- Bitcoin has shown above-average returns following major geopolitical risk events in the past.

- Our findings support previous analyses that support the thesis that cryptoassets may act as a hedge against geopolitical risks.

- This is generally consistent with the fact that Bitcoin can act as a safe-haven asset on account of its counterparty risk-free and censorship-resistant nature as well as its scarce supply characteristics.

“Buy when there is blood in the streets”

The quote "buy when there is blood in the streets" is commonly attributed to Baron Rothschild, an 18th century British nobleman and member of the Rothschild banking family. The full phrase is often rendered as

The time to buy is when there's blood in the streets, even if the blood is your own,

and it emphasises the idea of investing during times of market panic or extreme distress, when asset prices are low and fear is high.

This contrarian investment philosophy suggests that significant gains can be made by buying assets when others are too scared to buy.

The major question for investors is how these developments might affect the performance of Bitcoin and other cryptoassets going forward?

What's the impact of geopolitical risk events on Bitcoin?

Most geopolitical risk events tend to be rather short-term in nature. Nonetheless, they tend to have a significant (negative) impact on most traditional financial asset prices due to an increase in uncertainty.

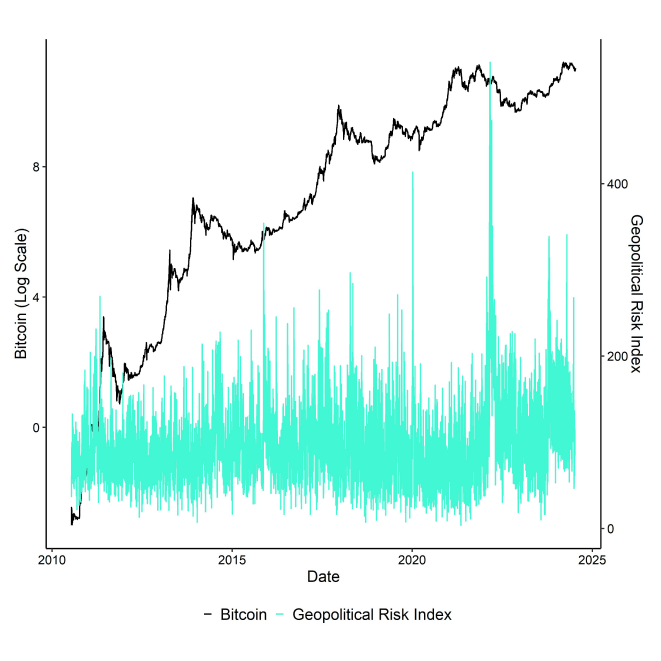

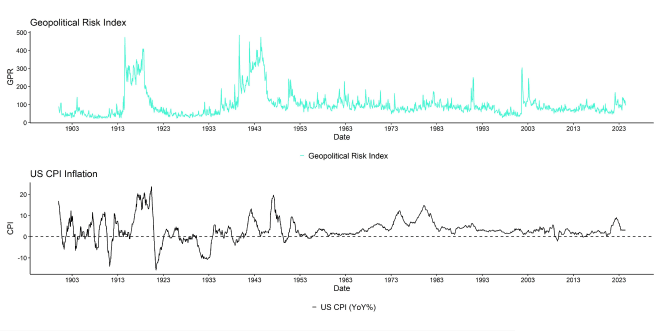

Although geopolitical risks seem to be hard to define at first there, is a wide array of research that has tried to quantify episodes of heightened geopolitical risks. One of these approaches was put forth by Caldara and Iacoviello (2022) who compiled a Geopolitical Risk Index based on relevant mentions in major newspapers. The rationale is that geopolitical risks are high when there is a high frequency of mentions in newspapers on geopolitical topics such as war threats or terror acts.

In fact, the Geopolitical Risk Index tends to spike during major geopolitical events such the Russian invasion of Ukraine in early 2022.

