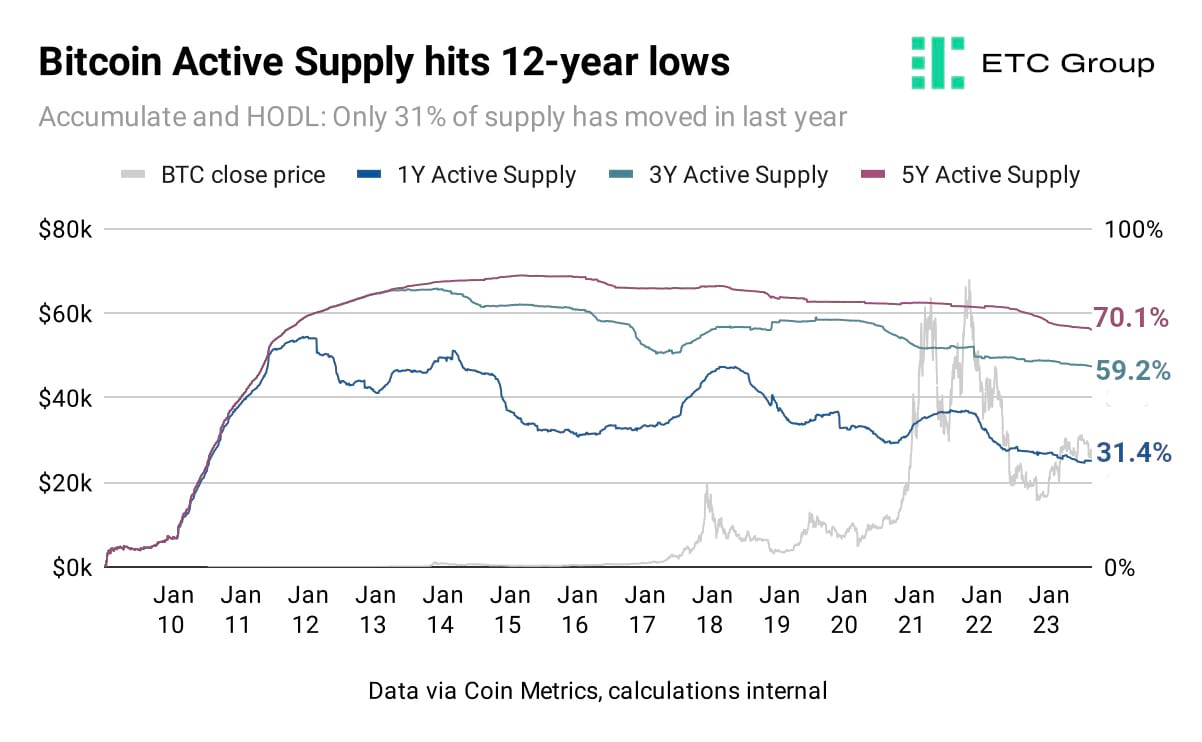

Bitcoin active supply drops to 12 year low

The active supply of the Bitcoin cryptocurrency has reached 12 year lows, according to data analysed by ETC Group, showing that long-term Bitcoin holders have been unmoved by recent price action and are increasingly holding and accumulating coins.

Active supply refers to coins that have been moved or transacted at least once over a period of time.

Data sourced from Coin Metrics shows that as of 6 September 2023, 6 million coins or 31.4% of total supply has moved in the last 12 months, leaving a record 68.6% unmoved in the same period.

As rival data provider Glassnode notes:

As investors accumulate and store coins for longer periods of time, we categorise them based on how long it has been since they last moved on-chain.

59.2% of the total 19.47m supply has been transacted at least once in the last three years, leaving 41.8% of the Bitcoin supply untouched over that period.

We can infer from this that 40% of investors (retail or institutional) who purchased Bitcoin in the run up to its November 2021 all time high of $67,413 have still not sold those coins, despite current market prices sitting at around $26,000.

Active supply tends to spike amid periods of rapid price appreciation, as tends to occur during bull markets, as holders move their coins to exchanges for sale in order to take profits.

However, as seen in the chart above, the magnitude of those active supply increases is diminishing over time.

