Ethereum makes history with September Merge in sight

A specific date for a massive Ethereum software upgrade that will fundamentally change the character of the second-largest cryptoasset has produced a huge rally in the blockchain's native token ETH, along with its associated technologies Polygon and Uniswap.

Since the local bottom of 18 June, the price of ETH has rocketed more than 100%, while its critically-important layer two add-on Polygon (MATIC) jumped 164% and the Ethereum-based decentralised exchange token Uniswap (UNI) soared by 142%. On stock exchanges across Europe, ETC Group's suite of physically-backed and centrally cleared exchange-traded products provide accurate exposure to the prices of these assets.

The Merge will now take place on 19 September 2022, according to Ethereum lead developer Tim Beiko. Several testnets (testing environments that mimic the blockchain's working without affecting it) have enacted Proof of Stake successfully.

With Ethereum creating upwards of ten billion dollars of revenue per year through transaction fees for the thousands of apps vying to use its platform, the wholesale switch to a new consensus mechanism is a risky business, akin to rebuilding an aeroplane while it is still in flight.

But derivatives markets offer critical insight into how institutional traders are pricing the effects of the Merge.

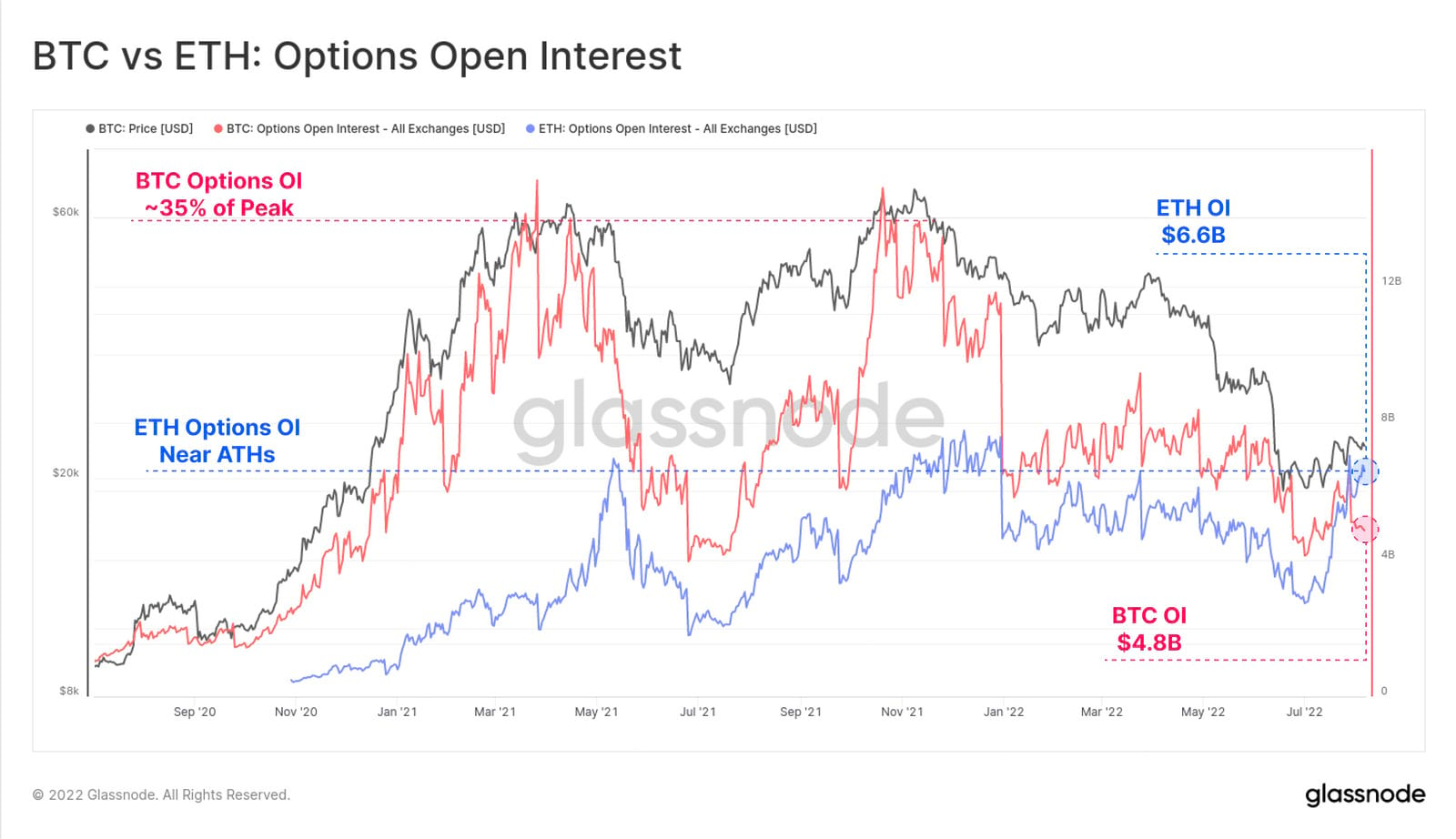

Ever since crypto derivatives became widely offered in 2020, the open interest in options contracts for Ethereum (ETH) has never exceeded that of Bitcoin (BTC). That curve flipped in July, with ETH options interest rocketing 32% higher than BTC. And so for the first time ever in early August, ETH options open interest at $6.6bn exceeded BTC at $4.8bn.

