- Performance: Macro uncertainty, driven by hawkish U.S. trade rhetoric and rising recession risks, weighed heavily on risk assets in March, while safe-haven assets outperformed. However, corporate bitcoin accumulation hit record highs, creating a supply deficit and offering key support to Bitcoin despite broader market weakness.

- Macro: Rising economic policy uncertainty in the US has weighed on risk assets, with worsening consumer confidence and government job cuts amplifying recession fears. While the Fed faces a policy dilemma between supporting growth and controlling inflation expectations, lower realized inflation and rising unemployment could push them toward more rate cuts in 2025.

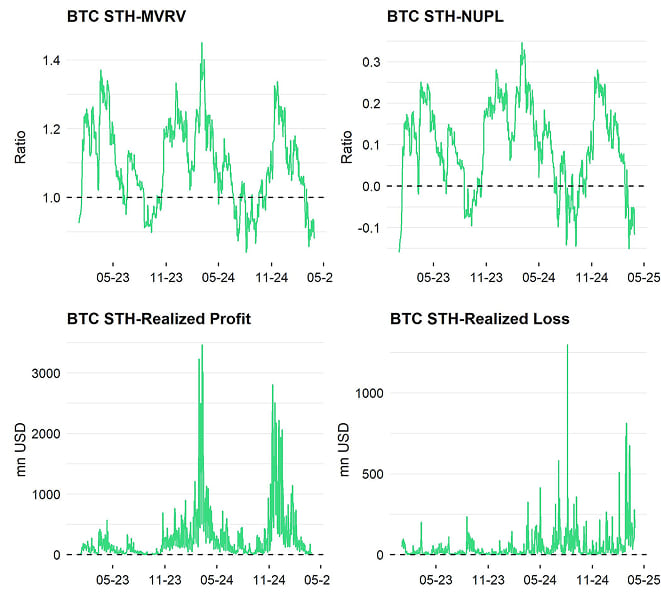

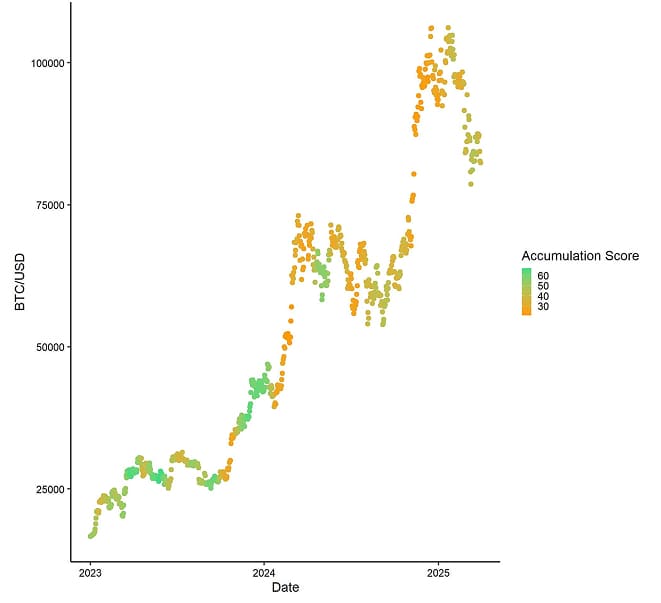

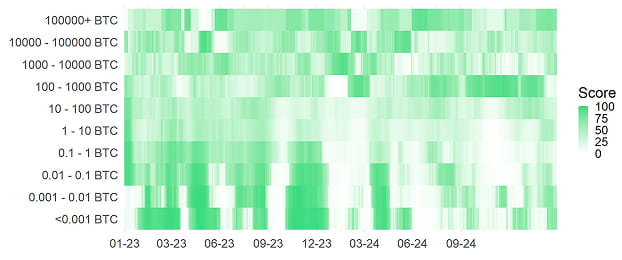

- On-Chain: Bitcoin and cryptoassets have already priced in significant US recession fears, but some downside risk remains if a recession materializes. However, improving macro factors, declining exchange balances, and strong accumulation trends suggest continued long-term support for Bitcoin's bullish trajectory. Improving macro conditions should also improve on-chain activity with a lag.

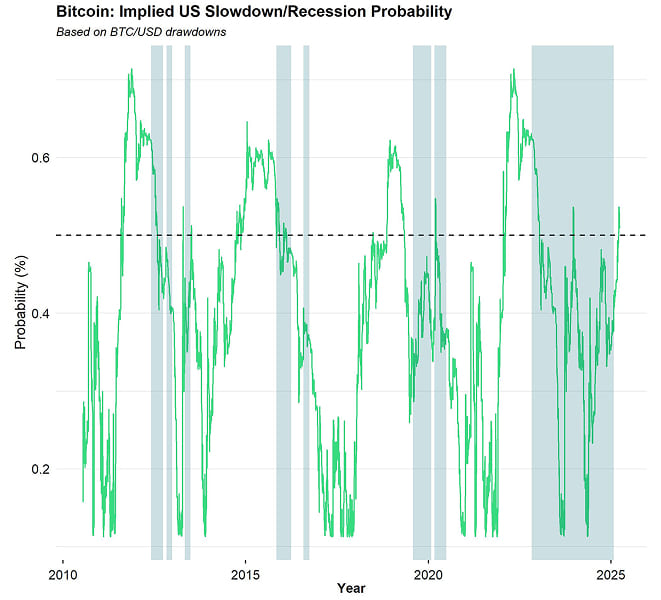

Chart of the Month

Performance

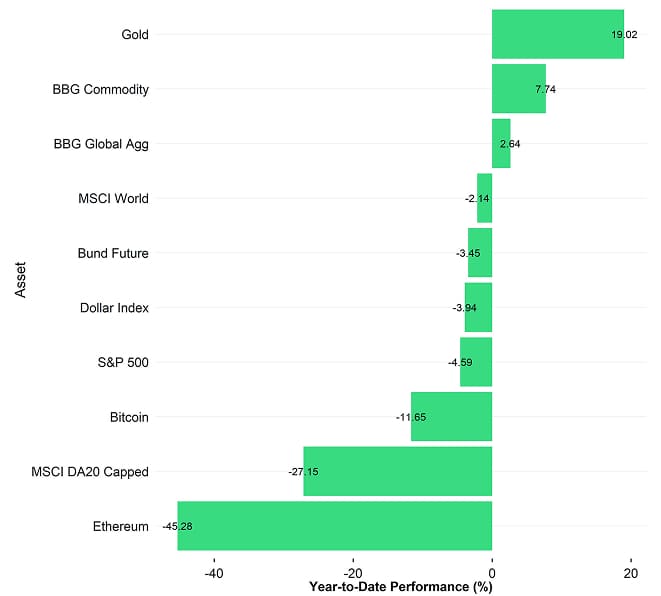

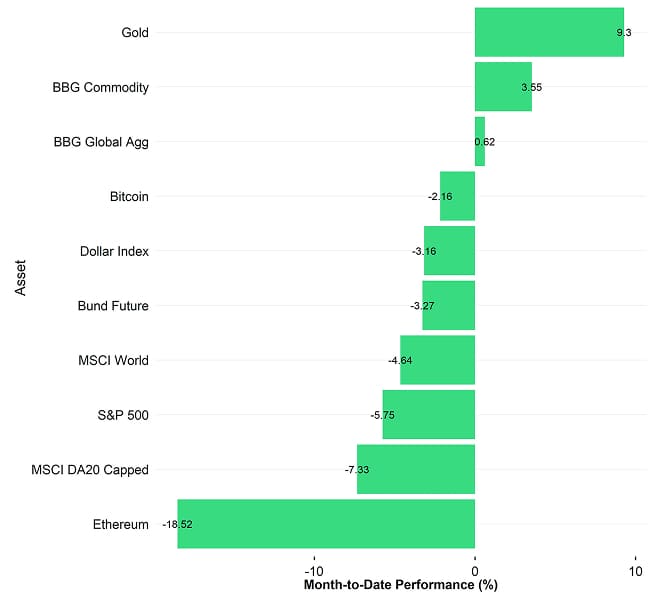

The performance in March was still dominated by heightened macro uncertainty. Most of this uncertainty was related to the hawkish trade rhetoric of the Trump administration, which weighed on risk sentiment across all asset classes.

