- Performance: April’s stability in Bitcoin and broader cryptoassets, driven by a reversal in risk appetite, a persistent supply deficit on exchanges and weakening dollar amid rising Fed-cut expectations, underscores Bitcoin’s growing role as a hedge against US Treasury and equity market stress. With macro uncertainty still elevated but now priced in, on-chain improvements and a potential Fed rescue suggest Bitcoin has already bottomed, setting the stage for renewed bull-market positioning.

- Macro: We think that mounting US recession risks and high policy uncertainty will drive Fed rate cuts and dollar weakness, creating looser financial conditions that have already enabled Bitcoin’s decoupling from equities. Combined with structural de-dollarisation, expanding global money supply and Bitcoin’s rising inverse sensitivity to the dollar, this positions Bitcoin as a superior hedge and alternative reserve asset—likely to outperform gold and traditional safe havens in the months and years ahead.

- On-Chain: Macro developments remain in the driver’s seat and, after a lag, are now visibly reversing on-chain weakness—our ‘apparent demand’ metric has turned positive thanks to renewed spot-ETF inflows and a surge in corporate accumulation (notably MSTR’s outsized April buys). At the same time, aggregate exchange supply is sinking to new multi-year lows, tightening liquid supply. Taken together, these factors underpin our constructive view that the current Bitcoin bull market still has room to run.

Chart of the Month

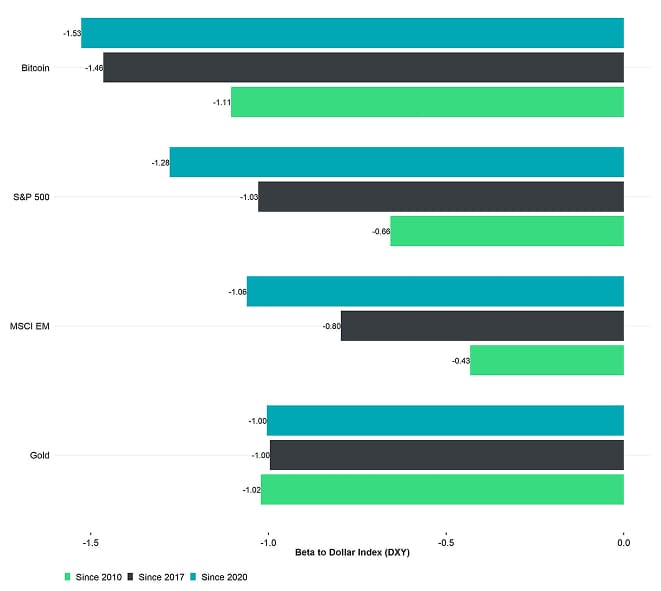

Full-Sample Beats of Assets vs. DXY

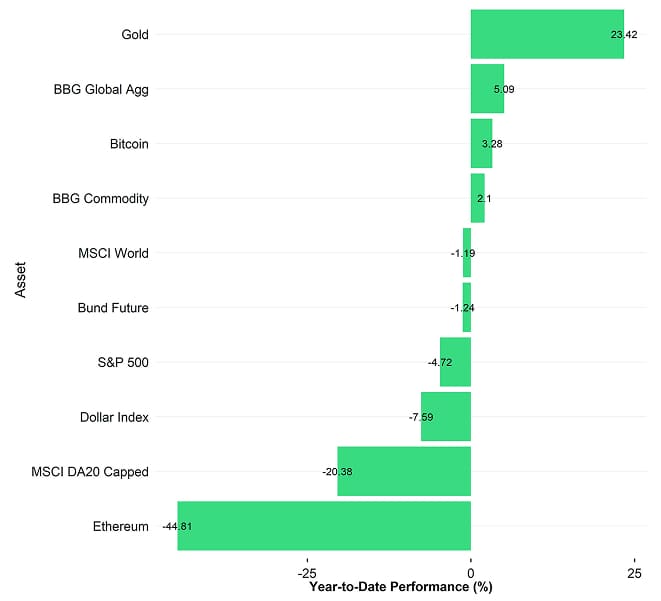

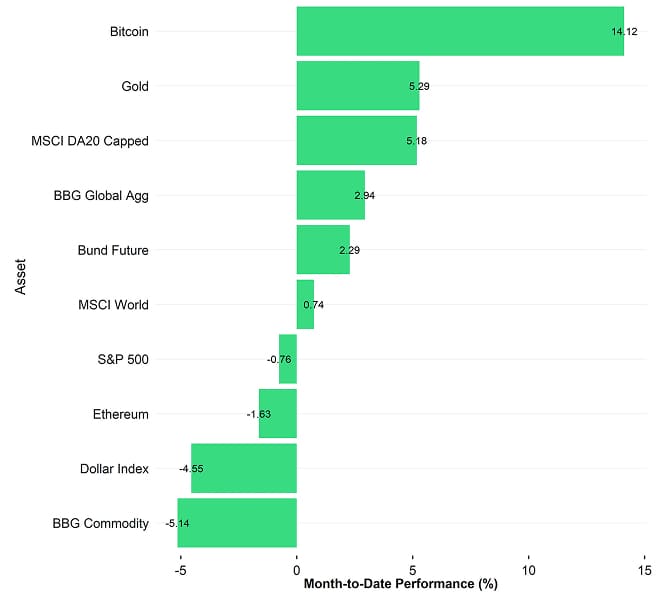

Performance

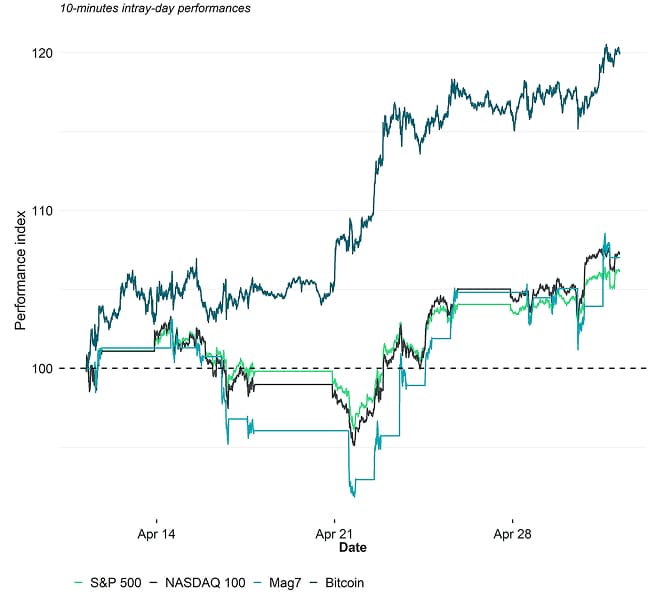

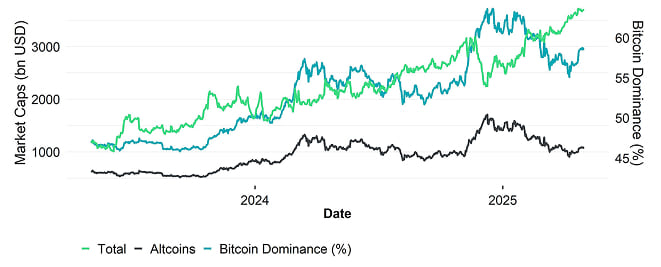

The performance in April was characterized by stabilization in Bitcoin and other cryptoassets due to a reversal in global cross asset risk appetite and continued support via an ongoing supply deficit of bitcoins on exchanges. It seemed as if financial markets have passed the point of ‘peak economic uncertainty’ caused by the US trade policies but remain relatively volatile. In fact, the US economic policy uncertainty index we highlighted in our previous weekly report has come off its recent all-time highs but remains elevated.

Meanwhile, higher Fed rate cut expectations and Dollar weakness amid US recession risks have moved into the spotlight of markets and are increasingly providing a tailwind for Bitcoin and cryptoassets.

