As Grayscale goes to court to force through conversion of its Bitcoin Trust, investors seek safer and better structured ways to get digital asset exposure; Ethereum revenue jumps sharply, and Bitcoin Ordinals are growing so fast they could hit 2.7 million mints in a year.

Grayscale’s bitter battle with SEC goes to court

The years-long fight between the largest US Bitcoin investment product issuer and the country's powerful market regulator has escalated to a new stage: the lawyers are here.

Grayscale's Bitcoin Trust (GBTC) was created in 2013 as a closed-ended fund. At the time, it was the only institutional-grade option for investing in Bitcoin markets. The options for professional investors have exploded in the years since, and premium products are now structured in a way such that shares can be created and redeemed daily.

Grayscale sued the SEC in June 2022 after the agency rejected its most recent application to convert GBTC into a Bitcoin ETF.

The District of Columbia Court of Appeals has expedited the case and oral arguments will begin on 7 March.

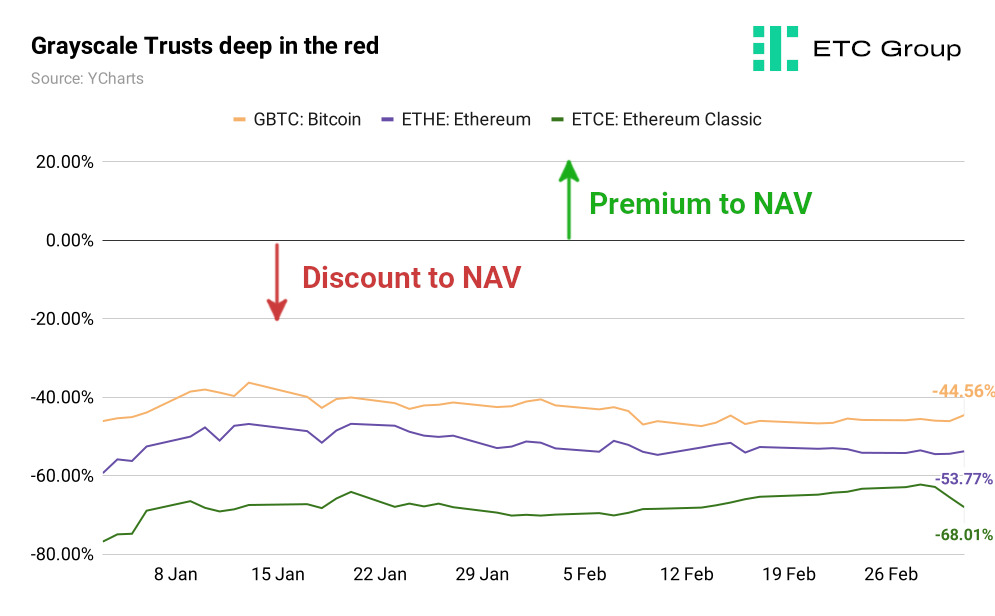

As the above chart shows, Grayscale's three largest single asset Trusts are deep in the red, trading at a very large discount to Net Asset Value (NAV).

As of 3 March 2023 the NAV of the shares in Grayscale's three largest Trusts - GBTC, ETHE and ETCE - are worth between 44.56% and 68.01% less than the digital assets in those funds.

GBTC remains the world's largest Bitcoin investment product by AUM with $14.07bn. ETHE, its Ethereum Trust, has $4.7bn in AUM, and its third-largest Trust, ETCE, which is intended to track the price of Ethereum Classic, has $230m AUM.

But because of the structure of GBTC and Grayscale's other Trusts, there is no mechanism for the digital assets held in these products to leave the funds.

By contrast, BTCE and other open-ended funds allow for creation and redemption of shares, which allows Bitcoin to both leave and enter and keeps the NAV tightly tracking the actual price of Bitcoin.

Bitcoin critic Amy Castor notably dubbed the GBTC Bitcoin Trust a ‘Hotel California' - referencing the 1976 Eagles song whose famous line is: “You can check in any time you like, but you can never leave.”

Over 3% of the world's Bitcoin supply, some 629,793 BTC, is stuck in this vehicle.

Grayscale says its intent was always to convert these Trusts into exchange-traded products.

While some jurisdictions, like Germany and its regulator BaFin, take a forward-looking approach to crypto investment products, the United States has not. In fact, Gary Gensler's SEC appears bent on hobbling its nascent crypto industry.

ETH revenue at 5-month high as demand returns

Blockchains are a delicate balance of incentives. Ask users to pay more fees and the network becomes more secure to attack and resistant to spam, while its supporters receive more valuable rewards, proportionally.

