- Global crypto asset adoption rates are significantly higher than previously estimated.

- The data generally suggest that both the US and Europe may be at the cusp of mass retail adoption – a situation often referred to as “Hyperbitcoinization” in the context of Bitcoin.

- Chances are that the growth of adoption will surprise to the upside due to the fact that we are most likely at the inflection point from "Early Adopters" to "Early Majority".

Trump recently made a public statement implying that 50 million Americans already held "crypto". The most recent surveys among US consumers seem to support this number.

It is no surprise that cryptoassets have become a major topic during the US presidential election as the parties have become increasingly aware that cryptoasset users could play a significant role at the ballot.

Both Trump and Robert Kennedy Jr. are scheduled to deliver a pro-Bitcoin speech at the upcoming Bitcoin conference in Nashville over the weekend.

It seems as if cryptoasset users are not a small minority anymore that can be ignored. Here are some recent US bitcoin and crypto adoption surveys for comparison (% of total population in brackets):

- Security.org: 93 mn (28%)

- Unchained: 86 mn (26%)

- Statista: 53.6 mn (16%)

- Morning Consult: 44.2 mn (13%)

- Finder: 38.4 mn (11%)

In general, cryptoasset adoption has been on the rise globally.

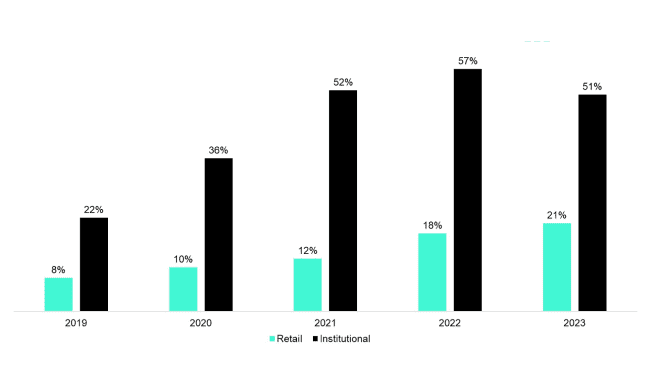

A recent global survey among institutional investors conducted by Fidelity even implies that 51% of surveyed institutional investors have already invested into cryptoassets such as Bitcoin.

Another recent consumer survey by Statista implies that approximately every 5th person (21%) worldwide has already invested into cryptoassets.

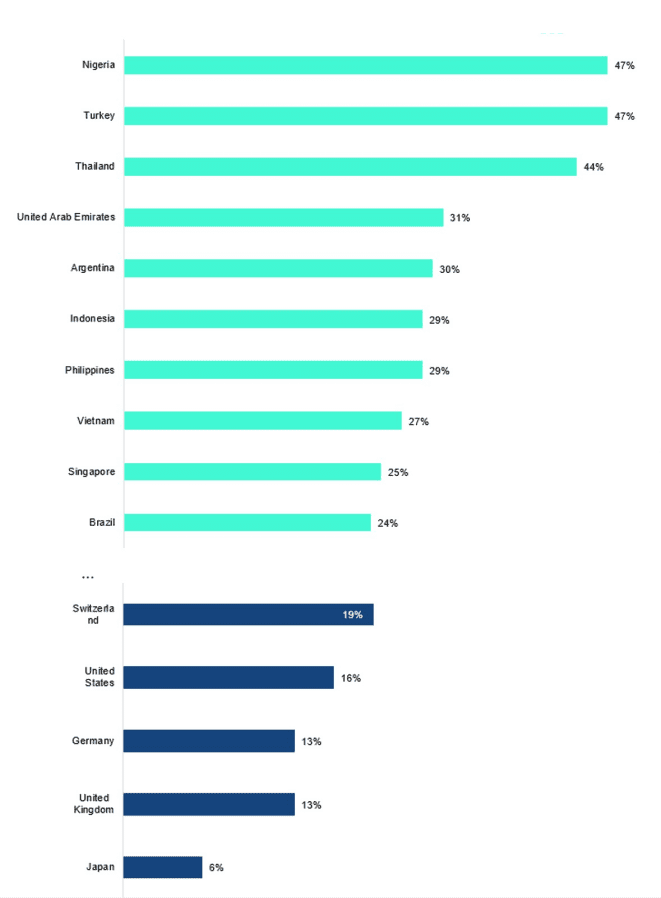

However, it's important to highlight that among the top 10 regions with the highest adoption rates, 8 regions are developing countries. So, cryptoasset adoption rates are even significantly higher among developing countries than in developed countries that often suffer from chronically high inflation rates and weak domestic currencies.

That being said, the data generally suggest that both the US and Europe may be at the cusp of mass retail adoption – a situation often referred to as “Hyperbitcoinization” in the context of Bitcoin.

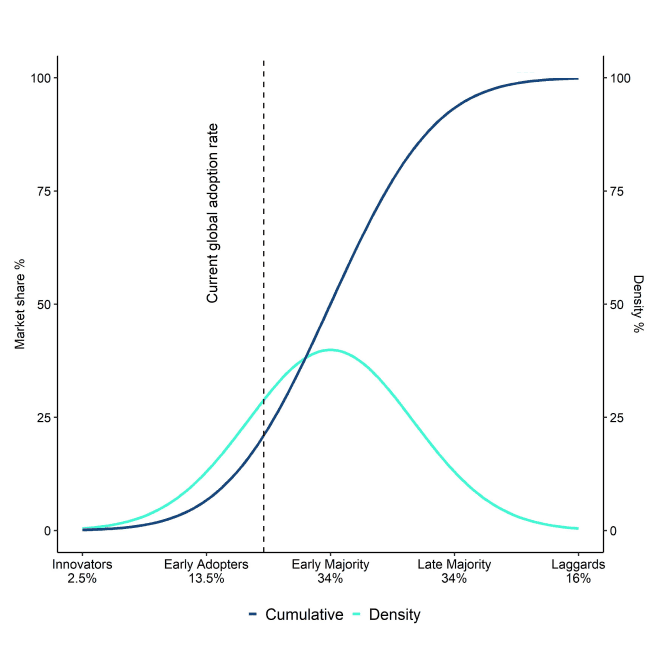

The reason is that technological adoption in general tends to accelerate at the threshold from the so-called “early adopters” to the “early majority” which is around 16% adoption rate based on the model of technological adoption famously put forth by Rogers (1962).

Global adoption rates are already at 21% while adoption rates in the US and Europe are at around 16% and 14%, respectively. So, there is a strong case for an acceleration of adoption rates in these regions and globally over the coming years.

Recent political developments in the US also imply that Bitcoin and cryptoassets are gradually becoming mainstream.

Trump has recently endorsed domestic Bitcoin mining in the US and both Democrats and Republicans have started accepting crypto payments for campaign financing. The big success of the spot Bitcoin ETFs this year and the fact that additional types of spot crypto ETFs are being launched marks a significant shift in sentiment among US regulators in this regard.

In short, chances are that the growth of adoption will surprise to the upside due to the fact that we are most-likely at the inflection point from "Early Adopters" to "Early Majority".

Bottom Line

- Global crypto asset adoption rates are significantly higher than previously estimated.

- The data generally suggest that both the US and Europe may be at the cusp of mass retail adoption – a situation often referred to as “Hyperbitcoinization” in the context of Bitcoin.

- Chances are that the growth of adoption will surprise to the upside due to the fact that we are most likely at the inflection point from "Early Adopters" to "Early Majority".

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

En

En  Fr

Fr  De

De