Institutional funds, DeFi show ETH is additional investment of choice

Analysis of data compiled across Q3 by ETC Group shows that Ethereum became another institutional investment of choice in cryptocurrency.

Figures from CryptoCompare’s Digital Asset Market Report 2021, released on 14 September, shows that Ethereum-based institutional investment products reached their highest market share of AUM in September, at 25.9%.

This suggests institutional investors are moving further down the value chain away from just Bitcoin for broader cryptocurrency exposure.

Grayscale’s Ethereum Trust (ETHE) was also the most-traded digital asset product in September, with average daily volumes increasing 29% to $250m, toppling Grayscale’s Bitcoin Trust (GBTC) for the first time ever. Average 30-day volume for ETHE hit $7.18m, compared to $5.16m for GBTC, CryptoCompare found.

ETH futures show the way

JP Morgan’s Global Strategy Report, released on 22 September 2021, supports this conclusion.

“Our metrics based on CME futures show strong preference for ethereum vs bitcoin by institutional investors,” the researchers noted.

Each CME Ether futures contract consists of 50 ETH, worth $216,000 at current market prices.

When demand for Bitcoin futures is strong, those futures trade at a positive spread over the spot price, called contango. But when demand is weak and expectations turn bearish, the futures curve shifts into backwardation.

This was the case between [May 2020 and July 2021]...we thus believe that the return to backwardation in September is a negative signal pointing to weak demand for bitcoin by institutional investors.

“In contrast, ethereum futures remain in contango and if anything this contango steepened in September towards a 7% annualized pace. This points to much healthier demand for ethereum vs bitcoin by institutional investors.

What is driving institutional interest in Ethereum?

Between January and September 2021, Bitcoin’s share of AUM in institutional funds fell from 81% to 67%, with the largest AUM winner being Ethereum, according to Coinshares data.

The explosion in Ethereum developer activity thanks to NFTs and DeFi has clearly buoyed investor confidence.

Cathie Wood, CEO of Ark Invest, spoke to this point at September’s SALT New York 2021, the global thought-leadership conference founded by Anthony Scaramucci’s SkyBridge Capital.

“I’m fascinated with what’s going on in DeFi, which is collapsing the cost of infrastructure for financial services in a way that I know the traditional financial industry does not appreciate right now,” she said, in comments reported by BlockWorks.

Our confidence in ether has gone up dramatically as we’ve seen the beginning of this transition from proof-of-work to proof-of-stake.

According to SEC 13F filings reported on 8 August 2021, Ark Invest is the largest investor in Grayscale’s Ethereum Trust (ETHE) with 721,936 shares worth $16.15m. Rothschild Investment Corp is the second-largest, with 303,554 shares totalling £8.3m.

Deflationary tokenomics

7.8 million ETH now sit in the ETH2 deposit contract, providing investors with an unparalleled insight into the robust community support for Ethereum’s long-term switch to a Proof of Stake consensus mechanism. This smart contract is where users send their ether to stake them on the network — with rewards due to participants of up to 23%.

Recent updates from the nonprofit Ethereum Foundation put the date of the Merge, where Proof of Stake takes over from Proof of Work, as Q1 or Q2 2022. This will eliminate the need for energy-intensive mining to secure the blockchain and cut Ethereum’s energy usage by around 99.95%, according to official estimates.

More clarity around this date has aided institutional investment in Ethereum: before these updates, stakers had entered into a near-indefinite lockup situation.

In addition, the changes made to Ethereum’s core tokenomics in Q3 produced a strong uptick in institutional interest.

Eric Conner, a core developer for Ethereum and co-author of the EIP1559 update, tweeted in the wake of the London hard fork on 7 August: “EIP1559 has cut the ETH yearly inflation rate from 4.2% to 2.6%. Once the merge happens and [Proof of Stake] is live, this will be a negative number. Ethereum will be secure while ETH [is] deflationary.”

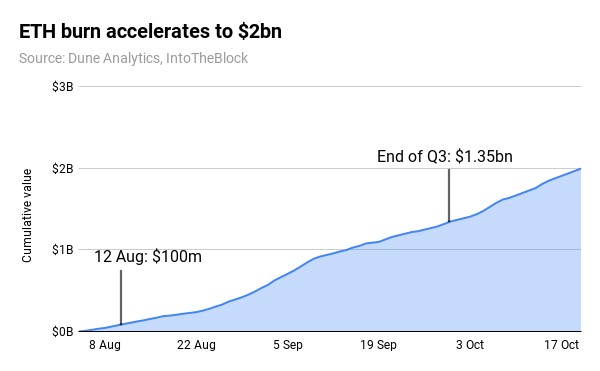

The total value of ETH removed from circulation reached $100m seven days after the hard fork and $500m within two weeks.