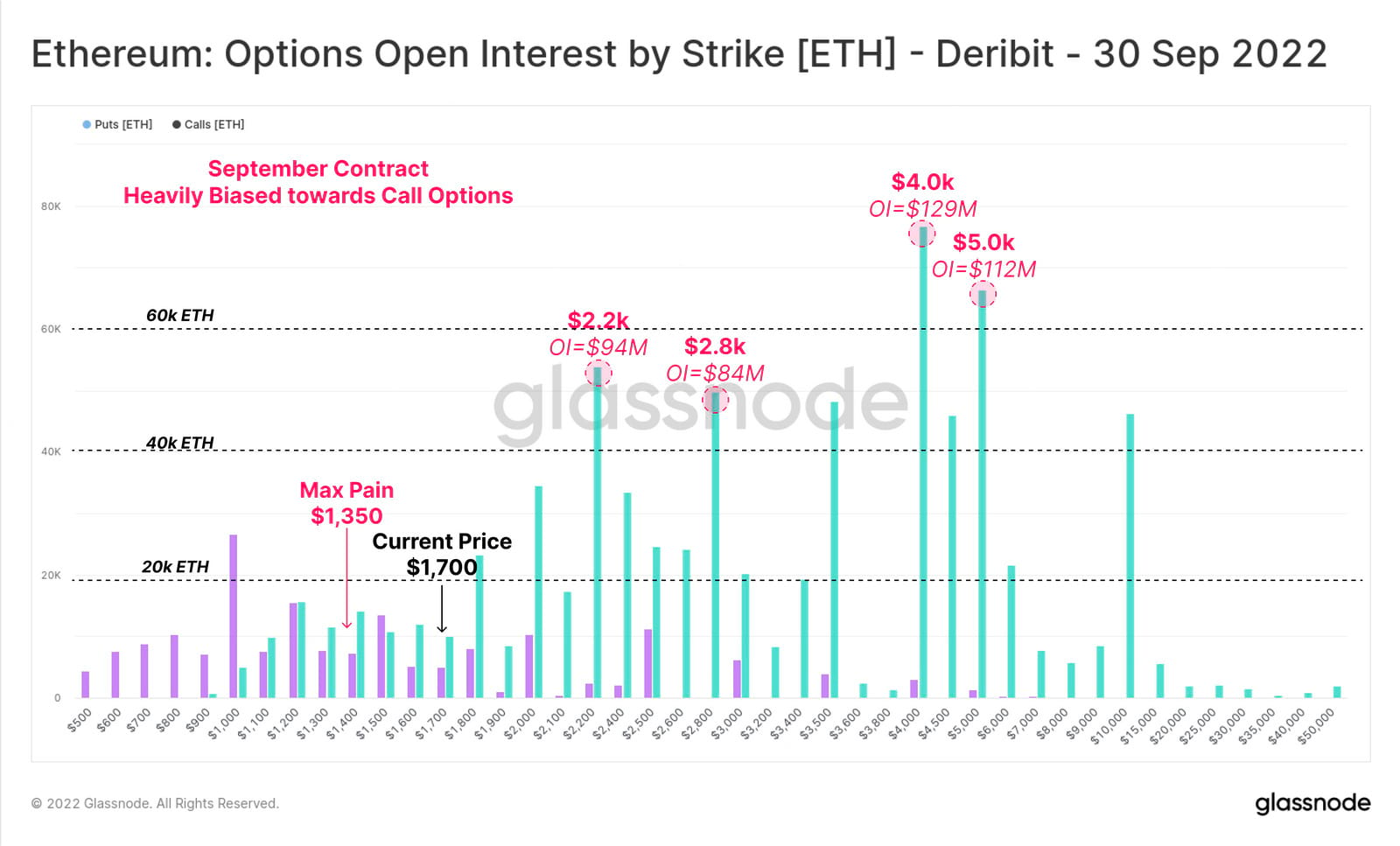

Bullish call options on Ethereum outweigh protective put options by a factor of three to one, the latest data show.

And looking at the open interest by strike price on Deribit, the largest crypto options exchange globally, there remains with significant interest out to an Ethereum price of $5,000, suggesting that traders are betting big on the Merge to send prices flying higher.

Ethereum is by far the largest blockchain ecosystem for decentralised apps and a key infrastructural building block for Web3.

It introduced smart contracts - self-executing programs written on the blockchain - when it launched in 2015 and as a result created the vast new crypto verticals of decentralised lending and borrowing (DeFi) and NFTs. But it has been a victim of its own success: the millions of people and programs competing to use its services mean that fees have regularly soared to extortionately high levels and the processing speed of the network has suffered.

Vitalik Buterin, the co-creator of Ethereum, originally scheduled the switch to Proof of Stake as early as mid-2016, making this perhaps the most overdue and highly-anticipated software upgrade in history.

At the time, Buterin quoted Hofstadter's Law, a somewhat joking adage often cited by programmers that describes the difficulty of accurately estimating how long it takes to implement tasks of substantial complexity.

It always takes longer than you expect, even when you take into account Hofstadter's Law.

There remains much discussion over what The Merge will and will not do for Ethereum. It will certainly move the platform from the Bitcoin-favoured Proof of Work to the newer technology of Proof of Stake, becoming 99.95% less energy intensive in the process.

Overcoming performance bottlenecks in the Ethereum ecosystem is already a multi-billion dollar business, hence the dramatic rise of Polygon. But for NFT and DeFi users to see lower fees, they will have to wait for the sharding upgrade that comes in 2023, which will split Ethereum's network compute load horizontally, and won't be affected by the Merge.

Crypto retakes $1T as macro signals flash deep recession warning

Crypto markets recaptured the psychologically important $1 trillion market cap in July to mid-August, even while macro signals continued to flash warnings of a global growth slowdown and deep recessions across major economies.

Equities bounced, with the S&P 500 returning 9.1% across July, but it was of course crypto products that drastically outperformed every other asset class when even a hint of risk-on attitude returned.

From the local bottom of 18 June 2022, Bitcoin climbed 36.9% to touch $24,000, while Ethereum reacted much more strongly, gaining 98% from its low of $897 to reach almost $1,800.

