1. Summary

- FTX blows up, gets taken over by Binance

- Sentiment switch: low volatility era poses upside potential

- Bitcoin investors overwhelmingly in HODL mode

- Institutional tidal wave flows in during Crypto Winter

- Best regulated countries grab largest slice of digital assets market

- A Tale of Two Recessions

- Ethereum Layer 2 Polygon is blockchain of choice for tech, consumer, banking

2. Overview

Regulation is coming to the crypto and blockchain space, and it can't arrive soon enough. Leverage, transparency, unaccounted lending - all will need to be addressed. Certainly, the takedown of a former darling of the crypto space in Sam Bankman-Fried is momentous news.

For the full story on the FTX crash, and its subsequent potential takeover by Binance, take a look at this recap.

Before that particular news broke in the second week of November, a slew of indicators suggested things could be looking up in crypto land. The signals were creeping in for a potential turnaround in sentiment for digital assets.

Crypto rallied in the final days of October 2022, sending Bitcoin to the edge of $21k and Ethereum 25% higher to $1.5k. Such sudden optimism after more than 10 months stuck in the depths of a Crypto Winter sent bearish traders running for cover.

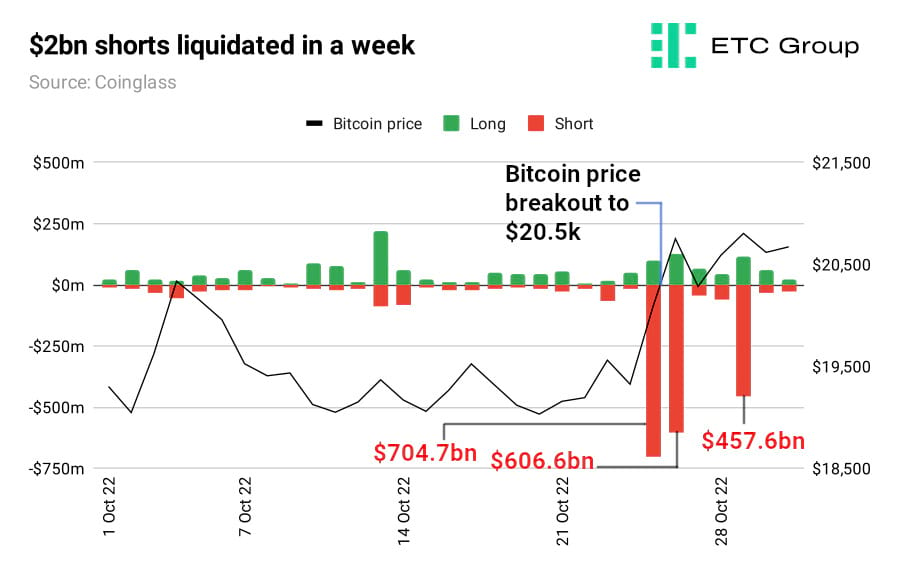

Was this the end of the bear market? Perhaps not. The data shows us the catalyst for the price spike was a huge short squeeze.

Between 26 October and 31 October, $2 billion in trader positions betting on the price of crypto to fall were liquidated. They happened across three major leveraged short liquidation events of more than $450m in a day. When traders short an asset, and the market moves against them, they have to cover those positions by buying back the asset (BTC/ETH) at the now higher market price, leading to a fast upward spiral in prices.

Prices spiked early on 26 October on macro moves. First, US housing market data showed a huge decline in mortgage applications and home prices falling at their steepest monthly pace in more than a decade. Then the Bank of Canada plumped for a rate rise of 50 basis points (bps) over the more aggressive expected 75bps increase.

Both scenarios put bears on the back foot. The implication was that the Federal Reserve could bring its aggressive hiking cycle to an end sooner than expected to lessen the impacts of a major US recession.

This would lead to a more favourable environment for those assets associated with a higher risk profile, including crypto.

A lack of major positive catalysts in the post-Merge lull has held back Bitcoin and Ethereum.

And yes, market moves like the one above were early signs the Crypto Winter could be thawing. Spring will return, as it always does, but precisely when it happens comes down to a series of ifs: If central banks pivot; if a global recession is not as deep and painful as expected; if crypto continues to hold its value while equities burn.