Traditional safe-haven assets like gold and bonds managed to outperform while risky assets such as equities and cryptoassets underperformed in March.

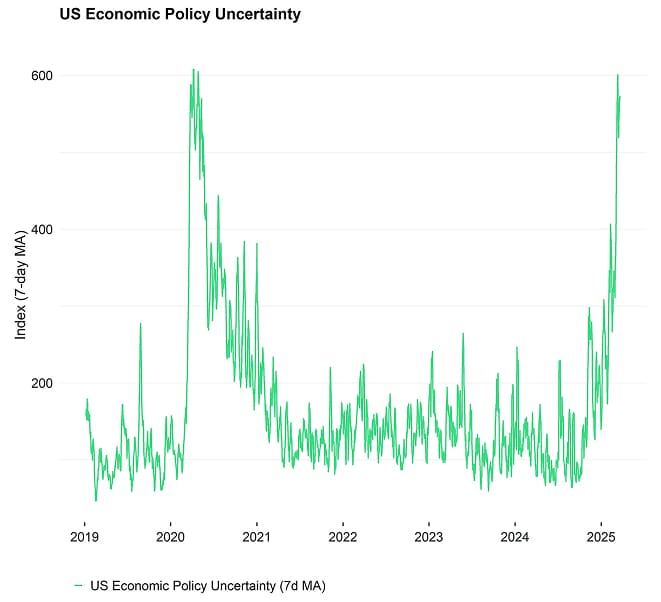

Rising US economic policy uncertainty has been a common theme over the past couple of weeks. In fact, US economic policy uncertainty has risen to the highest level since Covid, as highlighted in one of our weekly reports as well.

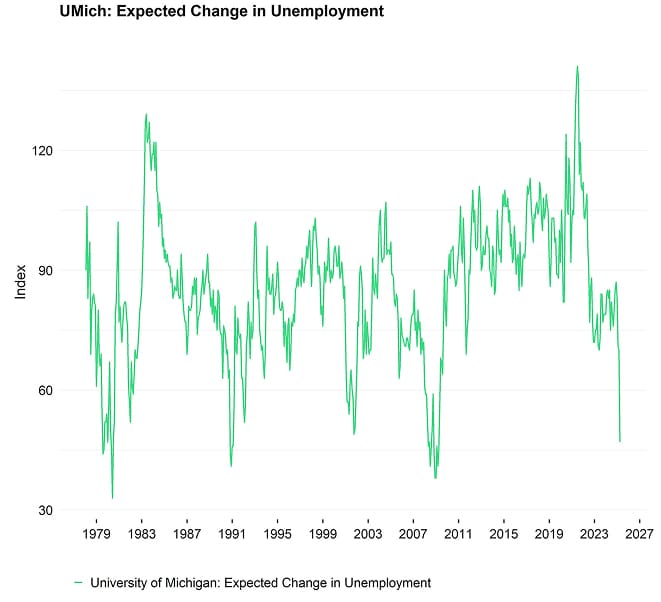

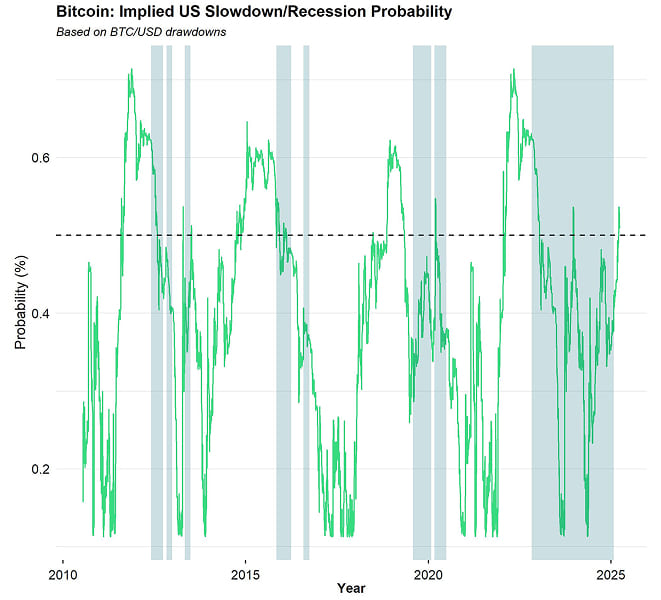

As a result, key macro leading indicators for US employment such as the University of Michigan consumer employment expectations have deteriorated more recently, and the risk of a US recession has clearly risen. Bitcoin's drawdown itself already signals an imminent risk of a US recession or at least a significant US growth rate cycle downturn (Chart-of-the-Month).

Negative net earnings revisions at S&P 500 companies are also not boding well for US PMIs over the coming months as these earnings revisions tend to lead sentiment among purchase managers. The latest regional PMIs like the Philly Fed and Empire State manufacturing surveys released for March have also supported this view.

On the bright side, from a pure contrarian point of view, the risk of a US recession appears to be increasingly reflected in market prices, implying that downside risks will gradually diminish while upside opportunities emerge.

On the liquidity front, global money supply has continued to expand and is close to new all-time highs as well. This tends to be a major tailwind for Bitcoin historically as highlighted here.

This trend will likely continue amid general Dollar weakness and the recent forward guidance by the Fed to end Quantitative Tightening (QT) amid recent market volatility and economic uncertainty.

If market expectations are correct, the Fed will likely cut rates three more times until the end of 2025.

However, while the macro environment has been affecting Bitcoin and cryptoassets negatively, some noteworthy drivers have continued to provide a support. Most notably, corporations have continued to expand their global bitcoin holdings to new all-time highs in March.

Strategy Inc. (MSTR) alone managed to raise around $1.3 billion in capital in March alone via its Strike (STRK), Strife (STRF) and common stock issuances that it used to buy additional 29,089 BTC. The latest bitcoin purchase announced at the end of March was the 5th largest ever made by MSTR. Other publicly listed companies like Meta Planet Inc. in Japan (3350 JP) have also made additional purchases and Gamestop (GME) has even announced to incorporate Bitcoin in its corporate treasury strategy as well.

Based on data provided by bitcointreasuries.net, publicly listed companies have grown their bitcoin holdings by +74,983 BTC in 2025 while the new supply of bitcoins has only grown by +40,369 BTC during the same period. Thus, corporations have continued to induce a supply deficit on exchanges.

