Introduction

The global investing megatrends of the past few decades have intensified world trade, as technical and financial innovation moves at breakneck speed. Under this banner, digital assets and blockchain have begun to persist in almost every sector and industry worldwide. While largely ignored for the first few years of their life, after Bitcoin’s whitepaper debuted on 31 October 2008, in the last four years, between 2017 and 2021, opportunities have largely moved from mere financial speculation to blockchain hardware and software infrastructure service provision, supply chain/manufacturing and data/asset management, with large corporate spending and fundraising increases across the board.

In economic terms, there is a new world order of monetary stimulus with which investors are being forced to grapple. During inflationary periods in history, bonds have traditionally suffered, which has led to wider equity losses. Rampant central bank money printing continues, even as inflation rates hit their highest level in 12 years. The European Central Bank, for example, said on 10 June 2021 it would maintain and even accelerate bond purchases under its €1.85trn pandemic emergency plan at “a significantly higher pace than during the first months of the year”. This state of affairs makes digital assets continually attractive. Despite this fact, and recent regulatory updates providing greater clarity, many institutional investors, by accident or design, are being shut out of the early stages of an exceedingly rare thing: the creation of an entirely new asset class.

The closer integration of digital and cryptoassets in world banking, supply chains, manufacturing and even as potential legal tender, perhaps supported by volcanic geothermal mining in El Salvador, throws up many opportunities but many challenges too.

For those unable to access digital asset markets, there are still wide-scale, long-term investment opportunities in the infrastructure behind the technologies themselves.

Investors guide to the Blockchain Ecosystem

While Bitcoin is the best-known and first globally-distributed application of blockchain, there are scores of use cases for the technology. The clearest opportunity appears to be in the realm of financial technologies. Indeed, according to IHS Markit the value of blockchain to the finance industry reached $1.9bn in 2019 and could rise as high as $492bn by 2030.

Over the next decade, the global financial market, which includes insurance and fintech, will continue to be the largest value market using blockchain technology. Because the financial sector includes markets of significant value, even a small percentage of cost savings and efficiency gains can lead to significant business value... By applying blockchain to the clearing and settlement of cash securities – specifically, equities – investment companies could save up to $12 billion in fees. Don Tait, Principal Analyst for blockchain and cybersecurity, IHS Markit

The Bank for International Settlements is among the global institutions to have studied the impact of blockchain on financial settlements. In a March 2020 paper, the ‘bank of banks’ highlighted that:

Incumbent financial institutions as well as new entrants are investing heavily in projects seeking to transform securities into digital tokens – digital representations of value that are not recorded in accounts. A key motivation is to lower the estimated USD 17-24 billion spent annually on trade processing. The clearing and settlement landscape could change rapidly in response to tokenisation [and it] could also transform how the underlying risks are managed. Morten Linnemann Bech, Jenny Hancock, Tara Rice and Amber Wadsworth, BIS Quarterly Review, March 2020

Blockchain-native companies have wasted little time in enacting these groundbreaking changes. Hg Exchange, for example, is a recent graduate of the Monetary Authority of Singapore’s fintech regulatory sandbox, and has since been granted a Registered Market Operator licence. It said in May 2021 it would offer tokenised versions of shares to include Uber, Airbnb and SpaceX.

More structurally important financial entities, for example, the European Investment Bank (EIB), are now getting involved in digitising capital markets. On 28 April 2021 the EIB issued the first ever bond on the Ethereum public blockchain, with Goldman Sachs, Banco Santander and Société Générale overseeing the sale. The €100 million ($121 million) bond is due to mature on April 28 2023. The EIB said the benefits of digitising bonds using blockchain included cutting fixed costs and intermediary costs, improving transparency and settlement speed.

