- Cryptoassets were mired in consolidation mode as some mixed news negatively influenced market sentiment.

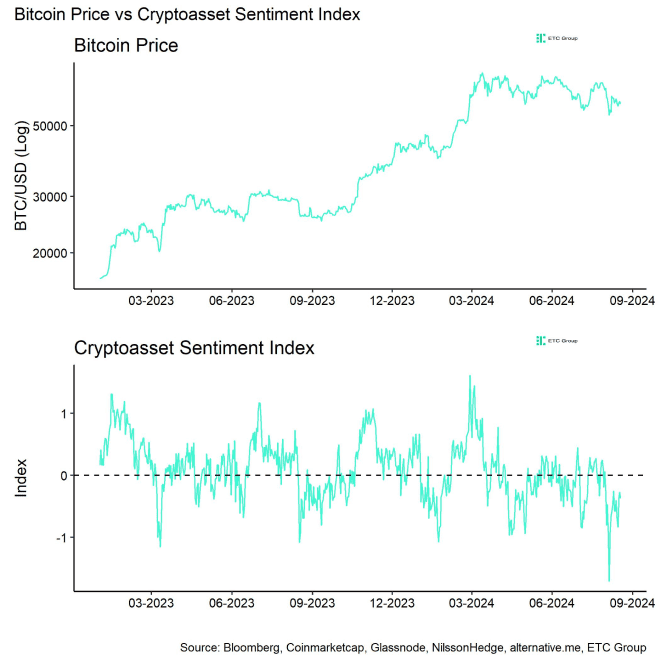

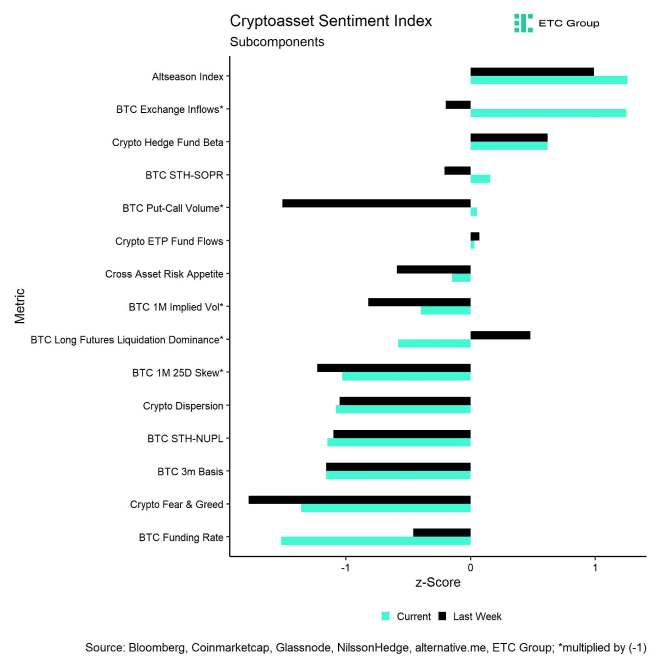

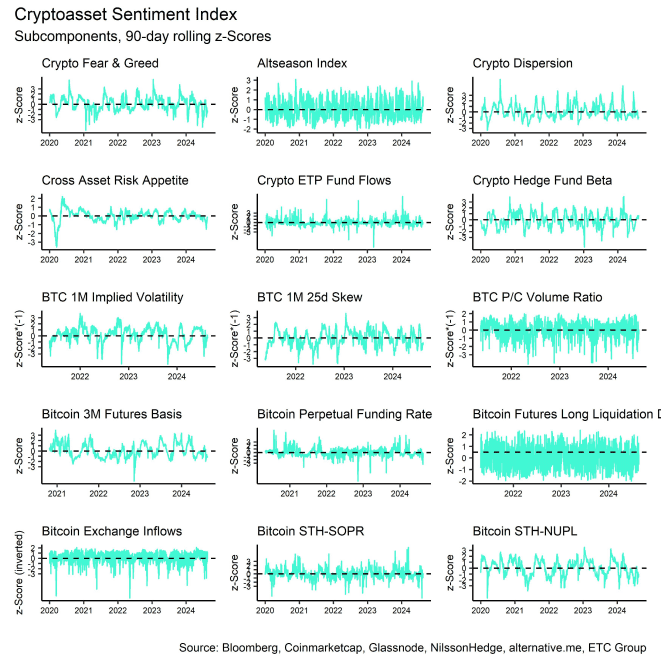

- Our in-house “Cryptoasset Sentiment Index” signals a bearish sentiment at the moment.

