1. Summary

- Metaverse/Web3 expansion could overtake 2023 narrative

- Retail investors ignore FTX and crypto lending turmoil to add Bitcoin at fastest ever rate

- Fed likely to ease aggressive rate hike campaign in H2 2023

- Crypto adoption is consolidating in Europe

- Bitcoin is decoupling from American and European equities

- The UK reiterates its goal to become a global crypto capital

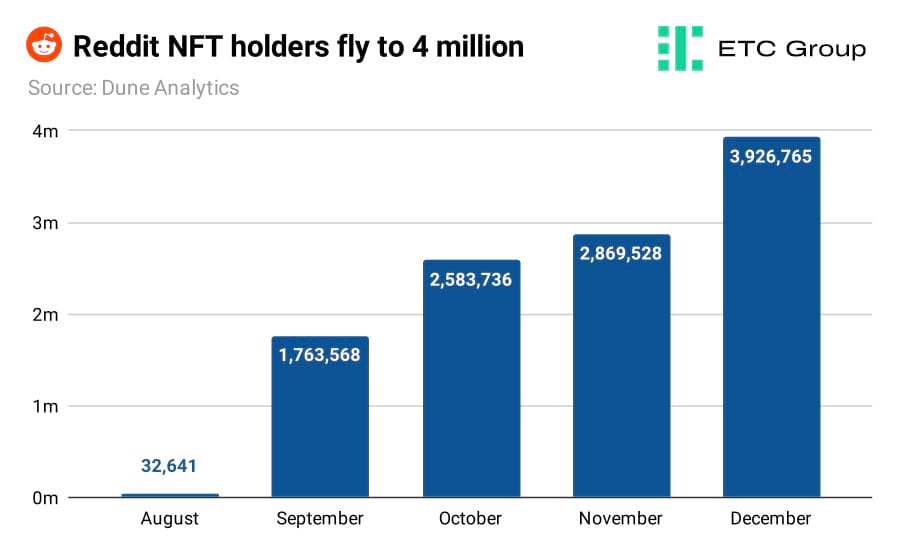

- Reddit NFT holders hit 4 million

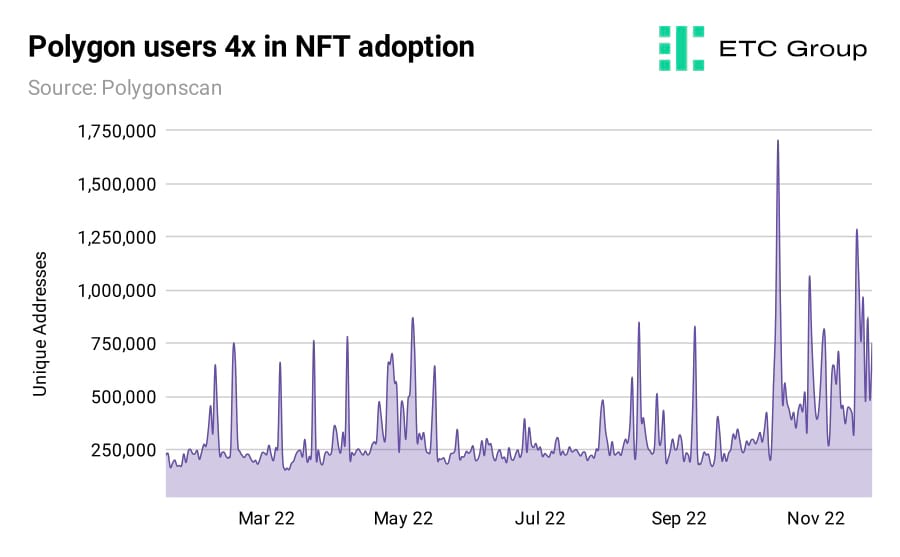

- Commercial giants leap to Polygon as they look to build on metaverse ambitions

2. Overview

It has been a challenge knowing where to begin when writing a summary of what happened in crypto, blockchain and the metaverse in November 2022. The elephant in the room is evidently the collapse of FTX and fears of a crypto contagion among lenders. That story has been covered in fine detail elsewhere, and anyone with even the slightest interest in this space will likely be well versed.

Readers here would gain little alpha from a rehash of the narrative, and with that in mind, our objective is really to lay out the facts.

- The FTX saga is an industry scandal, and investors have realised overwhelmingly that this failure has nothing to do with blockchain technology, nor its many innovations

- FTX and Alameda collapsed in May/June of this year along with Three Arrows Capital, and this is simply an inevitable, if delayed, aftershock

- Criminals and their shockingly poor business practices have been exposed, which is good for the overall health and maturity of the industry

- There is a mass wealth transfer ongoing in the space from overleveraged traders to value-seeking investors

- Regulated entities offering reliable, sound investment products will be the biggest winners

- Blink and you will miss the next Web3 innovation

3. Macro Signals

While later in this report we will get into the details of why the smallest Bitcoin holders are buying the price dip in record numbers, it has to be said that there are macro headwinds into 2023.

One point of contention not covered by economists is that while crypto and Bitcoin are now in general more correlated with macro cycles, this market is an entirely separate asset class to traditional risk assets like equities and its rises and falls do not necessarily coincide with the wider economy.

There is also the 2024 Bitcoin halving to consider. We have witnessed a huge upswing in speculation on Litecoin, the silver to Bitcoin's digital gold, over the last two months. This is in part due to the upcoming Litecoin halving, whereby block rewards for the cryptoasset are sliced in half. We are approximately 240 days away from the next Litecoin halving. Between 1 November and 30 November, Litecoin added to its price by a whopping 38.52%, while the overall crypto market went the entirely opposite direction, declining by an average of 16.61%. Bitcoin, historically, has bottomed in price between 542 days and 386 days away from its halving.

US: Which rate hike comes next?

