ETC Group Crypto Minutes Week #35

Cuba’s central bank is the latest to accept Bitcoin, long-term ETH and BTC holders refuse to sell and US regulators start watching the $85bn DeFi market.

Cuba’s central bank is the latest to accept Bitcoin, long-term ETH and BTC holders refuse to sell and US regulators start watching the $85bn DeFi market.

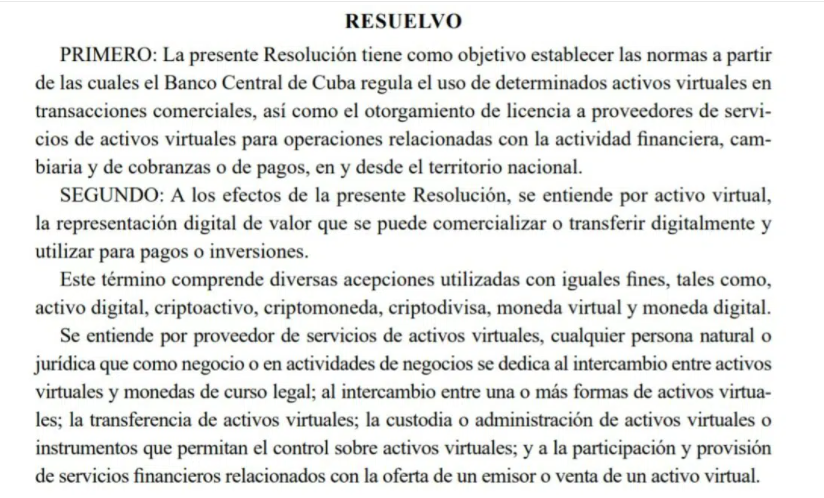

Cuba’s central bank has started accepting Bitcoin and other cryptocurrencies. A 26 August resolution signed by the Banco Central de Cuba President, Marta Sabina Wilson Gonzalez, notes that the use of “certain virtual assets in commercial transactions” is now enabled throughout the Central American country.

The text of the law leaves the door open for the adoption of a range of cryptocurrencies nationally, but local media reported that both bitcoin (BTC) and ether (ETH) will be accepted as the two most recognised and highest-value cryptocurrencies.

— Extract from the Official Gazette of Cuba , 26 August 2021

— Extract from the Official Gazette of Cuba , 26 August 2021

It means Cuba is the latest Central American country to adopt cryptocurrency at a national level.

The same circular lays out the central bank’s definition of cryptocurrencies:

Digital representations of value that can be transferred digitally and used for payments or investments. Translated from Spanish

The use of cryptocurrency is not mandatory, unlike in Cuba’s neighbour to the south El Salvador, however the resolution does recognise cryptocurrencies as a means of payment exchange for banks and institutions, and says the central bank will grant licences to crypto service providers.

Spanish-language cryptocurrency news website CriptoNoticas was first to report on the resolution.

Cuba’s GDP is currently $103bn annually, according to data from The World Bank, putting it on a par with Ethiopia and Morocco, and just behind European countries like Hungary and Greece.

Part of the reason for this national adoption of cryptocurrencies is likely to be the cost of remittances. We already know that reducing the cost of remittances is key to the evolution of Bitcoin adoption in Central America and beyond. And that is the assessment of the region’s development bank, the CABEI, in conversation with Reuters this week. CABEI is offering El Salvador technical assistance on implementing the use of cryptocurrency.

Everyone is watching if it goes well for El Salvador and if, for example, the cost of remittances drops substantially...other countries will probably seek that advantage and adopt it. Guatemala, Honduras and El Salvador are the countries that would have the most to gain if the adoption of bitcoin lowered the cost of sending remittances. Dante Mossi, executive president, Central American Bank for Economic Integration

Cuba’s move indicates that grand experiments using crypto are now accelerating at an international level.

