- Performance: In September, cryptoassets, particularly Bitcoin and gold, outperformed traditional assets like equities and bonds, driven by central bank easing measures, and Bitcoin's historically poor September performance was positively surprising with a +7.4% gain. With further Fed rate cuts expected and seasonal trends favouring strong performance in the final months of the year, Bitcoin and other cryptoassets are anticipated to benefit from increasing liquidity and could see significant gains through 2025.

- Macro: A US recession remains our base case for the time being on account of several leading labour market indicators that still signal an increase in the US unemployment rate. That being said, a US recession may not be as detrimental to Bitcoin and other crypto assets as some might fear. On the contrary, it could lead to greater expectations of Fed rate cuts and US Dollar weakness, which might actually provide a tailwind for Bitcoin. The rising global liquidity tide will be a strong support for scarce assets like Bitcoin over the coming months and well into 2025.

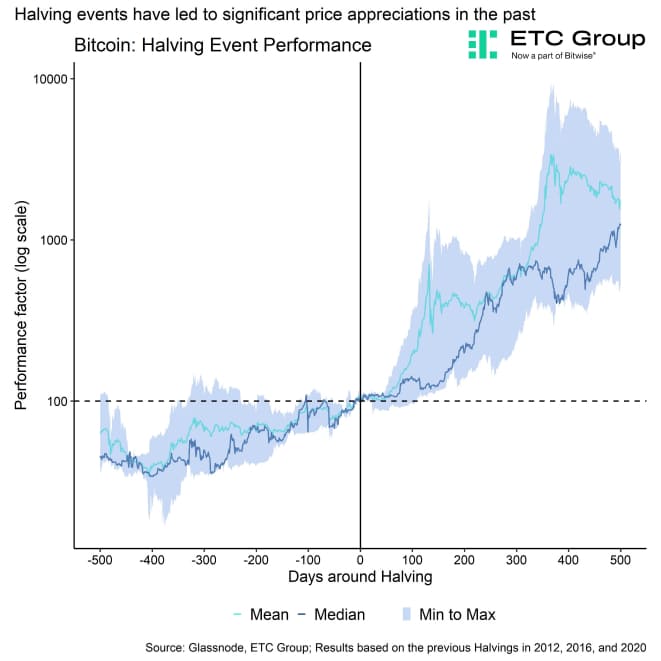

- On-Chain: If past Bitcoin Halving events are any guide, the Halving effect is becoming increasingly significant since late July/early August this year. However, retail participation still remains somewhat subdued, but we expect a pick-up in Q4 due to more favourable seasonality. All in all, several on-chain metrics for illiquid supply imply that bitcoin’s supply scarcity due to the Having and renewed accumulation is indeed intensifying.

Chart of the Month

Performance

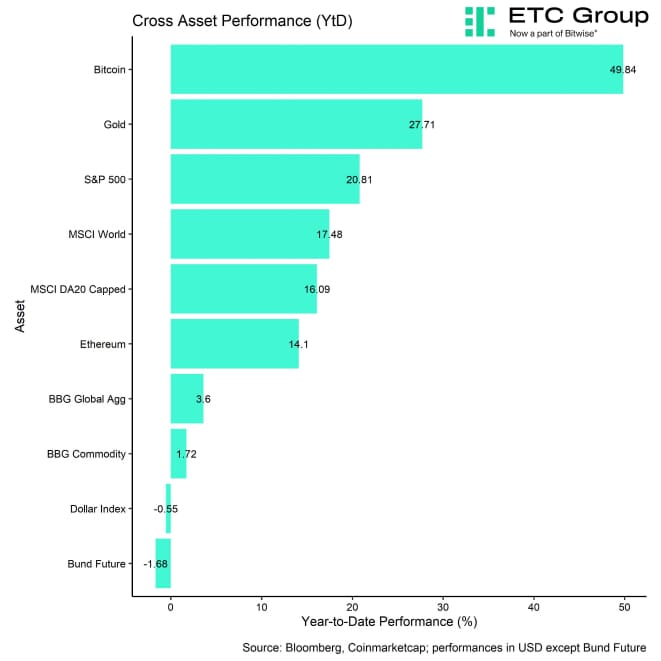

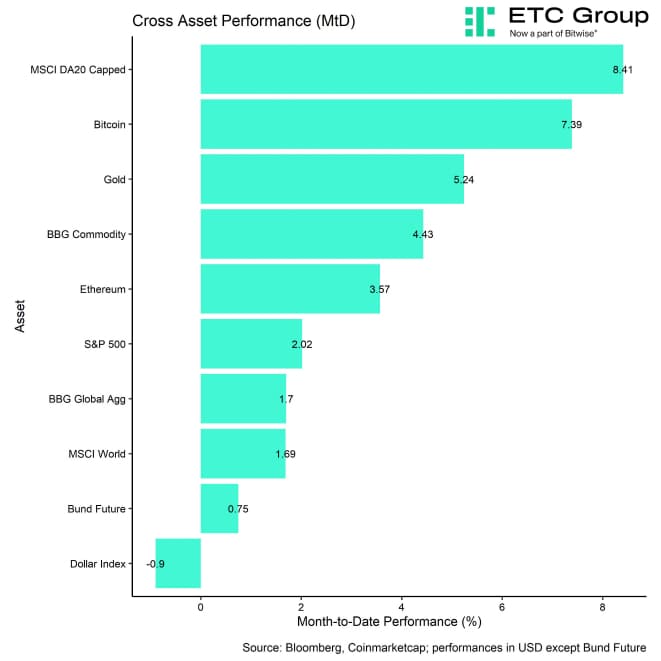

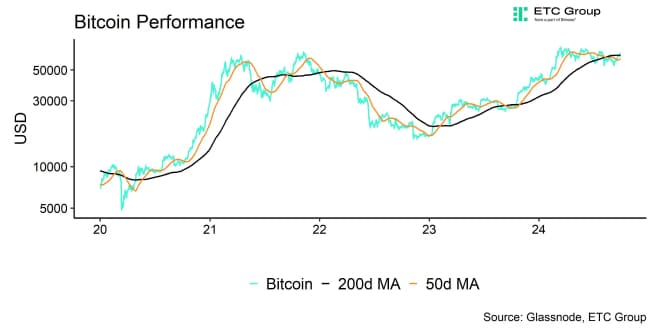

September was characterized by an outperformance of cryptoassets and Bitcoin against major traditional assets including gold. Both cryptoassets and gold outperformed global equities and bonds in September.

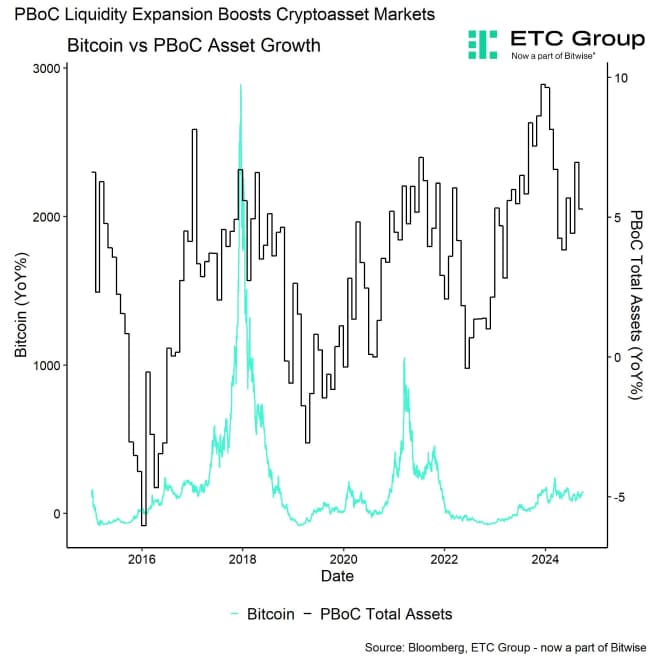

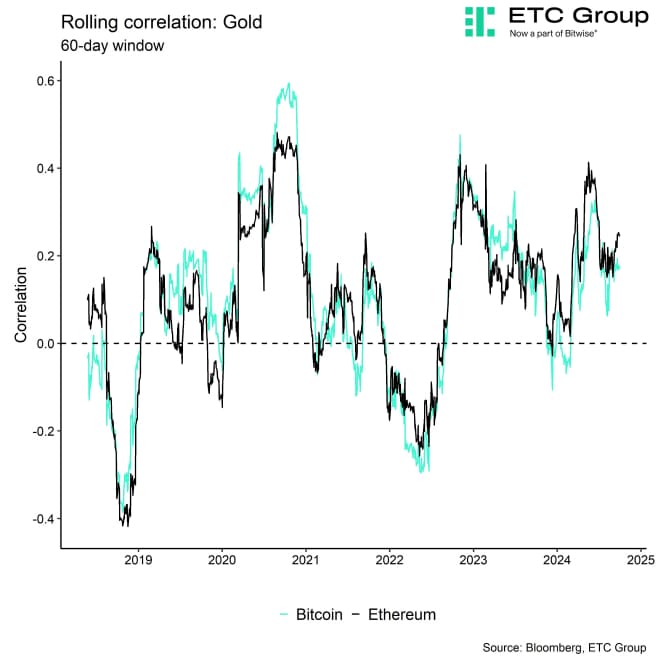

The outperformance of hard assets like bitcoin and gold in September was also consistent with policy actions by major central banks such as the Fed and the PBoC which reduced key interest rates and reserve requirement ratios for banks. Bitcoin and gold remain the best-performing assets year-to-date.

