- Mainstream Adoption of Cryptoassets and ETFs: 2024 marks the beginning of the mainstream era for cryptoassets, with Bitcoin and Ethereum spot ETFs achieving significant milestones. Bitcoin spot ETFs have become the most successful ETF launch in history, and other cryptoassets like Solana and XRP are strong candidates for future ETF approvals, signalling growing institutional and retail interest.

- XRP's Unique Position and Use Cases: XRP stands out due to its long history, high retail investor interest, and practical use cases in cross-border payments. It offers instant payment solutions, addressing a substantial global market for cross-border payments estimated to reach $250 trillion by 2027, and is complementary to other cryptoassets like Bitcoin.

- Reduced Regulatory Uncertainty and Valuation Potential for XRP: Ripple's legal clarity, achieved through its landmark SEC case victory, positions XRP as a strong contender for future growth. With a favourable regulatory environment anticipated and XRP trading at "fair value" based on MVRV metrics, the asset holds significant upside potential, particularly with its growing adoption in real-world applications.

2024 appears to be the year where cryptoassets have entered the mainstream era. Bitcoin spot ETFs have started trading in January this year and have already become the most successful ETF launch in history, outpacing first year inflows into ETFs like Gold (GLD) or the NASDAQ 100 (QQQ) by a very wide margin.

Ethereum spot ETFs have also been approved this year and the set of possible investment vehicles is on the rise.

Several other spot ETFs on major cryptoassets have already been filed this year, including on Solana as well as on XRP. Much attention has been paid to Solana as a likely candidate for the 3rd single asset spot ETF approval and there is a high probability that XRP ETFs could be approved as the 4th single asset spot ETF in the US.

5 key observations about XRP:

1. Long track record

XRP (formerly known as Ripple) is one of the oldest tokens among all cryptoassets. It has stood the test of time and still remains among the top 5 cryptoassets by market cap (ex stablecoins) in the world. It is also among the top 5 non-stablecoin cryptoassets by average trading volume across various exchanges. [1]

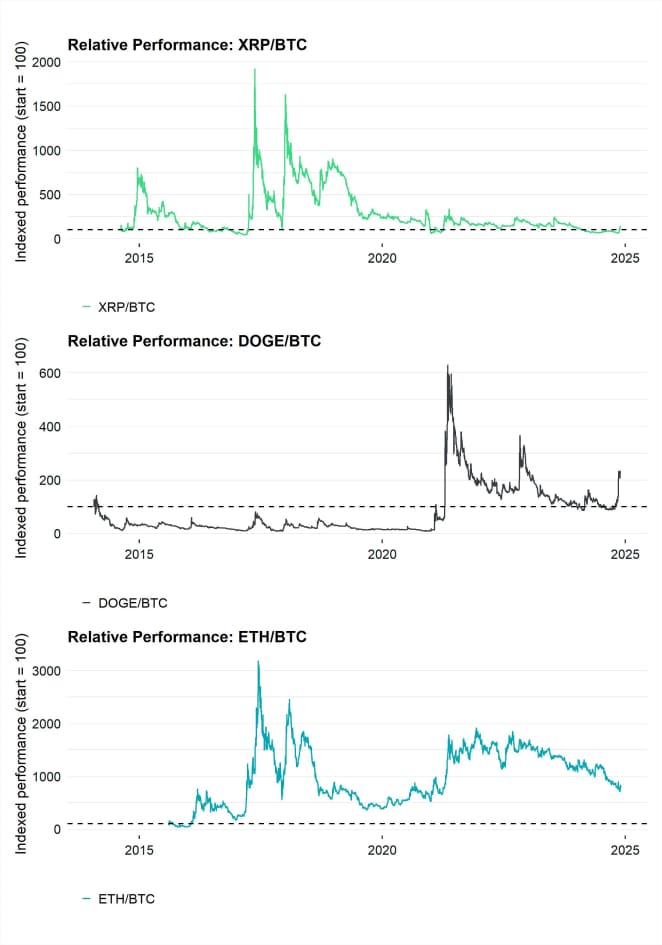

XRP has already been established in June 2012 and has already started trading in August 2013, even before major cryptoassets like Dogecoin (DOGE) or Ethereum (ETH).

In fact, XRP is the 5th oldest cryptoasset ever established and it is one of the few cryptoassets which has even managed to outperform Bitcoin (BTC) in two consecutive bull market cycles, which has only been achieved by Dogecoin (DOGE) and to some extent by Ethereum (ETH) so far.

