- Last week, cryptoassets continued to consolidate on account of continuing worries about the US economy, renewed net outflows from US spot Bitcoin and Ethereum ETFs as well as some idiosyncratic negative news flow around Ethereum.

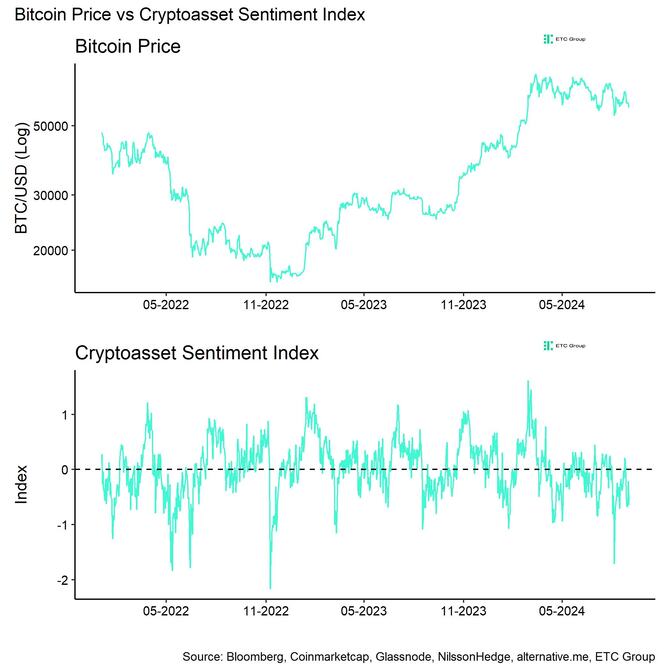

- Our in-house “Cryptoasset Sentiment Index” has reversed from neutral levels and has turned bearish again.

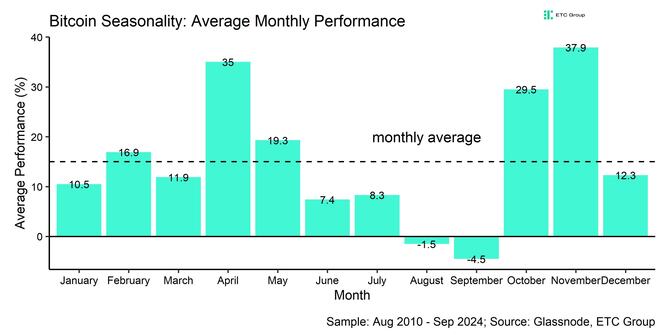

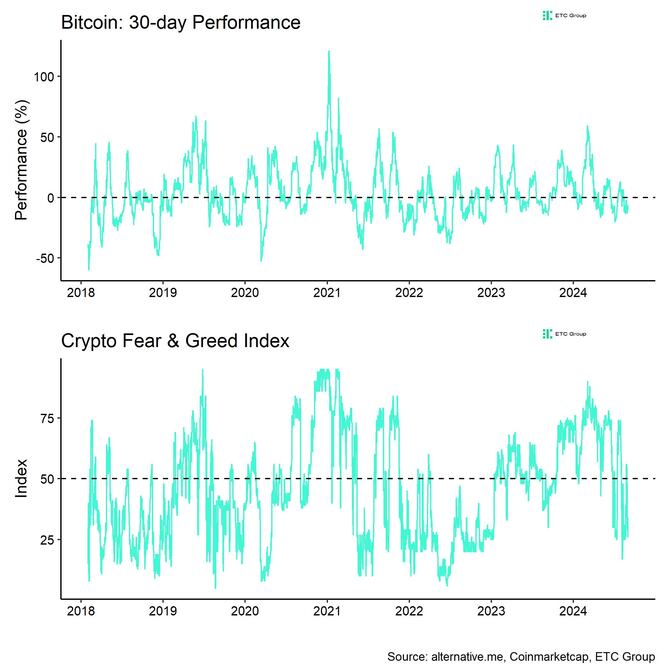

- It is quite likely that September will see continuing consolidation until Q4 as September has historically been the worst month for Bitcoin’s performance from a pure seasonality perspective.

