- Performance: February was marked by heightened economic uncertainty due to rising U.S. tariffs, inflation fears, and the largest crypto hack in history, leading to volatility and bearish sentiment across markets. However, with expectations of strong ETF inflows and bullish institutional developments, crypto markets have begun to rebound.

- Macro: Institutional investors are increasingly moving away from US Treasuries amid concerns over inflation, liquidity constraints, and geopolitical risks, leading to greater diversification into alternative assets like gold and Bitcoin. With macro conditions improving and the Fed potentially stepping in to ease liquidity pressures, Bitcoin could benefit as a hedge against financial instability and sovereign debt risks.

- On-Chain: On-chain activity for Bitcoin has slowed recently, with retail participation declining and ETF outflows accelerating, largely due to the unwinding of basis trades. However, corporate Bitcoin accumulation remains strong, exchange balances continue to decrease, and historical post-Halving trends suggest significant upside potential in the coming months.

Chart of the Month

Performance

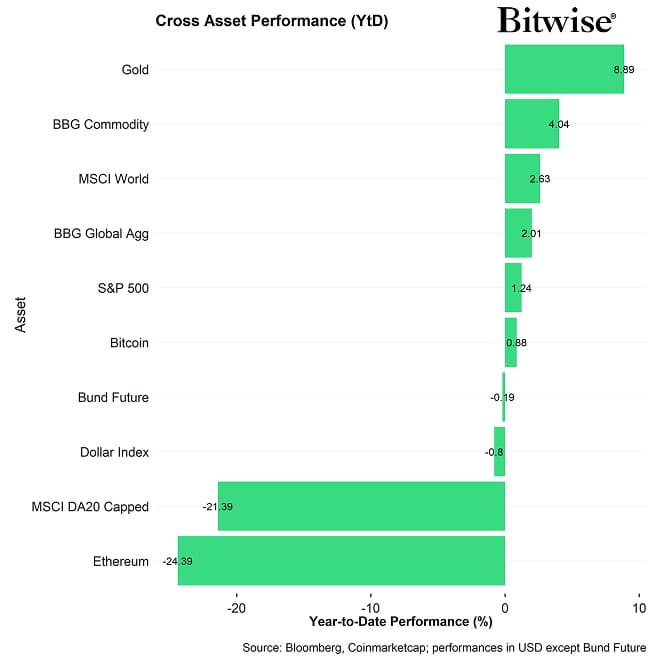

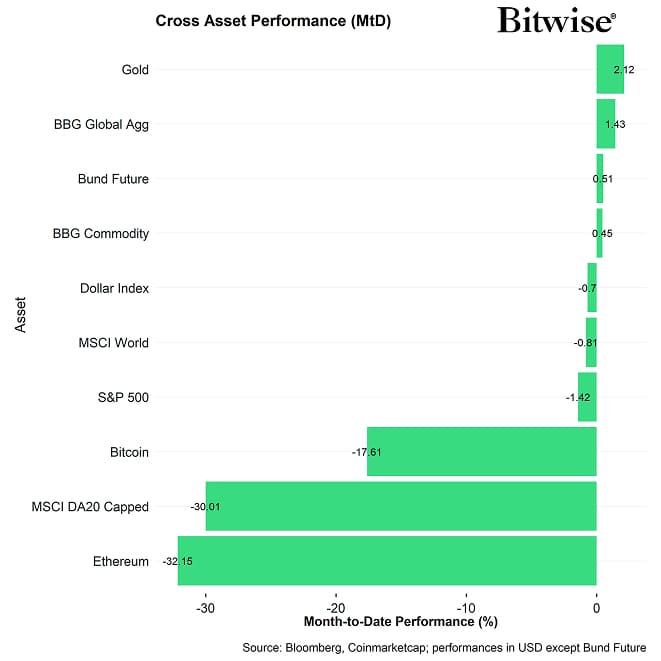

The performance in February was significantly affected by a general decline in cross asset risk appetite due to rising global growth woes on account of the new US import tariff policies.

The Trump administration announced a hike in import tariffs on Canadian, Mexican, European and Chinese imports which are likely going to increase the average import tariff rate of the US to the highest level since the Great Depression of the 1930s.

As far as macro developments are concerned, January trade data have already revealed a very significant increase in US merchandise imports in anticipation of these tariffs which has led to the largest US trade deficit in US history. This will likely lead to a technical contraction in US GDP in Q1 due to a significant widening of the trade deficit and negative net exports which is already reflected in the latest GDP Nowcast by the Fed of Atlanta.

The gold market has also suffered significant disruptions as gold traders rushed to import physical gold into the US which amongst others resulted in a significant shortage of physical gold in Europe in the London gold market which was accompanied by a significant rally in the price of gold.

All these developments are indicative of rising global economic uncertainty which has also weighed on Bitcoin and cryptoassets more broadly. They are also indicative of a general increase in inflation expectations due to rising tariff rates and geopolitical risks that tend to disrupt global supply-chains.

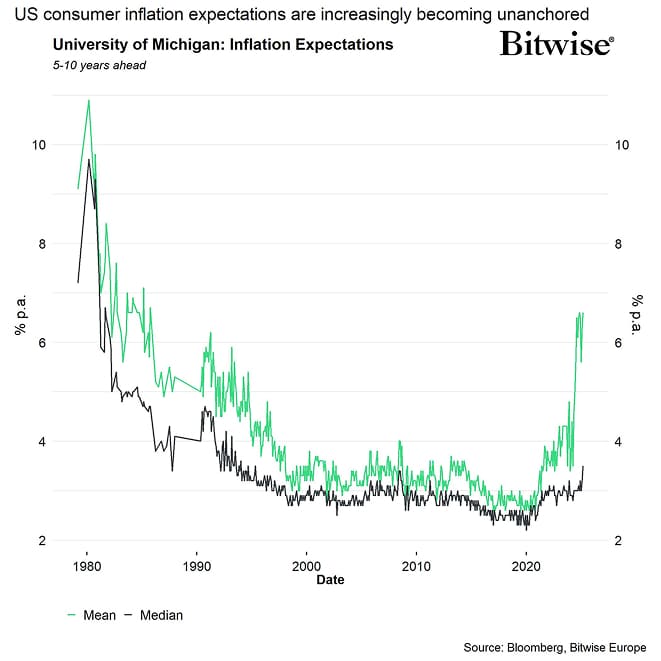

In fact, the latest University of Michigan US consumer inflation expectations have revealed that mean medium-term inflation expectations have increased to the highest level in over 40 years. Dispersion within this survey has also increased significantly which is signalling increased uncertainty about the prospects for inflation.

It is interesting to note that US Treasury yields have continued to drift higher for the most part of February due to these developments, despite the fact that other high-frequency indicators for global growth such as the copper-gold ratio or the Chinese 10-year yield have declined significantly (more about this in the macro section below).

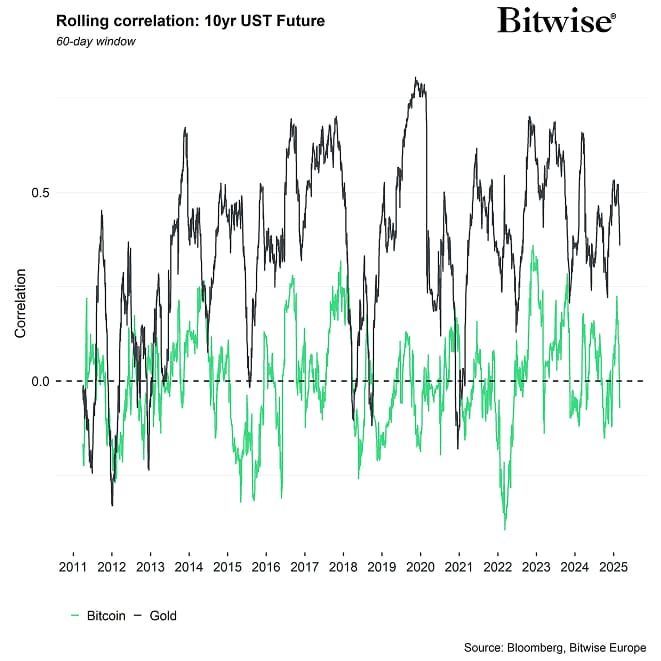

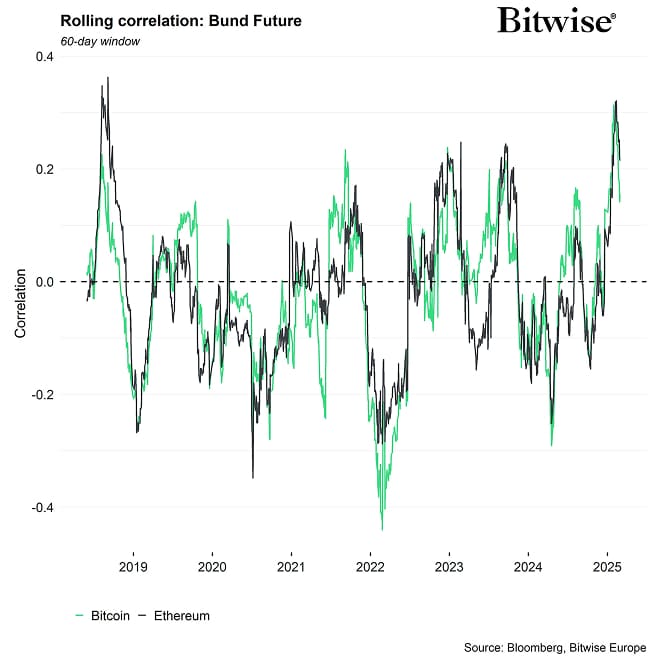

We think that the continued uptrend in US Treasury yields is indicative of a structural shift in Treasury markets due to rising worries about inflation and/or fiscal sustainability in the US. In this context, Bitcoin may act as a “portfolio insurance” against sovereign default due to its low correlation relative to US Treasuries which could also explain the recent efforts by some central banks to look into Bitcoin as an alternative reserve asset (Chart-of-the-Month).

