- Performance: In December 2024, crypto markets faced macroeconomic headwinds, including profit-taking, reduced institutional exposure, and tightening financial conditions driven by US Dollar appreciation and revised Fed policies, which weighed on Bitcoin and altcoins despite ongoing on-chain support. While short-term risks persist, long-term bullish factors like the Bitcoin Halving and potential strategic reserves support forecasts of significant price appreciation, with Bitcoin expected to outperform traditional assets through 2025 and beyond.

- Macro: The December FOMC meeting resulted in a 25 bps rate cut but signalled higher-than-expected future rates, tightening financial conditions despite efforts to ease them, posing risks to Bitcoin and traditional markets due to declining global liquidity and a strong dollar. Meanwhile, inflation pressures and weak labour market indicators highlight economic fragility, with Bitcoin's performance remaining tied to traditional markets like the S&P 500, which may face downside risks from growth repricing.

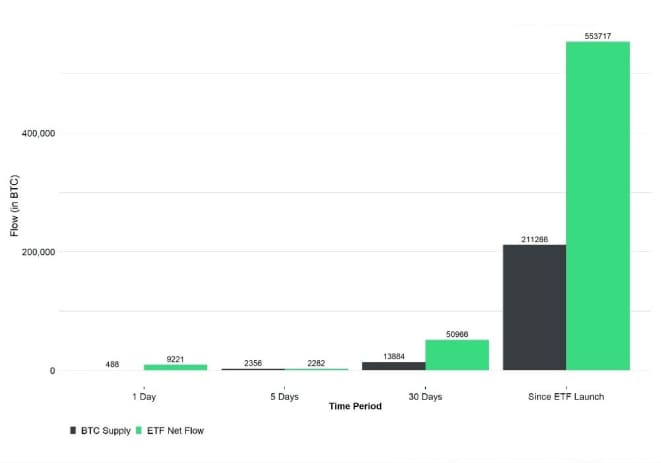

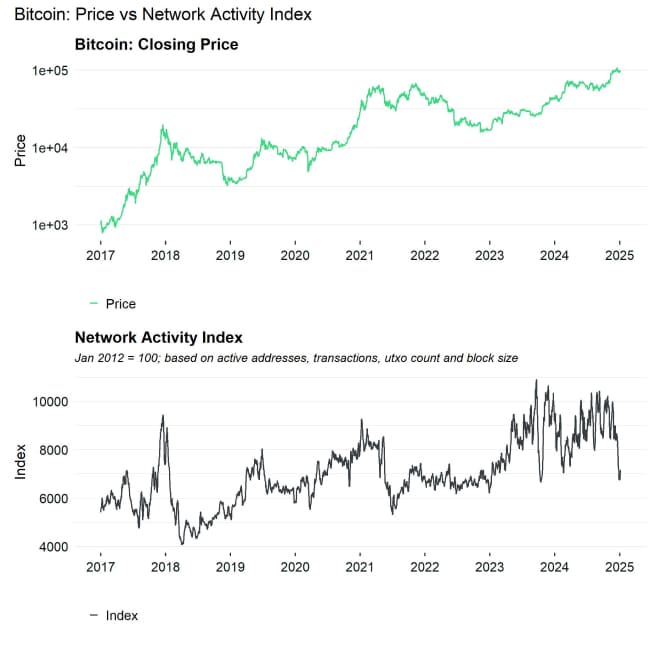

- On-Chain: Despite macroeconomic headwinds, strong on-chain demand from ETFs, corporate treasuries, and retail participants has created a significant Bitcoin supply deficit. While some on-chain activity has cooled, key metrics like reduced exchange balances and rising hash rates signal ongoing resilience.

Chart of the Month

Performance

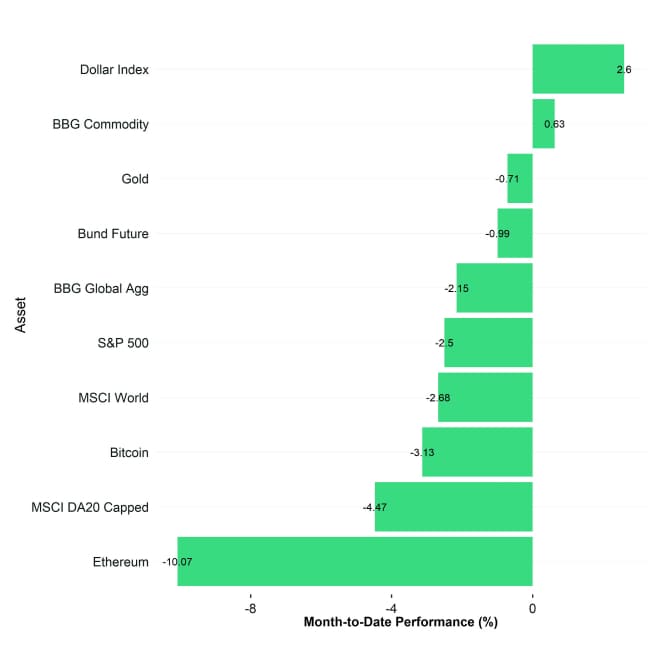

The performance in December was characterised by a reduction in exposure towards year-end and elevated profit-taking by long-term bitcoin holders. This might be related to rebalancing trades of institutional investors who reduce exposure to take profits and bring back their cryptoasset allocations to neutral.

In fact, we have continued to observe that crypto hedge funds further decreased their market exposure to Bitcoin in December 2024 to yearly lows based on data provided by NilssonHedge and our own analyses. Overall crypto ETP exposure was also reduced in December in particular towards year-end where we saw 2 consecutive negative outflow weeks on aggregate globally.

Another important catalyst for the recent price action in December has been the FOMC meeting on the 17 th /18 th of December 2024. Although the Fed cut the Fed Funds Target Rate by 25 bps, the Fed also revised its Summary of Economic Projections (aka “dot plot”) to only include 2 additional rate cuts in 2025, less than previously telegraphed and also less than anticipated by traditional financial markets.

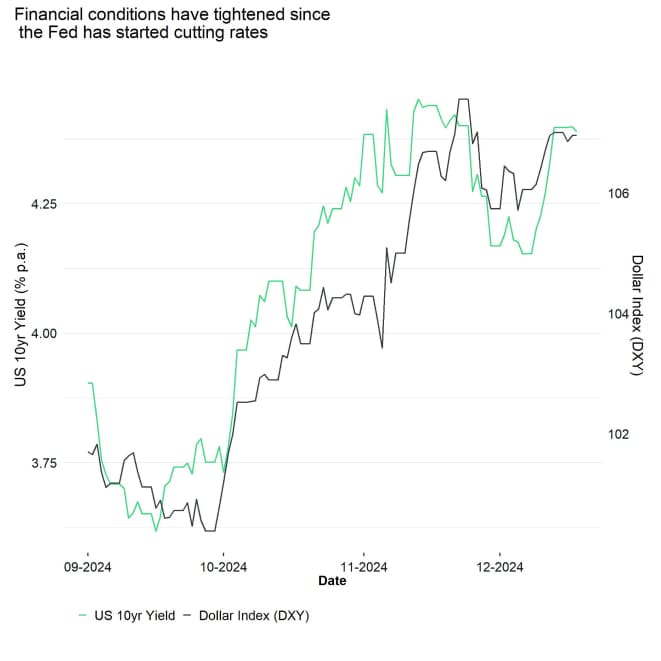

As a result, long-term US Treasury bond yields have continued to increase, and the Dollar has continued to appreciate in December. This has also led to a further tightening in financial conditions as measured by the Goldman Sachs US Financial Conditions Index.