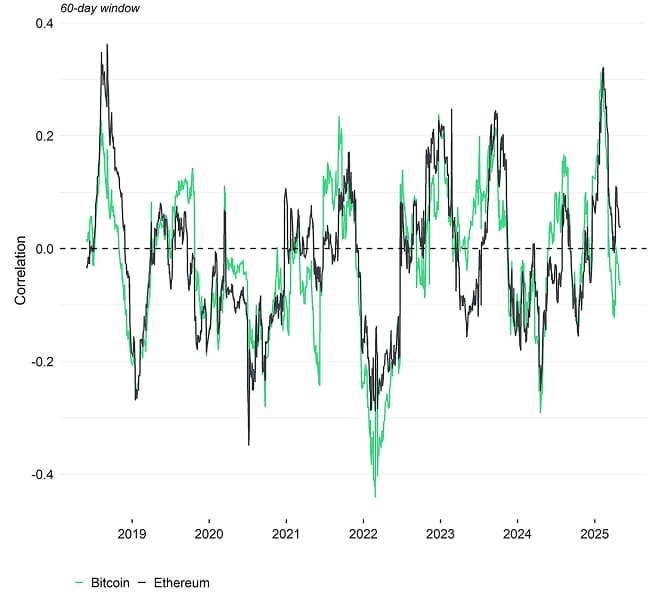

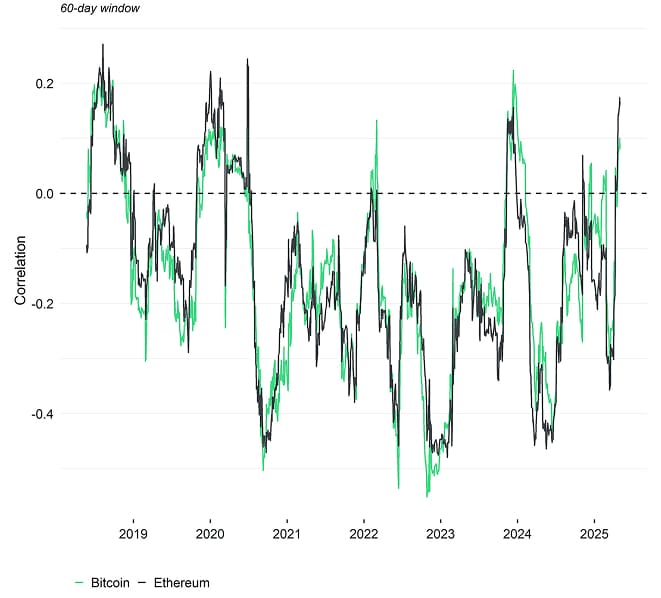

What is also worth noting is that Bitcoin managed to decouple from the performance of US equities during the escalation of the trade feud as highlighted in one of our weekly reports which also resulted in a systemic bond market capitulation.

The ‘sell America’ trade has led to a big international investor rotation away from US assets and in particular away from US Treasury bonds which suffered significantly despite a broad-based risk-off in financial markets. This was also one of the key reasons for the significant Dollar weakness observed during April.

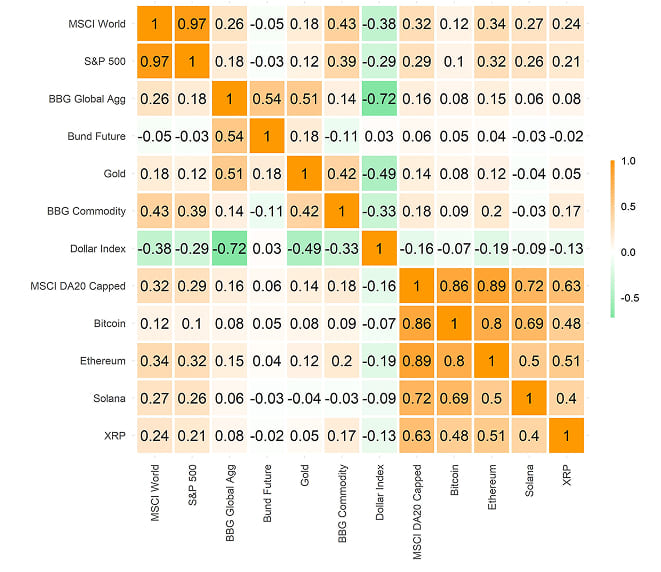

In this context, it is worth mentioning that Bitcoin can serve as a hedge against US Treasury downside due to its low correlation and the fact that it is essentially free of counterparty risks as highlighted in one of our recent Crypto Market Espresso reports as well.

The short-term increase in systemic risks related to the US Treasury market has not only renewed interest in bilateral trade talks between the US and China, but it was also most likely the reason why Bitcoin started to decouple from the performance of US equities as a systemic risk hedge. In any case, a significant dysfunction of the US Treasury market had likely entailed an intervention by the Fed which would have been a major tailwind for Bitcoin and cryptoassets.

In general, the seeds for a likely intervention of the Fed appear and a protracted Dollar weakness seem to be growing. The latest regional manufacturing surveys have cemented the view that the US economy is sliding into recession as we speak which is so far also being implied by the latest nowcast of the Fed of Atlanta. Besides, leading labour market indicators also signal an imminent increase in US unemployment over the coming months.

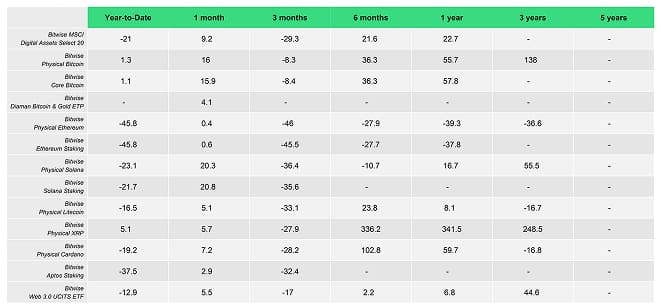

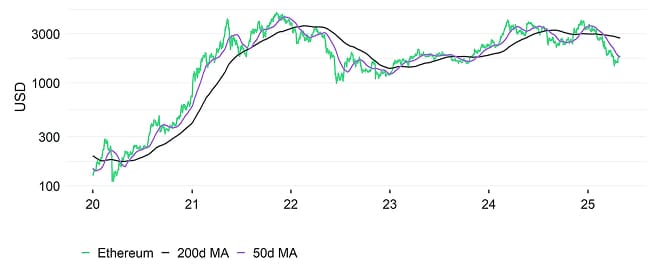

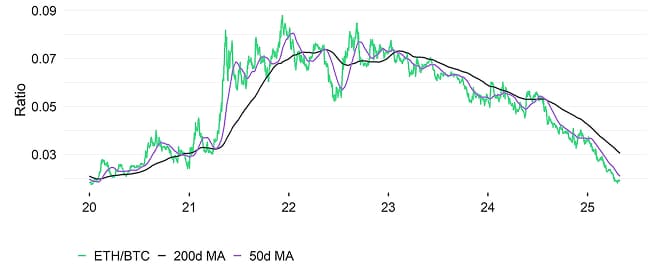

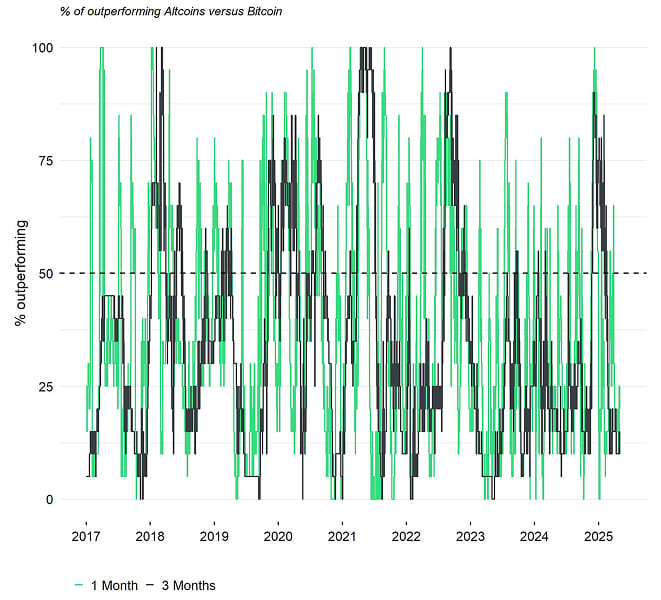

A closer look at our product performances reveals that Bitcoin has mostly outperformed other altcoins in April. Altcoins were generally under pressure relative to Bitcoin as overall market risk sentiment remained cautious.

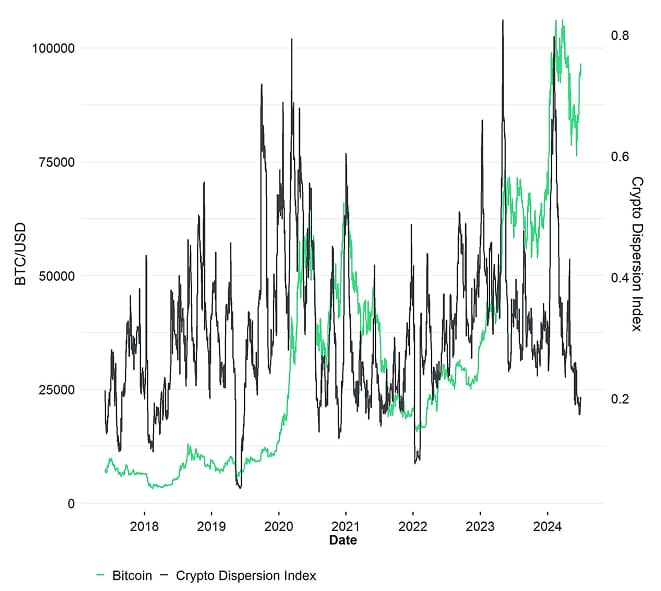

Performance dispersion among altcoins also declined considerably to the lowest level since November 2022 as altcoin performances remained dominated by global macro developments and less by coin-specific investment narratives.

