ETC Group Crypto Minutes Week #44

Seismic shifts are coming. Is Crypto Winter starting to thaw? Visa and Google both launch crypto services, while the UK extends its crypto oversight far beyond stablecoins.

Seismic shifts are coming. Is Crypto Winter starting to thaw? Visa and Google both launch crypto services, while the UK extends its crypto oversight far beyond stablecoins.

Previous Crypto Winters — so called because they don’t necessarily coincide with equities market slowdowns — have been characterised by extended periods of low price volatility, flat crypto trading volumes, bearish price action and large drawdowns from record prices.

Crypto rallied in the final days of October 2022, sending Bitcoin to the edge of $21k and Ethereum 25% higher to $1.5k. Such sudden optimism after more than 10 months stuck in the depths of a Crypto Winter sent tongues wagging and bears running for cover. So what happened? The data shows us the catalyst was actually a huge short squeeze.

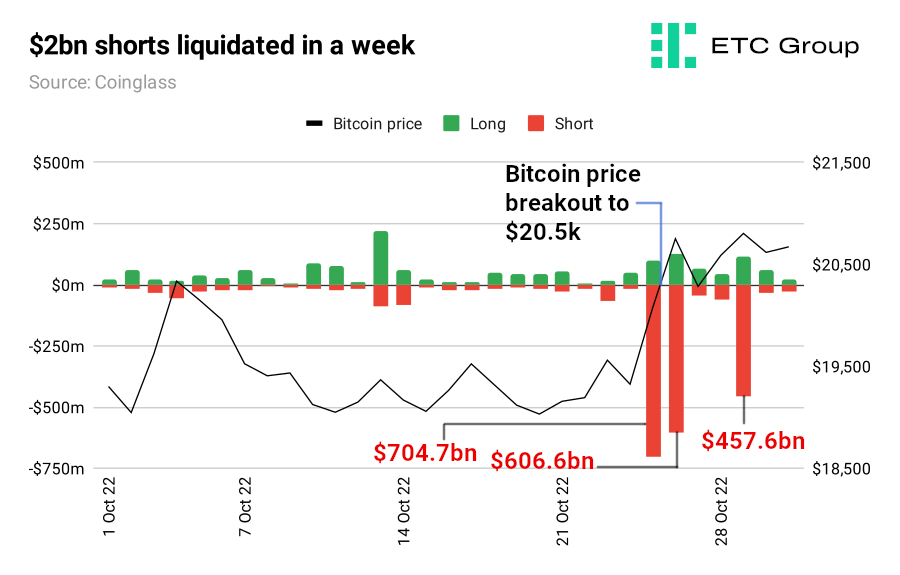

Between 26 October and 31 October, $2 billion in trader positions betting on the price of crypto to fall were liquidated.

They happened across three major leveraged short liquidation events of more than $450m in a day.

The chart shows a very long period of low activity for the vast majority of October 2022.

When traders bet against an asset, they have to borrow the underlying and sell it in advance. If the market moves against these short sellers, they are forced to buy back the underlying asset (in this case Bitcoin and Ethereum) at the now-higher market price, thereby creating a short but intense upward pressure on prices.

With traders still positioned heavily short across major exchanges, there is potential for another short squeeze should Bitcoin rally further.

Prices spiked early on 26 October on macro moves. First, US housing market data showed a 40%+ decline in mortgage applications and home prices falling at their steepest monthly pace in more than a decade. Then the Bank of Canada plumped for a rate rise of 50 basis points (bps) over the more aggressive expected 75bps increase.

Both scenarios put bears on the back foot. The implication now is that the Federal Reserve could bring its aggressive hiking cycle to an end sooner than expected to lessen the impacts of a major US recession.

This would lead to a more favourable environment for those assets associated with a higher risk profile, including crypto.