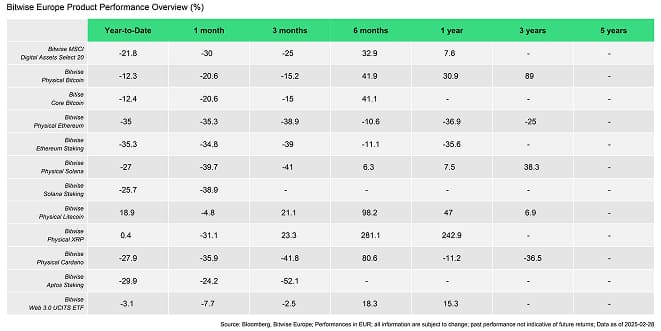

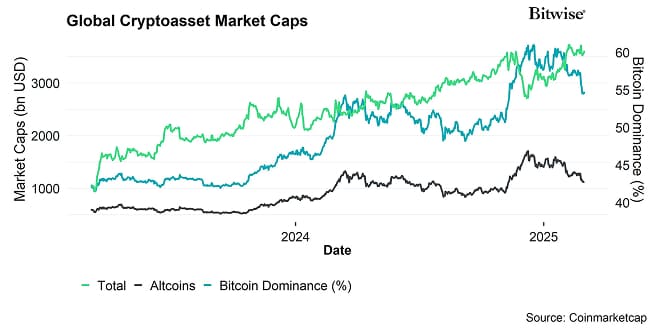

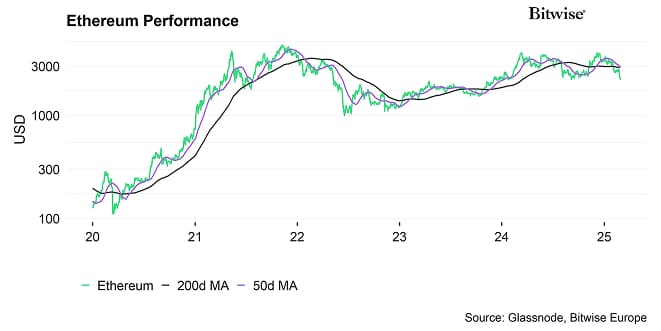

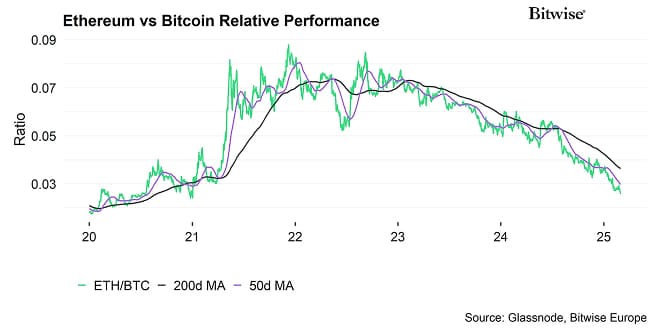

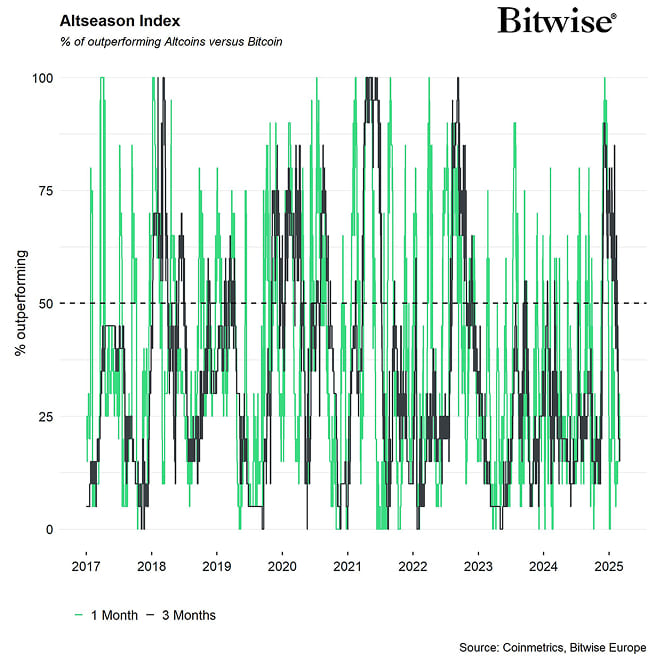

A closer look at our product performances reveals that altcoins significantly underperformed in February as well. In fact, our Altseason Index implies that only 30% of our tracked altcoins managed to outperform Bitcoin on a monthly basis. Ethereum also underperformed Bitcoin in February.

A notable development which significantly clouded market sentiment in February was the ByBit exchange hack.

Approximately $1.4 billion worth of Ethereum (ETH) was stolen from the UAE-based crypto exchange ByBit, marking the largest cryptocurrency hack in history. We covered this event in detail in our weekly report last week.

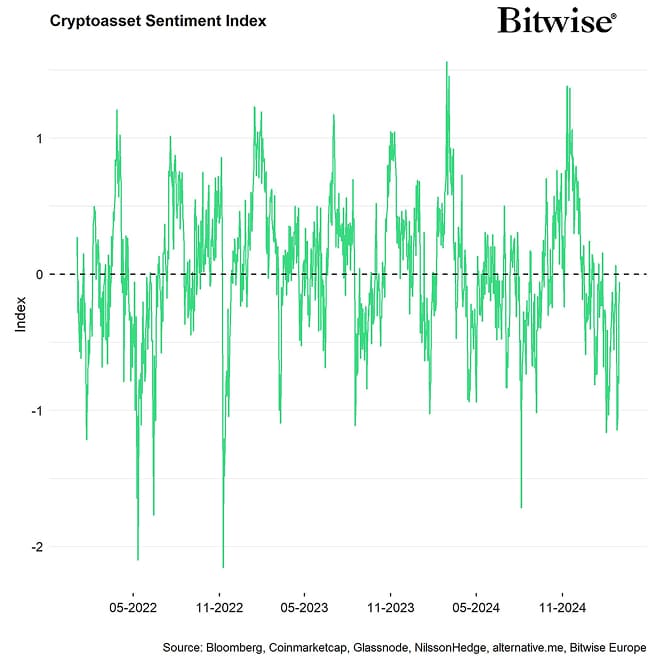

The ByBit hack significantly dampened market sentiment, triggering technical contrarian buying signals in our Cryptoasset Sentiment Index (falling below -1 standard deviation) early last week (see our latest weekly report published today). Additionally, bearish sentiment was evident not just in crypto markets but also in U.S. equities, as indicated by the AAII U.S. equity retail survey, where bearish readings hit their highest level since 2022.

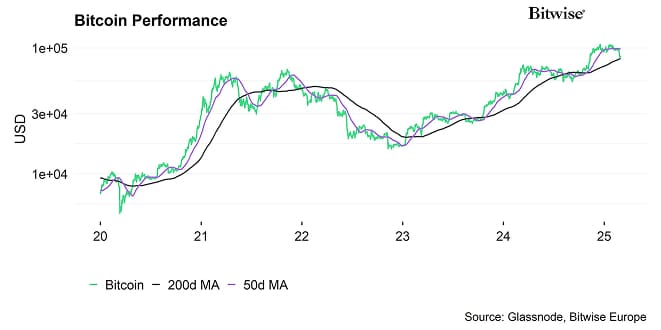

Despite a slightly negative performance across most cryptoassets last week, the market experienced considerable volatility. At one point, Bitcoin alone saw a -27.6% drawdown from its all-time high, briefly entering bear market territory.

The primary driver of selling pressure appeared to be the unwinding of basis “carry trades.” In such trades, investors short calendar futures while simultaneously going long on the underlying spot asset to capture the "basis rate." This rate had recently declined significantly for Bitcoin and Ethereum, reflecting a reduced contango in the futures market. For instance, Bitcoin's 3-month annualized basis rate dropped from 16.3% per year in November 2024 to just 6.7% recently.

On February 26th, when the bulk of the sell-off occurred, most realized losses came from large short-term investors ("whales") holding between 1,000 and 10,000 BTC for one day to one week. This led to the largest daily and weekly net outflows from global crypto ETPs, particularly U.S. spot Bitcoin ETFs, which saw a single-day net outflow of $1.14 billion on February 25th.

However, such extreme bearish sentiment could also be interpreted as a contrarian signal.

A key reason for optimism is the expectation of even higher net inflows into U.S. spot Bitcoin ETFs in 2025 compared to 2024, which was already a record-breaking year. This suggests a structural trend of positive flows into these ETFs in the coming months.

Recently, crypto prices have rebounded, driven by two major catalysts.

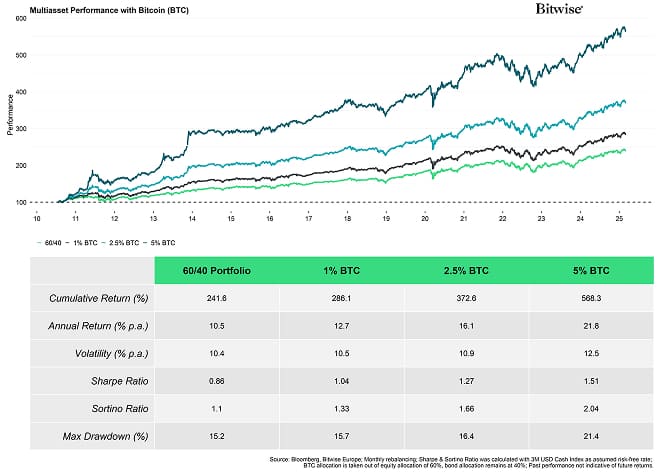

First, BlackRock announced its plans to incorporate Bitcoin into its model portfolios, potentially allocating 1%-2% across its multi-asset investment strategies.

