ETC Group Crypto Minutes Week #40

Ethereum makes up 77% of NFTs as their rapid growth rolls on, $1 trillion Europe is the world’s largest crypto economy, and Visa builds the Holy Grail: a way for central bank money and crypto to talk to each other.

Ethereum makes up 77% of NFTs as their rapid growth rolls on, $1 trillion Europe is the world’s largest crypto economy, and Visa builds the Holy Grail: a way for central bank money and crypto to talk to each other.

It’s a simple enough concept to grasp. Imagine splitting the bill at dinner with friends, and everyone is using different currencies. I prefer to spend Dai, while my wife wants to use USDT. Two friends are visiting from Sweden and they’d like to pay in e-krona. Currently, this is impossible.

One of the biggest issues stopping greater mass adoption of blockchain technologies is the lack of cross-chain interoperability. That’s a fancy way of saying that sellers (merchants, shopping malls or grocery stores) don’t have a way for different types of private money to interact with each other.

That’s what stablecoins are in effect: different versions of money which are not issued by a government or central bank. CBDCs like the e-krona, the Sand dollar from the Bahamas central bank, or China’s e-CNY, are central banks’ reactions to this new technology.

$493bn market cap Visa (NYSE:V) knows this. With its Universal Payment Channel (UPC), released on 30 September 2021, we have a kind of “universal adapter” for blockchain payments. The idea is to allow banks, businesses and consumers to seamlessly exchange value, no matter the form of the money.

How do you get different digital currencies, relying on different tech stacks and protocols, with different compliance standards and market requirements, to “talk to each other? How about sending $500 in USDC to a friend in London, and having those funds automatically converted to digital British pounds before they arrive in her CBDC wallet. Imagine this happening in real time, across multiple networks, and compatible with multiple digital wallets. Visa, press release, Universal Payment Channel

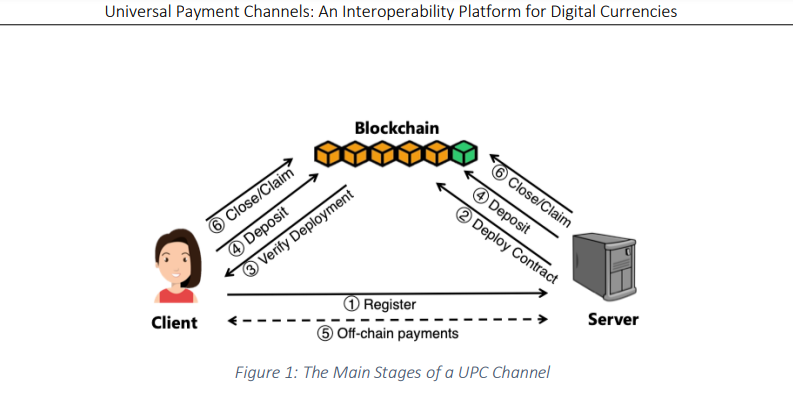

The research paper behind this makes for interesting reading. UPC uses payment channels off-chain, to save on fees and improve the speed of transaction confirmations, as well as using smart contracts to communicate with various blockchain networks.

Previous payment channel designs rely on the sender providing both the funds and the cryptographic proof to ‘unlock’ and complete transactions. But with UPC, the sender provides the funds, and the receiver completes a transaction by supplying the proof.

Visa compares UPC to three Layer 2 technologies currently working to speed up blockchain-based payments and make them much cheaper by moving confirmations off-chain: Bitcoin’s Lightning Network, Ethereum’s Raiden, and Polygon, a proof of stake sidechain to Ethereum. Each, in its way, has failings that UPC addresses, Visa says, namely using timelocks and hashlocks to minimize counterparty risks, (payer-hub-payee), under a hub-and-spoke design.

The immediate benefit of such a protocol is the ability to scale UPC to millions or even billions of users and/or transactions while imposing minimal liability on the UPC hub via a prefunded model and consequently reducing fees and complexities of cross-border payments. Visa, research paper, Universal Payment Channels

We know that digital currencies are here to stay. Why? Well, the world’s largest businesses are building a future with them, specifically, in mind.