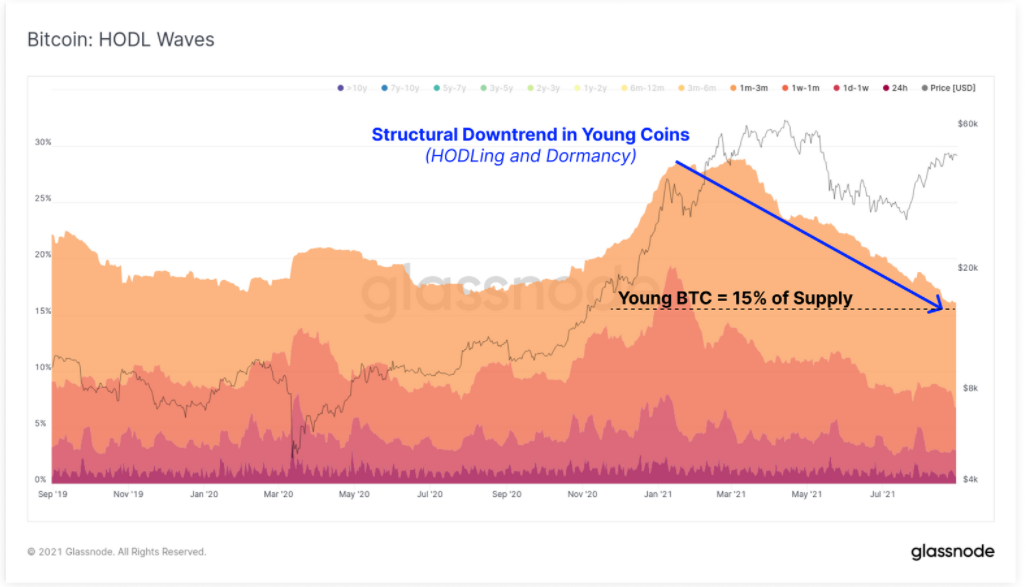

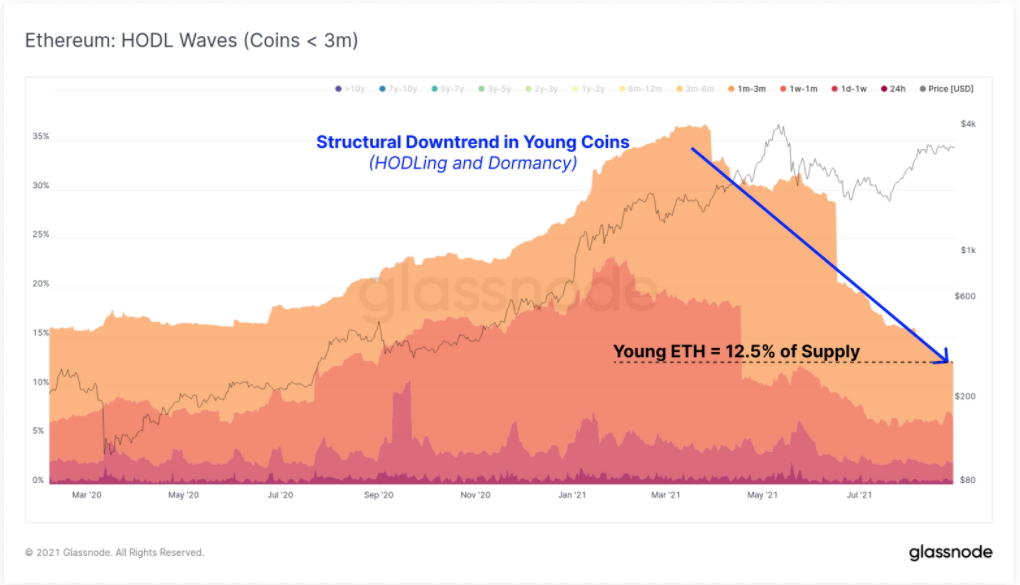

Metrics compiled by data provider Glassnode show that long-term bitcoin and ether holders are unwilling to sell their coins.

The changing market behaviour indicates a bullish intent for both the Bitcoin and Ethereum trading markets as we head further into 2021.

In agreement with a minimal desire for long-term investors to spend coins, the Liveliness metric for both chains has entered a very strong downtrend [and] Bitcoin liveliness has re-entered a downtrend which has accelerated during this price rally. Ethereum supply shows a similar trend with a whopping 70% of the ETH coin supply dormant for at least three months. For both assets these uptrends in older coins supply commenced around March 2021, which therefore reflects a very strong demand to buy and hold throughout this bull market. Glassnode, The Week On-Chain, 30 August 2021

‘Liveliness’ delineates whether more coin days are accumulated (investors hold BTC and ETH) or destroyed (investors spend their BTC or ETH) by total coin supply.

Downtrends in this metric suggest greater accumulation, where more dormancy and coin maturity is building up, and less spending is taking place. Steeper trends suggest stronger fundamental changes are at play.

Glassnode points out a structural downtrend in ‘younger’ bitcoin and ether being sold, which suggests more holders are clinging onto their BTC and ETH and not quickly returning it to the market.

Young coins are those created in the last three months, and are those most likely to be spent in periods of market volatility. Young BTC now represent only 15% of the total coin supply in circulation today.