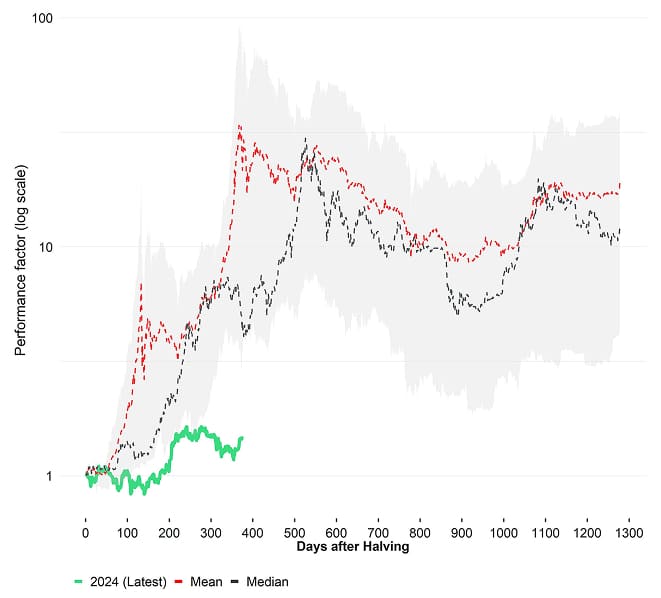

We think it’s quite likely that macro developments will remain at the forefront of Bitcoin and crypto markets over the coming months amid ongoing uncertainty around US trade policies and increasing evidence that the US economy is sliding into recession.

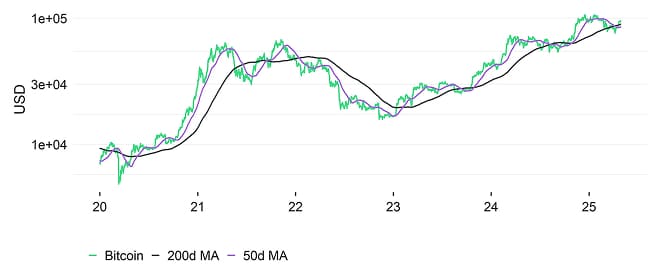

However, we think that due to very pessimistic sentiment in April, improving on-chain data and a rising tailwind from monetary policy as well as a weaker Dollar that Bitcoin has most-likely passed the bottom already. Investors should reposition their exposure for a continuation of the bull market.

Bottom Line: April’s stability in Bitcoin and broader cryptoassets, driven by a reversal in risk appetite, a persistent supply deficit on exchanges and weakening dollar amid rising Fed-cut expectations, underscores Bitcoin’s growing role as a hedge against US Treasury and equity market stress. With macro uncertainty still elevated but now priced in, on-chain improvements and a potential Fed rescue suggest Bitcoin has already bottomed, setting the stage for renewed bull-market positioning.

Macro Environment

The macro environment in April continued to be heavily influenced by high economic policy uncertainty in the US.

However, a notable development was the performance decoupling of Bitcoin from US equities. Bitcoin managed to decouple and outperform US equities due to rising US Treasury risks for which Bitcoin appears to be a superior hedge than gold as highlighted in one of our latest Crypto Market Espressos.

In fact, major tailwinds for Bitcoin and crypto assets have emerged in April such as expectations for looser Fed monetary policy and the weaker Dollar due to increasing US recession risks and the new US trade policies.

It is quite likely that both of these drivers will continue to provide a major macro support for Bitcoin in particular.

As far as monetary policy is concerned, it is quite likely that markets will start to price in more Fed rate cuts over the coming months.

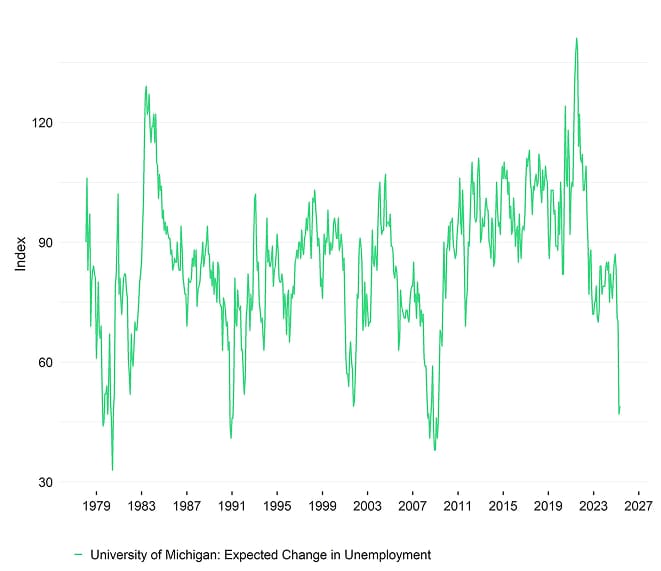

The reason is that leading US employment indicators have continued to deteriorate which increase the likelihood of a negative non-farm payroll print over the coming months. It will become increasingly harder for the Fed to justify high rates especially amid an increase in the unemployment rate.

UMich: Expected Change in Unemployment

In this context, a classical Taylor Rule already implies that the Fed Funds Target Rate should be significantly lower than today and a continuous decline in the inflation rate implied by high-frequency indicators as well as an increase in unemployment will likely increase that gap between Fed Funds Target and what is warranted by underlying economic conditions even further.

Moreover, there is rising political pressure on Fed chairman Powell exerted directly by president Trump as can be seen here and here.

We think that a negative NFP print could be the catalyst to watch for a commencement of larger easing measures by the Fed. In this scenario, it’s very likely that financial markets will start to price in more Fed rate cuts in advance which will most-likely entail a further depreciation of the US Dollar and looser financial conditions.

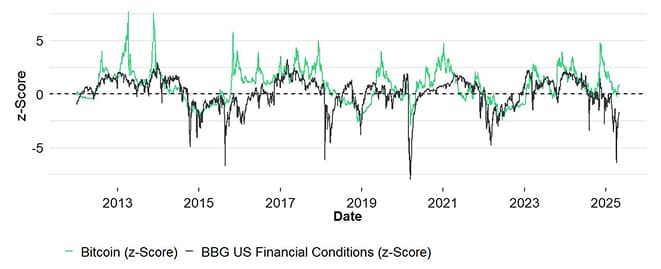

US financial conditions have been the tightest since the Covid recession in 2020 so there is a high chance that these could loosen from here due to further rate cuts and Dollar depreciation. Bitcoin tends to thrive during periods of loosening financial conditions and usually tends to be under pressure when financial conditions tighten as the chart below highlights:

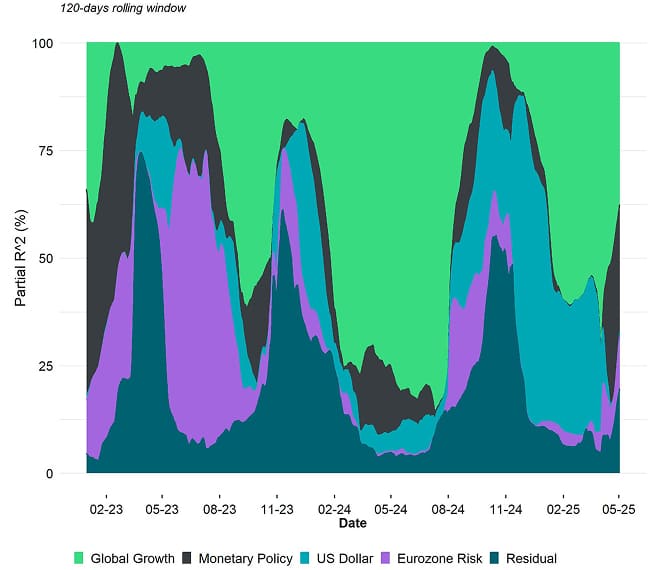

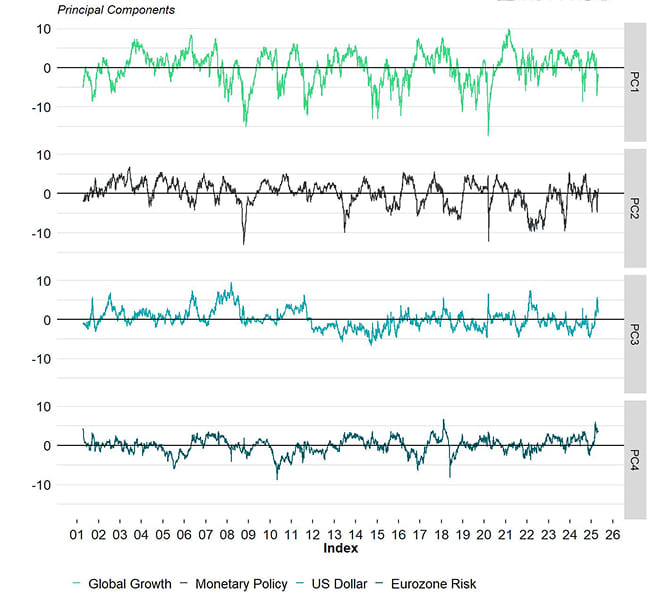

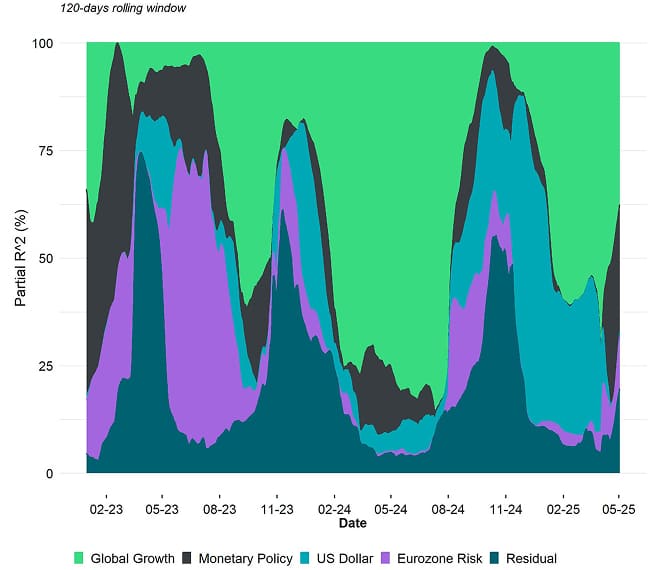

The reason is that monetary policy is becoming increasingly relevant for the performance of Bitcoin as the quantitative analysis below shows. From a pure quantitative perspective, the share of bitcoin’s performance explained by global growth has been declining recently in favour of a rising share of monetary policy:

Rolling partial R^2 of macro factors to Bitcoin

These looser financial conditions will be a key positive macro driver for Bitcoin & cryptoassets over the coming months.

As far as the US Dollar is concerned, recent political developments in the US have accelerated the depreciation and the Dollar Index (DXY) has recently touched a 3-year low.

An increase in US import tariffs are bound to reduce the US merchandise trade deficit over the medium- to long-term due to the so-called ‘J-curve effect’ which is supposed to strengthen the Dollar.

However, the key to understand the recent depreciation of the Dollar is related to its global reserve currency status which necessitates a continuous expansion of the US trade deficit to disseminate US dollars to the rest of the world.

In other words, the US economy needs to run an increasing trade deficit to increase the supply of Dollars to the rest of the world which is unsustainable for the Dollar-based system as a whole over the long run (so-called ‘Triffin Dilemma’).

Key to understand is that the decline in the supply growth rate of Dollars to the rest of the world via lower trade deficits will ultimately entail lower ‘recycling’ of those accumulated US Dollars overseas into domestic US assets.

This is also what is being anticipated by US capital markets as well.

Moreover, the trade feud between the US, China and other foreign countries will likely entail a lower usage of the US Dollar in international trade which should accelerate the ongoing De-Dollarisation trend – another factor that should structurally weigh on the Dollar.

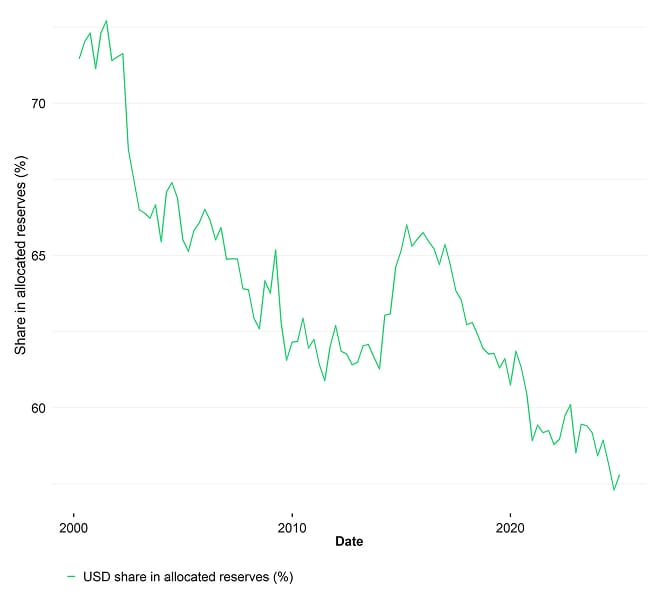

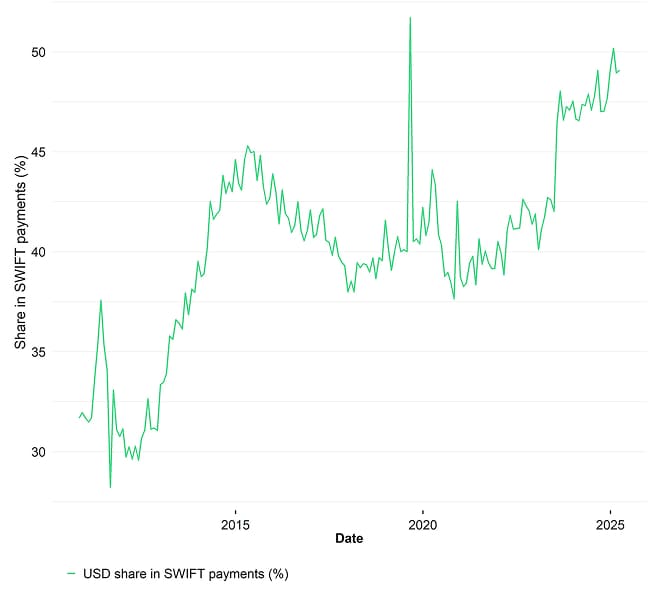

In this context, it is important to highlight that De-Dollarisation has been ongoing since the 1990s already based on the US dollars share in international FX reserves. For instance, the share of the US Dollar in international reserves was around 71.4% in Q1 1999 – it has now declined to only 57.8% per Q4 2024.

Meanwhile, the US Dollar’s share in SWIFT payments has actually increased and is close to a multi-year high. This is mostly a consequence of the Russian-Ukrainian war and the lower usage of Euros in Russian trade.

But it can generally be stated that the US dollar is less being used as store-of-value in international reserves and increasingly being used as a medium-of-exchange in international payments..

This also means that the velocity of circulation of international Dollars is increasing which tends to be inflationary. This should be interpreted as a red flag since inferior monies tend to be spent while superior monies tend to be hoarded.

All in all, these developments also imply that a transition to a new global reserve currency is already well underway.

It is also no surprise that both gold and bitcoin are one of the best performing assets year-to-date in such an environment.

Bitcoin generally profits from Dollar depreciations for several reasons:

- Dollar depreciation implies a loosening of global financial conditions

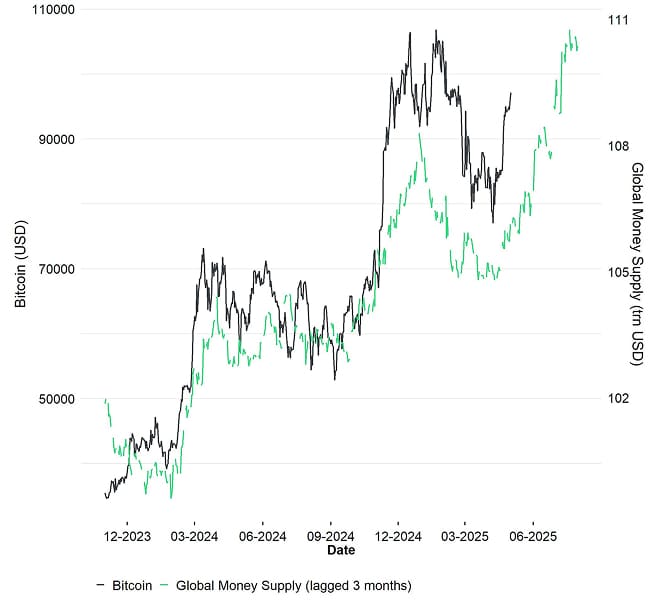

- Dollar depreciation tends to increase global money supply

- Dollar depreciation implies a decline in the denominator of the BTC/USD exchange rare

On the money supply, global supply is expanding and even Crossborder Capital’s Michael Howell has recently stated in one of his newsletters that global liquidity has reached a new all-time high as well.

