Bitcoin ETPs win big with nine-figure AUM hike

Since the 2022 collapse of crypto lending platforms like BlockFi, Celsius and Voyager Digital, institutional investors in Europe have consistently moved away from esoteric, double-digit yield-promising platforms, instead seeking out the safest way to access Bitcoin in their portfolios.

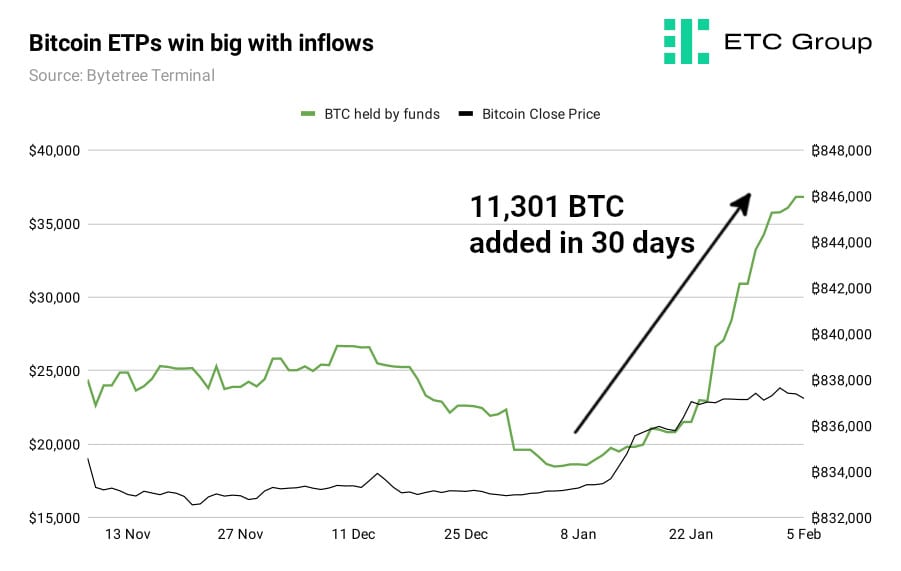

As such, European Bitcoin ETPs have witnessed massive inflows over the last four weeks.

The biggest winners have been physically-backed BTC investment products, while synthetic funds have underperformed the market.

Europe’s biggest winner of 2023 so far is ETC Group’s BTCE which saw 2,173 BTC of inflows from 3 January to 3 February, representing an $154.8m increase in AUM and taking its Bitcoin assets under management to $431.98m.

Taking second place was the 3iQ CoinShares Bitcoin ETF, with 1,952 BTC of inflows over the same period.

In all, the total amount of BTC held by funds grew by 11,301 BTC ($260m) from 834,667 to 845,968 BTC between 3 January and 5 February 2023.

Physical ETPs like BTCE replicate the price performance of Bitcoin by physically holding BTC with a third party custodian in cold storage. Synthetic ETPs instead rely on derivatives called swap agreements with counterparties — for example crypto asset lending platforms — to do the same thing.

The two lowest-performing European funds, with net outflows of 38 BTC (€805k) and 26 BTC (€551k) respectively, are both synthetic Bitcoin ETPs: Bitcoin Tracker One and Bitcoin Tracker Euro.

Data provider CryptoCompare notes that the total assets under management of digital asset investment products globally jumped 37% in January.

BTCE and ZETH holders have a legal claim on underlying Bitcoin and Ethereum in each fund. This compares favourably to the state of affairs for the 600,000 customers of bankrupt crypto lender Celsius who will be last in line to be refunded their $4.2bn in deposits.

Celsius rose to prominence, offering incredible yields of up to 20% on crypto deposits.