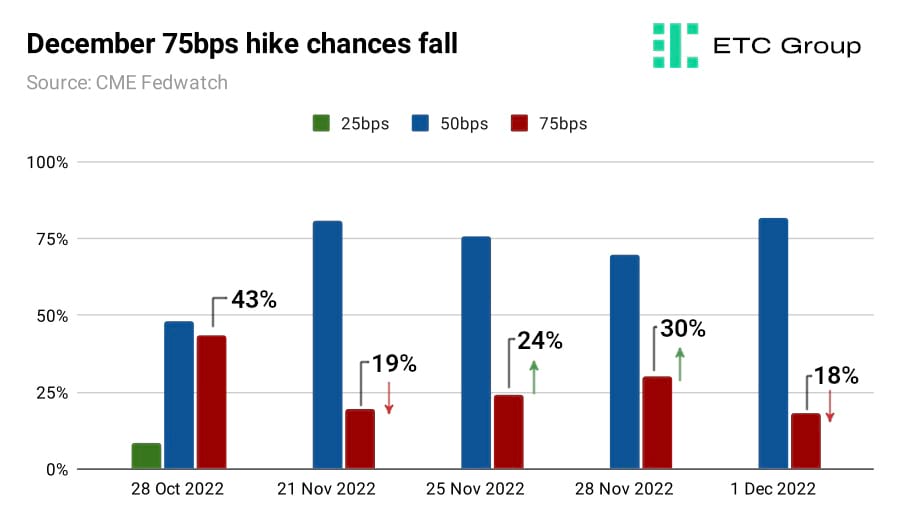

The probability of another 75 basis point rate hike at the final FOMC meeting of 2022 on 14 December has been swinging around wildly depending on the leading comment of the day.

Futures traders switched hawkish following China protests over Covid lockdowns and comments from St Louis Fed President James Bullard in mid-November calling for US interest rates to rise as high as 7%. Currently the US rate sits between 3.75% and 4%.

The chances of a 75bps rate hike in December 2022 swung back the other way after Jerome Powell's more dovish comments, suggesting that smaller rate hikes could come into play in the FOMC meeting on the 14th of this month.

As of 28 October the chance of a 25bps hike (to 4% to 4.25%) was still on the table, although the figures were low. These chances had reduced to zero by mid-November.

Now the majority of traders strongly believe a 50bps hike is incoming, potentially followed by two sets of 25bps hikes in 2023, making these three the last of this current US interest rate hiking cycle.

Bond market futures traders have recalculated their positions to an 81.8% chance of a 50bps hike, compared to just 18.2% for a 75bps jump.

Pause or Pivot?

It has become increasingly clear that crypto acts as a leading indicator for the health of the global economy.

The first sign that interest rate hikes could be coming to an end - not that they are ending yet, just the signal that they are ending - will be positive for risk-on appetite and hence broad scale investments in cryptoassets.

By looking at the Secured Overnight Financing Rate (SOFR), or the rate at which banks lend to one another, we can see that traders are staking their claim on a US interest rate that peaks at a terminal high of between 4.905% and 5.125% by the middle of next year.

This would make the cost of capital prohibitively high for startups and those seeking to raise in the first half of 2023, leading to a wide-scale industry slowdown - the final hibernation of crypto winter before the crypto spring, if you will - before roaring back in the second half of next year when those capital costs start to come down.

As such, crypto markets will likely be on pause for the first few months of the new year.

A cynic may argue that what is most likely to happen is that the Fed will continue to raise interest rates for six months longer than it needs to, before realising the depth of the recession facing the world's second-largest economy.

And the main questions consuming analysts today is: will we have a soft landing or a hard landing? If the world does face recession, which sectors and nations will be hit hardest, and will the long-tail effects be mild, moderate or severe?

US yield curve inversions - what bond markets are telling us

Taking a brief detour into US bond yields, a couple of things leap out at us. The first is just how far and how fast interest rates have been raised in 2022 to date. The second is that it should come as little surprise that assets further out on the risk curve, like crypto, have been depressed by the epic rise of these rates.

The yield curve is the closest thing investors have to a crystal ball.

When considering the potential for recession, analysts look at two things: the depth of inversion and duration of inversion.

In happier economic times, long-term 10-year treasury bonds should pay a higher yield than shorter-dated 2-year treasury bonds, to compensate investors for the opportunity cost of locking up their cash for longer. When recession is on the horizon, these metrics flip, as investors see more risk in holding US debt for longer.

The US 2 year/10 year yield curve has now been inverted for over 140 days - almost four months. We know a 2y/10y inversion has been a harbinger of every US recession since the 1970s.

This long duration has been matched by depth.

The spread between the 2 year and the 10 year treasury hit 51 basis points in late September. This is deeper than the 2007 inversion that preceded the Great Financial Crisis, deeper than the 2000 inversion that led up to the 2001 recession, and deeper than 1989 which set the stage for the 1990 recession.

As of 1 December 2022 that inversion is an even wider 74 basis points.

In fact you have to go all the way back to 1981 to find a deeper 2y/10y yield curve inversion. Suffice it to say things are not looking good for traditional assets, and it's why so many investors are selling bonds and moving into cash and hard assets like Bitcoin.

The 3-month to 10 year yield curve is also deeply inverted at negative 73 basis points. Every time the 3mo/10y yield curve has inverted, there has been a US recession.

The Fed will be forced to cut rates aggressively in the second half of 2023. That is of little doubt. Some analysts are expecting rate cuts in the region of 300 to 350 basis points (3% to 3.5%). Given a terminal interest rate high of 5%, that means we could end 2023 with US interest rates as low as 1.5%.

With the Bitcoin halving then just around the corner, this could factor into the start of a huge bull market for the progenitor of this new asset class.

The US is one of the world's largest markets for crypto, but it is certainly not the only market. As proven by Chainalysis in their recent Global Adoption Index 2022: central, northern and western Europe is the world's largest crypto economy, topping the tables for the second year in a row. Users and institutional received $1.3 trillion in crypto between July 2021 and June 2022. Western Europe alone contains six of the 40 largest adopters: the UK, Germany, France, Spain, Portugal and the Netherlands.