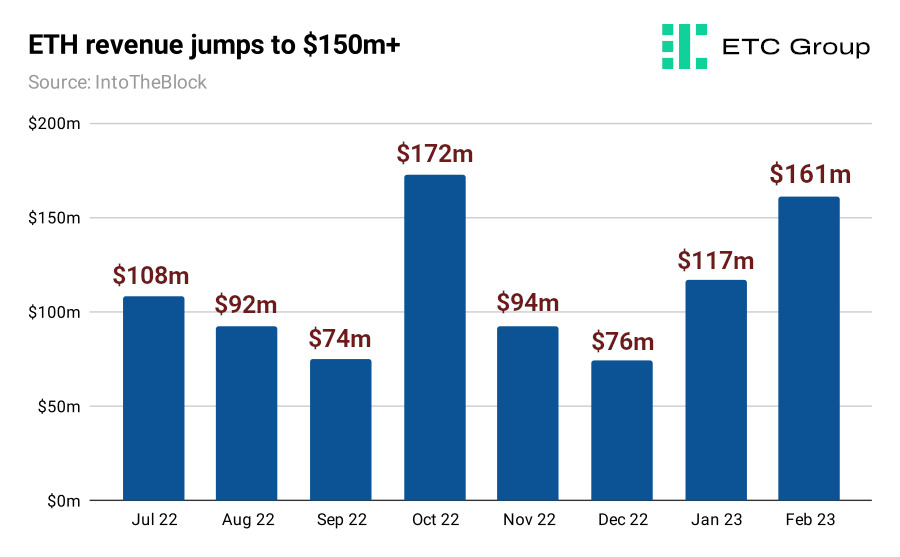

The average fees paid to stakers and validators on Ethereum have tripled since November 2022 with $161m in fee revenue recorded across February. This represents the largest monthly spend since October 2022.

Despite being a shorter month, February's total fees outpaced seven of the previous eight months.

And Ethereum's deflationary supply tokenomics continue.

Data reviewed by ETC Group shows that Ethereum token supply is deflating at its fastest ever rate. In the 173 days since The Merge, 47,259 ETH has been deleted from supply.

Driving the shift are:

- The after-effects of The Merge, which moved the network from Proof of Work to Proof of Stake and started to reduce supply. Under Proof of Work, miners were issued approximately 13,000 ETH per day. Stakers under the new system are instead issued ~1,700 ETH per day, cutting new issuance by around 88%.

- Increased ETH burn: This fluctuates according to network demand.

- Higher NFT trading volumes and DeFi TVL, shown by rising gas fees and increasing the associated ETH burn (where Ethereum tokens are deleted from circulation).

- Ethereum's upcoming Shanghai hard fork, which will allow stakers to withdraw locked ETH for the first time

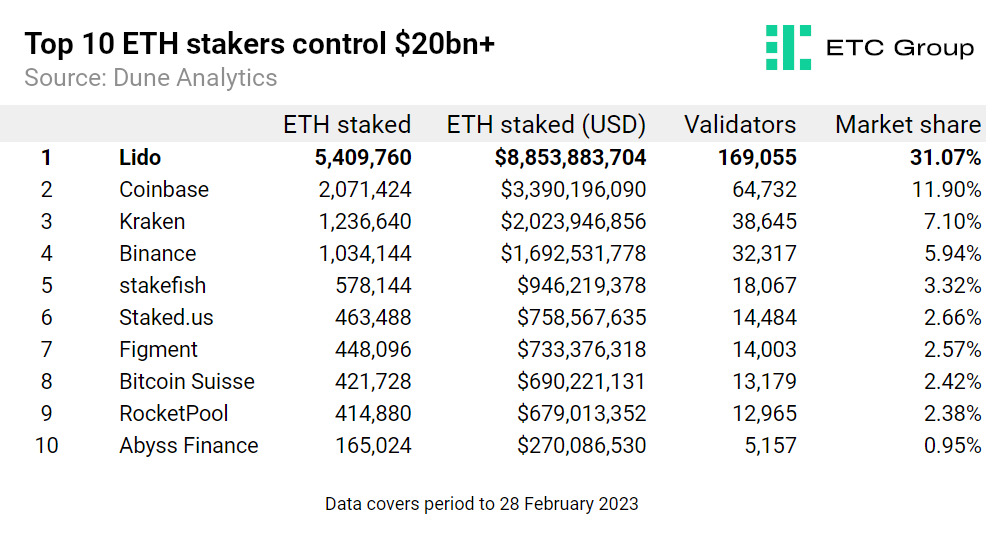

With 17.4 million ETH deposited into Ethereum staking services as of 28 February 2023, the top 10 Ethereum staking protocols and platforms now account for more than $20bn in deposits, the latest updates show.

