- In general, corporations are still one of the smaller holders of Bitcoin with around 1 million BTC or approximately 4% of supply being held by both public and private companies worldwide but with significant upside potential.

- The number of bitcoins held on public corporate balance sheets has already more than doubled in 2024 and has outpaced the new supply of bitcoins in 2025 already.

- The potential for further adoption of Bitcoin by corporations is huge. The amount of free cash flow among S&P 500 companies alone already amounts to almost 1.5 trillion USD, approximately 2 times larger the amount of capital ever invested into Bitcoin.

While most investment analysts have been focusing on the potential sovereign adoption of Bitcoin as a strategic reserve asset, especially in the US, another type of buyer has already been acquiring Bitcoin as a store-of-value quite aggressively: Corporations.

There was a lot of attention on Microsoft's shareholders who recently disapproved BTC as a corporate treasury asset. However, there are other major companies that are currently reviewing the case for BTC as treasury asset such as Meta or Amazon.

The US car manufacturer Tesla has been holding BTC on its corporate balance sheet since February 2021 and has only sold a small portion of it. According to the latest company reports, Tesla still holds around 9,720 bitcoins on its corporate balance sheet.

So far, Tesla has refrained from acquiring more bitcoins due to environmental concerns regarding Bitcoin mining but has promised to review the case once most of the Bitcoin mining comes from zero-emission energy sources. [1]

The rationale behind the increasing adoption of Bitcoin as a corporate treasury reserve asset is relatively simple: Corporate cash balances denominated in fiat monies like the Euro or the US Dollar are subject to inflation and lose purchasing power over time.

Bitcoin is seen as a monetary substitute to maintain and even increase purchasing power over time, thereby maximising value for the companies' shareholders.

Other types of corporations like Bitcoin mining companies have naturally accumulated Bitcoin on their balance sheet as part of their mining business but most publicly listed miners such as Riot Platforms (RIOT) and Marathon Digital (MARA) have even announced to purchase BTC outright as part of their corporate treasury strategy.

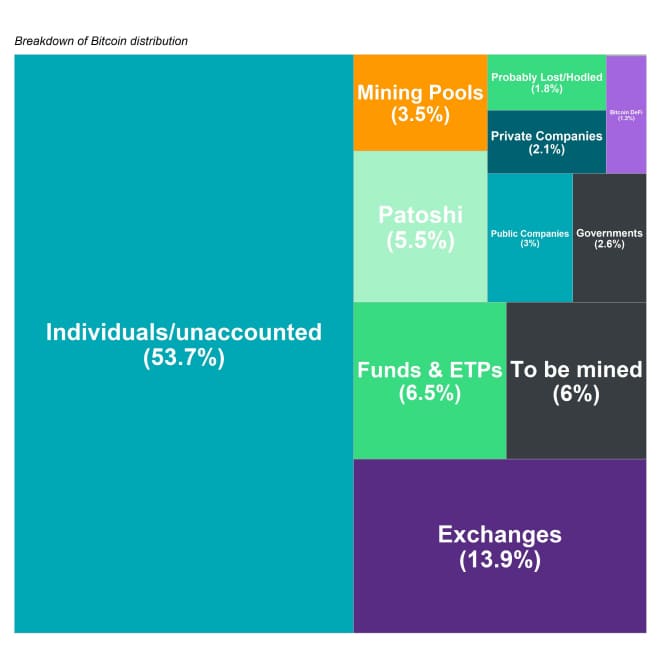

In general, corporations are still one of the smaller holders of Bitcoin with only around 1M BTC or approximately 4% of supply being held by both public and private companies.

However, they are one of the fastest growing entities with respect to overall Bitcoin holdings.

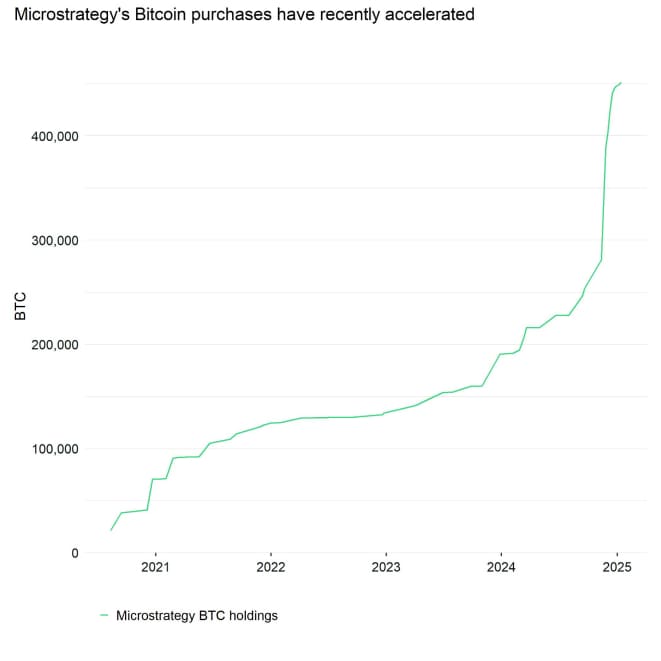

Most famously, Michael Saylor's Microstrategy (MSTR) has been the most aggressive acquirer of Bitcoin and now already holds 460,000 BTC or approximately 2% of Bitcoin's supply on its balance sheet.