Across 12 months the UK received $233bn in raw crypto transaction value, the research shows, making it the largest of any European nation. This is despite the lack of a comprehensive cryptocurrency regulation framework in place in Britain. Clarity around taxation is advanced in the UK, but a much larger crypto economy could grow here with sensible legislation that allows innovation while protecting consumers.

Lobbying for strong consumer protections while allowing digital asset innovation will remain an uphill battle, given the number of skeptics in high office. On 30 November, economists at the European Central Bank fired yet another shot across Bitcoin's bow.

Ulrich Bindseil and Jürgen Schaaf write that Bitcoin's stabilisation in the wake of FTX is “an artificially induced last gasp before the road to irrelevance”.

If one was being uncharitable, one could suggest that such a description actually refers to money-printing central banks and not to crypto. But the fact remains that Bitcoin is not going away, much as its critics would like it to.

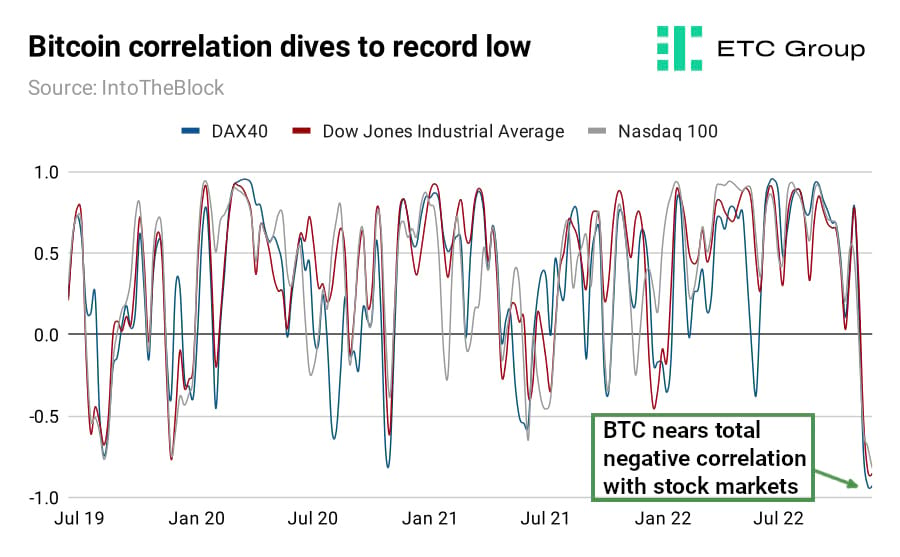

Bitcoin at record negative correlation with Euro stocks

The correlation between Bitcoin prices and traditional European stock markets have fallen to their lowest levels on record. The DAX40 is an index of the 40 largest companies listed in Germany, that trade on the Frankfurt Stock Exchange.

Germany at large is considered a bellwether for the European economy, and the DAX40 is a shorthand measure of the health of the nation's companies.

Data via IntoTheBlock shows the BTC/DAX40 correlation at -0.92 as of 1 December 2022. This is the lower figure ever recorded.

German and European investors could see this negative correlation, with BTC prices stable going into H2 2023, as a relatively positive signal for asset allocation. German traders are certainly pricing in more deflationary risks than inflationary risks in the first half of 2023, as we have seen the 10y/30y bund yield switch negative not once but twice in the past two months.

Before December 2022 the 10y/30y German bund yield curve had only inverted once before, for a single day in July 2008.

The ECB vice president Luis de Guindos said the FTX collapse was “not a surprise”, but said the rapid demise of the unregulated offshore exchange had made little impact on broader financial markets.

“European citizens were not so affected,” argued Philipp Sandner, head of the Blockchain Center at the Frankfurt School of Finance and Management. National regulations in Germany specifically require companies holding customers' crypto to register with financial authorities. BaFin is the financial regulator for Germany.

The best-regulated players in the space include (surprise surprise) ETC Group, whose crypto ETP products are all issued from BaFin-approved prospectuses. All ETC Group products, including BTCE which tracks the price of Bitcoin, and ZETH, which tracks the price of Ethereum, are issued under the key EU legislation MiFiD II.

Correlations between BTC and stock markets dive to their lowest level in three years.

The scale for correlations runs between +1 and -1. A correlation of 1 means asset prices move perfectly in tune. A correlation of -1 means asset prices move in the exact opposite direction to one another.

Since April 2022 the correlation peaks where Bitcoin moves more in tandem with stocks have been getting shorter and shorter.

What conclusions can we draw from this? Bitcoin's heavily hyped correlation with Western equities in the S&P 500 and Nasdaq earlier this year drew strong condemnation from crypto critics. It would follow, naturally, that if Bitcoin were to diverge significantly from markets, as it has done here, surely those critics would turn more positive? As a hard asset with a limited and predictable supply schedule, it would make sense if Bitcoin is being treated less as an inflation hedge, but more as a hedge against calamity.