Chart of the Week

Performance

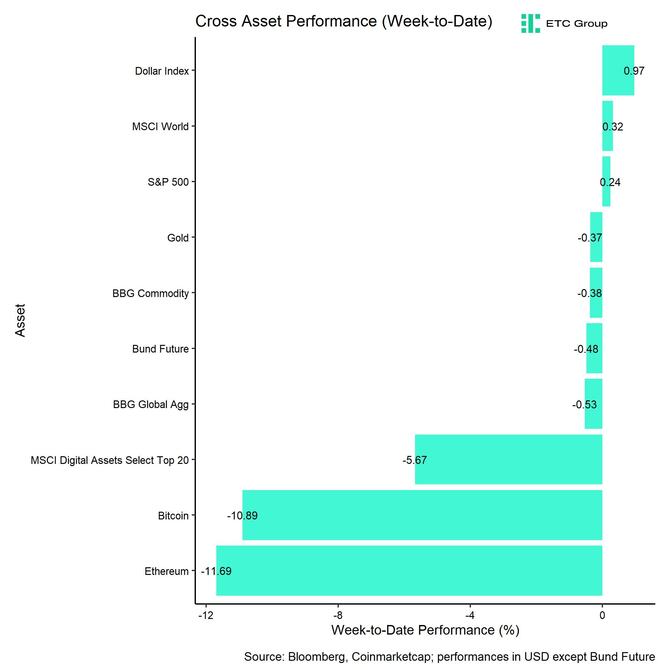

Last week, cryptoassets continued to consolidate on account of continuing worries about the US economy, renewed net outflows from US spot Bitcoin and Ethereum ETFs as well as some idiosyncratic negative news flow around Ethereum.

Leading indicators of US unemployment such as the Conference Board’s difference between “jobs hard to get” and “jobs plentiful” have continued to worsen signalling an increasing probability of a US recession.

In traditional finance, major retail stocks of discount stores such as Dollar General plunged significantly after reporting a dismal financial condition of US lower-income consumers.

What is more is that Nvidia’s stock price declined by more than -5% despite sales and earnings consensus beats which signals increasing investor expectations of peak revenues of the 3rd biggest global company by market cap.

This negative mood spilled over into cryptoassets as both US spot Bitcoin and Ethereum ETFs experienced negative net outflows on aggregate last week.

This was also exacerbated by an idiosyncratic negative news flow around Ethereum. On-chain data revealed last week that Ethereum founder Vitalik Buterin distributed an additional 1k ETH. Vitalik’s on-chain Ethereum holdings have declined by around -5k ETH in August, according to data provided by Arkham. These distributions are following recent sales by the Ethereum Foundation which damped market mood even further.

Apart from this, we saw significant futures long liquidations as bitcoin declined from 64k USD to sub-60k USD again and Ethereum declined from around 2700 USD to sub-2500 USD. More specifically, long bitcoin futures liquidations increased to 29.3 mn USD and long Ethereum futures liquidations also increased to 29.2 mn USD according to data provided by Glassnode - the highest levels since the capitulation event in early August.

As a result, overall crypto sentiment has turned bearish again. It is quite likely that September will see continuing consolidation until Q4 as September has historically been the worst month for Bitcoin’s performance from a pure seasonality perspective (Chart-of-the-Week).

On a positive note, we think that the crypto bearish sentiment makes further downside risks less likely in the short term and, thus, we also do not expect that the market will revisit the lows from early August.

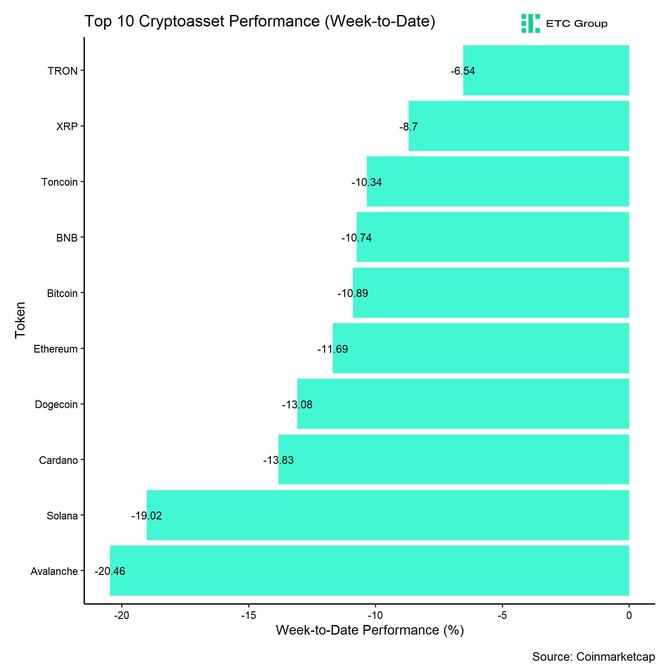

In general, among the top 10 crypto assets, TRON, XRP, Toncoin were the relative outperformers.

