Bitcoin Hits Yearly High as Spot ETF Prospects Grow

Bitcoin has largely consolidated at the $34,000-$35,000 range with any climbdown from this level inviting heavy buying pressure.

The digital asset is up 27% in the last month and its market dominance has swelled to 53% – a feat it has not reached since April 2021 as market participants feed into the narrative of a spot Bitcoin ETF launching in the US.

There is growing market confidence that spot Bitcoin investment products will be approved by the SEC for the first time. Industry voices have pointed out that this could happen as soon as January 2024 if not before.

The progress of BlackRock’s Bitcoin ETF application has played a large role in stoking the enthusiasm. Market sentiment received a boost on 23 October after BlackRock’s iShares Bitcoin Trust fund was catalogued by the Depository Trust and Clearing Corporation (DTCC) under the ticker IBTC. The DTCC provides clearance, settlement, and custody services for Nasdaq.

On the same day, the US Court of Appeals formally directed the SEC to reconsider Grayscale’s petition to convert GBTC, the world's largest Bitcoin investment vehicle with an AUM of $21 billion, into a spot Bitcoin ETF. Although, the directive was anticipated given the SEC’s decision not to appeal the verdict produced by the court back in August.

The market optimism in the likelihood of a favourable outcome is reflected in GBTC's discount narrowing to 13.72% compared to 46% at the start of the year.

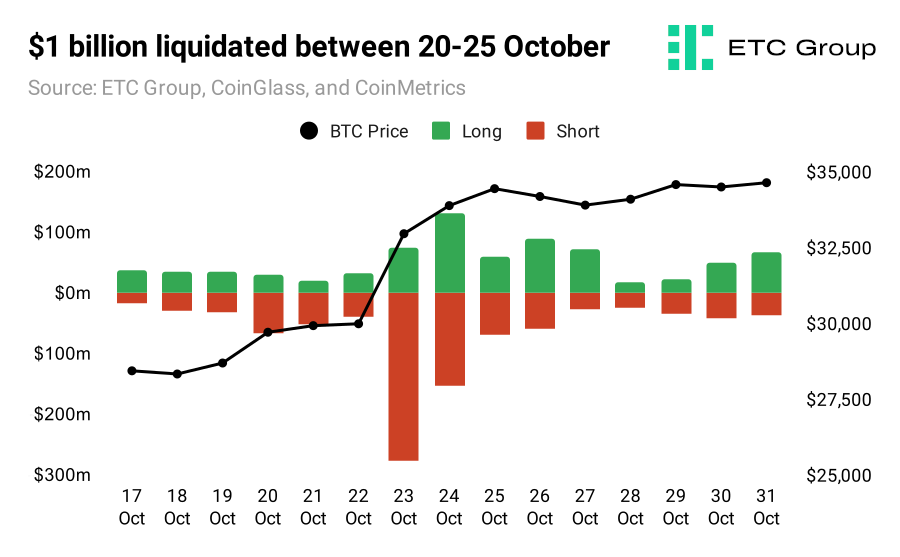

The market volatility triggered liquidations across the crypto ecosystem with $1 billion wiped out between 20 and 25 October. This encompassed $350 million from leveraged long position holders and $655 million from traders shorting the market. The extensive shorting inadvertently led to a short squeeze, compelling traders to cover their positions, giving Bitcoin's price an added impetus.

As the US inches closer to embracing a spot Bitcoin ETF, it's worth mentioning that financial products with similar structures have already carved a niche in Europe. ETC Group Physical Bitcoin (BTCE) is fully backed by the underlying asset and trades on several European exchanges. With a traded value of $1.5 billion this year, it stands as Europe's most liquid Bitcoin ETP.