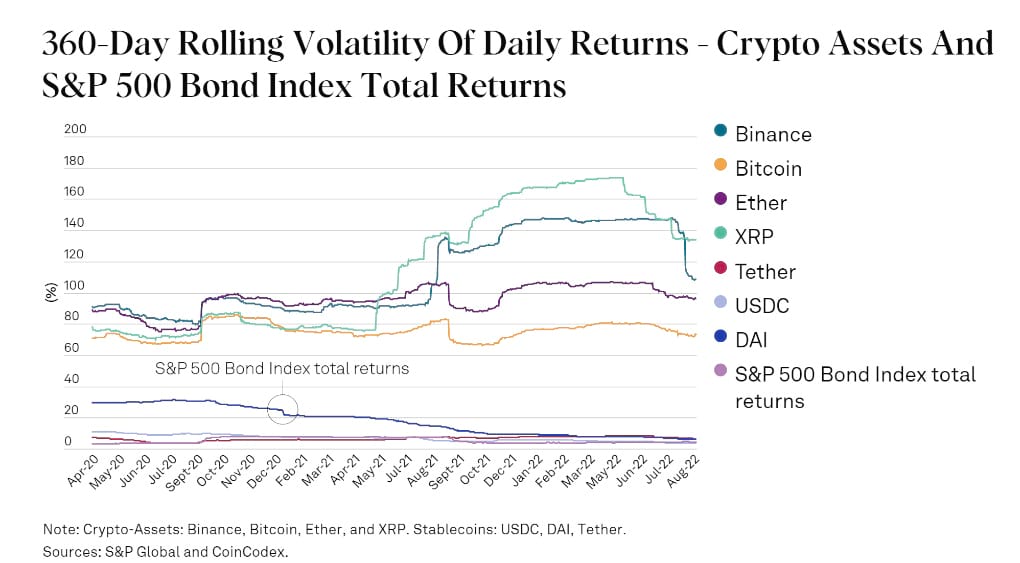

Even S&P Global, not noted for their crypto evangelism, wrote in November what many holders know to be true, that over a longer time horizon: “Cryptocurrencies have generally shown low return correlation with traditional financial assets.”

Bond indices align much more closely with gold than they do with cryptocurrencies, S&P's research found.

But what is startling here is the lack of conclusions even the most highly-respected analysts can draw. Is Bitcoin a commodity, like gold? Not really. Is it more akin to a tech stock? “Some market participants attribute to cryptocurrencies a behaviour closer to technology stocks, rather than to a currency, a commodity, or a large cap equity index: high risk, high reward, and speculative in nature.”

S&P Global analysts found little evidence to support this thesis either.

There is a problem with the question. And hence the answer is difficult to find. Look at the opening line: “Some market participants attribute to cryptocurrencies…”

One can easily suggest that while they are based on the same blockchain technology, there is such variance between Bitcoin and Ethereum that neither should be considered part of the same market sector. One is a currency (or a store of value depending on who you ask), while Ethereum is a global supercomputer designed for the arbitrary computation of automatically-executing smart contracts.

The differences between other crypto projects (with many displaying no elements of currency whatsoever) are larger still. As this area of research grows, we expect a broadening out of suggestions to look at Bitcoin and Ethereum in much different terms.

There remain multiple conflicting factors when predicting how badly the EU will be affected by recession. Traditional measures such as employment are faring rather well, considering. On 1 December 2022 euro area unemployment dropped to 6.5%, the lowest since records began in 1998.

Still, it will be tough for the ECB to continue raising rates as recession bites. As ING analysts note: “It is one thing to hike into a recession, it is a different thing to hike in the middle of one.”

A pause or pivot in ECB tactics would again be positive for risk-on assets.

Bitcoin at historic negative correlation with US stocks

The correlation between Bitcoin prices and both the Nasdaq and the Dow Jones have fallen to their third lowest levels on record. Analysing how far and how fast Bitcoin prices move in relation to the US stock indices, we can see that BTC has a 30-day rolling correlation to the NASDAQ 100 of -0.81999, and with the Dow Jones Industrial Average of -0.85241.

As of 1 December 2022, the correlation between Bitcoin and the NASDAQ hit its third-lowest value ever. Only two previous times has this score been lower: on 20 May 2019 and 27 May 2019, right at the nadir in the bottom of the 2018-2019 bear market. Similarly, only two readings on the BTC/Dow Jones correlation are lower: on 13 May 2019 and 20 May 2019.

At this time, the price of Bitcoin was between $7,892 and $8,396.

4. Regulatory Signals

Three signs the UK wants to be the biggest market in Europe for crypto

Testament to the fact that even at the highest level there are clear distinctions being drawn between Bitcoin, crypto and the debacle that went on at FTX were comments made by Andrew Griffith, economy secretary to the UK Treasury.

“I'd like to reiterate that ambition of becoming a crypto hub,” he noted at a Financial Times banking conference. I see crypto assets [and] distributed ledger technology as an evolution of the UK's existing strength in fintech.”

In the first days of December TradFi giant TP ICAP gained a UK crypto licence for its upcoming exchange.

On 29 November 2022 FTSE Russell, the index company behind the FTSE 100, launched its first index series covering the crypto market. This move is the latest signal that the traditional finance world is taking the long view on digital asset investments and embracing it, even while markets suffer short-term pain from the FTX fallout. The company is a subsidiary of the London Stock Exchange Group. Among the indices it now provides are: FTSE Russell Bitcoin, FTSE Russell Cardano, FTSE Russell Ethereum, as well as eight market-cap weighted baskets from large cap to nano-cap.

Blockchain leader wins key role in US Congress

Rep Tom Emmer is an avowed fan of blockchain technology and one of its lead proponents in Washington. The Congressman from Minnesota's 6th district is the co-chair of the Congressional Blockchain Caucus. In the recent midterm elections he won the Republican party Whip, a position which gives Emmer significant power and influence, and in which he is charged with mobilising party support for various bills.

Earlier this year legislation lodged with lawmakers by Emmer and Texas senator Ted Cruz attempted to prevent the Federal Reserve from ever issuing a CBDC directly to individuals. With a Democrat-led Senate and with the Republicans winning a slim majority in the House, it is likely that only bipartisan bills will make it to the President's desk.

FTX crash couldn't happen here, says Europe

Brussels lawmakers believe they have cracked crypto regulation and say that an FTX -style crash would not be possible under upcoming Markets in Crypto Assets regulation.

5. On-Chain Signals

Bitcoin

Liquidity demand: Exchange flows

Outflows and inflows largely matched one another in November despite market turmoil. Bitcoin inflows climbed by 75% to $21.6 billion in November while outflows jumped by 62% from to $23.1 billion.

Heightened inflow activity was like a result of traders moving Bitcoin into selling positions on exchanges after the collapse of FTX while outflows represented users moving their BTC away from exchanges and into self-custody. Neutral Bitcoin.