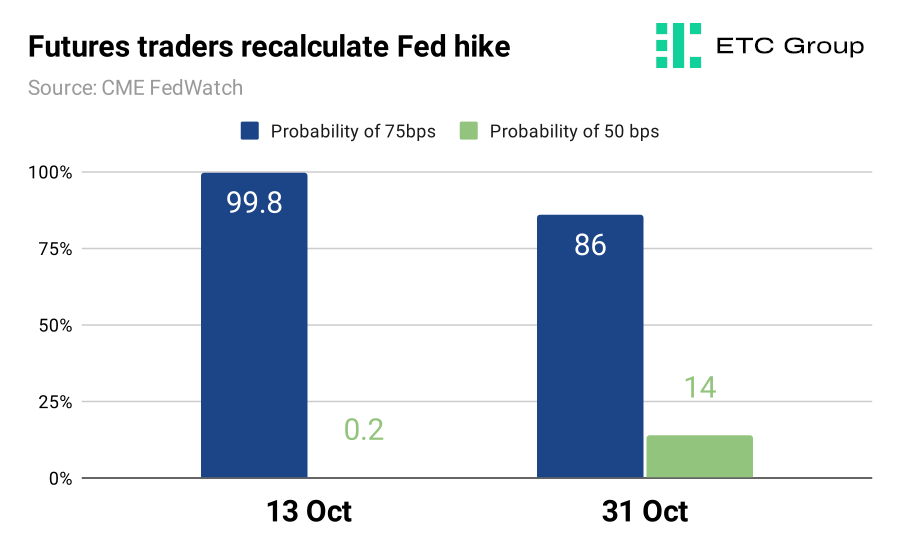

While the split between the probability of a 75bps hike versus a softer 50bps hike has come down from virtual certainty in mid-October (99.8% probability), the CME’s Fedwatch tool still has futures traders betting heavily on the larger interest rate rise at the 2 November central bank policy meeting.

Structural reversal

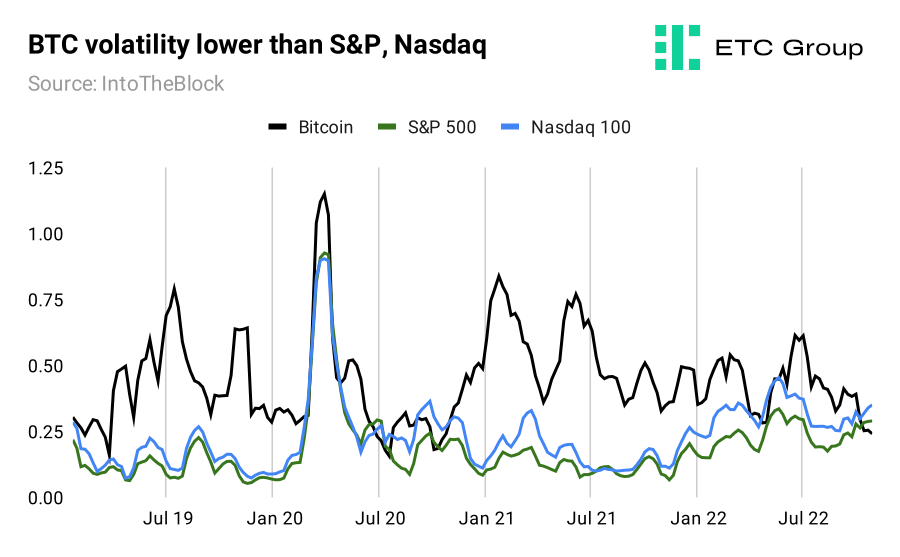

A lack of marginal sellers in the Bitcoin and Ethereum markets has seen price volatility dive to near-six year lows.

Bitcoin’s 30-day volatility is currently lower than that of the Nasqdaq and S&P 500. This has only happened twice since 2017.

Looking further ahead, it is highly likely that Bitcoin will rally ahead of other asset classes when traders and investors get a hint that rate hike cycles are coming to an end. In this way, the world’s first cryptocurrency is becoming a leading indicator for macro moves.

Three major indicators would imply that crypto markets are reversing course.

