Executive Summary

- Markets sideways but confidence up in face of macro turmoil

- Ordinals & BRC-20: New developments in Bitcoin

- Ethereum derisked post-Shapella with staking withdrawals

- Institutional crypto AUM up 60%

1. Overview

After a buoyant March which saw the total crypto market cap climb back above $1.1 trillion, April was more of a momentum pause than a continued upward swing.

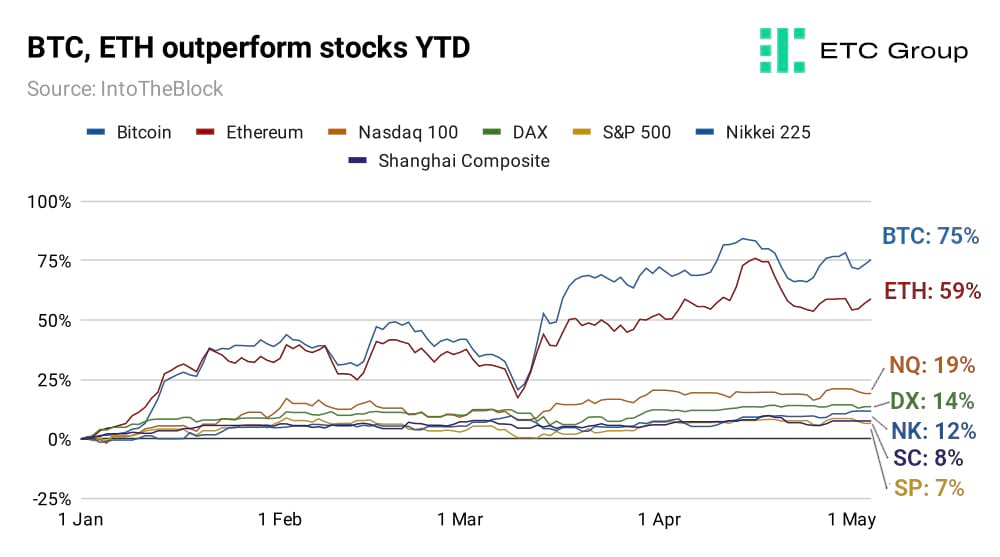

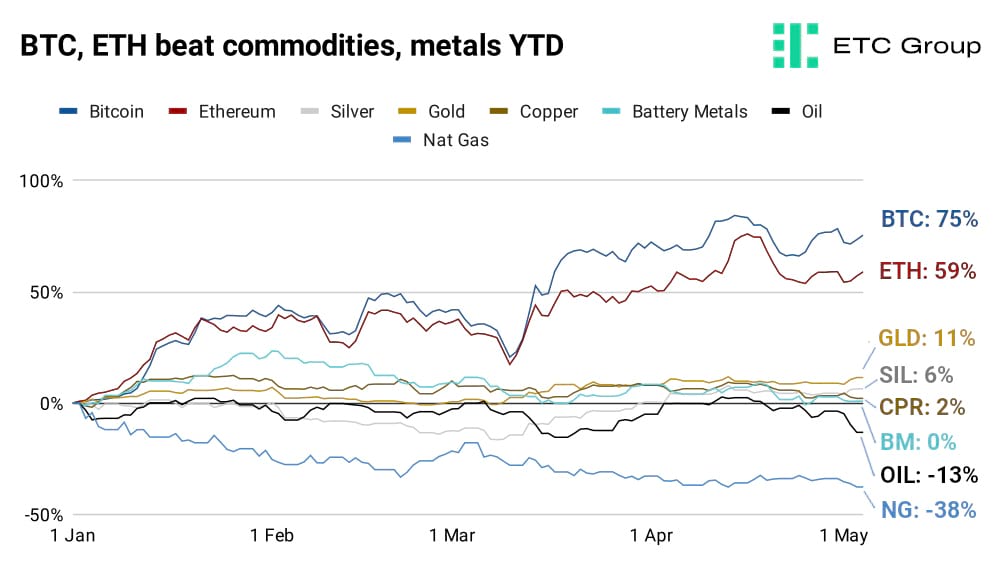

Crypto markets chopped sideways across the month, but with volatility evident in global stock indices, and with oil and energy prices crashing, and both industrial and precious metals flat in the year to date, both Bitcoin and Ethereum continued to show relative outperformance.

In the year to date, Bitcoin has gained 75.4%, while Ethereum is 58.9% higher.