Second, Donald Trump declared on Truth Social his intention to establish a "U.S. Crypto Reserve," covering the top five non-stablecoin cryptoassets by market capitalization: Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA). This announcement sparked a sharp market rally, with Bitcoin surging nearly 10% on Sunday.

Following Trump's statement, the probability of a U.S. national Bitcoin reserve in 2025 surged above 50% on Polymarket, currently standing at around 62%.

More details on these developments are expected at the first-ever White House “Crypto Summit,” scheduled for Friday, March 7th.

Bottom Line: February was marked by heightened economic uncertainty due to rising U.S. tariffs, inflation fears, and the largest crypto hack in history, leading to volatility and bearish sentiment across markets. However, with expectations of strong ETF inflows and bullish institutional developments, crypto markets have begun to rebound.

Macro Environment

In this month's edition, we wanted to take a closer look a potential structural break in US Treasuries and how this could affect Bitcoin and other cryptoassets going forward.

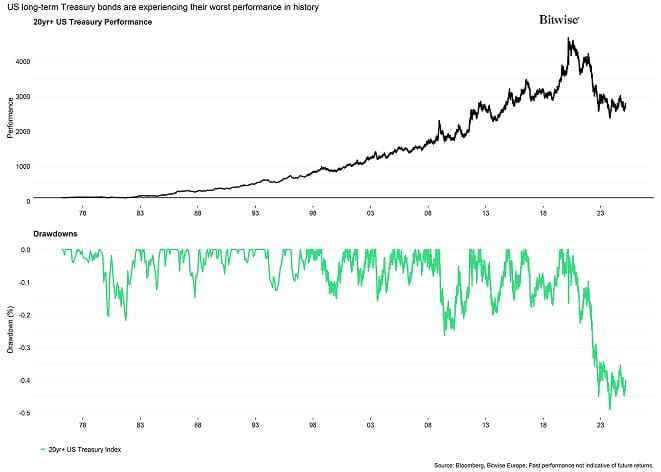

A key observation centres around the fact that long-term US Treasury bonds are currently mired in their worst bear market in history with still more than -40% drawdown from its latest peak.

Institutional investors have generally moved away from US Treasuries, especially since Russian foreign assets were frozen following the Ukraine invasion in February 2022.

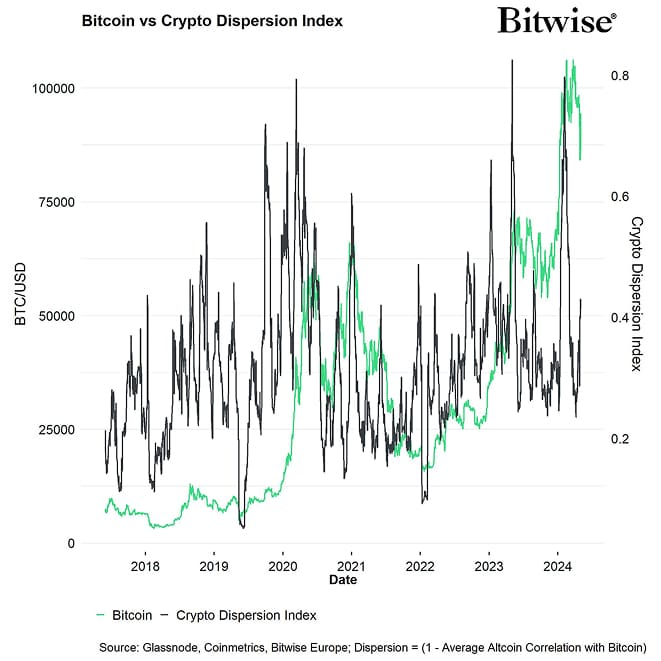

Since then, we have seen major breakdowns in established correlations that hint towards a structural break in US Treasuries and suggest that investors are increasingly diversifying their holdings into alternative safe-haven assets.

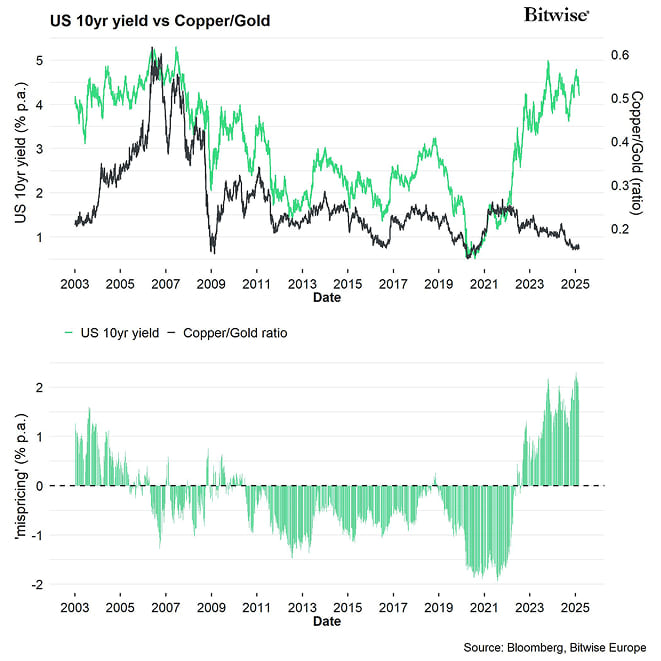

In this context, we have seen major breakdowns in correlations between US Treasuries, commodities and other bond markets. For instance, the ratio between copper and gold tends to be a high-frequency macro indicator. While the copper/gold-ratio has been trending downwards, US Treasury yields have continued to trend upwards. The copper/gold-ratio has been signalling a gradual slowdown in global growth since 2022 already.

The copper/gold-ratio alone signals that US 10-year Treasury yields are around 2%-points ‘mispriced', i.e. deviate around 2%-points from the long-term relationship.

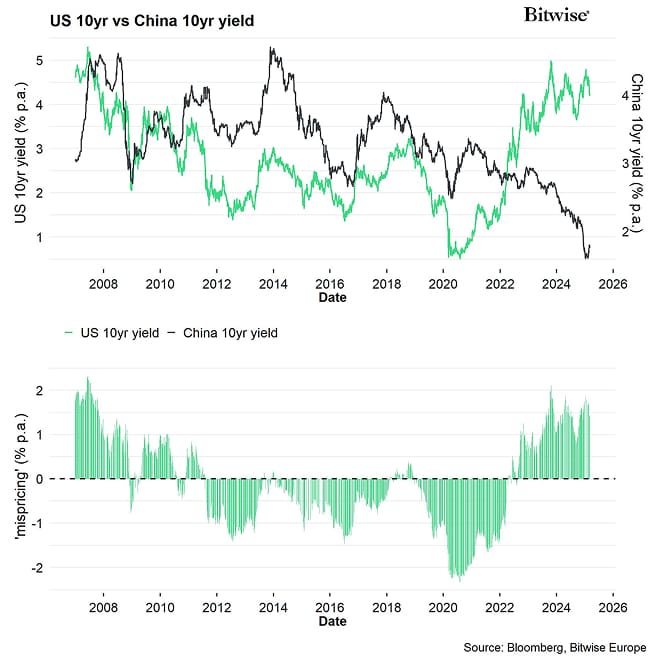

You can observe similar signals from the Chinese 10-year sovereign yield that has been declining to all-time lows more recently as the Chinese economy has been decelerating significantly. The Chinese 10-year sovereign yield itself also implies that the US 10-year Treasury yield should be around 2%-points higher.

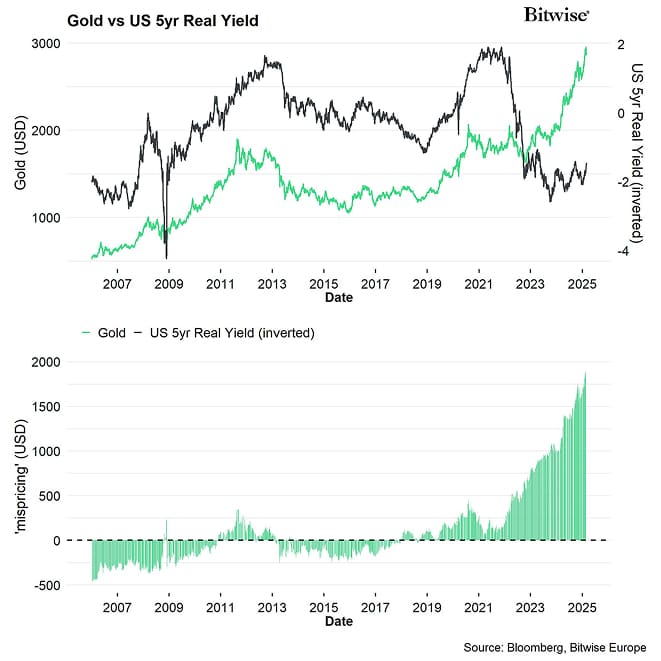

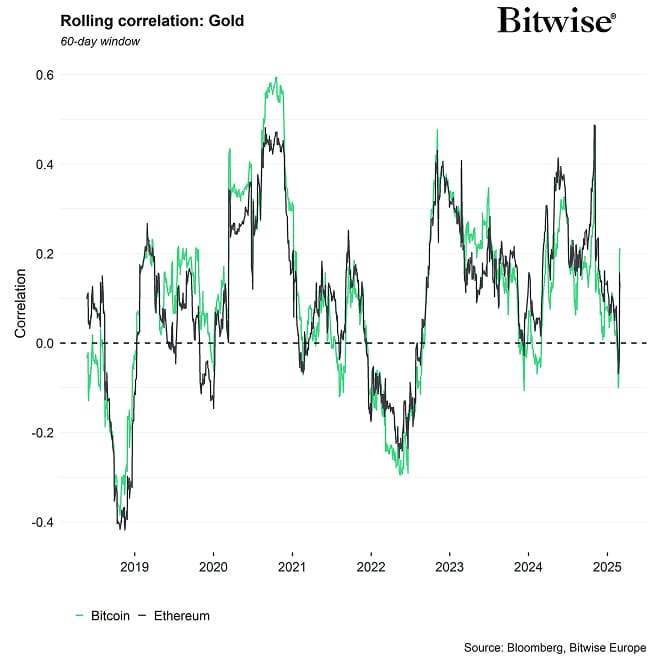

We are also seeing considerable deviations of gold from US real yields. Until the year 2022, there has been a very tight inverse relationship between the US 5-year real yield (TIPS yield) and the price of gold. This relationship has recently broken down as well. While real yields have increased, the gold price has continued to rally to new all-time highs.