By mid-September, more than $1bn in ETH had been burned. These numbers are continuing to accelerate. In total to date more than 588,00ETH ($2bn) has been excised from the Ethereum supply and continues at an average rate of $30m a day.

So what of Ethereum’s Layer One competitors?

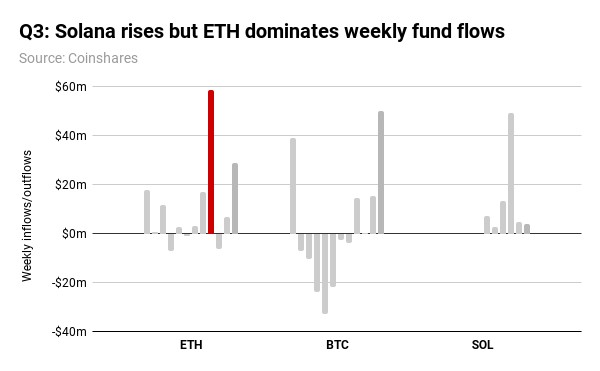

Inflows to institutional Solana (SOL) funds began in August 2021, garnering a large amount of media headlines. But Ethereum still largely dominates weekly institutional fund flows, as per data published by CoinShares.

The figures cover funds aimed at institutional investors that are issued by Grayscale, ETC Group, 21Shares, BitWise, 3iQ, Purpose and CoinShares.

The AUM of Solana products also remains miniscule compared to Ethereum. As noted above, Ethereum’s share of institutional investment products grew to almost 26% of the market in September. Despite one week where investors ploughed nearly $50m into SOL funds, the blockchain made up only $88m of the total $52.9bn invested in cryptocurrency funds as recorded by CoinShares. Bitcoin comprises $35.5bn of the total market AUM while Ethereum makes up $12.9bn.

And It has not gone unnoticed among institutions that Solana does sacrifice decentralisation to a degree. Sufficient decentralisation both in geographic distribution and in terms of who runs validating nodes is a non-trivial security question, one that both Bitcoin and Ether have both answered. Solana, however has significant critics in this area: Messari Research suggests that 49% of SOL tokens are owned by insiders.

Ethereum is no longer the only show in town, but it remains dominant among smart contract platforms.

Investors seek Ethereum’s security in blockchain DeFi wars

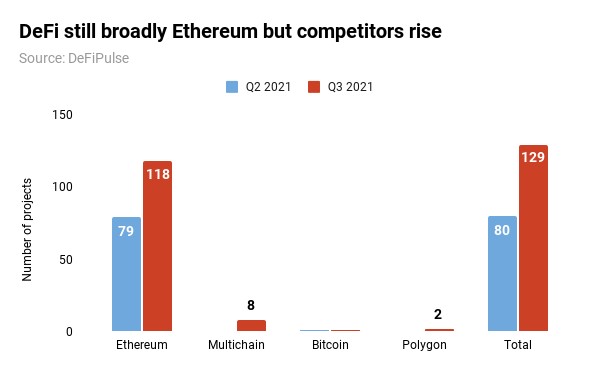

Evidence built across the financial quarter that DeFi developers are starting to broadening their focus to multichain applications instead of focusing solely on Ethereum.

In Q2 2021, 79 of the top 80 projects as tracked by industry data site DeFiPulse.com used Ethereum.

By the end of Q3 those numbers were starting to shift. In the hunt for faster and cheaper services, the largest and third-largest DeFi protocols by TVL, Aave and Curve Finance, switched from Ethereum-only to multichain support, while Polygon entered the charts for the first time with two DeFi projects.

Not recorded in these figures are the rise of Binance Smart Chain and Solana. In the post-quarter period the latter secured its largest haul of $12.7bn liquidity locked in DeFi protocols.

And initial look at Ethereum’s largest smart contract competitor, Binance Smart Chain, would seem to suggest that it is way out in front. Daily transaction rates on CZ Zhao’s dapp-centric blockchain were nearly 5 times that of Ethereum, according to ETC Group analysis of blockchain explorer data in Q3.