These digital bonds will play a role in giving the Bank a quicker and more streamlined access to alternative sources of finance to boost finance for projects across the globe Mourinho Félix, EIB Vice President

The broad integration of blockchain into the world’s major cross-border payments companies offers an interesting opportunity for investors. Rapid change is afoot. The $515bn market cap Visa (NYSE:V) announced in March 2021 it would support transaction settlements with USDC, a USD stablecoin pegged 1:1 against the dollar and powered by the Ethereum ecosystem. Payments will be routed through Anchorage; the first digital asset bank to win federal charter status in the United States as recently as February 2021.

Previously niche subsectors of blockchain financial technology, specifically decentralised finance applications (DeFi) and non-fungible tokens (NFTs) have also expanded rapidly in the past four years. Each is largely built on the Ethereum blockchain. DeFi has exhibited healthy growth, with nearly $50bn in total value locked in asset swaps and yield-producing deposits, despite a fall-off from an $86bn high recorded in May 2021.

The ability to sell NFTs: unique collectible items whose provenance is provable and traceable using blockchain digital ledgers has attracted growing numbers of tech titans. They include the likes of Twitter founder and Square CEO Jack Dorsey, who on 22 March 2021 sold an NFT of the first ever tweet for $2.9 million, paid for using Ether. Sir Tim Berners-Lee, inventor of the world wide web, announced on 15 June 2021 he would auction off the source code to the original web browser encoded as an NFT, via Sotheby’s. The auction house’s Head of Contemporary Art Auctions and NFTs, Max Moore, told UK broadsheet The Guardian on 23 June 2021:

It’s a movement in and of itself. It’s a reflection in response to the changing times. It’s been like a tech start-up for the first four months, but I think now we’ll see it converted into a more organic, traditional market, that grows at a much healthier pace

According to a Q1 2021 state of the market report by Nonfungible.com, NFT sales across the first quarter of the year 2021 climbed 2,100% compared to the previous quarter, to more than $2bn. At time of writing, sales of NFTs grew from $18.4m in Q3 2020 to $3.66bn across Q3 2021. While trading volumes for these unique blockchain-based products vary, there is significant investment potential in trading venue infrastructure, and the provision of hardware and software services to this niche.

While trading volumes for these unique blockchain-based products vary, there is significant investment potential in trading venue infrastructure, and the provision of hardware and software services to this niche.

The blockchain and digital assets sector has also been characterised by surging IPO activity in the last three years.

For example, crypto mining company Bitfarms (TSX.V:BITF) initially listed on the junior/venture market of the Toronto Stock Exchange in July 2019. On 7 May 2021 it announced its intention to list on NASDAQ, commencing trading subsequently on June 21st.

The UK’s first (and currently only) cryptomining stock, Argo Blockchain (LSE: ARB), began with a 2018 listing on the AIM growth market and in February 2021 expanded to OTCQX in the United States. More recently on 3 June 2021 the cryptominer noted a strategic investment in NFT company WonderFi Technologies.

On 16 April 2021 Argo broke fundraising records for the UK’s AQSE exchange, raising ?35m for NFT offshoot NFT Investments, then days later listed DeFi investment company Dispersion Holdings in a ?25m IPO.

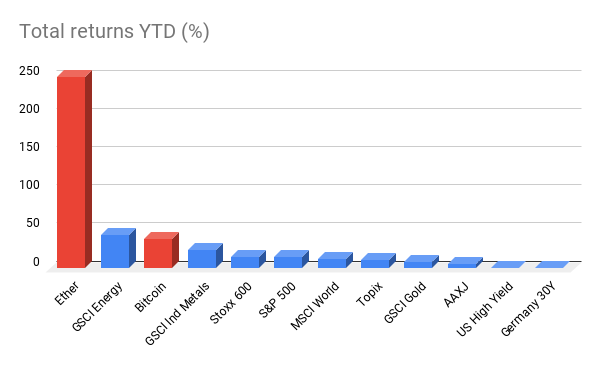

At time of writing, global equity markets, commodities and indices are in general delivering positive returns, almost without exception. By June 15 2021 European shares were on their longest winning streak in two years, according to Reuters. And yet digital assets continue to outperform.