Futures activity

Bitcoin futures trading volume continued to decline in November and fell to $631 billion by month's end. This was the lowest level of futures activity recorded this calendar year. Bearish Bitcoin

HODLer behaviour

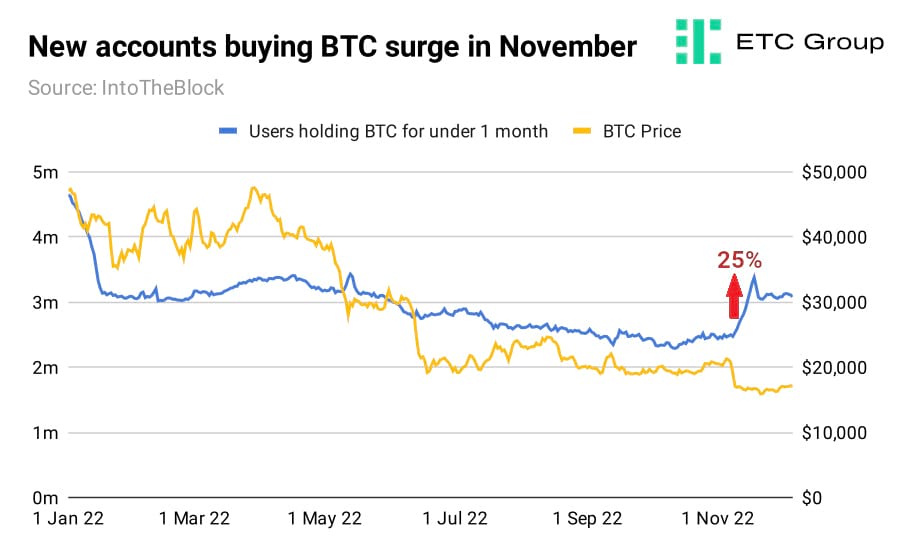

In the month of November, the number of accounts holding Bitcoin for under one month jumped by 25% in spite of the price of Bitcoin falling by roughly 17%. First-time buyers looked to capitalise on distressed market conditions by purchasing Bitcoin at fire sale prices. Bullish Bitcoin.

Institutional Demand

Institutional demand for BTC dissipated in November with European Bitcoin ETPs registering $400 million worth of redemption orders. Bearish Bitcoin.

Ethereum

Liquidity demand: Exchange flows

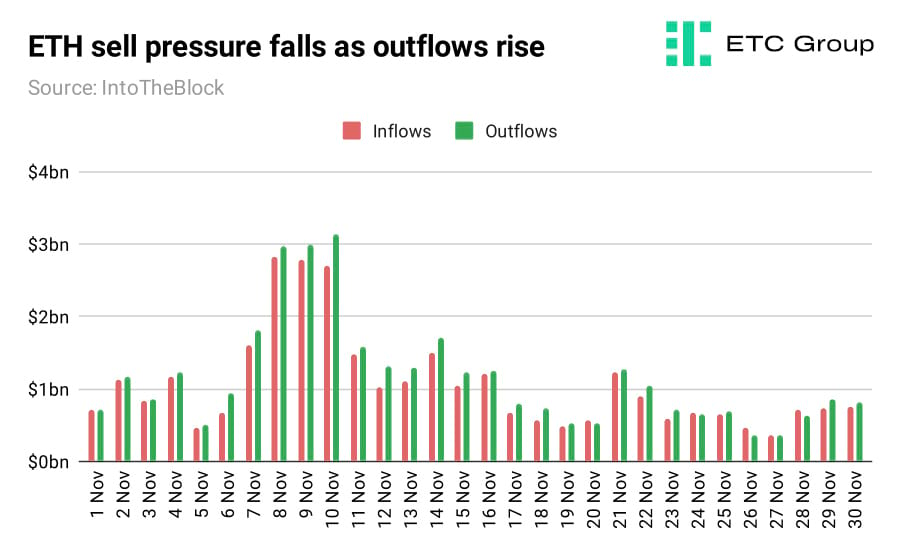

Outflows marginally eclipsed inflows in November. Ethereum exchange inflows bounced by 58% to $31.6 billion in October while outflows vaulted by 71% to $34.6 billion.

Inflows signalled traders looking to sell ETH on exchanges while outflows indicated investors looking to pull liquidity away from exchanges and into self-custody in light of users losing confidence in centralised custodians like FTX. Neutral Ethereum.

Futures activity

Ethereum futures trading volume recovered to $667 billion in November after experiencing a lull in October. Bullish Ethereum.

HODLer behaviour

Ethereum holders continued to accumulate in November. The total number of Ethereum holders continued to reach new heights and currently stands at 86 million users. Bullish Ethereum.

Institutional demand

November was marked by heavy flows away from Ethereum investment products in the European ETP market. Investors chose to move away from risk-on assets with as much as $292 million withdrawn from funds tracking Ethereum. Bearish Ethereum.

6. Altcoin Brief

Cardano

Emurgo, the commercial arm of Cardano, has announced that it will be launching a stablecoin pegged to the US dollar on the Cardano blockchain in 2023. The stablecoin will be called USDA and will let users convert USD or Cardano's native token, ADA, on its network to improve liquidity.

This could significantly enhance activity within the Cardano DeFi ecosystem that has less than $60 million in TVL at this time – a fraction of the figure found on Ethereum or Binance.

Earlier in September, Emurgo committed $200 million over the next three years to improving Cardano's decentralised landscape and improving user participation.

Litecoin

Litecoin saw its price surge in November despite the implosion of FTX that engulfed the wider cryptoasset market. Its price appreciated by 42% in November – from $55 to $78.

Litecoin's breakout performance comes in light of data released by the Litecoin Foundation that shows mining difficulty reached an all-time-high of almost 18 million hashes in November. This means more miners are joining the network than ever before but also that there is more competition for mining rewards.

Part of the reason why miners are turning to Litecoin may also find its explanation in Ethereum's switch to Proof of Stake in September that left many in search of new Proof of Work blockchains on which to deploy GPU mining equipment.