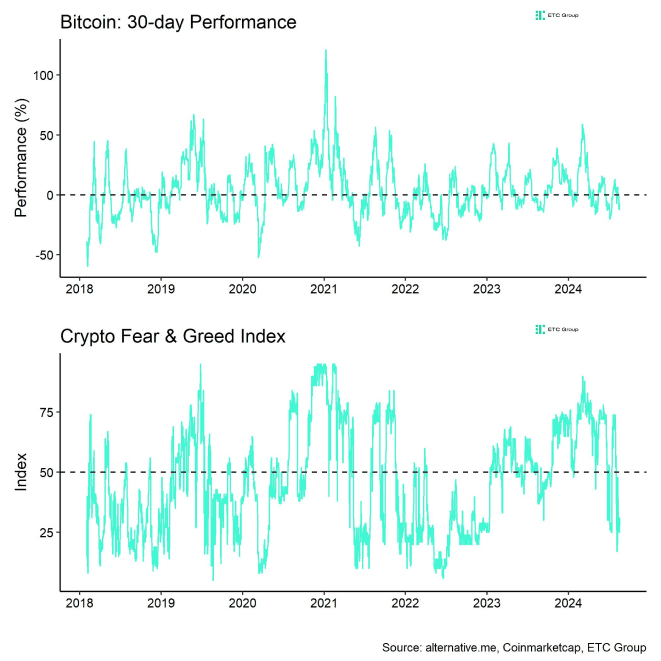

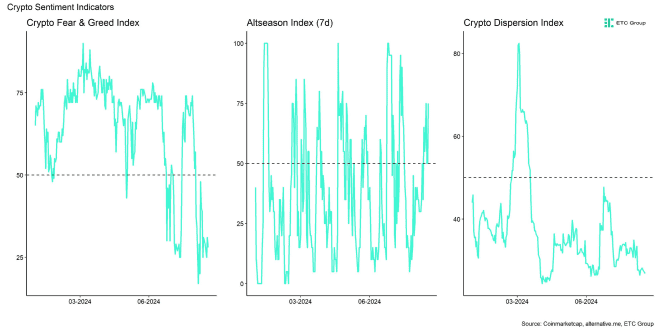

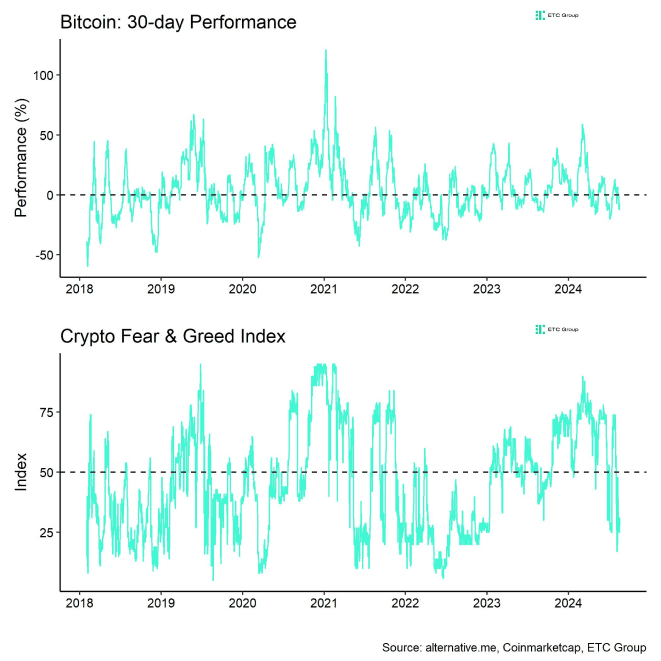

- The latest developments have generally clouded market sentiment as the “Crypto Fear & Greed Index” continued to hover at or near “Extreme Fear” levels last week

Chart of the Week

Performance

Last week, cryptoassets were mired in consolidation mode as some mixed news negatively influenced market sentiment.

The US government transferred around 10k BTC that were seized during the “Silk Road” trials to a Coinbase Prime address in a sign that the current administration still wants to distribute the current BTC holdings. These were the bitcoins that were supposed to be held as part of the strategic reserve envisioned by Trump and other Republicans.

At the time of writing, the US government still controls 197k BTC across different wallets according to data provided by Glassnode.