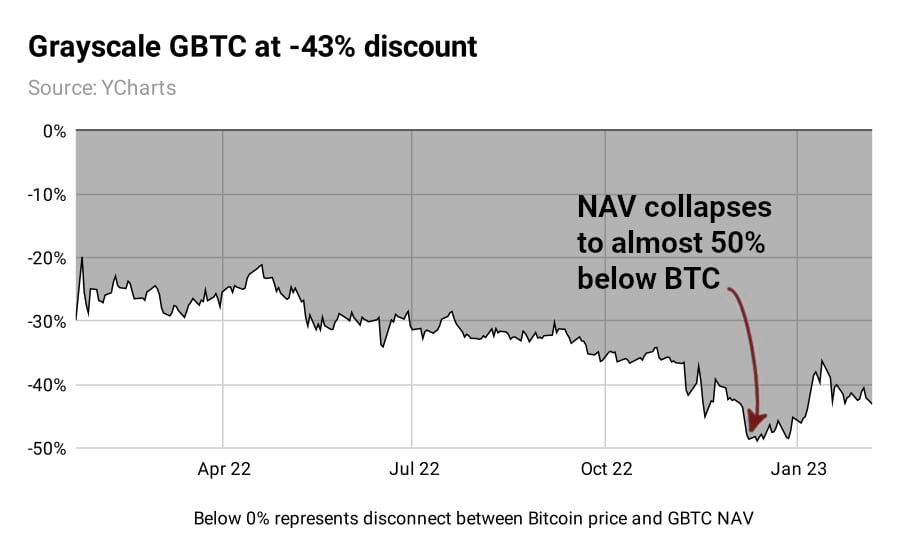

Analysis has shown such offerings were largely based on trading the Grayscale GBTC premium.

That trade disappeared by early 2021 when the Grayscale premium switched to a discount.

The discount has widened ever since, with the $14.5bn in Bitcoin unable to leave Grayscale’s closed-ended fund and the US market regulator denying the company’s repeat attempts to convert the fund into an ETF. As of 6 February 2023 the Net Asset Value (NAV) of GBTC shares are now worth 43.06% less than the Bitcoin in the fund.

By contrast, BTCE and other open-ended funds allow for creation and redemption of shares, which allows Bitcoin to both leave and enter and keeps the NAV tightly tracking the actual price of Bitcoin.

The closest thing to a risk-free trade in Bitcoin — trading the basis with futures — also spurred flows over recent weeks, according to data surveyed by ETC Group.

Traders buy spot Bitcoin (or a highly liquid associated product like BTCE), while simultaneously selling long-dated Bitcoin futures, collecting ‘risk-free’ premium.

Because of its liquidity profile, BTCE has become the instrument of choice for hedge funds and other institutions making this type of trade.

The latest available data from Deutsche Börse XETRA, one of the six European stock exchanges on which BTCE trades, shows that the physically-backed Bitcoin ETP was the third-most traded product of its type across December 2022, with an order book turnover more than three times larger than the next crypto product. Only WisdomTree’s daily leveraged and short NASDAQ funds traded more volume across the month.

Bitcoin NFTs spark biggest debate since Blocksize Wars

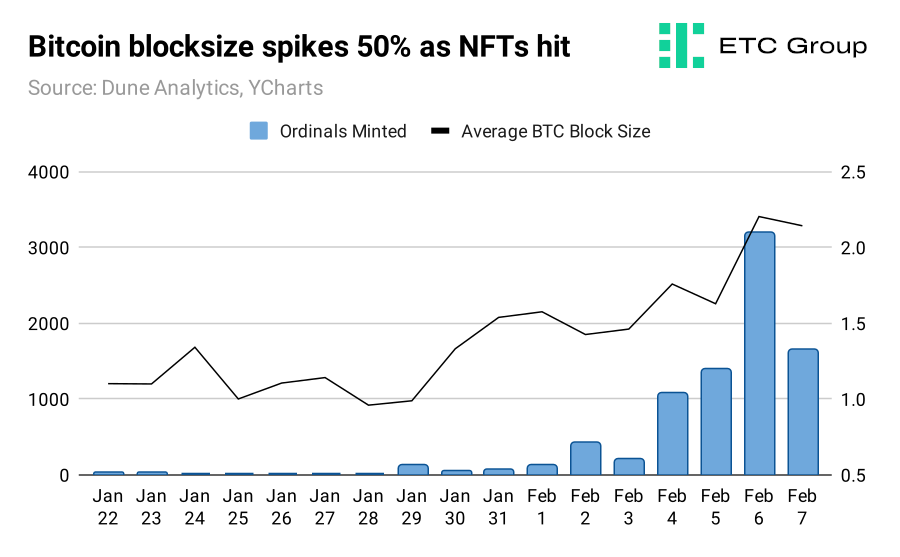

Bitcoin’s average block size has rocketed to an all time high over the last few days. The catalyst? Bitcoin NFTs.