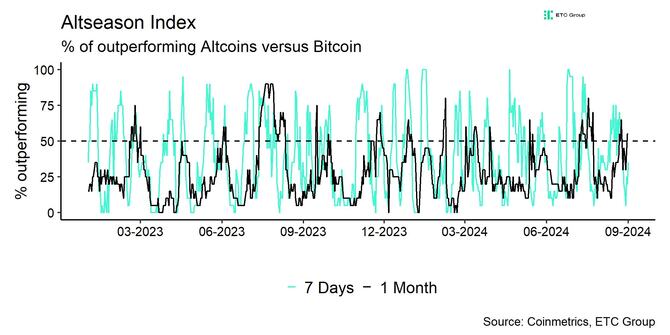

Overall, altcoin outperformance vis-à-vis Bitcoin reversed to the downside again, with 35% of our tracked altcoins managing to outperform Bitcoin on a weekly basis, consistent with an underperformance of Ethereum relative to Bitcoin.

Sentiment

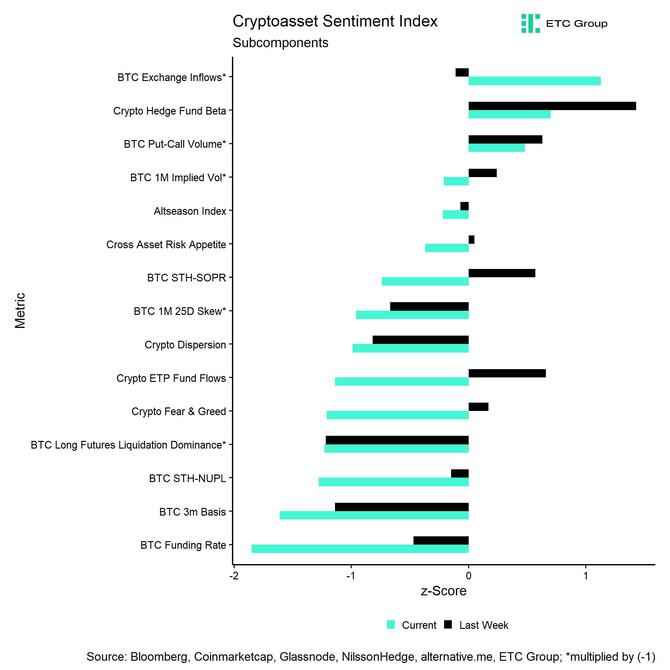

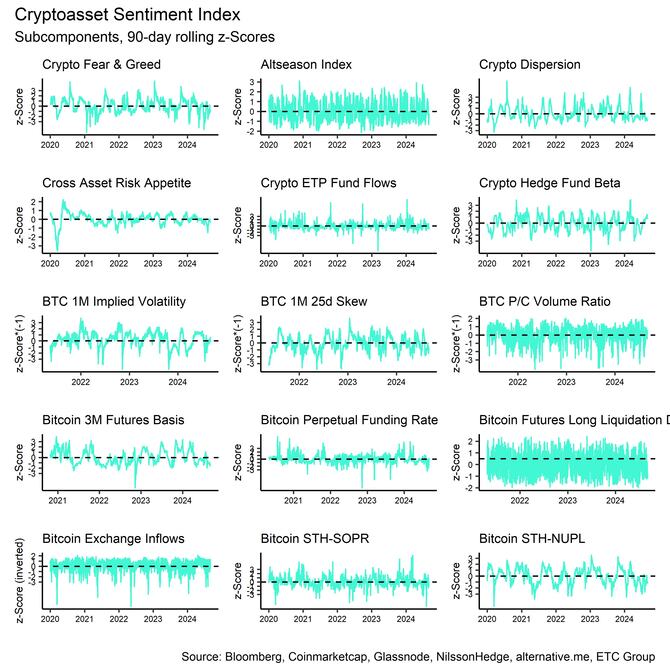

Our in-house “Cryptoasset Sentiment Index” has reversed from neutral levels and has turned bearish again.