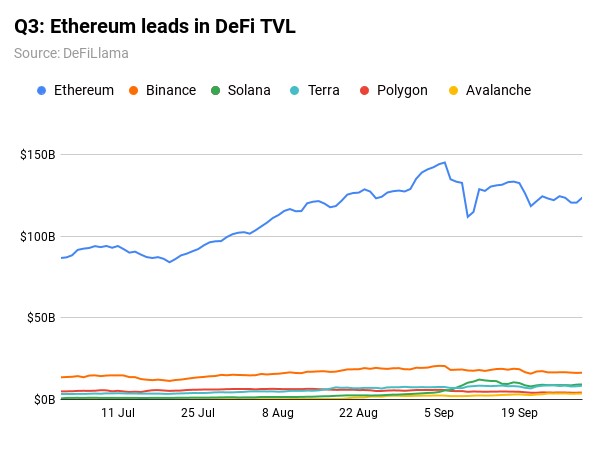

But at the same time, the Total Value Locked in smart contracts has barely moved for BSC in Q3 2021. At the start of the period, $13.5bn was locked in BSC DeFi smart contracts, according to DeFiLlama data. By the end of Q3, this figure shifted just 20.1% to $16.4bn. Compare that to the 42.7% rise in liquidity locked in Ethereum across the quarter, from $86.7bn to $123.9bn

Flash loan attacks on Binance Smart Chain protocols continue to cause considerable damage to investor confidence.

And large institutional transactions — those over $10m — accounted for 60% of DeFi in Q2 2021, compared to under 50% for all cryptocurrency transactions, according to research published by Chainalysis on 24 August.

So since we now know that institutions are now carrying out the majority of DeFi activity, one obvious conclusion is that institutions are avoiding Binance for the safety of Ethereum.

Speaking to Forkast.News, one institutional DeFi operative who runs a corporate debt marketplace on Ethereum laid out the scenario.

[Institutions are] most attracted by capital preservation and risk mitigation because these are fixed income products. They think in risk-adjusted terms, so they’re looking for yields that are more attractive than what is available in traditional finance, but these yields can’t come at the expense of risk management and security. Sidney Powell, CEO, Maple Finance

Maple Finance provided $72.7m in undercollateralised loans to partners in Q3 2021, and the company claims that over 80% of deposits were larger than $1m, demonstrating the depth of institutional capital on the platform. Two key points to make here are a) that the quality of counterparties plays a big role in how institutions interact with DeFi and b) security must be as close to unimpeachable as possible.

We would assert that continued failures, flash loan attacks and exit scams on Binance Smart Chain make it difficult for institutions to assign capital to projects there.

Interrogating alternative datasets provides slightly differing figures, but ultimately the same conclusion. Data provider DeFiLlama attests that Ethereum led strongly in terms of TVL across Q3 2021, with Binance in second spot and newer protocols Solana, Terra and Avalanche providing just a fraction of the total.

As Glassnode research published on 26 August found, among Solana, Avalanche and Terra, none of the three hosted more than five projects with greater than $100m in liquidity.

If Ethereum [Layer 2 projects] struggle to scale the network, or create a heavy barrier for user experience, users may naturally gravitate towards alternative chains [but] while some alternative layer one smart contract platforms [have grown], actual liquidity on each chain remains limited relative to the Ethereum chain...developers will have to assess the viability and longevity of additional users and capital moving on or off of Ethereum.

There are regulatory factors to consider, too. Of the crypto projects on the market, only Bitcoin and Ether have been determined as sufficiently decentralised to not to considered securities by the SEC. The same cannot be said for Binance, which has faced multiple regulatory setbacks, including the 6 August exit of its US CEO Brian Brooks after just three months in the job. Brooks, let us not forget, is a former OCC Comptroller, responsible for some of the most high-profile crypto-friendly policy shifts in US banking history.

Conclusions

Ethereum became the institutional investment option of choice in Q3 2021. It still dominates DeFi markets, despite the rise of alternative blockchains, largely due to ongoing network effects and the perception of its strong decentralisation and security.

More certainly about the date for Ethereum’s Merge has aided this perception, and the ongoing growth of the size of the ETH2 deposit contract to more than $25bn is testament to the faith that both retail and institutions have in the programmable money blockchain.

Finally, while Layer 1 competitors like Solana have captured the imagination of retail investors, and provide the kind of trade finality, speed and transaction fees with which Ethereum cannot currently compete, institutional investors remain relatively cautious about allocating capital to protocols using these alternatives.

