Markets

Markets drifted sideways in July with little movement to show for a succession of positive developments across regulation, policy and institutional support for cryptoassets.

While the lack of action could be ascribed to the summer doldrums also evident in equities, this is a rather simplistic conclusion to draw.

It is worth noting that Ripple’s partial victory against the SEC on 14 July — which did not denote the cryptoasset as a security under US law — provided a massive upswing in spot XRP prices that did not translate into a statistically-significant movement in either BTC or ETH.

Bitcoin and Ether continue to hover around their respective key psychological price points of $30k and $2k; and while a more positive outlook is stacking up for crypto and blockchains this has not been expressed in market repricing. The reasons for this become a little clearer once we consider the state of market liquidity and volatility.

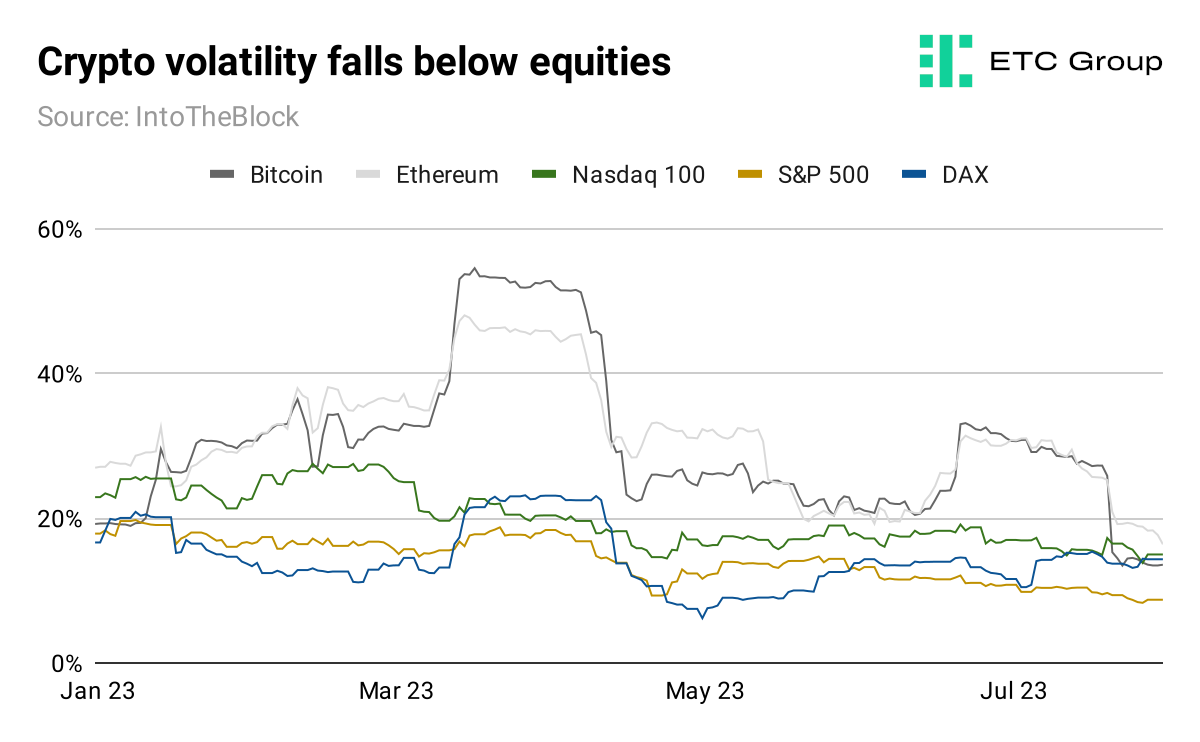

Annualised volatility in crypto markets is now at or below the volatility in equity markets, as evidenced by data from IntoTheBlock. Here the 30-day volatility compares Bitcoin, Ethereum and traditional equity indices including the Nasdaq 100 and S&P500.

Last month’s policy and product moves produced a clear signal that there will be many trillions of assets under management eligible to buy Bitcoin in the near future.

Three of the largest beyond BlackRock’s Bitcoin ETF filing were HSBC (which launched Bitcoin and Ethereum ETFs for sale in Hong Kong), Germany’s banking giant Deutsche Bank filing for a digital asset licence to be a crypto custodian and the 20 June launch of the Fidelity/Citadel/Charles Schwab-backed EDX Markets exchange.

And so the market positivity that accompanied Bitcoin’s $5k+ move from $25k to $30k in the wake of BlackRock’s filing appears to have dissipated for now. This may provide investors with another more appetising entry point into blue-chip cryptoassets with many more tailwinds to come in the months ahead.