At the moment, only 3 out of 15 indicators are above their short-term trend.

Last week, there were significant reversals to the downside in the BTC funding rate and BTC 3-months basis rate.

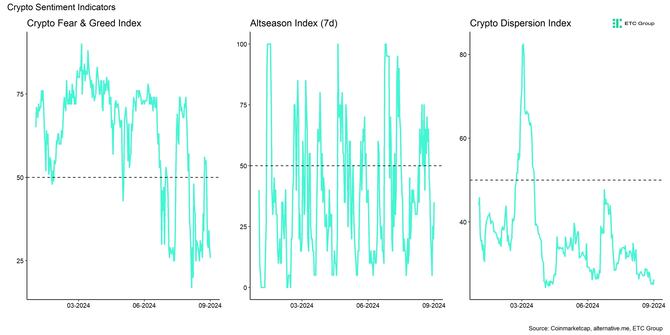

The Crypto Fear & Greed Index currently signals a “Fear” level of sentiment as of this morning.

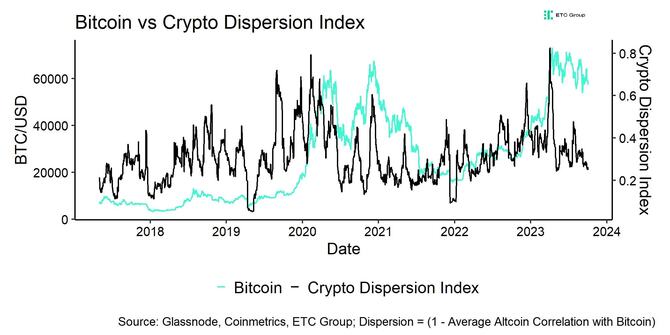

Performance dispersion among cryptoassets still remains at very low levels. This means that altcoins are still very much correlated with the performance of Bitcoin.

Altcoin outperformance vis-à-vis Bitcoin reversed last week, with 35% of our tracked altcoins outperforming Bitcoin on a weekly basis. This was also consistent with an underperformance of Ethereum vis-à-vis Bitcoin last week.

In general, increasing (decreasing) altcoin outperformance tends to be a sign of increasing (decreasing) risk appetite within cryptoasset markets and the latest altcoin underperformance signals decreasing risk appetite at the moment.

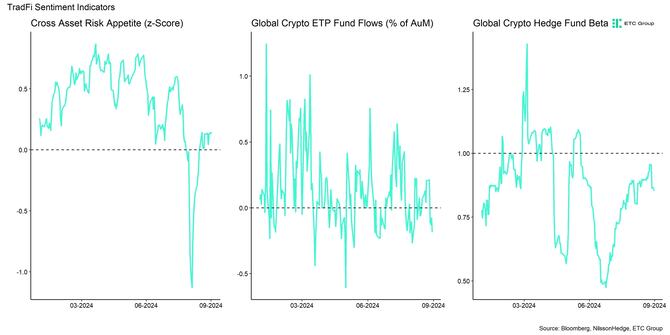

Meanwhile, sentiment in traditional financial markets as measured by our in-house measure of Cross Asset Risk Appetite (CARA) still remains at neutral levels after having recovered sharply from the very low levels observed in early August.