The “Fed pivot” has finally arrived and it is quite likely that the most recent interest rate cuts are just the beginning of a more protracted global monetary policy easing cycle that will last well into 2025. Markets are still pricing in additional 200 bps in Fed rate cuts until the end of 2025 and a terminal rate of ~3% which is also consistent with the long-run rate telegraphed by the Fed itself.

An ongoing easing cycle should provide a significant tailwind for scarce assets like Bitcoin and other cryptoassets which stand to profit the most from an easing in financial conditions and an increase in global liquidity.

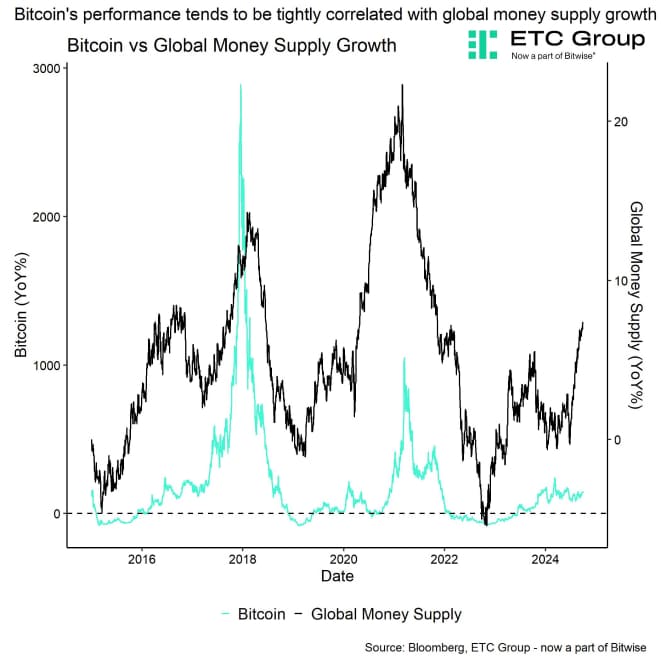

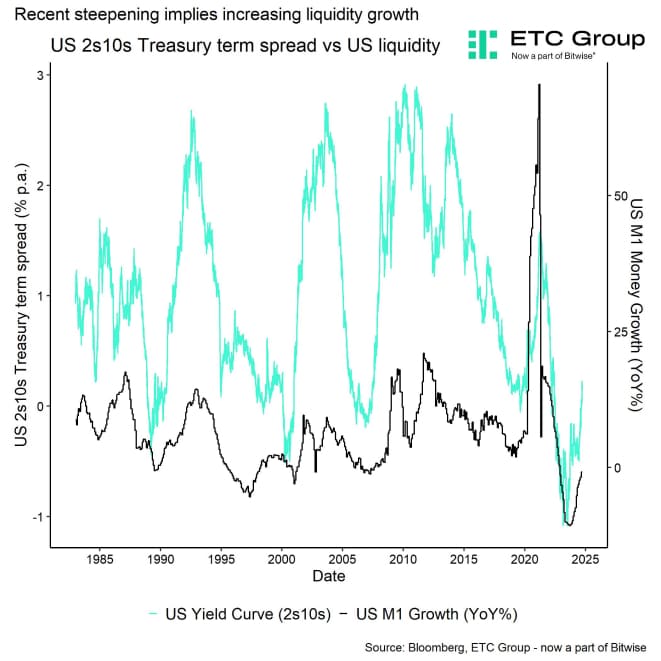

In general, Fed interest rate cuts are historically associated with an increase in narrow monetary aggregates such as M1 (“liquidity”) that are stimulated by an increase in bank lending activity (Chart-of-the-Month).

It is quite likely that cryptoassets (once again) could be the best asset class in 2025 as global money supply has already reached a new all-time high and is currently accelerating.

As far as performance seasonality is concerned, September tends to be the worst month for Bitcoin's performance historically which is why the latest positive performance of +7.4% in September has positively surprised most market participants. What is probably even more important is the fact that the performance seasonality for Bitcoin will continue to improve over the coming months.

On average, October and November have delivered a monthly performance for Bitcoin of 29.5% and 37.9%, respectively, based on our own calculations since 2010 based on Glassnode data. So, we expect the positive performance in September to continue in Q4 as well.

Since reaching its all-time high in March 2024, the market has been stuck in what we call "chopsolidation"-a volatile but consolidating range-bound market. This stagnation was due to factors like government bitcoin sales, the Mt. Gox trustee's bitcoin distributions, and macroeconomic capitulation in August 2024. We anticipate that bitcoin will break out of its chopsolidation phase in Q4, with the Fed's recent pivot potentially serving as the perfect catalyst for the next leg up.

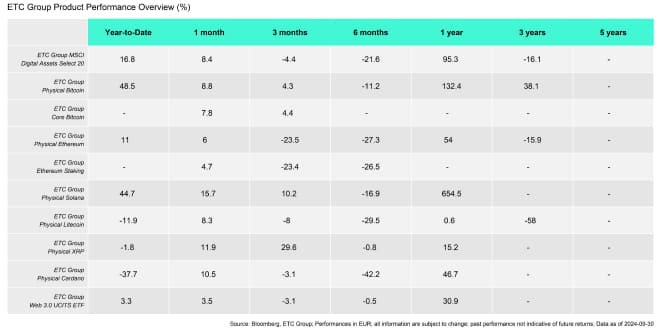

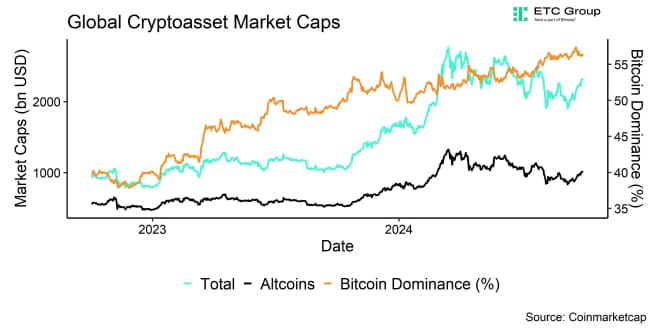

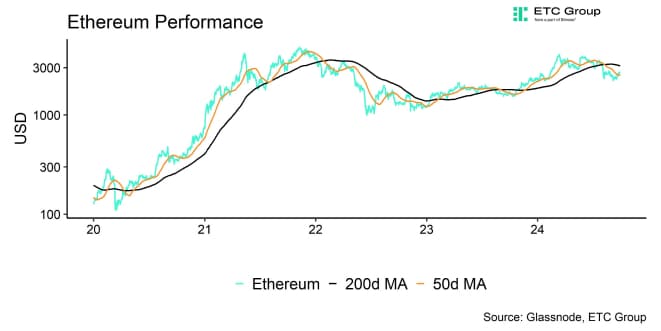

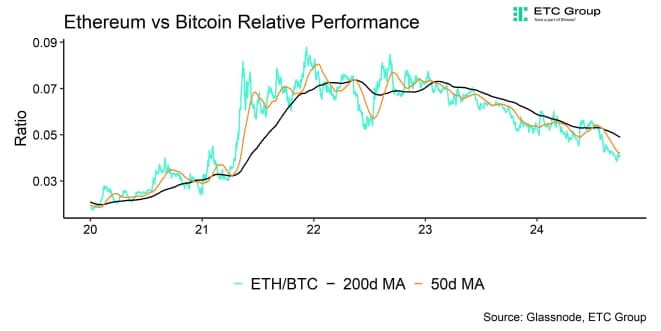

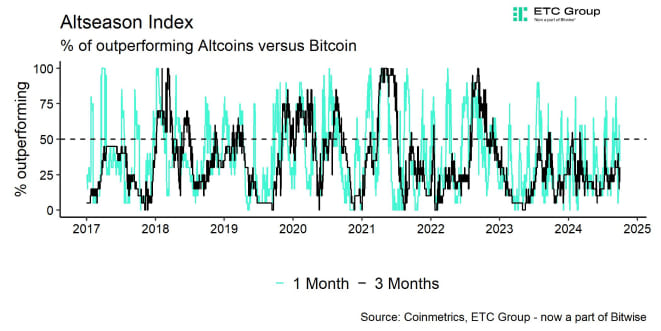

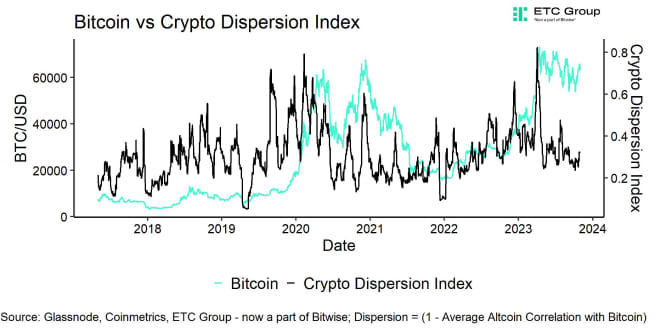

Altcoins generally managed to outperform Bitcoin in September which is why the MSCI Global Digital Assets Select 20 Capped Index also outperformed strongly.