Macro

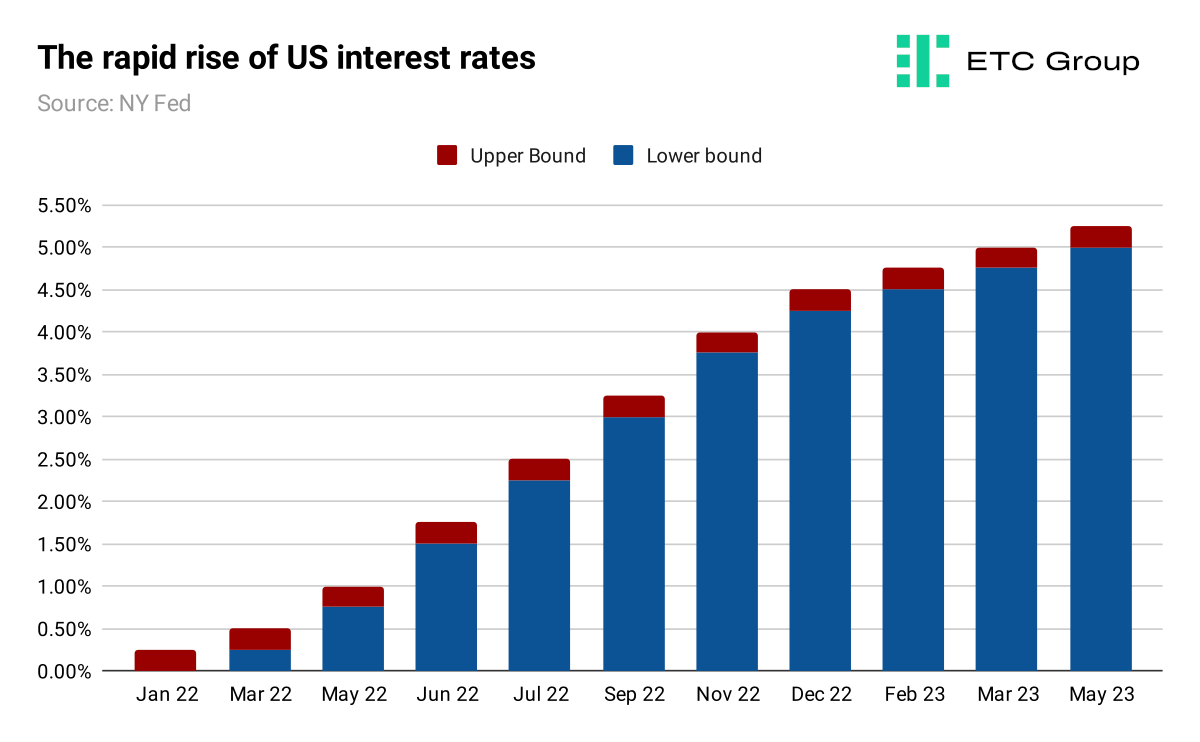

The Federal Reserve raised rates by 25bps on 25 July, its 11th such move in 12 meetings over the last two years, with chair Jerome Powell leaving the option open for one more rate hike in September. That puts US interest rates at the 5.25% to 5.50% range, as Reuters noted “a level last seen just prior to the 2007 housing market crash and which has not been consistently exceeded for 22 years”.

Under such a sharp tightening cycle it’s easy to forget that the central bank was holding rates at zero as recently as Q1 2022, as well as stimulating the US economy with bond purchases running into the billions of dollars each month.

Analysts are also tipping that the Bank of England will raise its own benchmark rate for the 14th time in a row, by 25bps to 5.25%. This would be its steepest level since March 2008.

Traders and investors are nearing exhaustion with interest rate hikes, and industry groups are urging central bankers to consider reversing course; one study by the CBI trade body concluded that the UK’s private economy is wilting in the face of high inflation and interest rates.

Elsewhere, the eurozone grew more than expected in Q2 2023, data from Brussels showed. GDP expanded by 0.3%, led by key markets in France and Spain shifting higher, while Italy fell into a contraction.

The IMF said at the turn of this year that approximately half of the EU and fully one-third of the countries globally would face recessions this year.

With mixed signals on the scope and scale of these economic downturns still confounding economists and investors alike, it is worth stepping back and considering longer-term data.