The first collection of ‘Ordinals’ hit the market in January, cramming additional data into Bitcoin’s blocks and sparking an intense debate over the “proper” uses for Bitcoin.

Larger block sizes - and more demand for value transfer across the Bitcoin network — should translate to higher fees per block.

According to CoinMetrics data, an average blocksize of 2.2MB as of 5 February represents an all time high, some 50% above the mean.

Ordinals work by storing images, text and other data inside Bitcoin transactions.

A satoshi (0.00000001 BTC) is the smallest unit of Bitcoin, worth approximately $0.00023. Ordinals allows for the tracking of satoshis by assigning data like images, text and video to them through a process called inscribing.

Up to 20% of Bitcoin blockspace is now being used by Ordinals, according to Dune Analytics data. The same dataset shows that almost 10,000 of these Bitcoin NFTs have been created to date.

This economic rebalancing has already aided miners as they receive transaction fees for mining blocks, as well as the 6.25 BTC block reward. This reward will drop to 3.125 BTC in the 2024 halving and transaction fees per Bitcoin block have dropped from a peak of 51.99% in 2017 to less than 3% today.

But some critics have gone as far as advocating that miners should censor and refuse to mine blocks that contain Ordinals.

This argument recalls the major disagreement between Bitcoin developers as to the true purpose of the blockchain, enshrined in history as the Blocksize Wars.

Bitcoin’s first major scaling solution in 2017 was SegWit (Segregated Witness), a code addition which placed transaction data outside blocks. BTC blocks remained at around 1MB allowing for fast read/write times, but the network only recognised those that included this appended data.

One cohort of original Bitcoin developers were concerned that, if Bitcoin stuck to its blocksize limit, it would not be able to scale effectively and become the global alternative payments network its creator Satoshi Nakamoto intended.

Supporters of the original chain wanted to keep blocks at a maximum 1MB — less than the amount of information contained on a floppy disk. This would keep the chain in line with what they believed was Nakamoto’s original vision, while retaining the most open-access possible, allowing anyone to read/write information to the Bitcoin blockchain.

Another cohort desperately wanted to remove the cap and expand Bitcoin blocks to 4MB, 8MB and beyond. With both sides controlling roughly equal hashpower, the result was a hard fork, splitting the chain into Bitcoin and Bitcoin Cash.

This fresh debate over Ordinals speaks to both scaling Bitcoin and what precisely the blockchain should be used for.

There are convincing arguments on both sides. Bitcoin maximalists — those who believe it should exist solely as a cross-border monetary instrument — scoff at Ordinals. The Bitcoin codebase was not originally designed to make it easy to host multiple types of assets.

Contrast this with Ethereum, Solana and other types of smart contract blockchains.

Ethereum is able (and designed) to store, represent and process the value of a theoretically unlimited number of tokens through repeatable token standards like ERC-20 and ERC-1155 for NFTs and semi-fungible tokens. To some, this makes Bitcoin look rather old hat.