Polkadot

Polkadot has launched nomination pools for stakers on its network. Nomination pools allow stakers to pool together DOT, the native token of Polkadot, to nominate validators and receive rewards. Users can stake as little as 1 DOT to earn rewards by securing the Polkadot network.

This represents an inflection point in the digital asset space as it lowers the barrier of entry for stakers and disincentives them from using third-party services that may look to establish centralised control of the network.

Polygon

Polygon's low gas fees and interoperability with Ethereum make it a popular chain for Web2 and Web3 companies to build on.

Solana-based NFT marketplace Magic Eden has extended support for Polygon NFTs as it looks to tap into the network's growing user base. Magic Eden is second to only OpenSea in terms of trading volume and saw $95 million worth of NFTs change hands on its platform in November.

Ripple

Ripple is seeking to obtain a digital asset provider licence in the Republic of Ireland so it can “ passport ” its services across Europe.

Ripple's long-run dispute with the SEC has driven most of its business outside the US with most of the enterprise blockchain company's revenue now coming from Europe.

Ripple recently signed deals with the French payment facilitator Lemonway and Xbhat, a company focused on remittance payments between Sweden and Thailand.

A host of digital asset firms are eager to enter the European market in light of the healthy regulatory standards MiCA promises to bring with it in contrast to the debated legal status of digital assets in the US. The EU will vote on the final draft of MiCA in February.

Solana

Solana lost more than half its value in November because of its ties with the now bankrupt FTX. It is reported that FTX and its sister company Alameda Research held $982 million worth of SOL as late as 10 November – making them among the largest holders of the token.

The association between Solana and FTX sparked a wave of panic selling and saw DeFi and NFT trading activity largely muted on the blockchain.

Solana ecosystem participants like representatives of the decentralised hotspot network Helium and Magic Eden have responded by underlining the fundamentals of the Solana blockchain remain unchanged for projects looking to build on it.

On 29 November, Phantom, the largest wallet in the Solana ecosystem, tweeted that it will be expanding its self-custody services to Ethereum and Polygon in a bid to compete with Web3 wallets like Metamask.

7. Into the Metaverse

November was a huge month for metaverse-related brands and products, with thematic signals around the megatrend continuing to attract investors far and wide.

Art Basel took centre stage in Miami in late November into the first days of December, with Nike debuting their CryptoKicks sneaker line and Porsche also launching its first range of NFTs. Famed NFT collector Gmoney (whose appearance on Bloomberg's Odd Lots podcasts remains a 2022 highlight) and his 9dcc fashion line were the talk of the town, with a clutch of limited edition garments with an NFC-enabled patches conferring holders a Proof of Attendance entry to additional events across the Bitcoin-friendly city.

While mainstream journalists are somehow still scoffing at the potential for brand engagement with fans through scarce digital property (upon which makers and creators can confer new experiences, rights and rewards), the fact is that NFTs are in the midst of mass mainstream adoption.

Reddit's Polygon-based Digital Collectibles are having a moment, and while it was amusing to see users on Twitter bash NFT technology in favour of praise for their new collectible avatars, they do not yet perhaps understand that Polygon is an Ethereum-scaling blockchain. The number of collectible avatar holders is now nearing 4 million, adding an additional $11.7m to Reddit's top line revenue.

Blockchain-based pictures designed by Reddit users have been available to purchase since July 2022, and despite a fall-off in the rate of new mints after an initial jump, those figures have come roaring back in the last two months.

Morningstar - a TradFi behemoth not known for its innovation, and which has a website that looks like it was made in 1995 - was among the sites to leap on a report suggesting that NFT sales fell a record amount in November 2022. First, this is an innovation just a couple of years old, so historic totals give us little data to rely on. Second, given the history of such skepticism we should expect many more reports suggesting that NFTs are so over.

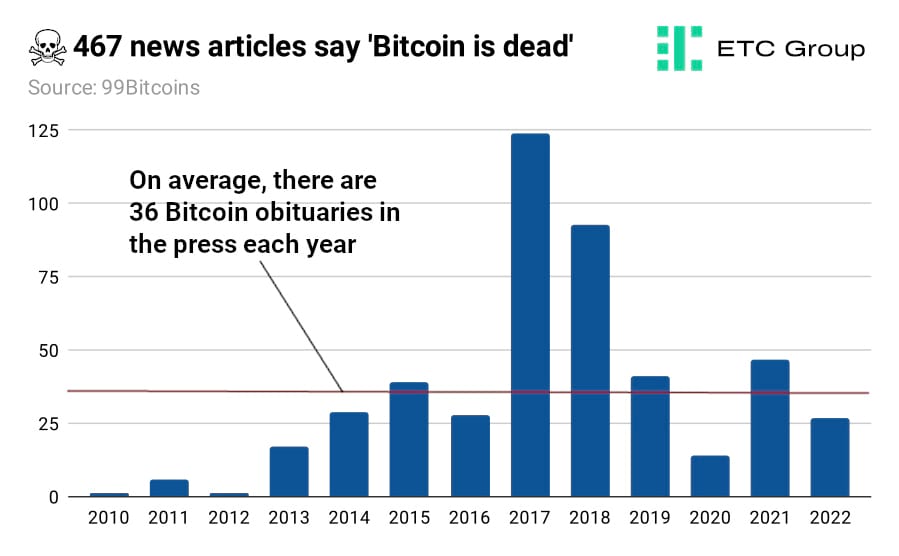

In this vein, it is worth noting that in 2022 to date, 27 news articles have declared Bitcoin, blockchain or crypto and its swathe of innovations to be useless, irrelevant or indeed, as dead as a doornail. In total, the figure is 467, and counting.

The first, from December 2010, was headlined ‘Why Bitcoin can't be a currency', and the latest, published on 30 November, was a two-man takedown of the progenitor of this new asset class by Ulrich Bindseil and Jürgen Schaaf of the European Central Bank, claiming Bitcoin is “on the road to irrelevance”. Amid the first speculative rush of 2017, 124 such hit-jobs made headlines, being the largest collection of falsehoods to date.