Two potential positive catalysts could aid the structural reversal:

A lack of major positive catalysts in the post-Merge lull has held back Bitcoin and Ethereum. There are early signs the Crypto Winter could be thawing. And of course, Spring will return, but precisely when it happens comes down to a series of ifs: If central banks pivot; if a global recession is not as deep and painful as expected; if crypto continues to hold its value while equities burn.

Corporate adoption of cryptoassets has continued apace.

In our last Crypto Minutes we talked about how the world’s largest custodian bank with $42 trillion of assets under custody, BNY Mellon, had completed its two-year regulatory push to hold Bitcoin and Ethereum for its clients, and how it was a huge signal that the space was now more legitimate than ever.

In fact, we said it was possibly “the most important institutional development we have ever witnessed.” That fact has been borne out by a slew of corporate announcements on crypto adoption in the last two weeks alone.

On 22 October payments giant Visa registered a series of trademarks for its own Bitcoin wallet and a slew of NFT and metaverse-related tech. One excerpt from the US Patent Office applications reads: “online non-downloadable software for management of digital transactions; non-downloadable virtual goods, namely a collectible series of non-fungible tokens; online non-downloadable software for us as a cryptocurrency wallet.”

It’s an obvious rebuttal for this article from January 2022 which posed the idea of a crypto ‘ice age’, where prices stay low for years, and investors lose interest.

At the time, James Malcolm, the head of forex strategy at UBS questioned: “A lot of people in the technology space seem to be questioning whether or not [crypto tech] is that effective. It begs the question if it was so blatantly next-generation technology, then why aren’t a lot of big tech companies all over it? Why isn’t Google massively invested?”

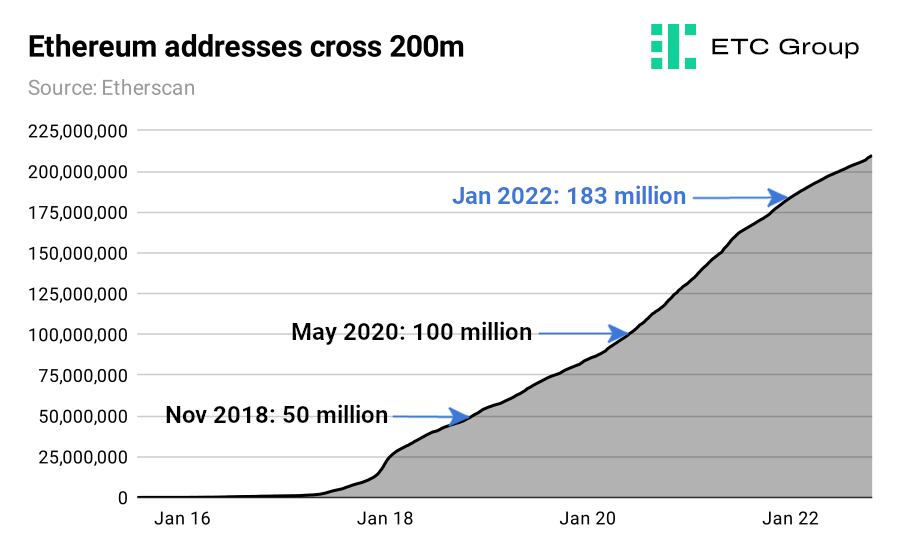

On 28 October Google announced that its cloud division would start offering node management services for Ethereum validators. At last count there were more than 456,000 validators on the post-Merge Ethereum blockchain. As the below chart shows, there are also now more than 209 million distinct Ethereum addresses, up from 183 million on 1 January 2022. The userbase continues to grow strongly.

Ethereum will be the first blockchain supported by Google Blockchain Node Engine,” the company said, “enabling developers to provision fully managed Ethereum nodes with secure blockchain access.”

Google set out a bold statement of intent earlier in October when it announced a partnership with Coinbase to allow Web3 companies to pay for hosting services in crypto.