Analysts have praised MSTR for its “speculative attack” on the US Dollar by issuing convertible debt to acquire Bitcoin which can become a procyclical “flywheel”: As Bitcoin appreciates, the value of MSTR's BTC holdings increases, financial conditions become easier allowing the company to issue more convertible debt or equity to acquire even more Bitcoin.

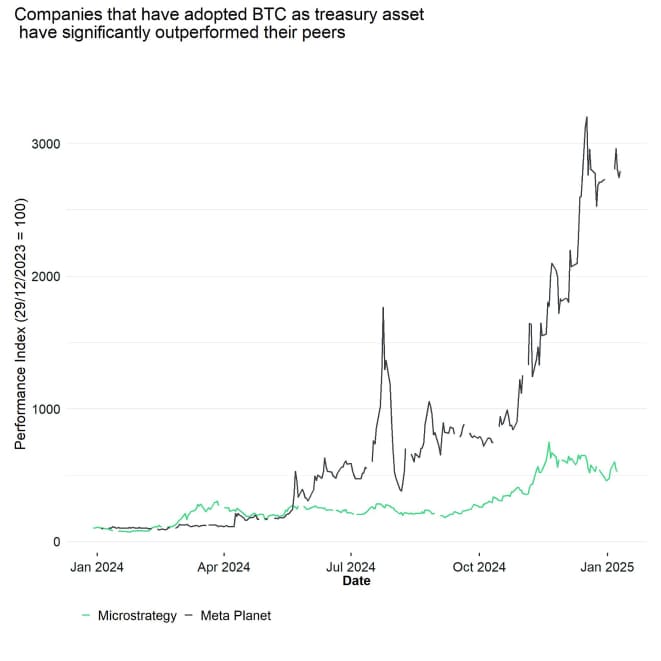

In general, companies that have announced acquiring Bitcoin have performed very well. For instance, both Microstrategy (MSTR) and Metaplanet Japan (3350 JP) are the best performing stocks within their respective stock indices outperforming their peers by a very wide margin.

Therefore, it is no surprise that an increasing number of corporations are currently adopting Bitcoin or are being pressured by its shareholders to review the case.

As a result, corporate treasury adoption of Bitcoin has been rising substantially in 2024 and continues to rise significantly in 2025 as we are writing this report.

According to data provided by bitcointreasuries.net, there are already 70 publicly-listed companies around the world that have announced to adopt Bitcoin as a corporate treasury asset.

What is more is that the amount of bitcoins on publicly-listed companies' balance sheets has increased from around 263k BTC at the end of 2023 to around 594k BTC at the time of writing this report – a growth rate of 127%.

In other words, the number of bitcoins held on corporate balance sheets has already doubled in 2024.

Meanwhile, Bitcoin's supply has only grown by 0.9% during the same period. So, there is a very significant demand overhang induced by the rising appetite of corporations for Bitcoin which is already 100x times larger than the production rate.

This is also exacerbating the supply shock that is emanating from the Halving:

MSTR purchases alone are already absorbing the new production of bitcoins which is why available liquid supply on exchanges has been drifting lower. At the time of writing this report, only 5 million bitcoins are deemed “liquid” or “highly liquid” according to on-chain data provider Glassnode and approximately 15 million bitcoins are already deemed “illiquid” as they are being used as a store-of-value.

The potential for further adoption of Bitcoin by corporations is huge. The amount of free cash flow among S&P 500 companies alone already amounts to 1.496 trillion USD of which 447 bn USD is attributed to the “Magnificent 7”.

In contrast, the amount of capital ever invested into Bitcoin only amounts to 766 bn USD. So, if only a small percentage of aggregate corporate cash balances would be allocated to Bitcoin, this could have a significant effect on prices.

Regardless of the shareholder vote of major corporations like Meta or Amazon, we think it is just a matter of time before not adopting Bitcoin could lead to a significant disadvantage for shareholders as those corporations adopting Bitcoin continue to outperform non-adopters by a very wide margin.

Bottom Line

- In general, corporations are still one of the smaller holders of Bitcoin with around 1 million BTC or approximately 4% of supply being held by both public and private companies worldwide but with significant upside potential.

- The number of bitcoins held on public corporate balance sheets has already more than doubled in 2024 and has outpaced the new supply of bitcoins in 2025 already.

- The potential for further adoption of Bitcoin by corporations is huge. The amount of free cash flow among S&P 500 companies alone already amounts to almost 1.5 trillion USD, approximately 2 times larger the amount of capital ever invested into Bitcoin.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

En

En  Fr

Fr  De

De