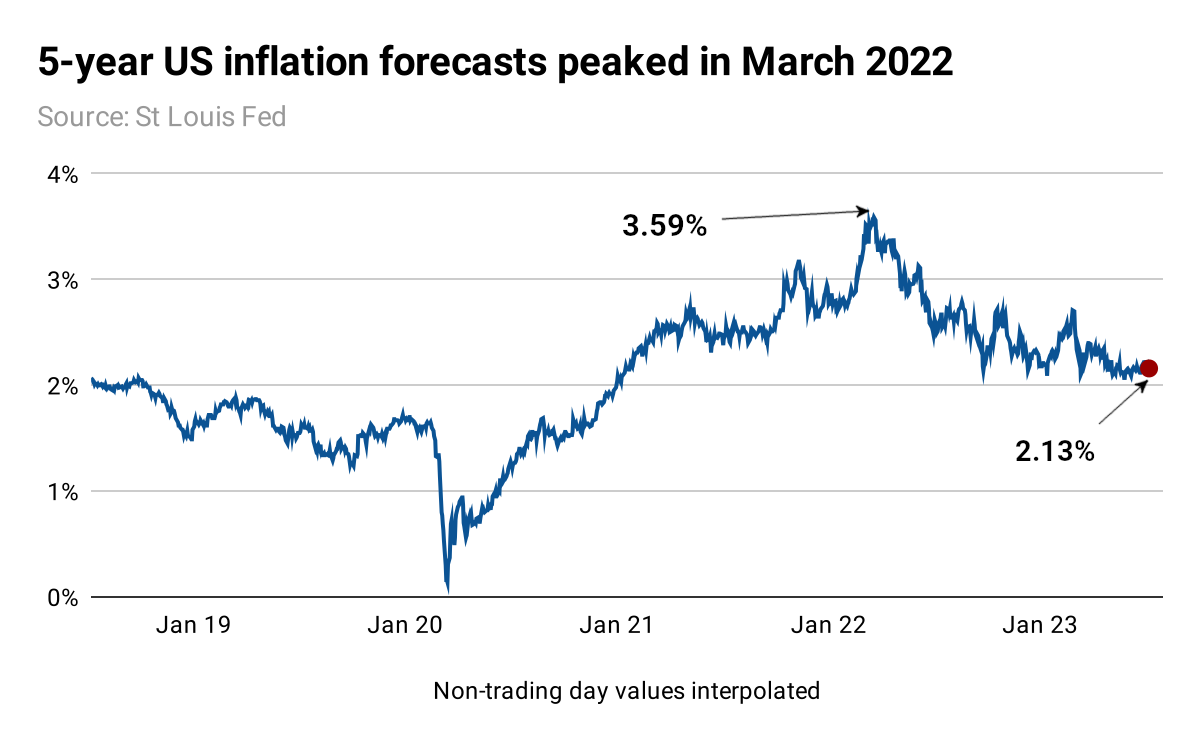

Five year forward inflation forecasts for the US actually peaked back in March 2022 at 3.59%, right at the start of the brutal crypto bear market.

It has been falling ever since, and today that figure of inflation expectations for 2028 stands at 2.19%.

So while the Covid crash saw the inflation figure plummet to near zero, traders and professional investors are preparing for several years of disinflationary pricing in goods and services, lower cost of capital and looser constraints on debt servicing.

Bitcoin

Trading volumes dulled in July and market prices remained in tight ranges in the weeks after BlackRock’s Bitcoin ETF filing. As with any other market, crypto traders prefer periods of higher activity and higher volatility, as it creates more opportunity for mispricings and arbitrage, and more opportunity for profit.