Another piece of news which also somewhat weighed on market sentiment last week was the fact that new evidence emerged that suggests that a potential Harris administration in the US could continue their crackdown on the crypto industry. Her advisor choices suggest she will keep Biden's hostile attitude towards crypto. Meanwhile, a new “Crypto4Harris” initiative tries to advocate for a more crypto-friendly stance within the democratic party and Harris' campaign.

At the time of writing, popular betting markets imply a chance of 51.8% for Harris to become the next US president, relative to only a 46.2% chance for Trump.

These developments have generally clouded market sentiment as the “Crypto Fear & Greed Index” continued to hover at or near “Extreme Fear” levels last week (Chart-of-the-Week ).

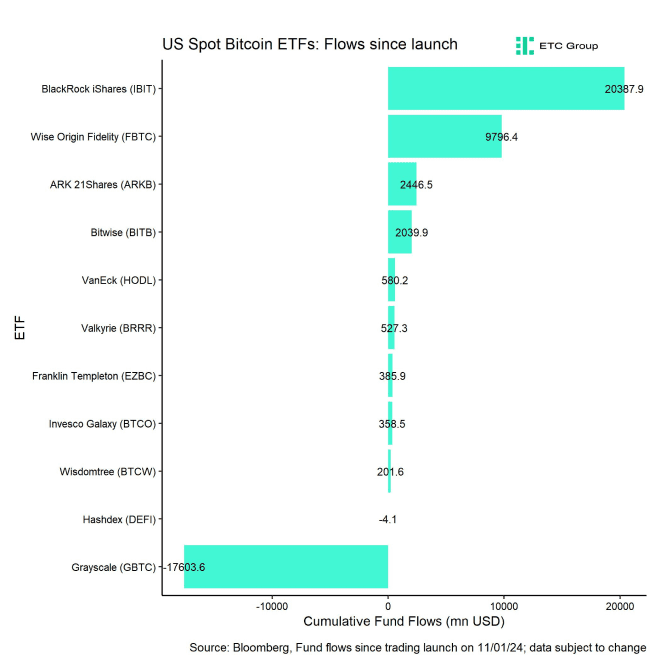

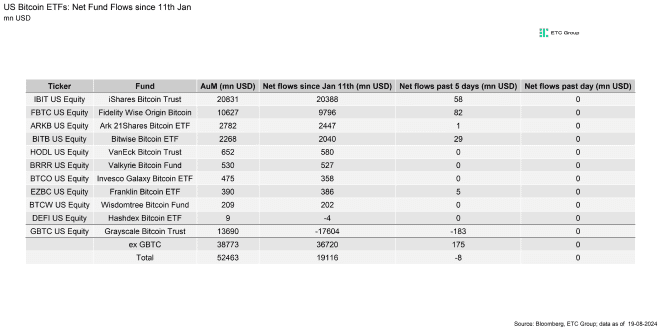

On the bright side, the most recent 13F filings in the US as of the end of Q2 2024 have revealed that US institutional investors have continued to increase their exposure to Bitcoin ETFs - total filings have increased relative to Q1 2024 despite the fact that the market has become increasingly volatile.

What is more is that US institutional investors have shown strong conviction in Bitcoin as those investors who already held Bitcoin ETFs in Q1 either maintained or increased their exposure even further. Traditional hedge funds continue to be major players in the asset class.

A key risk for crypto markets remains a further repricing in global growth expectations amid a likely US recession. That being said, we think that traditional financial markets have already priced in the majority of bad macro news.