MicroStrategy's Bitcoin Bet Pays Off

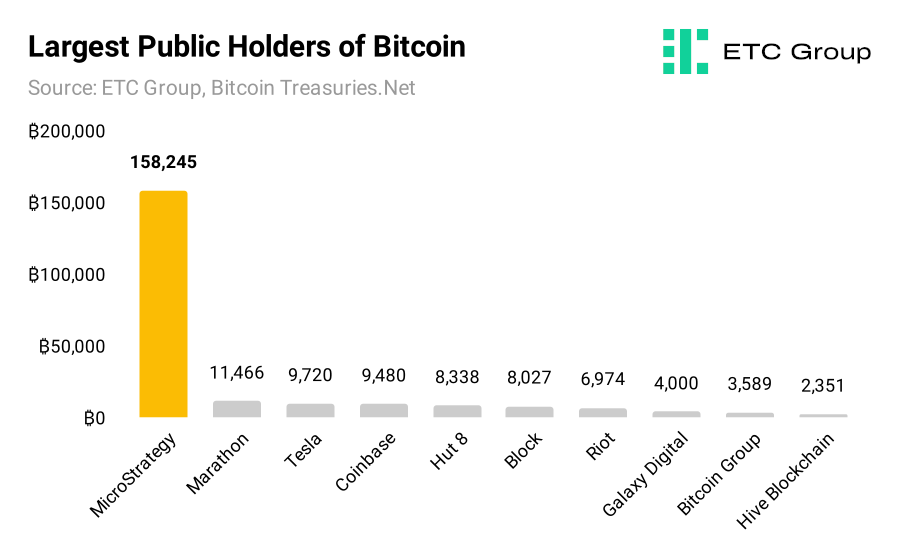

The Bitcoin holdings of MicroStrategy (MSTR) have turned net positive amid Bitcoin’s breakout performance. The company holds 158,245 BTC that is worth $5.4 billion today.

MicroStrategy is the world’s largest publicly-listed holder of Bitcoin and holds more than 13 times as much Bitcoin as the next institutional holder.

The company began aggressively purchasing the digital asset in August 2020. It has spent roughly $4.68 billion on Bitcoin with an average purchase price of $29,582 per coin.

MicroStrategy’s most recent purchase took place in September when it added 5,445 BTC to its treasury for just under $150 million.

The firm has only sold Bitcoin on one occasion. It sold 708 BTC for $11 million during the height of the bear market in December 2022.

Upcoming catalysts such as the likely approval of a spot Bitcoin ETF in the US and next year’s Bitcoin halving have propelled the price of Bitcoin and the shares of MicroStrategy that see their value largely tied to it.

Given the size of MicroStrategy's Bitcoin holdings, its stock tends to act as a leveraged Bitcoin play. Its share price has outperformed Bitcoin this year with MicroStrategy up 160% YTD compared to Bitcoin’s gains of 105%.

CME is Now the Second-Biggest Bitcoin Futures Exchange

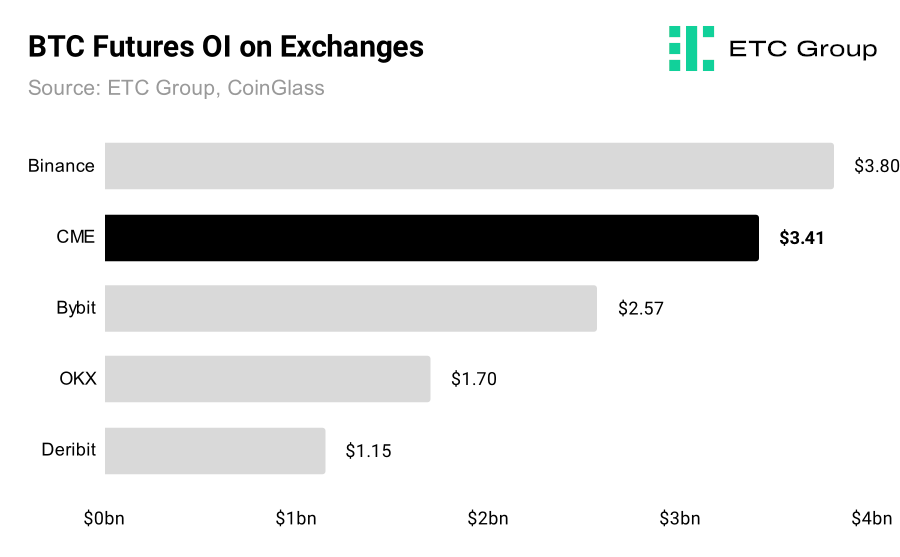

The Chicago Mercantile Exchange (CME) is now the second-largest Bitcoin futures exchange with a notional open interest (OI) of $3.4 billion.

It stands only behind Binance with its market share representing 22% of the $15.4 billion BTC futures open interest market.

CME is the world’s largest futures exchange and launched Bitcoin futures contracts in 2017. The exchange recently surpassed 100,000 BTC in open interest for the first time.

The activity on CME likely indicates increasing interest in Bitcoin from institutional investors that prefer to engage with traditional finance platforms over crypto native exchanges that offer similar services.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.