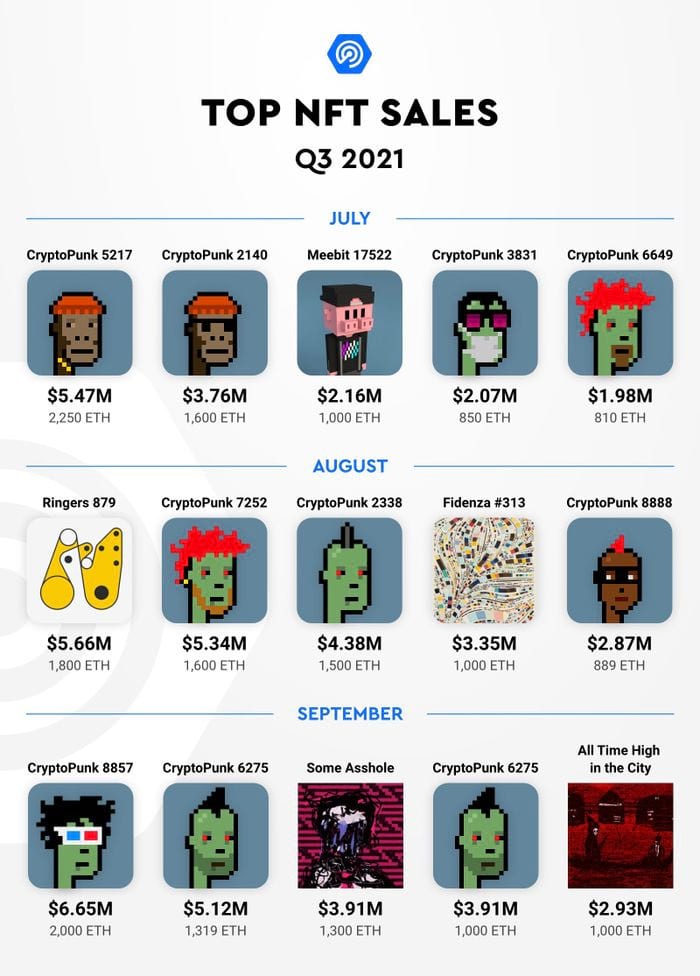

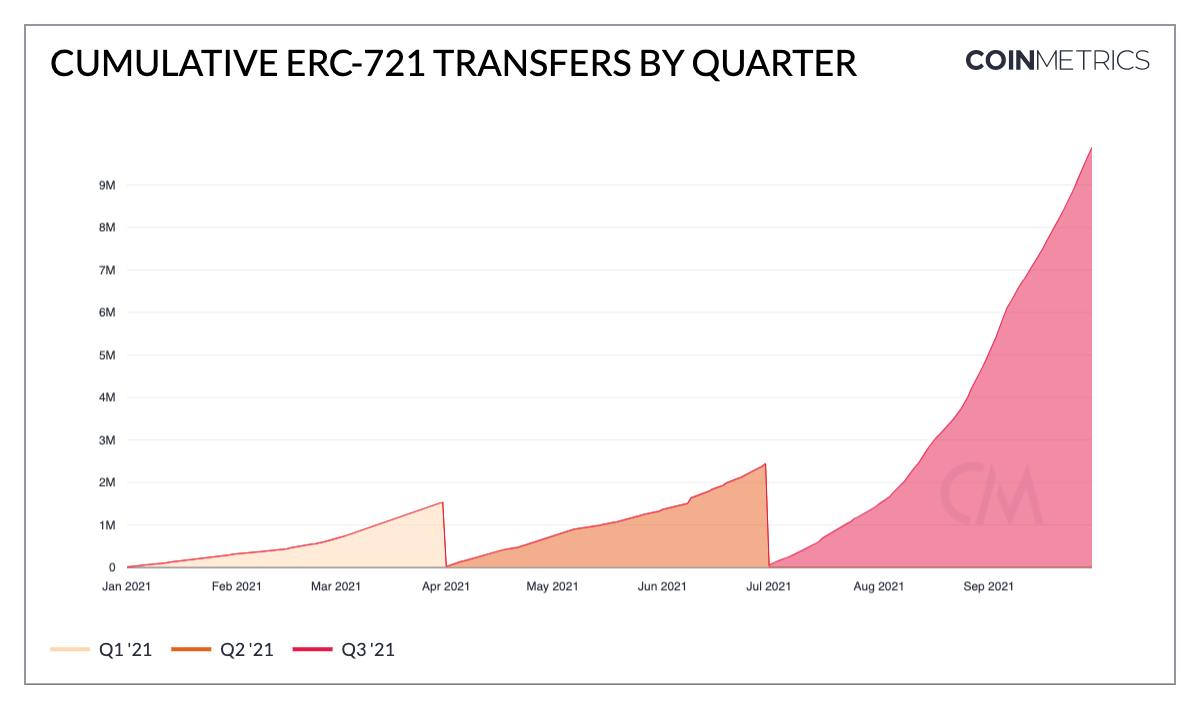

NFTs have had a stellar year, and their rapid growth continues to impress while equities, gold and bond markets are stuttering.