The Investment Case for the Blockchain & Digital Assets Sector

Nearly a decade of global innovation in blockchain and digital assets has not dented investor or corporate enthusiasm for new products and use cases. In terms of annual spending by corporates, projections for blockchain reach nearly $16bn by 2023,according to CB Insights, with as many as 58 industries from insurance to gaming to cannabis utilising blockchain applications.

Actual spend, as tracked by the IDC Worldwide Blockchain Spending Guide, was $2.1bn in 2019, $4.4bn in 2020, with $6.6bn forecast for 2021. The same projections put a figure of $19bn on the total spend by 2024.

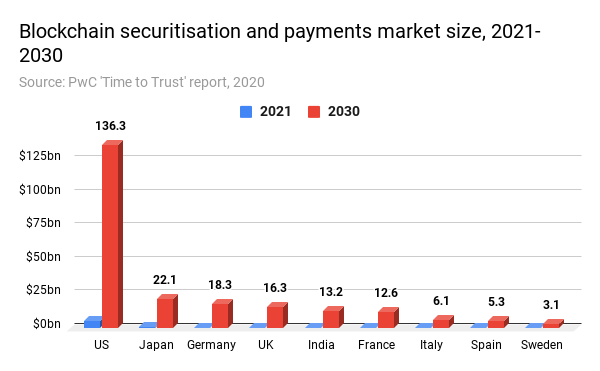

PwC’s 2020 Time to Trust report suggests the largest economic impact of blockchain will be in securitisation and payments. Specifically, impacts are forecast to grow worldwide by 2030 between 1,933% and 3,000% for the selected countries surveyed.

Among the largest forecast increases are those countries that have regulated in favour of allowing banks to custody or trade in cryptoassets.

The United States market, for example, is forecast to grow from $5.2bn to $136.3bn. The United Kingdom is expected to increase revenues from $0.6bn to $16.3bn while Germany could grow from $0.7bn to $18.3bn.

Relevant PESTEL changes that support growth

Political

Lobbying once confined to small industry volunteer groups is now becoming more professional and involves executives from the largest asset managers in the world.

In April 2021 the $10.4trn AUM asset manager Fidelity, Coinbase (NASDAQ: COIN), crypto investor Paradigm and Twitter CEO Jack Dorsey’s payments company Square (NASDAQ: SQ) launched a new lobbying group called the Crypto Council for Innovation. Its stated aim is to “correct misinformation on cryptocurrency” in Washington and beyond.

Economic

Greater integration of blockchain and digital assets into the infrastructure of capital markets and asset management has transformed the economic outlook for the space.

The Bank of New York Mellon, with $41trn of assets under custody, and $2.2trn of assets under management, is the world’s largest custodian bank. Its February 2021 entry into the market, to custody digital assets for its clients denotes a shift towards the global normalisation of digital assets. In the wake of safe custody, pension funds are starting to offer digital assets as longer-term investments. On 10 June 2021 401(k) provider ForUsAll partnered with Coinbase on a plan to allow investors to allocate 5% of their retirement funds to digital assets. The world’s largest university endowments, including Harvard, Yale, Brown and the University of Michigan (combined AUM of approximately $87bn) have all been purchasing digital assets direct from exchanges, Bloomberg reported in January 2021.

Social

One widely underreported element of social analysis in blockchain and digital assets is the status of religious beliefs in. For example, Islamic scholars continue to debate the status of digital assets as halal or haram. One of the first rulings appeared in 2014 from prominent Islamic finance author Dr Monzer Kahf, who determined bitcoin was a legitimate medium of exchange. In recent years, as markets have matured, scholars have tended to distinguish between different assets rather than taking crypto as a single entity.

Islamic jurists in South Africa have ruled in favour of cryptocurrencies, noting both that they have become socially acceptable and widely used, while Shariah-compliant exchanges have since launched, for example CoinMENA in Dubai in January 2021, with a license from the Bahrain central bank.