Fund Flows

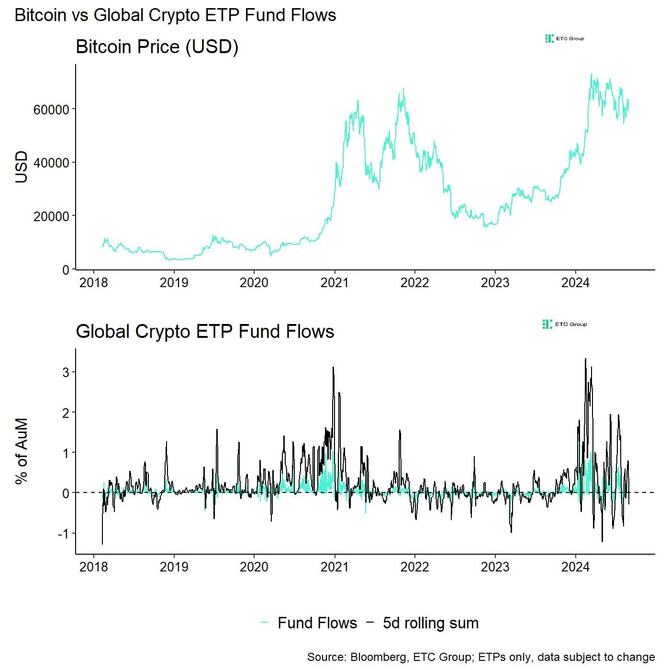

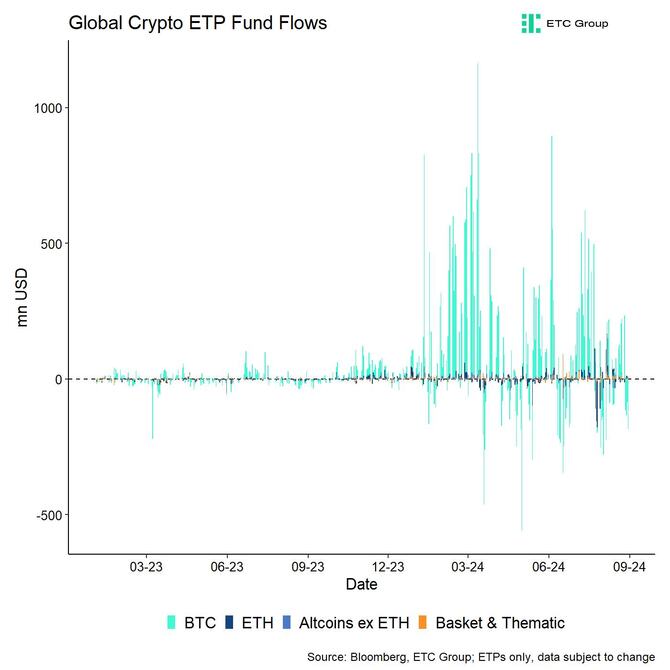

Fund flows into global crypto ETPs reversed significantly last week.

Global crypto ETPs saw around -265.0 mn USD in net outflows across all types of cryptoassets which is a significant reversal from the positive +688.5 mn USD in net inflows observed the week prior.