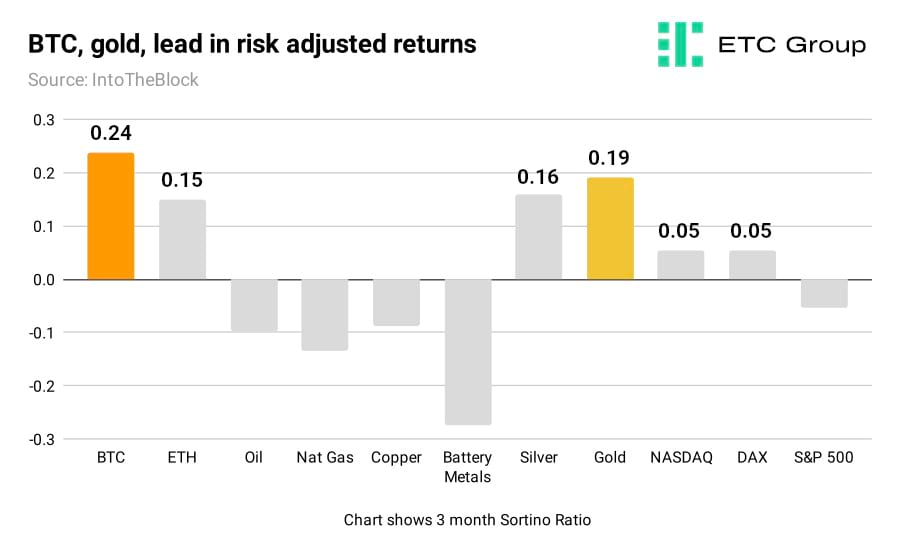

In terms of risk-adjusted returns, Bitcoin and Ethereum have also shown strong outperformance.

The 90-day Sortino ratio to 4 May 2023 shows Bitcoin's risk-adjusted returns at 0.24 with gold taking second spot at 0.19, silver in third at 0.16 and Ethereum fourth at 0.15.

The Sortino ratio is an extension of the classic Sharpe ratio for portfolio management. It takes an asset's return and subtracts the risk-free rate, then divides that by the asset's downside deviation.

Copper, considered a bellwether metal for the health of the global economy, produced a negative risk-adjusted return over the last three months, alongside the S&P 500, oil, natural gas and battery metals.

In the year to date, both Bitcoin and Ethereum have shown more volatility and larger intraday moves than stock indices, but better risk adjusted returns.

Ordinals & BRC-20: New developments in Bitcoin

Bitcoin also saw a dramatic increase in fee revenue for miners in April due to new technological developments on the blockchain.

One of the main criticisms levelled at Bitcoin as other blockchains have arisen over the last 10 years is that it can only host one asset: BTC. Compare this to Ethereum, for example, upon which a near-infinite number of new assets can be created, hosted and traded.

And in the last decade, Bitcoin's share of the total crypto market cap has reduced from 100% to 45% today.

Novel scripting and coding developments now mean that Bitcoin could be about to reverse that trend.

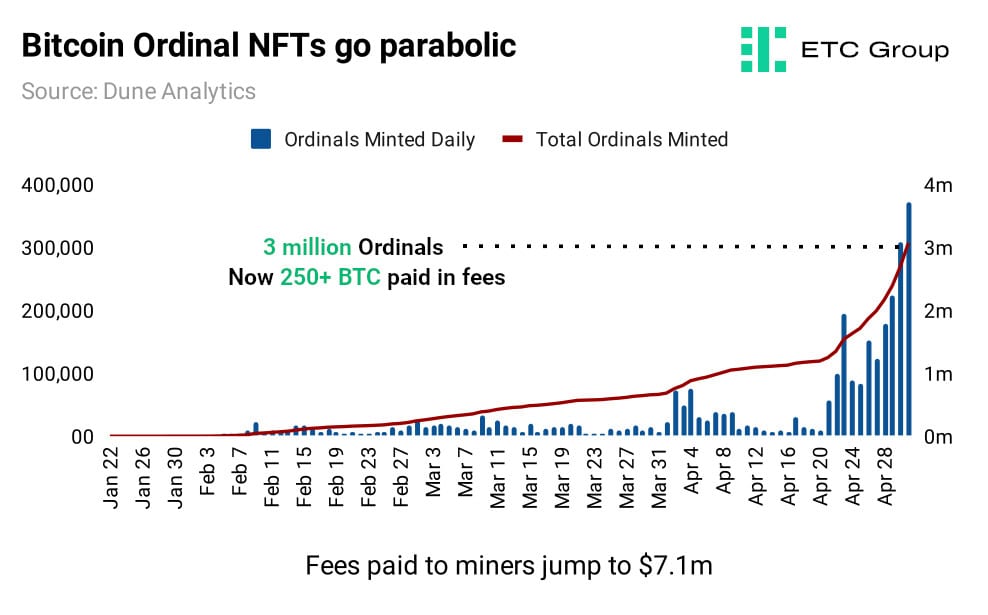

Firstly, Bitcoin's own version of NFTs, called Ordinals, saw rapid uptake across the month with more than 2 million Ordinals created.

Ordinals were created in late 2022 by researcher Casey Rodarmor. They allow users to inscribe individual satoshis - the smallest unit of a Bitcoin - with additional data, such as text, images, audio or video files, thereby creating unique and non-fungible assets that can themselves be traded.

