September 2024 Update

On September 2, 2024, the MSCI Global Digital Assets Select Top 20 Capped Index underwent its latest quarterly rebalancing, following the guidelines outlined in its index methodology. This index, designed to track the performance of the 20 leading investable cryptocurrencies, covers approximately 90% of the total cryptocurrency market capitalization. It is calculated by MSCI and updated on a quarterly basis.

In line with this, the portfolio of the Bitwise MSCI Digital Assets Select 20 ETP (DA20), which passively replicates the index, was also rebalanced on the same date. The DA20 ETP, traded on Xetra under ISIN DE000A3G3ZL3, offers investors exposure to a carefully curated selection of digital assets.

As with all ETC Group crypto ETPs, the digital assets in the basket are securely stored using regulated cold-storage custody, ensuring maximum efficiency for investors.

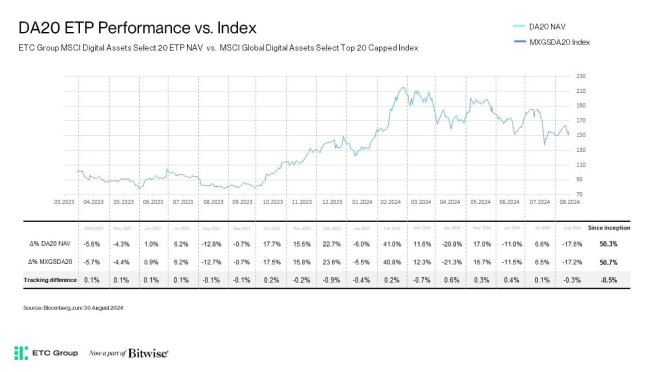

The chart below highlights the exceptional tracking performance of the ETP compared to the index since its inception:

Bitcoin and Ethereum continue to dominate the portfolio, each holding the maximum 30% allocation. Meanwhile, Solana takes the third-largest share, with a 14.44% weighting.

Overview of index portfolio and weighting as per rebalancing on 02.09.2024

| Name | Symbol | Added to index | Weighting |

|---|---|---|---|

Bitcoin Bitcoin |

BTC | 01.03.2023 | 30.00% |

Ethereum Ethereum |

ETH | 01.03.2023 | 30.00% |

Solana Solana |

SOL | 01.03.2023 | 14.44% |

Ripple Ripple |

XRP | 01.03.2023 | 6.50% |

Tron Tron |

TRX | 01.03.2023 | 2.86% |

Cardano Cardano |

ADA | 01.03.2023 | 2.61% |

Avalanche Avalanche |

AVAX | 01.03.2023 | 2.05% |

Chainlink Chainlink |

LINK | 01.03.2023 | 1.46% |

Bitcoin Cash Bitcoin Cash |

BCH | 01.03.2023 | 1.37% |

Polkadot Polkadot |

DOT | 01.03.2023 | 1.28% |

Near Protocol Near Protocol |

NEAR | 01.03.2023 | 1.05% |

Uniswap Uniswap |

UNI | 01.03.2023 | 0.96% |

Litecoin Litecoin |

LTC | 01.03.2023 | 0.95% |

Polygon Polygon |

MATIC | 01.03.2023 | 0.93% |

Internet Computer Internet Computer |

ICP | 03.06.2024 | 0.76% |

Aptos Aptos |

APT | 01.03.2024 | 0.66% |

Ethereum Classic Ethereum Classic |

ETC | 01.03.2023 | 0.58% |

Stellar Stellar |

XLM | 01.03.2023 | 0.57% |

Stacks Stacks |

STX | 01.03.2024 | 0.52% |

Filecoin Filecoin |

FIL | 01.03.2023 | 0.46% |

As always, the weighting of cryptocurrencies within both the index and ETP changes daily, reflecting price changes in the underlying assets. You can stay updated by visiting the ETP product page for the latest breakdown of the index components.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

En

En  Fr

Fr  It

It  De

De