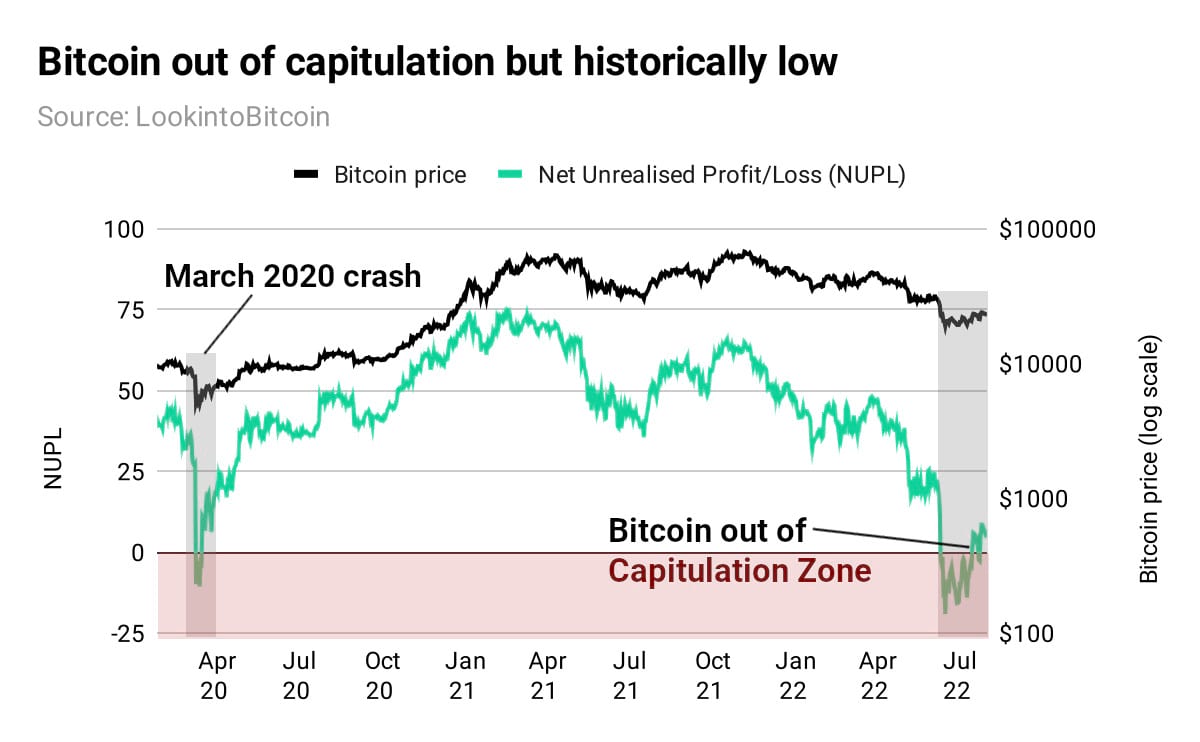

In the last Crypto Minutes, we described a key on-chain metric for Bitcoin: Net Unrealised Profit and Loss (NUPL). A NUPL below zero is the Capitulation Zone, where the largest relative profits are made by long-term investors.

As of 9 August, Bitcoin has now swung back out of the Capitulation Zone, but remains at an historically low level.

The unprecedented nature of the economic times in which investors find themselves makes forward predictions exceedingly tricky.