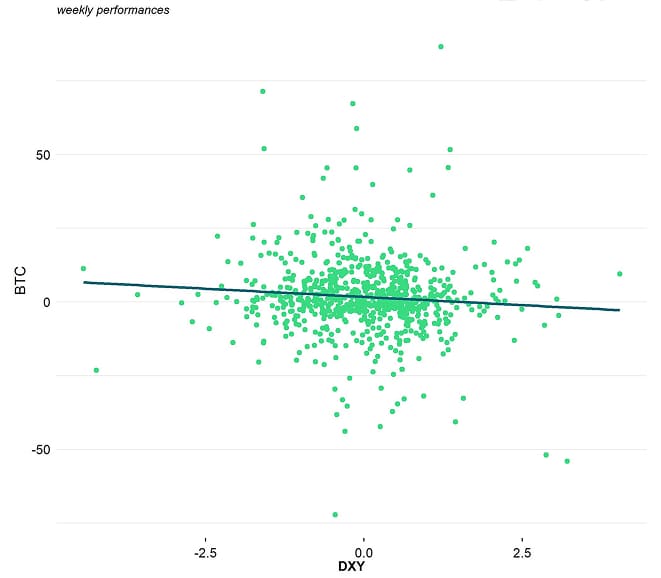

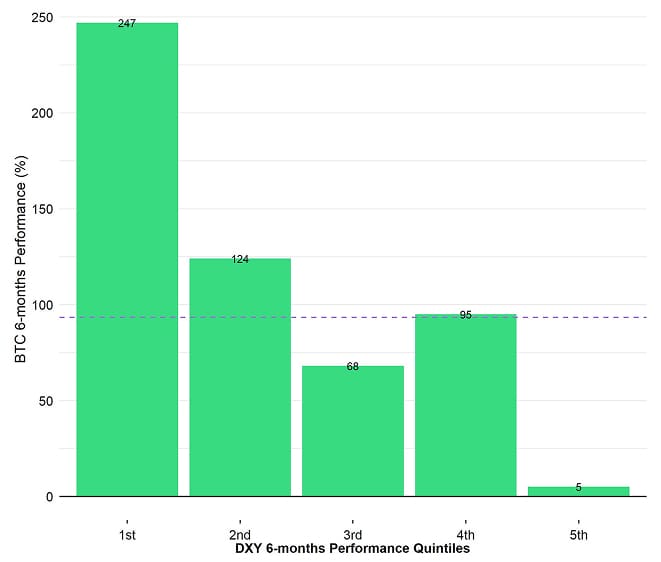

In fact, Bitcoin’s performance tends to be inversely related to changes in the Dollar and the best performances for Bitcoin have been recorded during periods when the Dollar depreciated the most and vice versa.

Bitcoin vs Dollar Index (DXY)

Bitcoin: Average 6M Performance per Dollar Quintile

Gray dashes line denotes mean BTC performance over a 6-months time period

We think that Bitcoin could emerge as the best hedge against pervasive Dollar depreciation and as an alternative reserve asset next to gold and US Treasury bonds.

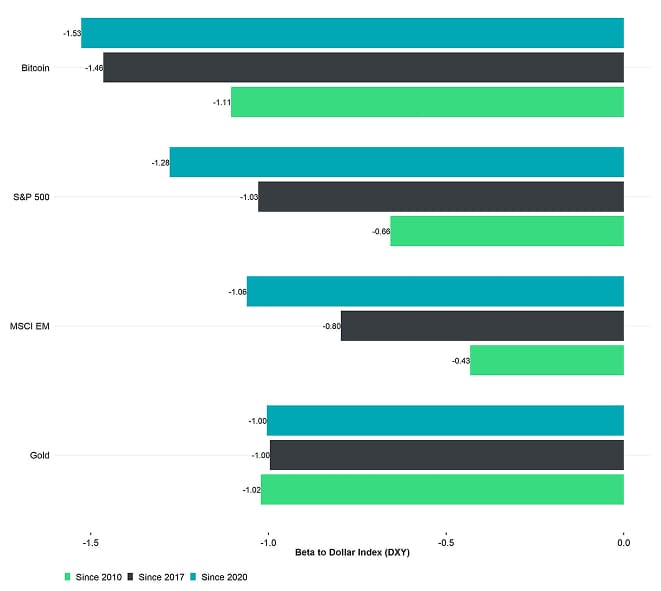

In this context, Bitcoin may provide one of the best hedges against such a scenario since it exhibits one of the highest inverse sensitivities (beta) to the Dollar. What is more is that bitcoin’s beta to the Dollar has increased in recent years, especially since Covid, and is also significantly higher than gold’s beta to the Dollar.

Full-Sample Beats of Assets vs. DXY

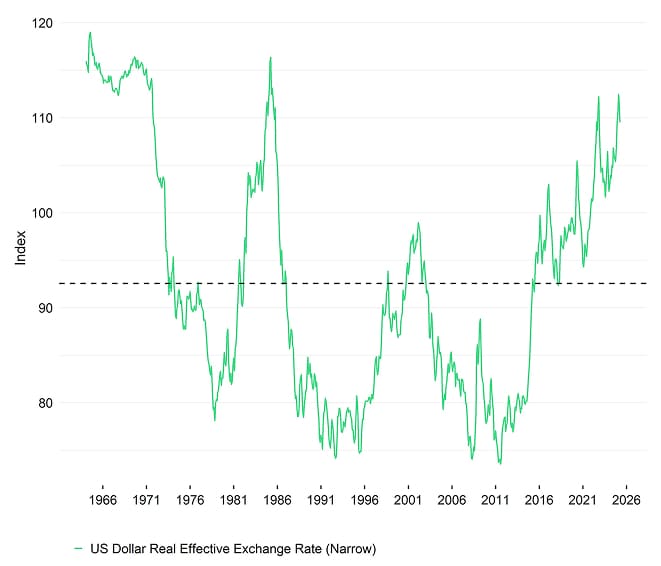

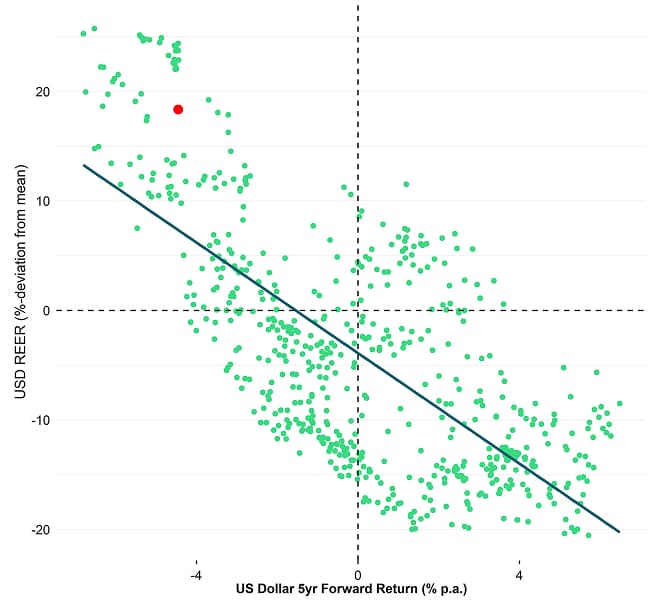

It is important to highlight that the US Dollar generally faces significant depreciation potential.

Based on the real effective exchange rate calculated by the BIS, the US Dollar is still significantly overvalued by historical standards. It is higher than its peak in 2001 and also close to its peak marked in the 1980s which prompted the ‘Plaza Accord’ in 1985 to weaken the Dollar.

Historically speaking, such large deviations from its long-term average increase the likelihood of so-called ‘mean reversion’. In fact, based on our estimations, the US Dollar faces around an average of -4% p.a. in depreciation over the next 5 years.

