- Strategy (MSTR - formerly Microstrategy) is the biggest corporate holder of bitcoins worldwide; it has recently come under increased scrutiny due to its significant bitcoin holdings of more than 2.5% of total supply.

- Strategy makes use of a procyclical leverage “flywheel” which has allowed it to acquire an increasing number of bitcoins; market participants have feared that Strategy could come under financial pressure in case of bitcoin price drawdowns.

- Although MSTR continues to hold low amounts of liquidity, insolvency and bankruptcy risks remain low and bitcoin supply liquidations are not imminent either; a clear game-changer would be the move to lend out bitcoins or use other business strategies in order to boost recurring revenues.

Strategy's (MSTR - formerly MicroStrategy) transformation from a business intelligence software company to a Bitcoin-focused entity began in August 2020 with its initial purchase of 21,454 BTC for $250 million. The company has since aggressively expanded its Bitcoin holdings through various financing methods, including convertible bonds and equity offerings.

The motivation?

Corporate cash balances denominated in fiat currencies like the US Dollar, or the Euro are subject to inflation and lose purchasing power over time – which is sub-optimal for existing shareholders of the company.

In fact, adopting bitcoin as a corporate treasury reserve asset has been rewarded handsomely by financial markets judging by the significant equity performance of those companies that chose to adopt a Bitcoin Standard.

For instance, Meta Planet Inc. in Japan (3350 JP) has been the single best performing stock in the Japanese Topix in 2024, rising by more than +2400% in 2024. It adopted a bitcoin standard in April 2024.

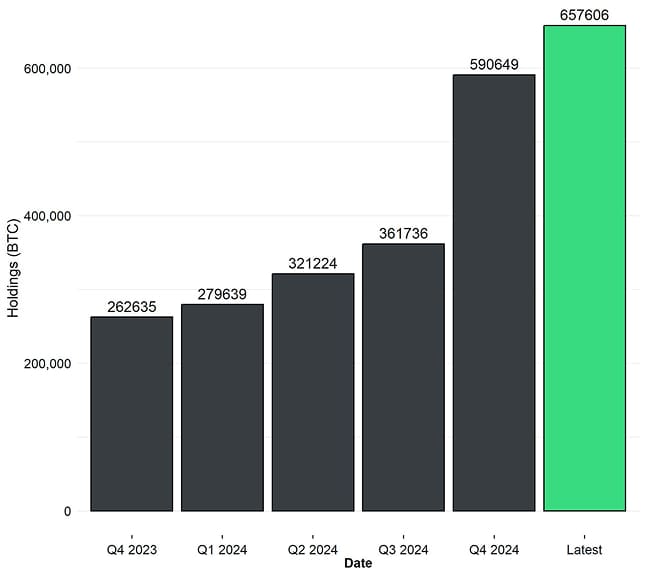

As a first mover, MSTR is emblematic of a global trend towards wider corporate treasury adoption of bitcoin. At the time of writing, 82 publicly listed companies worldwide are holding bitcoin on their balance sheet with a combined holding of around 656.7k BTC according to data provided by bitcointreasuries.net.

Global Corporate BTC holdings

A large chunk of this has been related to MSTR's BTC holdings which is by far the single biggest corporate holder of BTC worldwide. The latest holdings imply around 500k BTC held by MSTR only which is already more than 2.5% of total bitcoin supply.

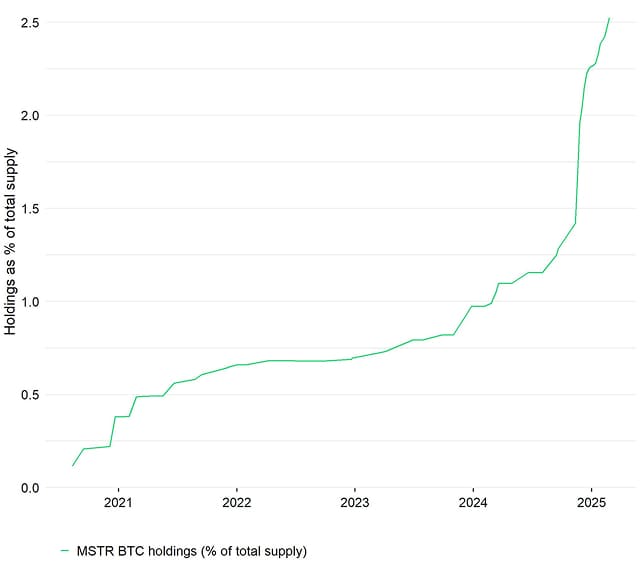

Strategy (MSTR) BTC Holdings as % of total

The increasing share of MSTR's bitcoin holdings has been one of the key reasons for increased scrutiny of MSTR's financial position as well.