A closer look at our product performances also reveals that high-beta altcoins such as Solana managed to outperform Bitcoin while Ethereum slightly underperformed Bitcoin in September:

Bottom Line: In September, cryptoassets, particularly Bitcoin and gold, outperformed traditional assets like equities and bonds, driven by central bank easing measures, and Bitcoin's historically poor September performance was positively surprising with a +7.4% gain. With further Fed rate cuts expected and seasonal trends favouring strong performance in the final months of the year, Bitcoin and other cryptoassets are anticipated to benefit from increasing liquidity and could see significant gains through 2025.

Macro Environment

"The time has come," remarked Federal Reserve Chairman Jerome Powell during August's Jackson Hole symposium. Indeed, on the 18 th of September, the Fed finally reduced its federal funds target rate by 50 basis points to 5.00% (upper limit), exceeding market expectations ahead of the FOMC meeting. In other words, the Fed pleasantly surprised the markets with this rate cut.

This move by the Fed is following other major central banks such as the ECB, Bank of Canada, SNB, Bank of England and even the People's Bank of China who all have reduced their key interest rates this year already.

To be more precise, the also PBoC reduced the rate on medium-term loans for one year by the greatest amount ever-from 2.3% to 2.0%. The MLF rate is thought to be the PBoC's primary policy rate.

In addition, the PBoC declared that the reserve requirement ratio for commercial banks would be lowered by 50 basis points in order to inject more than 1 trillion CNY in liquidity into the Chinese banking system.

In addition, the PBoC announced lowering mortgage rates and first-time house buyer down payments, which were bolstered by lowering property purchase restrictions in major cities including Shenzhen, Guangzhou, and Shanghai.

The ECB, the Fed, and the Bank of England are just a few of the significant central banks that have begun to loosen monetary policy in tandem with the PBoC's most recent actions.

Thus, it is evident that a global easing cycle is about to begin, and this will likely provide Bitcoin and other cryptoassets a big boost in the future.

As far as the Fed is concerned, it's quite likely that the Fed is merely beginning its cycle of rate reductions:

As of now, markets are already pricing in an additional 75 basis points in cuts by the end of the year, with approximately another 125 basis points in reductions expected by the close of 2025.

The Fed has also signalled further cuts through its latest Summary of Economic Projections (SEP), often referred to as the "dot plot" until a terminal rate/long-run rate of 3% p.a. will be achieved. Fed Funds Futures markets are in line with these telegraphed forward guidance by the Fed so far.

In this context, it should be noted that projections by the FOMC do not possess the best track record:

For instance, while the US economy was already in a recession, the FOMC's projections failed to forecast it in their June 2008 meeting (the recession officially already began in December 2007). There are similar instances in the past before prior US recessions. So, FOMC projections should generally be taken with a big grain of salt.

What is more is that, despite the larger-than-anticipated 50 basis point cut, the Fed may still be "behind the curve." For instance, a standard Taylor rule, which takes into account unemployment and core PCE inflation, suggests that a target rate closer to 3.6% is justified given the current economic and inflationary trends.

Moreover, the latest Bank of America fund manager survey shows that, as of September 2024, monetary policy was still considered "too restrictive"-in fact, the most restrictive since October 2008, according to the survey.

The Fed officially cut its target rate because of deteriorating labour market conditions which have heightened recession risks more recently.

Indeed, the risk of a US recession remains elevated, with several reliable indicators, including the well-known "Sahm rule," still triggered. This indicator was also featured in one of our weekly reports. Newest layoff estimations by the Fed of Minneapolis also imply that the true level of layoffs remains underestimated by the well-known JOLTS dataset.

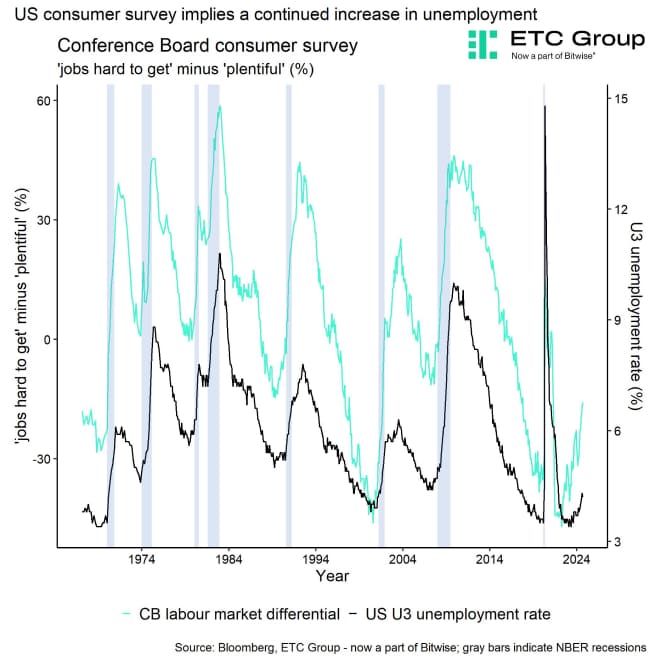

Moreover, the latest Conference Board survey implies that the unemployment rate will continue to climb over the coming months. The spread between the % of consumers reporting „jobs hard to get“ relative to „jobs plentiful“ has risen to a fresh multi-year high.