NFT sales up 20,000%

NFTs the ‘Trojan horse’ to bring crypto to 1bn users

Cryptocurrency adoption has hit 200m users, according to the latest available data, but NFTs will be the spark to take crypto to its first 1 billion users.

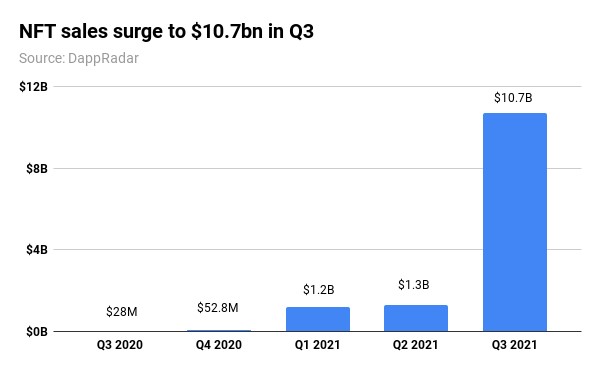

NFT sales are up a stunning 20,000% year on year, analysis by ETC Group reveals. The rate of growth in this crypto niche has shocked even seasoned investors, despite its relatively long history in cryptocurrency terms.

Sales of non-fungible tokens grew from $18.4m in Q3 2020 to $3.66bn across Q3 2021.

Relatively unheralded in the outside world when they arrived in 2017, the first NFTs, CryptoKitties, were so popular among Ethereum users that their use routinely overloaded the network.

But it was in Q3 2021 when NFTs really hit their stride. The crypto subsector was undoubtedly the story of the quarter, and figures compiled by ETC Group show that sales are up by 19,793% year on year. NFT sales are also up by 385% quarter on quarter.

The NFT craze has been happening for years, in various cycles. Beginning with CryptoKitties and moving through NBA TopShot, now through to the Opensea and Rarible art and meme markets.

There is no question that these newer marketplaces are responsible for the growth of the wider market.

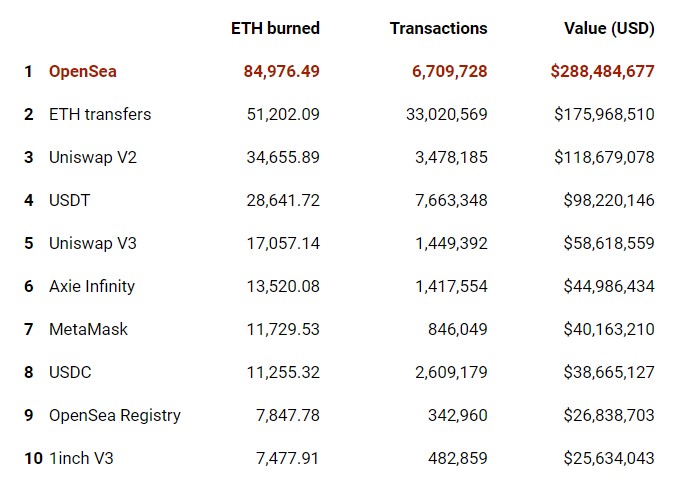

OpenSea is the number one ETH burner after the introduction of deflationary tokenomics to the Ethereum blockchain in August’s London hard fork. Data from Dune Analytics shows the marketplace eclipsed Uniswap DeFi transactions, Axie Infinity, stablecoins Tether (USDT) and USDCoin (USDC) and crypto wallet MetaMask, and to date has burned almost twice as many ETH as any other platform.

Why are NFTs growing so quickly?

NFTs hit an inflection point in Q3 2021, and now invite the same excitement as the ICO boom of 2017-2018, the formation of the first true capital markets for cryptocurrency.

One reason for the spike in NFT markets is that, in direct opposition to fungible tokens and blockchains, there is a strong shared technical basis for NFTs. The vast majority of the market is made up of NFTs created as ERC-721 and ERC-1155 tokens on the Ethereum blockchain.

Around 77% of all NFTs use Ethereum, according to research of Q3 figures by Dappradar. The blockchain intelligence platform tracks sales across four major blockchains: Binance Smart Chain, Ethereum, Flow — home to NBA’s Top Shots — and Wax.