Technological

Bitcoin’s scarcity drives its value: its production rate is arrived at programmatically, halving every four years until a hard cap limit of 21 million bitcoin are in the wild, sometime around 2140. The same cannot be said for any other commodity or asset. If the price of silver rises, production usually scales up to meet demand. In terms of the technology itself, innovation is driving growth, with a growing appreciation for the ability to build entirely new decentralised and trustless financial markets on top of foundational technology like the Ethereum blockchain. The second iteration of Ethereum, a multi-stage release slated to be complete by 2023, will cut energy use by 99.95% and introduce new deflationary currency mechanics.

Environmental

Digital assets are not a monolith: there are a vast range of different protocols, from Bitcoin and Ether to Litecoin, Stellar, XRP and approximately 10,000 cryptoassets on the market of varying stripes. Each has slightly different underlying mechanisms and some use more energy than others.

However, ongoing concerns over the carbon footprint of Bitcoin mining should not be underplayed. And while there are questions to answer of the factual accuracy of the most common criticisms of Bitcoin’s proof of work algorithm, and the side effect of securing the network with ever-increasing amounts of computing power, there is now a movement towards greater use of renewable energy for mining. Argo Blockchain’s development of the first green mining pool to use 100% clean energy to mine cryptocurrencies is the first step along this road. It is extremely likely, given the amount of global focus on climate change and carbon emissions, that more miners will follow.

New indices by asset managers like One River Digital’s BTC.X show the extent of institutional interest in carbon-free Bitcoin mining. That index is based on the estimated carbon emitted per bitcoin mined, along with the market price of the offset required to net that emission to zero.

Very recent developments in China in terms of banking policy have produced a seismic power shift in Bitcoin and cryptocurrency mining. US and UK-located miners are expected to benefit the most from China’s highly-publicised crackdown, as it forces mining companies to relocate their business to overseas jurisdictions.

Legal/regulatory

Regulation of the sector to date has largely been piecemeal, country- or region-specific, and covering only parts of the digital asset spectrum. Much has been punitive and backwards-looking, for example China’s September 2017 ban on crypto fundraising through Initial Coin Offerings. But more recently, the ability of banks to deal with digital assets as they would any other asset class has been a boon to the sector.

Germany and Switzerland have shown the most innovation in terms of banking architecture for digital assets, with BaFin and FINMA overseeing the space in each country respectively, but the United States has followed swiftly behind in recent months.

In June 2020 the US national banking regulatory, the Office of the Comptroller of the Currency, released guidance through Interpretive Letter 1170, which said that federally-regulated US banks could custody cryptocurrency. In January 2021, Interpretive Letter 1174, allowed banks to participate as nodes in blockchain networks, as well as use stablecoins for payments settlement.