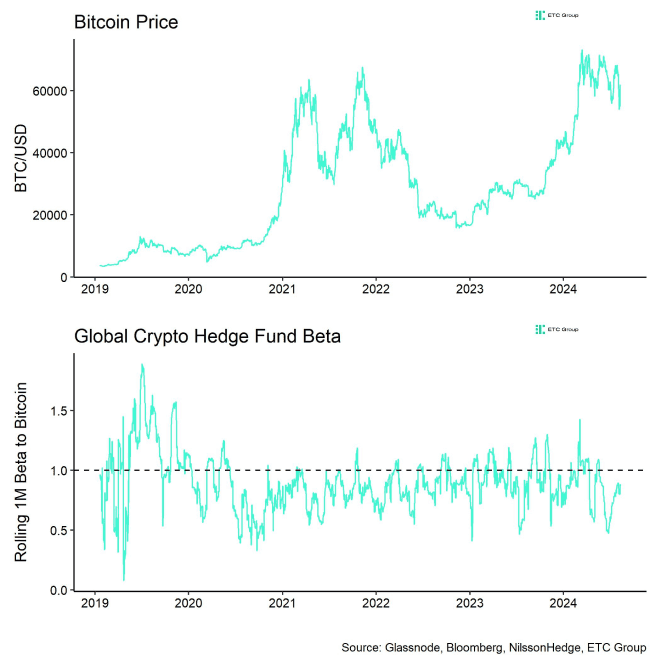

Besides, we are observing increasing evidence for a potential performance decoupling between Bitcoin and the S&P 500 as residual non-macro factors are becoming increasingly relevant for the performance of Bitcoin from a pure quantitative perspective.

We therefore think that downside risks to crypto markets remain relatively muted amid bearish sentiment and increasing evidence for a decoupling from traditional macro factors.

We also reiterate our stance that the positive tailwinds emanating from the Bitcoin Halving should become increasingly significant over the coming months and therefore remain relatively optimistic for the remainder of the year 2024.

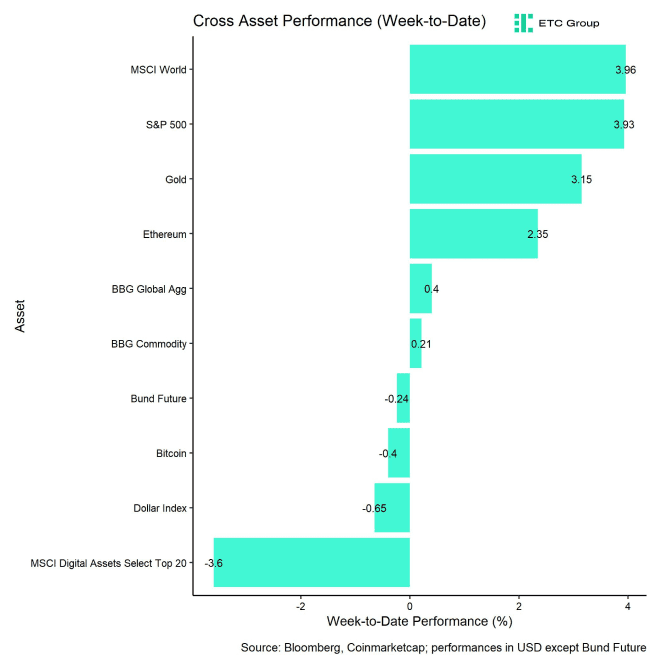

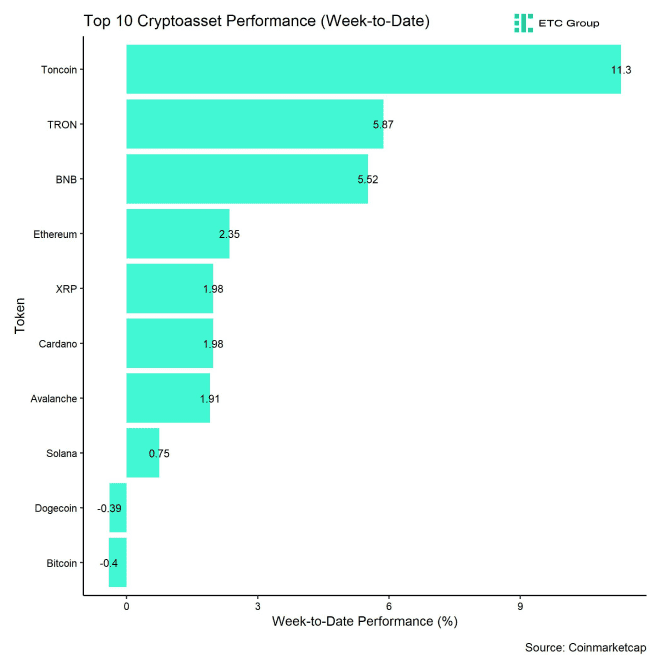

In general, among the top 10 crypto assets, TON, TRON, and BNB were the relative outperformers.