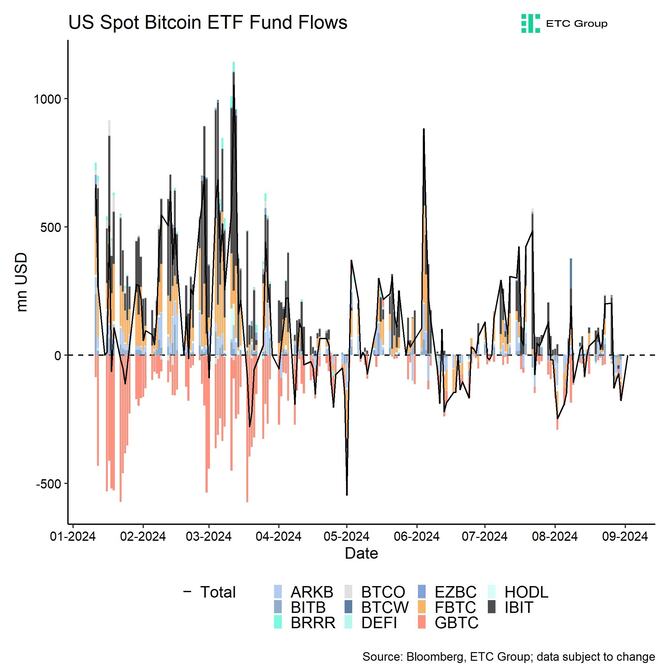

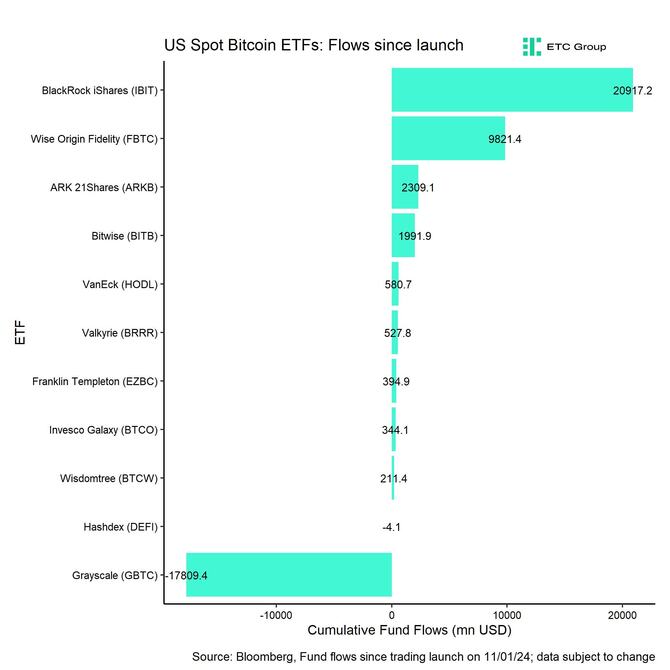

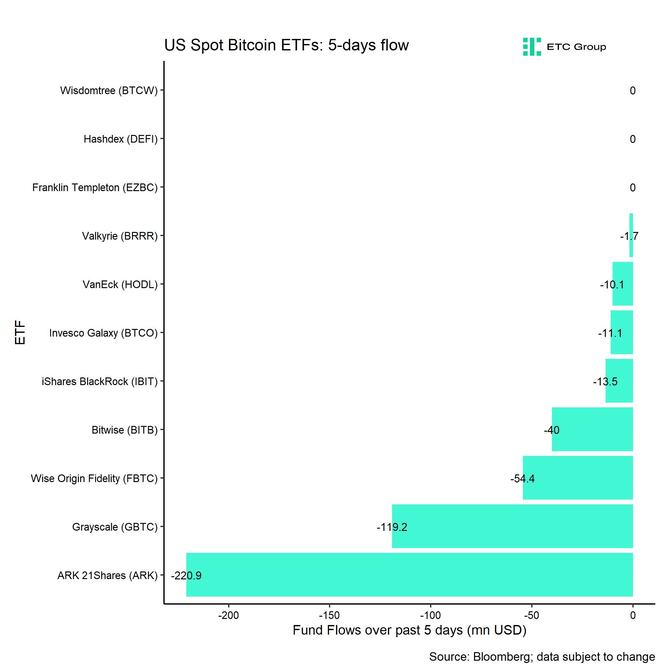

Global Bitcoin ETPs saw net outflows of -287.2 mn USD last week, of which -268.3 mn USD in net outflows were related to US spot Bitcoin ETFs alone. In contrast, Hong Kong Bitcoin ETFs still managed to attract +14.1 mn USD in net inflows.

Outflows from the ETC Group Physical Bitcoin ETP (BTCE) decelerated further last week with net outflows equivalent to -7.5 mn USD and the ETC Group Core Bitcoin ETP (BTC1) even saw minor net inflows of +0.04 mn USD.

The Grayscale Bitcoin Trust (GBTC) continued to see net outflows, with around -119.2 mn USD last week. However, the ARK 21Shares Bitcoin ETF experienced even higher net outflows with around -220.9 mn USD last week according to data provided by Bloomberg.

Meanwhile, global Ethereum ETPs continued to see net outflows last week of -5.2 mn USD, albeit at decelerating pace. US Ethereum spot ETFs saw around -12.6 mn USD in net outflows in aggregate. However, this was mostly related to continuing outflows from the Grayscale Ethereum Trust (ETHE) again which experienced -27.8 mn USD in net outflows last week.

Hong Kong Ethereum ETFs saw minor net outflows last week (-1.9 mn USD).

The ETC Group Physical Ethereum ETP (ZETH) defied negative market developments and showed minor net inflows (+0.4 mn USD) while the ETC Group Ethereum Staking ETP (ET32) even managed to attract +2.9 mn USD in net inflows last week.

Altcoin ETPs ex Ethereum also experienced positive net flows of around +12.3 mn USD last week.

Besides, Thematic & basket crypto ETPs also saw continued net inflows with around +15.1 mn USD last week. The ETC Group MSCI Digital Assets Select 20 ETP (DA20) saw neither in- nor outflows last week (+/- 0 mn USD).