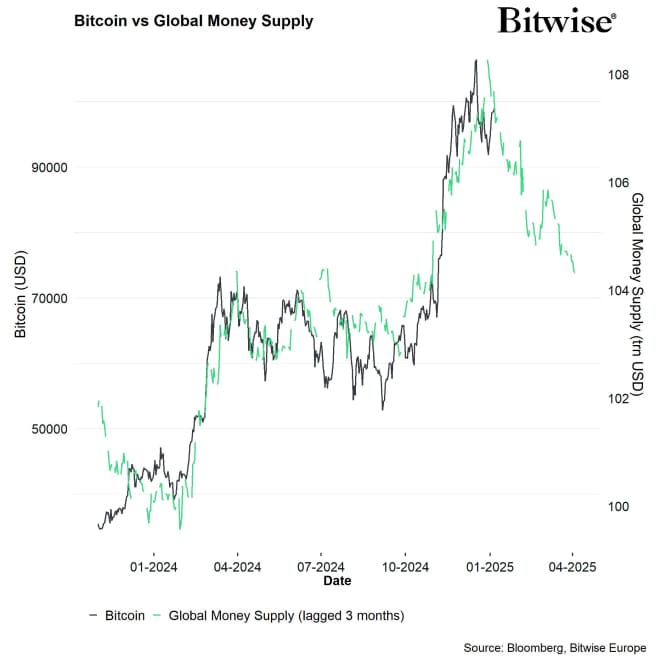

This has generally weighed on Bitcoin and crypto markets since an appreciation of the US Dollar generally leads to a contraction in global money supply as highlighted in our previous Bitcoin Macro Investor report in December 2024.