While adopting bitcoin as a corporate treasury asset has proven lucrative during Bitcoin bull markets, it could introduce significant risks during Bitcoin bear markets that merit careful analysis.

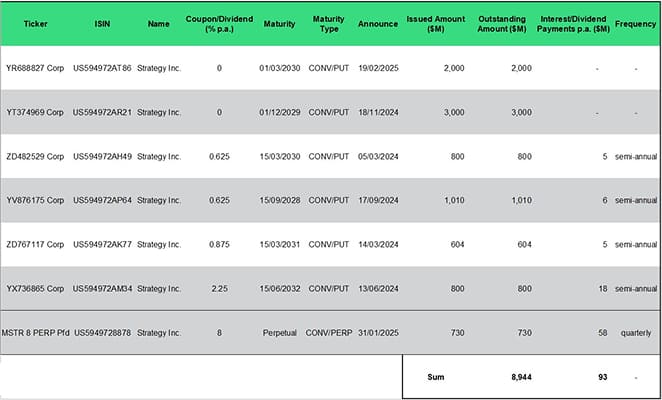

In the context of MSTR, the primary concern centres around MSTR's interest and dividend payment obligations and potential scenarios that could force liquidations of MSTR's bitcoin holdings. Bond repayment schedules along with bitcoin price scenarios require scrutiny to determine financial vulnerability thresholds for MSTR and, in turn, supply distribution risks for the overall Bitcoin market.

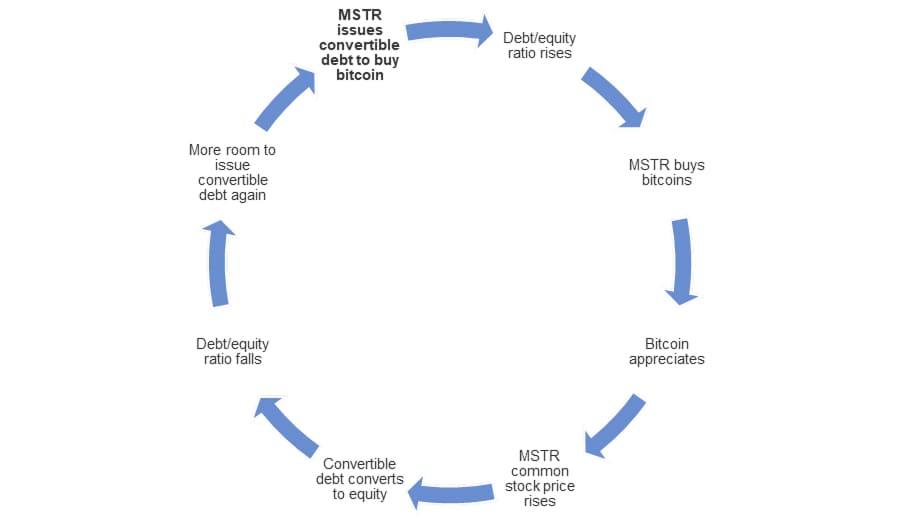

Understanding MSTR's “flywheel”

Put simply, MSTR's investment strategy has made use of the fact that bitcoin's returns over the medium- to long-term (~50% p.a.) are significantly outweighing interest paid on its convertible debt and perpetual preferred equity (0% p.a. - 8% p.a.)

This kind of “fiat-to-bitcoin carry trade” has allowed MSTR's assets to outgrow its liabilities via significant bitcoin price appreciations.

The fact that MSTR has preferred issuing convertible bonds has created a positive feedback loop (“flywheel”) which has allowed MSTR to increasingly issue new debt to buy even more bitcoins.