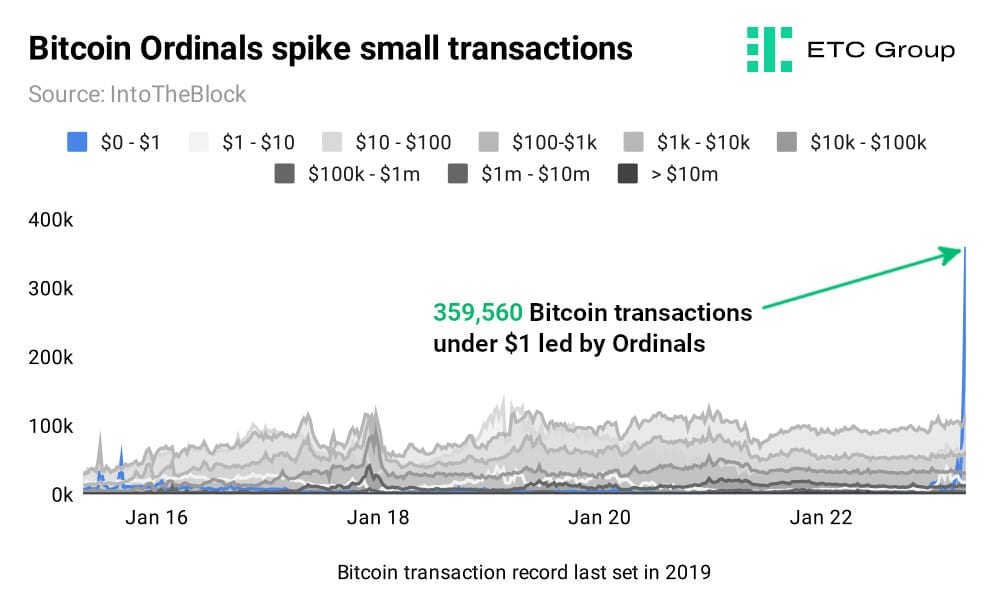

The use of Bitcoin's newest native asset - NFT-like Ordinals - has spiked small transactions on the network to a new all time high. Bitcoin's record was last set in June 2019, when 372,130 transactions were completed in a single day. At the time, the Bitcoin price was $11,670.

But the rapid rise of Ordinals means that the daily count of Bitcoin transactions hit a record of more than 568,000 on Sunday 30 April. Analysis of these transactions show that more than 300,000 came from Bitcoin Ordinals.

Despite a slow initial discovery process, it appears these new assets are reaching critical mass as more than 3 million Ordinals have been inscribed to date.

Since the start of the year, more than 250 BTC (~$7.1m) has been paid to miners for

processing transactions related to Ordinals.

One of the more intriguing aspects of this new asset type for Bitcoin has been the rise of small transactions under $1.

At the point in time that the last daily transaction record was set, some four years ago, the vast majority of transactions were concentrated in the $1,000 to $10,000 range, implying that the main use case for Bitcoin was as an asset for trading.

Compare that with today, where 359,560 of the total transactions processed were less than $1. This suggests a broad increase in retail and small users utilising the network for its new technological applications.

The second intriguing development in Bitcoin coding is the rise of so-called ‘BRC-20' tokens.

ERC-20, for which this new phenomenon is named, is a standard for creating a token used on the Ethereum blockchain. Examples of ERC-20 tokens include Circle's US dollar stablecoin USDC, Chainlink's price oracle token LINK and decentralised exchange token Uniswap (UNI).

For this reason, Ethereum is often referred to as the “programmable money” blockchain.

BRC-20 tokens utilise the same format as Ordinals to create fungible tokens on top of Bitcoin, using inscriptions to store new types of tokens on top of individual satoshis.

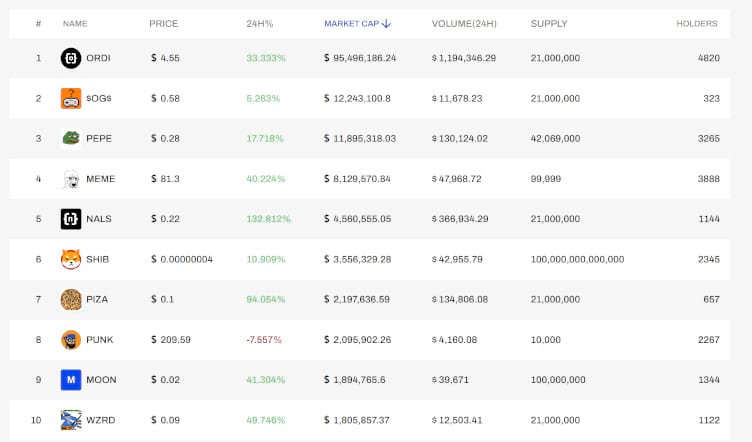

As Lucas Outmouro from data provider IntoTheBlock notes: “The market cap of BRC-20 has climbed to $160m since their creation two months ago. The new standard has been embraced by the meme token community and has led to a new all time high in Bitcoin daily transactions.”

Token tracking site Ordspace shows the leading BRC-20 tokens, each boasting several thousand holders each. With this token standard, developers can create new assets with a supply cap similar to Bitcoin's 21 million, and their introduction has broadly ramped up Bitcoin's network activity.

In the wake of these new developments, Bitcoin fees have reached their highest level since May 2021. The average daily Bitcoin transaction now costs $6. Larger fees can incentivise new miners to mine Bitcoin, thereby increasing network security.

But the implementation is not without its controversy. Some sections of the Bitcoin community consider both Ordinals and BRC-20 tokens to be against the ethos of the original blockchain, and that blockspace should be reserved for transactions only instead of speculative applications.

The bar for making changes to Bitcoin's core operations is extraordinarily high. For example, to institute the SegWit soft fork, 95% of supporters (which include node operators and miners) had to agree to support the new chain. This makes broad changes to Bitcoin extremely difficult given the proportion of participants who must be incentivised to alter Bitcoin's core code and has led to alternative blockchains innovating more quickly than Bitcoin over the last decade.