What is puzzling many analysts is generally the fact that US Treasury yields have continued to move higher since the Fed commenced its rate cutting cycle in September 2024.

The latest data on foreign US Treasury holdings reveal that major holders like China have continued to reduce their US Treasury holdings while central banks have also continued to buy significant amounts of gold. Net foreign purchases of US Treasury bonds & notes has declined by -49.7 billion USD – the biggest drop since March 2021.

We also know that the percentage of gold in international FX reserves has continued to increase to new multi-year highs and has already overtaken the Euro.

This strongly suggests that foreign institutional investors have been diversifying their US Treasury holdings into other assets like gold.

The recent scarcity of physical gold and the failure by the Bank of England to deliver gold immediately to COMEX in New York speaks volumes in this regard.

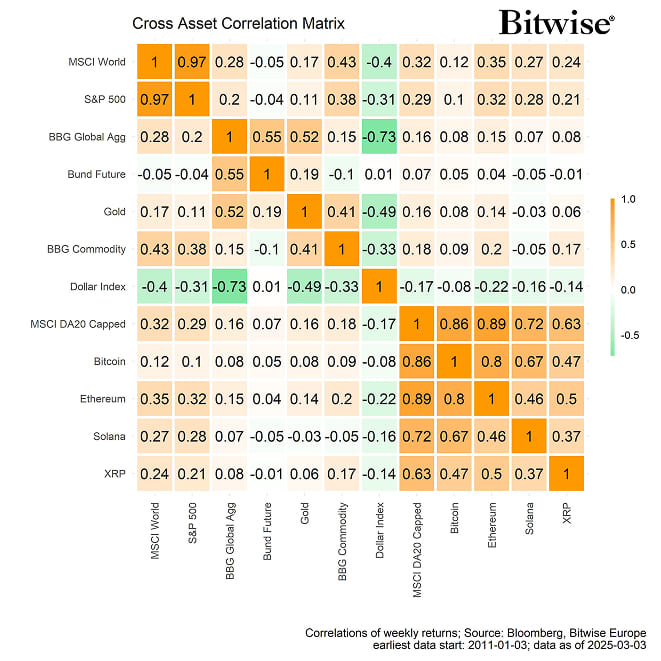

The overall macro implication for Bitcoin is that institutional investors are moving away from US Treasuries and are looking for alternative assets.

The recent announcement by the Czech National Bank to diversify parts of its official reserves into Bitcoin is a clear indication for that. There are also other foreign central banks that are contemplating to diversify parts of their US Treasury holdings into Bitcoin. Furthermore, the recent 13F filings in the US have also revealed that sovereign wealth funds have started investing into Bitcoin ETFs as well.

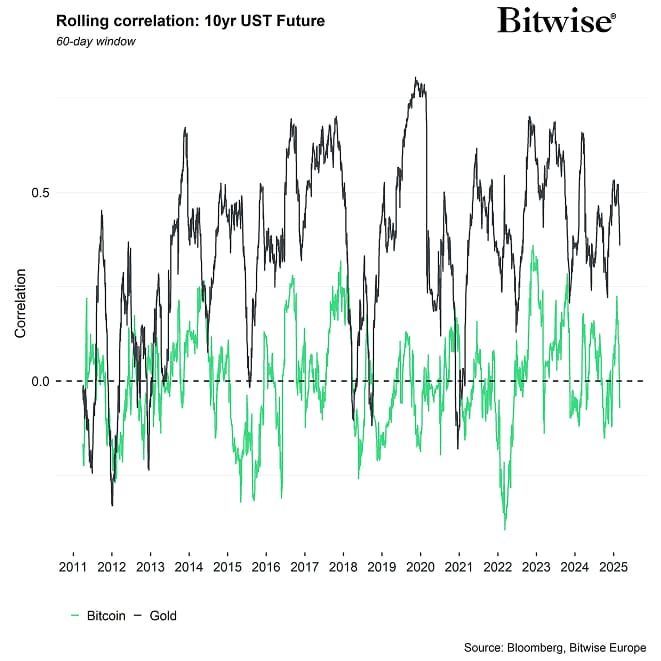

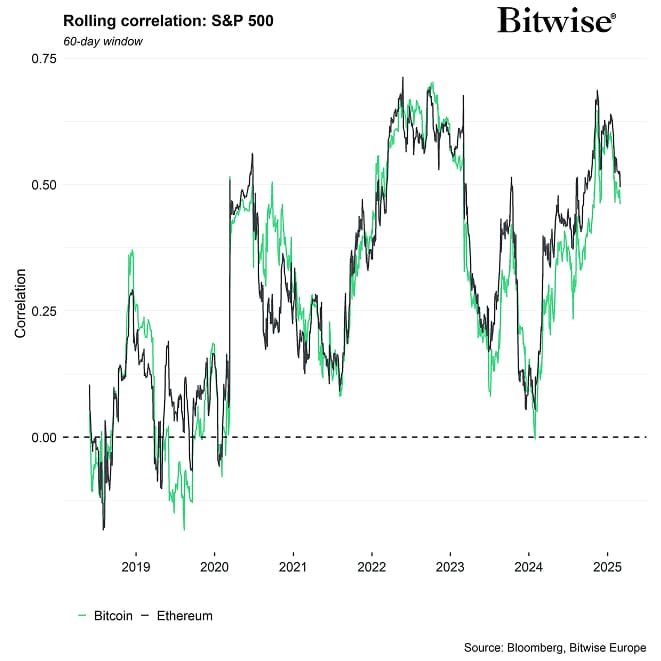

In fact, there is a strong case for Bitcoin as a “portfolio insurance” against sovereign default, especially since Bitcoin can act as a better hedge against bond drawdowns than gold. Moreover, Bitcoin's correlation to US Treasuries is also significantly lower than between gold and US Treasuries.

This so-called “Bitcoin-Bond Conundrum” is described in more detail here.

Another reason for this appears to be related to the fact that medium-term US consumer inflation expectations are moving up again amid rising geopolitical uncertainty and the prospect of higher import tariffs implemented by the Trump administration.

Now, the Fed is even contemplating about ending Quantitative Tightening (QT) based on their latest deliberations revealed in the latest FOMC Minutes from January 2025 meeting:

“[…] reserves might decline quickly upon resolution of the debt limit and, at the current pace of balance sheet runoff, might potentially reach levels below those viewed by the Committee as appropriate.”

Market participants generally expect the Fed to end QT in mid-2025.

In fact, US liquidity conditions are still unfavourable. US Fed net liquidity has been propped up by the drawdown in both the Treasury General Account (TGA) and Reverse Repos which both appear to be almost depleted. A renewed increase in both the TGA (due to the debt limit resolution) and the Reverse Repos could significantly inhibit efforts to provide ample liquidity to the banking system.

Furthermore, this liquidity drawdown could be exacerbated by the maturity of Bank Term Funding Program (BTFP) which is set to be repaid in full at the end of this month.

The general issue remains that overall liquidity is still getting tighter as evidenced by the elevated SOFR-Fed Funds Rate spread.

In addition, recent comments by the new Treasury secretary Scott Bessent imply that market liquidity in long-term US Treasuries remains bad which is also exacerbated by the Fed's ongoing QT efforts.

The Fed and the US Treasury have been “buying time” by shifting significant parts of debt issuance to the front end of the curve which has also led to “stealth QE”. The terms "stealth QE" or "QE, not QE" refer to policies where central banks inject liquidity into the financial system in ways that resemble Quantitative Easing (QE) but are not officially labelled as such.

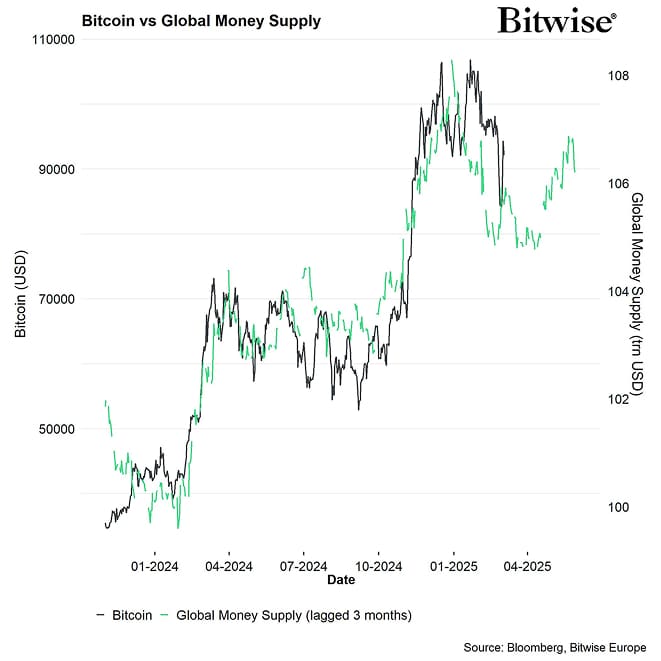

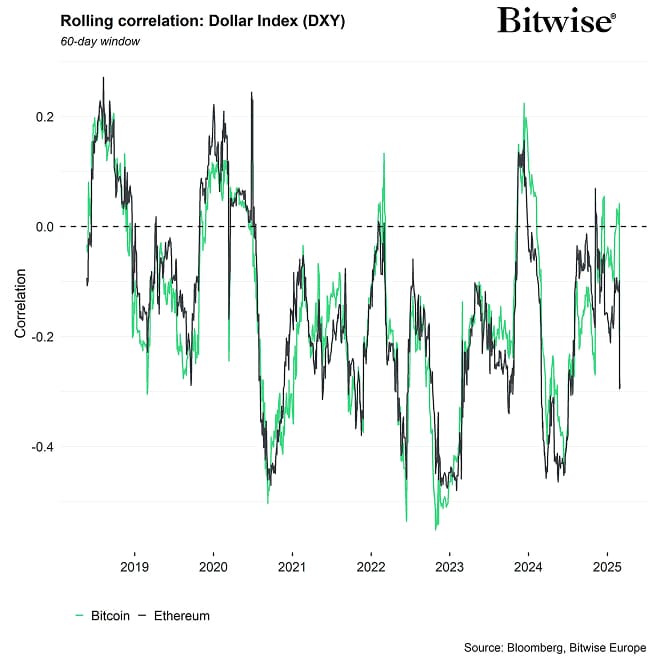

That being said, we are generally observing a decline in global liquidity conditions induced by the latest tightening in financial conditions, especially due to the previous Dollar strength. This has specifically weighed on global money supply as outlined in our monthly report in December 2024 already.

