The situation in Kazakhstan is terrible for its people and we hope everyone there is staying safe.

On a financial level we think what we saw with the Bitcoin price dipping ~7% overnight is a simple supply and demand story. It’s likely we saw Kazakhstani cryptocurrency miners looking to flee the country and liquidating Bitcoin they had already mined, in order to finance that move. With a greater supply of Bitcoin hitting the market, the price fell.

Kassym-Jomart Tokayev, the president of Kazakhstan, upended Bitcoin miners’ businesses on Wednesday 5 January when he ordered the country’s largest telecom provider Kazakhtelecom to pull the plug on the nation’s internet.

The largest global Bitcoin mining pools such as AntPool and F2Pool showed an almost immediate dip.

Normally we know that quite a lot of Bitcoin supply is stored up in HODLers’ wallets and in very popular exchange traded products like our Bitcoin ETP (BTCE), and therefore isn’t available to the general market. As Brian Brooks, former acting head of the US federal banking regulator, told the House Financial Services Committee last month, something like 80% of Bitcoin holders have never sold any at all. So when there’s a sudden increase in supply it naturally depresses the price.

There is also a lot of speculative leverage in the riskier portions of the crypto daytrading market.

With supply hitting the market and the price falling suddenly, we saw a cascade of highly leveraged long positions being liquidated — and the subsequent margin calls — and more liquidations. ETPs like ours aren’t leveraged to the hilt, or leveraged at all, they are physically-backed 1:1 and so just track the price of Bitcoin and other cryptoassets very accurately, so they aren’t subject to these same kinds of risks.

More than 225,000 traders had nearly $1bn of leveraged long positions liquidated in the following 24 hours, according to Coinglass.

How do we know Kazakhstani miners dumped BTC supply onto the market? Well, it happened before, in China.

With the Kazakhstan government turning off the internet, it was widely reported that cryptominers along with everyone else were unable to get online.

As of last week, Kazakhstan accounted for around a fifth (18.1%) of the Bitcoin hashrate, that’s the amount of computing power globally that is dedicated to mining Bitcoin, verifying transactions and creating new bitcoins. These are figures from the pre-eminent researchers in the space, the Cambridge Centre for Alternative Finance.

