- Sovereign default risks have been on the rise globally as fiscal debt-to-GDP levels have reached new record highs; France’s and UK’s fiscal situation is becoming particularly concerning for bond investors.

- In a theoretical model, Bitcoin can serve as “portfolio insurance” against the default of a basket of major sovereign bonds with a current “fair value” of around 219k USD based on this model.

- Bitcoin can be an interesting alternative for investors looking to hedge both a sovereign default and hyperinflation scenario on account of its decentralised counterparty risk-free characteristics and its increasing scarcity.

Public debts are on the rise worldwide. US public debt has just recently surpassed 36 trillion USD which amounts to around 123% of GDP – the highest level ever recorded. What is more is that the growth in US public debt appears to accelerate – since the beginning of September, US total public debt has already grown by +917 bn USD according to data provided by Bloomberg.

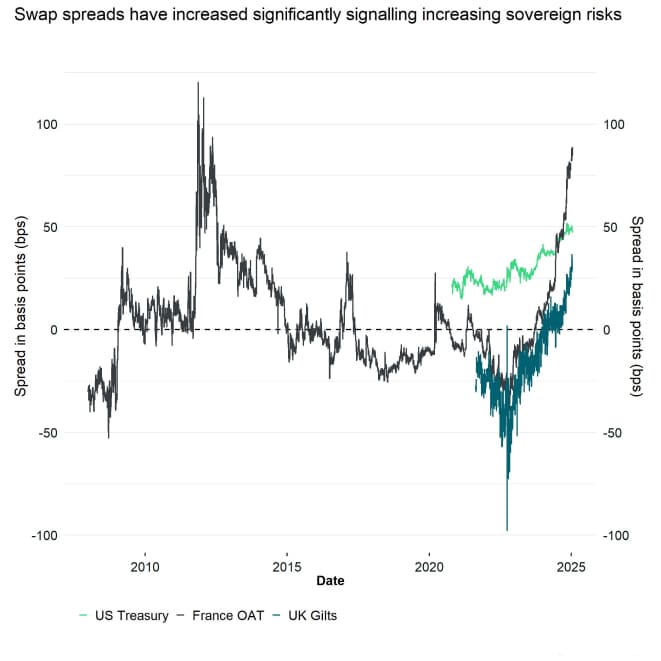

But rising fiscal debt is not only an issue for the US. Major sovereigns like France and the UK have been facing increasing pressure by “bond vigilantes” on account of their rising fiscal debt load and increasing domestic political instability more recently.

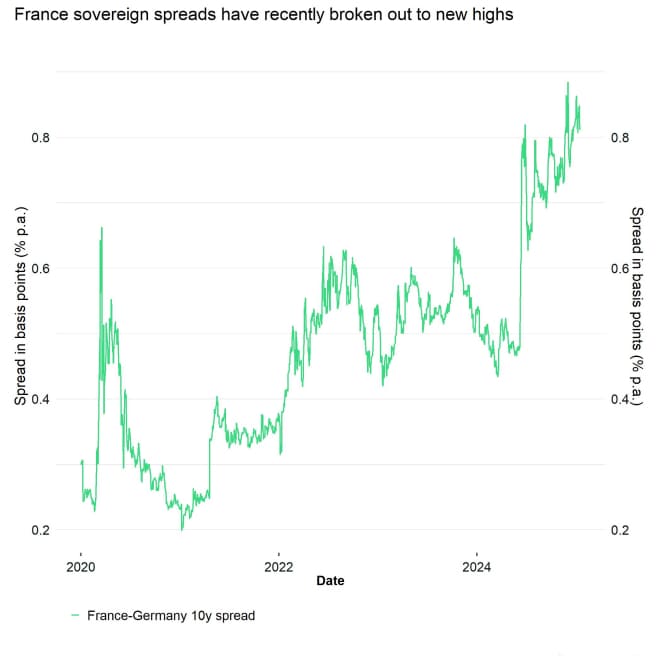

For instance, the spread between French 10-year yield and the German government 10-year yield has risen to the highest level since July 2012 – when the Euro debt crisis plagued the European continent. France's 10-year yield has recently risen above the yield of Greece which speaks volumes in terms of fiscal uncertainty facing the French sovereign.

In general, government risk premia have been rising for major sovereign issuers like the US, UK, or France as evidenced by their rising swap spreads (see first chart above).

Thus, it is no surprise that investors have been looking for alternative stores of value to mitigate increasing counterparty risks. Gold has been traditionally used by investors to mitigate counterparty risks and even central banks still hold a larger share of their international reserves in gold.

An attractive digital alternative to gold is Bitcoin.

The Bitcoin network consists of redundant decentralised nodes without a central entity that is scattered across the globe. The Bitcoin ledger that features all transactions and balances that happened with BTC, is also secured by a decentralised network of miners that adheres to consensus rules to validate transactions and produce new units of bitcoin.

Thus, investors in Bitcoin essentially don't face counterparty risk as their holdings are not intermediated by a third party. Moreover, Bitcoin holdings and transactions are not subject to potential censorship or confiscation by a central party.

Furthermore, the underlying blockchain technology of Bitcoin minimises trust within transacting parties which is why it is often referred to as a “trust less system” which is different from a sovereign bond contract that is heavily reliant on the trust in the sovereign's ability to pay back its debts.