It is particularly significant that tech and payments giants continue to integrate cryptoasset infrastructure in the middle of a deep price retracement, when the market has shed two-thirds of its value. The world’s largest companies are not exiting the space in their droves. In fact, quite the opposite.

In financial technology the ground is always shifting under one’s feet. But it always pays to take notice of the biggest changes.

The UK has a new Prime Minister in Rishi Sunak and his victory coincides with the Financial Services and Markets Bill passing its Second Reading in the House of Commons.

It has been a fraught time for UK politics in the last few months. The former Chancellor under ex-PM Boris Johnson, Sunak replaced the disastrous Liz Truss just 45 days after she assumed office.

Truss became the shortest-serving leader in UK history after markets baulked at an uncosted budget proposal, forcing the Bank of England to intervene with £65bn in bond-buying and sending pension funds into meltdown.

Sunak is seen as a safe pair of hands to stabilise a turbulent UK facing multiple pressures at home and abroad. Before his political career Sunak was an analyst at Goldman Sachs, a hedge fund manager with TCI and co-founded equity fund Theleme Partners. None of these previous roles make it onto Rishi’s CV.

However, they must inform his ambition “to make the UK a global hub for crypto asset technology”. Sunak made the call in April 2022 and his re-entry at the top of the political pile puts crypto squarely on the agenda going into the final stretch of the year.

Part of this shift was the launch of a blockchain-focused regulatory sandbox due to launch in 2023, that will see the UK test distributed ledger technology for improving trading and settlement. Regulatory sandboxes have been a highly effective method of advancing fintech globally, whereby crypto-native companies can try out new products in emerging markets while minimising risks for consumers.

What’s new

While stablecoins may seem the most obvious low-hanging fruit for regulators laser-focused on expanding and legitimising the use of crypto in their economies, the UK has just gone one step further.

As Reuters reported on 27 October, Britain would have the power to regulate all cryptoassets under an amendment to the Financial Services and Markets Bill “that will almost certainly pass”.

Andrew Griffith was reappointed City Minister, with oversight of London’s financial sector, under Sunak’s leadership.

The Bill in its original form gives the FCA the power to oversee stablecoins. However Griffiths’ amendment broadens the scope to include promotions for all cryptoassets.

This could lead to a wholesale shift in how cryptoassets are made available for investment in the UK. Since October 2020, retail investors in the UK have not been allowed to invest in crypto ETPs trading on regulated exchanges in Europe, because of a much-derided FCA ruling. There are at least 70 crypto ETPs in Europe run by the largest asset managers and issuers in the world, including ETC Group, Van Eck and WisdomTree.

Speaking to Parliament in support of the amendment, Griffiths said: “The government believes that certain cryptoassets and distributed ledger technology could drive transformational changes in financial markets, offering consumers new ways to transact and invest, and that such technology could pose risks to consumers and financial stability. The Bill therefore allows the Government to bring digital settlement assets inside the regulatory perimeter.”

Sunak’s initial announcement on 4 April included:

This latter point is particularly impactful. London has long been a centre of the fund management industry globally and UK tax treatments are designed to attract foreign investment funds to use UK fund managers: regulated funds are not considered to be UK tax resident even if their central management “abides” in the UK.

But The City has been badly hurt by Brexit, with the finance sector losing most of its access to the European Union, its largest export partner, Square Mile policy chief Catherine McGuinness told Reuters earlier this year.

The IME effectively aims to cut the UK tax take on investment transactions and attract foreign investment funds to London.

Make no mistake: Rishi Sunak’s long-term plan is to attract the world’s largest cryptoasset investment funds to The City (and hence, pull them away from Dublin, the EU, Singapore, Hong Kong and New York) by offering significant tax incentives.

Sunak’s arrival in Number 10 was a positive signal both for the capital and crypto markets. Sunak has championed embracing cryptoassets as a means of direct investment in the UK and has showcased his willingness to make the UK a fintech and crypto leader.