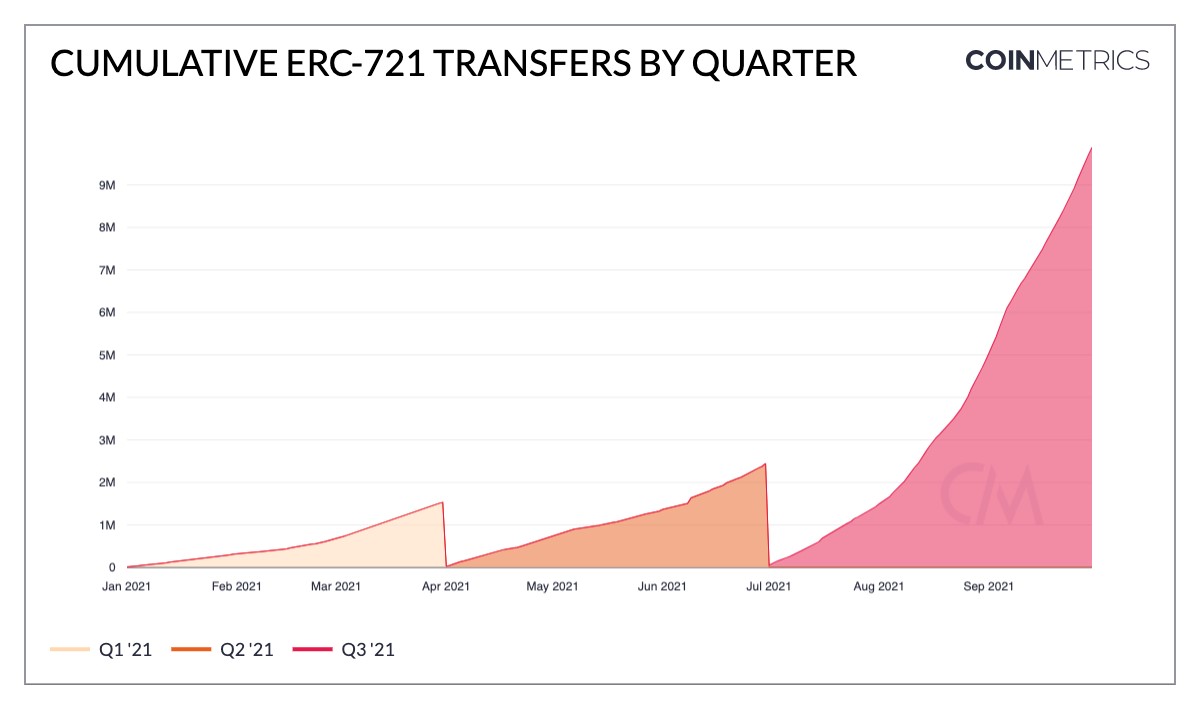

According to CoinMetrics, there were a total of 9.8 million ERC-721 token transfers in Q3, up 305% quarter-on-quarter.

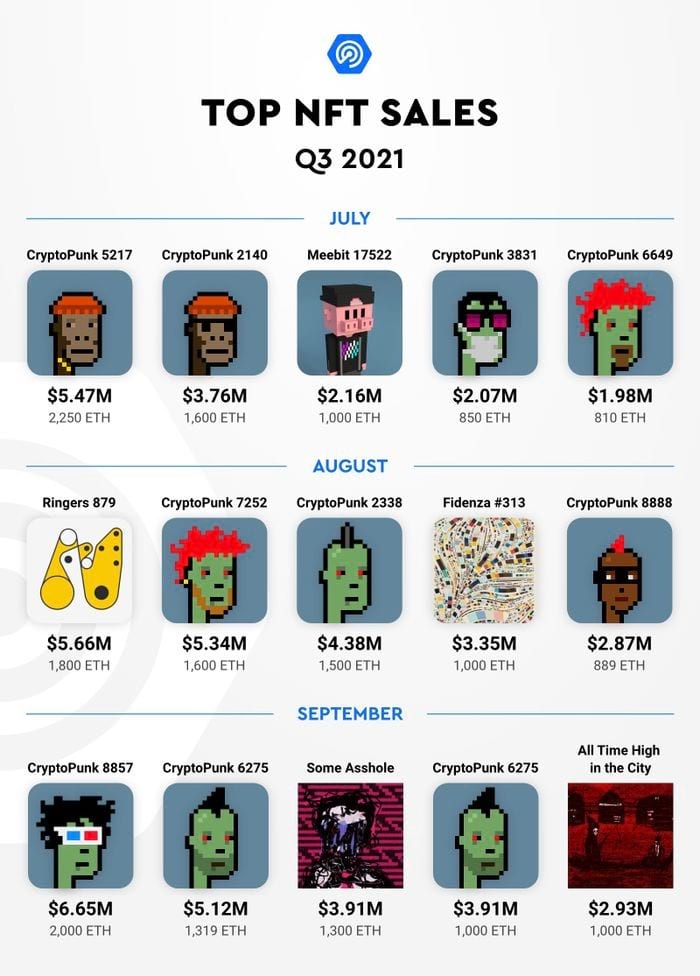

It’s not just retail traders either. Corporates are starting to enter the NFT space in increasing numbers. Visa’s 23 August purchase of CryptoPunks #7610 — a digital avatar of a woman with green eye makeup and red lipstick — for $150,000 in ETH is emblematic of the way that corporations are thinking about NFTs going forward.

