Crypto rallies: What happened and what comes next

Crypto markets have stabilised somewhat in the wake of a mass deleveraging event in decentralised finance that predicated the collapse of several highly risk-tolerant and interconnected parties, including prominent Singaporean hedge fund Three Arrows Capital, prime broker Voyager Digital and lender Celsius Network.

In the last few weeks markets rebounded to settle around a $1 trillion total market cap. For a sentiment switch like this to grip and take hold, markets don't need euphoric buying from all quarters, but simply for rampant and aggressive selling to stop.

One particularly powerful metric we watch to get a sense of whether markets are cooling or overheating is Bitcoin Net Unrealised Profit and Loss (NUPL). This measures the price of bitcoins when they were last moved between wallets, and as such estimates whether the majority of holders are holding in profit or at a loss.

The usual disclaimers apply. Past performance is not indicative of future results. But prices do matter. Investors have little say over which way prices move in this world, but they can control when they buy assets and when they sell.

In the last Crypto Minutes ETC Group revealed that forced selling by overleveraged participants had pushed Bitcoin's NUPL metric into the negative ‘capitulation' zone. This is the point at which even long-term holders of BTC begin selling to meet other commitments, and the point at which opportunistic investors start building long-term positions at their expense. That NUPL metric reversed and turned positive again as of 18 July.

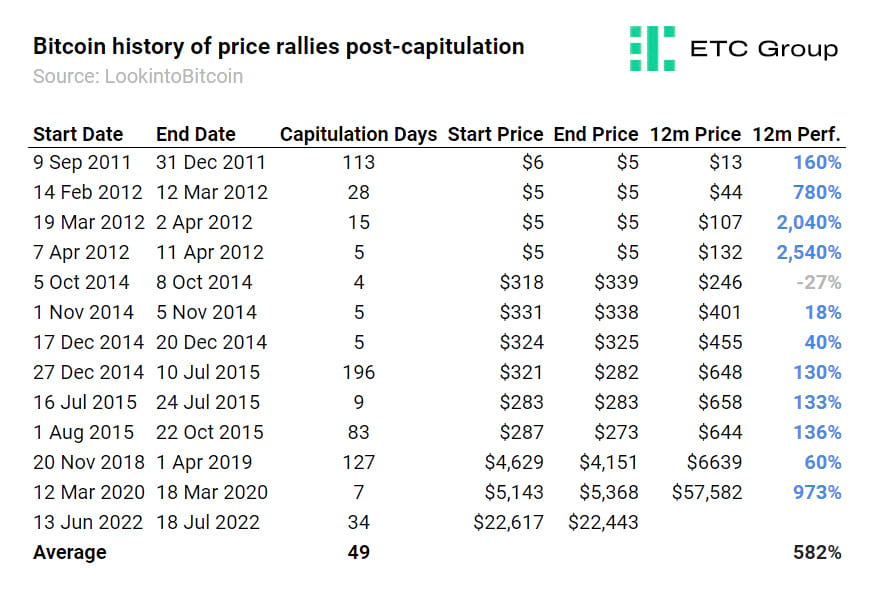

NUPL has only turned negative 12 times in Bitcoin's history. Looking at historical averages, Bitcoin has returned gains of 582% in the 12 months after NUPL has turned from negative to positive.

So what of near-term price predictions? If conditions become more encouraging, the cycle will likely resume where traders and investors become more comfortable speculating with long bets further down the value chain, into key Web3 blockchains such as Avalanche, Polkadot and Cosmos.

While it remains unlikely that the rest of 2022 will be a resumption of the relentlessly bullish trend from late 2020 to late 2021, what we may have found here is a local bottom, with the most aggressive selling and price drops tempered, Bitcoin holding steady in the $19k to $22k region, and the total market cap of all cryptoassets sitting in the $850bn to $1trn range. More sideways movement is the most likely outcome for the rest of 2022.

There exists significant monthly support for BTC in particular at around $17.9k and $13k, and those are the pivot points that we are watching closely. If traders decide the global macro outlook is too ugly to bear, specifically with regard to interest rate-sensitive risk-on assets like crypto, we could see BTC retest those levels in the coming months.

However, if as we suspect, the Federal Reserve reverses course and ends its interest rate hiking programme in the autumn, after the 75bps jump expected on 27 July, crypto markets could easily move back towards the $28k-$30k Bitcoin that would mark the resumption of a bullish trend.