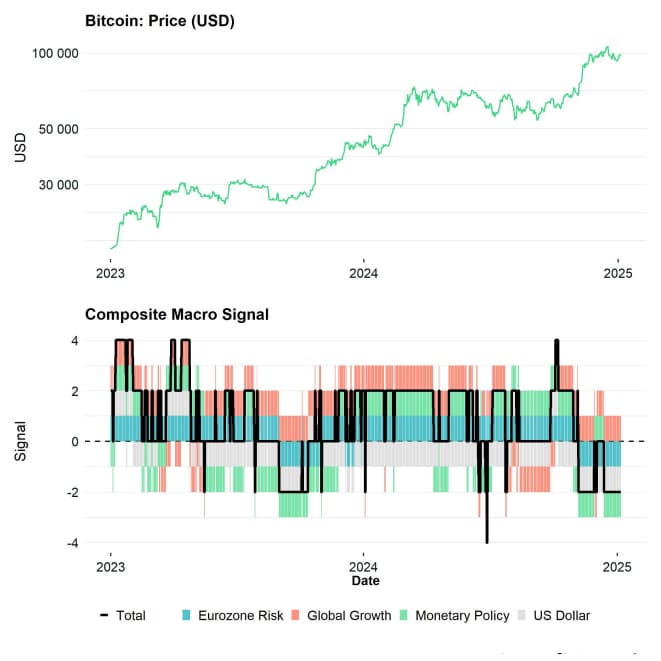

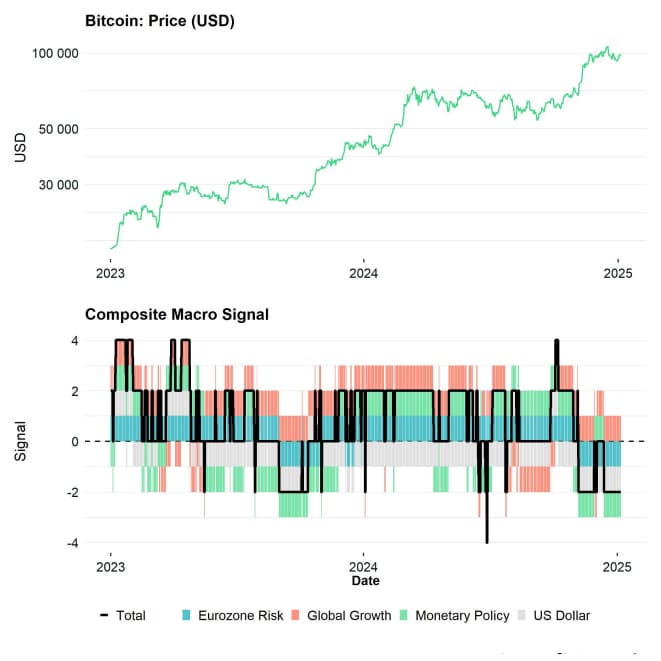

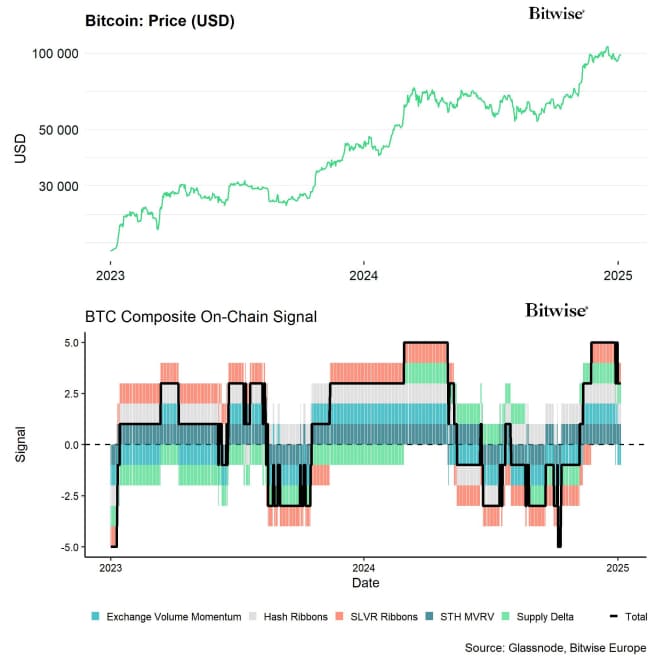

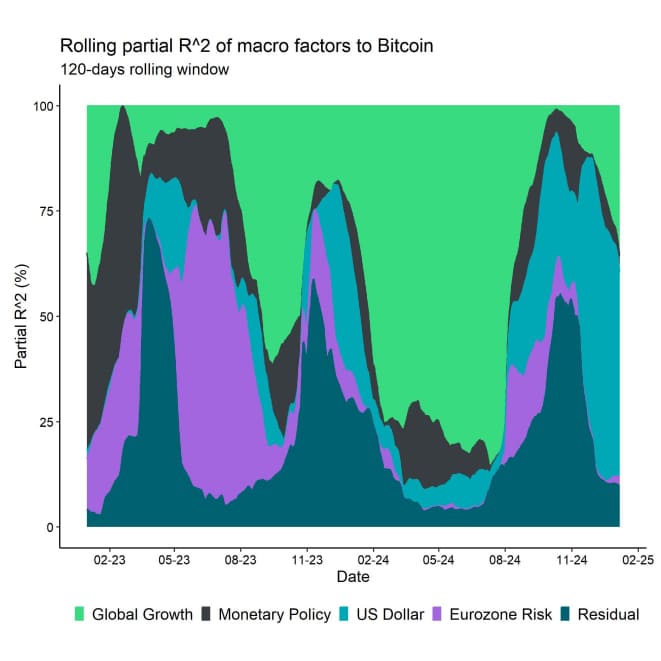

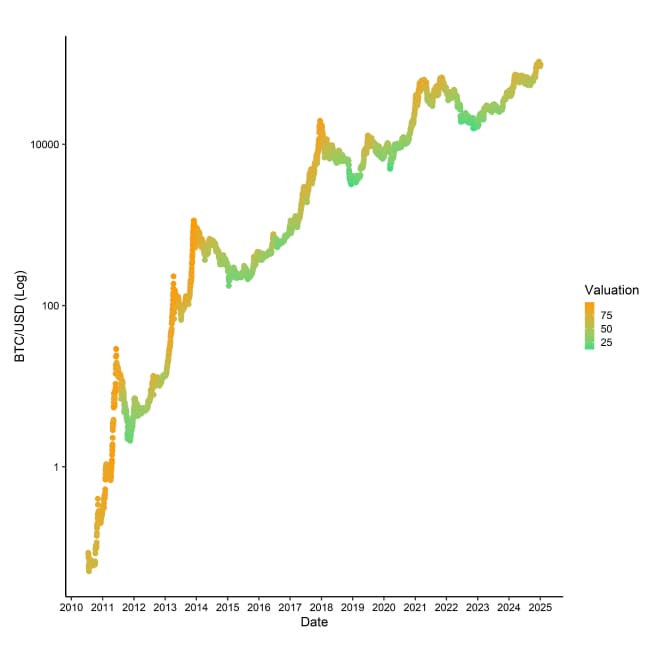

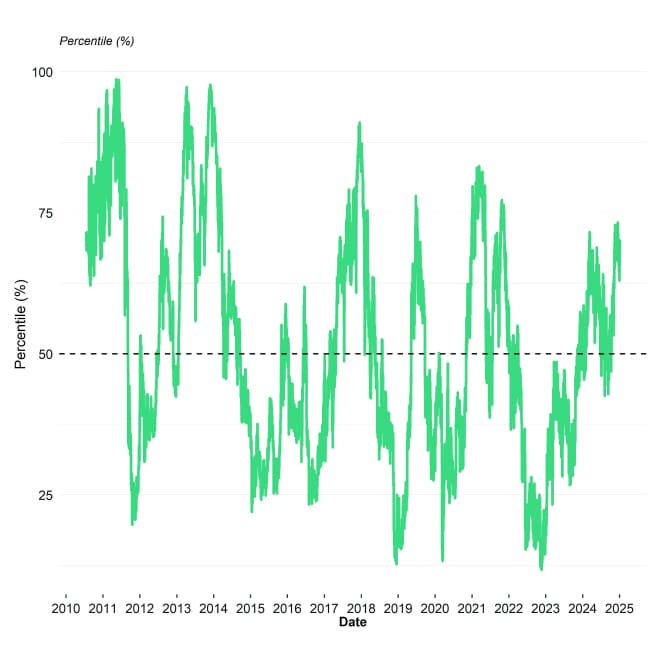

While on-chain metrics continue provide a tailwind and to support our Bitcoin supply deficit investment hypothesis, the latest macro developments imply that macro factors are increasingly becoming a headwind for bitcoin and cryptoassets (Chart-of-the-Month).

We are generally observing a divergence between increasing macro headwinds but also ongoing on-chain tailwinds for Bitcoin.

It is quite likely that the recent deterioration in monetary policy expectations combined with the ongoing US Dollar appreciation and increasing Eurozone sovereign risks (France) could lead to a repricing in global growth expectations to the downside as well. In this context, the latest macro developments in China, in particular, the steep decline in Chinese long-term bond yields, also points towards increasing Chinese and global recession risks.

A repricing in global growth expectations tends to coincide with a decline in cross asset risk appetite which tends to affect cryptoasset sentiment negatively as well.

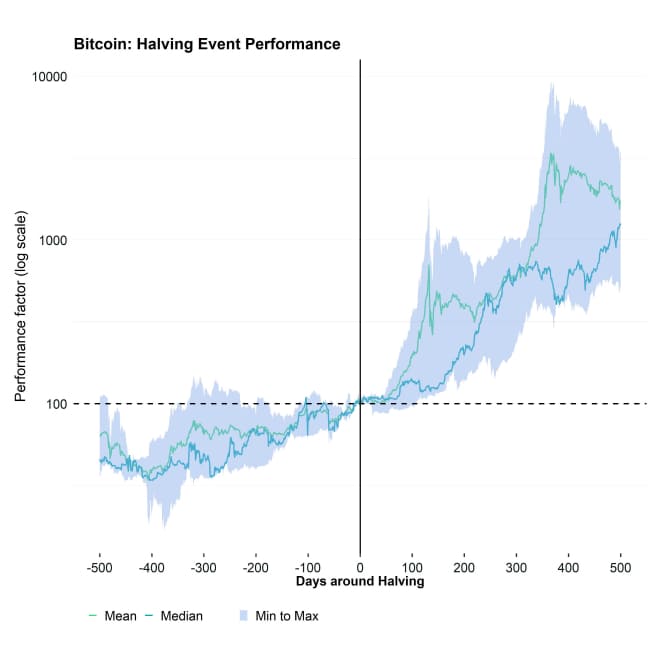

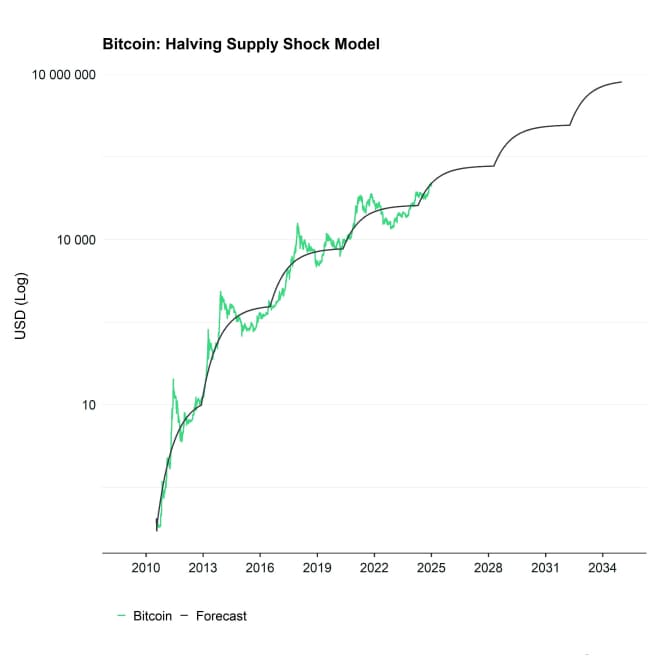

However, our main investment hypothesis remains that on-chain factors should continue to provide a tailwind at least until mid-2025 due to the lagged positive effects emanating from the Bitcoin Halving.

Special factors like the potential establishment of a Strategic Bitcoin Reserve in the US and other nations should also provide a positive tailwind.

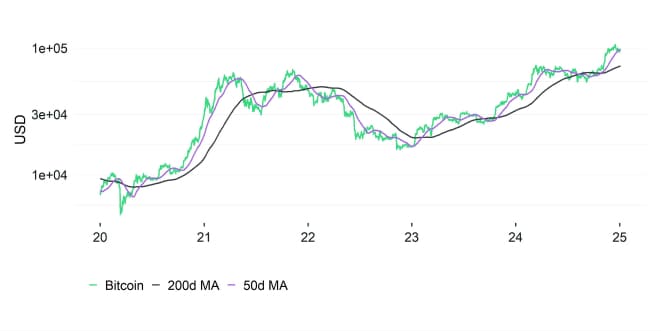

We reiterate our predictions that Bitcoin should reach 200k USD by the end of 2025 and potentially 1M USD by the year 2029 which is why we think that any macro-related sell-off in the short term could be an attractive opportunity to increase exposure to bitcoin and other cryptoassets.

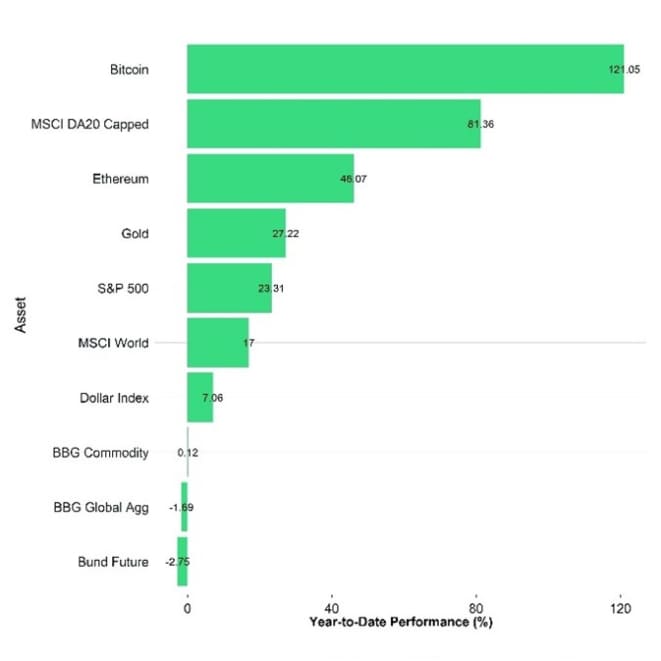

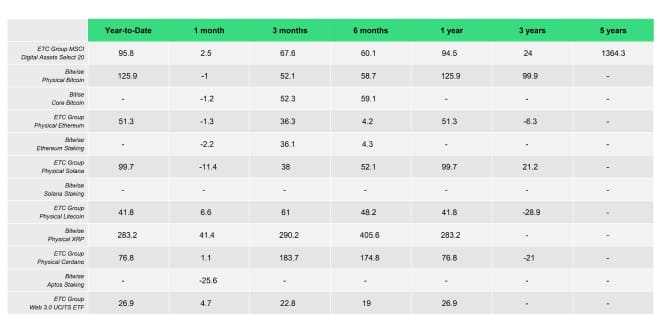

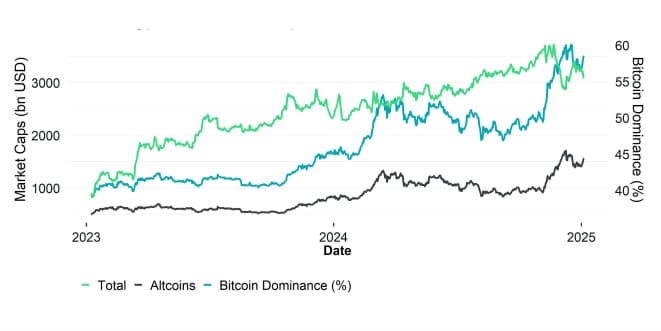

It is also worth highlighting the full-year 2024 performances of cryptoassets. Although December was a rather weak performance month for Bitcoin and cryptoassets, overall performances were very decent: Bitcoin and other cryptoassets outperformed every other major traditional financial asset in 2024 by a very wide margin.