So who sold the CryptoPunk to Visa? A former equities trader known pseudonymously as G.money. He appeared on the Castle Island Ventures podcast On The Brink to explain the rampant growth of NFTs.

“You know that Bank of America, Mastercard and Capital One are all looking at Visa to see how they could enter the space too,” he said.

Brands, whether financial or otherwise, are constantly seeking to signal to consumers that they are authentic and that they “get” their audience. NFTs are one of the ways they can do this.

Two other major corporates entered NFTs in the second half of the year.

The first was TikTok, which announced on 30 September it was opening its first creator-led NFT collection, featuring one-of-one and limited edition NFTs from some of its top talent, including Lil Nas X, Grimes, Rudy Willingham and Bella Poarch.

Inspired by the creativity and innovation of the TikTok creator community, TikTok is exploring the world of NFTs as a new creator empowerment tool. NFTs are a new way for creators to be recognised and rewarded for their content and for fans to own culturally-significant moments on TikTok...TikTok will bring something unique and groundbreaking to the NFT landscape by curating some of these cultural milestones and pairing them with prominent NFT artists. TikTok, blogpost, 30 September

In the days before this launch, the short-form video social media platform announced it now has over 1 billion monthly active users.

TikTok will partner with Immutable X, a Layer 2 scaling solution for Ethereum which promises to sidestep increased gas fees on the underlying blockchain.

The platform noted: “The one-of-one NFTs will be made available on Ethereum, and the limited edition NFTs will be powered by Immutable X. A series of weekly drops will take place through the end of the month [October 2021], after which the NFTs can be minted and traded with zero gas fees on the Immutable X Layer-2.”

The one-of-one NFTs will be made available on Ethereum, and the limited edition NFTs will be powered by Immutable X. A series of weekly drops will take place through the end of the month [October 2021], after which the NFTs can be minted and traded with zero gas fees on the Immutable X Layer-2.

Despite the use of the Flow blockchain by NBA, and the other options available in Binance Smart Chain, Waves and recent risers Solana, Avalanche, and Terra, it is significant that Ethereum remains is TikTok’s venue of choice.

Immutable X promises zero gas fees — one of the biggest barriers to entry for trading on Ethereum — with no custodial risks, as users keep hold of their own private keys, scalability up to 9,000 transactions per second, and access to the decentralised security of the Ethereum blockchain. One of the main criticisms of Layer 2 sidechains like Matic, xDai and SKALE are that they are heavily centralised, vulnerable to 51% attacks, and so cannot compete with the level of security that Ethereum offers.

Just days after Q3 ended, Coinbase made its own grand entrance into NFTs. The largest digital asset exchange in the United States announced it is launching its own NFT marketplace — again using Ethereum as its main base.

Buying and selling will be core features of Coinbase NFT. We will make it effortless for artists to maintain creative control through decentralized contracts and metadata transparency. All NFTs are on-chain. The initial launch will support Ethereum-based ERC-721 and ERC-1155 standards with multi-chain support planned soon after. Coinbase, blogpost, 12 Oct 2021

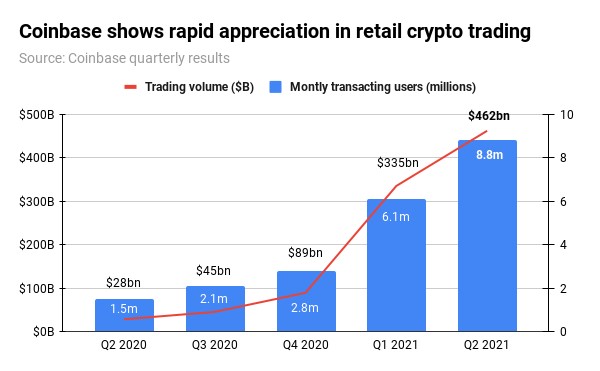

Coinbase has amassed a market cap of $52.9bn since its NASDAQ debut and it knows NFTs are a rapid-growth area it cannot afford not to exploit. Coinbase is the largest digital asset exchange in the United States with 8.8 million monthly transacting users.