Ethereum staking stabilises and tokenised assets soar

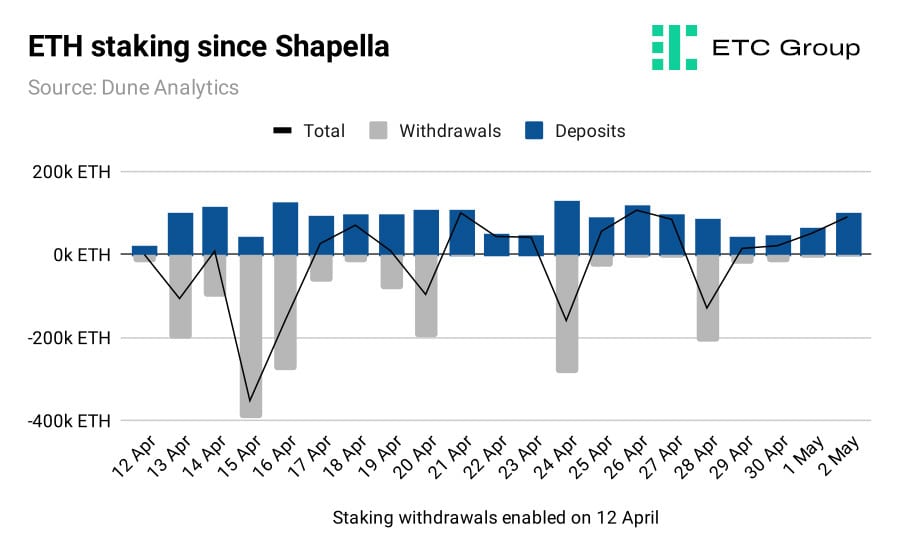

The completion of Ethereum's network switch to Proof of Stake was finalised with the Shapella hard fork on 12 April.

This concludes a years-long move to end Proof of Work mining on the second-largest blockchain by market cap, and enables a mass derisking for investors by allowing them to withdraw accrued staking rewards.

Since December 2020, Ethereum has allowed investors to lock up ETH to support the blockchain's security model, amassing yield in the form of more ETH as a result. Annual yields have typically ranged from 4% to 8% depending on the staking venue.

Critics had suggested that Ethereum could see a mass price depreciation in the weeks after Shapella with validators pulling their accumulated rewards out of the network and depositing them on the market, with that mass supply overwhelming demand.

But those fears have proved unfounded. In fact, since Shapella more staking deposits have flooded into Ethereum rather than out of it.

This brings us to three fairly obvious conclusions. First, the more risk-averse institutional investors who were perhaps sitting on the sidelines waiting for Shapella to complete have witnessed a broad derisking from a technically complex upgrade, and broad stability in the weeks since from the programmable money blockchain.

Second, larger validators now have much improved capital efficiency.

Third, this shows that the ETH carry trade works, in that traders can complete the final leg of the trade: they can borrow, buy ETH, stake it and obtain the yield, but critically, can unstake as well.

This fact - just as it did post-Merge in September 222 - has imbued markets with increased confidence in the Ethereum ecosystem while also unlocking new pools of capital to take part in ETH staking

Experiments in tokenisation using Ethereum and its scaling solution Polygon have continued apace.

On 20 April, Societe General Forge (SocGen) became the first global systemically important bank to launch a stablecoin on the Ethereum blockchain. SocGen released the EURCV stablecoin, noting that it would be backed by less high-quality collateral than supports the likes of Circle's USDC, which uses US Treasuries and Treasury repo.

As LedgerInsights reported: “Collateral backing EURCV will be cash at a bank with at least the credit rating of SocGen, and short term securities with an unsecured credit rating.”

On 26 April, the money manager Franklin Templeton, which has $1.5 trillion AUM, launched its first onchain money market fund on the Polygon blockchain.

Polygon is a scaling upgrade for Ethereum which bundles together transactions and processes them in batches without relying on the processing power of the Ethereum base chain. This means that transactions can be confirmed much more quickly and much more cheaply than using Ethereum alone.

As Duncan Trenholme, co-head of digital assets at TP ICAP noted last year at the launch of its wholesale crypto spot market: “We believe blockchain will lead to the tokenisation of traditional asset classes. This will result in a more efficient, automated and risk-mitigated trading and settlement process for financial markets.”

Digital asset investment AUM up 60%

According to data provider CryptoCompare, In April 2023, the total assets under management (AUM) for digital asset investment products rose by 6.94%, making April the fifth consecutive month of growth.

Analysts wrote that year to date AUM registered a 59.9% uplift “highlighting the renewed interest in digital assets amid failures within traditional finance and market turbulence.”

Weekly average net flows reached $25.4m in April, the highest since January, according to data provider Digital Asset Research.

In the year to date, BTCE increased its market share of the Bitcoin ETP space from 17.19% to over 20.1%. This makes ETC Group's Bitcoin investment product the second-largest fund by AUM globally and extends its lead as the largest physically-backed Bitcoin product in Europe.

Despite Shapella and the mass de-risking on Ethereum, BTC investment products increased their market share to 72% of total AUM, suggesting an extreme flight to quality with macro concerns increasing.

2. Macro Signals

Macro sentiment has worsened as the year has worn on, with traders now shifting their concerns from liquidity and credit issues to the broader demand outlook.

And while a risk-on mood has fuelled a rally in equities, there are multiple headwinds on the horizon from banking turmoil, an oil shock and slowing global growth.