A closer look at our product performances for the full year of 2024 also reveals that the Bitwise Physical Bitcoin ETP (BTCE) was one of the best performing products in 2024 although the Bitwise Physical XRP ETP (GXRP) also performed very well.

Please note that we are still transitioning from ETC Group product names to Bitwise following the recent acquisition. We have also launched a new Bitwise Solana Staking ETP. Read more about this launch here.

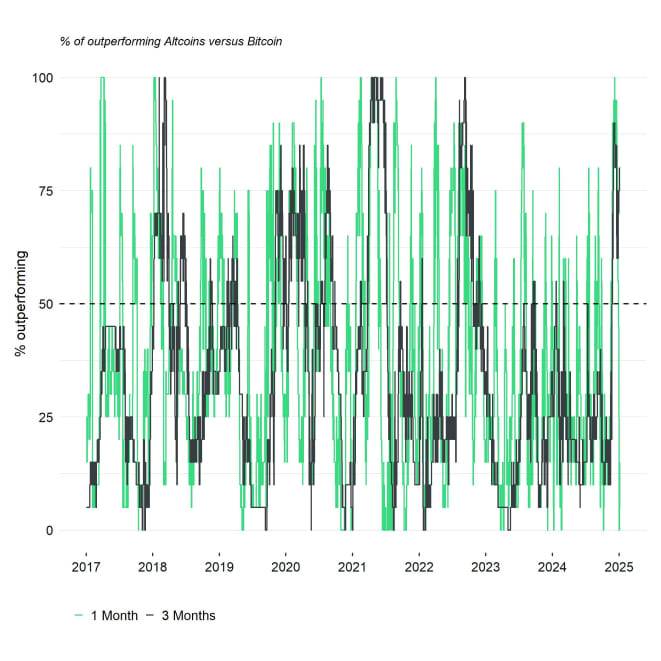

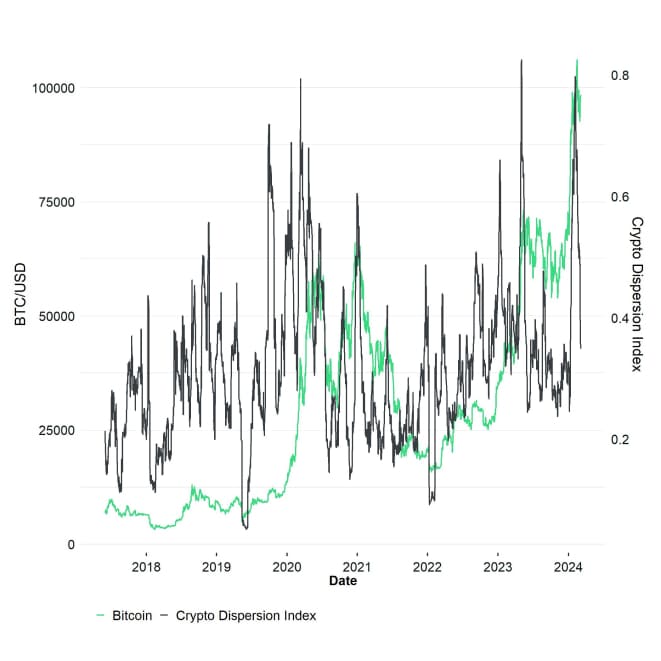

A point that is worth highlighting in December is that as BTC traded lower, most altcoins also underperformed and became more correlated to BTC as well.

Our Altseason Index implies that only 10% of our tracked set of major altcoins managed to outperform BTC monthly. This decline in altcoin outperformance also coincided with a steep decline in performance dispersion among cryptoassets as evidenced by our Crypto Dispersion Index.

Bottom Line: In December 2024, crypto markets faced macroeconomic headwinds, including profit-taking, reduced institutional exposure, and tightening financial conditions driven by US Dollar appreciation and revised Fed policies, which weighed on Bitcoin and altcoins despite ongoing on-chain support. While short-term risks persist, long-term bullish factors like the Bitcoin Halving and potential strategic reserves support forecasts of significant price appreciation, with Bitcoin expected to outperform traditional assets through 2025 and beyond.

Macro Environment

Major macro focus in December was the FOMC meeting on the 18 th of December 2024.

The Fed reduced its target rate by 25 bps as expected which was the 3rd consecutive rate cut since September 2024. Nonetheless, traditional financial markets reacted negatively at first as the accompanying forward guidance was hawkish.

The updated Summary of Economic Projections (aka “dot plot”) showed that the median projected Fed interest rate for the year 2025 moved from 3.375% in September to 3.875% in December. So, the Fed communicated a higher prevailing interest rate than previously anticipated and pencilled in less rate cuts.

The Fed appears to be stuck between a rock and a hard place as financial conditions have continued to tighten since the Fed embarked on a rate cutting cycle in September.

For instance, the Dollar Index has been moving up and US Treasury yield have also continued move higher despite 3 consecutive Fed rate cuts since September.

We have already highlighted the negative effect of a strong Dollar on global money supply growth in our previous monthly report already. Dollar appreciations tend to be bearish for Bitcoin because of global money supply contracts when the US Dollar appreciates and vice versa.

This continues to be a major macro risk for Bitcoin going into 2025.

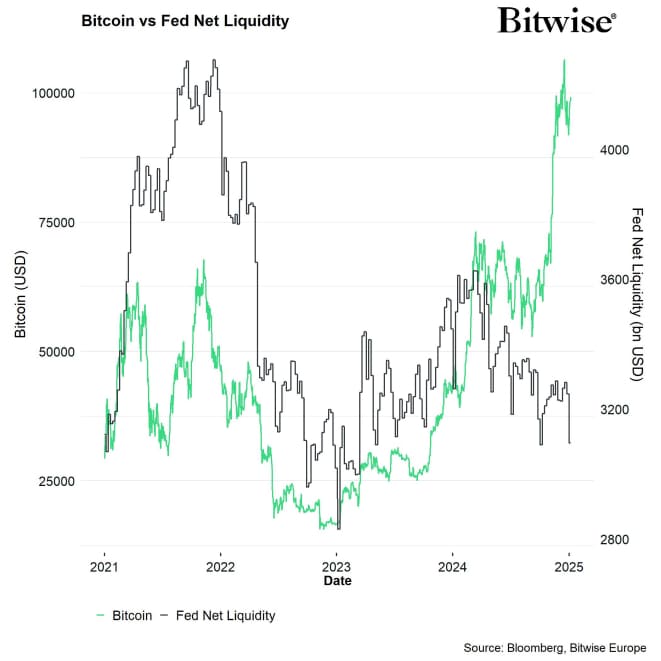

One of the major reasons for this decline in liquidity is the ongoing decline in global central bank liquidity despite ongoing efforts to decrease key interest rates.

As far as the US is concerned, the major reason for the ongoing decline in central bank liquidity is the ongoing “Quantitative Tightening” that is induced via the continued reduction of the Fed's US Treasury and MBS holdings on its balance sheet.

This has been somewhat cushioned by declines in both the Reverse Repos and the decline the Treasury General Account (TGA) that have technically added to the Fed's net liquidity provision. However, the recent rise in Reverse Repos towards the year-end has also led to a significant decline in Fed net liquidity as well.

However, the ongoing decline in Fed net liquidity is also an ongoing macro risk for Bitcoin and traditional financial markets as well.

Meanwhile, high-frequency indicators for US consumer price inflation have started to re-accelerate again based on the US inflation rate tracker provided by Trueflation to the highest level since April 2024.