Corporations have clearly emerged as one of the key demand drivers for bitcoin in 2025.

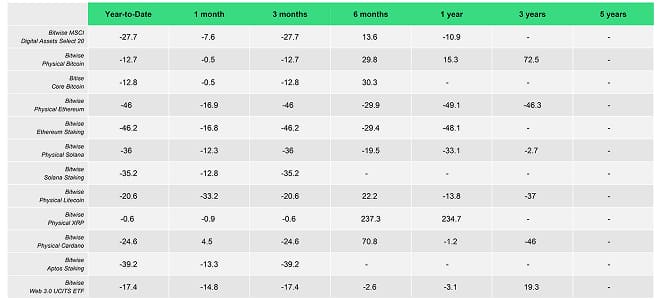

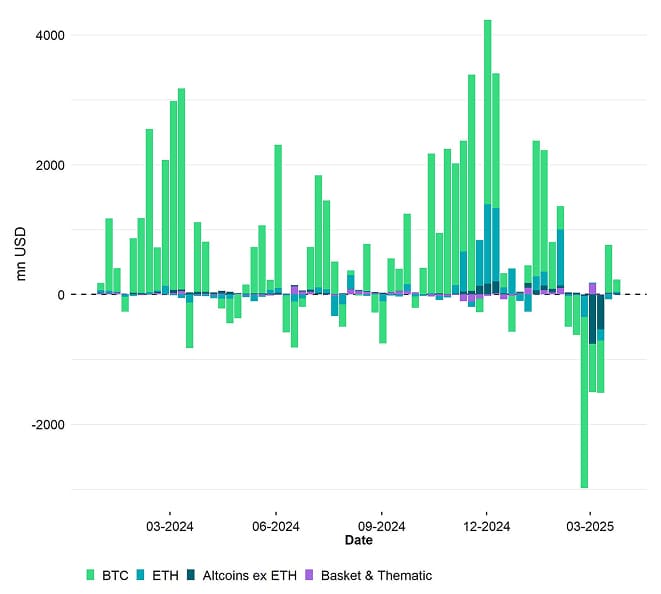

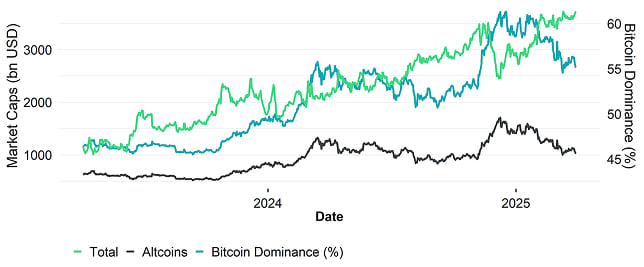

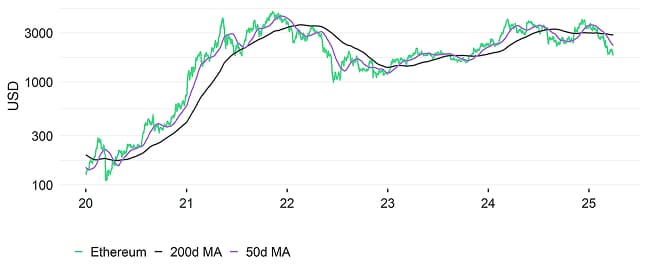

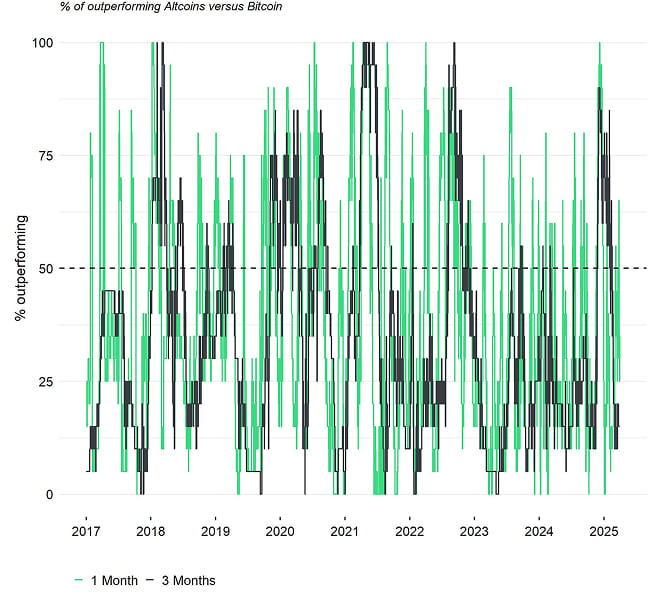

A closer look at our product performances reveals that altcoins have continued to underperform in March. In fact, our Altseason Index implies that only 35% of our tracked altcoins managed to outperform Bitcoin on a monthly basis. Ethereum also underperformed Bitcoin significantly in March.

Bottom Line: Macro uncertainty, driven by hawkish U.S. trade rhetoric and rising recession risks, weighed heavily on risk assets in March, while safe-haven assets outperformed. However, corporate bitcoin accumulation hit record highs, creating a supply deficit and offering key support to Bitcoin despite broader market weakness.

Macro Environment

The macro environment in March was heavily influenced by increasing economic policy uncertainty in the US, which affected risk assets including bitcoin and other cryptoassets negatively.

In fact, the US economic policy uncertainty index complied by policyuncertainty.com has increased to the highest level since the Covid recession in 2020, as reported in one of our weekly reports as well.

This increase in general policy uncertainty has weighed on US consumer confidence and employment prospects as well. For instance, the latest University of Michigan consumer survey for March has revealed a significant decline in employment prospects of US consumers.

This is also related to job cuts in the government sector related to the new Department of Government Efficiency (DOGE). In fact, the latest job cut announcement data compiled by Challenger, Grey & Christmas have also revealed that the majority of jobs cuts were related to government jobs.

The issue with government-related job cuts for the overall US labour market is related to the fact that the vast majority of job growth over the past year was related to increases in government payrolls or sectors dependent on government spending such as education and health care.

US consumers generally view business conditions the least favourable on record based on the 45-year history of the University of Michigan survey. Critics have pointed out that the University of Michigan consumer survey has increasingly been biased by diverging partisan views.

However, the recent decline in US economic activity is also echoed in other important macro data.