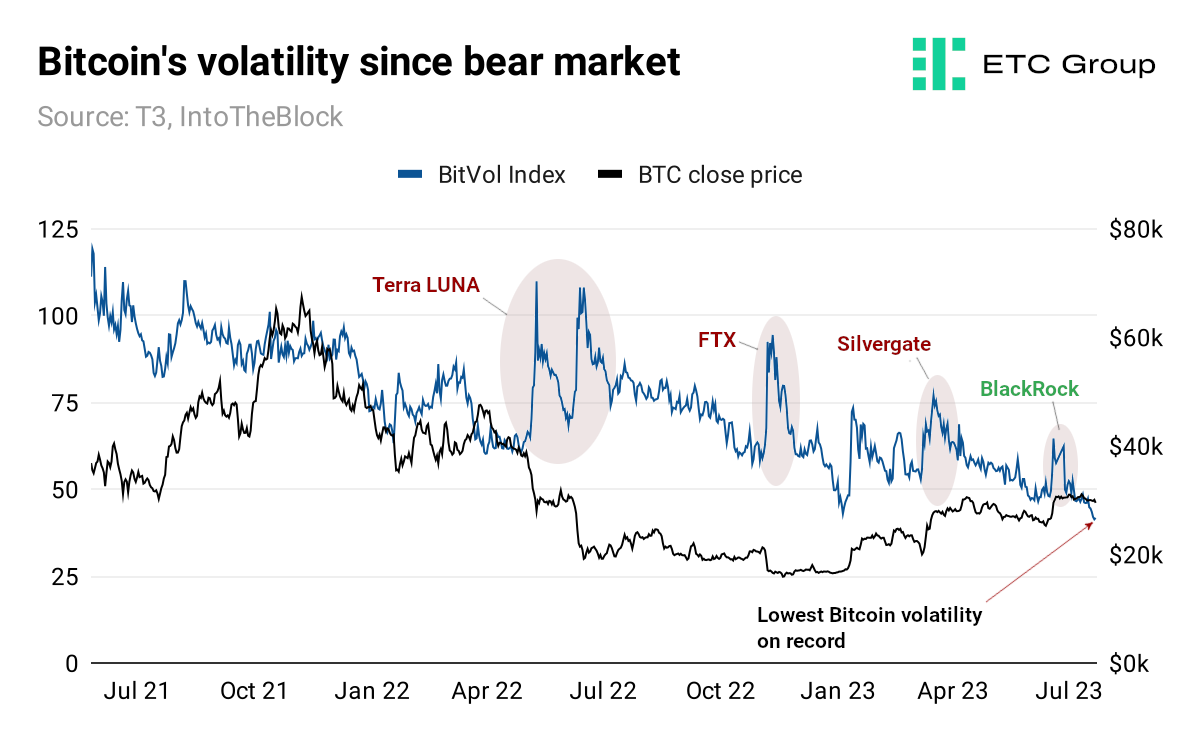

Spikes in market volatility tend to be event-driven and are reactions to both perceived positive and negative situations: as with FTX in November last year; the collapse of Silvergate Bank in March; and BlackRock filing for US spot Bitcoin ETFs in mid-June.

The average intraday move for Bitcoin has dropped sharply over the last month, and annualised volatility for Bitcoin, at 13.46%, is now lower than both the DAX40 at 14.31% and the Nasdaq at 14.98%, according to IntoTheBlock data.

T3’s BitVol index, referenced in the chart above, is particularly pertinent because it measures the expected 30-day ahead volatility by using BTC option pricing, linearly interpolating between the expected variances of the two closest expiry dates.

State Street Global Advisors remarked on the outlook for volatility in a brilliant paper by Kishore L Karunakaran: “To the extent that Black-Scholes [option pricing] provides a meaningful description of financial markets…this suggests that volatility cannot be created or destroyed. If volatility appears low, that’s because it’s been .”

We can see that volatility — by any measure — is now the lowest on record for Bitcoin markets.

What this means in practice is that periods of extreme low volatility are like a coiled spring, and the longer volatility remains low, the more violently it tends to expand upwards when a market-driven event occurs. This is the position we find ourselves in currently.

More than 44% of the total Bitcoin supply has not moved in two years, Coinmetrics data shows. This means that those holders who bought before the run up to Bitcoin’s all time high of $67k in November 2021 have held on all the way through to the bear market low of $15.5k and back up to where we sit now at around $30k. The implication is that these holders will hold out for a price point beyond $70k before they would even consider selling.

With the 2024 Bitcoin halving less than a year away , and long-term holders gripping tightly to their accumulated stockpiles, this growing narrative that there are ever fewer coins available for sale is likely to strengthen.

Ethereum

July was the month that Ethereum scaling solutions really broke cover. Each of these technological add-ons have the primary goal of improving the speed of and reducing the cost of transaction throughput on the dominant smart contract blockchain.

Ethereum’s token standards and developer tooling have become adopted as the industry standard for blockchain infrastructure. There are currently many developer teams vying to make their Layer 2 (L2) the industry standard method of interacting with Ethereum.

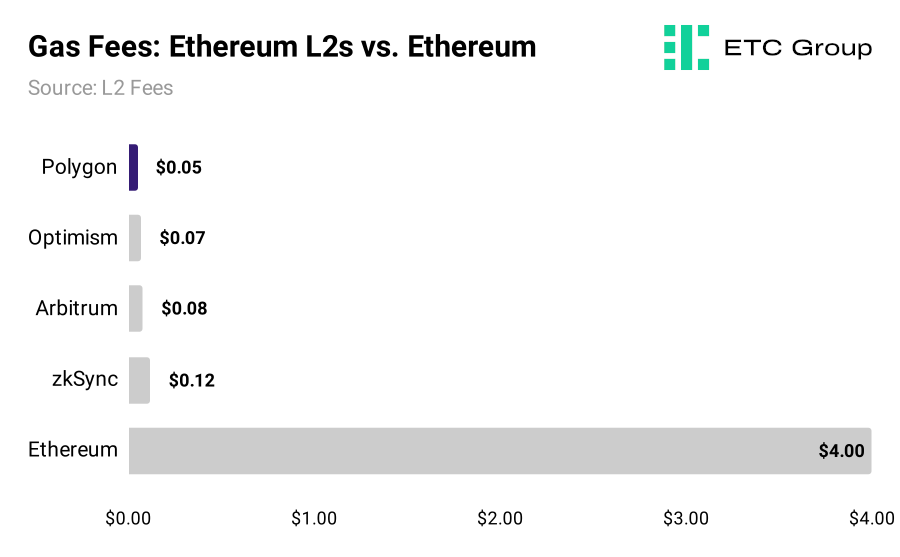

Ethereum L2s and sidechains like Polygon, Optimism, and Arbitrum act as safety valves for the base layer by relieving pressure on the Ethereum network. Transaction fees on Polygon are almost 100x cheaper than sending ETH on the Ethereum network.