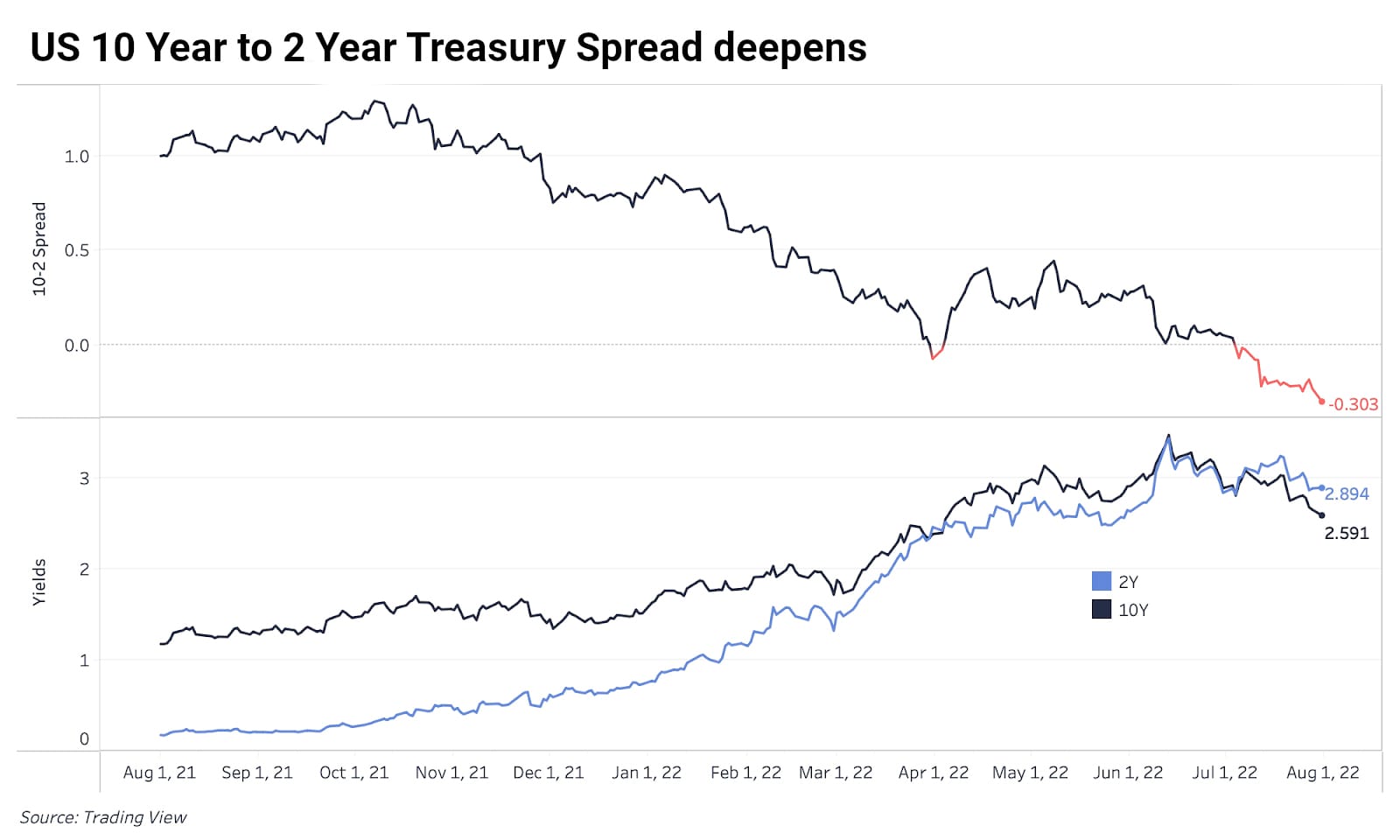

The US Treasury 10 year/2 year yield curve, a highly-watched macro metric, has now been negative for more than a month, and the spread continues to widen.

By 9 August 2022 it stood at 44bps, far beyond the 16bps inversion that preceded the 2008-9 financial crisis, and approaching the largest negative spread on record, the 47bps of March 1989. This suggests the world's largest economy is entering an unprecedented period of crisis.

US yield curve inversion is worthy of note: firstly, because it has happened so infrequently - just six times since 1978 - and secondly, because it suggests that the near-term economic outlook is riskier than the long-term. Inversions in this portion of the yield curve have preceded every recession since the 1970s, making this metric a key leading indicator.

Out there in the wider world, central banks are in a bind and according to some economists far too late in their hiking cycle. Persistent inflation continues to rocket higher along with consumer prices.

In July, the Bank of England raised interest rates by 50 basis points (bps), the largest such increase since 1995. The European Central Bank also raised rates for the first time in more than a decade, ending the era of negative rates dating back to the Greek debt crisis of 2012.

Bitcoin was born in the wake of the 2008-9 financial crisis as a direct response to massive central bank quantitative easing, and over the last 13 years inflated money supply with currency duation has not abated.

Markets have yet to see how crypto will perform under such historic conditions, but one thing remains true. Bitcoin remains the only desirable asset in history whose supply schedule is deflationary and laid down in code in advance.

Reality bites for Meta but metaverse interest soars

Meta Platforms ( NASDAQ: META ) has had a torrid year. The social media giant's share price has shed 49% this year, alongside a broader decline in the tech sector.

This can be attributed to factors both within and beyond its control. Rising consumer and energy prices and a contracting US economy have led many companies to slash spending on online advertisements – Meta's core income stream.