Consider the following macro releases:

- Atlanta Fed GDPNow Q125 - minus 2.8%

- February job cut announcements - highest since Covid

- March UoM employment expectations - lowest since Covid

- January US pending home sales - all-time low

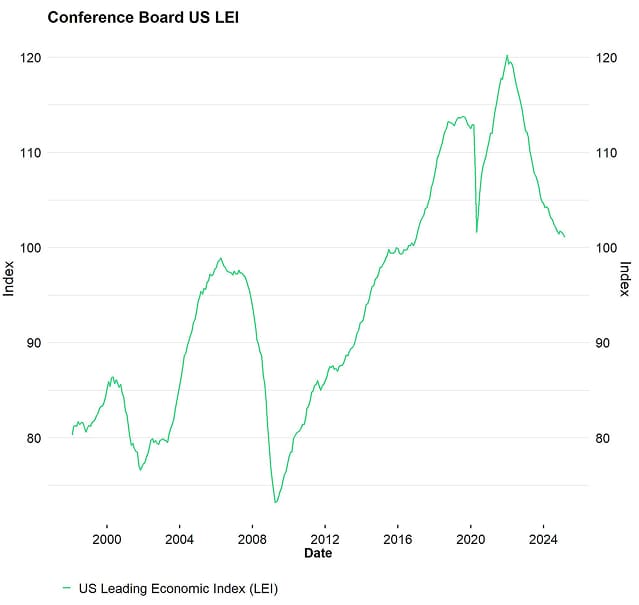

- January Conference Board Leading Economic Index (LEI) – lowest since Covid

We had already pointed out in previous monthly reports that especially US housing indicators have remained very weak by historical comparisons. In general, the housing cycle tends to lead the overall business cycle in the US, i.e. manufacturing output, employment etc.

Meanwhile, short-term inflation expectations in the University of Michigan survey over the next year have increased to 4.9% - the highest reading since November 2022. Besides, medium-term inflation expectations (over the next 5-10 years) have increased to a fresh multi-decade high in March.

In other words, the likelihood for a stagflation in US – i.e. contraction in real economic output with positive inflation – has significantly increased which is probably the reason why the price of gold has been rallying to new all-time highs as well. Gold tends to thrive during periods of stagflation as it implies declining real interest rates.

This macro environment is potentially creating a serious policy dilemma for the Fed:

On the one hand, the Fed has to counter the economic contraction via easier monetary policy. On the other hand, the Fed might risk a further de-anchoring of already high inflation expectations if it really starts to ease monetary policy significantly.

This has probably been the reason why the Fed refrained from cutting rates again at the March FOMC meeting although a slowdown in Quantitative Tightening (QT) has lifted market sentiment temporarily.

It is quite likely that the Fed will rather stay reactive than proactive but the weakening labour market will probably pressure the Fed to deliver more cuts in 2025.

In the context of inflation, it is very important to note that while inflation expectations continue to increase, high-frequency indicators of US consumer price inflation point towards a continued deceleration in realized inflation rates over the coming months.

This is what we also highlighted in our previous monthly report which also demonstrated that the lagged effects of the preceding money supply growth contraction will likely continue to be a drag on realized inflation rates at least until the end of 2025 when we could start to see a significant re-acceleration in inflation rates again.

All in all, the prospects for higher unemployment and lower realized inflation rates could create more wiggle room for the Fed to continue easing monetary policy.

In fact, a standard Taylor Rule estimate implies that a Fed Funds Target Rate of only 3.75% is already warranted based on current US core inflation and unemployment indicators, i.e. around 62.5 basis points lower than the current mid point of 4.375% in the current Fed Funds Target Rate.

Lower realized inflation and higher unemployment rate (e.g. implied by Truflation's inflation estimate and job cut announcements) will further decrease this Taylor Rule over the coming months.

The risk to that more optimistic view is that the Fed might keep interest rates higher for longer because of the abovementioned concerns about the unanchoring of inflation expectations.

Bottom Line: Rising economic policy uncertainty in the US has weighed on risk assets, with worsening consumer confidence and government job cuts amplifying recession fears. While the Fed faces a policy dilemma between supporting growth and controlling inflation expectations, lower realized inflation and rising unemployment could push them toward more rate cuts in 2025.

On-Chain Developments

How could a potential US recession affect Bitcoin & cryptoassets?

Unfortunately, we only have a single observation since Bitcoin's genesis in 2009. The Covid recession during 2020. Bitcoin sold off more than -50% before ending the year with a +300% performance. Based on this experience, it is quite likely that bitcoin is likely going to stay under pressure if equity downside continues.

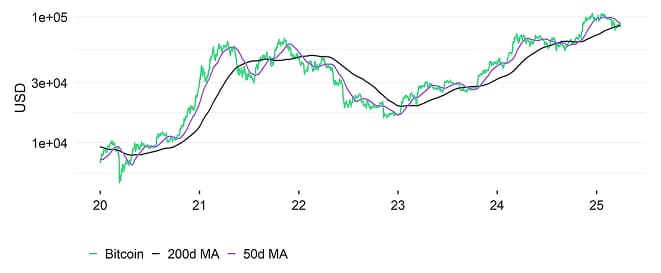

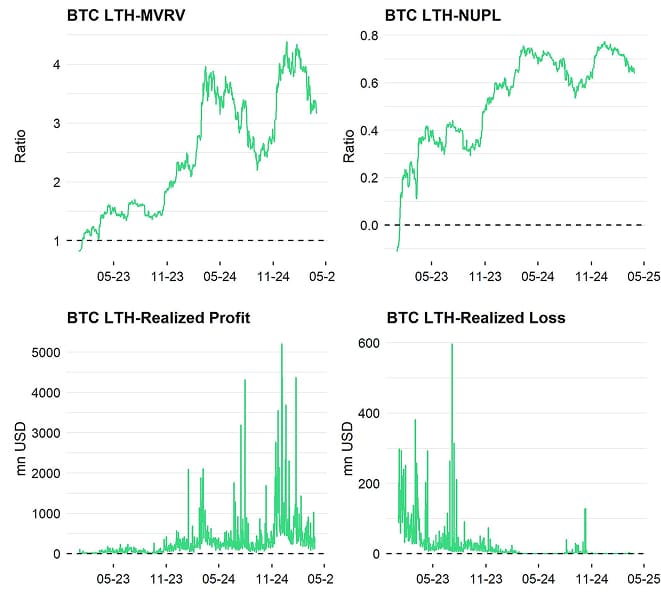

That being said, bitcoin has already experienced a drawdown of slightly more than -27% from peak to trough as most of the bad news and recession fears already appears to be reflected in the price.

This was also our take last month which we reiterate here again.

More specifically, Bitcoin's recent drawdown is already a US recession/growth rate cycle downturn probability of around 50% defined as an ISM Manufacturing Index below 50.

The key takeaway here is that US recession fears are already being priced into bitcoin and other cryptoassets as we speak but there might still be a little bit more downside left if a US recession actually materialises.