Physically-backed ETPs that track the price of Bitcoin and Ethereum, such as BTCE and ZETH, have been attractive portfolio diversifiers across the board. Spot gold climbed back above $2,000, reaching $2,041/oz at time of publication, its highest point this year.

The Federal Reserve raised interest rates again in early May, adding 25 basis points to their benchmark rate to take the effective federal funds rate to between 5% and 5.25%. We expect one more 25 basis point hike before the de facto US central bank reaches its terminal rate and begins to pause or cut rates into the second half of the year.

The collapse of First Republic Bank is the second-largest in US history, after the 2008 failure of Washington Mutual. The FDIC struck an agreement for JP Morgan to take over the bank's assets, including $173bn of loans and $30bn of securities, as well as $92bn in customer deposits.

Both the Federal Reserve and President Joe Biden have insisted that the US banking crisis is “contained”, but it is clear that market fears persist. Especially with the Federal Reserve suggesting that rates will stay higher for longer, the terminal rate is now pegged at 5.5% by June, rather than 5% by May, which was our earlier estimate.

And as interest rates rise, bank loan books and their investment portfolios become less valuable.

JP Morgan struck a deal with the Federal Deposit Insurance Company to take over the bank's assets, including $92bn in customer deposits and $173bn of loans. The investment banking giant has since attempted to calm markets, offering reassurances that there is little chance of these multiple bank failures accelerating into a 2008-style financial crisis.

But markets are becoming increasingly jittery after similar statements were made after the sudden collapse of Silicon Valley Bank and the liquidity crisis at Credit Suisse in March. Californian lender PacWest Bancorp (NASDAQ:PACW) could be the next domino to fall as its shares have plummeted 62% in the year to date, with deposits down almost 20% during Q1 2023. Institutional investors control 90.9% of the company's outstanding shares, more than almost any other US bank.

There was continued nervousness about making the call that US banking contagion was no longer an issue. Statements like this tend to live in infamy, especially given the global macro outlook.

As CNBC reported in May 2007, the former chair of the Federal Reserve Ben Bernanke had told Congress: “We believe the effect of the troubles in the subprime sector on the broader housing market will be limited and we do not expect significant spillovers from the subprime market to the rest of the economy or to the financial system .”

Just months later, the globe was in the grip of the Great Financial Crisis and mortgage-backed securities were giving asset managers and investors waking nightmares.

Amid all of the turmoil around the US banking system, and three of the four largest bank collapses in American history this year, is the debt ceiling argument, a fiscal phenomenon that hits Congress once every couple of years.

Since 1960, Congress has raised the debt ceiling 78 times, and increased the limit on its spending 17 times since Bitcoin was created in 2008. The possibility of the US defaulting on its debts is never a real possibility, given the outsize effect it would have on global markets.

Still, this kind of furore continues to push investors to diversify into both traditional and non-traditional stores of value as a hedge against calamity.

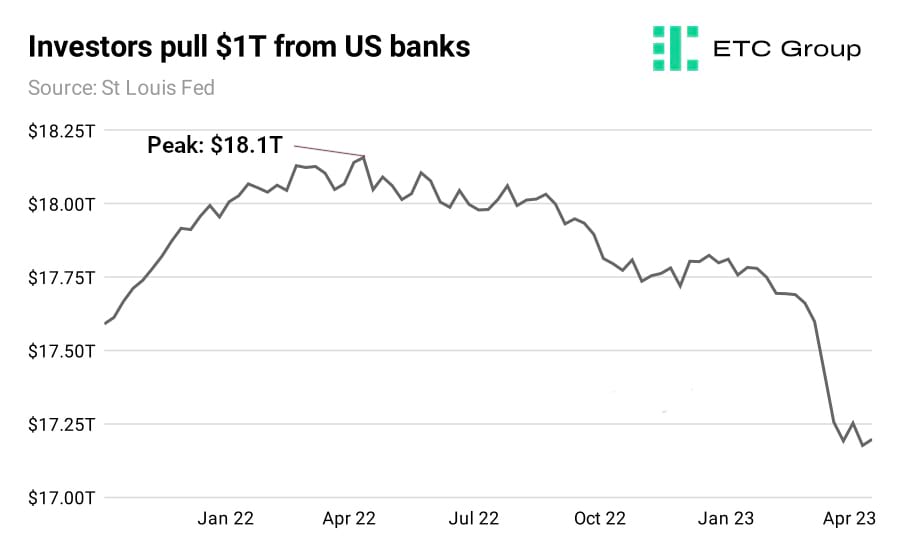

Deposits climbed at a record pace in 2020 and 2021 amid the uncertainty of the pandemic but after peaking at $18.18 trillion, cash has been flying out of commercial banks at a rapid rate.

Investors have pulled over $1 trillion from US commercial banks since deposits peaked in April 2022.

US banking worries continued to roil markets, which has been a net benefit to Bitcoin, gold and other safe-haven plays such as money market funds (MMFs).

MMFs in general invest in short-dated US treasuries, and with 1-month T-bills offering upwards of 4% yield, while bank accounts are stuck near zero, it has been no surprise to see customers pulling funds from commercial banks in a mass deposit flight.

And while the Federal Reserve has raised rates at the fastest pace in 40 years, US banks have failed to pass on those rises to savers, leading to investors seeking better yields elsewhere. Savings accounts up to $100,000 at Wells Fargo, for example, pay just 0.25% interest.