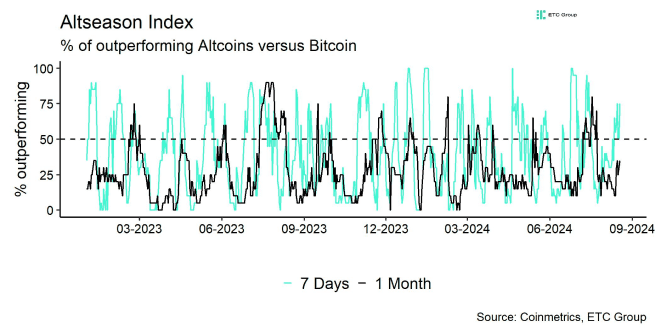

Overall, altcoin outperformance vis-à-vis Bitcoin has increased significantly lately, with 75% of our tracked altcoins managing to outperform Bitcoin on a weekly basis. Ethereum also managed to outperform Bitcoin on a weekly basis.

Sentiment

Our in-house “Cryptoasset Sentiment Index”continues to signal a bearish sentiment at the moment.

At the moment, only 6 out of 15 indicators are above their short-term trend.

Last week, there were significant reversals to the downside in BTC perpetual funding rate and also BTC futures long liquidations dominance.

The Crypto Fear & Greed Index currently signals a “Fear” level of sentiment as of this morning.

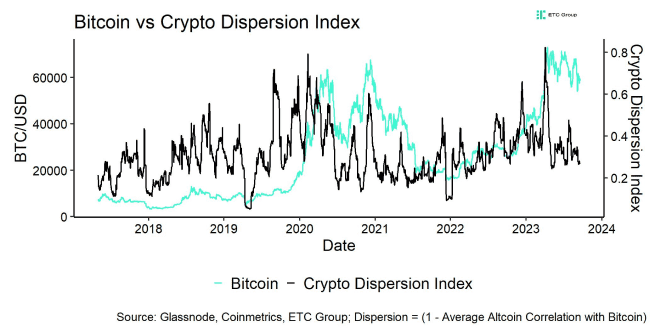

Performance dispersion among cryptoassets still remains at low levels. This means that altcoins are still very much correlated with the performance of Bitcoin.

Altcoin outperformance vis-à-vis Bitcoin has recently increased, with 75% of our tracked altcoins outperforming Bitcoin on a weekly basis, which is consistent with the fact that Ethereum also significantly outperformed Bitcoin last week.

In general, increasing (decreasing) altcoin outperformance tends to be a sign of increasing (decreasing) risk appetite within cryptoasset markets and the latest altcoin outperformance is a signal of increasing appetite for risk at the moment.

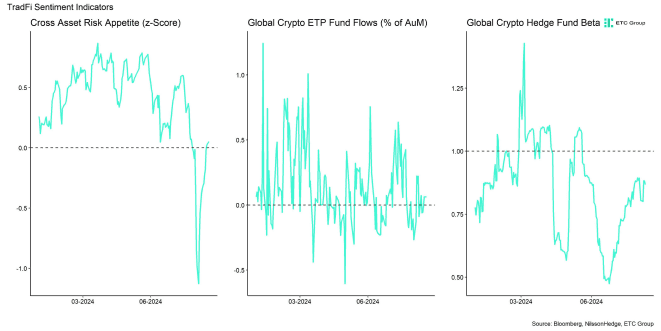

Meanwhile, sentiment in traditional financial markets as measured by our in-house measure of Cross Asset Risk Appetite (CARA) has significantly recovered following the capitulation event on the 5th of August.