We start with Polygon, which released a whitepaper proposing to reinvigorate its network and replace native token MATIC with a new ERC-20 token called POL. MATIC is currently the 13th largest crypto by market cap, with a valuation of $6.45bn.

POL will be capable of being staked across multiple chains within the Polygon ecosystem and serve as a single token for all of Polygon’s interoperable chains: Polygon Proof of Stake (PoS), zero-knowledge Ethereum Virtual Machine (zkEVM), and Supernets.

This will allow greater connectivity in Polygon’s blockchain infrastructure, connecting each chain with a single token.

It is presently cheaper to use Polygon than its primary rivals for market share like Optimism and Arbitrum.

If the Polygon community passes the proposal, MATIC will be deprecated and MATIC holders will gain POL in exchange on a 1:1 basis.

Token holders would be required to send their MATIC tokens to a specific smart contract, which would then return an equivalent number of POL tokens. MATIC token holders will have four years to do this, the whitepaper notes.

There may be more competition coming to Polygon, Optimism and Arbitrum soon, too. Mobile-first blockchain Celo has proposed to end development of its own Layer 1 blockchain and pivot towards becoming a Layer 2 for Ethereum.

At the EthCC development conference in Paris, Marek Olszewski, CTO for the core development team behind Celo — cLabs — told The Block that in the future, “hundreds if not thousands of chains will all be rolling up to Ethereum”.

Altcoins

Bullish intent has gripped Litecoin traders with the blockchain’s halving now just days away.

On 3 August the Litecoin block reward for miners will be cut in half, an event that occurs once every four years and has only happened twice before.

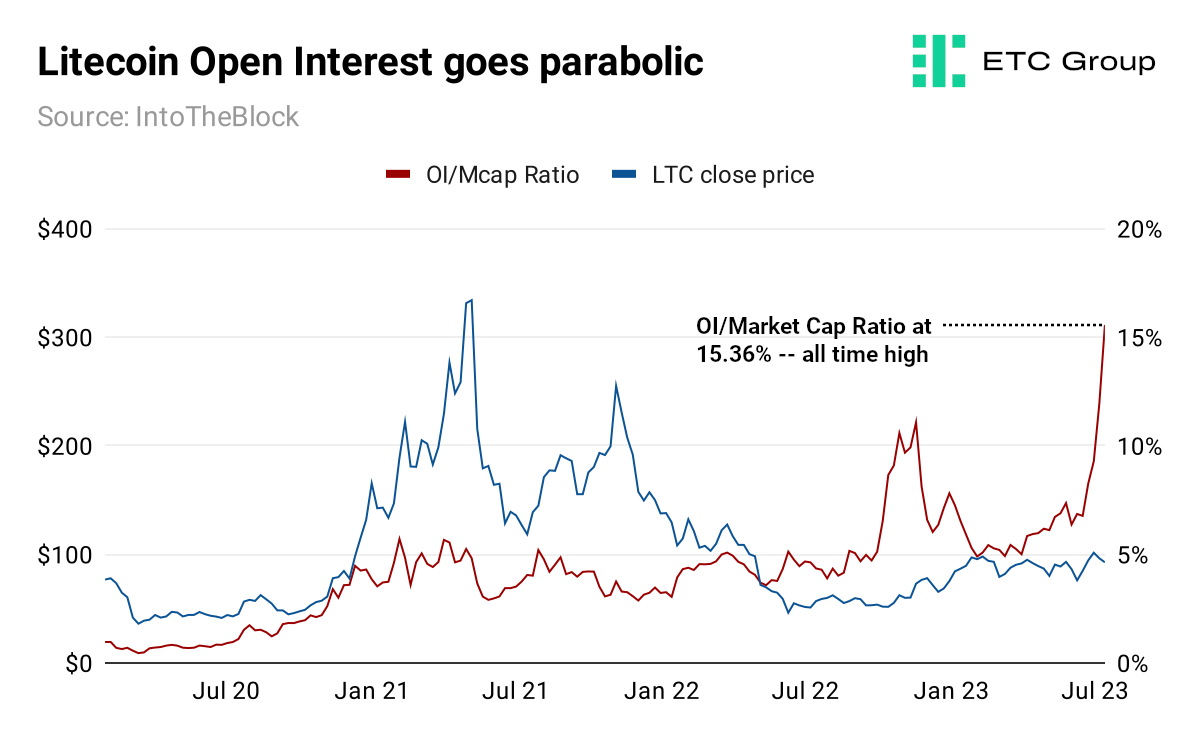

Open Interest (OI) as a percentage of Litecoin’s market cap hit 15.36% on 24 July, an all time high. OI is the total sum of outstanding derivatives contracts (including options and futures) for a particular asset. OI increases as capital flows into traders’ derivative positions, and declines as capital flows out.

IntoTheBlock data shows there are $1.06bn in outstanding Litecoin derivatives contracts, the highest since May 2021. In fact, there have only been nine days in Litecoin’s entire trading history when OI was higher: 15-16 April 2021, and 5-12 May 2021.