Active supply falls when more of the circulating supply of Bitcoin is inactive, which means those coins are being held instead of traded. This reduces the supply available to purchase on the open market.

Active Supply also tends to gradually reduce due to the growing number of BTC held for a very long time, as well as the proportion of coins which researchers believe are lost or permanently inaccessible.

Visa taps Solana to expand USD stablecoin merchant pay network

The world's 11th largest company, global payments giant Visa (NYSE:V) has announced it is expanding its stablecoin settlement capabilities to Solana after beginning an experiment with Ethereum last year.

Visa said it will use the Solana blockchain to settle USDC transactions with merchant card payment processors Nuvei (TSX:NVEI) and Worldpay.

Critics have long derided the perceived lack of real-world use cases for digital assets and blockchains, but one suspects given the mass institutional appreciation for blockchain technology that they simply have not been paying close enough attention.

Take for reference the rise in TradFi exchanges creating blockchain-based markets to speed up and reduce the cost of fund, bond and stock issuing and settlement. Singapore's national exchange was one of the first to cross the Rubicon, while the most recent entrant is the London Stock Exchange, which said this week it would create a new digital assets arm and open a blockchain-based market inside 12 months.

The Visa move has huge implications outside of crypto, as noted by Bitcoin writer and Castle Island Ventures partner Nic Carter:

This is a huge deal,” he said. “Writing on the wall, [stablecoins] will become the de facto interbank settlement solution via card networks.

USDC is a US dollar-denominated stablecoin. 1 USDC is equal to $1 and is backed 1:1 by cash and cash-equivalents.

While rapid, digital cross-border settlement has been possible since Bitcoin was created in 2009, newer blockchains like Solana have focused on making this process near-instant. Due to their smart contract capabilities, blockchains like Ethereum and Solana can host and settle stablecoin transactions as well as those of their own native currencies.

Visa said it had already moved millions of USDC between partners using Solana and Ethereum.