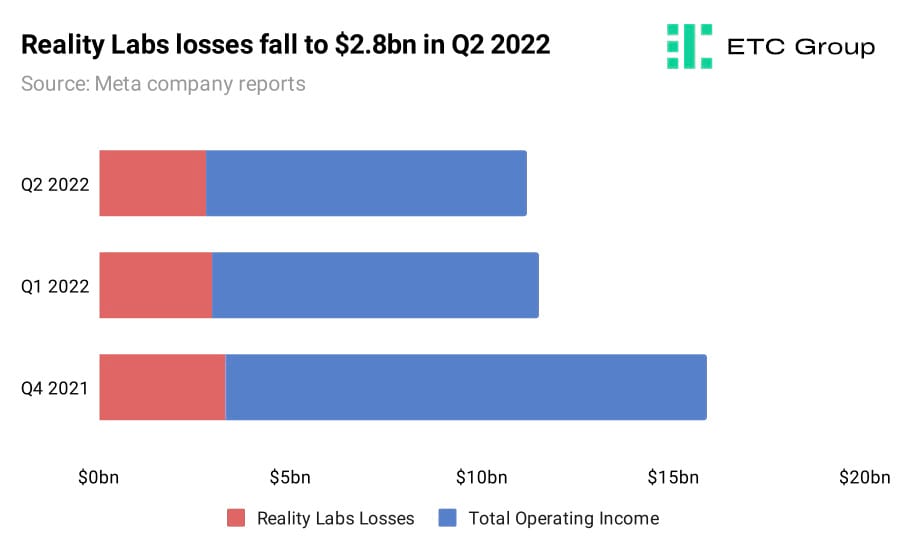

Meta's virtual reality division – Reality Labs – has also been a costly enterprise. It has not turned a profit since its inception last year and recorded $2.8 billion in losses in Q2 2022.

Looking at the data, this is actually less than the $3.3bn loss from Q4 2021 and the $2.95bn loss from Q1 2022. But with lower total income, the spotlight has turned more strongly onto Meta's pivot.

The Metaverse - a shift towards 3D, persistent, shared virtual worlds slated to disrupt every industry from gaming to social media and real estate, has been pegged as a $13 trillion opportunity by 2030 by leading US investment banks. And both retail and institutional interest remains markedly strong, with ETC Group's FTSE-listed Metaverse ETF recording a 20.6% price rise in July, more than double that of the S&P 500.

A couple of billion dollars of investment did look a prudent move in the face of such gargantuan potential gains, but with 2022 so far being the worst first half of a year for equities in 50 years, investor focus has flipped from opportunities to cost-cutting.

Meta has been a victim of timing, to some extent. Its name change from Facebook in October 2021 came at the height of a $3 trillion crypto market cap and Bitcoin's $69,000 all time high. Optimism seemed strong. But we are now dealing with a much different macro outlook.

Mark Zuckerberg has warned stakeholders that losses from Reality Labs could endure over the next few years. But the Meta CEO remains committed to pivoting the company toward what he believes will be the generational shift in Big Tech: Web 3 and the Metaverse.

Despite the losses stemming from Reality Labs, Meta still has some room to manoeuvre in. The company had a net profit of $8.3 billion in Q2, which means it still has resources to spare to continue with its experiments in the blockchain space.

On 28 July, Meta sealed a partnership with Oasis Labs, a privacy-focused Web3 company, using their cryptographic technology to safeguard data privacy on Instagram.

In other news, Meta's use of Ethereum as the basis for its Instagram NFT experiment is getting a massive expansion.

Today we're starting international expansion to 100 countries in Africa, Asia-Pacific, the Middle East, and the Americas,

said a 4 August blog post, sharing the case study of one NFT-using photographer who utilised the feature to drive engagement with her work, seeing an associated increase in sales.

Hundreds of leading tech companies, fashion brands and sports giants from football to Formula One has seized on the NFT opportunity to extend their reach, with Ethereum and Polygon consistently chosen as the best platforms to provide the background infrastructure.

There is one point of contention on the horizon. Meta still faces a legal test from the US Federal Trade Commission (FTC). The regulatory body is aiming to prevent Meta from “ conquering ” virtual reality in light of the aggressive acquisitions it has made in the space since it purchased VR headset manufacturer Oculus in 2014.

Public criticism and legal scrutiny have left some investors pessimistic about the company's Metaverse ambitions. However, if Meta can fend off these challenges, it stands a strong chance of becoming one of the first leading internet giants to successfully transform itself into a Web3 company – and accessing the huge financial windfall that comes with it.

If Zuckerberg gets this right, it will redeem any investors scooping up Meta shares at the relative bargain they are priced at today.

