- Altseason is most likely not over. The Altseason Index continues to provide actionable signals, with the (0% - 20%) band offering the best opportunities for long-term accumulation and the (80% - 100%) band supporting momentum-based strategies.

- The (40% - 60%) and (60% - 80%) bands demonstrate inconsistent and muted relative returns for most assets, with Solana being the exception.

- The sharp reversals in the Altseason Index emphasize the importance of aligning investment strategies with periods of extreme pessimism or exuberance, as these moments historically yield the most significant relative returns.

Altseason, or "Altcoin Season," refers to periods in the cryptocurrency market when alternative coins (altcoins) experience significant price increases, often driven by a shift in investor focus from Bitcoin to other promising digital assets. These phases are typically marked by a decline in Bitcoin dominance and an increase in altcoin market capitalization, accompanied by heightened market activity and speculative trading. Some examples of altcoins, or "alts," include Ethereum, Cardano and Aptos.

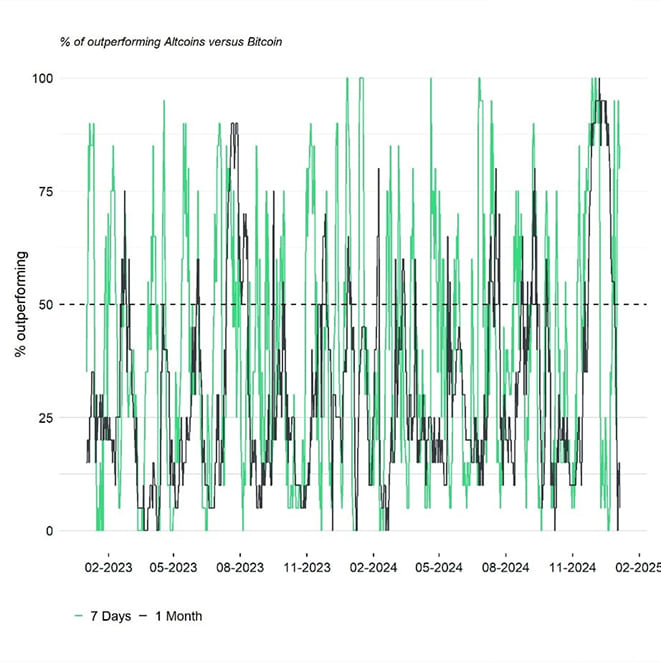

To track the performance of altcoins relative to Bitcoin, investors rely on the Altseason Index, a metric that measures the relative outperformance of altcoins to Bitcoin over a certain period. A high index value usually signals strong altcoin performance and is often indicative of an ongoing Altseason. Recently, however, the 1-month Altseason Index experienced a sharp decline, falling into its lowest band (0% - 20%) earlier this week. This event follows a December 2024 peak, where the index recorded its strongest readings of the year, marks one of the steepest reversals in the index's history.

Such extreme movements raise two critical questions for investors:

- Is Altseason over?

- Does the Altseason Index act as a contrarian indicator or as a momentum indicator?

To answer these questions, we took a systematic approach, focusing on Ethereum, Solana, and XRP as proxies for the altcoin market. These assets were chosen because of their high levels of adoption and representation in institutional portfolios as well as their significant market caps. Furthermore, their performance relative to Bitcoin was analysed, as the Altseason Index itself is a measure of altcoin outperformance versus Bitcoin. This approach allows us to assess whether the recent drop in the index signals a bearish outlook for altcoins or presents an opportunity to increase exposure.

Our Methodology

The Altseason Index measures the relative outperformance of altcoins versus Bitcoin. To align with this metric, we analysed the relative forward returns of ETH/BTC, SOL/BTC, and XRP/BTC across five distinct bands of the 1-month Altseason Index: (0% - 20%), (20% - 40%), (40% - 60%), (60% - 80%), and (80% - 100%).

For each band, we calculated average relative forward returns over six time horizons: 7 days, 14 days, 30 days, 90 days, 180 days, and 365 days. This approach allowed us to assess whether the Altseason Index serves as a reliable indicator for tactical or strategic allocations to altcoins.

Key takeaway 1: Contrarian Opportunity at the Lowest Band (0% - 20%)

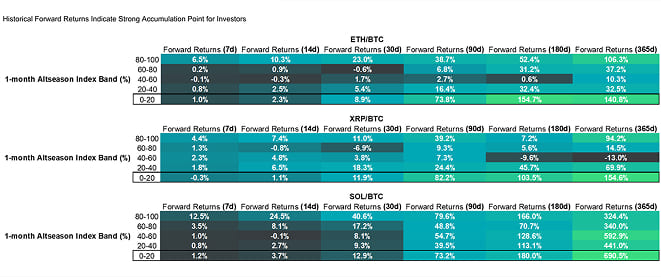

Historically, when the 1-month Altseason Index falls to its lowest band (0% - 20%), relative forward returns for Ethereum, Solana, and XRP have been exceptionally strong, signalling a contrarian buying opportunity.