Fund Flows

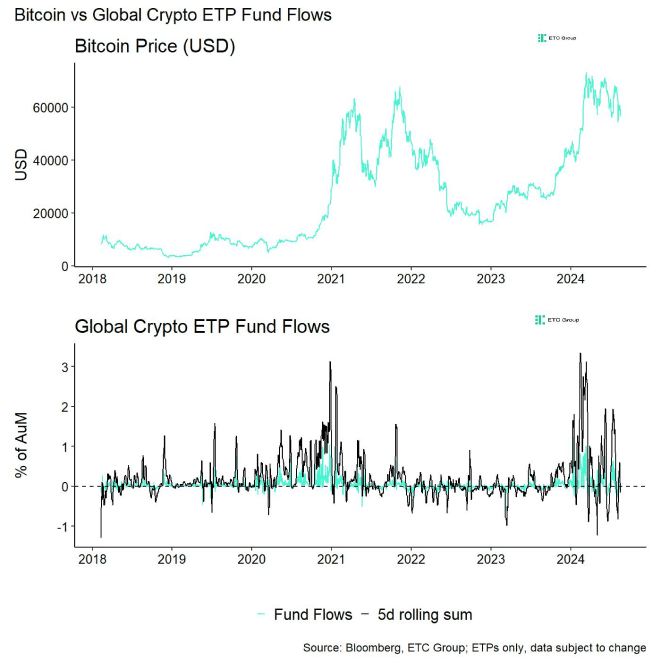

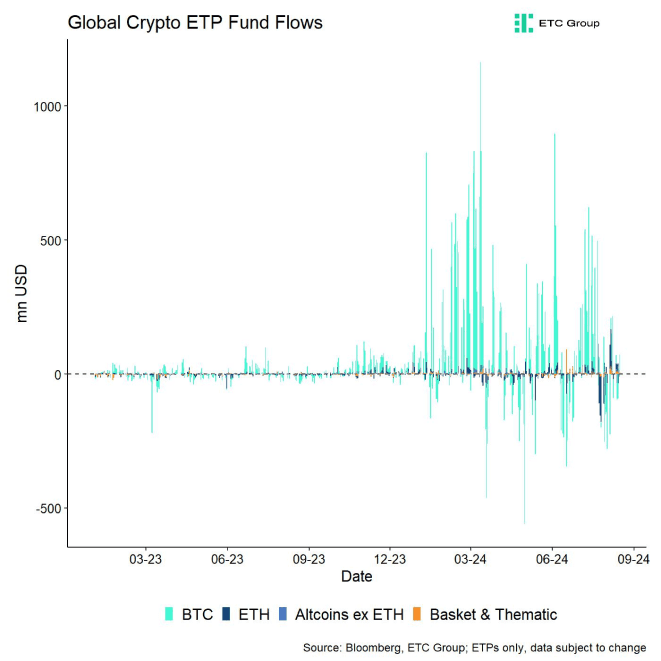

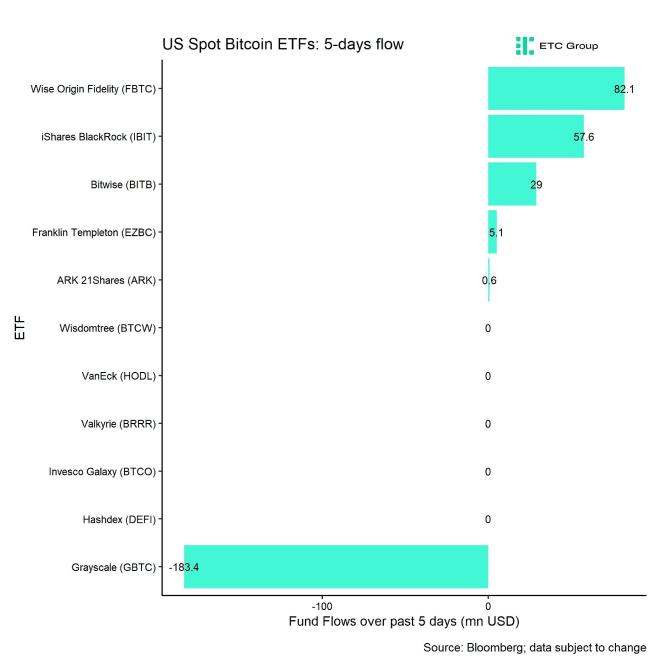

Fund flows into global crypto ETPs were mostly flat during last week but with significant dispersion across various products.

Global crypto ETPs saw around -4.2 mn USD in net outflows across all types of cryptoassets.

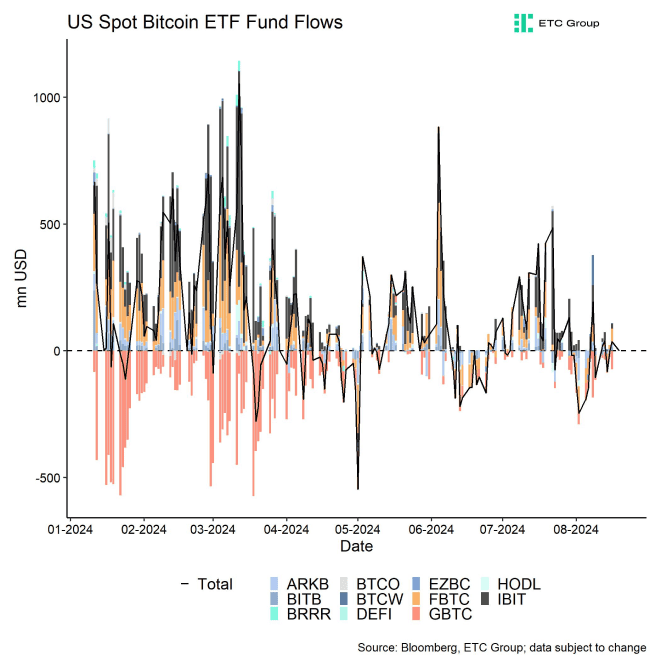

Global Bitcoin ETPs saw slight net outflows of -22.8 mn USD last week, of which -9.0 mn USD in net outflows were related to US spot Bitcoin ETFs alone.

