Post-Shapella: Staking withdrawals and Ethereum to $150k?

Ethereum users can finally withdraw their stake from the Beacon Chain since the earliest adopters first began staking in December 2020.

The 12 April ‘Shapella' hard fork - a portmanteau of the ‘Shanghai' upgrade to Ethereum's execution layer, and the ‘Capella' update to the Beacon Chain - ushers in a new era for the ~$40bn of staked ETH and is the first major change to the second-largest blockchain since September 2022's Merge.

And despite bearish predictions of catastrophe once staking withdrawals were enabled, Ethereum has been on a bull run since its network upgrade.

ETH crossed $2,000 for the first time since May 2022 and the market has largely absorbed the 1 million ETH (~$value) supply from the 21,000 addresses withdrawing their staking rewards.

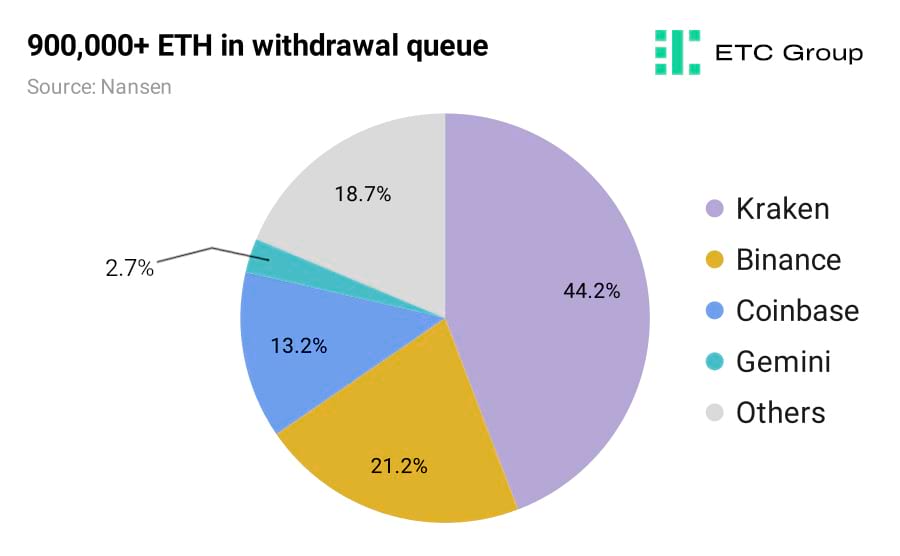

At the time of writing, a further 910,000 ETH ($1.9 billion) from 28,306 validators is waiting for a full exit. A full exit refers to the exercise of removing all staked ETH from the chain while partial exits encompass users withdrawing ETH accrued as rewards.

Kraken accounts for 400,000 ETH waiting to be withdrawn, which is more than 44% of the total in the queue. This can be attributed to the exchange's settlement with the SEC in February, where the regulator took a $30m fine and started the process of shutting down Kraken's staking services to US customers.

More broadly, the ability to withdraw staked funds and rewards is widely seen as a significant de-risk for Ethereum stakers.

Users can take comfort from the fact their staked ETH will not be locked up for an indefinite period of time (as it had been since December 2020). Shapella is also likely to bring in the more risk-averse institutional market – that has so far been watching from the sidelines– to participate in staking. Improved capital efficiency for large validators is another knock-on effect.