In other words, the Fed either risks to “kill” the current economic recovery via even tighter financial conditions if they don't provide liquidity more aggressively or risk a re-acceleration in inflation rates in 2025 et seqq.

Moreover, US labour market conditions remain relatively weak as evidenced by high-frequency indicators like the decline new job postings on Indeed or the ongoing decline in the LinkUp 10,000 index.

What is more is that an analysis by the Philadelphia Fed concludes that recent growth in state employment payrolls (a major driver of recent overall jobs growth) in the first half of 2024 have proven to be illusive and job growth appears to be lower than previously expected in the vast majority of US states:

According to the early benchmark (EB) estimates conducted by the Phily Fed, employment was lower in 25 states, higher in two states, and lesser changes in the remaining 23 states and the District of Columbia.

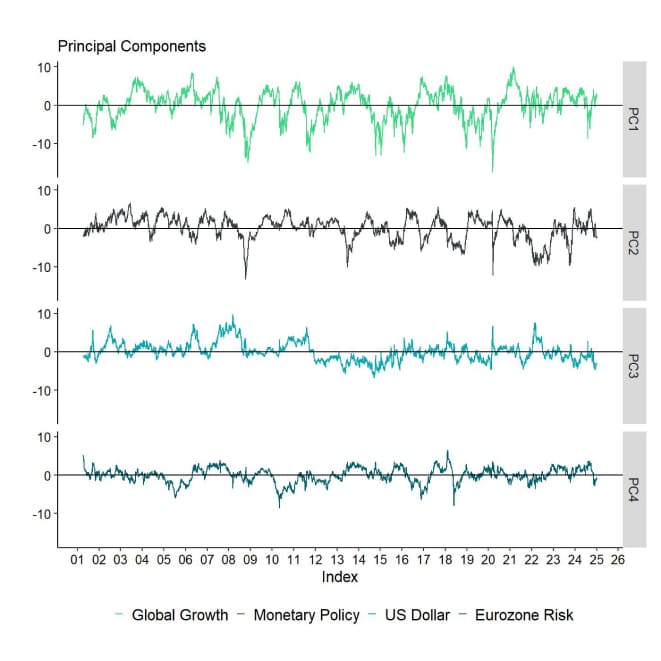

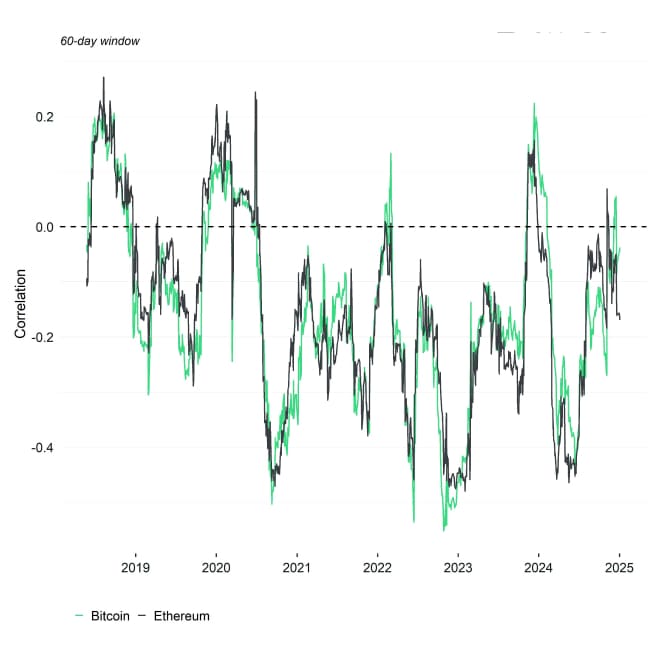

In general, our in-house macro factor model also implies that global macro conditions have been weakening over the past couple of weeks which is also our Chart-of-the-Month:

This has generally been related to a deterioration in the monetary policy factor and the US Dollar factor which have turned into a macro headwind more recently. Furthermore, the recent rise in French sovereign risks has led to a deterioration in the Eurozone Risk factor as well. Only global growth expectations continue to be a macro tailwind for the time being.

However, latest high-frequency indicators out of China like the Chinese 10-year Treasury yield point to a pronounced deceleration in Chinese growth momentum, and by derivation, global growth momentum.

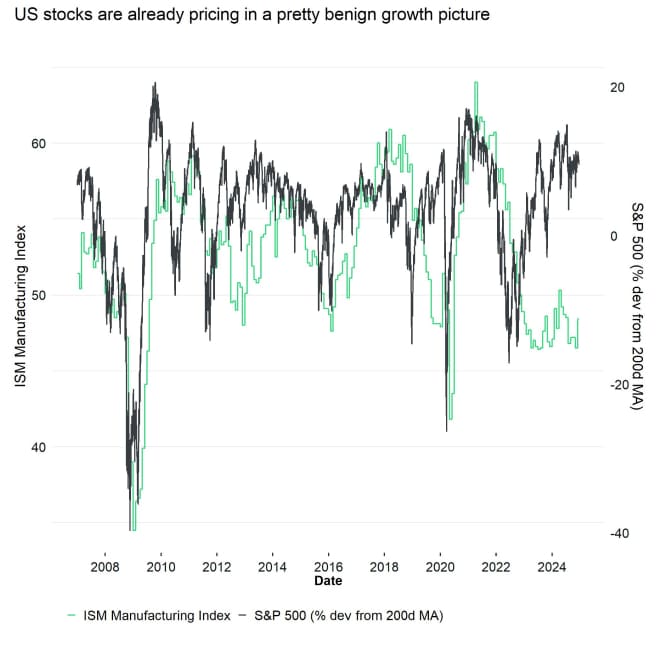

In the context of global growth expectations, the risk appears to be more tilted to the downside since traditional financial assets already reflect a relatively benign global growth picture.

For instance, this can be observed in the large divergence between cyclicals and defensives stocks but also in the fact that the S&P 500 has been rallying despite no material improvement in leading indicators like the ISM Manufacturing Index. In other words, traditional financial markets have already priced in the “soft landing” scenario to a very large extent.