One of those potential alternative yield opportunities is the revitalised Ethereum, which completed its Shapella hard fork on 12 April, allowing users to withdraw ETH staked on the Beacon Chain.

And while pre-Shapella, concerns rippled through the market about increased Ether supply hitting the market and causing a price dump those fears have not materialised. While in the days after Shapella, withdrawals outpaced staking deposits, the ratio is tighter than analysts first suggested it could be.

3. Regulatory Signals

The UK has doubled down on efforts to welcome crypto businesses to its shores with a swathe of industry consultations, most notably from the Financial Conduct Authority regulator.

In a 25 April speech, the FCA's executive director of markets, Sarah Pritchard, hit the nail on the head, asking: “Have you ever notice how something once alternative or niche suddenly becomes mainstream?”

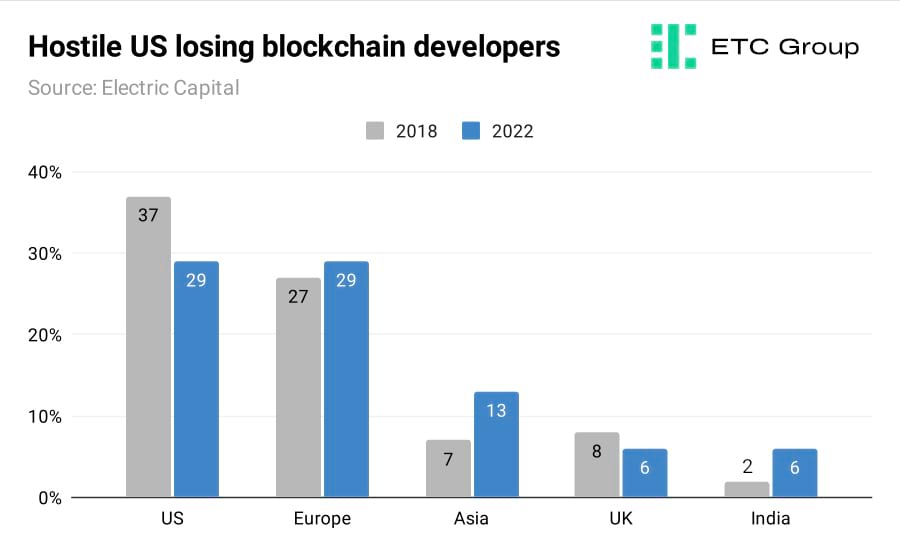

While there was increased more hostility and a broad lack of understanding over in the States, with the White House proposing a 30% tax on crypto miners, there was much more positivity in Europe, with the EU Parliament and the European Council in mid-April jointly passing the landmark Markets in Crypto Assets (MiCA) legislation.

Crypto investors have had to deal with living in a post-FTX world since the collapse of the derivatives exchange sent shockwaves through the industry in November 2022. The end of SBF's empire - which included the market maker Alameda - had serious effects on liquidity and on institutional confidence.

But MiCA (Markets in Crypto Assets) represents a bright spot on the legal and regulatory side due to its dispassionate and sensible attempt to classify tokens and provide stable rules of the road. MiCA is likely to enter into force in July 2023, with its major provisions coming into play between 12 and 18 months later.

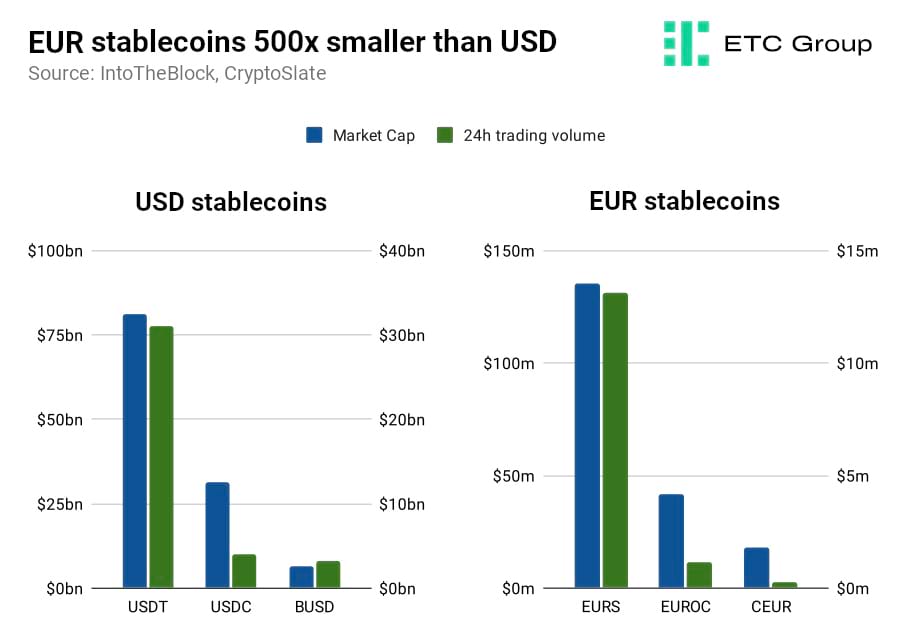

It is also a powerful statement of intent that Circle, the USDC issuer, chose Paris as its European hub to launch its Euro-based stablecoin EUROC. Circle CEO Jeremy Allaire cited the crypto-friendly climate in France as key to its decision. There remains much opportunity for growth, should the US continue on its short-sighted crusade against crypto.