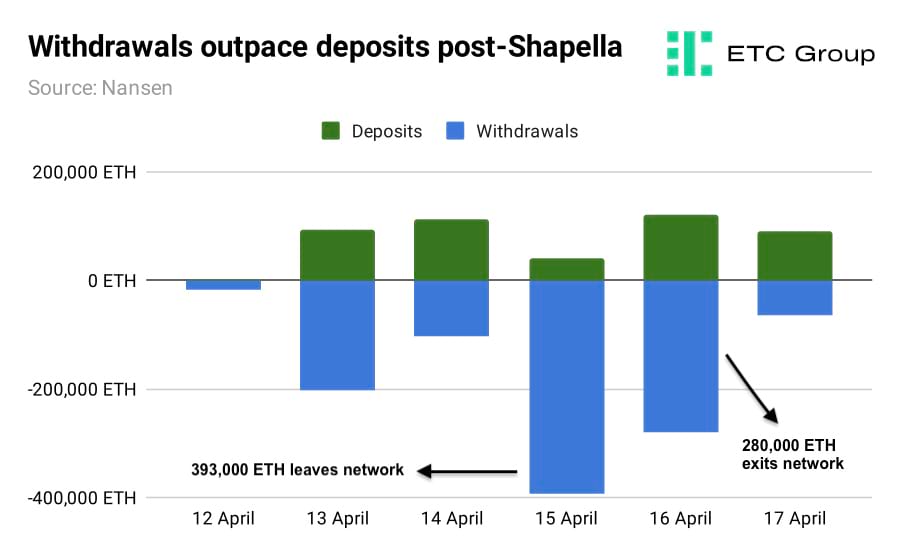

In the week since Shapella was enabled, withdrawals have been outpacing deposits, contributing to a small amount of selling pressure and slowing Ethereum's recent price momentum.

The largest withdrawals to date took place on 15 and 16 April, with almost 700,000 ETH departing from the network.

However, it is important to note that the network also saw a heavy inflow of deposits to the staking contract and markets reacted positively to the second drama-free network upgrade in less than 12 months.

Post-Shapella, Ethereum caps the number of validator withdrawals at 1,800 per day, so the current queue is expected to be cleared within 10 days.

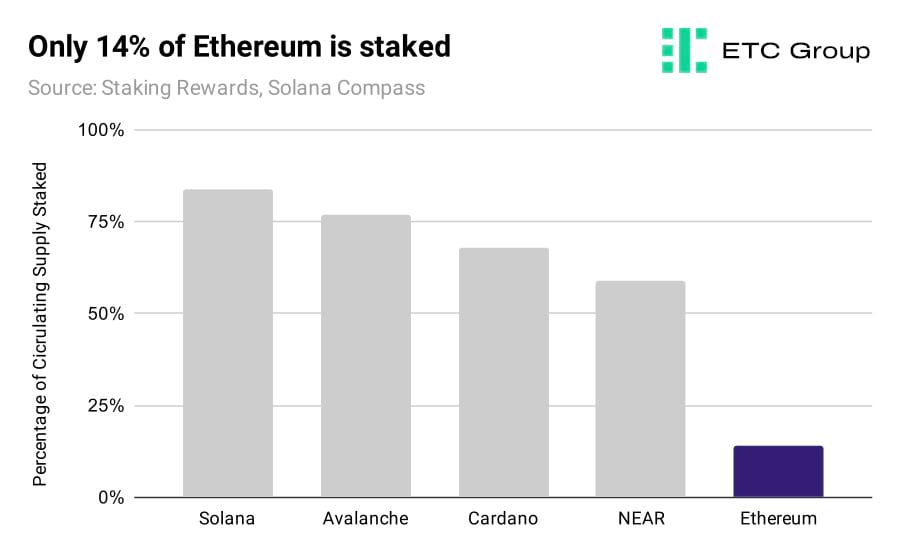

Before Shapella, only 14% of the total circulating ETH supply was staked by holders and this has little changed despite this being the final manifestation of Ethereum's move from Proof of Work (PoW) to Proof of Stake (PoS).

Other major PoS networks, including Solana, Avalanche and Cardano maintain a 40% to 75% staking percentage ratio.

If Ethereum's staked supply reaches the level of these other Layer 1 chains, it could lead ETH's price higher because the commensurate fall in circulating supply will create additional scarcity.

Ethereum's supply has been net deflationary since the Merge, and as we mentioned in the weeks leading up to Shapella, it made little sense for there to be a mass exodus, if only because 70% of stakers were underwater from the time they staked ETH. Withdrawing their stake would have meant realising paper losses.

We already know that Ethereum's development team is among the best in the world. This was proven by the successful shepherding from Proof of Work to Proof of Stake, which reduced Ethereum's energy consumption by 99.95%.

With another success in the rear-view mirror, it may be time to revisit Nikhil Shampant's prediction of $150,000 ETH: made in the run up to the largest bull market in crypto history to date. In it, Shampant likened the impact of EIP-1559 and staking withdrawals to a ‘Triple Halving', referencing Bitcoin's once-every-four-year supply reduction where block rewards are sliced in half.

Europe's MiCA crypto regulation ready for vote as US falters

Crypto investors have had to deal with living in a post-FTX world since the collapse of the derivatives exchange sent shockwaves through the industry in November 2022. The end of SBF's empire - which included the market maker Alameda - had serious effects on liquidity and on institutional confidence.

But one bright spot on the legal and regulatory side of things is Europe's inbound MiCA (Markets in Crypto Assets) legislation, which goes to a European Parliament discussion on 18 April, with a vote expected on the final text a day later.