Here we can see that Ethereum delivers exceptionally high relative returns in this band, particularly at the 90-day (73.8%) and 180-day (154.7%) horizons. Solana significantly outperforms Ethereum and XRP in this band, with a staggering 690.5% relative return over 365 days. XRP demonstrates solid performance at this band, with 365-day relative forward returns of 154.6%, although it lags behind Solana.

The main takeaway is that the (0% - 20%) band is a prime accumulation zone, particularly for investors looking to increase their altcoin exposure.

Key takeaway 2: Momentum Plays at the Highest Band (80% - 100%)

The (80% - 100%) band reflects a period of strong altcoin performance relative to Bitcoin, often driven by favourable market conditions and investor exuberance. Relative forward returns in this band indicate momentum persistence, particularly for medium time horizons.

In the highest band, Ethereum exhibits strong medium term relative returns in this band, with 38.7% and 52.4% gains over 90 and 180 days, respectively. Solana again leads the pack with 79.6% and 166% gains over 90 and 180 days, respectively, and a remarkable 324.4% over 365 days. XRP's momentum signal is weaker, with relative forward returns of 7.2% over 180 days. However, its 90-day relative return of 39.2% suggests that it still offers opportunities for medium-term momentum strategies.

Overall, we observe that the (80% - 100%) band is ideal for momentum-based strategies.

Key takeaway 3: Caution in Mid-Range Bands (40% - 60% and 60% - 80%)

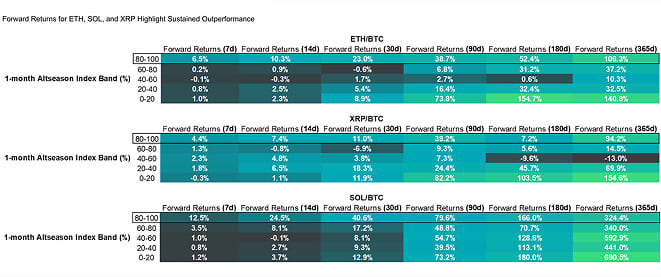

The (40% - 60%) and (60% - 80%) bands present mixed and often inconsistent relative forward returns

Ethereum's relative returns are muted in these bands, with inconsistent performance over longer time horizons. We also see that in the (40% - 60%) band, Ethereum provides one of the lowest relative forward returns, booking only 10.3% over 365 days. In contrast, Solana challenges the general view of muted relative returns in mid-range bands, delivering a strong 54.7% relative return in the (40% - 60%) band and 48.8% in the (60% - 80%) band over 90 days.

This resilience can be attributed to Solana's unique market positioning, underpinned by its execution-driven growth, developer magnetism, and a scalable infrastructure that consistently attracts real economic activity. XRP, on the other hand, continues to underperform in mid-range bands, offering limited relative forward returns and failing to provide actionable signals for tactical or strategic allocations.

While the (40% - 60%) and (60% - 80%) bands generally exhibit inconsistent and muted relative returns, Solana is a notable exception. Its ability to deliver robust performance in these bands makes it an outlier and a potential candidate for maintaining exposure. Investors should remain cautious with Ethereum and XRP in these ranges, as their relative returns lack the consistency seen in Solana.

In conclusion, the recent reversal of the 1-month Altseason Index into its lowest band (0% - 20%) has reignited concerns about the future of altcoins relative to Bitcoin. However, historical performance across multiple bands of the index suggests that Altseason is far from over. Instead, this phase represents a natural cycle within the market, where extremes-both high and low-offer distinct opportunities.

The (0% - 20%) band presents a contrarian signal for long-term accumulation, while the (80% - 100%) band serves as a momentum signal for medium-term tactical plays.

Bottom Line

- Altseason is most likely not over. The Altseason Index continues to provide actionable signals, with the (0% - 20%) band offering the best opportunities for long-term accumulation and the (80% - 100%) band supporting momentum-based strategies.

- The (40% - 60%) and (60% - 80%) bands demonstrate inconsistent and muted relative returns for most assets, with Solana being the exception.

- The sharp reversals in the Altseason Index emphasize the importance of aligning investment strategies with periods of extreme pessimism or exuberance, as these moments historically yield the most significant relative returns.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

En

En  Fr

Fr  De

De