These macro developments have major market implications:

- Drawdown in TGA, RRPs and Fed's net liquidity along with latest FOMC comments on pausing QT suggests that Fed may step in sooner rather than later.

- Potential breakdown of the Treasury market due to structural shifts by foreign investors also implies a higher probability that the Fed may need to step in to provide liquidity to the Treasury market.

- Strains on liquidity are raising the odds of an “accident” in the traditional financial system.

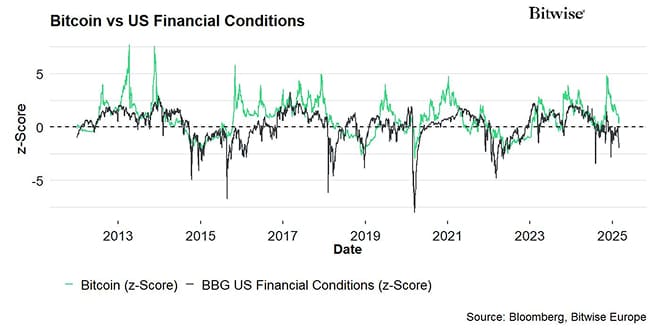

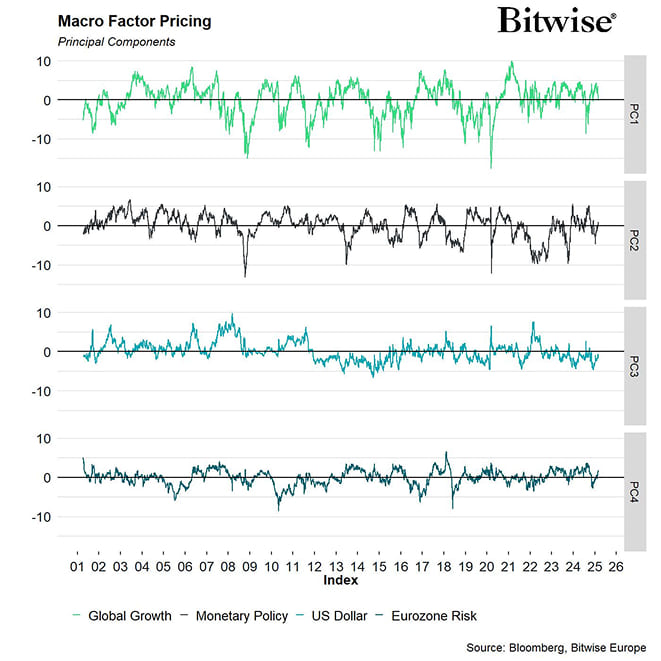

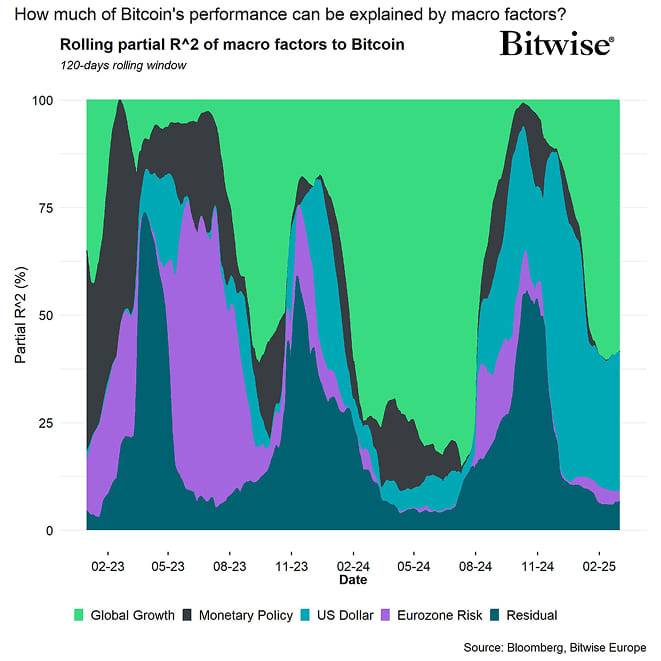

In the meantime, financial tightening tends to be a headwind for Bitcoin & cryptoassets as shown by the following chart:

Negative readings of the BBG US Financial Conditions imply that financial conditions are tightening and vice versa.

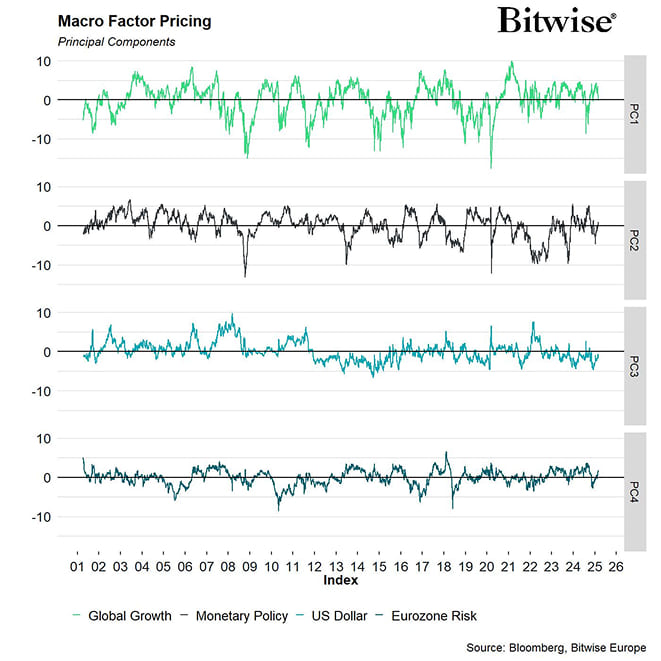

The good news is that overall macro conditions have recently improved significantly and only the strong US Dollar (due to the hawkish US tariff rhetoric) remains a headwind. All other macro factors including monetary policy, global growth expectations and Eurozone Risks have been improving.

More recently, Bitcoin has been following weaker global money supply growth lower more recently but the most recent reversal in the Dollar and re-acceleration in money supply suggests that this decline in global liquidity will probably prove to be short-lived.

US recession fears have also resurfaced last month because the Department of Government Efficiency (DOGE) has already laid off tens of thousands of federal employees this year.

According to Capital Economics, up to 200k federal workers have likely been made redundant in 2025 so far. As a result, the Bloomberg story count about job cuts, firings and layoffs has increased to a 1-year high and Google searches for “filing for unemployment” in the District of Columbia are the highest in the US. In fact, the latest data on initial unemployment claims in DC have increased to the highest since the Covid recession.

These layoffs will hit a labour market that is generally less able to absorb a sudden increase in unemployment since overall job openings have continued to stay weak based on the Daily LinkUp 10,000 index. In the context of job openings, the recent decline in construction job openings also points towards an increasing effect of the weak US housing market on construction employment. US housing will be a key area to watch to assess the probability for a recession.

Another key headache for markets is the increasing economic uncertainty induced by the US import tariffs.

The latest trade data have revealed the largest trade deficit in US history due to higher imports. This may lead to a technical contraction of GDP via deeply negative net exports. As a result, the GDP Nowcast by the Fed of Atlanta has recently declined significantly as well.

As far as inflation is concerned, US import tariffs are likely going to be inflationary via higher import price and producer price inflation.

That being said, tariff fears might be overblown in the short term because of the significant drag from US money supply growth that is still feeding into US core inflation via shelter and rent inflation.

Money supply growth also affects inflation with “long and variable lags” (around 30 months) which is why the most recent re-acceleration in US money supply growth won't affect US CPI inflation anytime soon. To the contrary, the preceding decline in US money supply growth will likely be a drag on US CPI inflation at least until the end of 2025.

The overall implication is that we might see a significant divergence between head and core inflation for the remainder of 2025 due to the distortions by higher import tariffs. However, the Fed may look through temporary increases in headline inflation as it's price stability mandate focuses on core (PCE) inflation as we won't see a renewed re-acceleration in inflation before 2026.

The latest high-frequency numbers by Truflation also point towards a significant decline in US headline inflation over the coming weeks.

This likely decline in inflation should take some pressure off the Fed and provide more room for further rate cuts which should provide a macro tailwind for Bitcoin and other cryptoassets.

A bigger economic uncertainty may come from the fact that the Mag7 stocks in the US are heavily exposed to foreign revenues. More specifically, the US IT sector generates almost 60% of its revenues abroad while the Mag7 derive around half of their revenues from business overseas. Adversarial foreign policies could possibly target this Achilles heal of the US economy. In fact, we have seen first indications into this direction by both the EU and China.