Litecoin is the 12th largest cryptoasset by market cap, valued at $6.89bn.

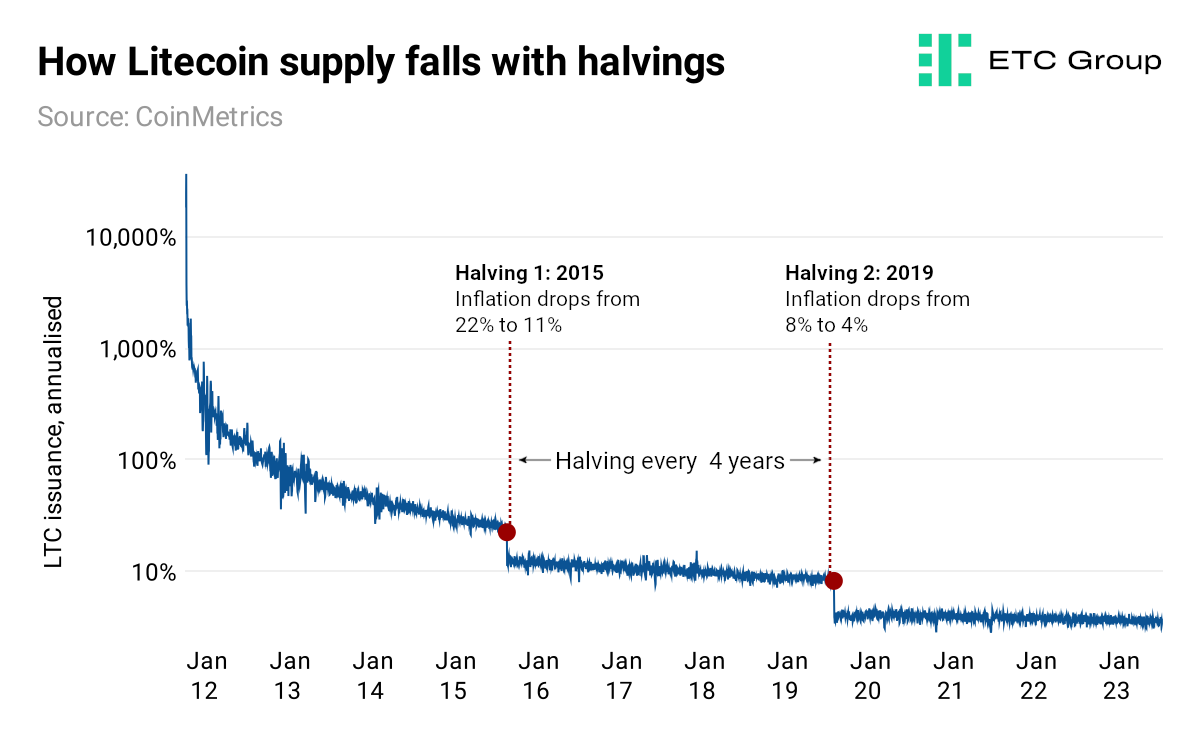

Just as with Bitcoin, this predefined halving event occurs once every four years, lowering the rate at which new LTC is created.

At launch in 2011, the Litecoin network paid a 50 LTC incentive to miners for processing each block of transactions. On 25 August 2015, Litecoin underwent its first halving with the block reward cut from 50 LTC to 25 LTC. Annualised supply inflation dropped from 22% to 11%. On 9 August 2019, the second Litecoin halving, with rewards cut from 25 LTC to 12.5 LTC, saw annualised supply inflation fall from 8% to 4%.

Litecoin was created in 2011 by the MIT-educated software engineer Charlie Lee, who helped develop some of the early iterations of Chrome OS and Youtube at Google, going on to become the Director of Engineering at Coinbase, leaving in 2017 to develop Litecoin full-time. As the name suggests, Lee’s intention for Litecoin was to be a ‘light’ version of Bitcoin: an altcoin more suited to internet payments than the original cryptocurrency, with faster transaction times and lower fees.

To account for these faster block times, Litecoin’s block reward halving occurs once every 210,000 blocks, compared to Bitcoin’s 840,000. Litecoin generates blocks at four times the speed of Bitcoin. This keeps both chains on a similar trajectory, with halvings occurring once every four years or so.

The moves being made by traders now are widely seen as a dry run for what will happen when Bitcoin’s next halving occurs in April 2024. At that point, Bitcoin’s annualised supply inflation will drop from 1.74% today to around 0.78%.

We expect heavy BTC accumulation, as well as futures and options volume to peak ahead of the Bitcoin halving. Certainly the addition of a swathe of new US spot Bitcoin ETFs would aid that move: If BlackRock were to invest 1% of its assets under management into Bitcoin, that would reckon on $800bn to $900bn of new assets coming into the space.

The number of addresses holding Litecoin continues to grow at pace. The total is now on the verge of 9 million, having only crossed the 8 million mark two months earlier.