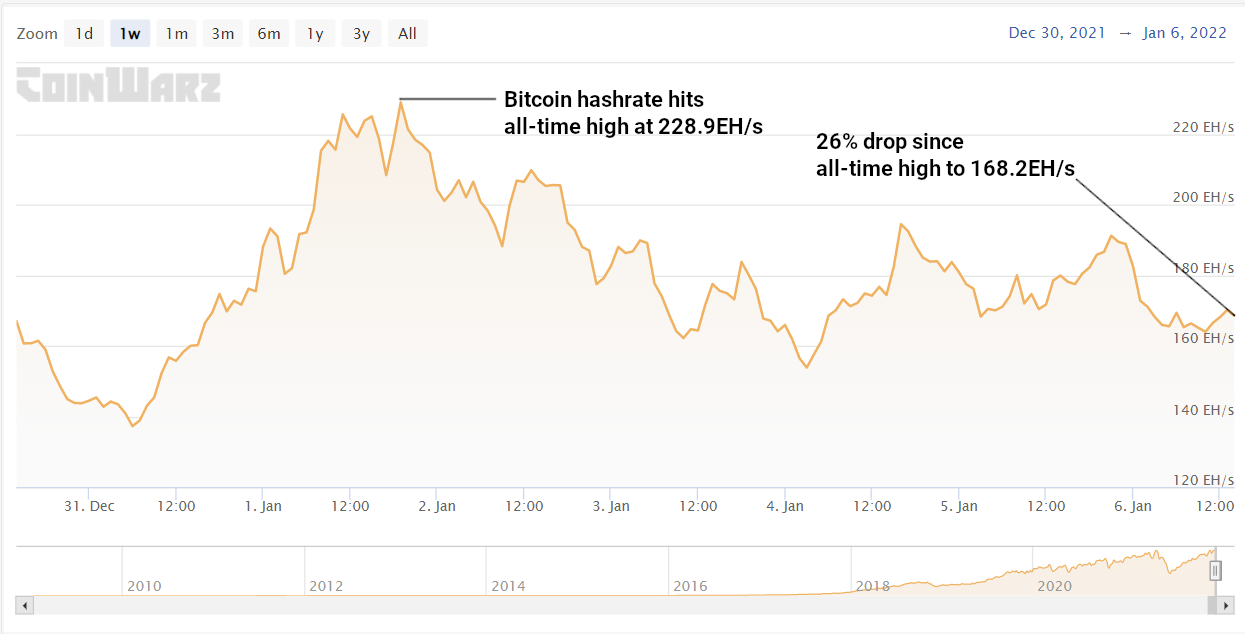

We’re starting to see this situation represented in the Bitcoin hashrate, which has fallen 26% from its all time high of 228 EH/s to 168 EH/s in the last few days.

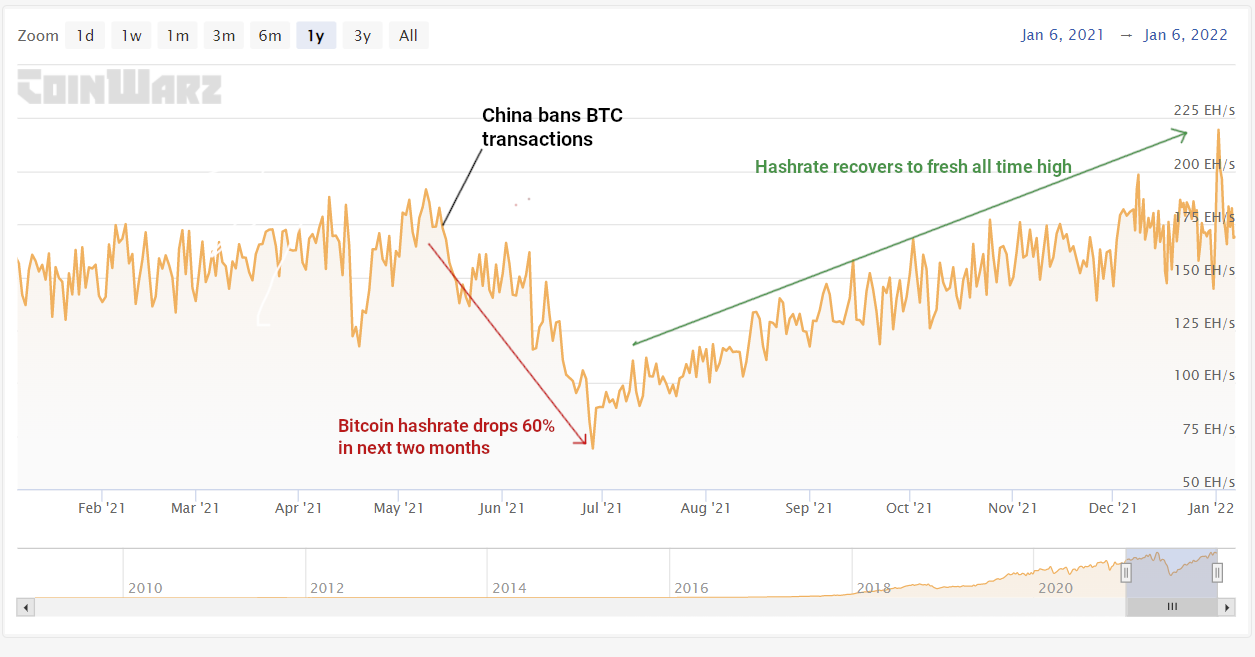

The same thing happened in China in May 2021, when the government started to turn off the power to crypto miners in large centres like Inner Mongolia.

At the time, the region, known for its cheap power, accounted for around 8% of global hashrate. In March 2021 the region’s provincial government cracked down on Bitcoin mining, giving businesses a two-month window to get out. The Chinese government then banned Bitcoin transactions altogether, and by July the Bitcoin hashrate had dropped 60%.

A glut of Bitcoin hit the market, a lot of it likely coming from Chinese miners looking to liquidate their holdings, and the price of 1 BTC cratered from $58,800 on 8 May to $29,700 by mid-July.

Hashrate had recovered to fresh all time highs as recently as 1 January 2022.