This remains a clear macro risk for Bitcoin due to the relatively high correlation between US equities and cryptoassets at the moment.

Bottom Line:Institutional investors are increasingly moving away from US Treasuries amid concerns over inflation, liquidity constraints, and geopolitical risks, leading to greater diversification into alternative assets like gold and Bitcoin. With macro conditions improving and the Fed potentially stepping in to ease liquidity pressures, Bitcoin could benefit as a hedge against financial instability and sovereign debt risks.

On-Chain Developments

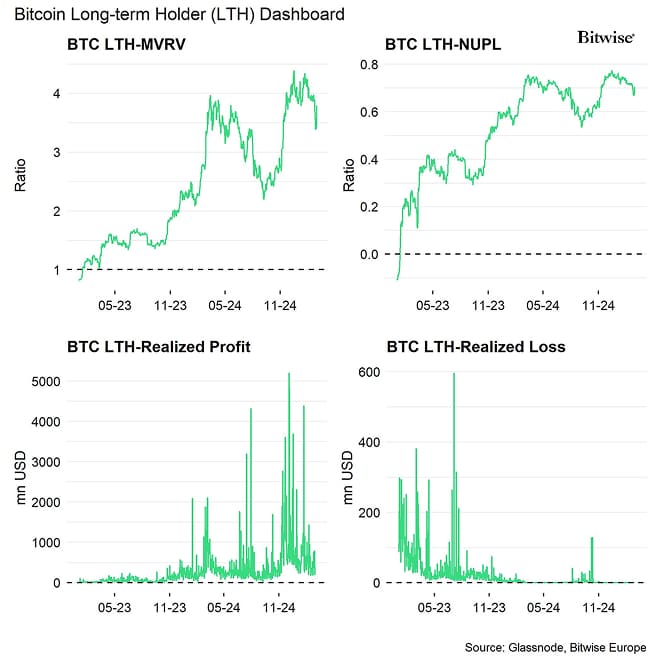

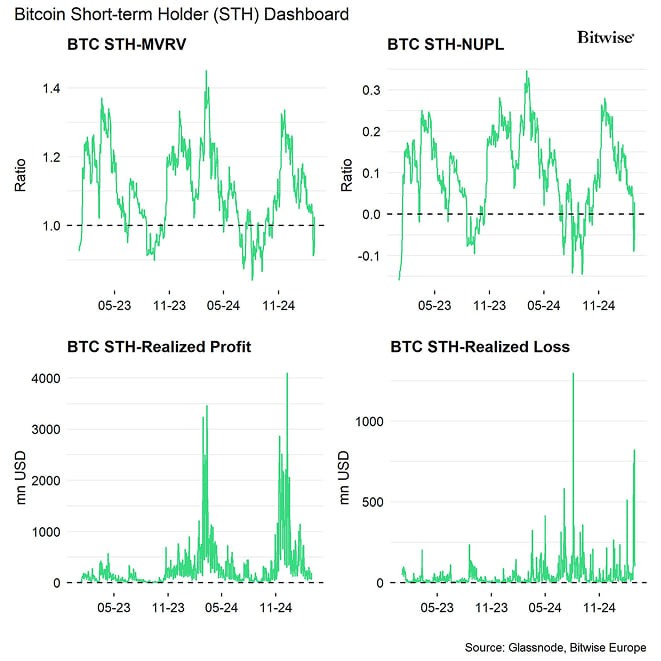

Macroeconomic uncertainty have certainly affected on-chain developments negatively as well.

We had already flagged the decline in macro tailwinds in our report in January 2025. The good news is that these macro drivers have recently improved again as pointed out above.

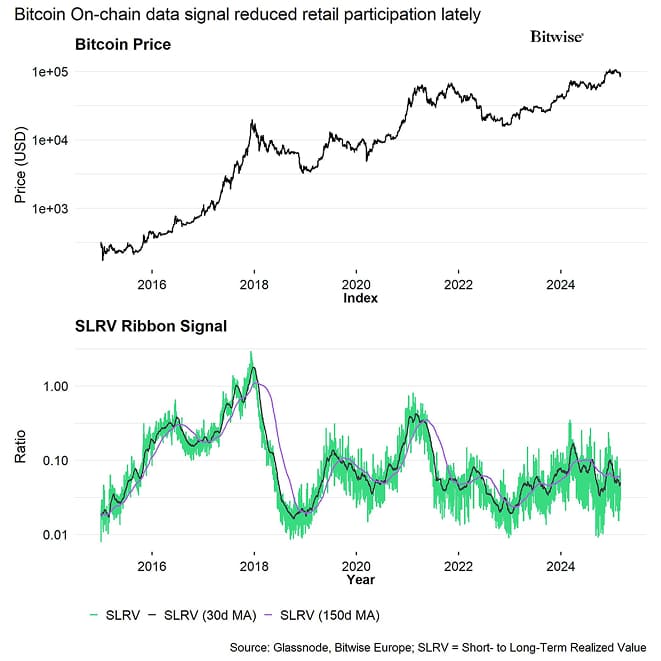

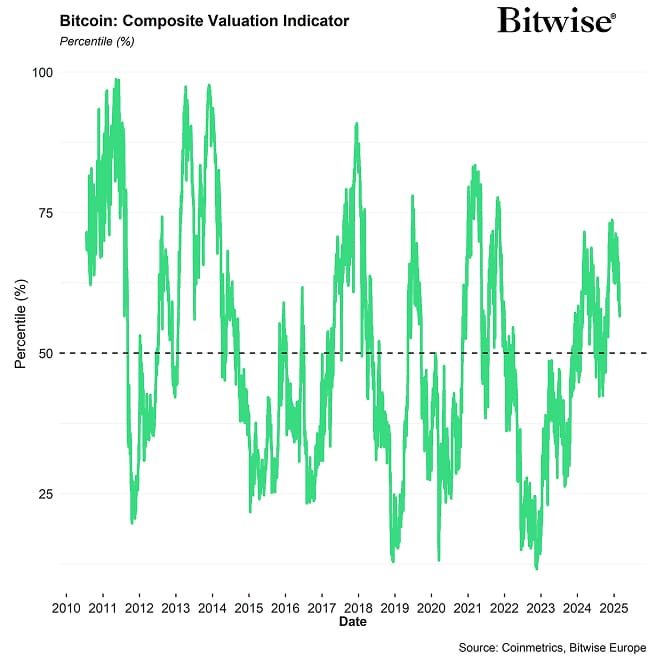

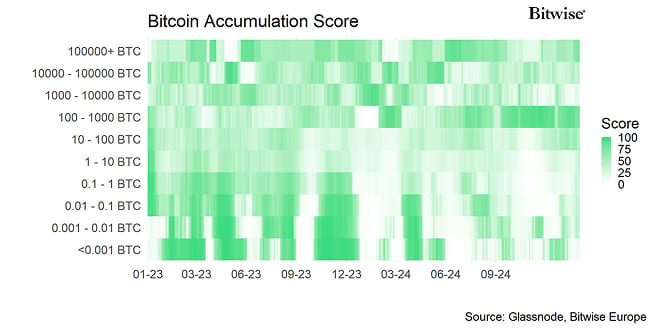

The bad news is that some of these on-chain signals mentioned in the January report have deteriorated since then. Most importantly, retail participation in Bitcoin has recently cooled off significantly judging by the decline in the SLVR Ribbons and Exchange Volume Momentum. The Supply Delta also looks relatively toppish signalling that the influx of new short-term capital into Bitcoin appears to be slowing down.

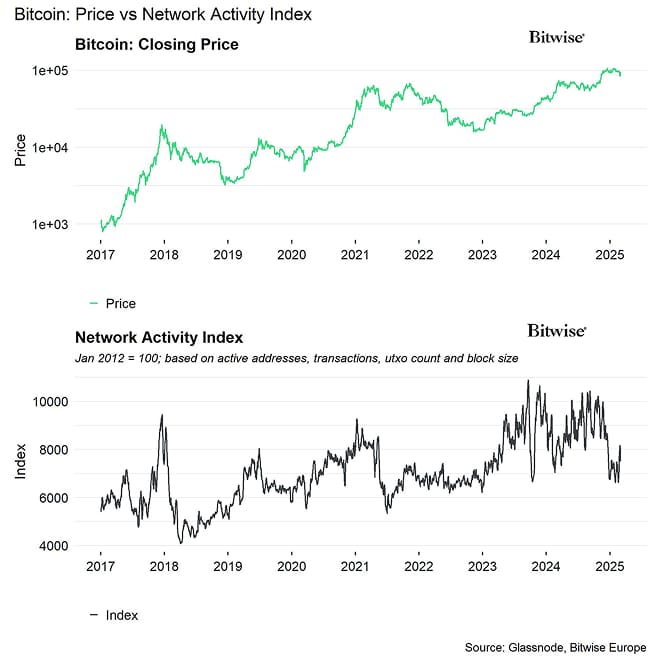

All of these indicators imply that overall on-chain activity for Bitcoin has been slowing down more recently.

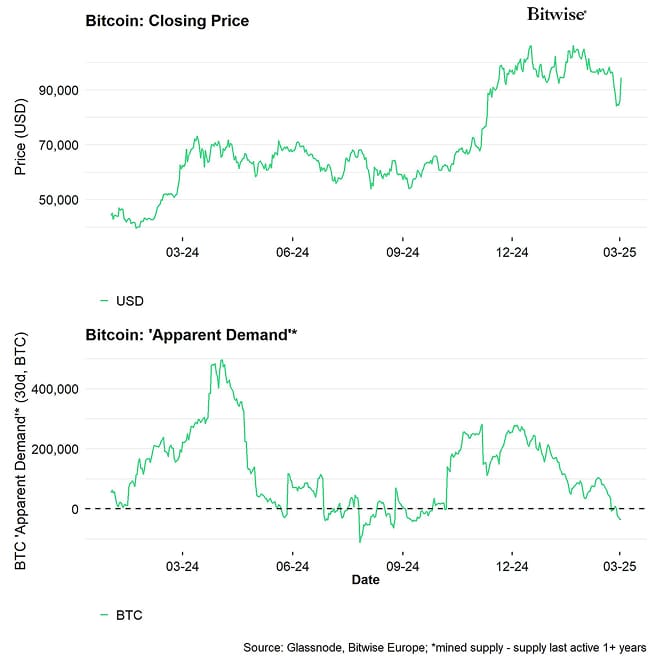

This take is also corroborated by the fact that “apparent demand” has been slowing down over the past weeks and has recently turned negative for the first time since September 2024:

Moreover, we have recently seen a significant deceleration in global ETP flows, especially in US spot Bitcoin ETFs which have seen record outflows last week. This has been attributed to the significant decline in the Bitcoin basis rate which has led to an unwind of basis trades and must have spurred outflows from spot ETPs.