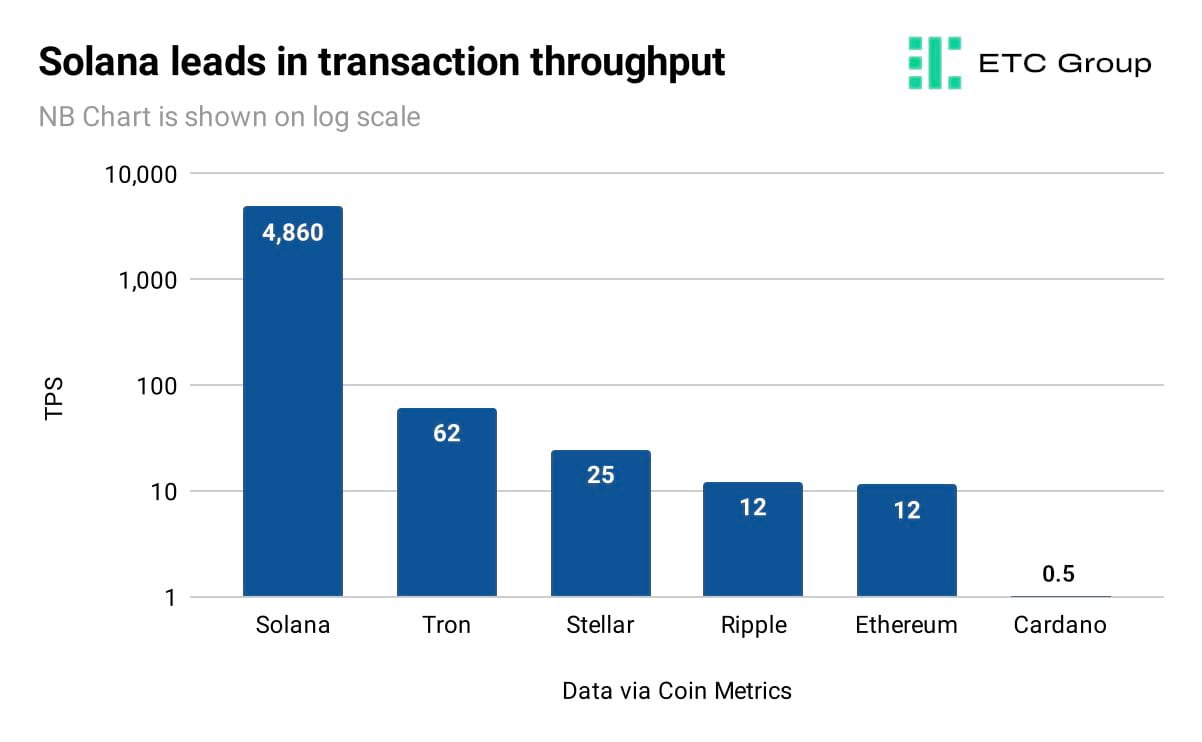

The latest data shows the Solana blockchain produces an average of 4,870 transactions per second (TPS) and has a block confirmation time of around 400 milliseconds.

When consumers use Visa cards to make a purchase, their payment authorisation is near-instant,

but what they don't see is that the funds need to move between their bank and the merchant's bank,

said its Head of Crypto Cuy Sheffield.

By leveraging stablecoins like USDC and global blockchain networks like Solana and Ethereum, we're helping to improve the speed of cross-border settlement and providing a modern option for our clients to easily send or receive funds from Visa's treasury.

Solana is the tenth-largest crypto asset by market cap, valued at $8.01bn. It was launched in August 2020. The network prioritises low fees and fast time-to-finality, but is not considered as structurally robust as the lower-TPS Ethereum.

Chances of US Bitcoin ETF approval up to 95% by 2024, ETH ETFs filed

The ongoing saga of the US crypto ETF denials continues, but the chances that the regulator will be entirely vindicated in its anti-crypto stance are vanishing, according to Bloomberg and JP Morgan.

The likelihood of a US spot Bitcoin ETF being approved has jumped from 65% to 75% currently, with the chances increasing to near-certainty by the end of 2024, Bloomberg duo Eric Balchunas and James Seyffart said.

The chances of the SEC approving spot Bitcoin ETFs this year have risen…following Grayscale's court win, while odds by the end of 2024 reach 95%,

the Bloomberg Terminal article reads.

Senior ETF analyst Eric Balchunas added on X, formerly Twitter:

We think the legal and PR loss will combine to make denial politically untenable.

The confidence comes from the manner in which the SEC was rebuked for its decision-making process, the analysts said.

There remain now only three serious options ahead of Gary Gensler:

- Deny all applications - this is highly unlikely given the manner of the court's decision.

- Revoke market access for the futures based Bitcoin ETFs and deny spot Bitcoin ETF applications - also highly unlikely

- Climbdown and approve all of the outstanding ETF proposals.

The importance of opening the US market to spot Bitcoin exchange-traded funds is hard to understate, given that there remain large pools of institutional capital unable to access crypto exposure without the recognisable ETF structure.

The crypto industry remains in the grip of a bear market, but has been granted two major regulatory boosts in the last month. On 13 August, Ripple won

a partial victory against the SEC's attempt to sue its executives, with courts deciding that sales of the XRP crypto asset did not constitute a sale of securities. Then on 29 August, a three-judge panel ruled that the regulator had showed “arbitrary and capricious” reasoning to deny attempts by the largest Bitcoin investment product, Grayscale's Bitcoin Trust (GBTC), to convert into an ETF. GBTC currently holds 569,894 Bitcoins, worth just over $16bn.

Alongside Grayscale, 10 other issuers have filed spot Bitcoin ETF applications with the regulator, including the world's largest asset manager BlackRock.

JP Morgan analysts noted the same point in a September report seen by Coindesk that Grayscale's regulatory win made the likelihood of a US spot Bitcoin ETF far more likely.

The most important element of the Grayscale vs. SEC court ruling was that the denial by SEC was arbitrary and capricious because the Commission failed to explain its different treatment of similar products, i.e. futures-based bitcoin ETFs,

the bank's analysts wrote.

In the last 48 hours, asset manager ARK has also filed an S-1 form to list a spot Ether ETF in the United States. That makes ARK the second issuer to propose a US-based exchange-traded fund after Van Eck's proposal in May 2021.

This will ultimately start the clock market watchers are so used to following with spot Bitcoin filings, Bloomberg Intelligence analyst Seyffart wrote.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.