The addition of a new Layer 2 (L2) scaling solution from Coinbase has also added additional excitement. The leading American digital asset exchange revealed Base at the end of February. Its testnet went live earlier in the month and the mainnet will be rolled out in the coming months.

Base is intended as an open ecosystem where developers can more easily build decentralised applications (dApps) while taking advantage of the security offered by the Ethereum network.

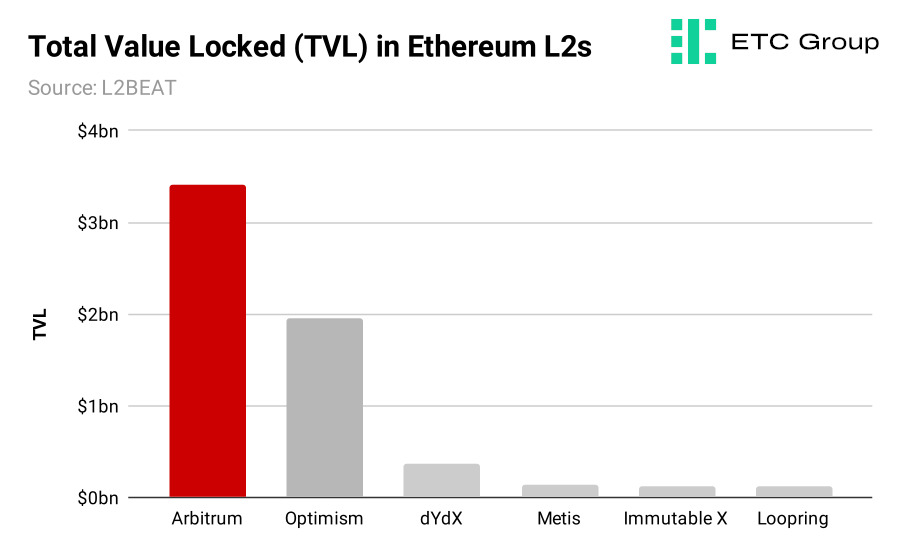

There is a total of $6.3 billion worth of digital assets locked in L2 applications in the Ethereum ecosystem. From these, Arbitrum dominates with 54% market share, worth $3.4 billion.

Will Ordinals delay The Flippening? Bitcoin NFTs race past 330,000 mints

Aside from a digital gold-like store of value, a new use case has suddenly appeared for Bitcoin. Anyone with an interest in the space has surely heard of Bitcoin Ordinals by now. If not, here's the rundown.

Ordinals are a new standard to track individual satoshis - the smallest unit of BTC - which can be used to inscribe arbitrary quantities of data into the Bitcoin blockchain. Arbitrary in this context just means ‘any amount', rather than ‘a random amount'.

The main complaint levelled at the Bitcoin network in its earliest incarnation was that it could only host one type of asset: BTC.

When Ethereum arrived on the scene in 2015, it did so with the intent to host any type of asset on its platform. This birthed the ERC-20 standard that allows developers to launch tokens relying on Ethereum's security model, thereby growing their market share and network effects without having to build or run their own blockchain.

The following Cambrian explosion in development produced tokens with tens of billions of dollars of market cap, including Circle's USDC stablecoin ($43 bn), Uniswap ($4.8 bn) and Chainlink ($3.5 bn), all of which sit in the top 20 assets by market cap as of 7 March 2023.

The use of Bitcoin's network to host alternative assets other than BTC has proved controversial among Bitcoin maximalists. This group believes that Bitcoin is a public good and a monetary asset, and so its blockspace should be reserved only for transaction data.

Placing arbitrary data like text, pictures of penguins and videos into blocks is a waste of space and contrary to Satoshi Nakamoto's original vision, they say.

The argument is not without merit, but it does ignore the fact that Bitcoin has greatly changed over time, and while today it still exists as a counterparty risk-free way of sending value across borders, its main use case has developed as digital gold. The velocity of money on the Bitcoin network has dropped significantly over time, suggesting that more holders see Bitcoin's value rising in the future than those that wish to use BTC as day-to-day currency.

As Bitcoin Ordinals creator Casey Rodarmor tweeted: “I understand the argument that NFTs are lame and stupid, but I don't understand the argument that NFTs are somehow *illegitimate*. Bitcoin has transcended its original creator and purpose. Bitcoin is not *for* some things and *not for* other things. It just is.”