Last week saw a continued deceleration in flows into Hong Kong Bitcoin ETFs to -125.6 mn USD in net outflows.

Outflows from the ETC Group Physical Bitcoin ETP (BTCE) persisted last week with net outflows equivalent to -15.6 mn USD and the ETC Group Core Bitcoin ETP (BTC1) also saw minor negative net outflows of -0.5 mn USD.

The Grayscale Bitcoin Trust (GBTC) continued to see net outflows, with around -183.4 mn USD last week.

Meanwhile, global Ethereum ETPs also saw net outflows last week of -22.4 mn USD. US Ethereum spot ETFs saw around -19.1 mn USD in net outflows.

Hong Kong Ethereum ETFs saw sticky AuM last week (+/- 0 mn USD).

The ETC Group Physical Ethereum ETP (ZETH) attracted some capital last week (+0.3 mn USD) while the ETC Group Ethereum Staking ETP (ET32) showed flat AuM last week (+/- 0 mn USD).

Altcoin ETPs ex Ethereum also experienced negative net flows of around -5.6 mn USD last week.

In contrast, Thematic & basket crypto ETPs saw very positive net flows with around +47.6 mn USD last week. The ETC Group MSCI Digital Assets Select 20 ETP (DA20) saw neither in- nor outflows last week (+/- 0 mn USD).

Meanwhile, global crypto hedge funds maintained their market exposure last week and remain somewhat underweight to Bitcoin. The 20-days rolling beta of global crypto hedge funds' performance to Bitcoin remained at around 0.86 per yesterday's close.

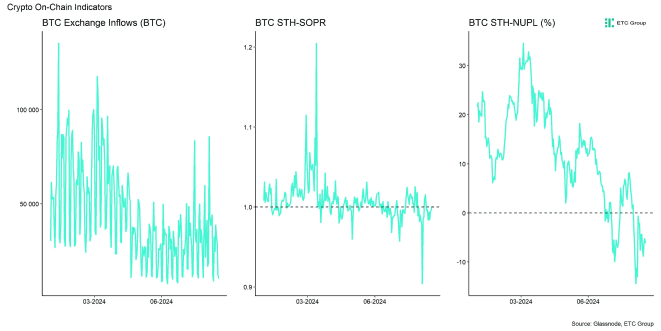

On-Chain Data

In general, on-chain conditions indicate a strong sense of conviction among Bitcoin investors.

Following a few months of comparatively intense distribution pressures, it seems that Bitcoin holders are returning to accumulation. In particular, larger BTC wallets have continued to increase their accumulation activity more recently which is a positive sign.

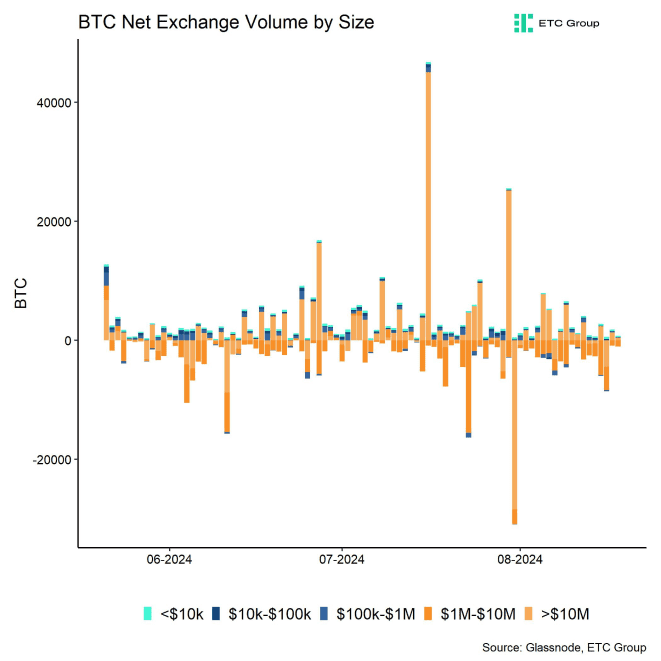

This is also visible in whale's net exchange transfers which have turned negative more recently. More specifically, BTC whales have transferred around 12.5k BTC off exchange. Whales are defined as network entities that control at least 1,000 BTC. As a result, on-exchange balances have declined over the past week.