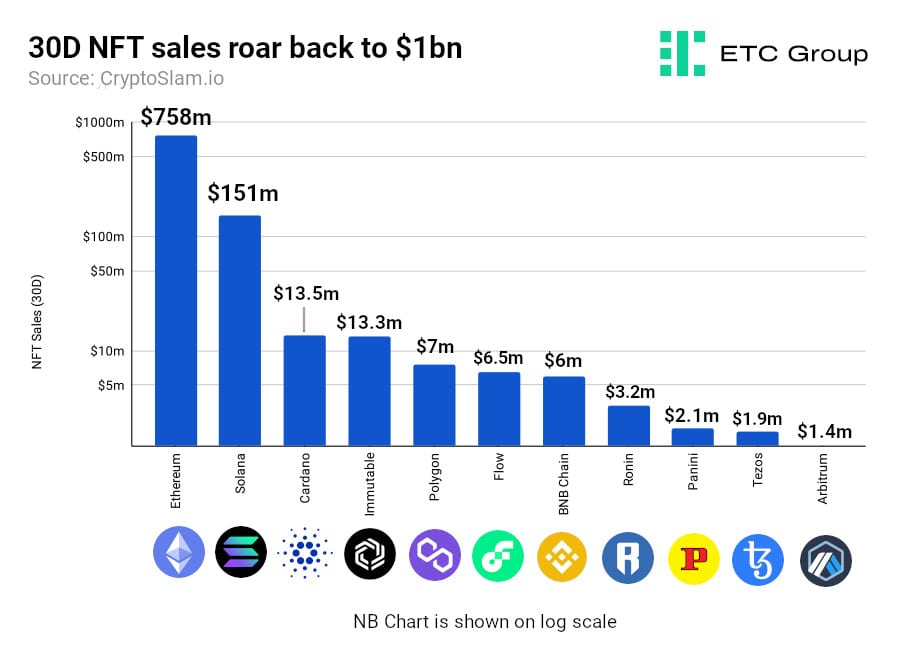

As ETC Group uncovered in its January 2023 Digital Asset Market Report for January 2023, NFT sales across the major blockchains advanced to almost $1bn across the month, an average 33.83% rise across the top 12 chains. Ethereum again led the way.

Bitcoin NFTs do not appear on this list, presumably producing far fewer than $1.4m in sales and sales on the blockchain are not tracked by data site CryptoSlam.

There have been a few exceptions that have utilised the limited smart contract support on Bitcoin. Stacks is a Layer 2 protocol set up in 2017 that functions on Bitcoin as a parallel blockchain network – running alongside Bitcoin – that runs smart contracts and rolls up transactions before settling them off-chain.

Zero-knowledge (ZK) rollups verify transactions off-chain. Because sets of transactions are confirmed off the blockchain, this makes them faster and cheaper to process. ZK proofs don’t reveal any other information about a transaction except that it is valid.

But rollups may not be exclusive to Stacks for those looking to make Bitcoin transactions in the future. New research suggests validity – or zero-knowledge – rollups could also improve functionality on the Bitcoin blockchain in a meaningful way without sacrificing Bitcoin’s core values or functionality as a peer-to-peer electronic cash system.

The Ordinals minting spree has been good news for miners so far, but not everyone is convinced that NFTs are a valid use of Bitcoin blockspace.

On one hand, consumers may care little about the fact that miners are receiving more transaction fees; if the Bitcoin network becomes proportionally more expensive for the end-user. If Bitcoin NFTs take off in the same way as CryptoKitties on Ethereum in 2017, critics fear this could produce similar network congestion and slower block times.

On the other hand, if this is a network that lives and dies by its adoption, growth in users and utility, then surely new use cases and an influx of new users are a good thing? The debate rolls on.

UK gets serious on crypto as US dithers

With the United States falling way behind Europe on comprehensive crypto regulation, another stalking horse has risen to capture regulatory arbitrage and attract the best crypto businesses to its shores.

On 1 February, the UK Treasury Department released an 82-page consultation paper underscoring the deficit between regulators and crypto companies that must be addressed if the UK wants to establish itself as a “competitive location for sustainable finance.”

The proposed regime would be centred on the existing Financial Services and Markets Act of 2000 that sets the rules for traditional trading venues.

This would mean crypto exchanges may be required to tackle market abuse and insider trading by sharing information with one another and proactively blacklisting offenders.

Would-be crypto trading venues and custodians would also have to adhere to strict new guidelines that will see them having to hand in their business plans, operational blueprints, and a detailed overview of their risk management contingencies if they want a licence in the UK. .

The prospective policy paper builds on some of the clauses within the Financial Services and Markets (FSM) Bill that is awaiting passage in parliament. It brings forward regulations for stablecoins and their role as a means of payment.