The mechanics of MSTR's flywheel can be described as follows:

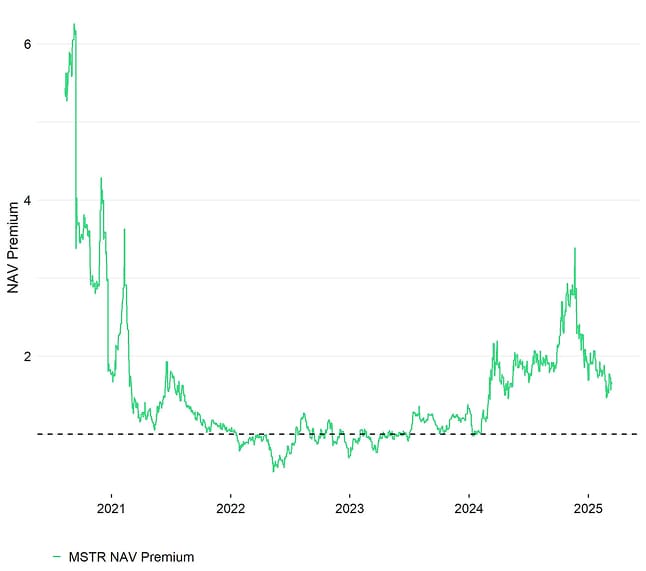

Moreover, bitcoin price appreciations have usually coincided with a widening NAV premium, i.e. MSTR's market cap has appreciated more than the underlying market value of bitcoins.

This has led to a more significant improvement in debt/equity ratios on a mark-to-market basis as well.

Besides, Strategy maintains a market capitalization above $60 billion, substantially above the value of its Bitcoin holdings. This premium to net asset value (NAV) also plays an important role with respect to Strategy's bitcoin accumulation strategy.

Unlike traditional equity raises where shareholder dilution occurs, MicroStrategy's significant NAV premium creates a unique dynamic: When the company conducts at-the-market (ATM) offerings to purchase Bitcoin, it actually increases Bitcoin-per-share despite the expanded float. This "Bitcoin yield" justifies the premium valuation to investors and establishes a self-reinforcing cycle.

Strategy (MSTR) NAV Premium

The effectiveness of this strategy is evident in MicroStrategy's impressive 74% Bitcoin yield throughout 2024, with a minimum target of 15% set for 2025. CEO Michael Saylor succinctly described this arbitrage opportunity on CNBC: "We sold $1.5 billion worth of stock backed by $500 million worth of Bitcoin. We bought back $1.5 billion of Bitcoin. We captured nearly a billion-dollar gain in the arbitrage."[1]

In fact, Strategy has generally managed to avoid shareholder dilution and has managed to maximise bitcoins per share – a key reason for the increasing NAV premium as well.

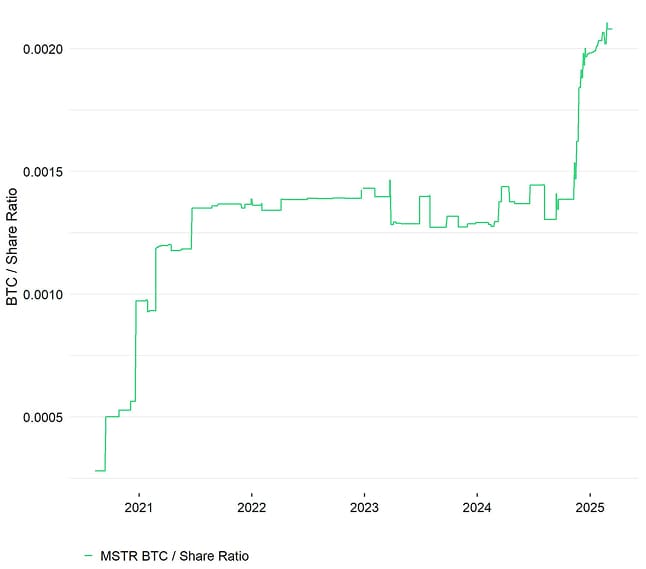

Strategy (MSTR) BTC per Share

How high is MSTR's liquidation risk of bitcoins?