Parliament and the European Council reached provisional agreement on MiCA in June 2022. This is coincidentally the point at which crypto markets started to show signs of bottoming out after the bear market crushed prices by 70%-75%. If passed, MiCA is likely to enter into force in July 2023, with its major provisions coming into play between 12 and 18 months later.

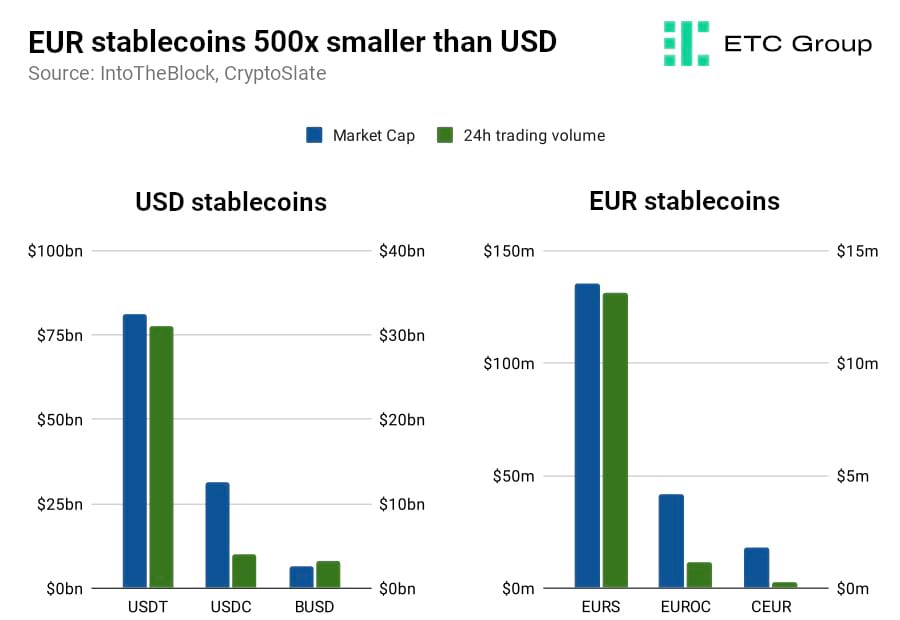

It is also a powerful statement of intent that Circle, the USDC issuer, chose Paris as its European hub to launch its Euro-based stablecoin EUROC. Circle CEO Jeremy Allaire cited the crypto-friendly climate in France as key to its decision. There remains much opportunity for growth, should the US continue on its short-sighted crusade against crypto.

USD-pegged stablecoins dominate crypto markets. The largest current Euro-pegged stablecoin, Stasis (EURS) has a market cap of $131m and a 24-hour trading volume of just over $13m. By contrast, Tether's USDT has a market cap and daily trading volume more than 500 times larger at $81bn and $31bn respectively. Taking second place in both markets are Circle's USD and EUR stablecoins, USDC and EUROC.

It is clear that MiCA will have long-reaching effects beyond its admittedly limited scope.

MiCA does not address crypto lending/staking, DeFi, nor NFTs. But simply having clarity on the rules of the road will be beneficial to the growth of the European crypto industry.