2020 was the so-called ‘DeFi summer’, when decentralised finance protocols broke through to the mainstream, and international media scrambled to understand markets with esoteric names, like Aave, MakerDAO and Uniswap.

Decentralised finance (DeFi) is an umbrella term for a range of fintech developments that use blockchain to enhance existing financial tools, everything from lending and borrowing markets, to derivatives (futures and options), yield aggregators and insurance.

DeFi marketplaces — largely based on Ethereum — have continued to grow strongly throughout 2021, even while media attention has shifted to the new hot market of NFTs (also mostly based on Ethereum). DeFiPrime records that the total value locked in DeFi protocols is now approaching its all time high, at $84.1bn.

This new set of digital asset marketplaces allow people to trade and lend cryptocurrencies with no middleman to set the rules or siphon off fees. Instead, smart contracts, mostly executed using the Ethereum blockchain’s virtual computer, define the terms of lending, borrowing or derivatives trades, and carry out functions automatically as soon as the conditions laid out in code are completed, for example, depositing coins in a particular wallet. Uniswap, DeFi’s largest trading venue with around $1.8bn daily volume, for example, is a collection of around 30,000 smart contracts running concurrently.

The appearance of these new tools has intrigued investors and regulators worldwide in equal measure.

And now the US market watchdog, the SEC — the gold standard for financial regulators globally — has signed a contract with blockchain analytics firm AnChain.AI to track transactions using these platforms. According to Forbes, the contract is worth $125,000 per year.

The upshot is that America’s Securities and Exchange Commission is now watching the $85bn DeFi market, with a view to implementing greater regulatory oversight on decentralised finance platforms.

The SEC is now under the leadership of former MIT professor Gary Gensler, who notably taught classes at the university blockchain and cryptocurrencies and released the lectures free on Youtube in 2018.

DeFi developers write software to automate transactions and then leave the code to do its job, allowing these smart contracts to run without a central entity in charge. They tend to argue that this kind of decentralisation defeats the need for oversight by the SEC.

However, Chairman Gensler told the Wall Street Journal that Uniswap et al each have features analogous to the kinds of entities that the SEC already oversees.

There’s still a core group of folks that are not only writing the open source software, but they often have governance and fees...There’s some incentive structure for those promoters and sponsors in the middle of this. Gary Gensler, chairman, SEC

BTC/USD

Bitcoin’s bullish run slid off this week, with a total 1.3% loss against the US dollar across the seven-day trading session. $50,000 remains a statistically significant resistance level, with BTC topping out only a few dollars shy of the round number at $49,879.08. The market is yet to reproduce the kind of speculative risk-on conditions that saw the original cryptocurrency race to an all-time high of more than $64,000 in April, but Bitcoin’s low point of $46,294.84 is the highest weekly low since mid-May 2021.

ETH/USD

Ethereum reached a 15-week high in trading this week, continuing the irrepressible bull run that started with the London hard fork. $3,000 remains a significant barrier for bears, as ETH traders showed characteristically strong buying support in this region. That said, price volatility appears to be contracting, with ETH moving just 4.8% higher in total against the US dollar this week.

LTC/USD

Further down the cryptoasset chain, the $11.5bn payments protocol Litecoin saw 4% shaved from its value against the US dollar this week. From a starting point of $182.50, LTC crept up by 3.4% to 188.62, before dipping slightly to end the week at $175.13. Still, this point in time represents the higher echelon of value creation for LTC, fully 68% higher than its 2021 low of $103.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

Bitwise is one of the world’s leading crypto specialist asset managers. Thousands of financial advisors, family offices, and institutional investors across the globe have partnered with us to understand and access the opportunities in crypto. Since 2017, Bitwise has established a track record of excellence managing a broad suite of index and active solutions across ETPs, separately managed accounts, private funds, and hedge fund strategies—spanning both the U.S. and Europe.

In Europe, for the past four years Bitwise (previously ETC Group) has developed an extensive and innovative suite of crypto ETPs, including Europe’s largest and most liquid bitcoin ETP.

This family of crypto ETPs is domiciled in Germany and approved by BaFin. We exclusively partner with reputable entities from the traditional financial industry, ensuring that 100% of the assets are securely stored offline (cold storage) through regulated custodians.

Our European products comprise a collection of carefully designed financial instruments that seamlessly integrate into any professional portfolio, providing comprehensive exposure to crypto as an asset class. Access is straightforward via major European stock exchanges, with primary listings on Xetra, the most liquid exchange for ETF trading in Europe.

Retail investors benefit from easy access through numerous DIY/online brokers, coupled with our robust and secure physical ETP structure, which includes a redemption feature.