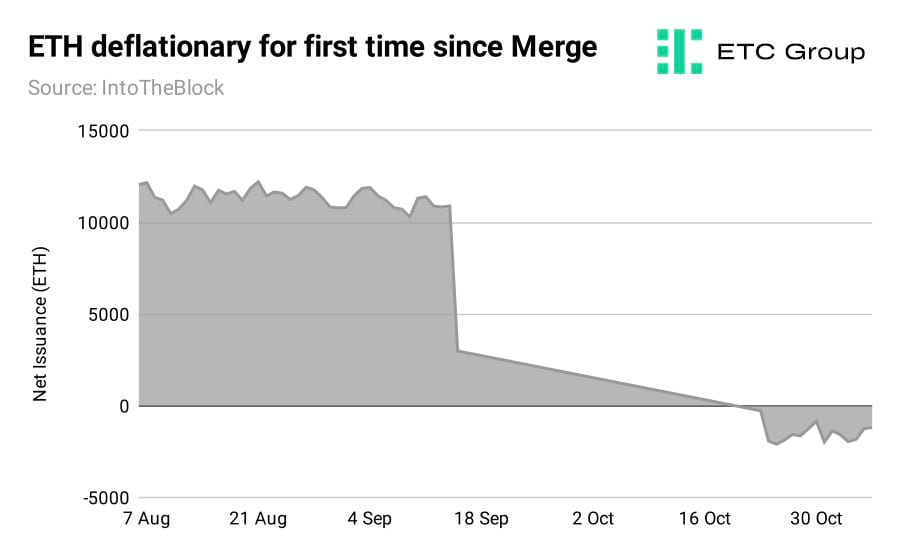

Ether tipped over into net deflationary issuance in the last month, which means ETH has legitimately picked up some store of value prospects with investors.

Risk assets tend to bottom first in bear markets. As ETC Group notes in its bi-weekly Crypto Minutes outlook, three major indicators would imply that we have found a floor price for Bitcoin, and hence crypto markets are getting ready to reverse course.

- Trading volumes recover

- Spot prices for the market leaders Bitcoin and Ethereum hold at steady levels, even while recessionary outbreaks occur

- Volatility remains near historic lows, just as it did when prices started to recover in the wake of both the 2015 and 2018 bear markets.

Two further potential positive catalysts that would aid and provide succour to a structural reversal are:

- Another piece of landmark legislation

- More major corporate adoption into crypto and Web3

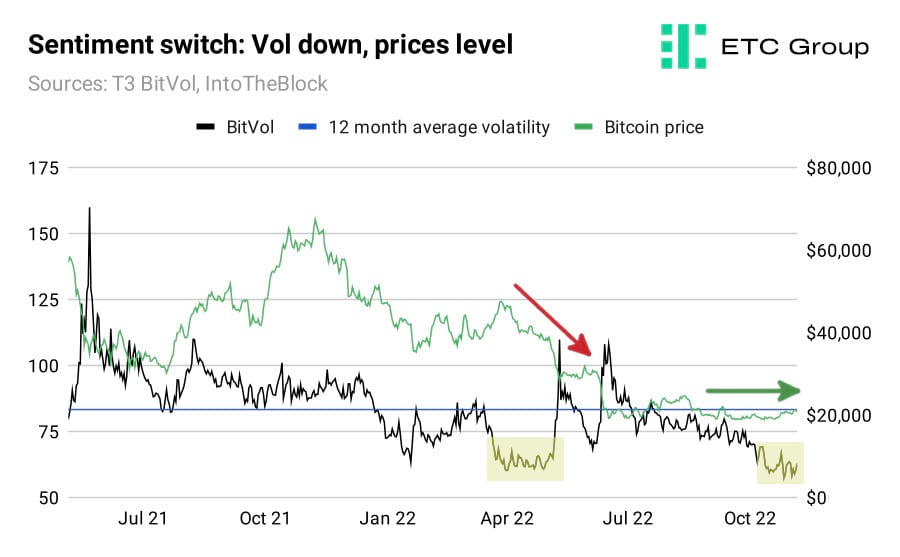

So let's take those points one by one. First, trading volumes across the major exchanges are starting to recover. In terms of spot prices, unfortunately we won't know the outcome there until it is in the rearview mirror. But on the third point, we can see that implied volatility (as measured by option pricing) remains near all-time lows.

On 2 April, Bitcoin volatility reached its lowest level since October 2020. As of the end of October 2022 Bitcoin volatility has now dropped below that low watermark to match levels last seen in July 2020.

We can see from the chart that the last extended period of low volatility (yellow boxes) was accompanied by a generalised price decline. As of early November 2022, the period of low volatility has been matched with steady and slightly up ticking prices. From this, we can infer that there has been a general sentiment switch in crypto markets.