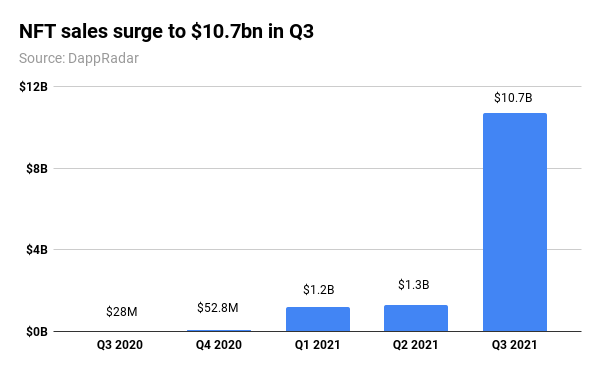

Analysis via DappRadar, reported in Reuters, suggests that sales of these unique tokens representing collectible items like images, videos, art, profile pictures or even digital land has soared to $10.67bn in Q3 2021. This is an increase of 704% from the previous quarter.

Sales volume from the largest marketplaces in the space is starting to outpace those in the non-crypto world.

OpenSea recorded $3.4bn of trading volume in August, beating the sales value for popular DIY art and collectibles marketplace Etsy (NASDAQ:ETSY) which recorded $2.8bn of sales in Q2.

DappRadar tracks NFT sales across the four main blockchains; Binance Smart Chain, Ethereum, Flow and Wax.

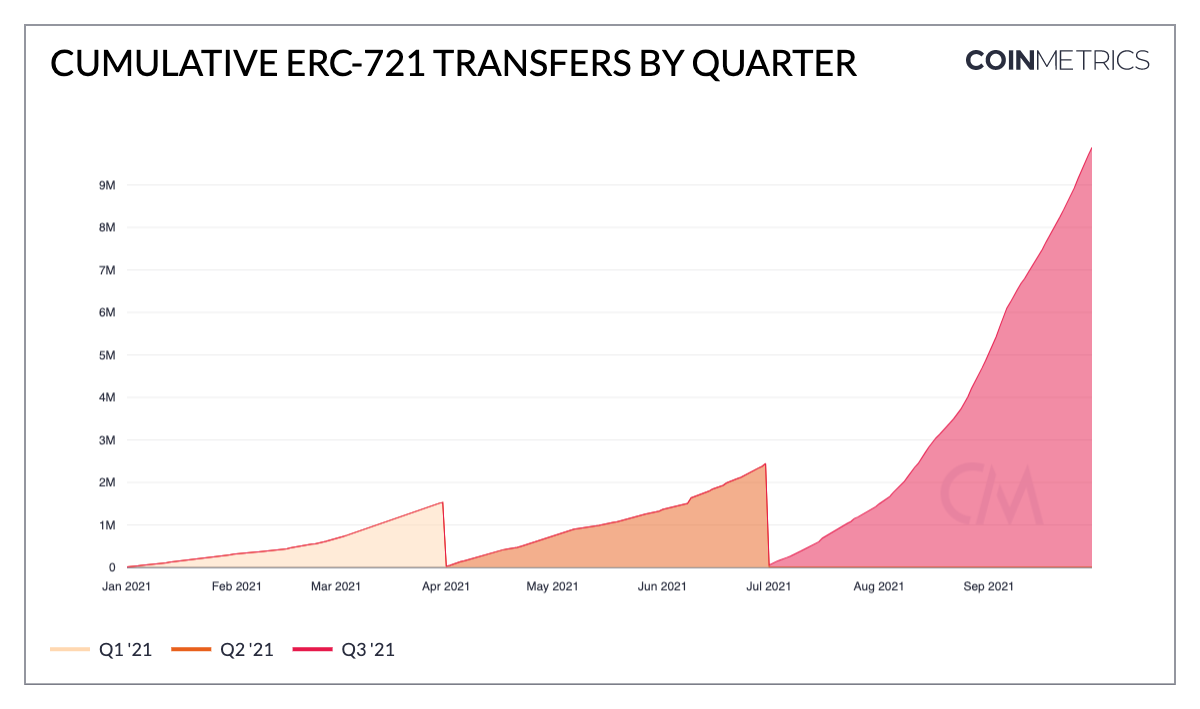

And around 77% of all NFTs use Ethereum, according to the research. NFTs are transferred on Ethereum as ERC-721 tokens. According to CoinMetrics, there were a total of 9.8 million ERC-721 token transfers in Q3, up 305% quarter-on-quarter.