In fact, large short-term holders were responsible for the bulk of realized losses during the firesale on the 26 th of February, not small retail investors, which supports the hypothesis of the basis trade unwind.

On the bright side, Cryptoasset Sentiment has already turned very bearish which makes more downside less likely in the short-term. In fact, our in-house Cryptoasset Sentiment Index has declined to the lowest level since August 2024 – when the last significant market capitulation occurred.

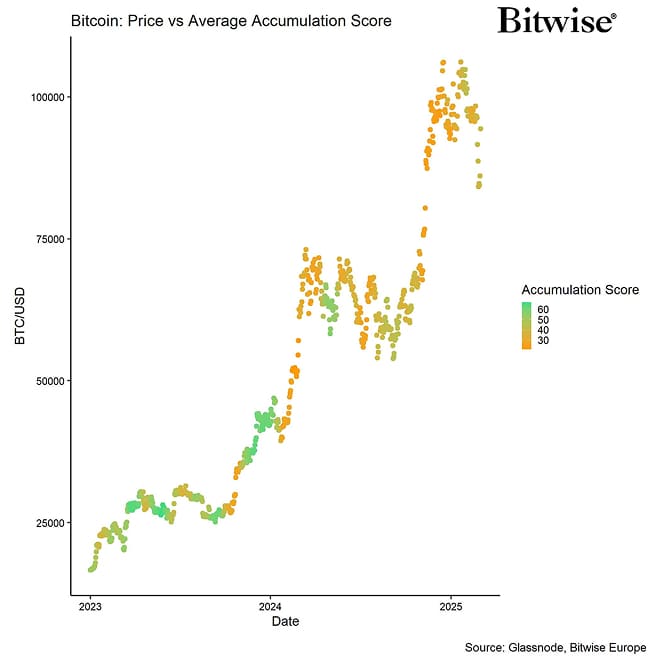

On another positive note, although US spot Bitcoin ETF flows have slowed down markedly, corporations have continued to add bitcoin to their corporate balance sheets, most famously Michael Saylor's Strategy (MSTR) which bought 27,989 BTC in February alone. Corporations generally seem to be more price-agnostic than ETP investors in this regard.

On aggregate, we have already seen corporate purchases outpacing the amount of new bitcoin supply in 2025 by a factor of 2.4x times.

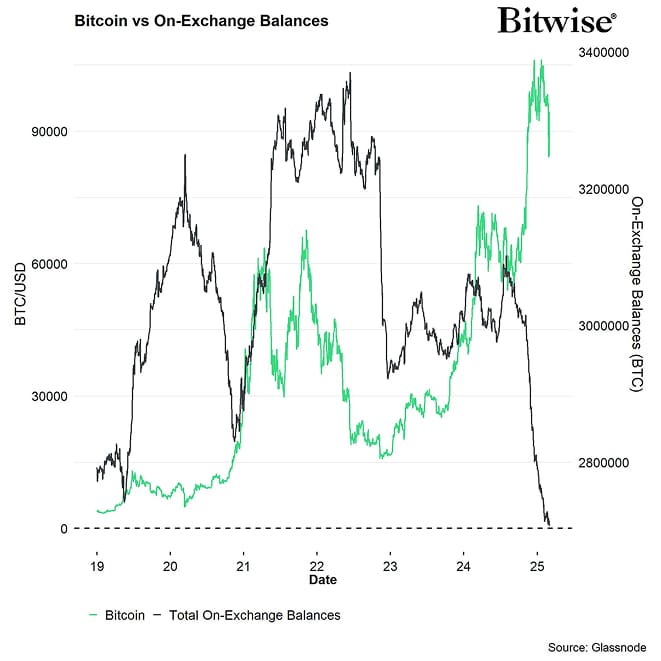

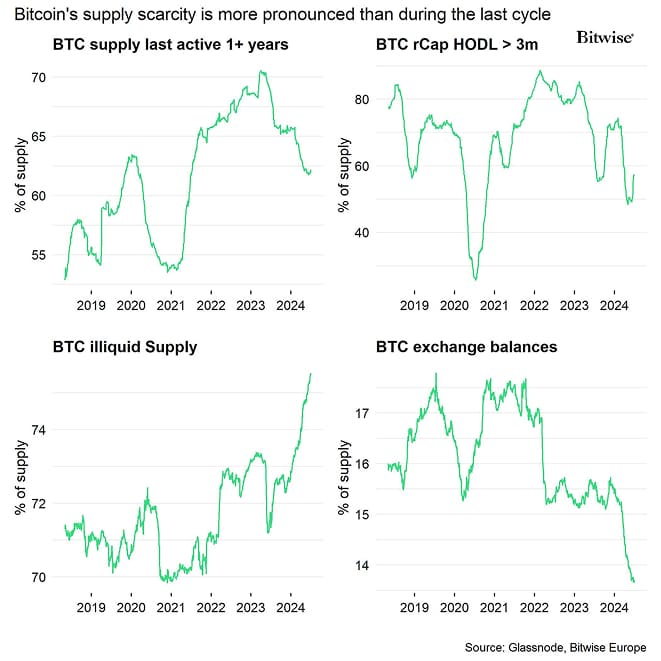

The impressive part is that exchange balances have continued to trend downwards which means that the liquid supply has continued to remain at low levels despite a very significant selling pressure on exchanges more recently. In fact, we have recently seen the highest amount of net selling volumes on Bitcoin spot exchanges since the China mining ban in May 2021.

The moment we see a reversal in ETF flows in the US which is very likely on account of the ongoing substitution of existing portfolio allocations into Bitcoin and other cryptoassets as outlined in our report last month, this should continue to exacerbate the supply deficit observed on exchanges.