USD-pegged stablecoins dominate crypto markets. The largest current Euro-pegged stablecoin, Stasis (EURS) has a market cap of $131m and a 24-hour trading volume of just over $13m. By contrast, Tether's USDT has a market cap and daily trading volume more than 500 times larger at $81bn and $31bn respectively. Taking second place in both markets are Circle's USD and EUR stablecoins, USDC and EUROC.

It is clear that MiCA will have long-reaching effects beyond its admittedly limited scope.

MiCA does not address crypto lending/staking, DeFi, nor NFTs. But simply having clarity on regulation will be beneficial to the growth of the European crypto industry.

The US has been suffering from an intense ‘brain drain' over the last five years as developers flee a hostile regulatory environment. According to Electric Capital's annual Developer Report, the US is losing blockchain developers to growth markets in Europe, Asia and India. The US has lost an average 2% market share for the last 5 years. This evidently threatens the US lead in finance and technology.

Standardised rules like MiCA also allow companies to innovate without fear of waking up one morning and being blindsided by SEC-style notice of prosecution. Coinbase had its shock Wells Notice in March, and in the last few days the regulator charged Seattle-based Bittrex with operating an unregistered securities exchange.

Two obvious second-order effects spring to mind for Europe: a more positive corporate environment encouraging innovation and growth, and a related improvement in market depth and liquidity. Crypto markets are their most volatile when liquidity is low. With less price support to both the upside and downside, it means larger buyers and sellers have relatively more impact on price.

The forced US closure of Silvergate Exchange Network on 3 March 2023 and the wind down of the 24/7 payment processing network Signet is significant as these two elements were some of the only USD payment rails for crypto. This means US exchanges were hit harder from a liquidity standpoint and market makers in the region faced unprecedented challenges.

Using Signet, companies could process transactions outside market hours which was particularly useful for minting and redeeming stablecoins like USDC.

As Paul Grewal, Coinbase's chief legal officer said earlier this year of the bitterly antagonistic US environment: “I think it is easy to look at the situation right now and conclude that the SEC is trying to change the rules of the game. What's actually happening is the SEC is trying to cancel the game after it has been played.”

MiCA will likely induce more participants to experiment with blockchain-based financial innovations. That includes the likes of Siemens, which in February 2023 issued a €60m tokenised bond under Germany's eWpG legislation for digitally-native electronic securities, passed in mid-2021, or the four German banks now trialling blockchain-based deposit tokens.

4. On-Chain Signals

Bitcoin

Liquidity Demand: Exchange Flows

Bitcoin outflows totalled $15.7 billion in April while exchanges saw $17.9 billion worth of inflows. Total activity amounted to $33.6 billion which marked a 22% decrease from exchange flows recorded in March.

The diluted activity signals that more traders may have adopted investment positions they are unwilling to move away from. To this end, inflows did beat outflows in April which shows that a larger percentage of active traders may be looking to move their digital assets to sell positions on exchanges. Neutral Bitcoin

Futures Activity

Bitcoin futures volume closed the month at $930 billion – roughly 20.5% less than the figure documented in March. Over $500 billion of Bitcoin futures were traded on Binance in April with ByBit and OKX also both witnessing over $140 billion of futures bets in the month. Bearish Bitcoin

Ethereum

Liquidity Demand: Exchange Flows

Ethereum outflows bested inflows by 20% in what was a massive month for Ethereum exchange flows. Ethereum inflows came in at $120 billion while outflows hit $100 billion. To put this into context, outflows were one-fourth of this number in March and inflows were about one-third of April's figures.

The frenzied activity can be ascribed to the release of staked ETH following the Shapella upgrade which saw a large number of users withdraw ETH from the network and add it to exchanges. At the same time, the success of the upgrade incentivised many investors to stake ETH for the first time and move it on on-chain and away from exchanges. Bullish Ethereum

Futures Activity

Ethereum futures trading topped off at $571 billion in April. This is less than the $634 billion posted in March but still reflects stabilising appetite for users to trade futures on centralised venues like Binance, OKX, and ByBit. Neutral Ethereum

5. Into the Metaverse

Fidelity has increased its investment in the Metaverse, with the aim of providing enhanced financial education experiences for investors. The company plans to launch two games on Metaverse platforms, namely Pancake Empire Tycoon on the centralised gaming platform Roblox, and Bloom-o-rama on the decentralised Web3 platform Decentraland.

Users who visit Fidelity's Bloom-o-rama on Decentraland will have the opportunity to navigate mazes and respond to quizzes on spending, saving, and investing, with the app designed to broaden financial education.

Fidelity's foray into the metaverse began with the launch of its metaverse ETF (LSE: FMVR) last year. At the close of April, FMVR was up 12.5% YTD, while ETC Group's own metaverse ETF (LSE: METR) has been one of Europe's highest performing alternative investment funds this year, adding 18% in the first five months alone.

The art auction house Sotheby's is expanding its NFT services by introducing a peer-to-peer secondary marketplace for digital art. The platform will allow for direct transactions between collectors, with sales being conducted fully on-chain via Ethereum and Polygon with users having the option to pay in either ETH or MATIC.

Sotheby's first entered the NFT market in 2021, and its NFT sales have now surpassed $120 million.

