, diverse DeFi ecosystem and “credible scalability plan”.

In a recent Twitter Spaces conversation, Helium podcast host Dezfuli-Arjomandi said: “Ethereum was just too slow. The other alternatives maybe had certain controversies or drawbacks that would not have made it possible to build.”

A developer post in September 2022 added: “The Solana Mobile Stack and Saga phone project are highly aligned with the Mobile and IOT goals of the Helium network. Although not required, we find this somewhat interesting when it comes to chain selection.”

As a non-financial application of blockchain, Helium represents one of the more intriguing uses for the technology.

While at the time of writing, it is only the 63rd largest cryptoasset by market cap at a $560m valuation, Helium is - by far - the world’s largest wireless network and supports nearly a million peer-to-peer internet hotspots.

The San Francisco-based broadband company was founded by CEO Amir Haleem in 2013, rebranding to a crypto company in 2018 and building its own blockchain. Haleem noted his team struggled with the decision, eventually deciding that a blockchain was the only way to organise a decentralised system of hotspots, using a novel consensus algorithm called Proof of Coverage.

As opposed to Bitcoin’s Proof of Work, and Ethereum’s Proof of Stake, Helium’s Proof of Coverage applies not to mining machines churning away billions of complex calculations, nor to validators posting a security deposit to secure the network.

Instead, Proof of Coverage helps to verify that wireless hotspots are honestly broadcasting their correct location, and hence contributing to network security. Haleem suggested in a recent Coinbase interview that he had been thinking about closing the Helium blockchain as long ago as 2020.

Helium Improvement Proposal 70 enacts the Solana move, and has proved less controversial than first expected. This network-wide governance vote passed with a wide majority of 81%.

Helium won a $111 million venture round led by Andreesen Horowitz (a16z) in 2021. Earlier this year, the Silicon Valley venture capital giant raised a record $4.5 billion for its fourth cryptoasset investment fund.

In ETC Group’s last newsletter, we noted that Helium’s potential migration to Solana could signal a turning point for the digital asset space. Such an event would demonstrate the ability of blue-chip blockchains like Solana – with their strong throughput, scalability, and user adoption – to draw in application-specific projects that enrich the industry at large.

After news broke that Helium could be abandoning its own blockchain for another, its value fell by more than 35%. Solana’s price remained unchanged. But with HIP 70 successful, it could trigger a longer-term SOL price rally in opposition to bearish conditions sweeping the market.

Testament to Helium’s importance was the 20 September bombshell news that T-Mobile had signed a major deal with the company that is now native to the Solana blockchain. It allows Helium subscribers to use a combination of Helium and T-Mobile’s 5G networks while earning crypto rewards in the form of MOBILE tokens. The $5/month subscription service runs Helium’s million-strong hotspot network alongside T-Mobile’s 5G grid. Speaking to Blockworks, the general manager of Helium Mobile Boris Renski said: “[Our token] value is tied to the volume of data on the network, so by embracing Helium 5G that was orders of magnitude higher volume of data on the network, we expect this will positively benefit the entire Helium ecosystem.”

Now that this ecosystem is inextricably tied to Solana, we would expect trickle-down value to accrue to SOL tokens and SOL-tracking ETPs like ETC Group’s ESOL as well.

Markets

The past fortnight has been full of tumult and turmoil for digital assets, but prices remain only slightly below where they were two weeks prior. That resilience in the face of central bank rate hikes, ongoing war in Ukraine and macro uncertainty should come as a boon to investors.

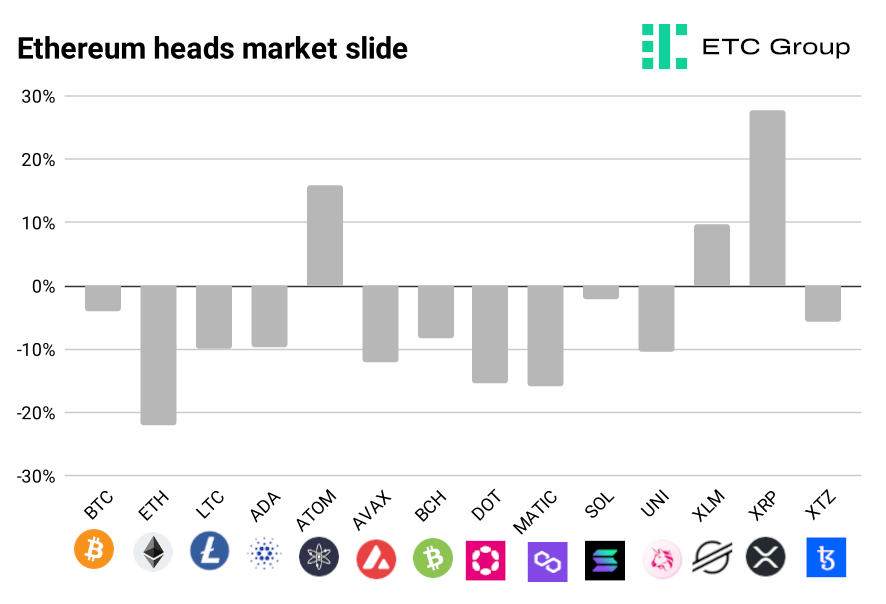

Ethereum’s expected dive post-Merge came to pass, while Bitcoin has struggled in the face of interest rate hikes from central banks worldwide.

And of course, the lower levels of noise and price euphoria is allowing builders and developers to do what they do best; to build world-changing applications without having to focus on token price, for now.

XRP emerged as the hands-down winner, on hints from Ripple’s general counsel Stuart Alderoty that a positive decision was incoming in the SEC’s case against the digital asset. The attorney wrote on Twitter that the regulator had been “unable to satisfy a single prong of the Howey Test”, that distinguishes assets as securities.

AVIS IMPORTANT :

Cet article ne constitue ni un conseil en investissement ni une offre ou une sollicitation d'achat de produits financiers. Cet article est uniquement à des fins d'information générale, et il n'y a aucune assurance ou garantie explicite ou implicite quant à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Il est recommandé de ne pas se fier à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Veuillez noter que cet article n'est ni un conseil en investissement ni une offre ou une sollicitation d'acquérir des produits financiers ou des cryptomonnaies.

AVANT D'INVESTIR DANS LES CRYPTO ETP, LES INVESTISSEURS POTENTIELS DEVRAIENT PRENDRE EN COMPTE CE QUI SUIT :

Les investisseurs potentiels devraient rechercher des conseils indépendants et prendre en compte les informations pertinentes contenues dans le prospectus de base et les conditions finales des ETP, en particulier les facteurs de risque mentionnés dans ceux-ci. Le capital investi est à risque, et des pertes jusqu'à concurrence du montant investi sont possibles. Le produit est soumis à un risque intrinsèque de contrepartie à l'égard de l'émetteur des ETP et peut subir des pertes jusqu'à une perte totale si l'émetteur ne respecte pas ses obligations contractuelles. La structure juridique des ETP est équivalente à celle d'une dette. Les ETP sont traités comme d'autres instruments financiers.