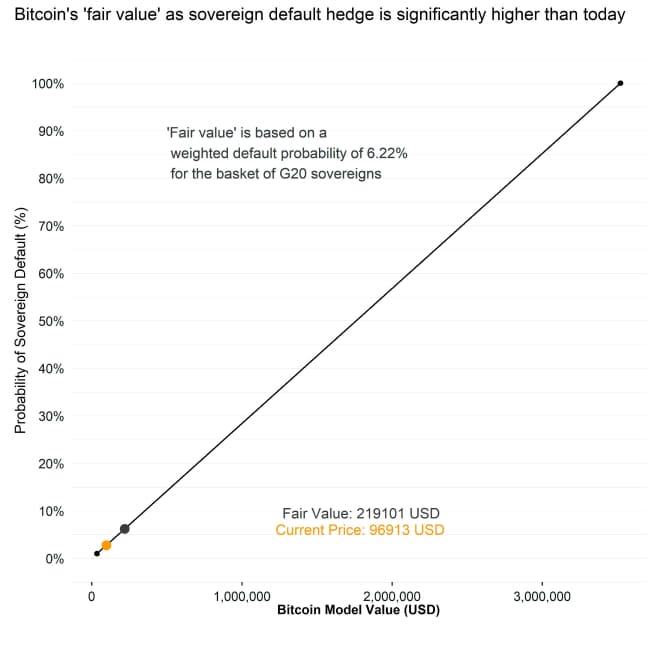

Due to these characteristics, Foss (2021) has already demonstrated that Bitcoin could serve as a “portfolio insurance” against the default of a basket of major sovereign bonds.

Under the assumption that Bitcoin would be used to hedge the market value of major sovereign bonds, a certain model value of Bitcoin can be derived from the associated default risk of those sovereign bonds.

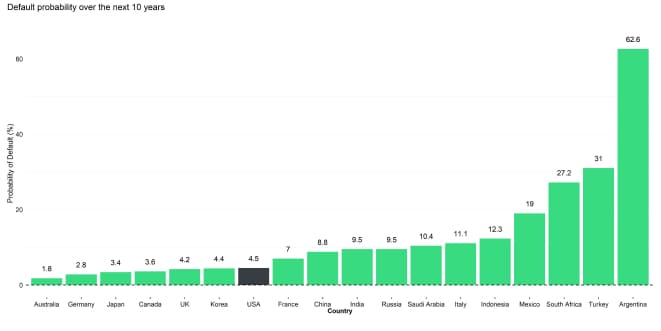

More specifically, the market value of G20 sovereign bonds currently amounts to around 69.1 trillion USD and the weighted average default probability over the next 10 years is priced at around 6.2% by the respective Credit Default Swaps (CDS).

For reference, US sovereign CDS price in a probability of default of around 4.5% over the next 10 years.

Based on this model, this would imply a “fair value” of Bitcoin of around 219 k USD per BTC already. In the unlikely event that all G20 sovereign bonds would default simultaneously, the theoretical “fair value” of 1 single BTC within this model would increase to approximately 3.5 mn USD.

Note that this calculation does not include unfunded liabilities of these G20 governments which would lead to even higher price estimates.

Although defaults by major sovereigns are not to be expected in the short term and are still relatively unlikely, this theoretical model goes a long way towards assessing where the bitcoin price could gravitate towards if such a scenario started to materialise.

Apart from this model, in a new paper Ahmed et al. (2024) have demonstrated that rising sovereign default risk are associated with rising cryptocurrency app downloads in emerging markets, i.e. increasing crypto adoption. So, there is supporting evidence that cryptoassets and in particular Bitcoin can be considered to be a hedge against sovereign default.

In this context it worth noting that sovereign defaults have historically occurred quite frequently.

In their famous book “this time is different” Reinhart & Rogoff (2009), have shown that sovereign default is also relatively common, especially on external, foreign currency denominated debt. Reinhart and Rogoff (2009) list approximately 320 instances of sovereign external debt default from 1800 to the early 2000s.

It is also important to note that a sovereign country can become insolvent in foreign currency or hard currency like gold but it can technically never become insolvent in domestic currency since it can create it “out of nothing”.

In other words, a sovereign country can technically resort to its own “printing press” (of the central bank).

That's why, historically speaking, fiscal debts in domestic currency tend to be inflated away while debtors tend to default on external debts in foreign currency.

Thus, a high-inflation scenario appears to be more likely than an outright default scenario on domestic debt.

That being said, if that was the case, a high-inflation scenario would benefit Bitcoin significantly as well since Bitcoin has become the scarcest major asset in the world in 2024 based on its supply growth rate of approximately only 0.9% p.a.

In any case, Bitcoin can be an interesting alternative hedge for investors looking to hedge both a sovereign default and hyperinflation scenario on account of its decentralised counterparty risk-free characteristics and its increasing scarcity.

Bottom Line

- Sovereign default risks have been on the rise globally as fiscal debt-to-GDP levels have reached new record highs; France’s and UK’s fiscal situation is becoming particularly concerning for bond investors.

- In a theoretical model, Bitcoin can serve as “portfolio insurance” against the default of a basket of major sovereign bonds with a current “fair value” of around 219k USD based on this model.

- Bitcoin can be an interesting alternative for investors looking to hedge both a sovereign default and hyperinflation scenario on account of its decentralised counterparty risk-free characteristics and its increasing scarcity.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

En

En  Fr

Fr  De

De