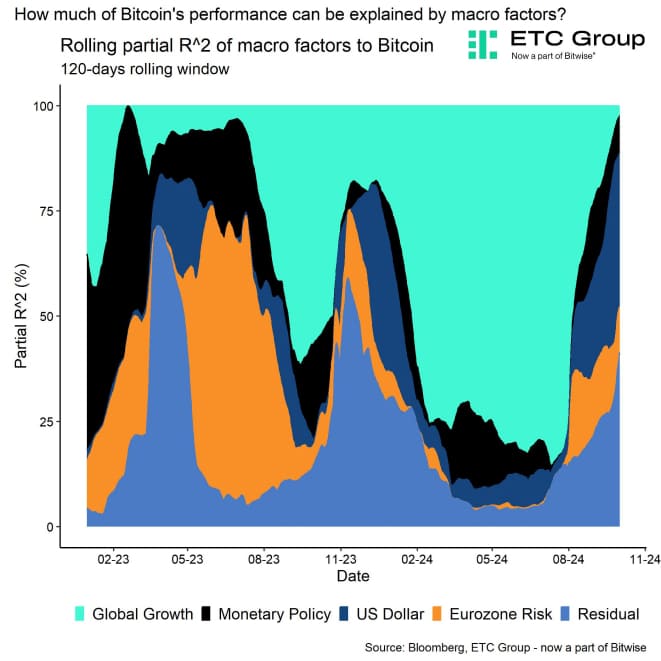

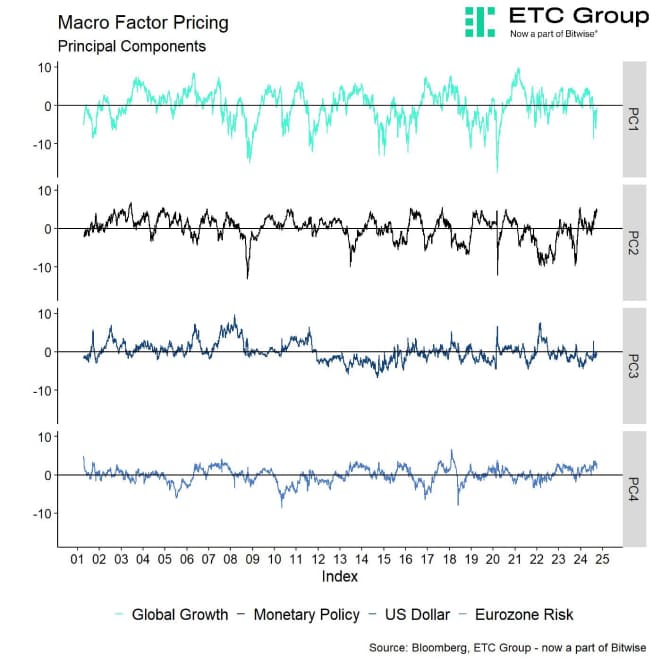

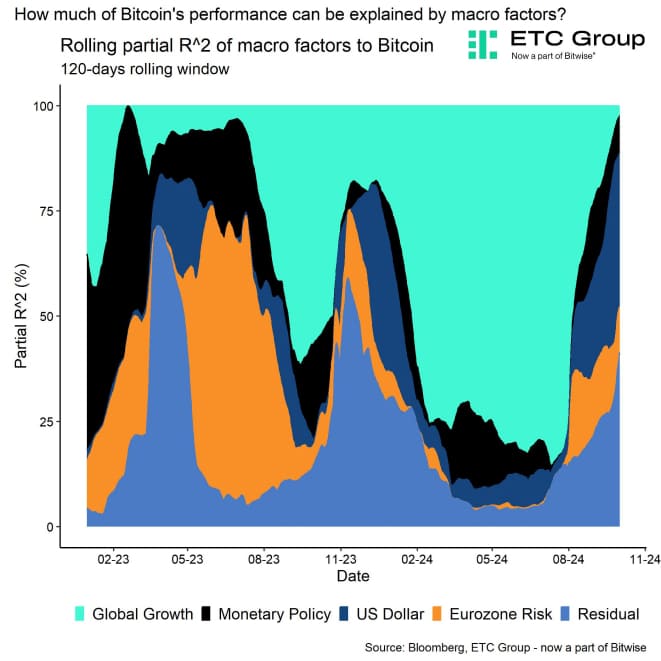

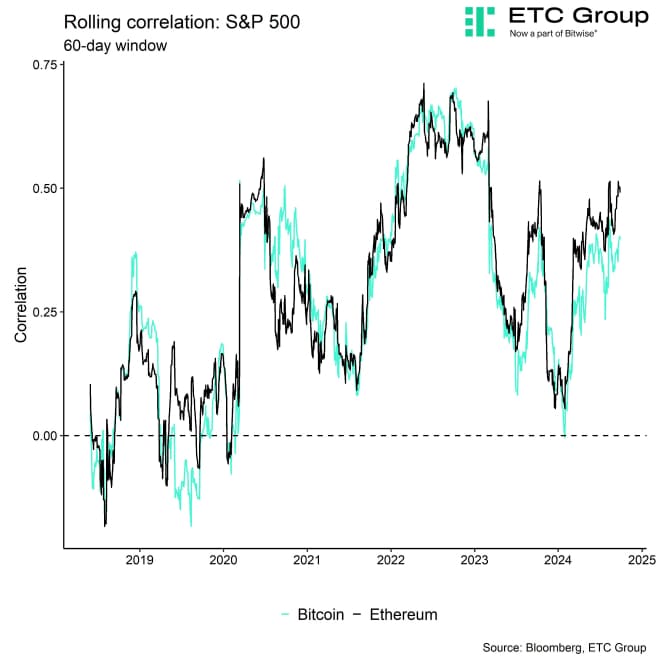

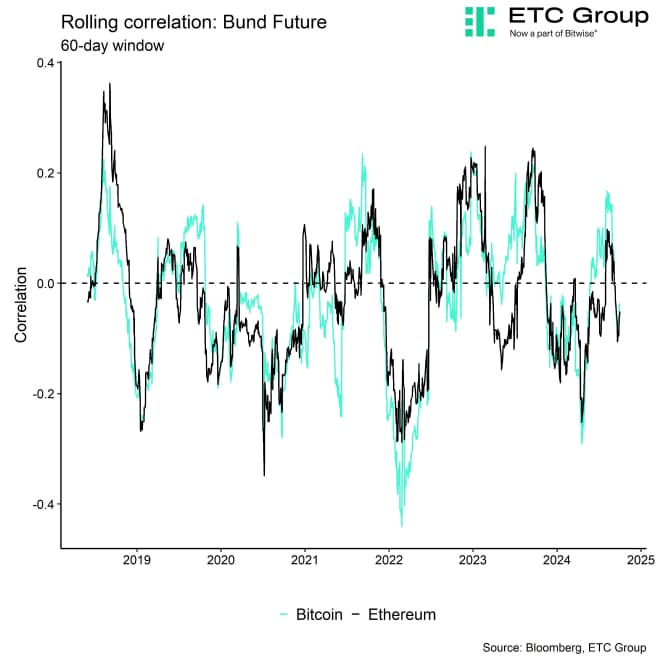

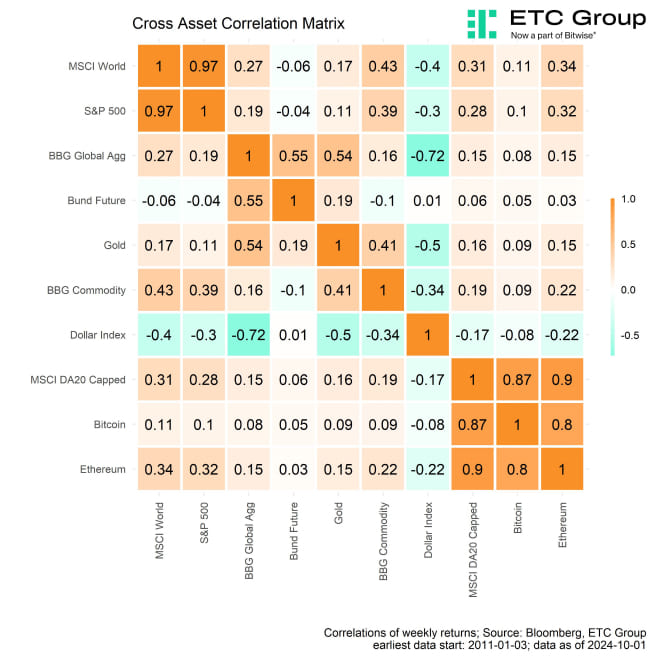

è However, our quantitative analysis suggests that global growth has become less crucial for bitcoin's performance, while other factors such as monetary policy and the US Dollar are becoming increasingly significant.

In other words, a US recession may not be as detrimental to Bitcoin and other crypto assets as some might fear. On the contrary, it could lead to greater expectations of Fed rate cuts and US Dollar weakness, which might actually provide a tailwind for Bitcoin.

With the Fed's latest moves, alongside actions from other major central banks like the PBoC, global liquidity is clearly on the rise. Global money supply has already reached new record highs and is accelerating. Historically, periods of expansionary money supply growth have been linked to bitcoin bull markets.

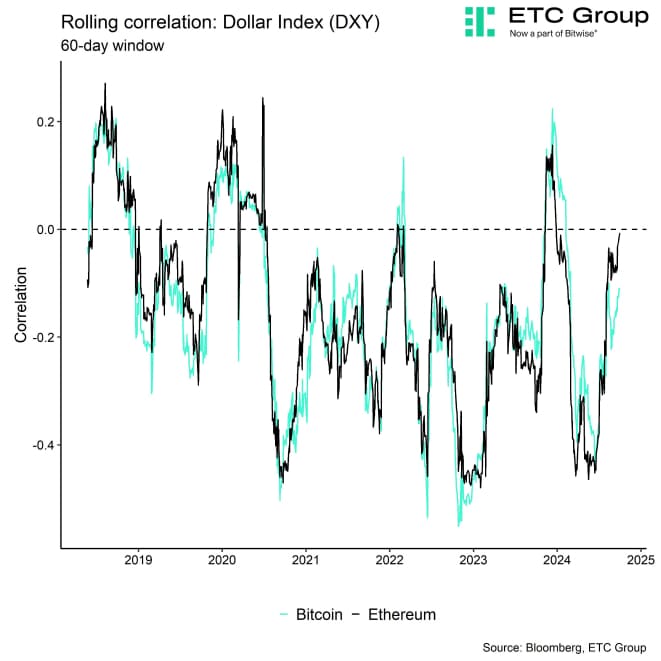

In fact, the latest data imply that Bitcoin has been most influenced by the US Dollar and coin-specific factors such as the Halving.

More specifically, the US Dollar and coin-specific factors alone have already explained more than 75% of the performance variation in Bitcoin over the past 120 trading days.

In plain English: Bitcoin doesn't seem to care about potential US recessions risks anymore.

At the time of writing, the 120-day rolling correlation between Bitcoin's performance and the Dollar Index (DXY) has been around -0.19. So, any Dollar depreciations should be associated with Bitcoin appreciations and vice versa.