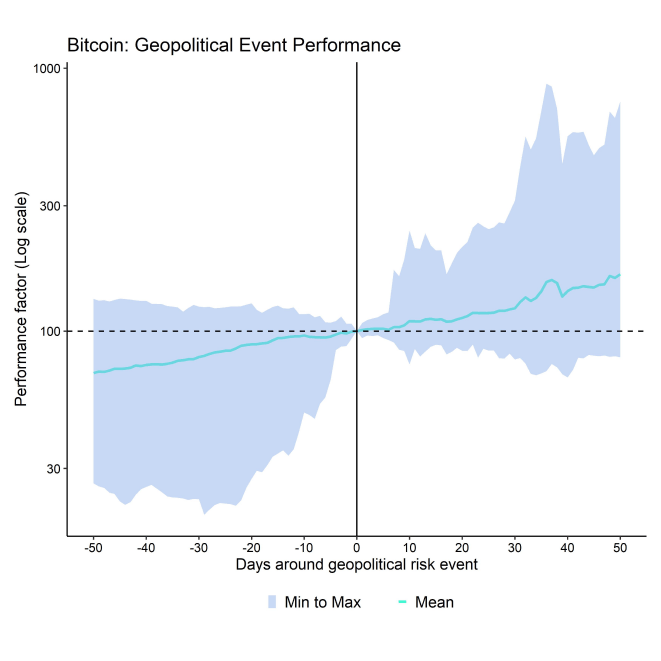

The following analysis looks at the performance track record of Bitcoin around these major geopolitical risk events.

Bitcoin – a hedge against geopolitical risks?

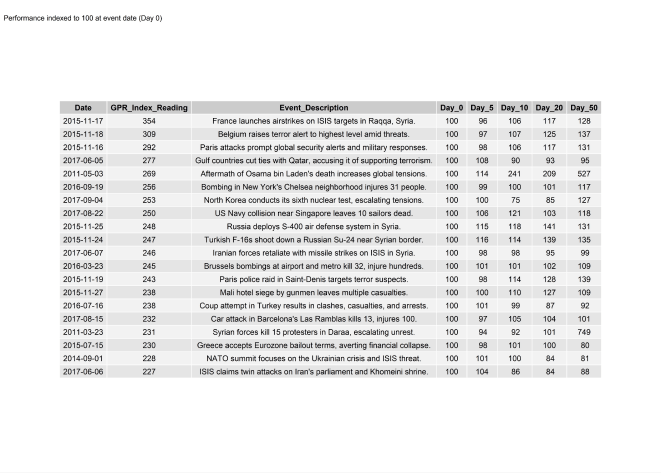

We have started our analysis by only looking at statistically significant geopolitical risk events, i.e. only those that exceeded the threshold of 2 standard deviations across the full sample of observations (July 2010 – today). In a second step, we have selected the top 20 geopolitical risk events based on the overall level of the Geopolitical Risk Index (GPR Index) itself.

The following table shows these top 20 geopolitical risk events and the subsequent performance index of Bitcoin up to 50 days after the event:

Results based on top 20 geopolitical risk events since July 2010 - today

On average, Bitcoin has appreciated significantly following these major geopolitical risk events in the past.

Resukts based on top 20 geopolitical risk events since July 2010 - today

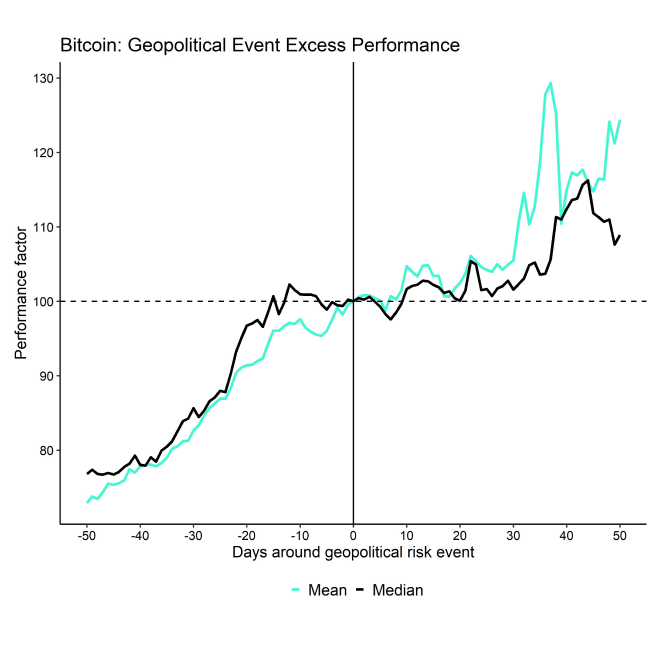

Even stripping out the average performance across a random window of 100 days, reveals that the “excess performance” of Bitcoin was still positive around these major geopolitical events.