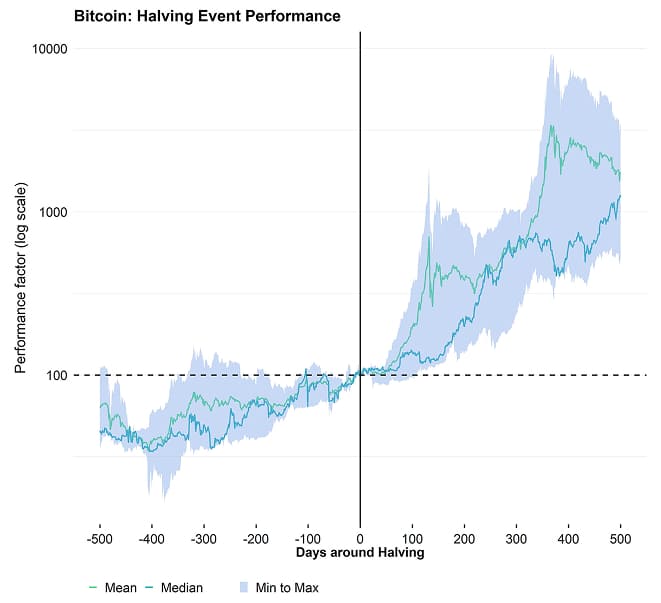

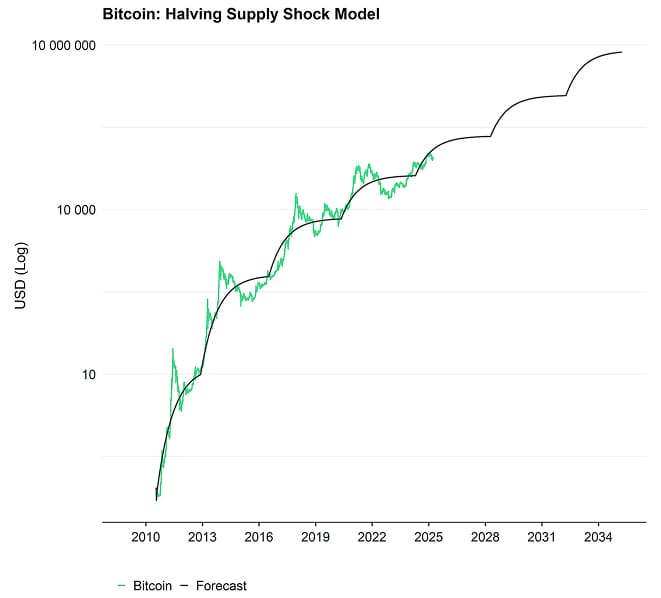

In this context, it is interesting to highlight the strong overlap of these macro business cycles with the Halving cycle. In fact, Bitcoin might very well be the “canary in the macro coal mine” as my colleague and CIO of Bitwise Matt Hougan has recently phrased it. Historically speaking, Bitcoin drawdowns tend to signal business cycle downturns well in advance.

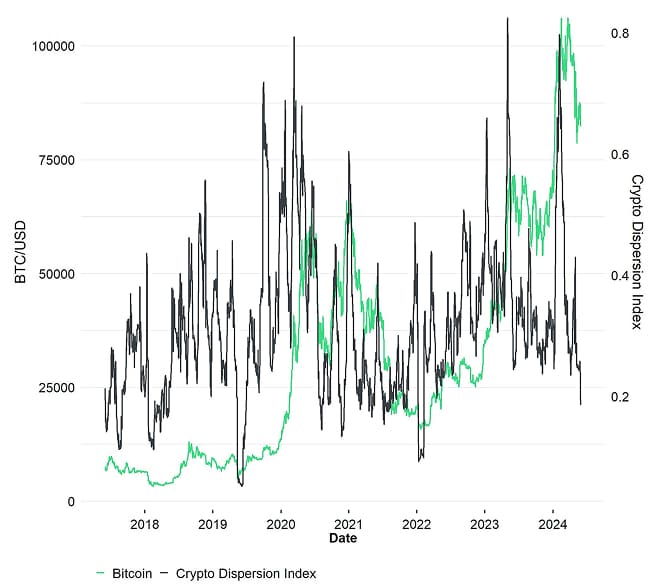

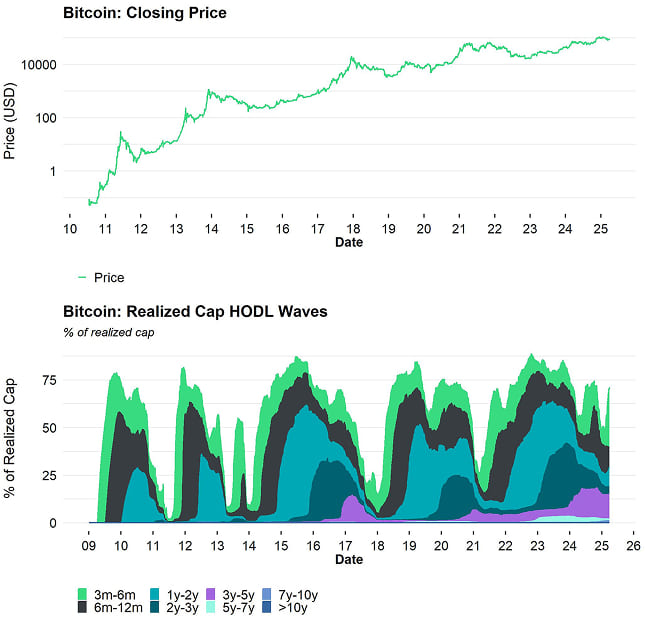

However, we think that Bitcoin should continue to be supported by the ongoing supply deficit emanating from last year's Halving event, as shown last month as well.

Besides, from a contrarian point-of-view, many indicators of also support this notion that we are close to “peak uncertainty” or “peak awareness” with respect to a potential risk of a recession.

Consider the following indicators:

- US economic policy uncertainty as high as during Covid (see chart above)

- Google search trends for the word “recession” also as high as during Covid

- Polymarket US recession odds are around 41% already

This appears to be priced in sentiment, flows and positioning data already judiging by our in-house Cryptoasset Sentiment Index which technically signalled a contrarian buying opportunity in late February as reported here as well.

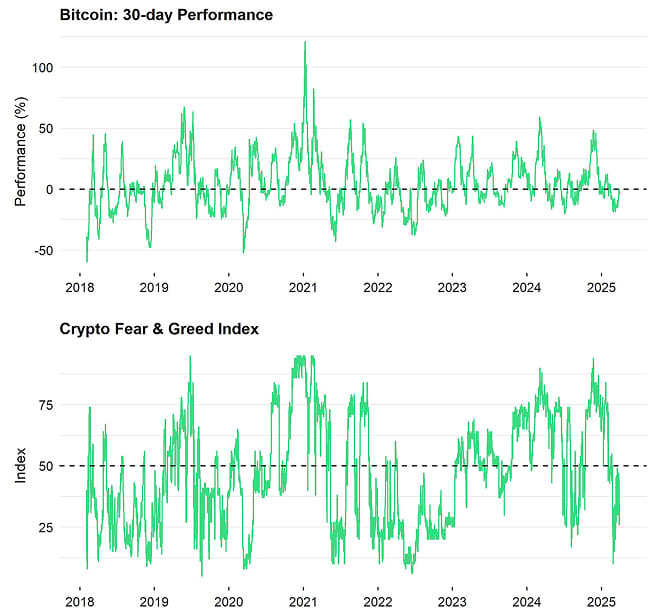

The Crypto Fear & Greed Index declined to the lowest level since FTX collapsed in November 2022.

What is more is that the bearishness in crypto sentiment has coincided with a significant bearishness in both retail (AAII survey) and institutional (Investor Intelligence survey) equity market sentiment which re-enforces the probability that this was most-likely the beginning of a renewed uptrend rather than the beginning of a bear market.

Moreover, despite record high macro uncertainty, we think that US regulatory uncertainty for cryptoassets more broadly continues to decline.