Bear markets in crypto - or Crypto Winters in the parlance of the sector - have in the past lasted an average of 289 days, a little over nine-and-a-half months. We are only a couple of months into 2022's Crypto Winter. We see a local bottom at these levels, but the unprecedented nature of decades-high inflationary risks and uncertain central bank responses makes concrete predictions exceedingly difficult at this stage.

Bitcoin, volatility and the Amazon story

A healthy dose of perspective is always prudent at times of wider market distress.

Warren Buffett famously said that markets are

a device for transferring money from the impatient to the patient.

He was, of course, referring to equities, rather than crypto, but the asset class does not really matter in this regard. In this bear market and Crypto Winter, wealth will be transferred from weak holders to strong holders.

It is certainly worth considering, as we note above, that crypto's recent price revival could be a bull trap: a temporary price reversal in an otherwise bearish-leaning market. What this conclusion would reveal is not to scare away those who are long crypto, but more to repeat the assertion that dollar-cost averaging into diversified positions will likely bear the most fruit for investors going forward.

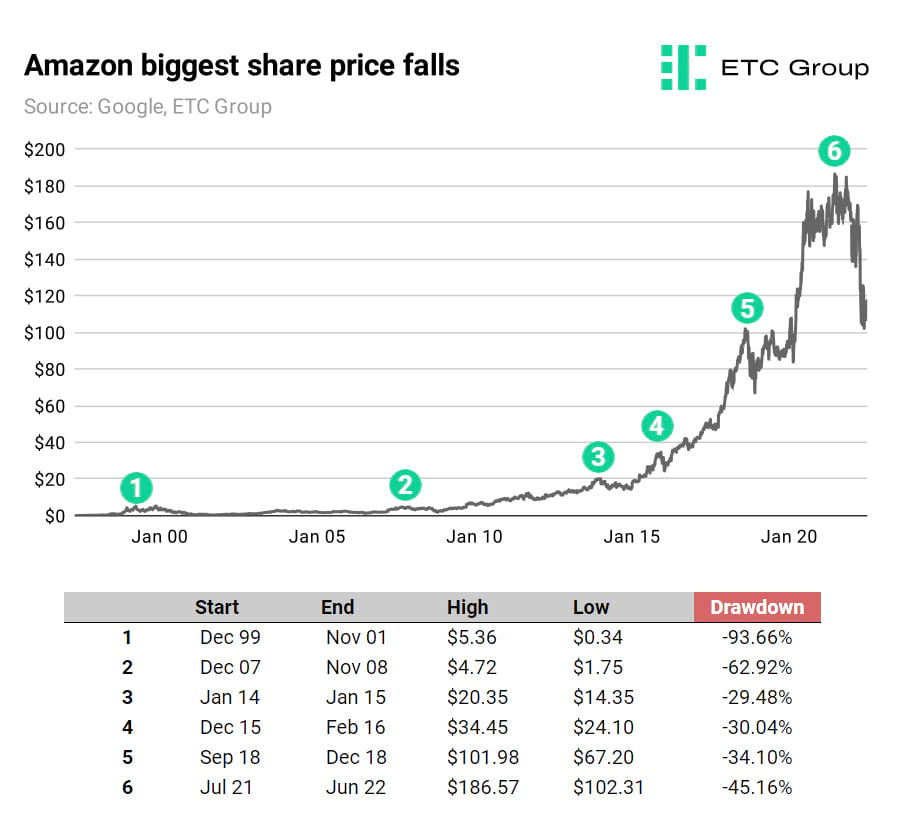

Take Amazon (NASDAQ:AMZN) for example. It has been a public company for 24 years. It is the world's fifth largest business at $1.2 trillion market cap.

How many people invested in Amazon on day one and have never sold? The numbers must be incredibly small. CEO Jeff Bezos is certainly one. His parents Jackie and Mike Bezos, are two more, having put $250,000 into the fledgling business in 1995.

The only other person on public record is the legendary investor Bill Miller. Miller made his name as a fund manager for Legg Mason by making contrarian bets that beat the benchmark US index, the S&P 500, for 15 years in a row between 1991 and 2005.

Miller notably bought his first Bitcoin at $200. Alongside his position in Amazon, the only other asset he has never sold is Bitcoin.

Bitcoin has gone up, on average, 170% every year for the past 11 years,

said Miller in a Wealthtrack interview, adding that he has enough long-term conviction to ride out the asset's volatility. More recently, he noted that he has 80% of his personal wealth in Amazon shares and Bitcoin.