NFT sales volume had surged to $2.5bn for the first half of the 2021. Now we are seeing quadruple that amount in a single three-month period.

Even Ethereum creator Vitalik Buterin has been surprised by the success of NFTs. In a Twitter Q&A session, the programmer conceded that there was a speculative aspect to the market, but noted that one of the more interesting aspects was that the explosion of NFTs was that it was an unintended consequence of the popularity of Ethereum’s ability to represent any kind of value as a token, in a way that is cryptographically secure and mathematically provable.

[It] allows groups of people who before had no business model at all, to finally have a business model of some kind for the first time [including creators, artists and charities]. Things like that can be used as a way to make some interactions happen that just could not happen before. Vitalik Buterin, Twitter, 2 September 2021

Twitter itself is also joining the NFT party. One exec shared a ‘sneak peek’ of a new feature that will allow its 206 million daily active users to verify their profiles using NFTs.

In a mocked-up video, users can click on their avatars and select ‘NFT’ then connect their preferred wallet, choosing from Coinbase, Argent, Metamask and Trust, and then download all their NFTs from OpenSea. Once they have chosen one to be their avatar, it could appear with an Ethereum check mark similar to the blue check mark given to verified Twitter users.

Here’s a sneak peek👀 on what we’re working on for NFT profile verification.

— Justin Taylor (@TheSmarmyBum) September 29, 2021

What do you think? pic.twitter.com/Z8c6tH3BBy

Analysis by data house Chainalysis has found that Europe is the world’s largest crypto economy.

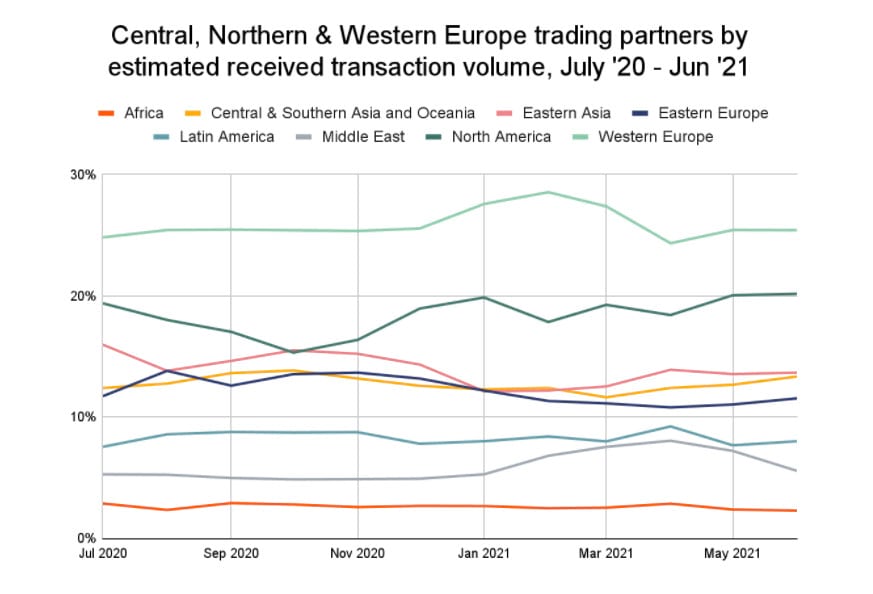

Central, northern and western Europe (CNWE) received over $1 trillion of digital assets across trade, investments and business dealings between July 2020 and June 2021, the research shows. That accounts for 25% of global crypto activity.

It’s really exciting news that Europe is the world’s largest crypto economy. We have seen tremendous enterprise and innovation in Europe in the crypto space with the help of some forward looking regulators. Bradley Duke, CEO, ETC Group

As the biggest counterparty to every other trading region globally, CNWE is a key source of liquidity to cryptocurrency investors around the world, the research shows.