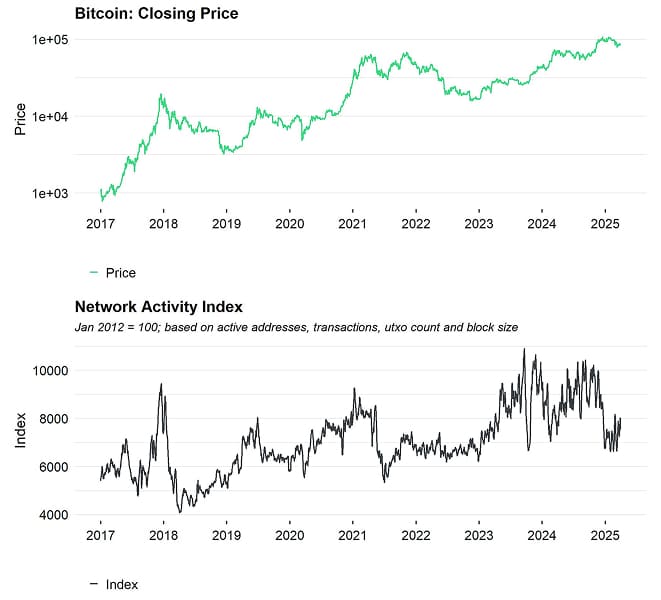

In general, we have seen a deterioration in overall on-chain activity more broadly. This could be a direct consequence of the record outflows from global crypto ETPs that appears to have emanated from the abovementioned increase in macro uncertainty.

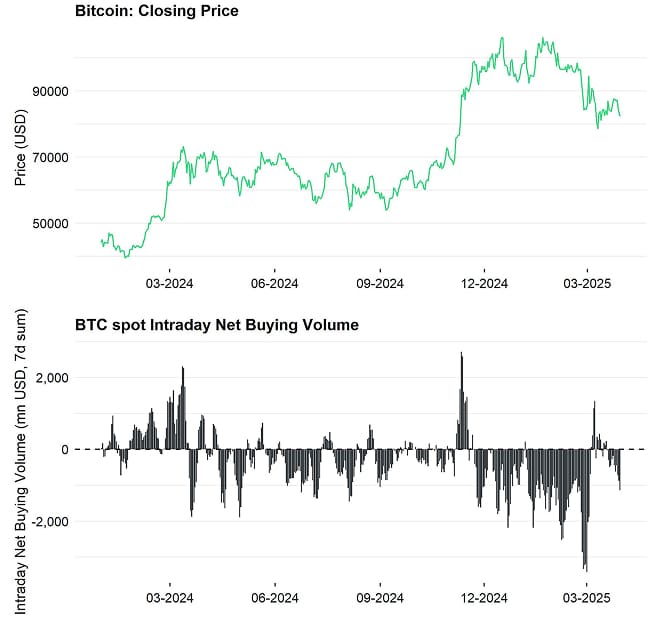

For instance, this was also reflected in the large intraday imbalance between buying and selling volumes on bitcoin spot exchanges as well. However, net selling volumes appear to be exhausted for the time being and more recently net buying volumes on bitcoin spot exchanges have even turned slightly positive again.

We had already flagged the decline in macro activity in our report in January 2025 and also the subsequent decline in on-chain activity for Bitcoin more recently as well in our report in March 2025.

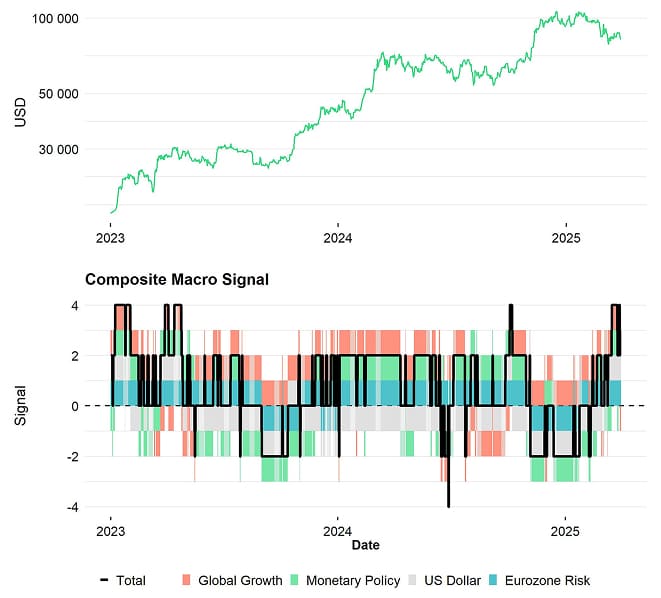

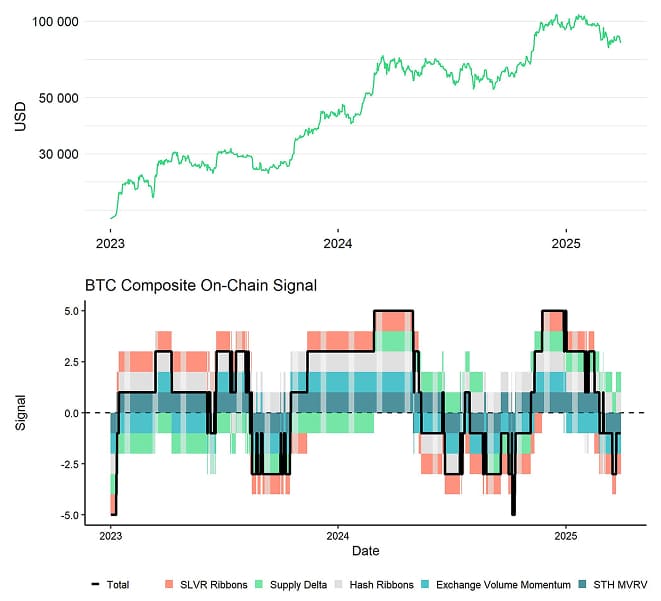

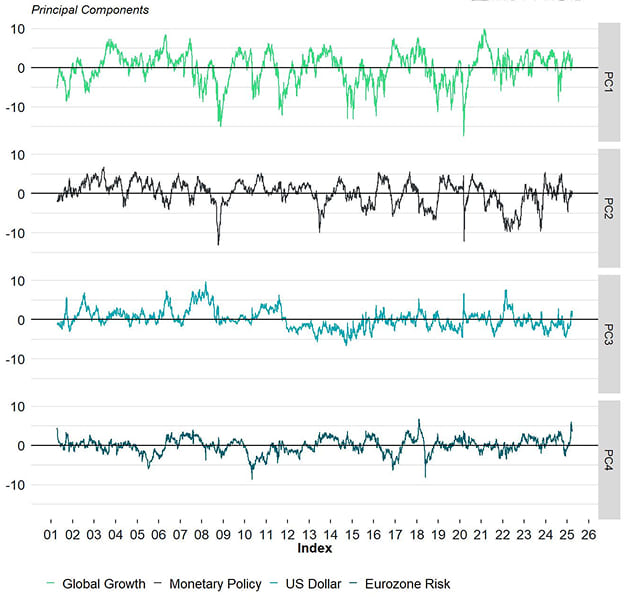

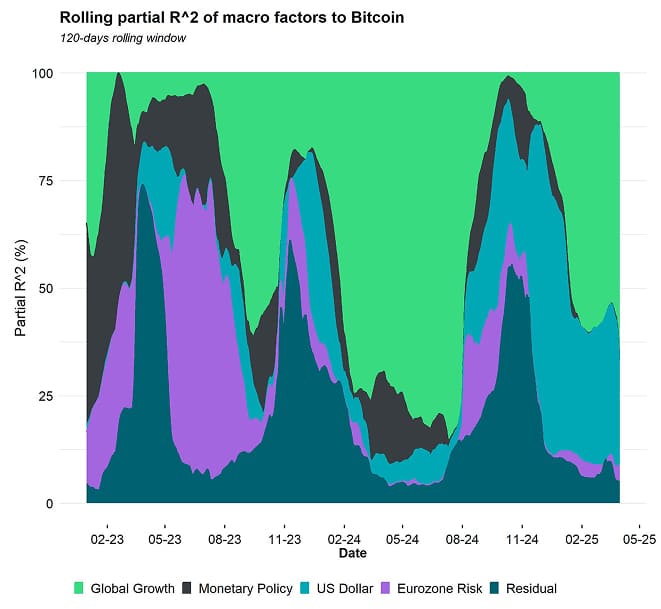

However, the macro equation has significantly improved again judging by our macro factor model for Bitcoin.