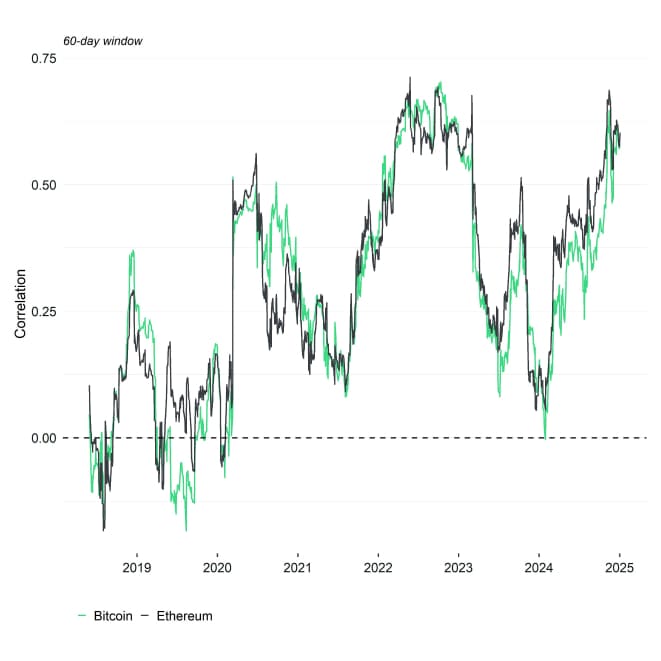

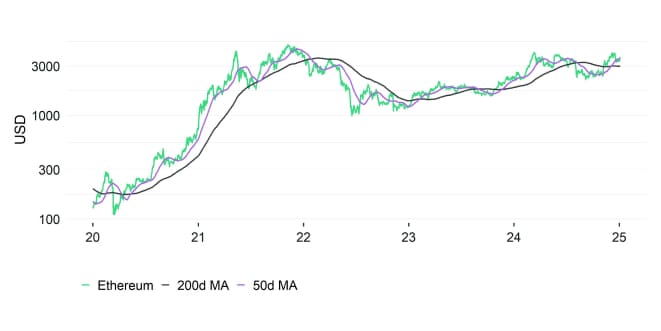

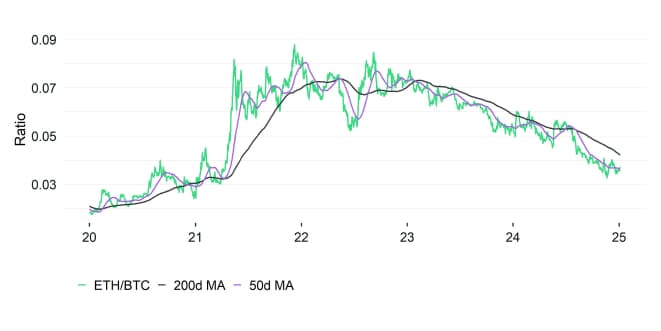

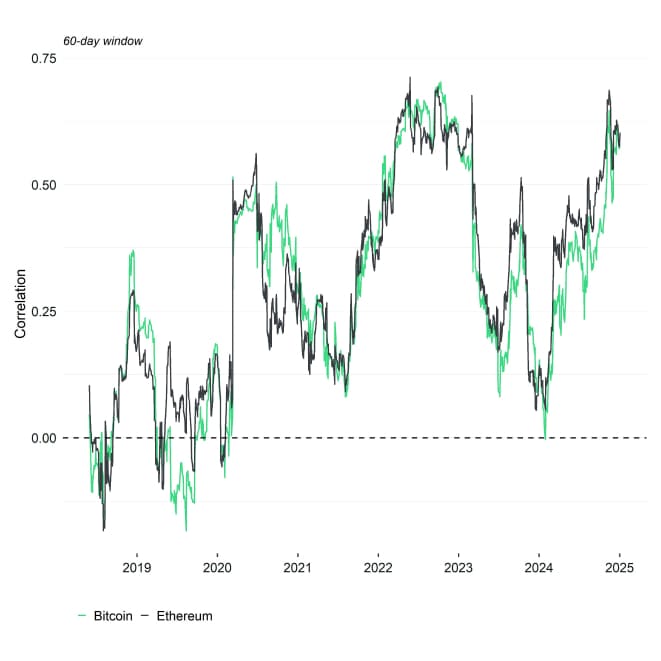

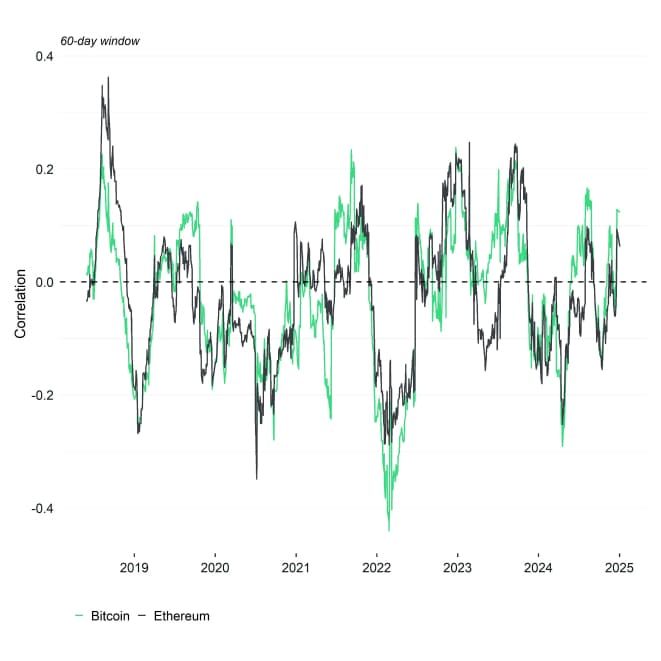

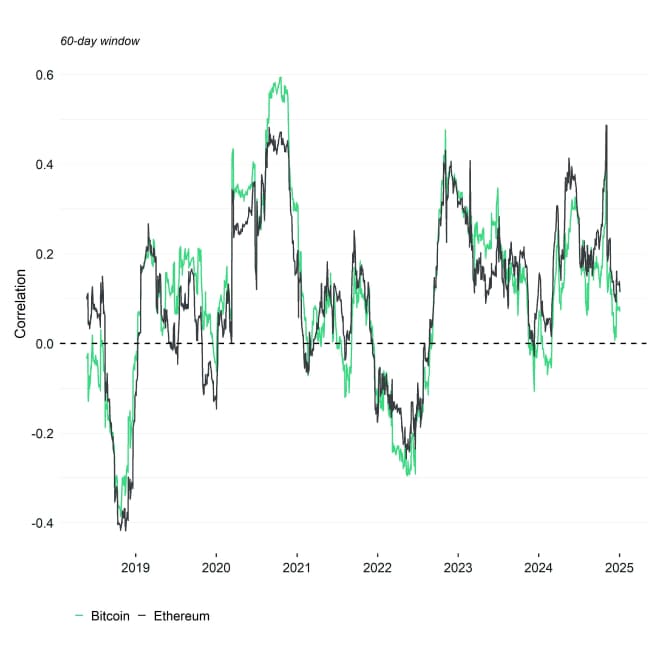

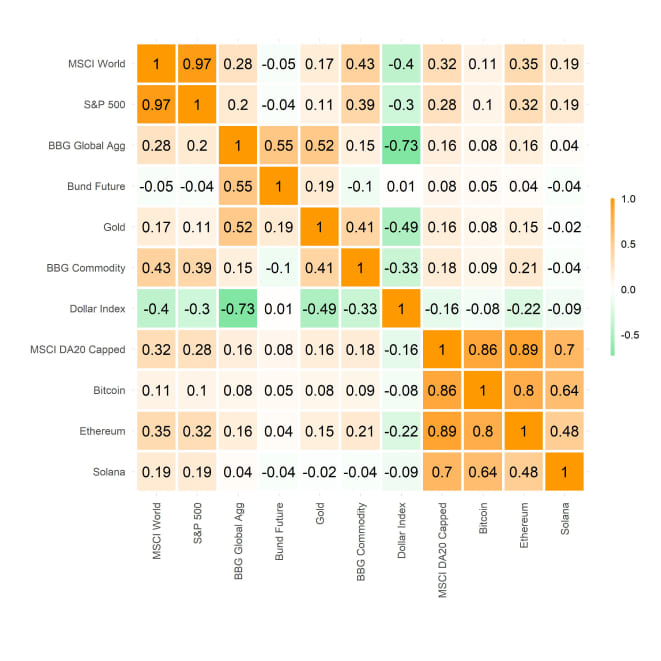

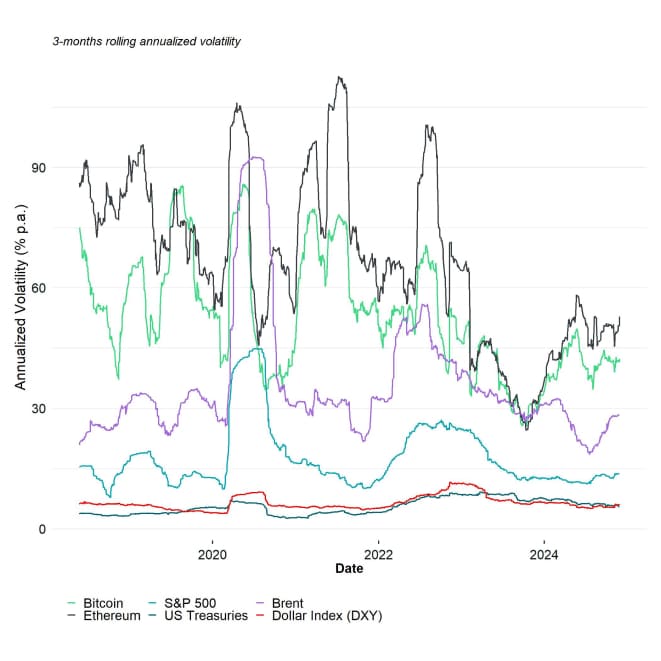

The reason why that is relevant for Bitcoin and other cryptoassets is the fact that both Bitcoin and Ethereum still remain highly correlated with the performance of the S&P 500.

Any correction in the S&P 500 related to a repricing in global growth expectations could therefore be negative for the performance Bitcoin and other cryptoassets.

Bottom Line: The December FOMC meeting resulted in a 25 bps rate cut but signalled higher-than-expected future rates, tightening financial conditions despite efforts to ease them, posing risks to Bitcoin and traditional markets due to declining global liquidity and a strong dollar. Meanwhile, inflation pressures and weak labour market indicators highlight economic fragility, with Bitcoin's performance remaining tied to traditional markets like the S&P 500, which may face downside risks from growth repricing.