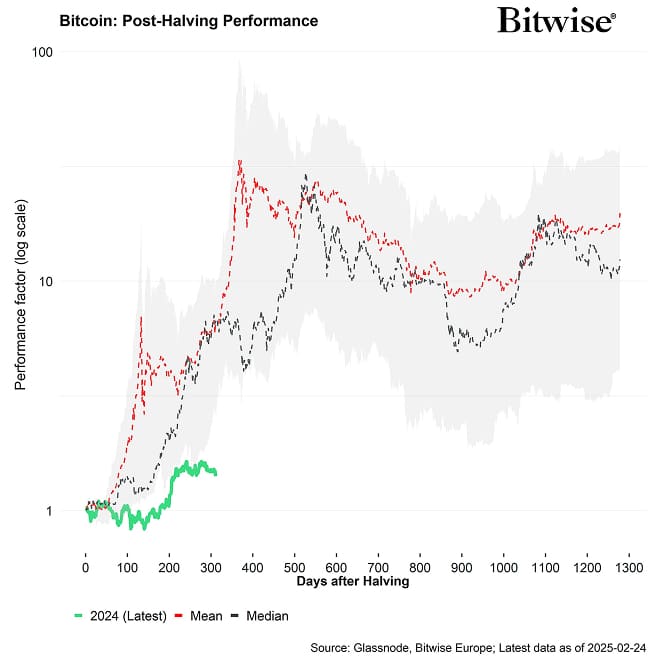

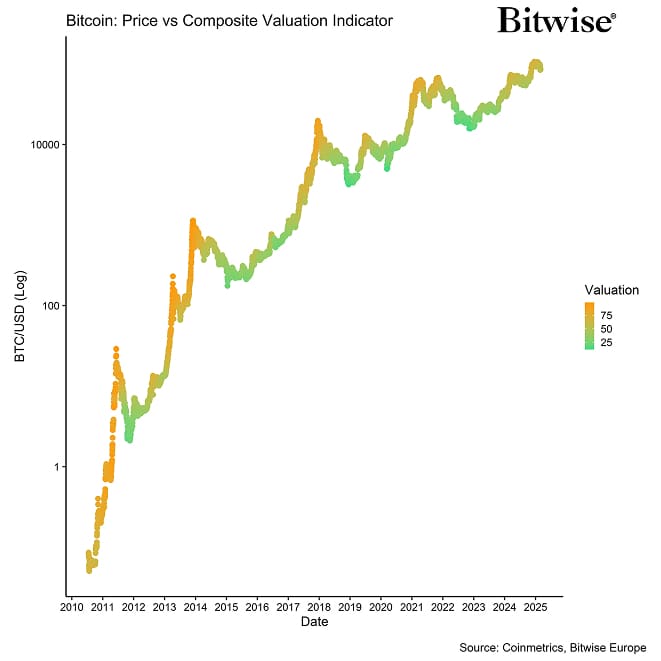

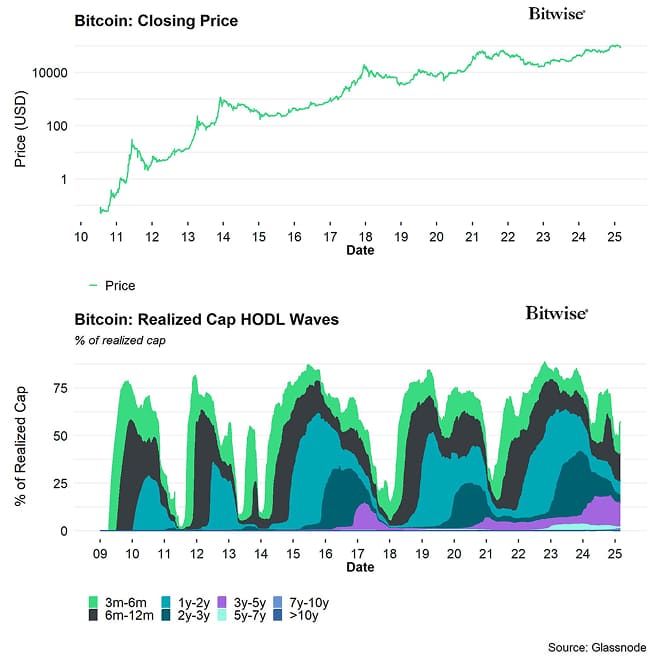

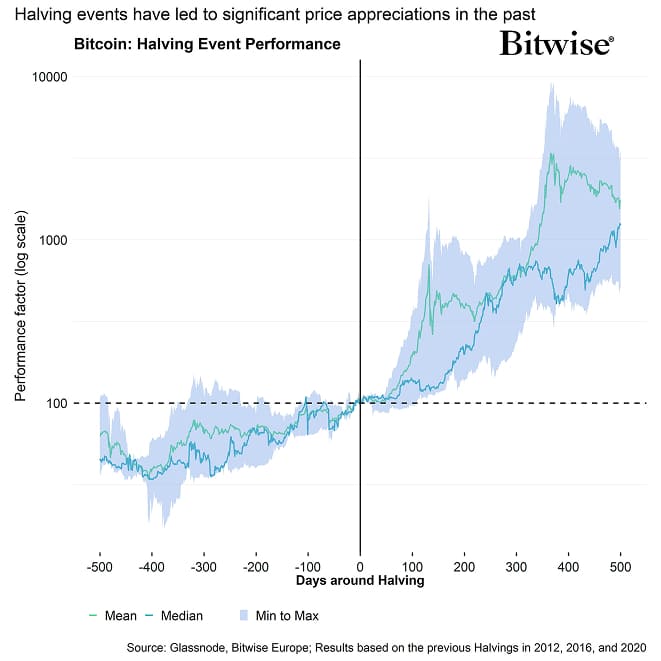

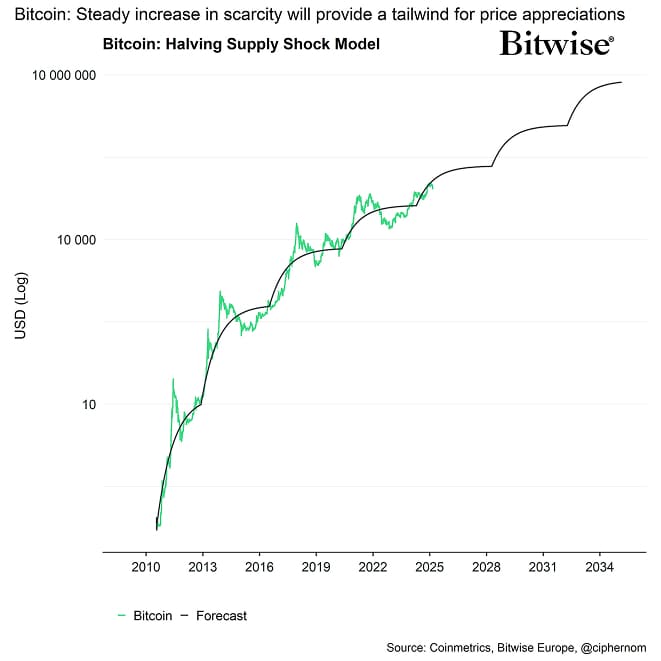

What is more is that the supply shock emanating from the Bitcoin Halving in April 2024 is likely going to enter its “hot phase” where the lagged effect from the Halving become most pronounced. Historically speaking, the positive performance effect from Halving tends to be most pronounced between 200 and 400 days after the Halving event. This time window will be over the next 3 months.

The median performance of Bitcoin was 18x over a 500-day period after the Halving, averaged across the past 3 Halving cycles (2012, 2016, and 2020).

In this context, it is important to highlight that Bitcoin is actually significantly below historical performance patterns post Halving. Since the Halving event in April 2024, (when Bitcoin was trading at around 65k USD) Bitcoin hasn't even doubled which still implies significant performance potential in this Halving cycle.

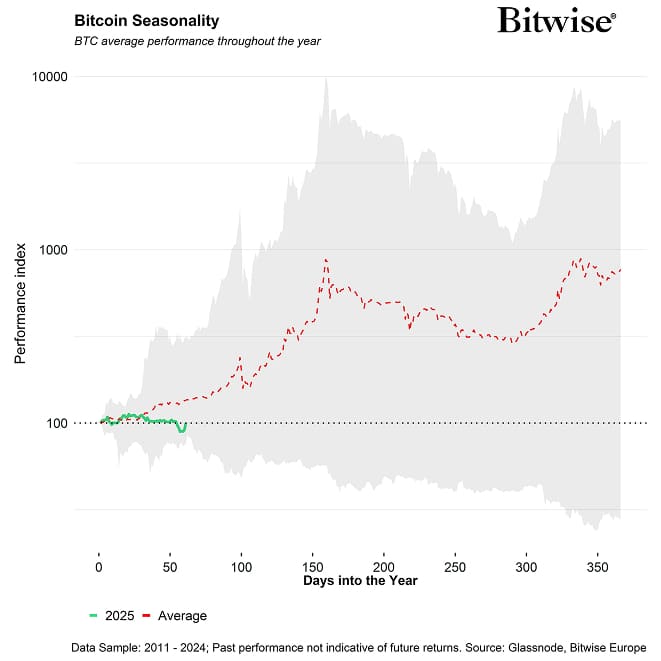

Diminishing returns have generally been expected for this cycle as well but this is still not even half the return so far we have seen in the very last Halving cycle post-2020 (where Bitcoin 6x'ed). The very positive performance seasonality for Bitcoin over the coming 3 months (until June) also dovetails this observation.

Recently, crypto asset prices have rebounded, driven by two key events.

First, BlackRock announced plans to incorporate Bitcoin into its model portfolios, potentially leading to a 1%-2% strategic allocation across its in-house multi-asset portfolios. Structural inflows into US spot Bitcoin ETFs will be a key driver this year as outlined in our 2025 predictions as well.

Second, Donald Trump declared on Truth Social his intention to create a “U.S. Crypto Reserve”, which would include the top five non- stablecoin cryptocurrencies by market capitalization: Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA). This news triggered a surge in crypto prices, with Bitcoin alone gaining nearly 10% on Sunday.

Following this announcement, the probability of the U.S. establishing a national Bitcoin reserve in 2025 spiked on Polymarket, surpassing 50% once again, and currently stands at around 62%. Further details on these developments are expected to be shared at the first-ever White House "Crypto Summit," scheduled for Friday, March 7.

Bottom Line: On-chain activity for Bitcoin has slowed recently, with retail participation declining and ETF outflows accelerating, largely due to the unwinding of basis trades. However, corporate Bitcoin accumulation remains strong, exchange balances continue to decrease, and historical post-Halving trends suggest significant upside potential in the coming months.

Bottom Line

- Performance: February was marked by heightened economic uncertainty due to rising U.S. tariffs, inflation fears, and the largest crypto hack in history, leading to volatility and bearish sentiment across markets. However, with expectations of strong ETF inflows and bullish institutional developments, crypto markets have begun to rebound.

- Macro: Institutional investors are increasingly moving away from US Treasuries amid concerns over inflation, liquidity constraints, and geopolitical risks, leading to greater diversification into alternative assets like gold and Bitcoin. With macro conditions improving and the Fed potentially stepping in to ease liquidity pressures, Bitcoin could benefit as a hedge against financial instability and sovereign debt risks.

- On-Chain: On-chain activity for Bitcoin has slowed recently, with retail participation declining and ETF outflows accelerating, largely due to the unwinding of basis trades. However, corporate Bitcoin accumulation remains strong, exchange balances continue to decrease, and historical post-Halving trends suggest significant upside potential in the coming months.

Appendix

Cryptoasset Market Overview

Cryptoassets & Macroeconomy

Cryptoassets & Multiasset Portfolios

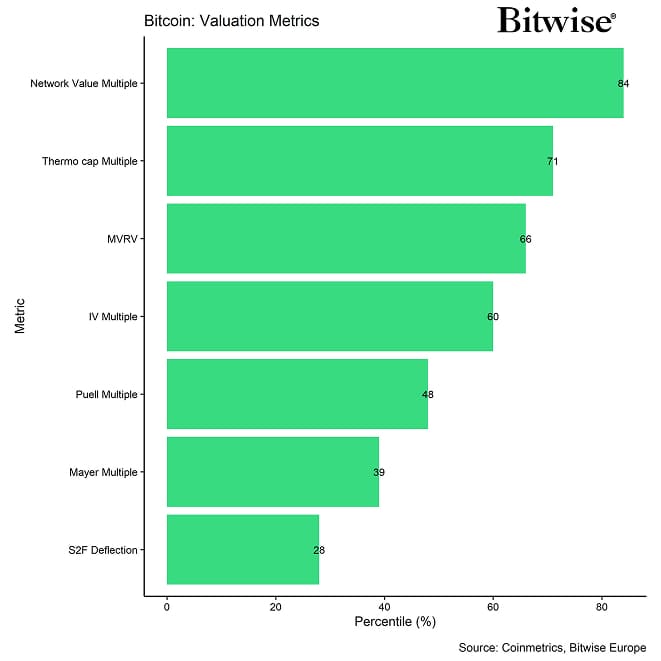

Cryptoasset Valuations

On-Chain Fundamentals

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

En

En  Fr

Fr  It

It  De

De