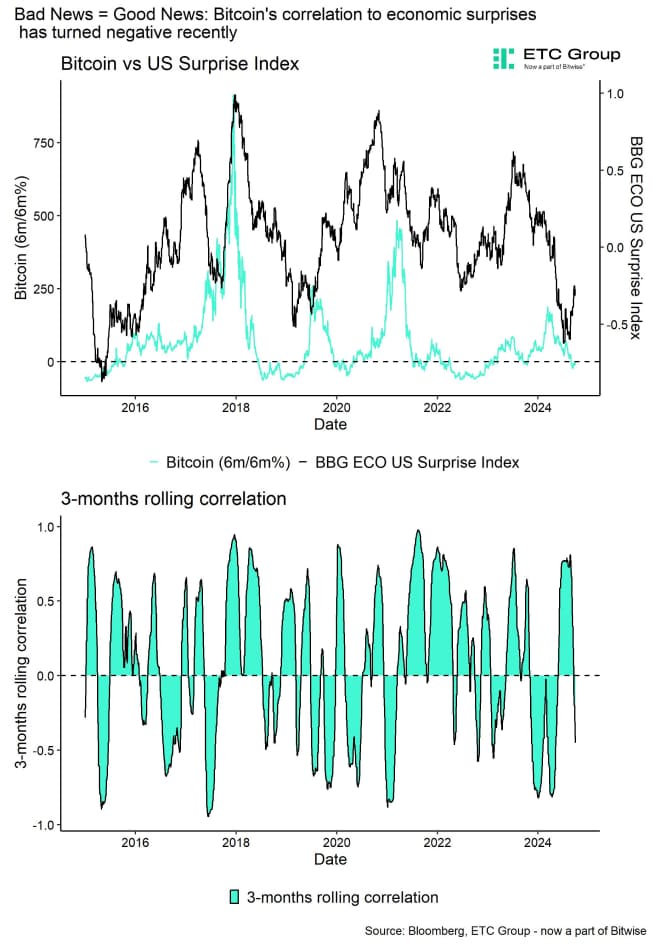

Furthermore, we are also observing increasing evidence that we are entering a kind of “bad new = good news” environment as the 3-months rolling correlation between US economic surprises and Bitcoin's performance has recently turned negative.

In this context, the re-steepening of the US yield curve, often viewed as a recessionary indicator, also signals increasing liquidity, which bodes well for scarce assets like bitcoin.

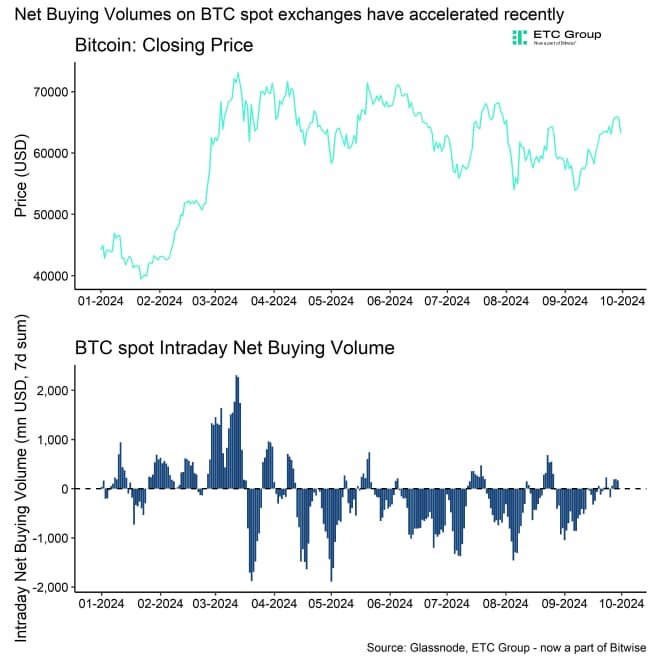

From the demand side, we have also seen an acceleration in net inflows into spot Bitcoin ETFs more recently that have pushed the price above 65k USD again. This has also improved net buying volumes on BTC spot exchanges more recently. Weekly flows net inflows into global crypto ETPs have recently topped 1.2 bn USD as highlighted in our latest weekly report of which US spot Bitcoin ETFs have accounted for almost 1.1 bn USD in net inflows.

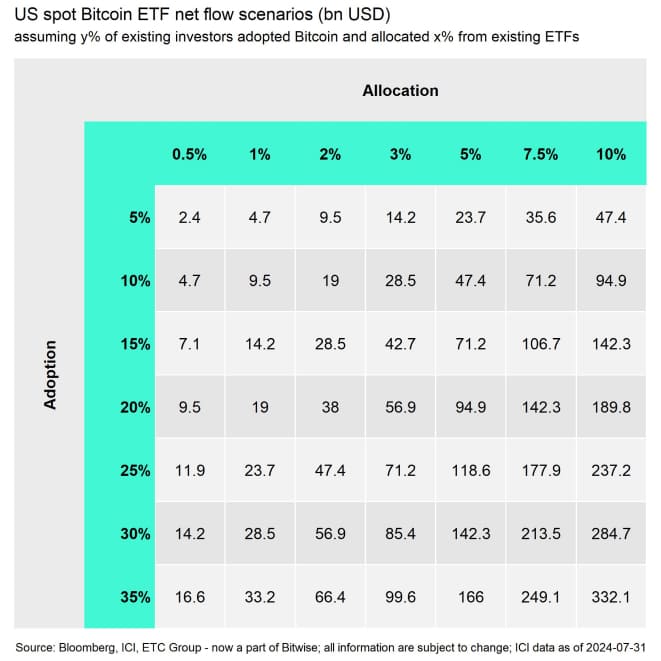

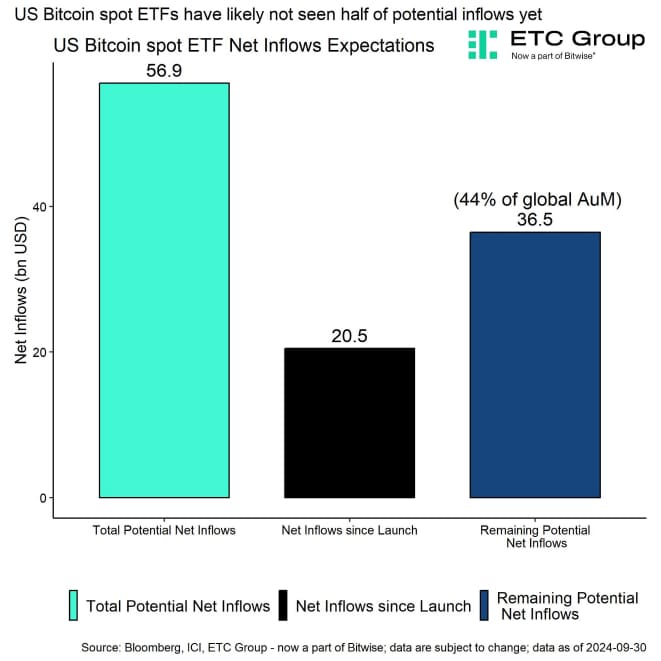

Despite the recent acceleration and sizeable net inflows we have seen in 2024 already, we still expect that the lion's share of structural flows into US Bitcoin spot ETFs is still ahead of us.

For instance, under the conservative assumption that only 20% of total passive ETF investments in the US were substituted by a 3% allocation in Bitcoin ETFs, we would still look at potential additional net inflows of around +37 bn USD (~44% of global Bitcoin AuM).

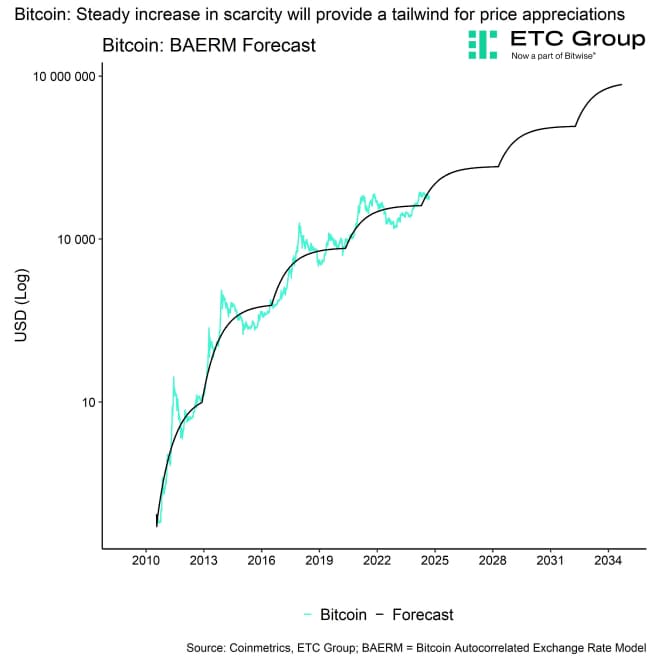

Thus, there appears to be a perfect convergence between rising potential demand, driven by global money supply and ETP flows, and decreasing available supply, resulting from the halving.