US Dollar: Real Effective Exchange Rate

Structural Dollar depreciation could also increase inflation rates *structurally* as well since a weak Dollar environment tends to be associated with a bull market in commodity prices. This will likely also benefit scarce store-of-value assets like Bitcoin.

Bottom Line: We think that mounting US recession risks and high policy uncertainty will drive Fed rate cuts and dollar weakness, creating looser financial conditions that have already enabled Bitcoin’s decoupling from equities. Combined with structural de-dollarisation, expanding global money supply and Bitcoin’s rising inverse sensitivity to the dollar, this positions Bitcoin as a superior hedge and alternative reserve asset—likely to outperform gold and traditional safe havens in the months and years ahead.

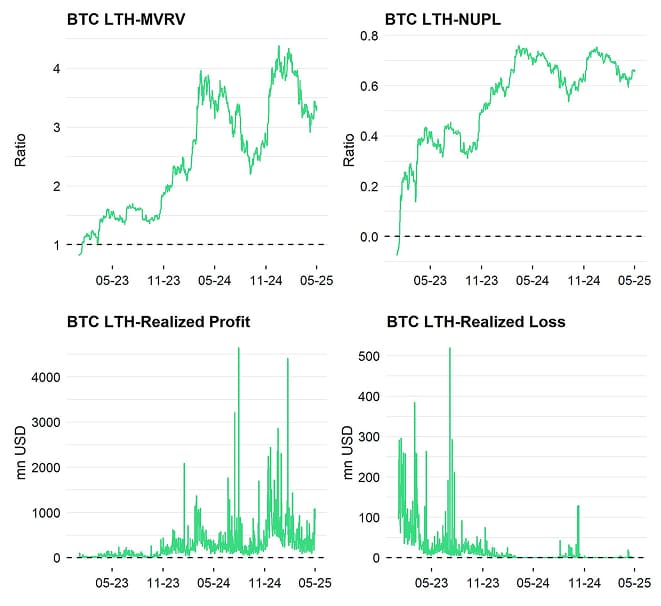

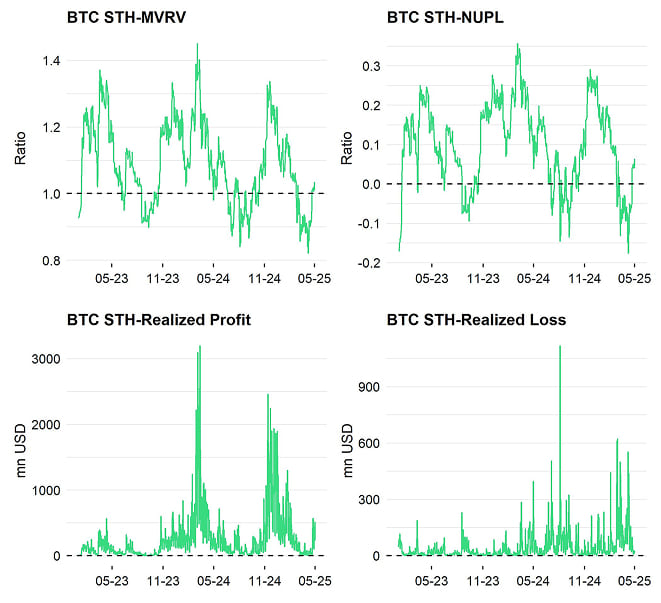

On-Chain Developments

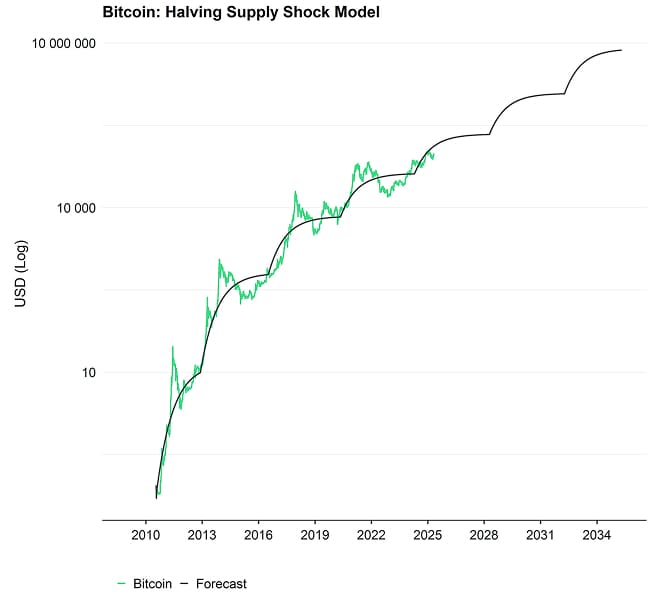

Our key thesis remains that macro developments remain in the driver’s seat right now, i.e. macro developments will likely lead changes in on-chain developments.

More specifically, we wrote in our April report last month: ‘Based on past patterns, our expectation is that this significant improvement in macro factors more recently will reverse the weakness in broader bitcoin on-chain fundamentals with a lag again.’

This appears to be happening right now.

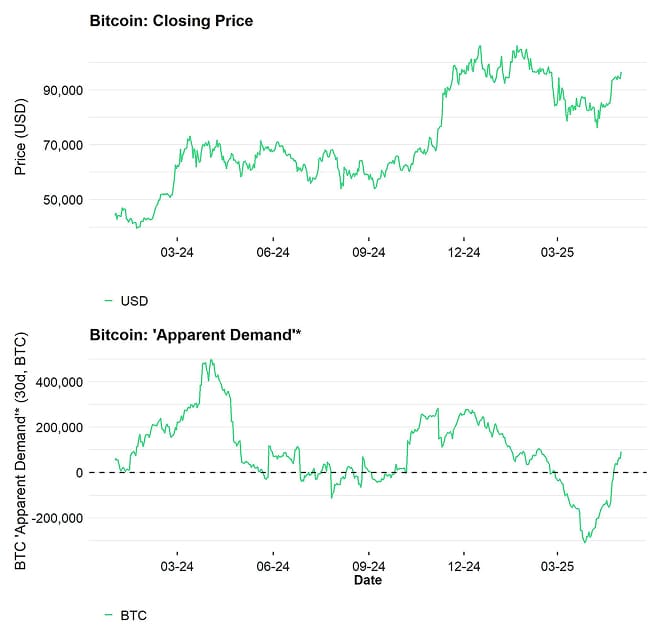

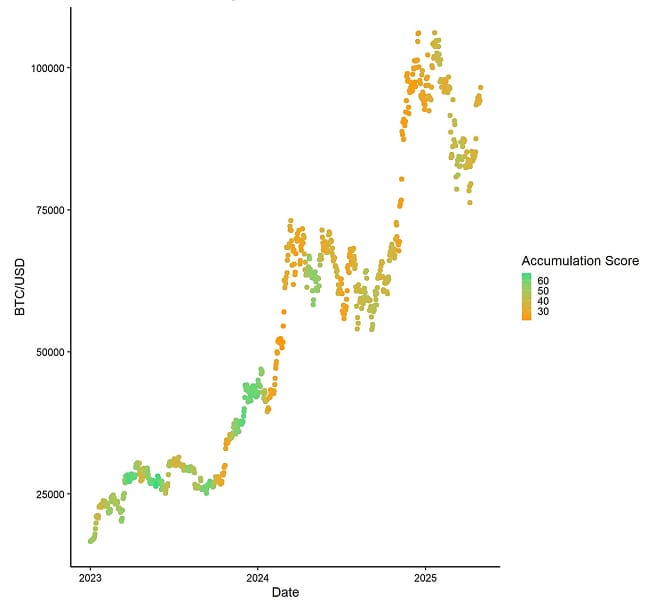

One of the key driver’s of this improvement is an improvement in on-chain demand for bitcoin. In this context, our metric of ‘apparent demand’ has stabilised and has turned positive again.

This appears to be mostly related to a significant reversal in spot Bitcoin ETF flows which appear to be the "marginal buyer" of bitcoins at the moment. The reason is that spot Bitcoin ETF flows can have a significant effect on net buying volumes on bitcoin spot exchanges.

This strong reversal in US spot Bitcoin ETF flows and crypto ETP flows more broadly also appears to be related to the improvement in global cross asset risk appetite in recent weeks.