However, Bitcoin spot market activity indicates that there has been a net tilt towards sell-side pressure recently, and this hasn't entirely abated. Over the past week, net selling volumes across BTC spot exchanges amounted to around -314 mn USD.

A major force behind this selling pressure was the fact that the US government transferred around 10k BTC that were seized during the “Silk Road” trials to a Coinbase Prime address in a sign that the current administration still wants to distribute the current BTC holdings.

These were the bitcoins that were supposed to be held as part of the strategic reserve envisioned by Trump and other Republicans. At the time of writing, the US government still controls 197k BTC across different wallets according to data provided by Glassnode.

Continued distribution of these bitcoins could weigh on market prices in the short term.

On the bright side, the Long-Term Holder (LTH) cohort currently holds a comparatively substantial portion of network wealth when compared to ATH breaks in previous cycles which potentially increases the longevity of this bull cycle.

During bull markets, long-term holders usually distribute their coins to short-term holders entering the market. A larger long-term holder supply increases the scope to what extent this distribution can take place.

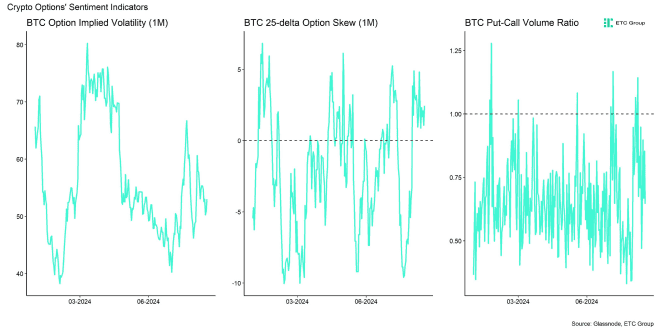

Futures, Options & Perpetuals

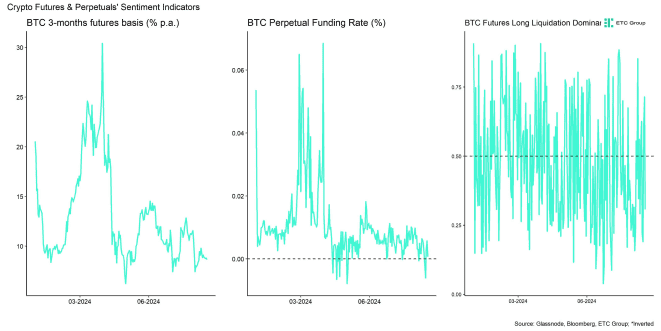

Last week, derivatives traders significantly increased their exposure to BTC via futures and perpetuals. More specifically, BTC futures open interest increased by +26k BTC and BTC perpetual open interest increased by +14k BTC.

This happened amid a general decline in prices which suggests that this increase in open interest was mostly related to short open interest.

This is also corroborated by the fact that BTC perpetual funding rates went negative on Wednesday and Thursday last week in a sign of significant crowding into short perpetual contracts which tends to be a countercyclical signal.

When the funding rate is positive (negative), long (short) positions periodically pay short (long) positions. A negative funding rate tends to be a sign of bearish sentiment in perpetual futures markets.

Meanwhile, both long and short futures liquidations remained relatively modest last week.

The 3-months annualized BTC futures basis rate continued to decline compared to the week prior to around 8.6% p.a.

Besides, BTC option open interest was mostly flat last week while the slight decline in put-call open interest ratio suggests a slight net increase in call demand relative puts. However, 1-month 25-delta skews for BTC remained positive suggesting a continued demand bias towards put options.

Meanwhile, BTC option implied volatilities continued to drift lower. At the time of writing, implied volatilities of 1-month ATM Bitcoin options are currently at around 53.0% p.a.

Bottom Line

- Cryptoassets were mired in consolidation mode as some mixed news negatively influenced market sentiment.

- Our in-house “Cryptoasset Sentiment Index” signals a bearish sentiment at the moment.

- The latest developments have generally clouded market sentiment as the “Crypto Fear & Greed Index” continued to hover at or near “Extreme Fear” levels last week

Appendix

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

En

En  Fr

Fr  De

De