2. High retail interest

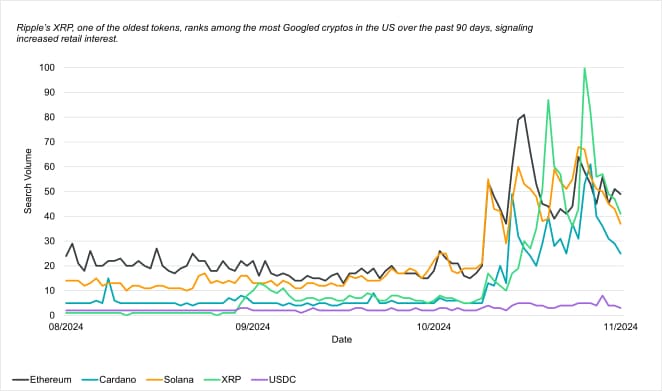

While some institutional fund manager surveys indicate more interest for Bitcoin, Ethereum, and Solana, we have identified a significant retail interest for XRP based on relative Google search interest.

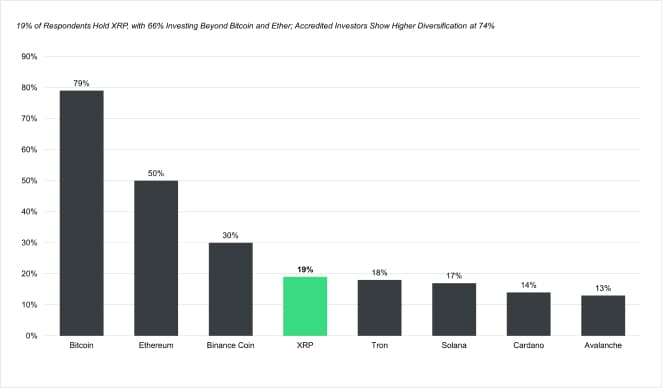

This observation is also supported by a recent survey by EY among retail investors that has revealed that XRP ranks among the top 4 cryptoassets by retail investor allocation:

In general, despite rising institutional interest in US spot crypto ETFs, the share of AuM held by retail investors is still approximately 80% based on the recent 13F filings for spot Bitcoin ETFs.

In other words, US spot crypto ETFs are generally still dominated by retail investors which potentially signals significant investor interest for the filed spot XRP ETFs in the US.

3. Decline in US regulatory uncertainty will benefit XRP

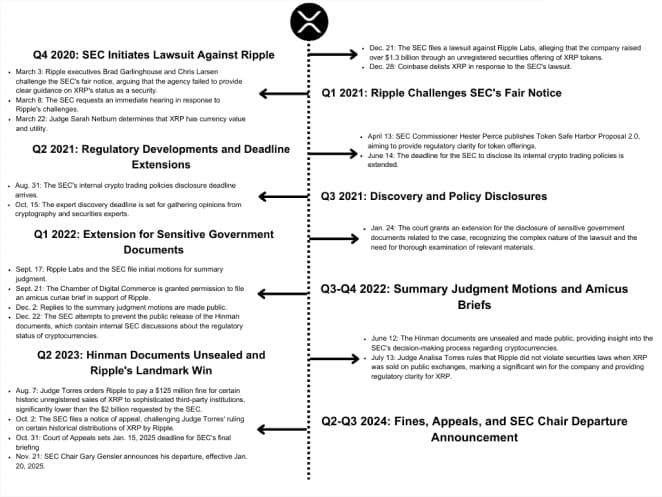

On the 13 th of July this year, Ripple celebrated the one-year anniversary of its landmark victory against the SEC, a pivotal event that provided regulatory clarity for XRP.

This decision solidified XRP's status as one of only two digital assets in the US deemed not to be securities.

Ripple is still awaiting a final decision from the court regarding remedies for institutional XRP sales conducted before December 2020. However, the key ruling-that XRP is not a security-remains unchanged. Ripple is optimistic that the Judge will handle this remaining aspect of the case fairly.

On October 2, the SEC announced its intention to appeal the Court's ruling that certain historical XRP distributions were not securities.

Importantly, the SEC is not challenging the determination that XRP itself is not a security-a point the Court made unequivocally in its July 2023 decision. While the SEC's appeal of other rulings was disappointing, it was anticipated given the agency's ongoing opposition to the crypto industry.

On October 24, Ripple filed its Form C, detailing the issues it intends to raise in its cross-appeal. In light of the pending appeals, Ripple has placed the $125 million remedies payment in escrow.