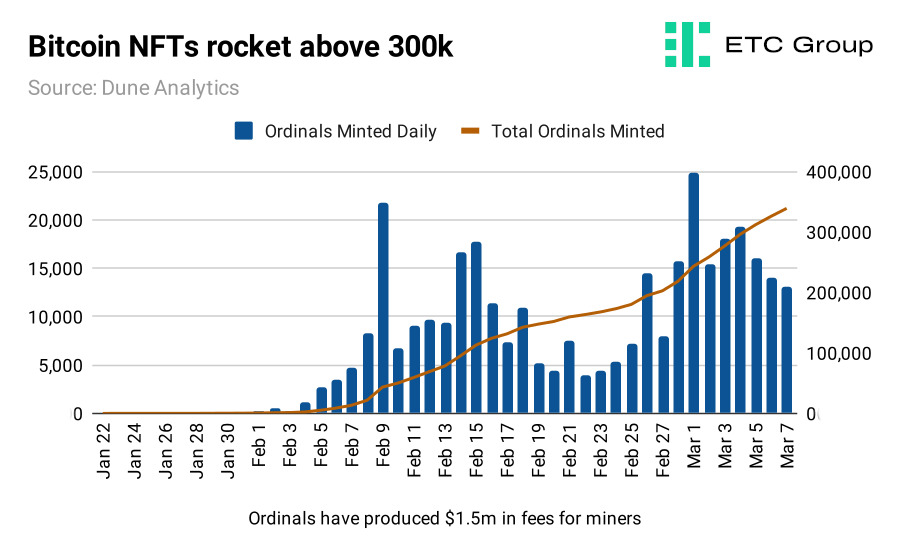

The introduction of NFT-like assets on Bitcoin have enthused developers and brought forward an enticing new revenue stream to miners. Data from Dune Analytics shows that mints have climbed to 339,000 as of 7 March 2023, producing more than $1.5m in new revenue for Bitcoin miners.

As a reminder, users of the Bitcoin blockchain pay fees to miners to have their transactions or data included in the next block. Once added, blocks cannot be removed from the Bitcoin blockchain, creating an indelible record that cannot be altered.

Pages like this are very helpful for live-tracking the use of Bitcoin Ordinals. As of 7 March, 68 BTC has been paid to include Ordinals in Bitcoin blocks.

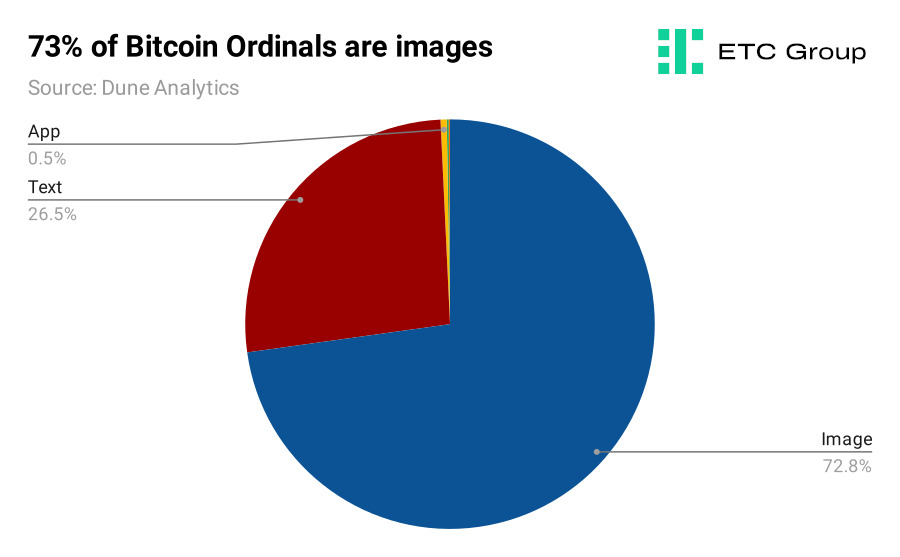

The vast majority of Bitcoin Ordinals are images akin to NFT-style collections. However, as interest and usage of Bitcoin Ordinals grows we expect the additional use cases to grow in volume. It is also possible to inscribe individual satoshis with text, video clips, GIFs, audio files and even JSON applications.

The creation of Bitcoin Ordinals requires a high degree of technical knowledge, and trading generally occurs OTC in disparate Discord servers instead of in public marketplaces.