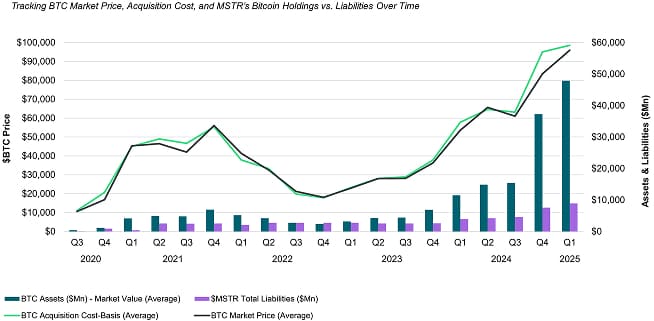

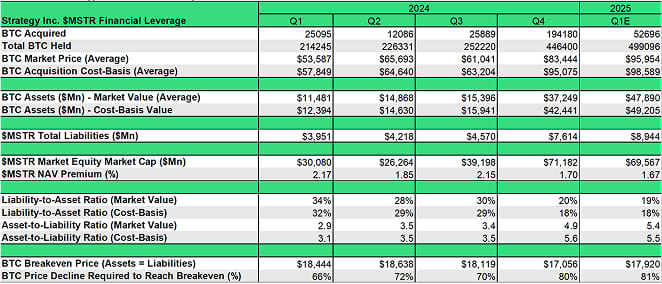

Strategy's core company financials have significantly improved since the bitcoin bear market in 2022.

However, a key area of concern for traditional equity analysts remains MSTR's low liquidity levels to service short-term liabilities such as recurring interest and dividend expenses.

Michael Saylor and Strategy is operating on the premise not to sell any bitcoins which is creating a pervasive shortage of cash on their balance sheet.

In fact, key liquidity metrics have continued to be relatively low which is theoretically increasing the insolvency risk for MSTR. This tends to confuse many traditional equity analysts.

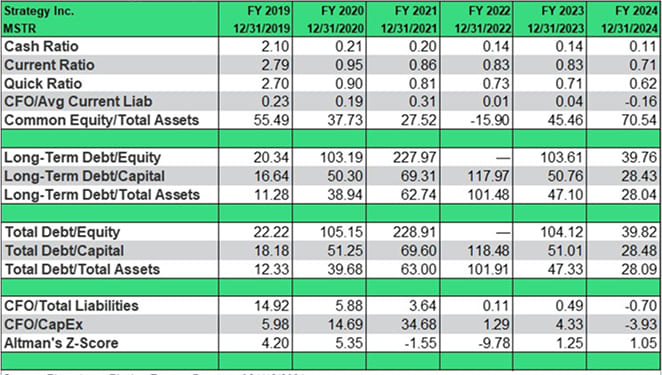

For instance, the cash ratio has declined from 2.10 in 2019 to just 0.11 in 2024, while the current and quick ratios have also weakened, signalling shrinking liquidity. Additionally, cash flow from operations (CFO) turned negative (-0.16) in 2024, and CFO relative to total liabilities (-0.70) suggests the company was struggling to generate enough cash to cover its obligations. With CFO/CapEx at -3.93, it may need to rely on external financing to fund operations.

Global Corporate BTC holdings

The Altman Z-Score, a measure of financial distress, was as low as -9.78 in 2022 and remains at a risky 1.05 per the end of 2024, indicating solvency concerns.

MSTR's financial stability is highly dependent on Bitcoin as its primary reserve asset. A significant drop in BTC prices could create additional liquidity shortfalls, making it difficult to meet obligations, including its 8% p.a. dividends on its planned $21 billion preferred stock offering.

More specifically, the new perpetual preferred stock offering of $21 billion could increase Strategy's total liabilities to around $29.9 billion and interest plus dividend expenses to approximately $1.77 billion per annum.

Although dividend payments on those preferred stocks can be deferred upon approval of the board of directors, deferred payments generally accumulate over time, necessitating payouts later. So, this can only be a temporary solution which would likely have significantly negative effects on MSTR's common stock price as well.

In comparison, MSTR only had $38.1 million in cash & cash equivalents per Q4 2024 against current liabilities of $117.4 million which includes interest expenses, dividend payouts, and employee compensation as well. This implies that MSTR is dependent on additional external financing to cover its short-term liabilities.

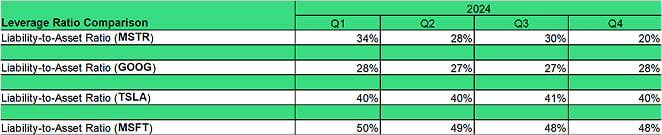

That being said, key corporate financials such as the leverage ratio (liability-to-asset ratio) remain significantly lower relative to other major tech companies such as Microsoft (MSFT) or Google (GOOG) which underscores MSTR's low bankruptcy risk because the company could always resort to selling parts of its highly liquid assets, i.e. bitcoin holdings.

MSTR has generally managed to create a large asset buffer relative to its liabilities which has mitigated bankruptcy risks significantly.

In fact, based on the latest available numbers, the price of bitcoin would need to decline by approximately -80% for MSTR's assets to decline below its liabilities (see also table below). We think this scenario is relatively unlikely in the short term.