Based on past patterns, our expectation is that this significant improvement in macro factors more recently will reverse the weakness in broader bitcoin on-chain fundamentals with a lag again.

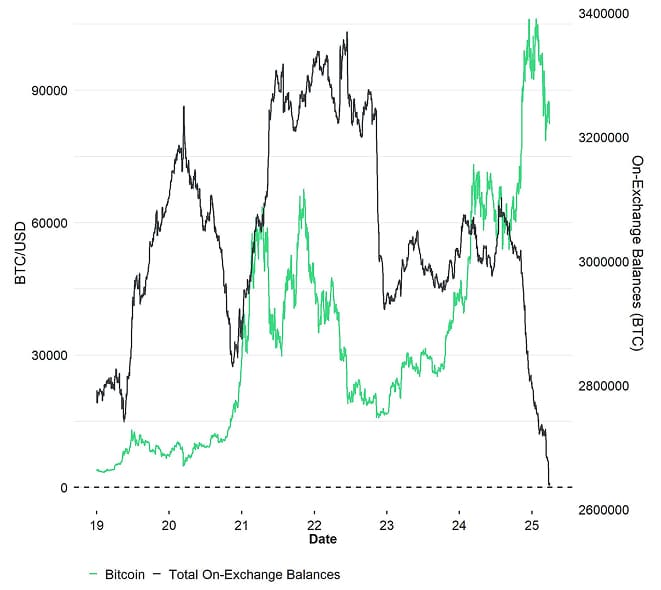

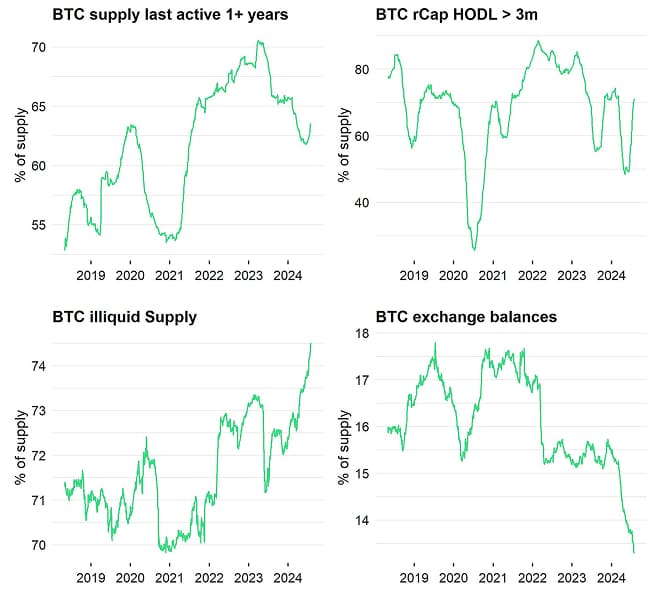

Moreover, the latest data provided by Glassnode imply that bitcoin on-exchange balances still continue to drift downwards which means that the liquid supply has continued to decline.

This should continue to support prices going forward and doesn't signal an imminent start of a bear cycle but rather a continuation of the current bull market.

Accumulation activity for Bitcoin has also accelerated to the highest level since March 2024 and is accelerating across all wallet cohorts with the exception of the 100 BTC – 1000 BTC cohort which is mostly reflecting the net outflows from spot Bitcoin ETFs.

Bottom Line: Bitcoin and cryptoassets have already priced in significant US recession fears, but some downside risk remains if a recession materializes. However, improving macro factors, declining exchange balances, and strong accumulation trends suggest continued long-term support for Bitcoin's bullish trajectory. Improving macro conditions should also improve on-chain activity with a lag.

Bottom Line

- Performance: Macro uncertainty, driven by hawkish U.S. trade rhetoric and rising recession risks, weighed heavily on risk assets in March, while safe-haven assets outperformed. However, corporate bitcoin accumulation hit record highs, creating a supply deficit and offering key support to Bitcoin despite broader market weakness.

- Macro: Rising economic policy uncertainty in the US has weighed on risk assets, with worsening consumer confidence and government job cuts amplifying recession fears. While the Fed faces a policy dilemma between supporting growth and controlling inflation expectations, lower realized inflation and rising unemployment could push them toward more rate cuts in 2025.

- On-Chain: Bitcoin and cryptoassets have already priced in significant US recession fears, but some downside risk remains if a recession materializes. However, improving macro factors, declining exchange balances, and strong accumulation trends suggest continued long-term support for Bitcoin's bullish trajectory. Improving macro conditions should also improve on-chain activity with a lag.