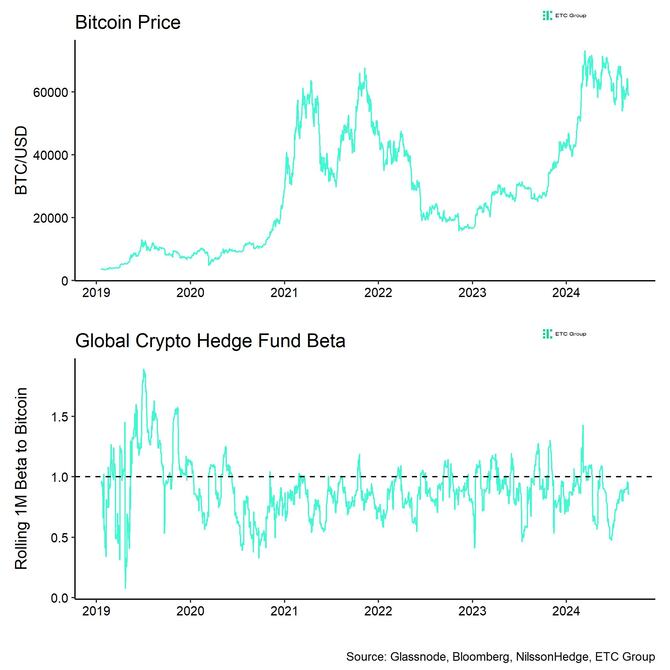

Meanwhile, global crypto hedge funds reduced their market exposure somewhat last week after reaching a 3-months high. Global crypto hedge funds still remain slightly underweight to Bitcoin. The 20-days rolling beta of global crypto hedge funds’ performance to Bitcoin decreased to around 0.85 per yesterday’s close.

On-Chain Data

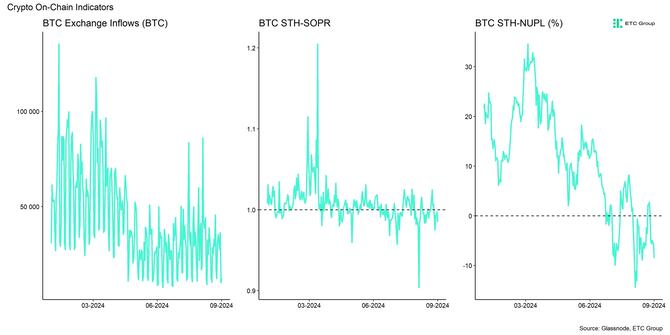

In general, major Bitcoin on-chain metrics have recently reversed to the downside again.

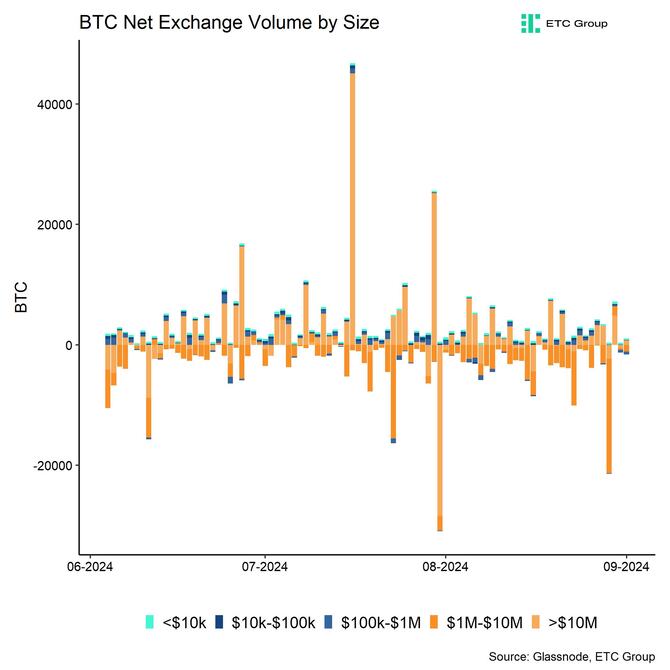

Bitcoin spot intraday net buying volumes have significantly reversed to the downside again after having touched a 3-months high recently. Over the past week, net buying volumes across BTC spot exchanges amounted to around -1,048 mn USD which is the lowest level since early August.

Last week’s selling pressure appears to have emanated to a large extent from net outflows from US spot Bitcoin ETFs.

Meanwhile, BTC whales have also transferred bitcoins to exchanges more recently which tends to pressure prices on exchanges. More specifically, BTC whales have transferred around 5.5k BTC to exchanges. Whales are defined as network entities that control at least 1,000 BTC. As a result, on-exchange balances have declined over the past week.

Nonetheless, it is also worth highlighting overall BTC net exchange transfers continued to be negative implying a decrease in available supply on exchanges which tends to be a positive development.