Institutional Blockchain

Tokenised debt and tokenised equity remain the market sectors with the largest number of new participants and these elements are gathering the most excitement from institutions about the disintermediation and cost savings possible from utilising public blockchains.

There are clear operational efficiencies from using Ethereum, for example, as the recording and settlement layer for tokenised bonds.

Faster settlement times have a huge effect on the amount of margin requirements that participants need to post. To take a TradFi example: i n the US, the Depository Trust and Clearing Corporation (DTCC) and its subsidiary the National Securities Clearing Corporation control almost all clearing and settlement.

When in 2017 the DTCC accelerated from T+3 (three-day) trade settlement to T+2, it saved the industry $1.36bn in margin requirements, freeing up that collateral for use elsewhere.

The DTCC has been working on an even shorter settlement cycle of T+1 since 2020. Ethereum’s globally synchronised public record of asset holdings and transactions promises a near-instant settlement process of T+0.

That means that the total addressable market for Ethereum — the dominant in-use public blockchain for this type of activity — is absolutely vast. The DTCC clears around $2.15 quadrillion in trades every year.

An 11 July report submitted by the Bank for International Settlements ahead of September’s G20 meeting in New Delhi concluded that tokenisation could “substantially increase…the systemic importance of the crypto ecosystem”.

It said: “Tokenisation of claims on real-world assets, such as stocks or real estate, is another way through which the interconnections between traditional finance and crypto could grow. This could result in the growth of crypto itself, as new money gets channelled into such tokenised assets. It could also engender a more complex web of interconnections between crypto and traditional finance as the activities of the entities in these two ecosystems become more intertwined.”

The authors, referencing a growing body of academic work on the use of Ethereum and its Layer 2 upgrade Polygon for issuing and recording ownership of tokenised versions of real world assets, concluded:

“Crypto offers some elements of genuine innovation, such as programmability and composability. With these new functionalities, sequences of financial transactions could be automated and seamlessly integrated. Together with tokenisation, this has the potential to reduce the need for manual interventions that currently delay transactions and create costs.”

Regulation

Americas

A long-awaited bill that would give US markets the clarity of a cryptoasset regulatory framework advanced on its own merits at the end of the month, marking what Reuters reporter Hannah Lang said was “a milestone for Capitol Hill in its efforts to codify federal oversight for the digital asset industry”.

The bill, called the ‘Financial Innovation Technology for the 21st Century Act’ would define which cryptoassets are commodities and which are securities under US law, and give the CFTC regulator greater oversight of the sector. The CFTC currently oversees Bitcoin futures products in the US, while the SEC has repeatedly denied a similar applications for spot-based Bitcoin products citing lack of investor protections.

The Republican-led bill has now been approved by both the House Financial Services Committee and its equally powerful House Agriculture Committee.

At the same time, a bill to adjudicate on stablecoin usage in the US is also working through Congress.

Republican Congressman Patrick McHenry has been working on The Clarity for Payment Stablecoins Act behind the scenes more than 15 months, but was perturbed by the level of consternation around the public release of a discussion draft in early June.

McHenry is the Chairman of the US House Financial Services Committee.

Further signs that the political support for blockchain-based technologies may be shifting in the US came from a bipartisan letter from the Innovation, Data and Commerce Subcommittee this month.

Apple currently restricts its terms around NFT services to ensure all payments are routed through its own platform. The knock-on effect has been that external developers have found it difficult to list NFT apps. At the end of last year Coinbase said that Apple blocked an update to its iOS app, and its team was forced to restrict NFT transfers to have its update accepted. US politicians fear that such gatekeeping by Big Tech companies could have a further chilling effect on US innovation in the sector.

The letter concluded that “Apple’s support of innovative new technologies such as blockchains, NFTs and other distributed ledger technologies could solidify American leadership of these technologies.

Europe

The UK appears to be ramping up its framework for supporting, rather than sanctioning, the burgeoning cryptoasset industry in the country. In July the UK government rejected a call from the Treasury Select Committee two months earlier to regulate cryptoasset services as a form of gambling, rather than as financial services.

The Markets in Crypto Assets (MiCA) framework was met with much praise when it was passed by the EU in April 2023. It was a first-of-its-kind bill that introduced regulatory standards for stakeholders like digital asset exchanges and custodians, while recognising the utility of digital asset – and particularly stablecoin – payments in Europe.

But its reach does not extend far enough into the digital asset universe, according to the Association for Financial Markets in Europe (AFME). The banking sector trade body has called for stipulations on decentralised finance (DeFi) to be included in MiCA.

DeFi represents the movement of financial instruments – as tokenised real world assets (RWAs) – between users without the need for centralised intermediaries like banks. The space also includes the lending of crypto tokens in return for yield through staking, or the use of digital assets as collateral against loans.