In March of last year, macro investor Raoul Pal of Real Vision famously described cryptocurrency as “an unprecedented call option on the future”.

Note how NFT traders are describing the space now.

I realised, NFTs are a hugely underpriced call option on ETH...I want them to be aesthetically pleasing, culturally relevant, and have the community around them. Those are my three points. 'Gmoney’, On The Brink podcast

Analysis via DappRadar, reported in Reuters, suggests that sales of these unique tokens representing collectible items like images, videos, art, profile pictures or even digital land has soared to $10.67bn in Q3 2021. This is an increase of 704% from the previous quarter.

Sales volume from the largest marketplaces in the space is starting to outpace those in the non-crypto world.

OpenSea recorded $3.4bn of trading volume in August, beating the sales value for popular DIY art and collectibles marketplace Etsy (NASDAQ:ETSY) which recorded $2.8bn of sales in Q2.

NFT sales volume had surged to $2.5bn for the first half of the 2021. Now we are seeing quadruple that amount in a single three-month period.

Even Ethereum creator Vitalik Buterin has been surprised by the success of NFTs. In a Twitter Q&A session, the programmer conceded that there was a speculative aspect to the market, but noted that one of the more interesting aspects was that the explosion of NFTs was that it was an unintended consequence of the popularity of Ethereum’s ability to represent any kind of value as a token, in a way that is cryptographically secure and mathematically provable.

[It] allows groups of people who before had no business model at all, to finally have a business model of some kind for the first time [including creators, artists and charities]. Things like that can be used as a way to make some interactions happen that just could not happen before. Vitalik Buterin, Twitter, 2 September 2021

Twitter itself is also joining the NFT party. On 29 September one executive shared a ‘sneak peek’ of a new feature that will allow its 206 million daily active users to verify their profiles using NFTs.

In a mocked-up video, users can click on their avatars and select ‘NFT’ then connect their preferred wallet, choosing from Coinbase, Argent, Metamask and Trust, and then download all their NFTs from OpenSea. Once they have chosen one to be their avatar, it could appear with an Ethereum check mark similar to the blue check mark given to verified Twitter users.

Here’s a sneak peek👀 on what we’re working on for NFT profile verification.

— Justin Taylor (@TheSmarmyBum) September 29, 2021

What do you think? pic.twitter.com/Z8c6tH3BBy

The point to be made, here, is that NFTs are a relatively easily-understood entrance into the rabbit hole of crypto from the perspective of the average user.

Trying to explain yield farming and DeFi liquidity protocols is difficult. But unique Fortnite skins? Unique digital avatars for social media? One-off songs, artworks, memes of my favourite artists, comedians, sportspeople and creators? That is much easier for retail users to get behind.

While the first ever tweet, codified as an NFT, sold for $2.9m, and Tim Berners Lee’s source code for the world wide web produced $5.4m at auction, early analysis of NFTs found that the average transaction was just $200. From this we can only conclude that NFTs remain to a great extent a retail avenue for the average person to gain exposure to crypto.

NFTs impact way beyond crypto

Collectible non-fungible tokens have clearly revolutionised the sale, ownership and trading of artwork. NFTs do not exist in a vacuum and their introduction has impacted the traditional art world too. As announced in a 4 October report by Artprice, the success of NFTs has driven the contemporary art market to a record $2.7bn in sales.

Photography and prints have been particularly successful in this new online environment and in 2021 we have seen the sensational arrival of completely dematerialised artworks, the famous NFTs. Meanwhile the extraordinary prices obtained for artworks by very young artists have profoundly transformed the entire art market. Thierry Ehrmann, CEO, Artprice

Having witnessed the collapse of auctioned art in 2020, with sales volumes dropping 34% compared to the year before as the pandemic hit, auction houses were rejuvenated by sales which more than doubled to increase 117% in 2021.

NFTs have already generated nine 7-digit sales figures, three times more than the photography medium in the same period, the report found. Works were sold through 770 auction houses in 59 countries, Artprice said.

Auction house Christie’s also announced on 28 September it had surpassed $100m in NFT art sales

Exceeding this $100 million milestone is huge for Christie’s and for all the creators and collectors in the NFT community. This confirms that the NFT market is here to stay. We will continue to invest in the opportunities NFTs offer us to deeply engage with new audiences and artists, an exciting new generation of collectors, and more expansive and inclusive markets. Guillaume Cerutti, CEO, Christie’s.