Moreover, bitcoin’s illiquid supply reached a new all-time high of almost 74% of circulating supply according to data provided by Glassnode signalling that the Halving-induced supply shock is actually intensifying. This should provide an increasing tailwind for Bitcoin and other cryptoassets over the coming months.

Besides, there were no distributions by large holders such as the Mt Gox trustee or the US government last week.

As far as Ethereum is concerned, there was some idiosyncratic negative news flow around Ethereum. On-chain data revealed last week that Ethereum founder Vitalik Buterin distributed an additional 1k ETH. Vitalik’s on-chain Ethereum holdings have declined by around -5k ETH in August, according to data provided by Arkham. These distributions are following recent sales by the Ethereum Foundation which damped market mood even further.

Overall ETH exchange balances also increased somewhat from its multi-year lows last week which has signalled a temporary increase in ETH selling pressure.

Futures, Options & Perpetuals

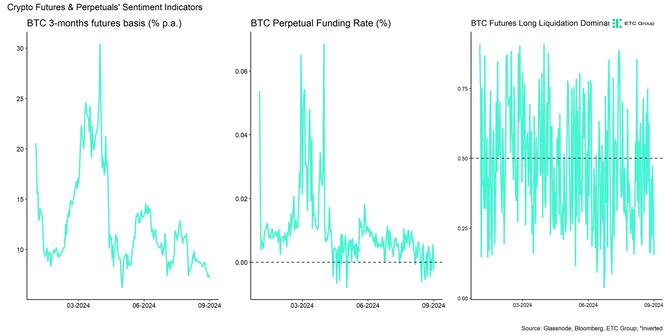

Last week’s developments in derivatives were dominated by significant futures long liquidations and reductions in open interest.

We saw significant futures long liquidations as bitcoin declined from 64k USD to sub-60k USD again and Ethereum declined from around 2700 USD to sub-2500 USD.

More specifically, long bitcoin futures liquidations increased to 29.3 mn USD and long Ethereum futures liquidations also increased to 29.2 mn USD according to data provided by Glassnode - the highest levels since the capitulation event in early August.

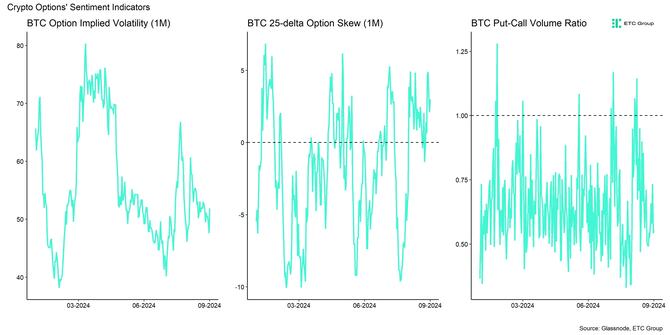

In consequence, both perpetual funding rates and the basis rates declines significantly. The BTC perpetual funding rate even turned negative again.

It is worth mentioning that out of the past 7 days, 3 days have seen negative perpetual funding rates in BTC, implying a significant build-up in short interest lately. We think that this could create a set-up for a significant short squeeze down the road.

When the funding rate is positive (negative), long (short) positions periodically pay short (long) positions. A negative funding rate tends to be a sign of bearish sentiment in perpetual futures markets.

The 3-months annualized BTC futures basis rate declined to a 4-months low to around 7.1% p.a.

Besides, BTC option open interest declined significantly on account of the end-of-month option expiries. However, the put-call open interest ratio also continued to decline suggesting a net increase in call demand relative puts which tends to be a bullish sign.

Nonetheless, the 1-month 25-delta skews for BTC increased significantly and turned positive suggesting increasing relative demand for put options.

Meanwhile, BTC option implied volatilities continued to move sideways. At the time of writing, implied volatilities of 1-month ATM Bitcoin options are currently at around 51.8% p.a.

Bottom Line

- Last week, cryptoassets continued to consolidate on account of continuing worries about the US economy, renewed net outflows from US spot Bitcoin and Ethereum ETFs as well as some idiosyncratic negative news flow around Ethereum.

- Our in-house “Cryptoasset Sentiment Index” has reversed from neutral levels and has turned bearish again.

- It is quite likely that September will see continuing consolidation until Q4 as September has historically been the worst month for Bitcoin’s performance from a pure seasonality perspective.

Appendix

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

En

En  Fr

Fr  De

De