Appendix

Cryptoasset Market Overview

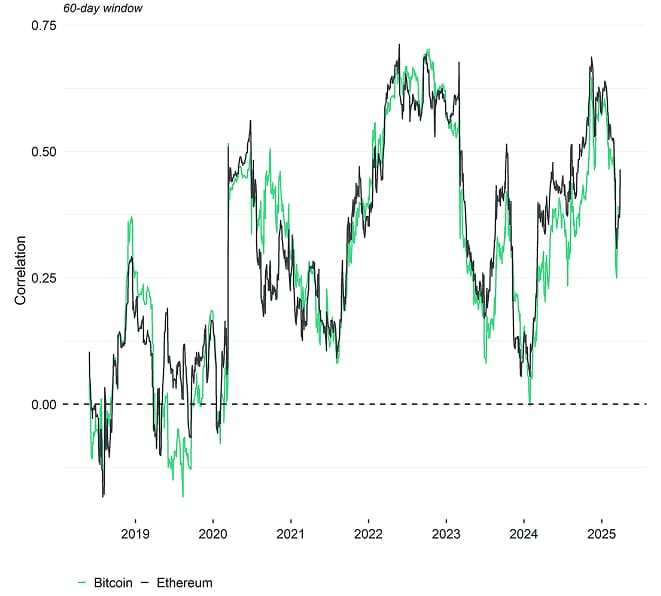

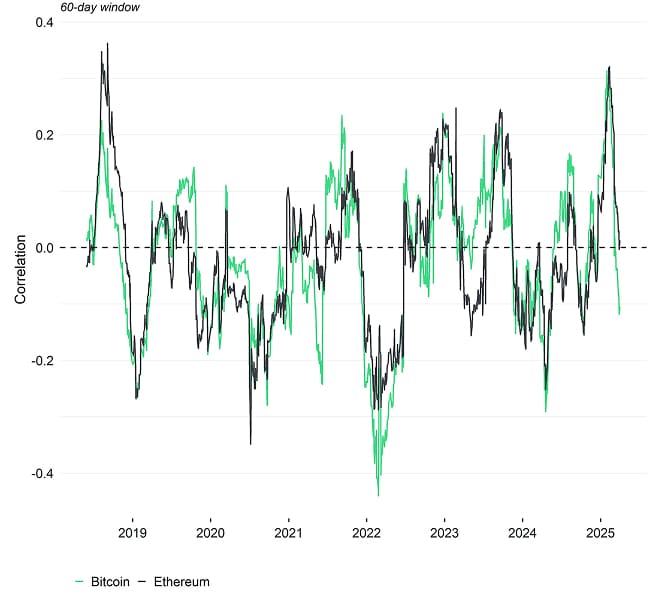

Cryptoassets & Macroeconomy

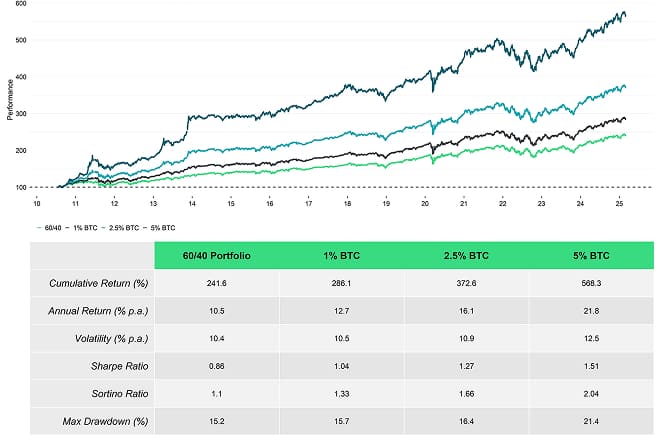

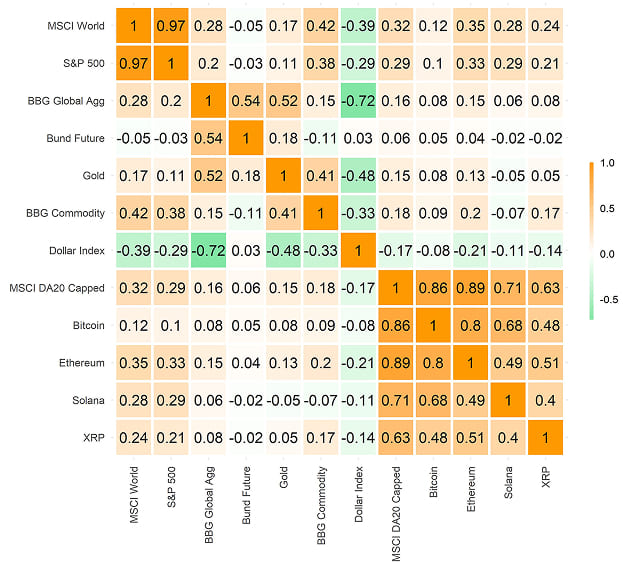

Cryptoassets & Multiasset Portfolios

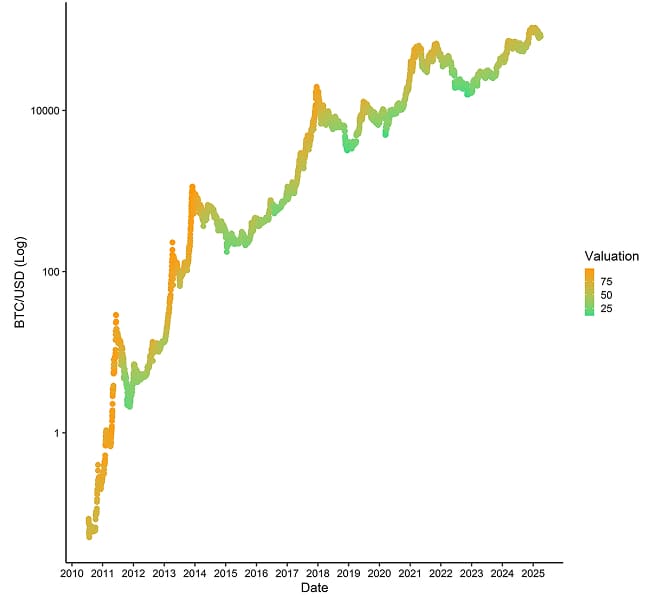

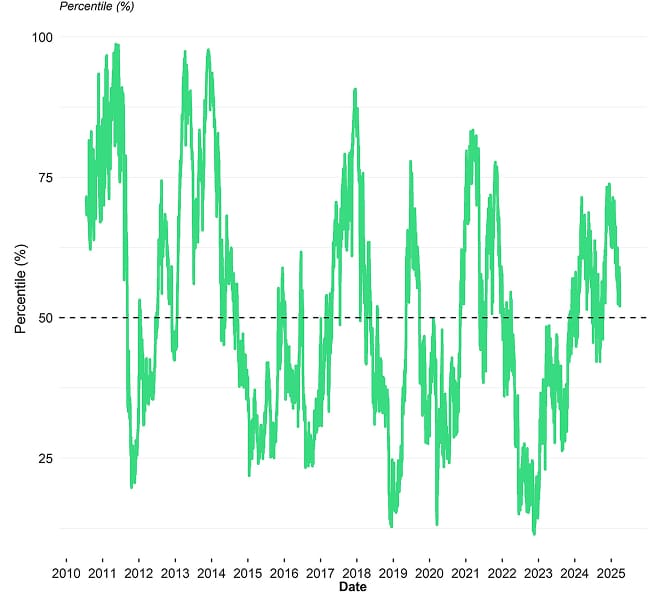

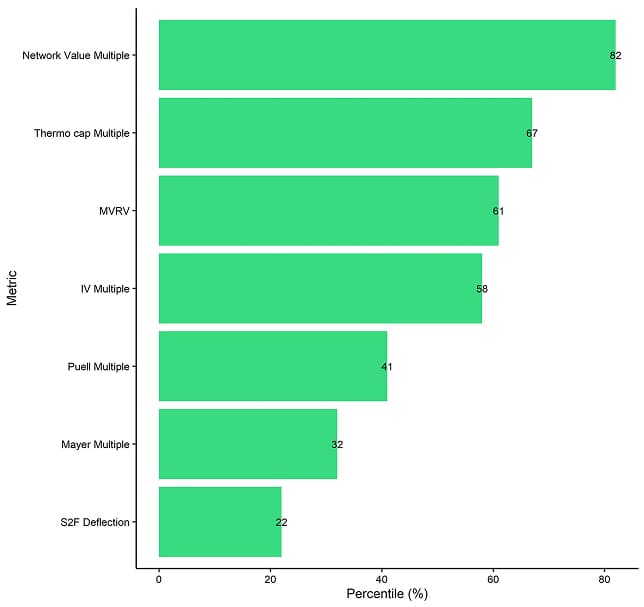

Cryptoasset Valuations

On-Chain Fundamentals

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

en

en  fr

fr  it

it  es

es