On-Chain Developments

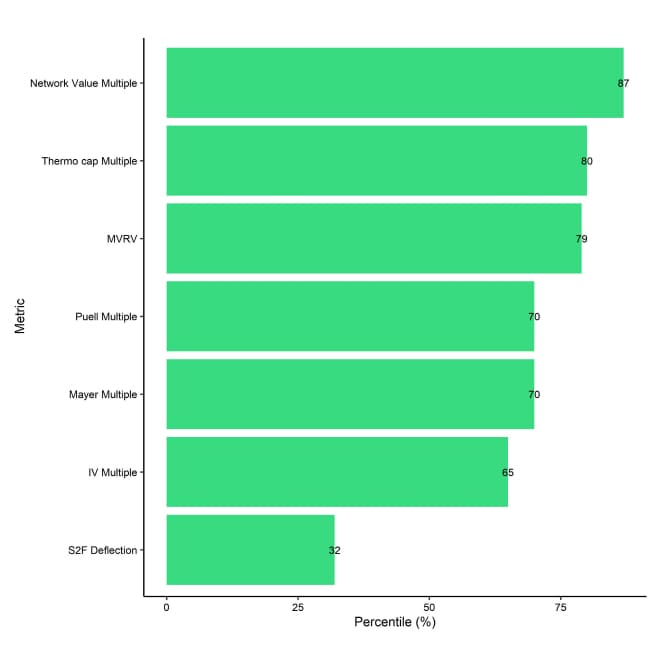

While macro factors have turned into a net headwind more recently, on-chain factors have continued to provide a very significant tailwind for Bitcoin.

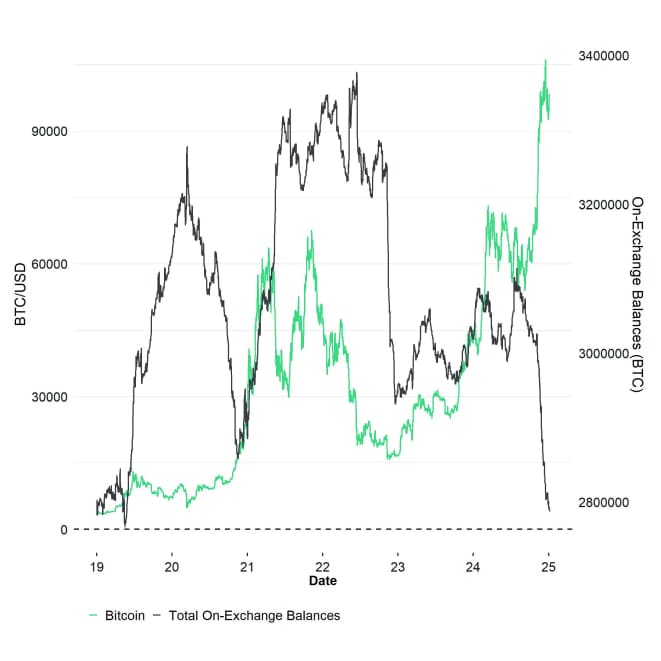

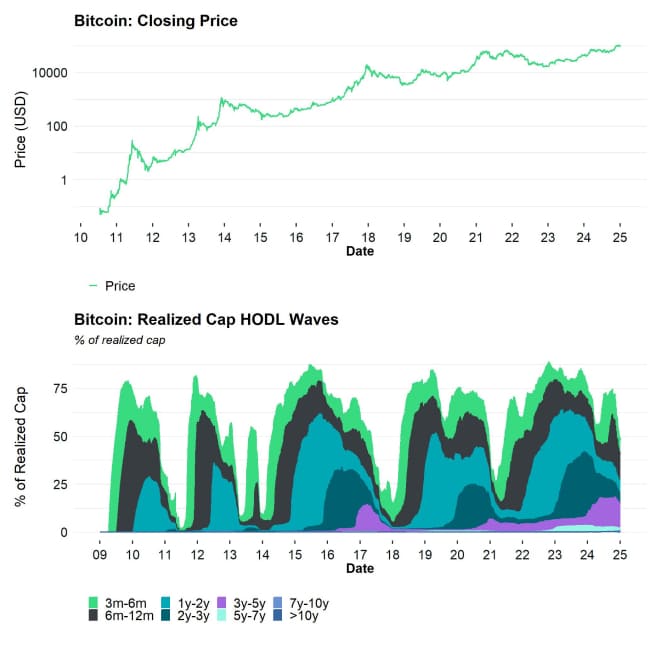

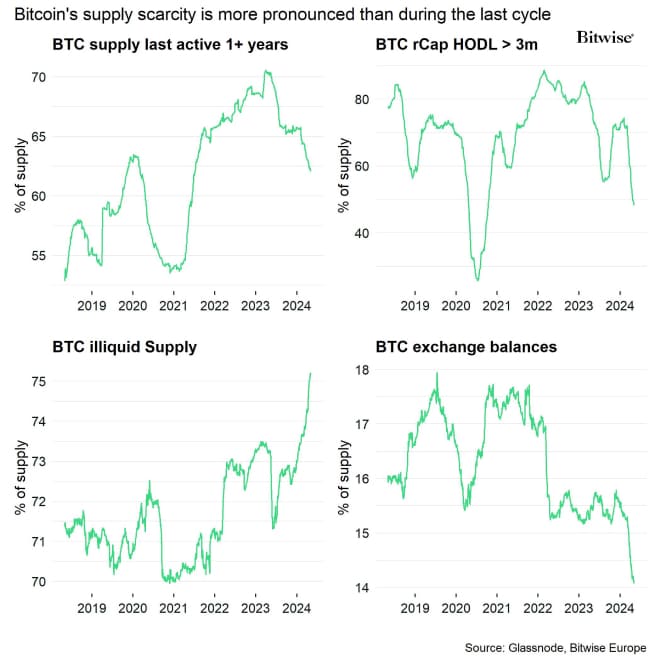

The BTC supply deficit has continued to intensify in December as evidenced by the continuing reduction in on-exchange balances and decline in liquid supply.

Key to this development has been the almost relentless demand coming from US spot Bitcoin ETFs but also the acceleration in the corporate treasury adoption of Bitcoin.