As an early adopter of NFT sales, Christie’s worldwide profile has been bolstered by its attention to this new market.

Curio Cards auctioned by Christie’s

1 October saw the first auction with live bidding conducted entirely in Ethereum. The Post-War to Present sale included Curio Cards, considered to be among the earliest art works created on Ethereum

These exist as ERC-1155 non-fungible tokens. With an auction estimate of 250-350ETH ($895,000 - $1.25m), one collector paid 393ETH ($1.4m) for the collection of 30 digital artworks.

The Christie's sale suggests that collectors will pay for ERC-1155 in just the same way as they would for ERC-721: proof positive that the debate over the validity of token standards is a non-issue, relatively.

NFTs; not just art

We are starting to see an expansion of NFT use cases, as Andrew Keys of DARMA Capital explained to TheBlockCrypto’s Frank Chaparro. Keys is the co-founding managing partner of DARMA Capital, which has more than $1bn of AUM and manages over 10,000 Ethereum validators at over 320,000 ETH, staking at an institutional grade. Keys was previously the head of global business development at Consensys.

The original concepts of CryptoKitties are now being used in NFTs by drug manufacturers, where you can track the provenance of the raw ingredients of the drugs to make the compounds. We are starting to see the NFT use cases in supply chains. You can add accounts receivable to that, and factoring [where a company buys invoices from another business] and then you really can actually use this technology to its fullest extent.

And not to labour the point, but even seasoned VCs and early adopters have been surprised by the growth of NFT markets.

“I did not at all think they would be this popular this quickly,” he said.

What I do think is phenomenal is that secondary and tertiary trade that can embed royalties to the primary creator. So if I sell you an NFT and I embed the business logic that says if you sell it to somebody else, I get a 10% royalty on that secondary or tertiary trade. I think that’s amazing.

Interestingly enough, among DARMA Capital’s investments, in September 2021, were that it led an $8m fundraising round for Layer 2 Ethereum scaling solution Nahmii, which claims to be able to employ verifiable KYC, create a whitelisted garden for counterparties to transact on, as well as transact with instant finality.

So even while Ethereum Layer 1 cannot cope with the kind of scale required to bring crypto to its first billion users, corporations are still determined that they need the underlying security that mainnet Ethereum affords.

Conclusions

In truth, NFTs recall the same kinds of themes that cryptocurrency started from: passionate insiders and hobbyists seeking new communities online that aren’t yet dominated by brands, corporates or faceless financial services giants.

The trends are clear: that NFT sales are rising in value, and that corporates, institutional investors and retail investors all see ongoing utility and desirability from the crypto subsector.

Ethereum remains the platform of choice, but its failings over transaction fees and network congestion continue to be problematic for this kind of scalability. In Q3 2021 as in Q2 2021, traders continue to peg their hopes on the future success of the ETH2 merger, with its expected speed and stability upgrades. In the meantime, as evidenced by TikTok’s entry into the market, Layer 2 scaling solutions are a decent interim solution.

While their growth and penetration has surprised even the most ardent fans, NFTs could be the key that unlocks the first billion users for crypto.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

About Bitwise

Bitwise is one of the world’s leading crypto specialist asset managers. Thousands of financial advisors, family offices, and institutional investors across the globe have partnered with us to understand and access the opportunities in crypto. Since 2017, Bitwise has established a track record of excellence managing a broad suite of index and active solutions across ETPs, separately managed accounts, private funds, and hedge fund strategies—spanning both the U.S. and Europe.

In Europe, for the past four years Bitwise (previously ETC Group) has developed an extensive and innovative suite of crypto ETPs, including Europe’s largest and most liquid bitcoin ETP.

This family of crypto ETPs is domiciled in Germany and approved by BaFin. We exclusively partner with reputable entities from the traditional financial industry, ensuring that 100% of the assets are securely stored offline (cold storage) through regulated custodians.

Our European products comprise a collection of carefully designed financial instruments that seamlessly integrate into any professional portfolio, providing comprehensive exposure to crypto as an asset class. Access is straightforward via major European stock exchanges, with primary listings on Xetra, the most liquid exchange for ETF trading in Europe.

Retail investors benefit from easy access through numerous DIY/online brokers, coupled with our robust and secure physical ETP structure, which includes a redemption feature.