The appeal and cross-appeal process is expected to continue into the first half of 2025, with oral arguments likely in Fall 2025, followed by a final ruling from the appellate court.

However, XRP is probably the token that should benefit the most from the recent change in the US administration and the decline in regulatory uncertainty, particularly because Gary Gensler has announced to step down as SEC chairman on the 20 th of January 2025.

è It is no surprise that XRP has already rallied +188% since the US election on the 5th of November 2024.

4. XRP already has a wide array of real use cases

Many traditional investors that are sceptical of cryptoassets often claim that most cryptoassets have “no use case”. However, XRP is not one of them.

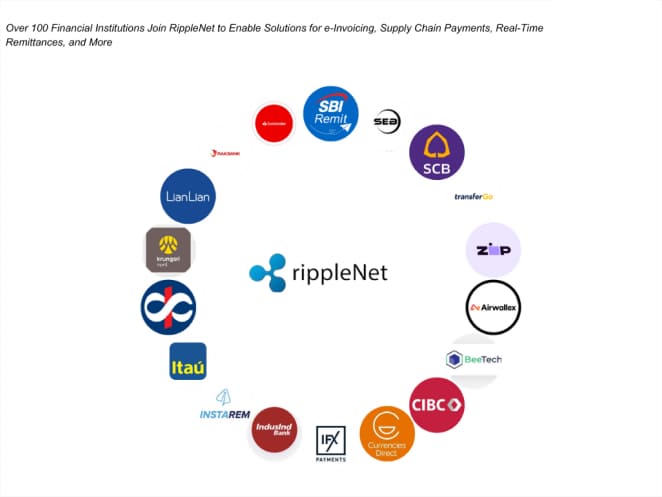

XRP has already a wide array of real use cases which mostly centre around cross-border remittance payments and payments in general. For instance, SBI Remit has teamed up with Ripple to power instant remittances between Japan and Thailand. MoneyMatch and Ripple make it cheaper and faster for Malaysian SMEs to pay global suppliers. Ripple helps Siam Commercial Bank drive innovation with instant cross-border remittances.

So, XRP is primarily utilised as a modern medium-of-exchange in the payments industry and therefore also complementary to other major cryptoassets like Bitcoin that are primarily regarded as a store-of-value asset.

The Total Addressable Market (TAM) of global cross-border payments is very substantial. According to a study by McKinsey , cross-border payment flows already reached approximately 150 trn USD in 2022 and are expected to reach 250 trn USD by 2027.

There is an increasing demand for instant payments which XRP is able to deliver with a payment finality of only 4 seconds on average and a max theoretical scalability of 1,500 transactions per second. In general, a small percentage of the global cross-border payments market could have a very significant impact on transaction count and overall network activity for XRP.

5. XRP is still reasonably valued and has significant upside potential

Despite the significant performance of XRP following the US election results, XRP is still not overvalued based on the Market Value-to-Realized Value (MVRV) valuation metric. The MVRV ratio is one of the most popular valuation metrics applied to cryptoassets and is similar to a price-to-book ratio in equities as it compares the market value with the cost basis of all tokens transacted.

This metric has recently increased back to its long-term average suggesting that XRP is currently at “fair value”.

_thumb.jpg)

All in all, these observations suggest that XRP is quite likely to be among the next wave of spot ETF approvals in the US with significant upside potential due to the decline in US regulatory uncertainty and the ongoing growth in cross-border payments worldwide.

Bottom Line

- Mainstream Adoption of Cryptoassets and ETFs: 2024 marks the beginning of the mainstream era for cryptoassets, with Bitcoin and Ethereum spot ETFs achieving significant milestones. Bitcoin spot ETFs have become the most successful ETF launch in history, and other cryptoassets like Solana and XRP are strong candidates for future ETF approvals, signalling growing institutional and retail interest.

- XRP's Unique Position and Use Cases: XRP stands out due to its long history, high retail investor interest, and practical use cases in cross-border payments. It offers instant payment solutions, addressing a substantial global market for cross-border payments estimated to reach $250 trillion by 2027, and is complementary to other cryptoassets like Bitcoin.

- Reduced Regulatory Uncertainty and Valuation Potential for XRP: Ripple's legal clarity, achieved through its landmark SEC case victory, positions XRP as a strong contender for future growth. With a favourable regulatory environment anticipated and XRP trading at "fair value" based on MVRV metrics, the asset holds significant upside potential, particularly with its growing adoption in real-world applications.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.