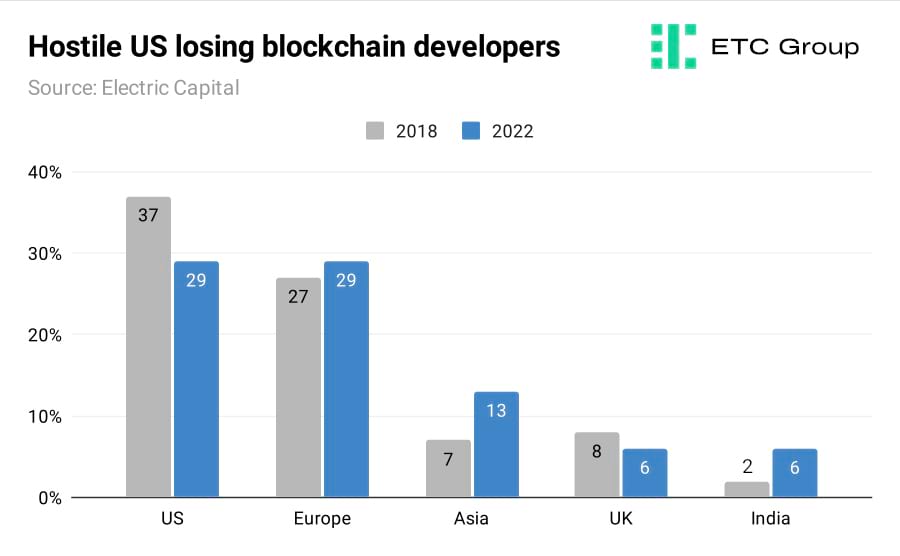

The US has been suffering from an intense ‘brain drain' over the last five years as developers flee a hostile regulatory environment. According to Electric Capital's annual Developer Report, the US is losing blockchain developers to growth markets in Europe, Asia and India. The US has lost an average 2% market share for the last 5 years. This evidently threatens the US lead in finance and technology.

Standardised rules like MiCA also allow companies to develop projects without fear of waking up one morning and being blindsided by SEC-style notice of prosecution. Coinbase had its shock Wells Notice in March, and in the last few days the regulator charged Seattle-based Bittrex with operating an unregistered securities exchange.

Two obvious second-order effects spring to mind for Europe: a more positive corporate environment encouraging innovation and growth, and a related improvement in market depth and liquidity. Crypto markets are their most volatile when liquidity is low. With less price support to both the upside and downside, it means larger buyers and sellers have relatively more impact on price.

The forced US closure of Silvergate Exchange Network on 3 March 2023 and the wind down of the 24/7 payment processing network Signet is significant as these two elements were some of the only USD payment rails for crypto. This means US exchanges were hit harder from a liquidity standpoint and market makers in the region faced unprecedented challenges.

Using Signet, companies could process transactions outside market hours, which was particularly useful for minting and redeeming stablecoins like USDC.

As Paul Grewal, Coinbase's chief legal officer, said earlier this year of the bitterly antagonistic US environment: “I think it is easy to look at the situation right now and conclude that the SEC is trying to change the rules of the game. What's actually happening is the SEC is trying to cancel the game after it has been played.”

MiCA will likely induce more participants to experiment with blockchain-based financial innovations. That includes the likes of Siemens, which in February 2023 issued a €60m tokenised bond under Germany's eWpG legislation for digitally-native electronic securities, passed in mid-2021, or the four German banks now trialling blockchain-based deposit tokens.

ETC Group's MSCI index ETP to capture rapid passive investing growth

In the past 10 years, crypto markets have grown 100x from a total market cap of $1.18 billion to $1.2 trillion.

But picking which blockchains will survive and thrive is a difficult task. Passive investment elements are particularly enticing for digital asset investors, where the winners and losers change on a month-by-month basis and it is not clear which blockchains or apps will end up on top.

So investors and financial institutions alike must pay attention to the next structural boom in crypto: passive index investing. Since the first index product was launched in 1993 in the US, capital has flowed into passive investments in extraordinary amounts.

40% of the total bond and equity markets in the US, and 20% of the total bond and equity markets in Europe are now passive investments.

Crypto index products, that bundle together the top-performing cryptos into one whole-market investment product, are fast growing their assets under management, but there remains huge potential for growth to come into line with equity and bond index products.

Passive investing simply refers to buying an investment product that tracks a popular benchmark, or index, like the S&P 500 in the United States or the FTSE 100 in the UK.

The ETC Group MSCI Digital Assets Select 20 ETP (expected ticker: DA20) is the world's first digital asset ETP based on an MSCI index. The ETP is a physically-backed exchange traded product that offers investors simple and cost-efficient access to the leading investable digital assets and cryptocurrencies, comprising around 85% of the total market cap.