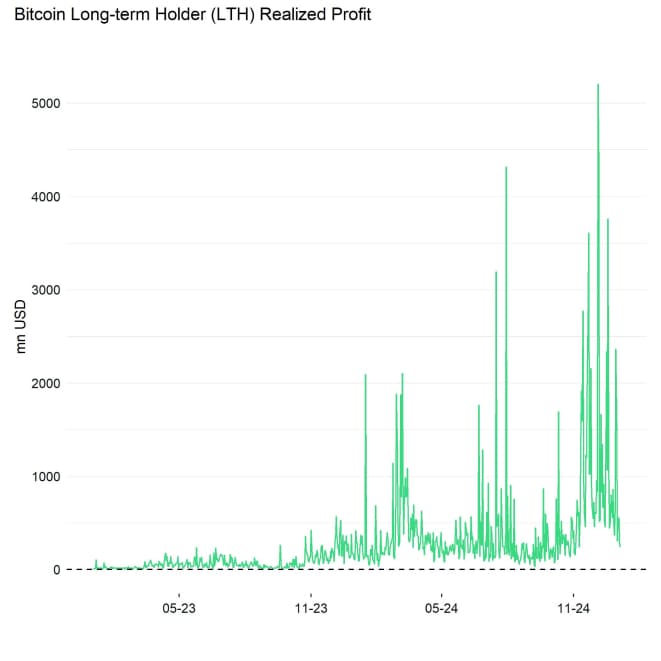

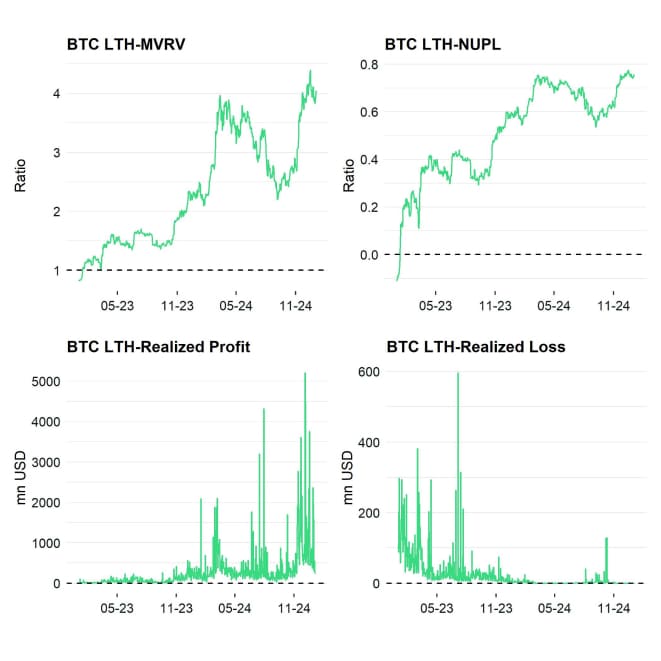

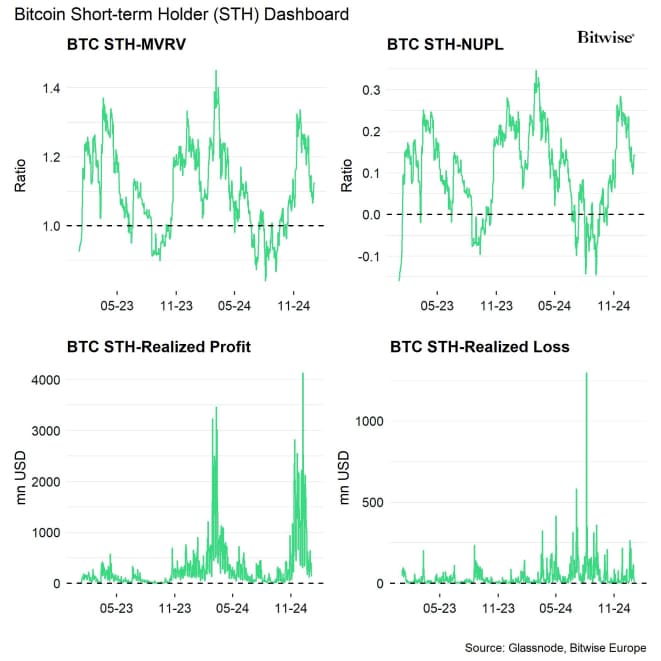

This is particularly important in the context of significant distributions by both long- and short-term holders of BTC in December. In fact, the distribution of bitcoins by long-term holders was the 3rd highest on record and the highest in USD-terms.

The continued decline in overall exchange balances implies that buying volumes were still able to absorb the amount of selling coming from whales and long-term holders of bitcoin.

For instance, net inflows into US spot Bitcoin ETFs in December alone have exceeded the new production of bitcoins by a factor of approximately 3.7x. BTC holdings by corporate treasuries have also increased significantly last month. Microstrategy's (MSTR) BTC purchases alone (~59.7k BTC) have exceeded the level of new production by a factor of 4.3x.

In general, demand for bitcoins also continues to outpace supply distribution judging by the apparent demand metric which estimates the demand based on changes in overall supply and illiquid supply. Although this metric has recently decelerated, it still supports the view of an ongoing demand overhang/supply deficit in the market.

Moreover, we saw an increase in retail participation in December which were accompanied by a solid increase in BTC hash rate as well.

Contrary to the negative picture painted by the current macro environment, on-chain factors have continued to provide a positive tailwind for Bitcoin and other cryptoassets.

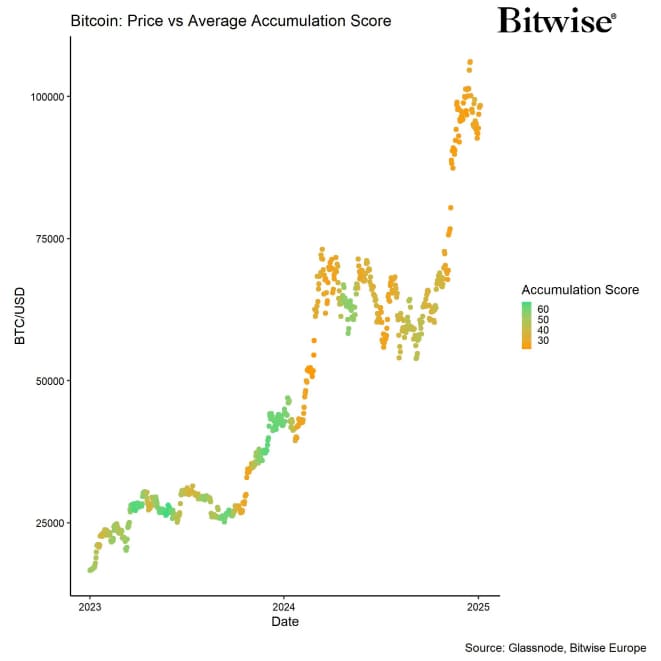

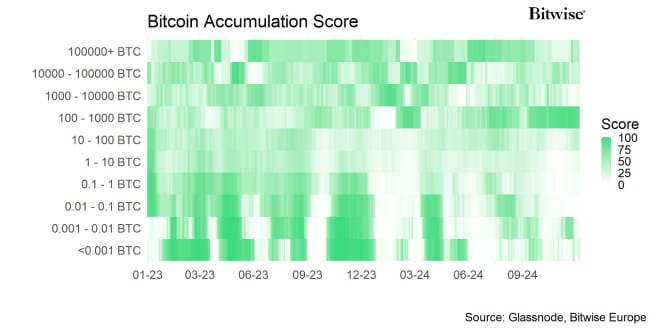

That being said, we are generally observing that on-chain data have been cooling down somewhat: Active addresses have declined from the recent highs in November and accumulation activity is rather low apart from the 100 BTC – 1000 BTC cohort which represents mostly ETF and corporate treasury demand.

Bottom Line: Despite macroeconomic headwinds, strong on-chain demand from ETFs, corporate treasuries, and retail participants has created a significant Bitcoin supply deficit. While some on-chain activity has cooled, key metrics like reduced exchange balances and rising hash rates signal ongoing resilience.

Bottom Line

- Performance: In December 2024, crypto markets faced macroeconomic headwinds, including profit-taking, reduced institutional exposure, and tightening financial conditions driven by US Dollar appreciation and revised Fed policies, which weighed on Bitcoin and altcoins despite ongoing on-chain support. While short-term risks persist, long-term bullish factors like the Bitcoin Halving and potential strategic reserves support forecasts of significant price appreciation, with Bitcoin expected to outperform traditional assets through 2025 and beyond.

- Macro: The December FOMC meeting resulted in a 25 bps rate cut but signalled higher-than-expected future rates, tightening financial conditions despite efforts to ease them, posing risks to Bitcoin and traditional markets due to declining global liquidity and a strong dollar. Meanwhile, inflation pressures and weak labour market indicators highlight economic fragility, with Bitcoin's performance remaining tied to traditional markets like the S&P 500, which may face downside risks from growth repricing.

- On-Chain: Despite macroeconomic headwinds, strong on-chain demand from ETFs, corporate treasuries, and retail participants has created a significant Bitcoin supply deficit. While some on-chain activity has cooled, key metrics like reduced exchange balances and rising hash rates signal ongoing resilience.

Appendix

Cryptoasset Market Overview

Cryptoassets & Macroeconomy

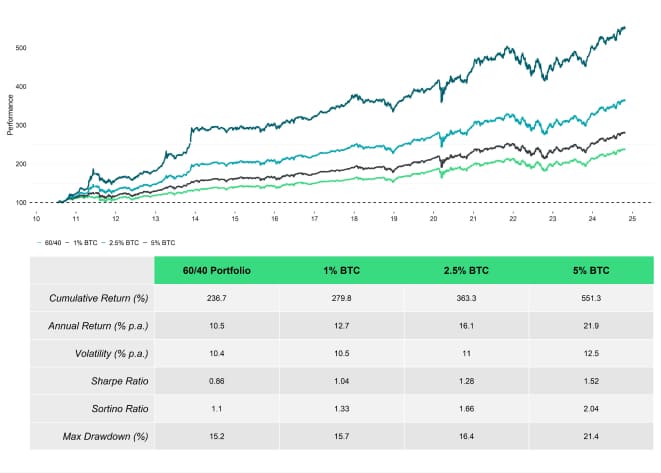

Cryptoassets & Multiasset Portfolios

Cryptoasset Valuations

On-Chain Fundamentals

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

En

En  Fr

Fr  De

De