It does seem to be a pretty irresistible if lazy conclusion, given the average 36 annual similar declarations by journalists and researchers. While Mark Twain may have something to say about BTC's death being greatly exaggerated, it is said those that fail to learn from history are doomed to repeat it, and one might suggest Messrs Bindseil and Schaaf could learn something from the phrase.

The number of daily active Polygon wallets has 4x'd in the last five months, from an average of fewer than 200,000 to over 1 million.

Polygon is a Layer 2 scaling solution for Ethereum, which allows the underlying blockchain to process transactions near-instantly and with vastly reduced fees.

The blockchain-based portion of the creator economy is alive and well, even while crypto markets struggle for momentum and direction in the midst of Crypto Winter. Toymaking giant Mattel is the latest domino to fall, launching an expanded version of its NFT marketplace on the Flow blockchain this month. The $6.3bn market cap Californian conglomerate owns the rights to popular brands including Barbie, Matchbox, UNO and Fisher Price.

Apple has now made its metaverse intentions quite clear, with a swathe of job postings picked up by Bloomberg. The tech giant is the world's most valuable company. And work on its highly-secretive but hugely anticipated virtual reality/augmented reality headset continues. In one job listing, Apple seeks developers for a “3D mixed reality world” that sounds very much like its own metaverse. In a second posting, Apple lays out its intentions to create a video service for the headset to feature “3D content that can be played in virtual reality. In May 2020 Apple acquired NextVR for a reported $100m, a company which develops tech for producing and broadcasting events in VR.

ETC Group created Europe's first Metaverse ETF (METR) to allow investors exposure to this megatrend, pegged at a total $13 trillion valuation by investment bank Citi.

Nike too has spied a major opportunity in NFTs, launching its Web3 platform .SWOOSH. It becomes one of a clutch of retail-focused platforms to partner with the Polygon blockchain to allow devoted creators to build and sell virtual trainers and clothing and unlock extra experiences using token incentives. ETC Group also offers a 100% physically-backed exchange-traded product (MTCE) which tracks the price of Polygon.

The sports brand joins Reddit, Starbucks, Instagram, Robinhood and JP Morgan as users on Polygon have exploded upwards. It is particularly interesting to see this mainstream adoption and NFT innovation come amid the worst bear market in recent memory.

Metaverse tech involves the development of a wide range of sectors, from smart manufacturing to gaming, VR to augmented reality, 5G, blockchain-based payments to digital identity, and more.

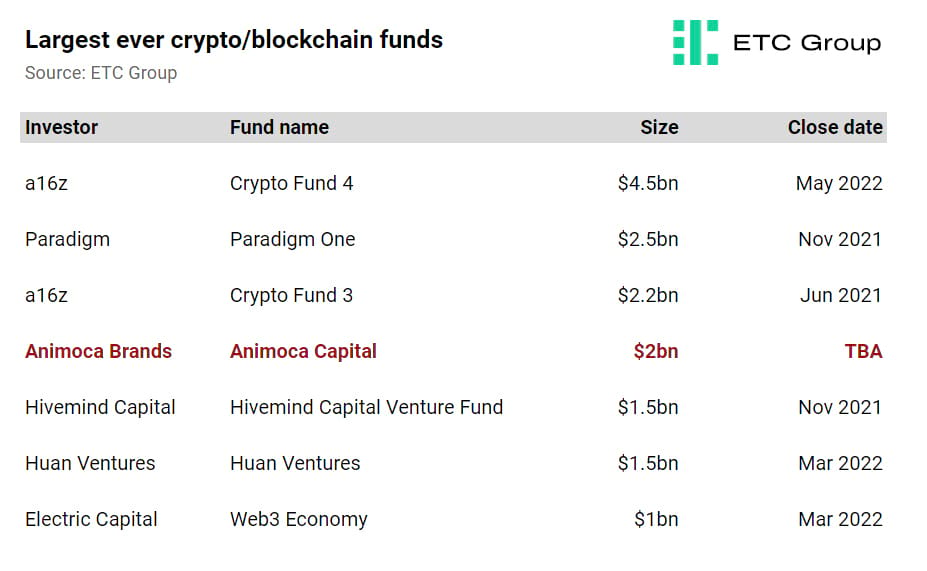

More good news from the metaverse space came in the form of a whopping $2bn fund announcement from Animoca Brands, as covered in a 30 November exclusive by Nikkei Asia.

For context, that makes it the fourth-largest crypto/blockchain fund in history, behind only behemoths a16z and Paradigm.

The fund will aid mid-to-late-stage startups, co-founder Yat Sui said, with a prime focus on “everything digital property rights”.

The Web3/NFT VC investor appears on the cap table of most leading brands in the space, from NFT marketplace leader Opensea, to NBA Top Shot creator Dapper Labs and play-to-earn gaming platform Axie Infinity. The fund intends to make its first investment in 2023, Sui said.

Animoca won $65m in funding in 2021 from French gaming studio Ubisoft, Sequoia Capital's Chinese arm and crypto-focused fund Dragonfly Capital, valuing it at $2.2bn.

ETC Group's METR ETF, a collection of the 50 companies slated to win biggest from the next logical iteration of the internet, was up 8.46% in November according to Financial Times data, outpacing the US technology sector by more than 6%. This marks another large win for diversified investors who have watched tech companies hit by recession fears start to make large layoffs. METR was the first metaverse ETF launched in Europe.

According to one tech sector tracker, there were 1138 rounds of job cuts in the wider sector through mid-November 2022, affecting 182,605 people. That such largesse is being reigned in means that canny investors must try to identify where the leanest companies reside and where the largest profits over the next two years are going to be made.