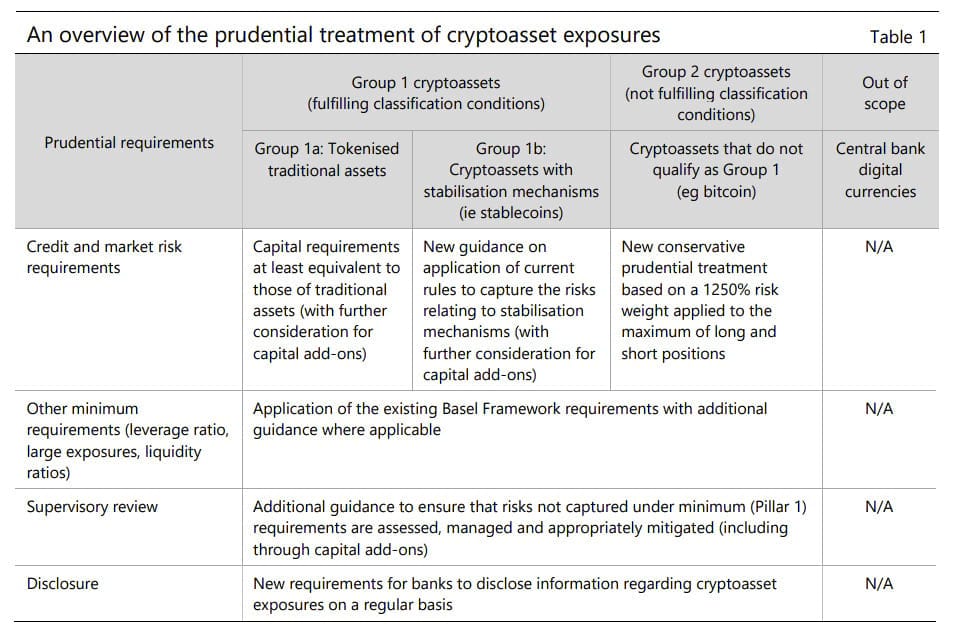

On 10 June 2021 the global banking regulator the Basel Committee released ‘Prudential treatment of cryptoasset exposures’, marking the first worldwide regulations aimed at covering the entire asset class. A public consultation will run until 10 September 2021. Their landmark proposal marks the first effort to classify the treatment of cryptoassets across jurisdictions for banking purposes.

This is a marked softening of tone from global regulators, indicating a move away from punitive actions and opening the door for more financial institutions to invest, trade, custody or otherwise deal with cryptoassets in a legal and secure way.

The Financial Action Task Force has determined that cryptoassets do not pose a threat to global financial stability. Indeed, the FATF has committed to producing ongoing 12-month reviews of cryptoasset companies’ compliance with its guidelines, released in June 2019.

The World Economic Forum recently released a policy toolkit for regulators delineating the taxonomy of DeFi, with the support of regulators like the US FinCEN.

Notable applications of blockchain across major sectors

General & political

El Salvador’s recent decision to adopt Bitcoin as legal tender – so ending the country’s reliance on US dollars, and applying zero capital gains tax to cryptocurrency – has kickstarted a wave of nations upgrading their regulatory infrastructure as regards the asset class. Specifically, Article 7 of the law states: “Every economic agent must accept bitcoin as a form of payment when it is offered by whoever acquires a good or service.” Policymakers across South America, including in Brazil, Paraguay, Argentina and Panama have signalled support for the decision.

India is a $3trn market and digital asset early adopter, relatively, and so of significant interest. Discussions have been going back and forth between the Reserve Bank of India and the Supreme Court since 2018 over the classification of cryptocurrency or a possible outright ban.

Industry sources cited in a 10 June 2021 report by the New Indian Express assured journalists that Nahendra Mohdi’s government would perform a volte-face, denoting crypto as a formal, investable asset class and allowing the country’s Securities and Exchange Board of India to oversee regulations for the sector.

There are substantial legal and regulatory risks ongoing in the sector. As described in Deloitte’s 2020 Global Blockchain Survey:

Businesses will likely face varying regulatory requirements as they juggle multiple, and sometimes competing and contradictory, regulations imposed by different jurisdictions Deloitte GBS2020

For example, Thailand’s market regulator, the Securities and Exchange Commission, banned digital asset platforms from trading NFTs on 11 June 2021. In response, the country’s largest NFT purveyor, the $36bn retail and mobile giant Jay Mart, vowed to list its blockchain-based products on foreign exchanges.

The introduction of Central Bank Digital Currencies, likely starting with China’s e-CNY, could complicate and compete with decentralised digital payments. And the legal definition of the emerging technologies of blockchain and digital assets is in constant flux. For example, in November 2019 the UK Jurisdiction Taskforce made a landmark ruling that smart contracts were legal under UK law. However, the UK’s independent Law Commission notes the jurisdictional issues this brings up:

With intangible assets and smart contracts having become so common in the “virtual world”, there are inherent difficulties in determining the geographical location of acts, actors, and intangible objects. For example, when a digital asset is hosted on a decentralised, distributed ledger, where is it? And if transferred or misappropriated, where has it moved from, and where has it moved to?"