Moreover, in case of a US recession, the Fed may even cut rates more than is currently anticipated by markets.

We have highlighted that the Fed has on average cut its target rate by 340 bps during US recessions in last month's report as well. Fed Funds Futures are currently pricing a terminal rate of slightly below 3%, i.e. additional 200 bps in cuts until March 2026.

With the most recent geopolitical escalation in the Middle East and Eastern Europe, geopolitical risks are certainly on the rise. However, we just wanted to highlight in this context one of our previous quantitative pieces that demonstrates that Bitcoin may provide an effective hedge against a rise in geopolitical risks.

Bottom Line: A US recession remains our base case for the time being on account of several leading labour market indicators that still signal an increase in the US unemployment rate. That being said, a US recession may not be as detrimental to Bitcoin and other crypto assets as some might fear. On the contrary, it could lead to greater expectations of Fed rate cuts and US Dollar weakness, which might actually provide a tailwind for Bitcoin. The rising global liquidity tide will be a strong support for scarce assets like Bitcoin over the coming months and well into 2025.

On-Chain Developments

The abovementioned global liquidity boost coincides with growing supply scarcity for bitcoin, which has intensified following the most recent halving event in April 2024. Our analysis indicates that the full impact of the halving takes time to materialize, as the supply deficit tends to accumulate gradually. Read our full Bitcoin Halving report here.

More specifically, the statistical evidence suggests that the positive effect emanating from the supply shock of the Halving starts to become statistically significant around 100 days after the Halving.

So, if past Halving events are any guide, the Halving effect is becoming increasingly significant since late July/early August this year.

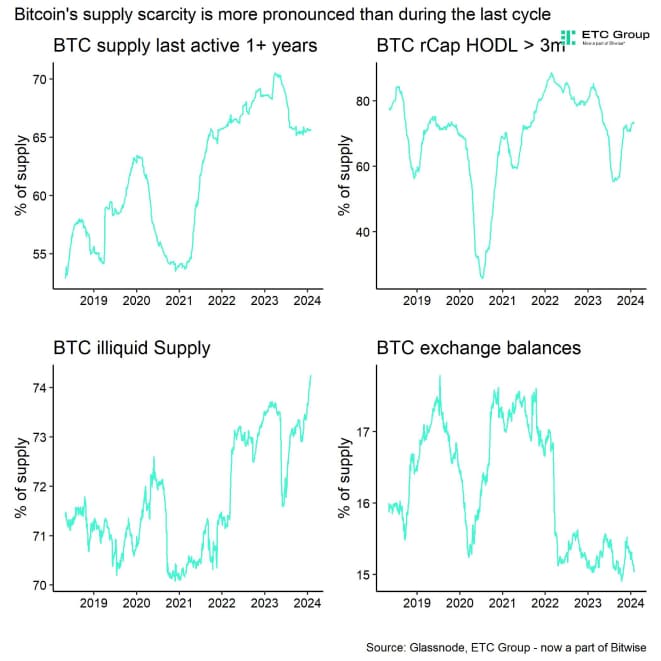

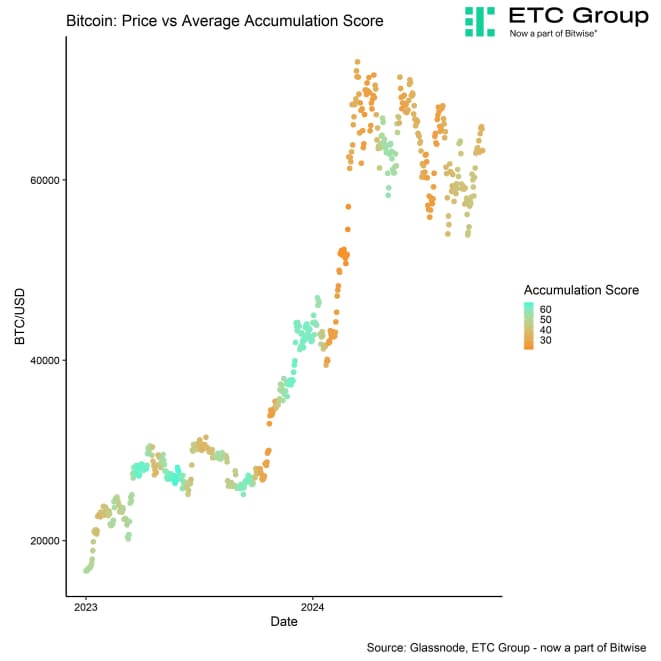

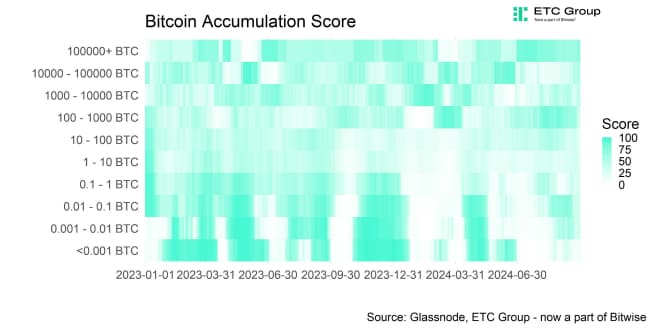

In fact, there is increasing evidence that Bitcoin‘s supply scarcity is intensifying.

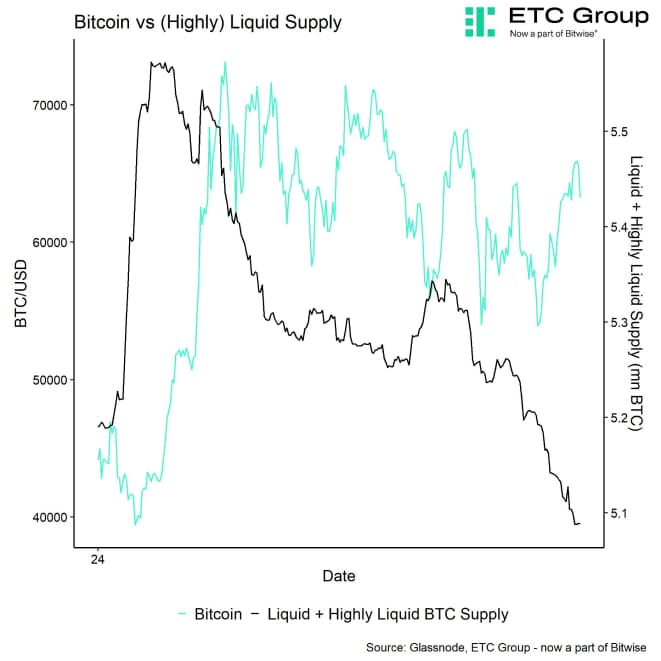

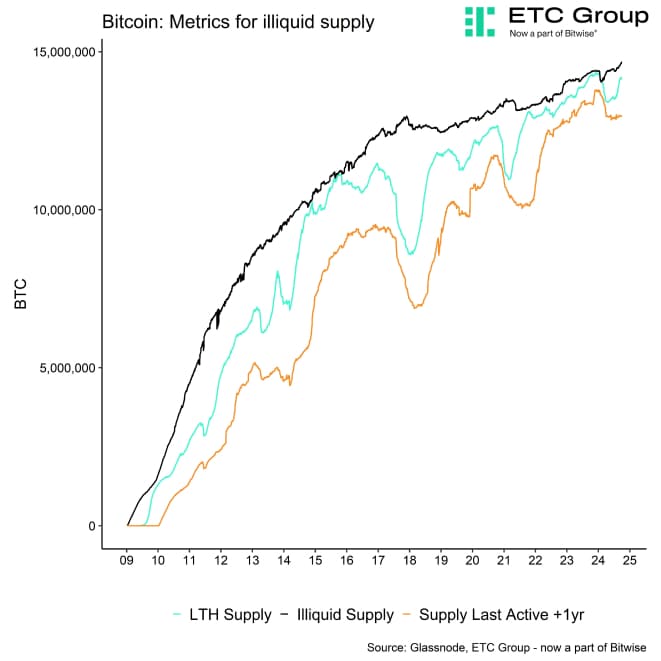

For instance, „illiquid“ supply of Bitcoin has reached a new all-time high and while an aggregate measure of „highly liquid“ and „liquid supply“ has also reached fresh year-to-date lows according to data provided by Glassnode.