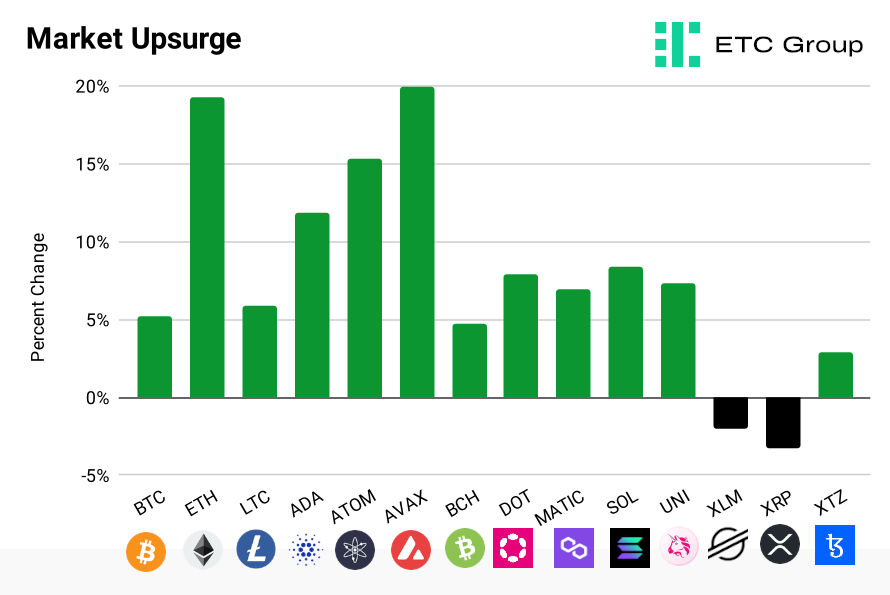

The digital asset market saw a resurgence to the end of October. Predictability breeds investor confidence and traders appear to have priced in another 75bps interest rate hike – set to be announced by the Federal Reserve this week.

The Web 3.0 building block Ethereum enjoyed outsized gains compared to Bitcoin that saw its value climb by 5%. The price of Ethereum breached the $1,600 resistance barrier earlier this week before seeing a minor retraction.

This is a key level Ethereum hasn’t come near since the market sell-off it experienced that came with the competition of The Merge in mid-September.

Avalanche (AVAX) has been the market leader with its price soaring by 20% to $19.34 at the time of writing. This has taken the market cap of the Layer 1 blockchain to over $5.6 billion.

Cosmos (ATOM) and Cardano (ADA) have also performed strongly with both digital assets bearing rises exceeding 10%.

Ripple (XRP) has been unable to sustain the momentum that carried its value during the opening half of October when the narrative against its long-standing legal feud with the SEC began to shift decisively in its favour. The digital asset has lost 3% of its value but has still almost doubled in value since the beginning of September.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

Bitwise is one of the world’s leading crypto specialist asset managers. Thousands of financial advisors, family offices, and institutional investors across the globe have partnered with us to understand and access the opportunities in crypto. Since 2017, Bitwise has established a track record of excellence managing a broad suite of index and active solutions across ETPs, separately managed accounts, private funds, and hedge fund strategies—spanning both the U.S. and Europe.

In Europe, for the past four years Bitwise (previously ETC Group) has developed an extensive and innovative suite of crypto ETPs, including Europe’s largest and most liquid bitcoin ETP.

This family of crypto ETPs is domiciled in Germany and approved by BaFin. We exclusively partner with reputable entities from the traditional financial industry, ensuring that 100% of the assets are securely stored offline (cold storage) through regulated custodians.

Our European products comprise a collection of carefully designed financial instruments that seamlessly integrate into any professional portfolio, providing comprehensive exposure to crypto as an asset class. Access is straightforward via major European stock exchanges, with primary listings on Xetra, the most liquid exchange for ETF trading in Europe.

Retail investors benefit from easy access through numerous DIY/online brokers, coupled with our robust and secure physical ETP structure, which includes a redemption feature.