The new paper also indicates NFTs and utility tokens should be governed by the same rules that apply to cryptocurrencies used as means of exchange if they are being used to lend, invest, or make payments.

The proposal also seeks to magnify the geographic reach of the country’s regulatory watchdog, the Financial Conduct Authority (FCA). The FCA currently has oversight over entities based in the UK that offer crypto services but the new rules would extend this to any company serving UK clients even if it is headquartered and registered on foreign shores.

Digital asset companies already have to undergo a rigorous review process before they are greenlighted in the UK. From the 300 companies that have applied for approval in the country, only 41 have gained it – a success rate of merely 14%.

Industry leaders have expressed their frustration by citing the FCA’s appetite for regulation by enforcement at times because of the absence of a uniform set of standards.

Former British Chancellor Philip Hammond has led calls for the UK to bring clarity on crypto regulation saying:

If we want to get ahead as a global leader in digital assets, we need to stop assessing firms, and start working with them to develop a regulatory framework.

Hammond is an advisor to, and owns a 5% stake in, crypto custodian Copper.co, which recently moved clients to Switzerland after trying and failing to win UK FCA registration.

On 7 February, the Bank of England also released a consultation paper on one of the most controversial potential spin-outs of blockchain technology: a Central Bank Digital Currency or ‘digital pound’.

With the EU working still working on its landmark bloc-wide MiCA rules, and the United States effectively pushing innovation offshore by failing to go beyond piecemeal state-by-state laws, there remains a large total addressable market if the UK can push through comprehensive, supportive crypto legislation.

Markets

Digital assets have consolidated the gains they made in January as fears of a major global recession begin to subside.

On 31 January, the IMF revised up its global growth performance and forecast for the next twelve months. The financial institution has said that demand, real GDP, and growth in the US and Europe are all “surprisingly strong”.

Their economists have upped their forecast for global growth this year by 0.2 percentage points, anticipating the global economy to expand by 2.9% in 2023 and then by 3.1% in 2024.

Bitcoin remains within the $22,800 - $23,500 range with the cryptoasset unable to entrench its position above the $24,000 resistance mark.

Ethereum is sitting at $1,600 and reached a market cap of $200 billion dollars for the first time since September 2022 in anticipation of the Shanghai hard fork in March.

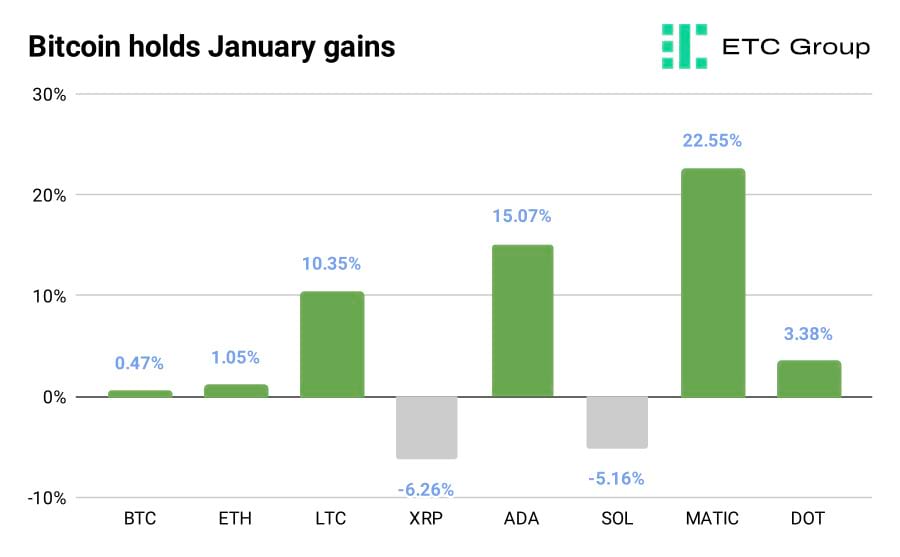

Polygon (MATIC) and Cardano (ADA) have been the big winners of the past fortnight, with the altcoins posting gains of 22% and 15% respectively.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.