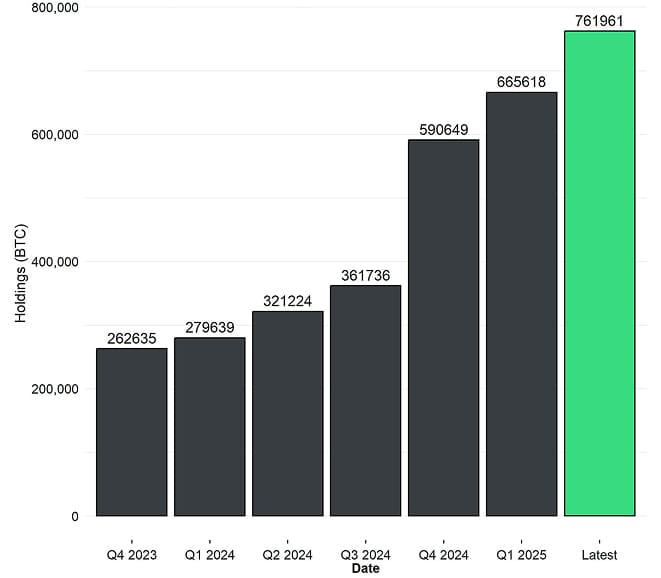

Moreover, corporations have evolved as one of the key demand drivers for Bitcoin in April. According to the latest data provided by bitcointreasuries.net, the number of corporations which hold BTC on their balance sheet has increased by \+15 while amount of bitcoins held by corporations has increased by another \+96,343 BTC, led by Strategy (MSTR) which has increased its bitcoin holdings by \+25,370 BTC in April.

Global Corporate BTC holdings

Based on the latest estimates, proceeds via their equity ATM issuance, which were supposed to be used until 2027, appear to be depleted already (after 6 months). In other words, Strategy has bought significantly more bitcoins than what was initially planned. However, Strategy still owns around 16 bn USD in capital from their fixed income security offerings that could possibly deployed to acquire more bitcoins.

In the context of corporate adoption, major players with deep pockets have announced that they will pursue a similar business strategy like MSTR.

Most notably, Twenty One a joint venture funded by the likes of Cantor, Bitfinex, Tether and Softbank will likely debut their operations with a multi-billion dollar market cap. At the current share price, the Cantor Equity Partner SPAC is already valued at 12 billion USD with approximately 4 billion USD worth of bitcoin holdings. Meanwhile, a similar company has been established in Brazil with the name Oranje which will be funded by the Brazilian banking behemoth Itaù.

Twenty One and others will certainly increase competition in the race for global bitcoin acquisitions.

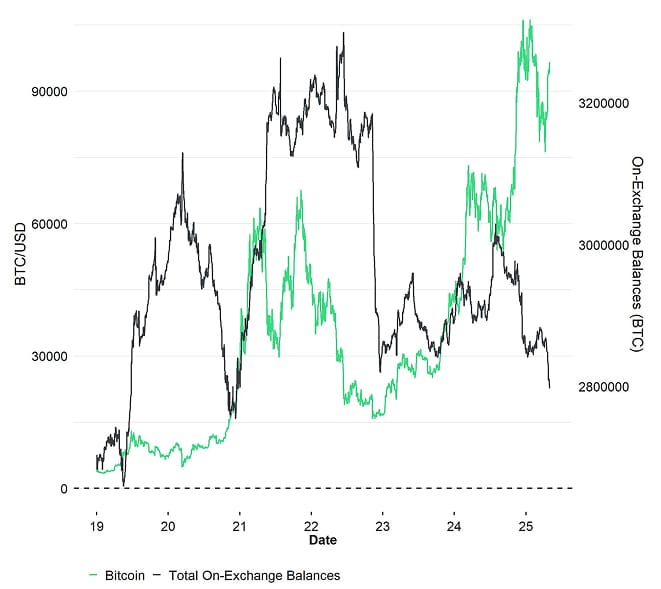

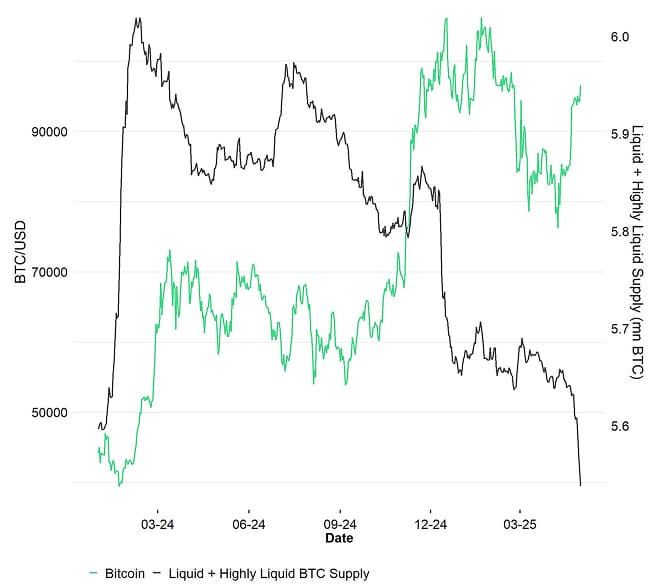

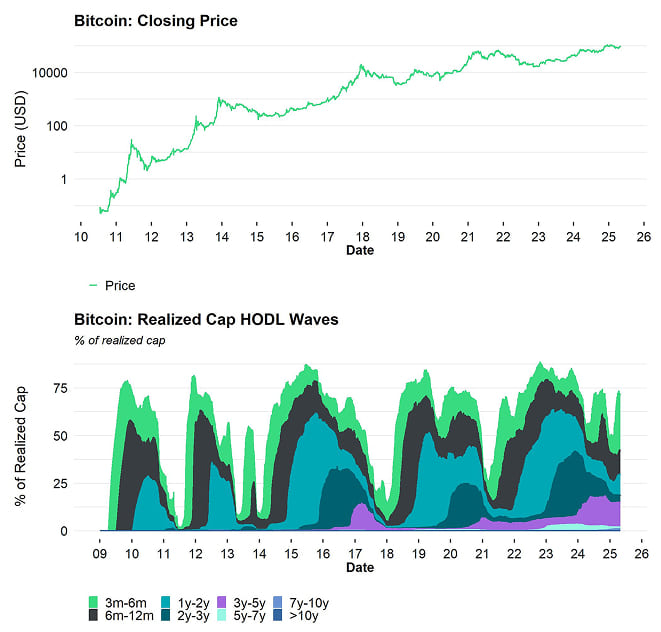

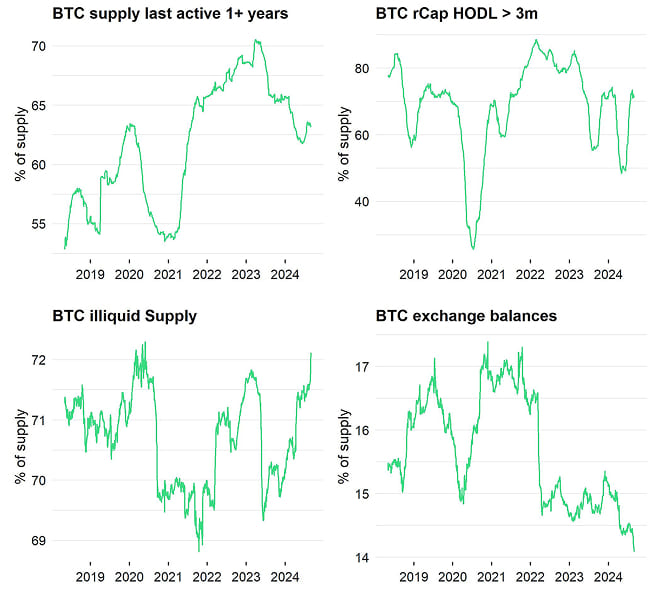

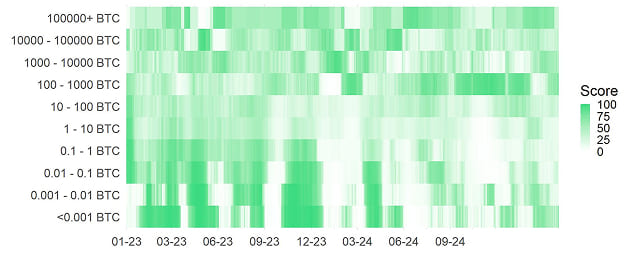

A major trend which continues to intensify is the ongoing decline in aggregate bitcoin supply on exchanges.

Despite the flurry of net outflows from global bitcoin ETPs until mid-April, aggregate exchange balances have marked a new multi-year low. On-chain analysts have repeatedly tried to dismiss this phenomenon with the remark that most of these exchange outflows appear to be related to off-exchange holdings at Coinbase (Prime) itself or mostly resembling internal exchange transfers.