"There is a sense that the international commercial community is waiting for a jurisdiction to grasp the nettle. A lack of clarity in relation to the rules may be inhibiting the uptake of new, and potentially more efficient, technology Consultation on 14th Programme of Law Reform, March 2021

Such discussions are extremely likely to continue in jurisdictions worldwide. In truth, the application of law based on software programs; as opposed to natural persons, is one that regulators and legal systems will have to engage with in future.

Healthcare

According to Health IT Security more than 176 million American patient records were exposed in data breaches between 2009 and 2017. In February 2021, France investigated a data leak of almost 500,000 medical records.

In the same month, President Emmanuel Macron announced a 1-billion-euro ($1.2 billion) programme to combat cybercrime, including in the medical sector.

Keeping important medical data safe and secure is the most popular blockchain healthcare application at the moment and its technology facilitates the secure transfer of patient medical records and manages the medicine supply chain. It not only reduces the risk of cyber-attacks but also reduces the high hospital costs and inefficient practices.

Blockchain can also be a security check for medicines. In most developed countries the medications are highly regulated however in less regulated markets dangerous trade in counterfeit drugs are growing.

The World Health Organisation has estimated that 1 in 10 medical products in low- and middle-income countries is substandard or falsified. According to the American Journal of Tropical Medicine and Hygiene 155,000 children die worldwide due to fake malaria drugs and a similar number of children dying from acute pneumonia after treatment with fake and substandard antimicrobials medication. similar number of children dying from acute pneumonia after treatment with fake and substandard antimicrobials medication.

The pharmaceutical industry has invested billions into defensive measures, but so far, their efforts have only slowed rather than stopped the counterfeiters. In healthcare, blockchain offers a new way to create digital trust in the supply chain and potentially prevent fake drugs from reaching patients.

Automotive sector

Blockchain has found its way to a number of applications within the automotive sector and car manufacturers have been developing proofs of concept for blockchain technology. There are a number of areas where blockchain can be implemented: supply chain, secure communication, direct payments via "e-wallets", streamlined contractual processes or digital identities for vehicles’.

Blockchain technology gives us the technical foundation we need to create helpful and effective solutions Dr. Andre Luckow, Head of Distributed Ledger and Emerging Technologies at BMW Group

Environmental sector

The most discussed implication of blockchain technology for the environment relates to its energy consumption, however blockchain can also support the environment protection in many ways.

Blockchain can be used for supply chain management in industries such as forestry, energy, food or mining. Since all information are transparent on the blockchain, it can support the application of sustainability criteria for the selection of suppliers, vendors, materials, and products, as well as the design of more sustainable logistics networks. It gives consumers the possibility to make choices that do not undermine environmental protection.

The recycling industry could benefit of the blockchain technology which may help to optimise recycling systems that are already in place.

Companies like RecycleGO’s, a blockchain-based software, can help recycling companies to improve tracking and therefore better optimise their recycling activities across their supply chain.

Germany chemical producer BASF uses blockchain technology to provide reliability to information about a plastic product as it moves through its life cycle. In 2020 BASF launched a blockchain plastic recycling pilot called reciChain. Plastic producers were asked to tag plastics using unique barcode to optimise tracking of the plastic product throughout its lifecycle and incentivise recycling.

Logistics industry

The maritime transport industry has a complex process and various documents. One of the main documents is the bill of lading. A bill of lading is a legal document issued by a carrier to a shipper that describes the type, quantity, and destination of the goods being carried.

The traditional way of shipping and freight companies using paper bills of lading is in process to be replaced with digital technology. Blockchain can make the whole process of documents open and transparent in terms of information sharing and traceability and the paper cost can be reduced.

In April 2021, MSC, world’s second largest container shipper adopted WAVE blockchain bills of lading. WAVE BL is a blockchain-based digital courier platform that mirrors the traditional process for transferring electronically original paper documents that includes Bill of Lading.

On 10 September 2021, Hapag-Lloyd, the fifth-biggest container shipper with a fleet of 250 container ships, sent a press release out, announcing their partnership with WAVE BL.