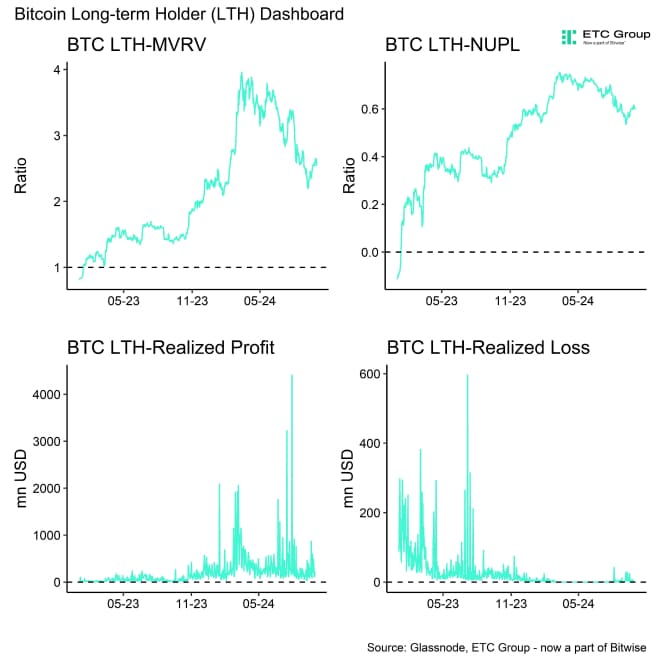

We are generally observing that measures of illiquidity have stabilised and/or are continuing to go up. For instance, the illiquid supply metric by Glassnode has recently reached a new all-time high. Long-term holder (LTH) BTC supply is also approaching its previous all-time high again. However, BTC supply held more than 1 year has not reclaimed its previous all-time highs but has only stabilised more recently:

All in all, these metrics imply that bitcoin's supply scarcity due to the Having and renewed accumulation is indeed intensifying.

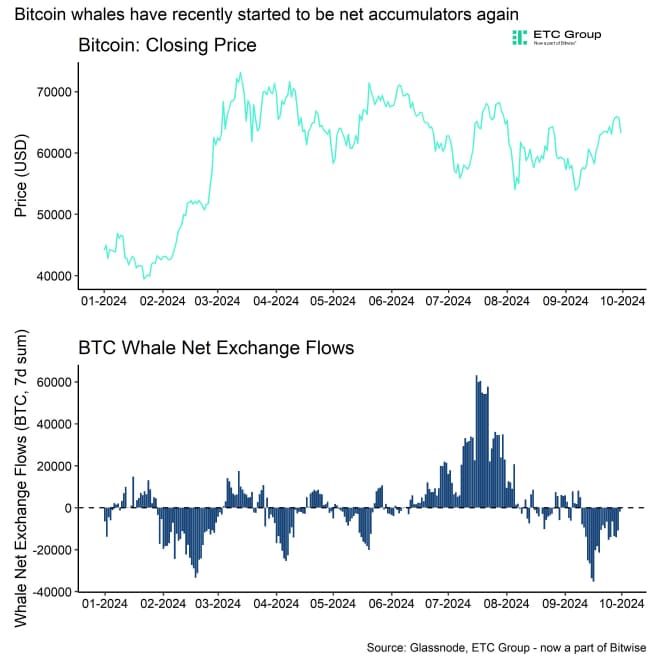

Meanwhile, BTC exchange balances have decreased to a 3-months low following one of the biggest BTC whale exchange transfers off exchanges this year according to data provided by Glassnode.

Alternative data provided by CryptoQuant on BTC exchange balances even imply that BTC reserves have hit fresh multi-year lows. These data also appear to be consistent with the decline in liquid and highly liquid supply metrics mentioned above.

Accumulation activity has also picked up especially in the larger wallet cohorts > 100 BTC which is an encouraging sign.

These are all factors that should provide an increasing tailwind over the coming weeks.

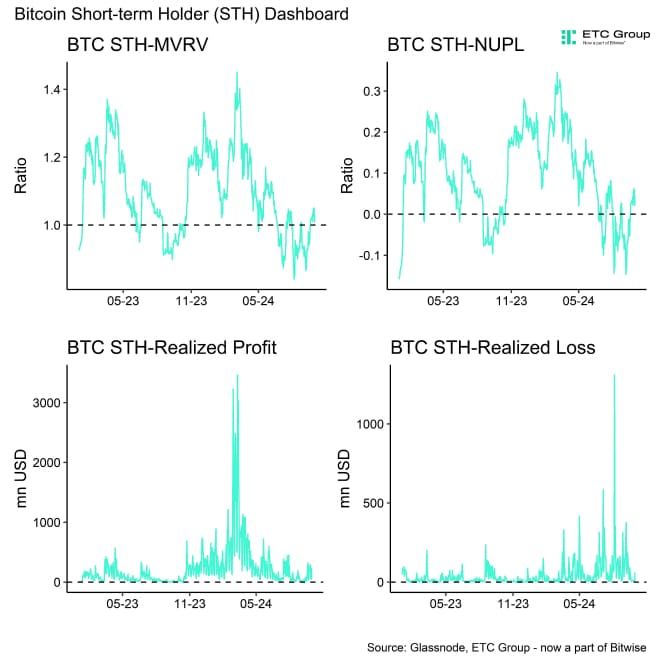

That being said, overall net buying volumes on BTC spot exchanges still remain relatively muted which is consistent with only a slight pick-up in best inflows into spot Bitcoin ETFs in the US which tends to be the „marginal buyer“ at the moment.

Moreover, overall on-chain flows into major cryptoassets such as Bitcoin or Ethereum are also still relatively subdued. We have yet to see are more significant pick-up in these metrics for a more pronounced breakout to the upside and a resumption of the bull market.

On the bright side, we are generally observing an improvement in on-chain activity across different signals, albeit from lower levels – Bitcoin's hash rate continues to climb to new all-time highs and short-term holders are back in the profit zone.

Increasing hash rate implies increasing economic resilience of BTC miners and therefore less distribution risk of bitcoins in the short-term. Increasing short-term holder profitability also limits any distribution risk in the short-term.

That being said, relatively low short-term holder participation and exchange volumes still imply that retail participation in crypto markets needs to pick up. However, Q4 should generally see an uptick in exchange volumes from a pure seasonality perspective.

Bottom Line: If past Bitcoin Halving events are any guide, the Halving effect is becoming increasingly significant since late July/early August this year. However, retail participation still remains somewhat subdued, but we expect a pick-up in Q4 due to more favourable seasonality. All in all, several on-chain metrics for illiquid supply imply that bitcoin's supply scarcity due to the Having and renewed accumulation is indeed intensifying.

Bottom Line

- Performance: In September, cryptoassets, particularly Bitcoin and gold, outperformed traditional assets like equities and bonds, driven by central bank easing measures, and Bitcoin's historically poor September performance was positively surprising with a +7.4% gain. With further Fed rate cuts expected and seasonal trends favouring strong performance in the final months of the year, Bitcoin and other cryptoassets are anticipated to benefit from increasing liquidity and could see significant gains through 2025.

- Macro: A US recession remains our base case for the time being on account of several leading labour market indicators that still signal an increase in the US unemployment rate. That being said, a US recession may not be as detrimental to Bitcoin and other crypto assets as some might fear. On the contrary, it could lead to greater expectations of Fed rate cuts and US Dollar weakness, which might actually provide a tailwind for Bitcoin. The rising global liquidity tide will be a strong support for scarce assets like Bitcoin over the coming months and well into 2025.

- On-Chain: If past Bitcoin Halving events are any guide, the Halving effect is becoming increasingly significant since late July/early August this year. However, retail participation still remains somewhat subdued, but we expect a pick-up in Q4 due to more favourable seasonality. All in all, several on-chain metrics for illiquid supply imply that bitcoin’s supply scarcity due to the Having and renewed accumulation is indeed intensifying.