On 14 November 2022 Nike launched its Web3 project SWOOSH “that champions athletes and serves the future of sport by creating a new, inclusive digital community and a home for Nike digital creations”. The $170bn market cap sporting giant launched its Virtual Studios arm earlier this year in a bid to capitalise on the massive retail opportunity from creators making scarce digital NFT sneakers and garments, and tagging on additional interactive experiences for fans. The company plans to use SWOOSH to sell virtual sneakers and other fashion goods, and allow consumers to show them off in virtual games. “Shortly after the first digital collection drops,” Nike writes, “members will be able to enter a community challenge to win the opportunity to co-create a virtual product with Nike”. The key point for investors to note, and the reason why NFTs expand far beyond speculative purchases of cartoon monkeys is here: “Those winners can earn a royalty on the virtual product they help co-create”. Expanding ownership to a company's audience is the very definition of Web3, and a democratising force that means anyone can create, collect and own a piece of this new digital world.

Global institutions are digging deeper into the metaverse.

On 23 November, KPMG appointed its first-ever Head of Metaverse Futures in Australia. KPMG holds that virtual interactions in the Metaverse will transform client engagement and open up additional revenue streams for the firm. The new role will look to make this a reality by attracting users to Metaverse pathways KPMG will be constructing over the next two years.

Ernst and Young (EY) is integrating Wavespace with the metaverse. Wavespace is a digital interaction network that was launched in 2017 to connect EY employees worldwide. The company's research team is already locating business opportunities in sub-sectors like web animation and game development in addition to Augmented Reality (AR) and Virtual Reality (VR) technologies.

The blockchain developer Elrond has rebranded to MultiversX in a pivot toward metaverse exploration. In the past, Elrond's operation had catered to Layer 1 blockchain tech but the company is now concentrating on creating metaverse-related products like a virtual reality portal and digital assets holder to spur user adoption.

Digital asset managers also remain committed to providing investors value from the latest innovations being made by companies working in the space. ETC Group's Metaverse ETF – METR – was rebalanced on 14 November 2022 as part of its quarterly rebalancing schedule. It provides exposure to the best global companies building out Metaverse technology.

Notable entries to METR include Snowflake (NASDAQ: SNOW). It is a leader in cloud-based storage solutions for companies around the world. It is increasing its revenue by a compound average growth rate of 133% per year, and is anticipated to become profitable for the first time in 2023.

NetEase (HK: 9999) has been another meaningful addition to METR. It is primarily focused on publishing popular PC, mobile and online games in Japan and South Korea. As a recent report on the Metaverse by Deloitte suggests, the opportunity here is “no longer science fiction”, and the metaverse as a whole should contribute $1.4 trillion each year to the Asian market.

8. Outlook

- The Federal Reserve is likely to ease its hawkish campaign of interest rate markups in December. Futures traders are pricing in the high probability of a 50bps rate hike during the upcoming FOMC meeting on 14 December. This would be a departure from the four consecutive 75bps rate hikes the Fed has already issued this year. The central bank is looking to avoid sending the US economy into a mild recession amid weakening signs of economic growth.

- Retail investors are adding Bitcoin to their kitty at the fastest pace recorded this year. In November, the number of accounts holding Bitcoin for under one month jumped by 25% from 2,434,057 to 3,079,997 in spite of the price of BTC falling by roughly 17%. Ethereum holder behaviour also remained resilient with the total number of ETH holders reaching new heights to stand at 86 million users. Crypto investor behaviour signals that sentiment remains undeterred by market fluctuations in the bear market.

- The correlation between Bitcoin and traditional US and European stock markets are near their lowest levels on record. As the correlation between Bitcoin and equities continues to unwind, digital assets are reclaiming their narrative as an investment alternative for market participants looking to hedge their bets against traditional financial assets.

- As more information on the illicit dealings of FTX are publicly disclosed, investors are quickly realising that its implosion had less to do with the fundamentals of blockchain technology and more to do with the pitfalls of using unregulated crypto exchanges. The most discerning retail and institutional investors' belief in the untapped value of the cryptoasset industry is gradually recovering.

- There are fresh industry calls in the US for enforcement agencies and lawmakers to come together and produce comprehensive legislation on how to regulate the cryptoasset space as the fallout from the FTX implosion rolls on. In contrast, the EU is establishing itself as a global leader in regulation as European lawmakers look set to vote in landmark Markets in Crypto Assets (MiCA) bill in February 2023 that will extend the block's oversight to exchanges, blockchain companies, and other digital asset service providers.

- The UK reiterated its aim in November to transform itself into a crypto capital and attract leading innovators, developers, and investors. The intent comes hand in glove with the government's efforts to bring clarity to the sector, through its Financial Services and Markets (FSM) bill, which is awaiting approval in the upper-chamber of parliament.

AVIS IMPORTANT :

Cet article ne constitue ni un conseil en investissement ni une offre ou une sollicitation d'achat de produits financiers. Cet article est uniquement à des fins d'information générale, et il n'y a aucune assurance ou garantie explicite ou implicite quant à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Il est recommandé de ne pas se fier à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Veuillez noter que cet article n'est ni un conseil en investissement ni une offre ou une sollicitation d'acquérir des produits financiers ou des cryptomonnaies.

AVANT D'INVESTIR DANS LES CRYPTO ETP, LES INVESTISSEURS POTENTIELS DEVRAIENT PRENDRE EN COMPTE CE QUI SUIT :

Les investisseurs potentiels devraient rechercher des conseils indépendants et prendre en compte les informations pertinentes contenues dans le prospectus de base et les conditions finales des ETP, en particulier les facteurs de risque mentionnés dans ceux-ci. Le capital investi est à risque, et des pertes jusqu'à concurrence du montant investi sont possibles. Le produit est soumis à un risque intrinsèque de contrepartie à l'égard de l'émetteur des ETP et peut subir des pertes jusqu'à une perte totale si l'émetteur ne respecte pas ses obligations contractuelles. La structure juridique des ETP est équivalente à celle d'une dette. Les ETP sont traités comme d'autres instruments financiers.