Trade Finance

Trade finance is the financing of goods or services in an international trade or transaction, from a supplier through to the end buyer. One of Trade Finance main component is the Letter of Credit (LC).

A Letter of credit is a banking instrument that guarantees payment from the buyer to the seller and is considered as the main document in international trade. LCs tend to be slow and paperwork heavy, something that blockchain aims to change.

One company which specialises in digitalising the world of trade finance is Contour. Contour, formerly called Voltron, digitises the trade finance process by removing the need for paper. Contour blockchain network was formed by a group of trade banks which includes HSBC.

Usually a typical cross-border LC issuance takes 24 to 72 hours. However, with Contour’s blockchain which leverages R3’s Corda blockchain technology, the issuance of a LC takes only 38 minutes. Contour estimates that digitising LCs would speed up the process by 90%.

Due to its secure data, transparency and efficiency, Blockchains and distributed ledger technologies can soon help a number of industries, such as automotive, banking and financial services, government, healthcare and life science, insurance, media and entertainment, retail and consumer goods and telecommunications.

Food industry

As blockchain is a source that allows to store all information about food and supplement manufacturers and brands onto a database, it has also found its way into the food industry. The stored information in the food industry includes information on farming, animal treatment, factory, production, expiration dates and the transportation of the products. Again, blockchain is a technology that allows for full transparency throughout the supply chain and can reduce transaction costs, improve margins and increase efficiency which will allow the farmer or producer to increase its profit.

Blockchain can also help to fight against food fraud. According to the Consumer Brands Association the food industry is affected by almost 10% of food fraud and is today a critical issue for major food companies. Research contacted by Juniper Research shows that blockchain could help end food fraud by secure tracking food across the supply chain and saving the food industry $31 billion globally by 2024. According to the 2018 policy paper by the Food and Agriculture Organization of the United Nations (FAO), blockchain could change the food supply chain in India. Blockchain technologies can help in building an immutable contract between the various players in supply chain, enabling further transparency in the system.

Trading coffee with the help of blockchain:

In 2019 The Indian Coffee Board launched a pilot program of the country’s first blockchain-based marketplace app called Eka for trading coffee. The app is now fully running and aims at getting coffee growers better returns by helping producers with transparency and traceability.

The blockchain-enabled marketplace is aimed at reducing growers’ dependency on intermediaries, bringing in trust and efficiency in the chain, ensuring traceability and helping farmers with market access. Srivatsa Krishna , CEO at Coffee Board of India

AVVISO IMPORTANTE:

Questo articolo non costituisce consulenza finanziaria, né rappresenta un'offerta o un invito all'acquisto di prodotti finanziari. Questo articolo è solo a scopo informativo generale, e non vi è alcuna assicurazione o garanzia esplicita o implicita sulla correttezza, accuratezza, completezza o correttezza di questo articolo o delle opinioni in esso contenute. Si consiglia di non fare affidamento sulla correttezza, accuratezza, completezza o correttezza di questo articolo o delle opinioni in esso contenute. Si prega di notare che questo articolo non costituisce né consulenza finanziaria né un'offerta o un invito all'acquisizione di prodotti finanziari o criptovalute.

PRIMA DI INVESTIRE IN CRYPTO ETP, GLI INVESTITORI POTENZIALI DOVREBBERO CONSIDERARE QUANTO SEGUE:

Gli investitori potenziali dovrebbero cercare consulenza indipendente e prendere in considerazione le informazioni rilevanti contenute nel prospetto base e nelle condizioni finali degli ETP, in particolare i fattori di rischio menzionati in essi. Il capitale investito è a rischio, e le perdite fino all'importo investito sono possibili. Il prodotto è soggetto a un rischio controparte intrinseco nei confronti dell'emittente degli ETP e può subire perdite fino a una perdita totale se l'emittente non adempie ai suoi obblighi contrattuali. La struttura legale degli ETP è equivalente a quella di un titolo di debito. Gli ETP sono trattati come altri strumenti finanziari.