Since its 1997 IPO, AMZN has compounded over 100% every single year. In that same timeframe, the share price has seen double-digit percentage falls each year. Twice over the last 24 years, including this year, that share price drop has been more than 45%. Two years after its public listing, the AMZN share price sank by more than 93%.

While nearly all investors understand the theory of buying assets at pessimistically low valuations, then profiting by selling to those who come late to the party at euphoric price highs, too many still witness large paper losses in the value of their portfolios and then crystalise those losses by panic selling.

The feature that stops most people from simply buying and holding over the long term is usually volatility. Volatility, or how quickly prices shift back and forth, is seen in traditional markets as a way to gauge how positive (bullish) or negative (bearish) investors are feeling. Volatility creates fear and uncertainty, and investors tend to associate high volatility assets with imminent loss.

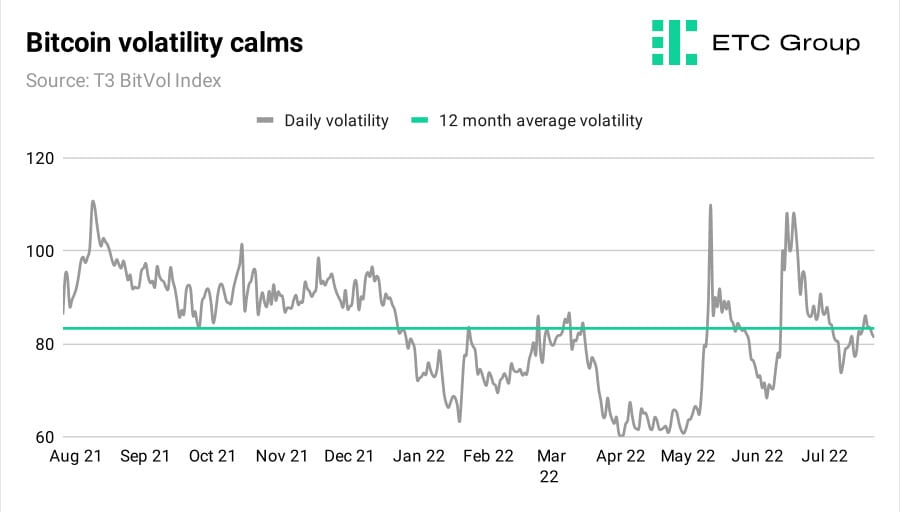

In traditional markets, the VIX is known as the ‘fear index', in that it gauges how volatile investors believe stock prices will be. In particular, it is used as a yardstick to measure the degree of downside fear among market participants. The Bitcoin equivalent is the T3 BitVol index, which uses forward option prices to generate a 30-day expected volatility level.

As of 2022, Bitcoin and crypto in general trade at much more elevated levels of volatility than equities: this is largely due to their nascent adoption and market size, which is around 1.1% of the stock market (~$1T versus ~$93T for global equities).

But as crypto options exchange Deribit notes:

Whilst in traditional markets, the [VIX] volatility index is known as a “fear gauge”, when looking at implied volatility in Bitcoin, we instead refer to this volatility index as an ‘action gauge'. Unlike the majority of traditional markets, Bitcoin options often have positive skew and the large moves are often expected on the upside as well as downside.

Many of those reading these Crypto Minutes will be coming from a traditional investing background, where volatility is synonymous with unnecessarily high risk. That isn't the case in crypto assets. In crypto, higher implied volatility is not a direct measure of downside fear and uncertainty, but of likely action: where and when the largest trading volumes will take place.

Volatility also makes investors wary of putting more capital into the markets. While this may seem a sound protective principle, all this really does is to make investors miss out on assets trading at historically attractive valuations. Those with conviction, like Bill Miller, tend to profit the most by holding for the long term when most would not.

Coinbase vs SEC: US falling behind on regulation

Coinbase and the SEC are caught in a war of words. The source of the tension is a recurring dilemma: are cryptoassets securities?

The SEC seems to think so. The debate was reignited after the federal regulatory body charged a former Coinbase employee with insider trading last week.

Coinbase's listings tend to be accompanied by positive price swings for digital assets, so tip offs of this nature, which are illegal, are akin to hearing about an IPO or corporate merger ahead of time.