Markets

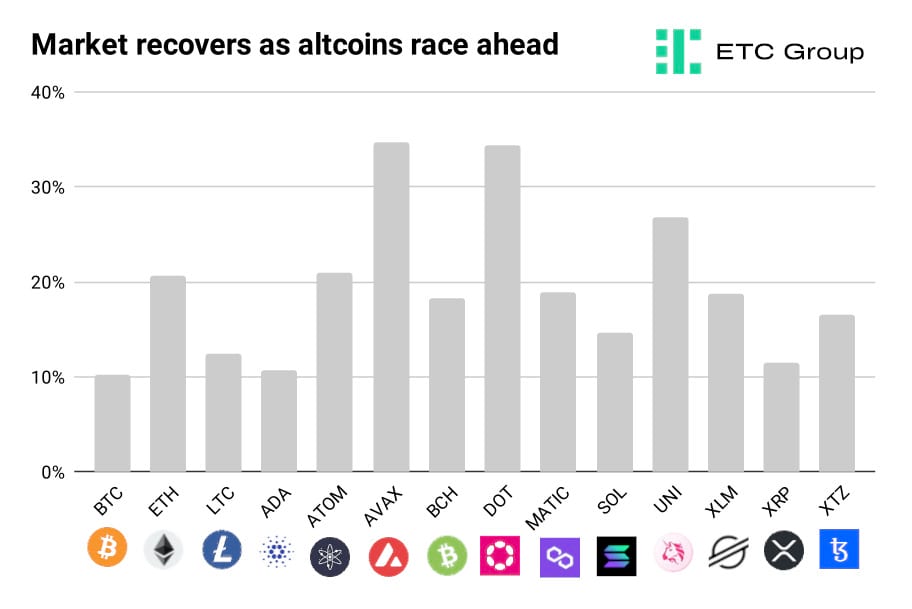

The rally that engulfed the market in July has defied worsening macroeconomic conditions and carried its momentum into August.

Bitcoin has established a support zone between $22,000-$24,000 and has appreciated by 10% over the last fortnight. Ethereum has continued to outperform Bitcoin, with the second-largest digital asset touching the $1,800 resistance level on 8 August.

The Bitcoin Dominance Index stands at 40.5%. Ethereum accounts for 19% of the total cryptoasset market cap and is on the path to a multi-year high.

Smart contract blockchains Avalanche (AVAX) and Polkadot (DOT) have both seen 34% breakouts in the last two weeks. Avalanche has benefited from a spike in NFT trading volumes on its platform while Polkadot impressed investors by reaching a high watermark in the number of grants it has provided to builders in its ecosystem.

Fellow smart contract platform Solana (SOL) had a sluggish start to the month compared to its peers. This was largely due to a vulnerability within a web wallet found on the Solana ecosystem that allowed a hacker to drain over 10,000 Solana-based wallets.

AVIS IMPORTANT :

Cet article ne constitue ni un conseil en investissement ni une offre ou une sollicitation d'achat de produits financiers. Cet article est uniquement à des fins d'information générale, et il n'y a aucune assurance ou garantie explicite ou implicite quant à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Il est recommandé de ne pas se fier à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Veuillez noter que cet article n'est ni un conseil en investissement ni une offre ou une sollicitation d'acquérir des produits financiers ou des cryptomonnaies.

AVANT D'INVESTIR DANS LES CRYPTO ETP, LES INVESTISSEURS POTENTIELS DEVRAIENT PRENDRE EN COMPTE CE QUI SUIT :

Les investisseurs potentiels devraient rechercher des conseils indépendants et prendre en compte les informations pertinentes contenues dans le prospectus de base et les conditions finales des ETP, en particulier les facteurs de risque mentionnés dans ceux-ci. Le capital investi est à risque, et des pertes jusqu'à concurrence du montant investi sont possibles. Le produit est soumis à un risque intrinsèque de contrepartie à l'égard de l'émetteur des ETP et peut subir des pertes jusqu'à une perte totale si l'émetteur ne respecte pas ses obligations contractuelles. La structure juridique des ETP est équivalente à celle d'une dette. Les ETP sont traités comme d'autres instruments financiers.