Appendix

Cryptoasset Market Overview

Cryptoassets & Macroeconomy

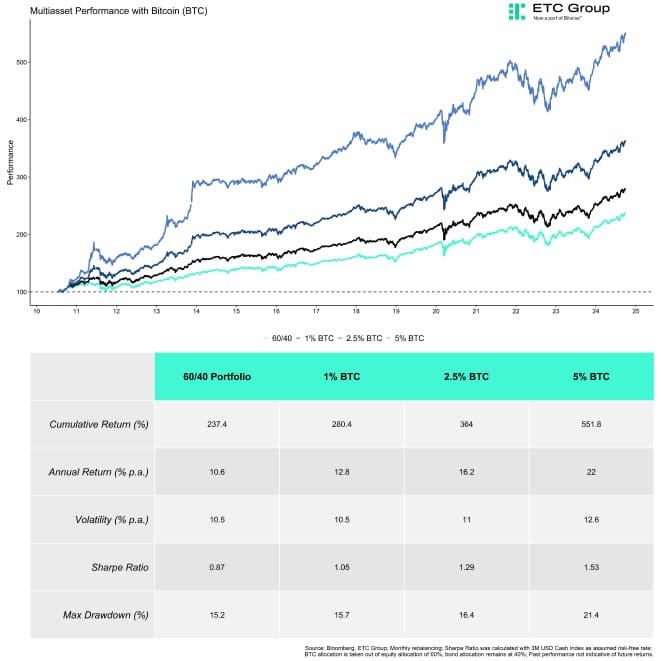

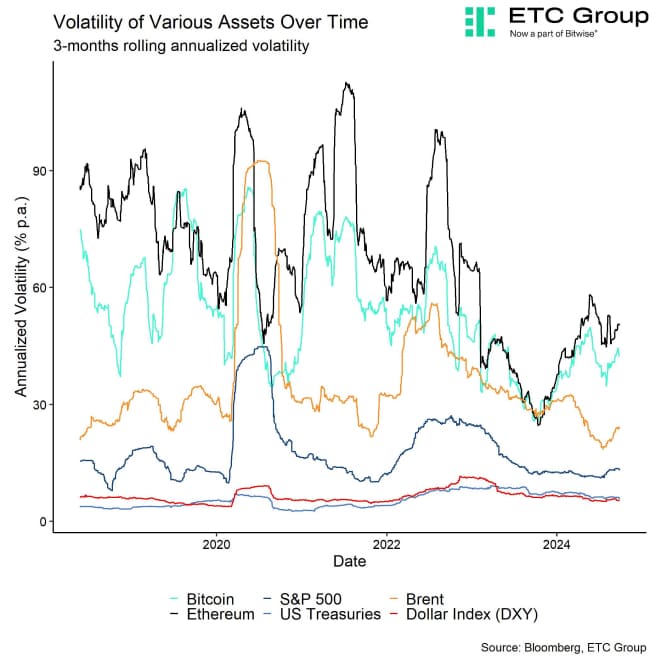

Cryptoassets & Multiasset Portfolios

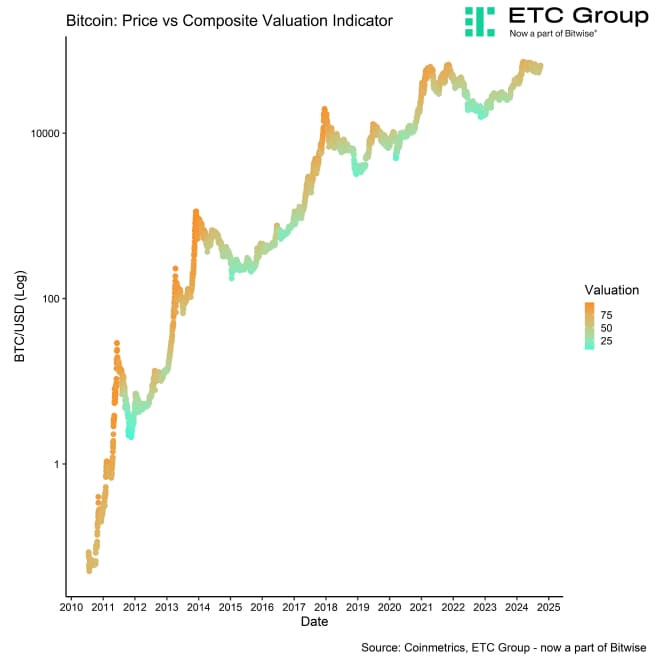

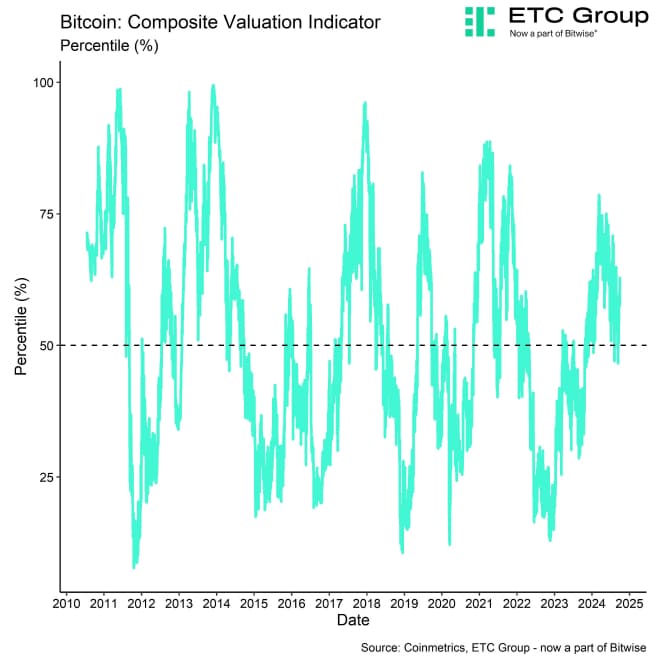

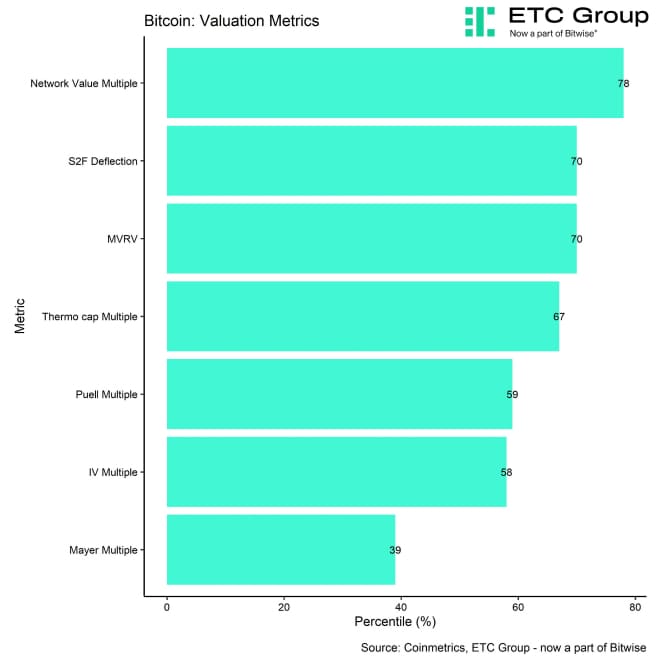

Cryptoasset Valuations

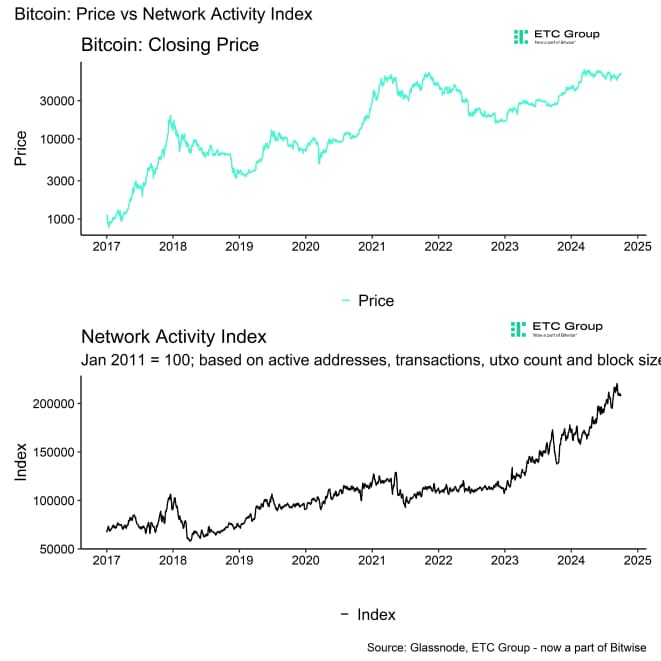

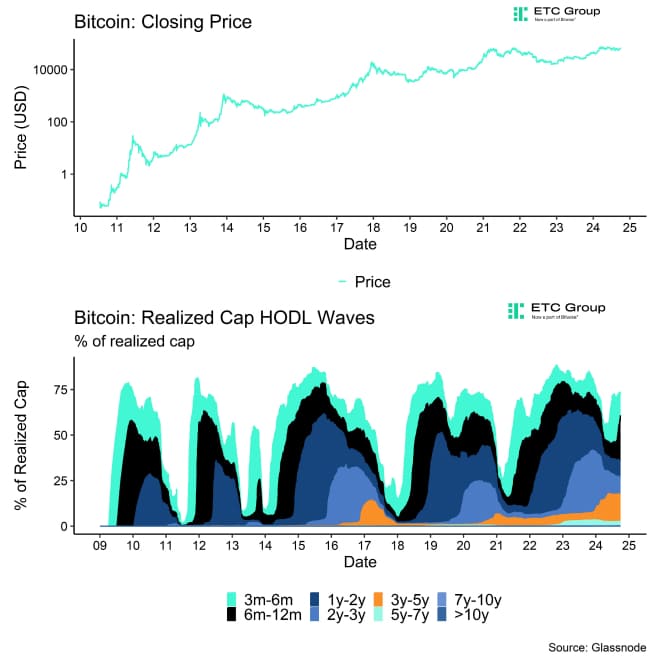

On-Chain Fundamentals

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

En

En  Fr

Fr  De

De