However, from our point-of-view the decline in exchange balances truly resembles a decline in overall liquid supply for the following reasons:

- (Highly) liquid supply is consistently making new multi-year lows as well (see chart below)

- Although some exchange outflow data might be erroneous, major data providers like Glassnode and CryptoQuant report a similar downtrend in balances

- ETF balances custodied at major custodians like Coinbase prime effectively remain rather illiquid supply and are literally off-exchange in cold-storage (not in hot wallets).

All in all, the on-chain data point towards a continuation of the current bull market which is why we remain constructive on the market.

Bottom Line: Macro developments remain in the driver’s seat and, after a lag, are now visibly reversing on-chain weakness—our ‘apparent demand’ metric has turned positive thanks to renewed spot-ETF inflows and a surge in corporate accumulation (notably MSTR’s outsized April buys). At the same time, aggregate exchange supply is sinking to new multi-year lows, tightening liquid supply. Taken together, these factors underpin our constructive view that the current Bitcoin bull market still has room to run.

Bottom Line

- Performance: April’s stability in Bitcoin and broader cryptoassets, driven by a reversal in risk appetite, a persistent supply deficit on exchanges and weakening dollar amid rising Fed-cut expectations, underscores Bitcoin’s growing role as a hedge against US Treasury and equity market stress. With macro uncertainty still elevated but now priced in, on-chain improvements and a potential Fed rescue suggest Bitcoin has already bottomed, setting the stage for renewed bull-market positioning.

- Macro: We think that mounting US recession risks and high policy uncertainty will drive Fed rate cuts and dollar weakness, creating looser financial conditions that have already enabled Bitcoin’s decoupling from equities. Combined with structural de-dollarisation, expanding global money supply and Bitcoin’s rising inverse sensitivity to the dollar, this positions Bitcoin as a superior hedge and alternative reserve asset—likely to outperform gold and traditional safe havens in the months and years ahead.

- On-Chain: Macro developments remain in the driver’s seat and, after a lag, are now visibly reversing on-chain weakness—our ‘apparent demand’ metric has turned positive thanks to renewed spot-ETF inflows and a surge in corporate accumulation (notably MSTR’s outsized April buys). At the same time, aggregate exchange supply is sinking to new multi-year lows, tightening liquid supply. Taken together, these factors underpin our constructive view that the current Bitcoin bull market still has room to run.

Appendix

Cryptoasset Market Overview

Cryptoassets & Macroeconomy

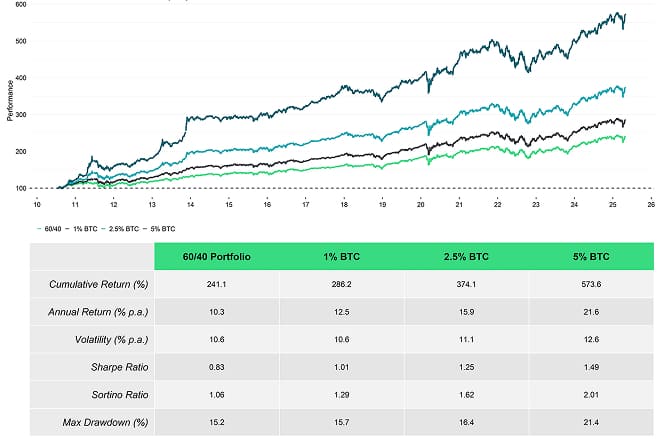

Cryptoassets & Multiasset Portfolios

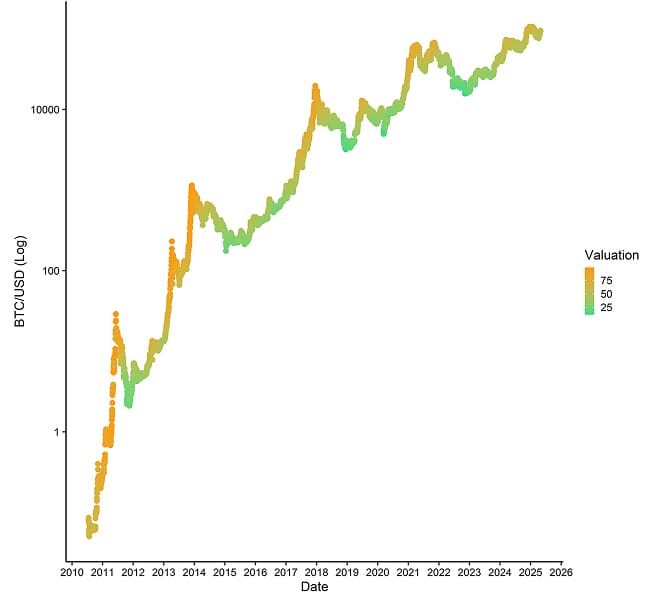

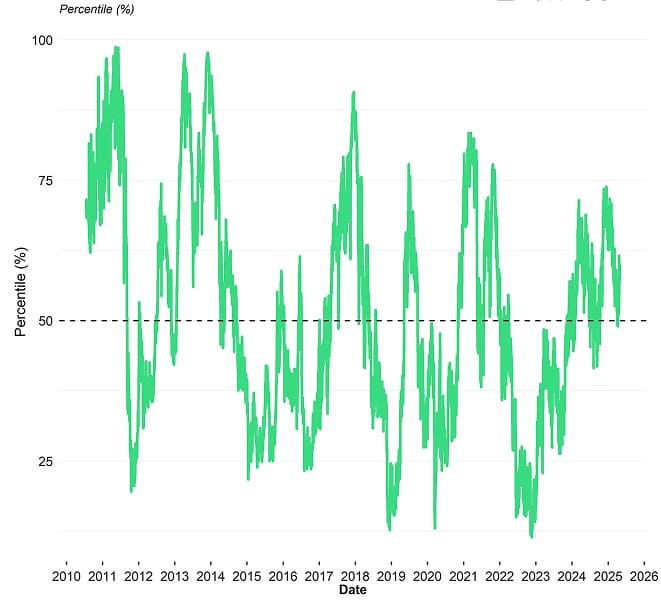

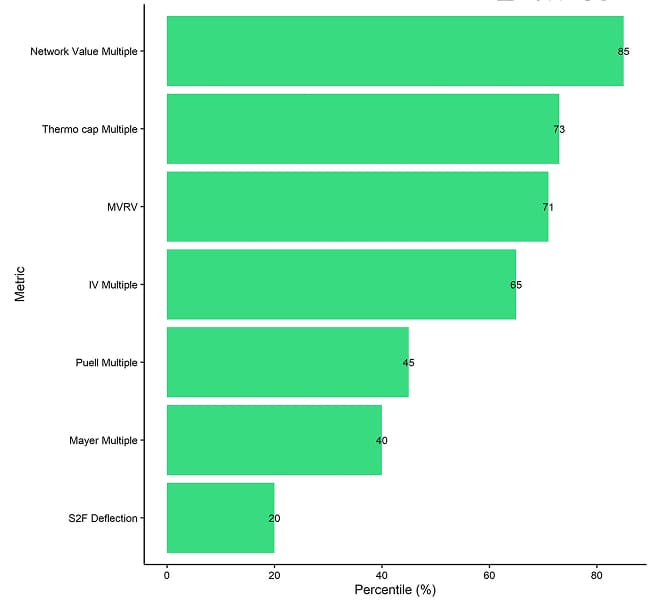

Cryptoasset Valuations

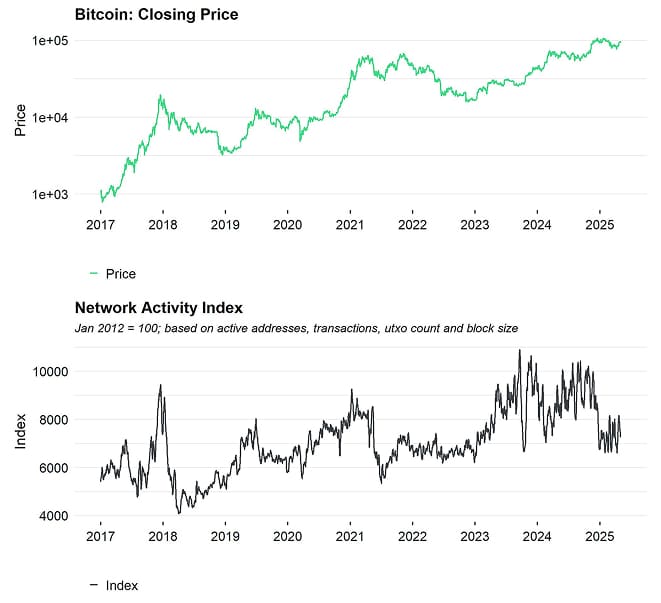

On-Chain Fundamentals

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

En

En  It

It