The accused is said to have passed on restricted information to a family member on the listing dates of 25 cryptoassets. In a separate complaint, the SEC said nine of the 25 tokens allegedly traded were securities. Bitcoin and Ethereum have not been mentioned, and only minor assets with tiny market caps are under consideration. The largest of the nine is Amp, the 91st largest crypto with a market value of just $350m.

While Coinbase has expressed that they have no tolerance for employee misconduct, they have taken up arms against the methodology used by the SEC to classify some cryptoassets as securities.

The exchange has filed a petition asking the SEC to formulate new rules for digital asset securities rather than repurposing century-old securities laws to fit the box and enforcing them arbitrarily. Modern securities protections in America can be traced back to the 1930s and were not framed with the intent of being applied to financial products powered by distributed ledger technology.

While in public statements SEC chair Gary Gensley suggests most cryptoassets aside from Bitcoin are securities, the SEC has been reluctant to commit to a new regulatory framework for digital assets. Coinbase meanwhile maintains that cryptoassets tend to have the characteristics of a commodity rather than a security.

The stalemate between the private and public sector will continue until Congress can address shared concerns on the financial taxonomy of cryptoassets by introducing a long-awaited framework as part of President Biden's Executive Order.

It is becoming increasingly evident that American regulators are falling behind their counterparts. The EU successfully pushed forward its Markets in Crypto Assets (MiCA) bill last month, while the UK is determined to enact landmark guidance on the use of stablecoins for payments. And in a call for evidence from the US Department for Commerce as part of President Biden's multi-agency push to examine the “risks and opportunities” of the sector, Mastercard was the only corporate to submit substantial comment, with a 16-page argument calling for digital asset regulatory clarity and inclusion in trade agreements.

If the US does not settle the regulatory uncertainty soon, it risks being overshadowed as the leading destination for blockchain innovation and investment.

Markets

Those macroeconomic elements that sparked a market downturn have not suddenly disappeared, namely record-busting inflation, decades-high central bank rate hikes and soaring energy prices.

But a relief rally gripped crypto over the last two weeks, sending Bitcoin to a recent peak of $24.1k.

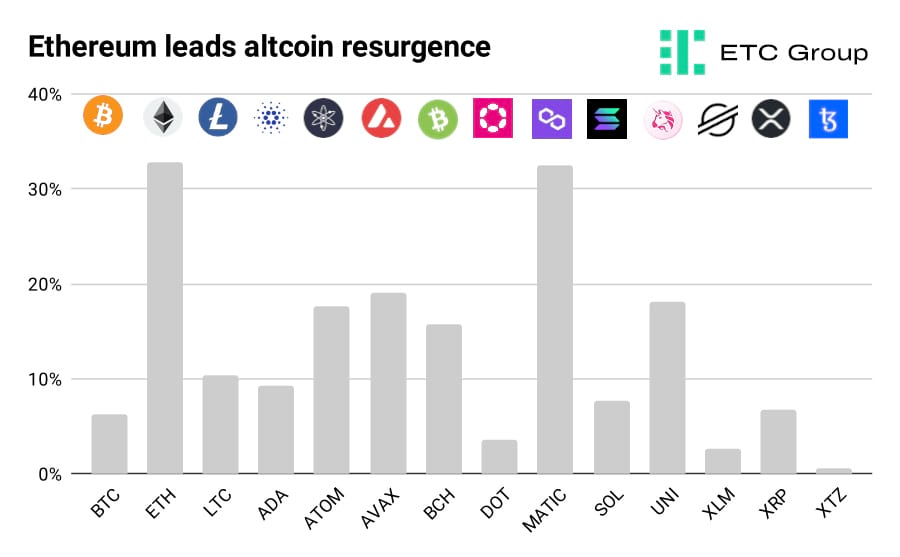

A solid date for the long-awaited Proof of Stake Merge of 19 September 2022 sparked a bullish breakout in ETH, with the smart contract leader flying 34% higher, from $1,036 to more than $1,600, before retracing to $1,400. Ethereum's Layer 2 protocol Polygon (MATIC), which helps traders and users bypass the platform's high transaction fees, also saw a 30%+ gain across the last two weeks.

The key Web3 smart contract platforms, namely Avalanche (AVAX) and Cosmos (ATOM), saw high double-digit gains from their lows, with the rally extending as far down the market cap chain as decentralised exchange token Uniswap (UNI), Litecoin (LTC), and Bitcoin Cash (BCH).

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.