But Bitcoin Ordinals have taken some of the wind out of Ethereum's NFT sails and are growing so quickly that, over time, they may even delay The Flippening - the putative point at which Ethereum overtakes Bitcoin to become the largest crypto by market cap value.

Bitcoin Ordinals can and will impact a number of different on-chain metrics, including:

- Mean block size

- Transaction fees paid to miners

- Number of transactions

- Velocity of BTC (Total Transfer Volume)

If Ordinals continue to grow at their current rate, an average of 26% per day, by the beginning of 2024 there would be 2,759,652 Ordinals inscribed on the Bitcoin blockchain.

At current market prices, that means 558 BTC ($12.5m) will have been paid to miners for processing blocks containing Ordinals.

Recent developments suggest that chain-agnostic market participants see long-tail value in Bitcoin Ordinals. Those early NFTs on Ethereum like CryptoPunks and Art Blocks now regularly sell for millions of dollars and there is hope that those collecting the first set of Bitcoin NFTs could be in for a similarly gigantic future windfall.

For example, the Bitcoin mining pool Luxor snapped up the Bitcoin NFT marketplace Ordinals Hub on 20 February. Ordinals such as TaprootWizards, Ordinal Loops and PunksonBitcoin have already seen sale prices in excess of 10 BTC ($237,000), Luxor said.

Yuga Labs, the company behind CryptoPunks and Bored Ape Yacht Club, also made moves in the latter part of February, releasing its first collection of Bitcoin Ordinals. Amid the first NFT craze of 2021, a seed funding round gave the company a monster $4bn valuation.

Anticipating the level of future growth in Bitcoin NFTs is difficult, and analysts should be wary of arrow-flight projections, suggesting that any market will grow upwards in a linear fashion indefinitely.

However, with almost 70 BTC in fees already paid to miners for inscribing Ordinals, this provides a new revenue stream for miners looking ahead to the 2024 Bitcoin halving, where block rewards will be sliced in half from 6.25 BTC per block to 3.125 BTC.

Markets

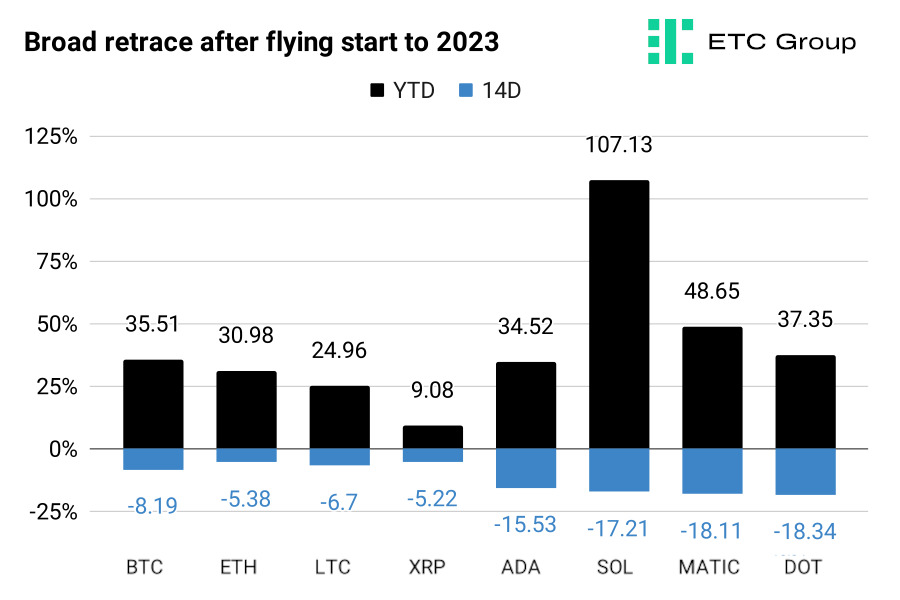

The past two weeks have seen the top digital assets by market cap in mid to high single-digit decline. After a rapid run up to the brink of $25,000, Bitcoin was rejected at this level and retraced back down to the $22,500 region, shedding a total of 8.19% across the fortnight. On a technical level, if Bitcoin was to hold its place above $25,212 for 90 days or more, this would mark the official end of the bear market.

Those assets which have shot up the most in the year to date saw the widest declines across the last two weeks. For example, Solana (SOL) fell by 17.22%, but is still up by more than 107% since the start of the year. Layer 2 scaling solution Polygon (MATIC) took an 18.11% hit over the course of the fortnight, but remains more than 48% higher since the turn of 2023.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.