Researchers found that activity really started to pick up in the middle of Q2 last year.

CNWE’s cryptocurrency economy began growing faster in July 2020. At this time, we saw a huge increase in large institutional-sized transactions, meaning transfers above $10 million worth of cryptocurrency. Large institutional cryptocurrency transaction value grew from $1.4 billion in July 2020 to $46.3 billion in June 2021, at which point it made up more than half of all CNWE activity. Chainalysis, research, 28 September 2021

For ardent institutional crypto watchers, these results will be no shock at all. China’s relationship with crypto has patently soured, putting Asian markets on edge, while the US has summarily failed to act on increased interest in investing in digital assets. The SEC added to its failures on 4 October 2021 by delaying for the ninth time the decision on whether to allow Bitcoin ETFs to trade on US markets.

As per TheBlockCrypto, issuers WisdomTree, GlobalX, Valkyrie and Kryptoin would all now receive extensions on their proposals until November and December this year. In a speech from August, SEC chair Gary Gensler expressed interest in reviewing applications for a Bitcoin ETF tied to futures under the US Investment Company Act of 1940.

Specific crypto products offering yield or returns — namely borrowing and lending protocols involved in DeFi — cannot avoid regulation, Gensler told a recent panel at a Financial Times conference.

Gensler’s intervention comes days after Coinbase, the listed cryptocurrency exchange, shelved plans to offer a digital asset lending product, initially promising a 4 per cent yield after running into resistance from the SEC. [The agency] threatened to sue the company if it launched the Lend [product], Coinbase said. Gary Silverman, Financial Times, 30 September 2021

That’s why institutional focus has remained on ETPs that faithfully and securely track the price of Bitcoin, Ethereum and the largest and most long-lasting cryptocurrencies.

BTC/USD

Bitcoin has taken quite the circuitous route back to $50,000, via a fairly extensive dip down into the low-$42,000 region over the past fortnight. One trading session even brought the original cryptocurrency beneath the $40,000 mark it has held since early August, but this remained a blip on the surge back towards the higher watermark. Across the two-week period Bitcoin gained a total of 21.03%, representing quite the reversal.

ETH/USD

Ether has recaptured the zeitgeist with a spell above $3,000, while bears have been trounced continually across the two-week trading period. Overall we’ve witnessed a quite stunning 27.6% turnaround for the blockchain, which after all is the basis for the vast majority of DeFi and NFT activity. And here, perhaps, have a preview of the march back towards the $4,000 region, with Ethereum ending the fortnight at $3,469.74, just a fraction of a percent below its peak.

LTC/USD

Litecoin’s dalliance with a $200+ level came to an end in the early part of September, but the payments protocol has since displayed admirable fortitude, gaining a total of 14.9% across the past two weeks. A dip to $139.64 represents a level not tested since early August, but LTC did not remain there for long. Bulls took hold in the latter part of the week, reversing the downward trend and allowing Litecoin to flourish at these historically elevated levels.

BCH/USD

Bitcoin Cash remained on course for a potential retest of $600 by the end of the fortnight, with a 7.8% dip as low as $471.03 a distant memory by the end of the trading session. From a start of $510.88, BCH gained a total of 11.3% against the US dollar as the weeks wore on, ending the period less than 2% below its $579.50 high.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

Bitwise is one of the world’s leading crypto specialist asset managers. Thousands of financial advisors, family offices, and institutional investors across the globe have partnered with us to understand and access the opportunities in crypto. Since 2017, Bitwise has established a track record of excellence managing a broad suite of index and active solutions across ETPs, separately managed accounts, private funds, and hedge fund strategies—spanning both the U.S. and Europe.

In Europe, for the past four years Bitwise (previously ETC Group) has developed an extensive and innovative suite of crypto ETPs, including Europe’s largest and most liquid bitcoin ETP.

This family of crypto ETPs is domiciled in Germany and approved by BaFin. We exclusively partner with reputable entities from the traditional financial industry, ensuring that 100% of the assets are securely stored offline (cold storage) through regulated custodians.

Our European products comprise a collection of carefully designed financial instruments that seamlessly integrate into any professional portfolio, providing comprehensive exposure to crypto as an asset class. Access is straightforward via major European stock exchanges, with primary listings on Xetra, the most liquid exchange for ETF trading in Europe.

Retail investors benefit from easy access through numerous DIY/online brokers, coupled with our robust and secure physical ETP structure, which includes a redemption feature.