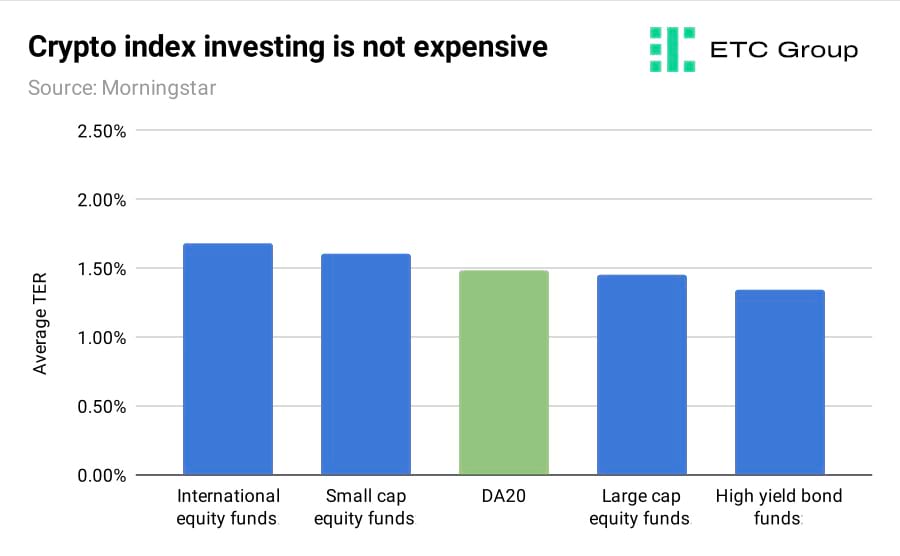

With an expense ratio of 1.49%, DA20 is cheaper than the average international equity fund, and the average small cap equity fund, as well as being comparable to both what investors would pay to invest in the average large cap equity fund or high-yield bond fund.

Passive investors usually prefer to buy and hold their investment over a long period of time: often a decade or more. For this reason, passive investing is often referred to as ‘Set it and Forget it'.

This strategy relies on time in the market to produce returns, and is a low-effort and low-cost way to gain potential upside from an entire sector or asset class.

With active strategies, traders must bet on potential winners and losers by watching markets daily, relying on being lucky enough to choose the best times to buy and sell.

- Active strategy: Timing the market

- Passive strategy: Time in the market

A well-thought out index product allows investors to get exposure to the upside potential of Bitcoin, Ethereum, Polygon, Solana and other digital assets without having to directly own or safely store them.

The ETP seeks to track the performance of the MSCI Global Digital Assets Select Top 20 Capped Index. The index is rebalanced on a quarterly basis.

ETC Group's latest investment product will list on XETRA in April.

Markets

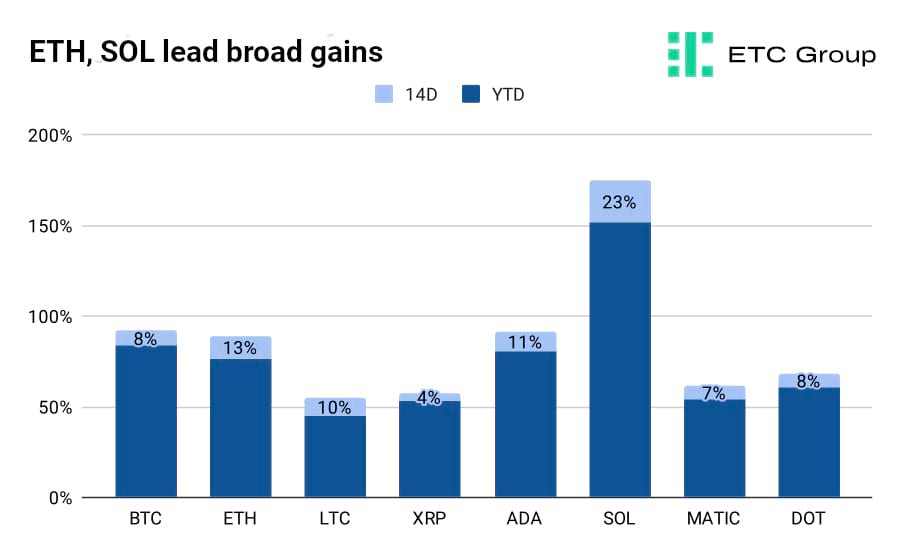

Markets have been buoyant in the past two weeks, with prices surging. Bitcoin reclaimed $30,000 for the first time since June 2022 and BTC dominance now stands at 46%, a level not seen since the summer of 2021.

Ether rallied above $2,100 in the days after Shapella, carrying Layer 1 tokens and competitors with it. Investor concerns that the release of staked ETH after Shapella would cause a sharp price depreciation have not been realised.

Other blockchain infrastructure protocols like Cardano (ADA) and Polkadot (DOT) have profited from an influx of optimism post-Shapella, with both up 11% and 8% respectively.

The surprise of the fortnight was not Ethereum, but Solana, which gained 23%. This came after Solana's development team announced it would release its long-awaited Saga mobile phone in early May.

However, exchange trading volume has weakened significantly in April, suggesting that the fervour that shot BTC to its highest point in 10 months could level off from here. There remains strong support in the $28,800 region, which will likely be retested in the coming weeks.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.