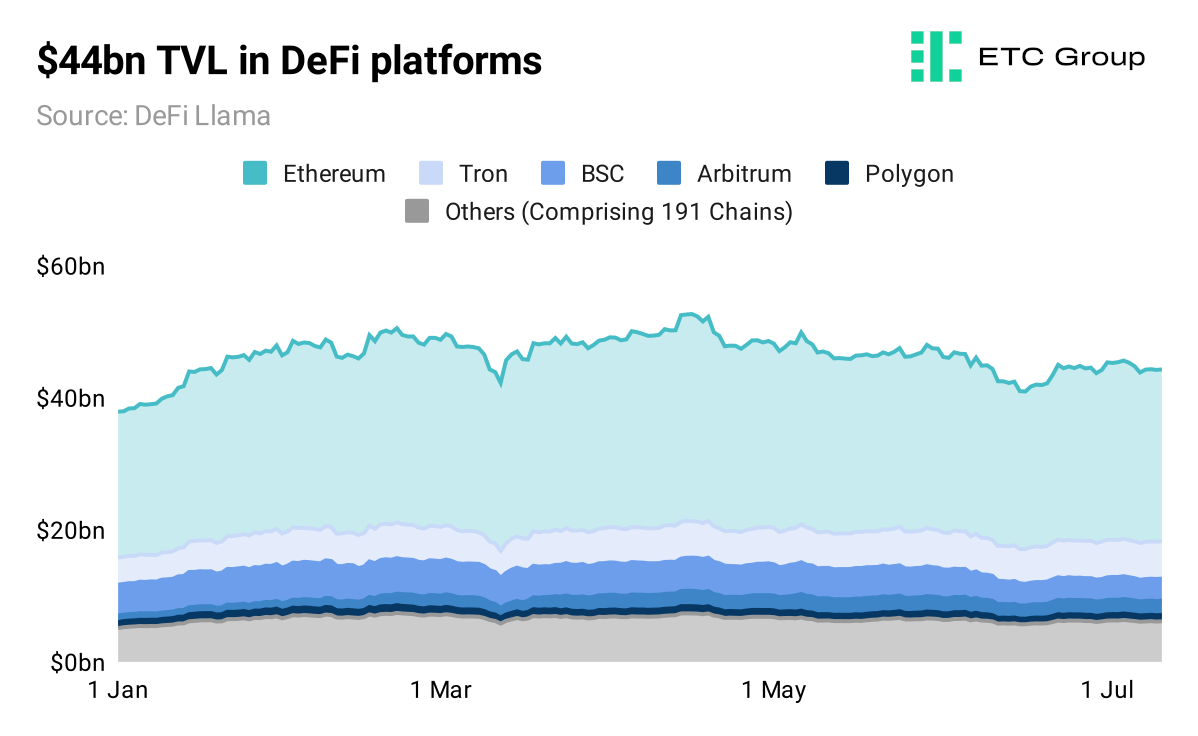

There is $44bn of cryptocurrency spread throughout DeFi sub-sectors across 196 blockchains. Of this, Ethereum’s giant ecosystem of decentralised exchanges, lending platforms, and liquidity pools make up almost 60% of the total value locked (TVL).

The AFME has warned that omitting activities taking place within the DeFi sector could endanger investors and have negative ramifications for wider capital markets if things were to go wrong. According to one estimate , $3 billion worth of crypto was lost to vulnerable DeFi protocols being exploited by hackers in 2022 alone.

A whitepaper released by the organisation says that “decentralised finance (DeFi) and its associated activities must be brought within the regulatory perimeter in an appropriate way to manage risks.”

Asia Pacific

Singapore’s High Court has ruled that crypto can be treated as property and hence held in trust, in a case involving the cryptoasset exchange ByBit. Judge Philip Jeyaretnam said that cryptoasset holders have “in principle an incorporeal right of property recogniseable by common law as a ‘thing in action’ and so enforceable in court”.

It follows April’s move by a Hong Kong court that also ruled cryptoassets could be treated as property. Hong Kong’s government said last month it was committed to introducing stablecoin regulations by 2024 in a bid to become the de facto global hub for Web3.

Outlook

With crypto market volatility at or nearing all time lows, investors are watching carefully for any signs of life.

Anecdotal evidence from institutional market participants suggests that selling volatility — and volatility suppression — is underway across the market, with no clear endpoint in sight.

On a more positive footing, the regulatory picture appears to be clearing up in the United States, and with the explosive rise of tokenisation on an institutional level in recent months, a clear framework there could attract AUM and talent out of Asia and Europe and back across the pond.

With the worst of the bear market — the collapse of crypto lenders, $15k Bitcoin and FTX-style frauds — appearing to be a long way in the rearview mirror, the thesis for investing in public blockchains has not changed. While there is still some time to wait for the next major protocol changes: Dencun for Ethereum, and the halving for Bitcoin, there is clearly much dry powder waiting to be deployed when market conditions improve further.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.