In general, there is no risk that any of MSTR's convertible bonds will come due before September 2027 - the very first official put date for MSTR's convertible bonds.

For instance, in the unlikely event that bitcoin should drop to a hypothetical price of only 30k USD in September 2027, bond holders could require MSTR to repurchase these bonds prematurely at par plus accrued interest.

The notional value of this issuance due in 2028 is $1,100 million which would still be manageable as the value of MSTR's bitcoin holdings would still be approximately $15 billion even at these lower bitcoin prices. So, MSTR would only need to liquidate around 7.3% of its existing bitcoin holdings to pay out bond holders in this unlikely scenario.

Apart from the official put option by bond holders mentioned above, the bond covenants generally don't put MSTR under pressure to repay its obligations in case of a significant drop in bitcoin's price. They only include the standard “fundamental change” and “cross default” clause which are unlikely to be triggered in absence of a significant change in MSTR's equity ownership.

Moreover, liquidity issues have been mitigated by the most recent security issuances. More specifically, MSTR has recently issued the 730 million USD notional 8% preferred stock offering in January 2025 and the 0% 2030 convertible bond issuance with a 2 billion USD notional in February 2025 though.

The proceeds from the latest issuance of the perpetual strike preferred stock of up to $21 billion will also be partially used as working capital:

“Strategy intends to use the net proceeds from the ATM Program for general corporate purposes, including the acquisition of bitcoin and for working capital .” [2]

So, insolvency risk is not an imminent concern and therefore we also don't expect any imminent liquidation of bitcoins either.

A clear game-changer is in the context of liquidity risks could be a change in corporate business strategy by MSTR.

This was also emphasised by Michael Saylor in a recent fireside chat with Bernstein analysts:

“The end game is to be the leading Bitcoin bank or merchant bank, or you could call it a Bitcoin finance company,” [3]

Any such move could significantly increase MSTR's recurring revenues and significantly decrease insolvency risks even amid bitcoin market downturns.

As a hypothetical example, if MSTR only lent out 50% of its current BTC holdings at 4% p.a., it could already cover all interest and dividend expenses, including the new liabilities incurred by the latest $21 billion perpetual preferred stock offering.

And this doesn't even factor in the expansion of its BTC holdings facilitated by said perpetual preferred stock offering.

Another possible business avenue could be to engage in covered call BTC option writing strategies in order to generate additional income from its bitcoin holdings. For instance, this is also done by Meta Planet Inc. (3350 JP) in Japan as well.

The recent reform of the FASB121 accounting rule in the US is generally opening a more efficient use of bitcoin holdings for MSTR.

Under the previous FASB 121 rules, Strategy had to record impairment losses whenever Bitcoin's price dropped below its purchase price, even if it later recovered. This led to artificially low earnings reports and a distorted financial picture, as the company couldn't recognize gains when Bitcoin appreciated.

However, the new FASB accounting rules (effective 1st of January 2025) will allow Strategy to report Bitcoin at its fair market value (mark-to-market), eliminating impairment-only accounting.

This change will enable the company to reflect its Bitcoin holdings more accurately, leading to a higher reported book value and more transparent financials. As a result, Strategy's earnings volatility will decrease, better aligning its financial statements with its long-term Bitcoin strategy.

It will also allow to ultilise Strategy's bitcoin holdings more effectively.

[1] MicroStrategy's Michael Saylor: We want to bridge traditional capital markets with crypto economy

[2] https://www.strategy.com/press/strategy-announces-21-billion-strk-at-the-market-program_03-10-2025 ; bold text added by the author

[3] https://www.dlnews.com/articles/markets/bitcoin-bank-is-microstrategys-end-game-says-saylor/ ; bold text added by the author

Bottom Line

- Strategy (MSTR - formerly Microstrategy) is the biggest corporate holder of bitcoins worldwide; it has recently come under increased scrutiny due to its significant bitcoin holdings of more than 2.5% of total supply.

- Strategy makes use of a procyclical leverage “flywheel” which has allowed it to acquire an increasing number of bitcoins; market participants have feared that Strategy could come under financial pressure in case of bitcoin price drawdowns.

- Although MSTR continues to hold low amounts of liquidity, insolvency and bankruptcy risks remain low and bitcoin supply liquidations are not imminent either; a clear game-changer would be the move to lend out bitcoins or use other business strategies in order to boost recurring revenues.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.