The HBAR foundation has allocated $250 million to a new fund aimed at attracting users, consumers, and brands to Hedera Hashgraph's Metaverse ecosystem. The capital will be directed towards four verticals, namely gaming, fashion, entertainment, and sports.

Hedera Hashgraph is a Web3 platform that allows developers to write smart contracts and users to make transactions, with the HBAR foundation being the entity behind it and consisting of a council of multinational corporations and educational institutions from around the world.

The fund is seeking to bring in business-to-customer and business-to-business-to-customer applications, in addition to supporting game developers interested in building within the ecosystem.

The HBAR foundation has made substantial investments in industry projects this year, including the $155 million Crypto Economy Fund launched in March, aimed at accelerating DeFi development on the Hedera network by providing grants and subsidies.

Developers of the popular meme token Shiba Inu have indicated that users will have their first opportunity to explore a Shiba Inu Metaverse by the end of 2023. This will only be the initial phase of the project's Metaverse development, with the long-term goal being to roll-out 100,000 plots of land in the form of NFTs that will be minted and traded by users.

The French Economic Ministry has released a consultation paper that focuses on preventing the dominance of tech conglomerates in the Metaverse. The paper seeks to identify homegrown alternatives to American internet giants, with a view to achieving "digital sovereignty" in Europe.

The European Commission championed a similar line of thinking in a consultation paper published in April that highlights the risks posed by "gatekeepers" who may block competition from smaller, innovative challengers in the EU in developing Metaverse platforms, technologies, and hardware.

6. Digital Asset & Metaverse Equities

Coinbase (NASDAQ: COIN) faced a tumultuous April, with its shares plummeting 15% to $53 due to mounting regulatory pressure from the SEC. A Wells notice from the SEC put Coinbase's spot trading, staking, and custody services in peril, prompting the company to take legal action against the enforcement agency

The exchange has responded by taking legal action against the SEC and has asked a federal judge to force the SEC to comment on Coinbase's petition from 2022 that asks it to justify whether existing securities rule-making processes should be extended to the digital asset sector.

Coinbase launched a derivatives exchange for non-US institutional investors to trade perpetual futures in the wake of more hostile pressure from domestic regulators.

“Perpetual futures accounted for nearly 75% of global crypto trading volume in 2022,” the release notes, “offering traders additional versatility in their trading strategies.”

Leading Bitcoin miner Riot (NASDAQ: RIOT) had a bullish month in April with the company adding 23% to its share price. Riot is already up by 250% YTD as it reaps the rewards of the rising price of Bitcoin and the gradual grinding down of operational and energy costs as inflation cools in the US.

Bitcoin miners benefit from elevations in the price of Bitcoin because the revenue they generate from operational activities (or mine) comes in the form of BTC. Any price movements directly impact their reserves – that are chiefly denominated in Bitcoin – and operational costs.

MicroStrategy (NASDAQ: MSTR) stock improved 10% by April end. The enterprise-software maker posted its first profit in nine quarters after registering a tax benefit related to its vast holdings of more than 140,000 BTC.

Their results for Q1 show that the company had a net income of $461m compared with a loss during this period last year. The rise in the price of Bitcoin this year has also allowed MicroStrategy to reduce its impairment loss to $18.9m compared to $197.6m in Q4 2022.

Meta (NASDAQ: META) shares climbed after reporting better-than-expected sales in the first quarter. It recorded earnings of $2.20 per share against analyst expectations of $2.03. It also beat estimates in metrics like quarterly revenue and daily active users (DAU) with revenue hitting $28.65 billion and DAU reaching 2.04 billion.

Apple (NASDAQ: AAPL) made modest gains of 2% ahead of its highly anticipated quarterly earnings announcement. Wall Street expects the company to announce that it will spend roughly $90 billion on buybacks and dividends in a demonstration of its financial muscle.

The company's entry into the metaverse space is expected to blossom with the launch of the Reality Pro VR/AR headset in June, as a direct competitor to Meta's market-leading Quest VR headset. Industry rumours suggest the Reality Pro could go on sale directly after its unveiling at the WorldWide Developer Conference in California.

One report from Taiwan's Economic Daily News quoted Foxconn subsidiary GIS, which claims to be supplying the lenses for the augmented reality headset, with GIS likely to ship an as-yet unnamed “metaverse-related product” in the second quarter of 2023.

7. Outlook

Crypto market prices are holding up and remaining steady, while commodities, equities and bond markets are all displaying signs of extreme stress.

It now appears that a pause in central bank rate hikes by the second half of the year could translate into another bullish phase for digital asset markets.

And while softening futures activity and thinner liquidity points to more volatility ahead for digital asset markets, the relative outperformance of the two largest assets, BTC and ETH, can not be ignored.

Amid deposit and capital flight from the US banking system, and the broad injection of positivity from the EU's passing of its bloc-wide standardised MiCA regulation, there remain multiple tailwinds for digital assets as we enter the second quarter of the year.

New technical and technological developments in Bitcoin - namely Ordinals and BRC-20 tokens - are sure to spark debate about the uses and usage of the oldest blockchain, and whether blockspace should be reserved against more speculative activity.

With central banks raising rates into brittle markets, outperformance from BTC and ETH on a risk-adjusted basis, massive yield curve inversions showing systemic fragility, and interest rates highly likely to reverse course in the second half of the year, this should push more investors into these non-traditional portfolio diversifiers over the coming months.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.