In other words, Bitcoin has even shown above-average returns following these major geopolitical risk events in the past.

Event Excess Performance = Event Performance - Full Sample Performance;

Results based on top 20 geopolitical risk events since July 2010 - today

This implies that Bitcoin appears to thrive in an environment of heightened geopolitical risk. This finding is also echoed in previous research by Almeida et al. (2024) who have found that cryptoassets can act as a hedge against geopolitical risks.

We think this is generally consistent with the fact that Bitcoin can act as a safe-haven asset on account of its counterparty risk-free and censorship-resistant nature as well as its scarce supply characteristics.

In fact, due to the latest Halving in the supply growth of Bitcoin, Bitcoin's supply has become double as scarce as gold for the first time in history.

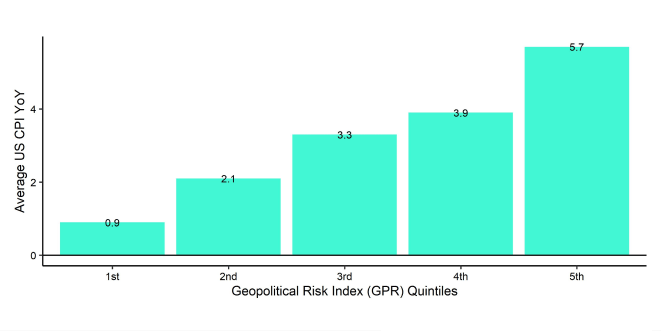

This investment hypothesis is also supported by the fact that periods of heightened geopolitical risks have been associated with high inflation regimes in the past.

One of the major reasons is the fact that major geopolitical tensions tend to be associated with supply-chain disruptions, commodity price spikes as well as looser monetary and fiscal policy.

Scarce assets like Bitcoin could particularly profit from such an environment.

Bottom Line

- Bitcoin has shown above-average returns following major geopolitical risk events in the past.

- Our findings support previous analyses that support the thesis that cryptoassets may act as a hedge against geopolitical risks.

- This is generally consistent with the fact that Bitcoin can act as a safe-haven asset on account of its counterparty risk-free and censorship-resistant nature as well as its scarce supply characteristics.

AVVISO IMPORTANTE:

Questo articolo non costituisce consulenza finanziaria, né rappresenta un'offerta o un invito all'acquisto di prodotti finanziari. Questo articolo è solo a scopo informativo generale, e non vi è alcuna assicurazione o garanzia esplicita o implicita sulla correttezza, accuratezza, completezza o correttezza di questo articolo o delle opinioni in esso contenute. Si consiglia di non fare affidamento sulla correttezza, accuratezza, completezza o correttezza di questo articolo o delle opinioni in esso contenute. Si prega di notare che questo articolo non costituisce né consulenza finanziaria né un'offerta o un invito all'acquisizione di prodotti finanziari o criptovalute.

PRIMA DI INVESTIRE IN CRYPTO ETP, GLI INVESTITORI POTENZIALI DOVREBBERO CONSIDERARE QUANTO SEGUE:

Gli investitori potenziali dovrebbero cercare consulenza indipendente e prendere in considerazione le informazioni rilevanti contenute nel prospetto base e nelle condizioni finali degli ETP, in particolare i fattori di rischio menzionati in essi. Il capitale investito è a rischio, e le perdite fino all'importo investito sono possibili. Il prodotto è soggetto a un rischio controparte intrinseco nei confronti dell'emittente degli ETP e può subire perdite fino a una perdita totale se l'emittente non adempie ai suoi obblighi contrattuali. La struttura legale degli ETP è equivalente a quella di un titolo di debito. Gli ETP sono trattati come altri strumenti finanziari.