Bitcoin miners forced out of China had originally chosen Kazakhstan for its cheap energy prices: around $0.05Kw/h compared to jurisdictions like the US which charge in the region of $0.12Kw/h. Hong Kong-based BIT Mining sent thousands of ASIC mining machines to the state in June last year, alongside Beijing’s Canaan.

With miners operating in Kazakhstan controlling such a large proportion of the Bitcoin hashrate they now face the same kinds of decisions as those businesses in Inner Mongolia, although circumstances demand a less orderly exit and much accelerated time-frame.

Again, this story is one of simple supply and demand.

The price action this time round may be much different: yes, there is a glut of bitcoin on the market but we are seeing some seller exhaustion in the $42k region and there is likely to be a relief rally that we are watching out for. If I’m an institutional investor, I’m finding it hard to see a 2x or 3x from Bitcoin from $69k when it’s already up 5x from January to November 2021. That calculation is a lot easier now at $42k.

We’re looking to US crypto miners like Riot Blockchain to win in the short term from picking up the slack in Bitcoin hashrate from Kazakhstan-based mining operators (like Canaan) going offline, and the time necessary in moving their operations overseas. And easy-access ETFs, like our Digital Assets and Blockchain Equity ETF (KOIN) that hold a good cross section of US crypto miners will likely be the immediate beneficiaries.

AVIS IMPORTANT :

Cet article ne constitue ni un conseil en investissement ni une offre ou une sollicitation d'achat de produits financiers. Cet article est uniquement à des fins d'information générale, et il n'y a aucune assurance ou garantie explicite ou implicite quant à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Il est recommandé de ne pas se fier à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Veuillez noter que cet article n'est ni un conseil en investissement ni une offre ou une sollicitation d'acquérir des produits financiers ou des cryptomonnaies.

AVANT D'INVESTIR DANS LES CRYPTO ETP, LES INVESTISSEURS POTENTIELS DEVRAIENT PRENDRE EN COMPTE CE QUI SUIT :

Les investisseurs potentiels devraient rechercher des conseils indépendants et prendre en compte les informations pertinentes contenues dans le prospectus de base et les conditions finales des ETP, en particulier les facteurs de risque mentionnés dans ceux-ci. Le capital investi est à risque, et des pertes jusqu'à concurrence du montant investi sont possibles. Le produit est soumis à un risque intrinsèque de contrepartie à l'égard de l'émetteur des ETP et peut subir des pertes jusqu'à une perte totale si l'émetteur ne respecte pas ses obligations contractuelles. La structure juridique des ETP est équivalente à celle d'une dette. Les ETP sont traités comme d'autres instruments financiers.

À propos de Bitwise

Bitwise est l'un des leaders mondiaux dans la gestion de crypto-actifs. Des milliers de conseillers financiers, de family offices et d'investisseurs institutionnels globaux se sont associés à nous pour saisir et exploiter les opportunités offertes par les crypto-monnaies. Depuis 2017, Bitwise affiche un palmarès impressionnant en matière de gestion de solutions indicielles et actives pour les ETP, les comptes gérés séparés, les fonds privés et les stratégies de hedge funds, tant aux États-Unis qu'en Europe.

En Europe, Bitwise (anciennement ETC Group) a développé au cours des quatre dernières années l'une des familles de produits crypto-ETP les plus vastes et les plus innovantes, dont le plus grand et le plus liquide ETP Bitcoin d'Europe.

Cette offre de produits crypto-ETP est domiciliée en Allemagne et autorisée par la BaFin. Nous travaillons exclusivement avec des entreprises réputées du secteur financier traditionnel et veillons à ce que 100 % des actifs soient stockés en toute sécurité hors ligne (cold storage) chez des dépositaires réglementés.

Nos produits européens comprennent une gamme d'instruments financiers soigneusement structurés qui s'intègrent parfaitement dans tout portefeuille professionnel et offrent une exposition globale à la classe d'actifs crypto. L'accès est simple via les principales bourses européennes, avec une cotation principale sur Xetra, la bourse la plus liquide pour le négoce d'ETF en Europe. Les investisseurs privés bénéficient d'un accès facile via de nombreux courtiers DIY, en combinaison avec notre structure ETP physique robuste et sûre, qui comprend également une fonction de paiement.