Extended periods of low volatility in BTC - as we saw between the end of March and the start of May - leads to only one outcome: high volatility. In May, the period was followed by a huge negative catalyst in the collapse of TerraUSD and the Do Kwon debacle, which spun out into the Three Arrows Capital/Voyager/Celsius crypto lending crisis and inspired research papers like this, looking at which crypto ETP issuers are quietly lending out their assets and exposing their customers to undue counterparty risk (hint: it's not ETC Group).

This time around, that lengthy stretch of low volatility could instead surge to the upside, barring any highly negative catalysts replacing the sentiment switch in the meantime.

The fourth and fifth points, on legislation and adoption, are where we start to really see the future emerging. In the US we had the midterm elections starting on 8 November with Republicans heavily favoured to take back the House of Congress. With betting even on who will hold the upper chamber of the Senate, only bipartisan bills, or those with both broad Democratic and Republican support, will make it through to law. And guess what? The House Financial Services Committee stablecoin bill that stalled in July would be the first to regulate crypto markets US-wide, is likely to be the first on the docket after the lame-duck session concludes in the final months of 2022.

Institutional tidal wave flows into digital assets

Onto the crypto corporate and institutional adoption in October. It was difficult to thin down this list, given the absolute avalanche of announcements.

The financial plumbing that allows asset managers and as-yet untapped pools of capital to invest in crypto took another huge leap forward in October 2022.

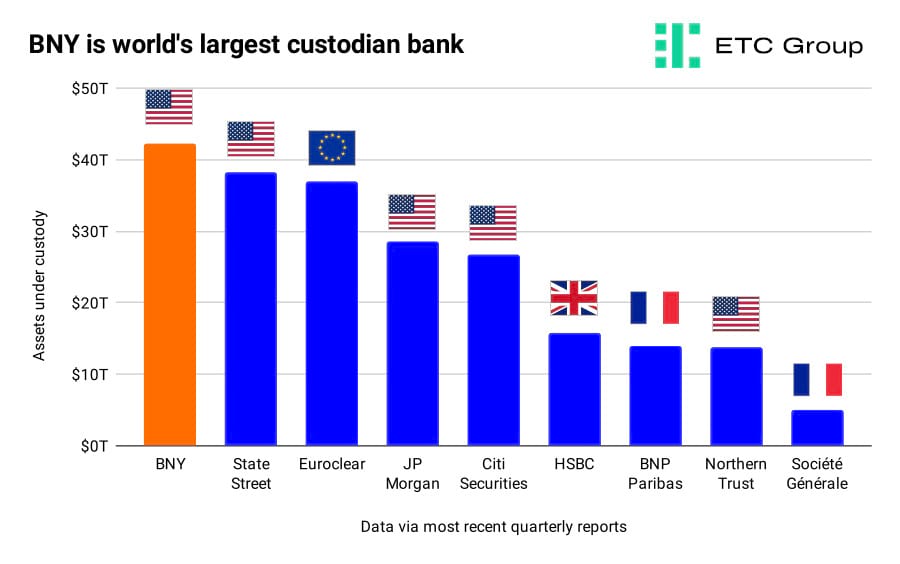

At a spritely 238 years old, BNY Mellon is America's oldest bank. It's also the newest upstart in crypto custody. BNY, or Bony as it's known in the trade, went public on 11 October to launch their custody business, holding Bitcoin and Ethereum initially.

In its announcement, the bank said it will be able to store and transfer BTC and ETH and provide bookkeeping services equivalent to those offered to fund managers in traditional assets.

This is a deal more than two years in the making, and BNY is the most trusted institution on the custody front in TradFi, so it represents an enormous leap forward for the industry.

This is certainly one of, if not the most important institutional developments we have ever witnessed.

When it comes to institutional players, there simply isn't anyone bigger or more prominent on the world stage than the Bank of New York Mellon. BNY has $42.2 trillion in assets under custody and $1.8 trillion in assets under management.

Not to be outdone, number three on this chart, the Euro securities settlement house Euroclear, said back in March that it had joined a group of banks building a tokenised asset payment system, to record company shares on public blockchains and speed up settlement of transactions worldwide.

But why is BNY's move such a huge deal?

Firstly, from a commercial point of view this move will unlock a massive amount of buy-side participation in crypto markets.

There are pools of capital out there in TradFi that are simply not comfortable holding their assets with existing crypto-native custodians, but they will be with BNY, because they will have existing relationships with BNY on the custody side.

If a sovereign wealth fund is looking to deploy large amounts of capital into Bitcoin or Ethereum, it becomes a very difficult conversation to get top leadership on board by suggesting custody with a crypto-native startup. That same conversation is a lot easier to explain if they simply say they chose BNY. It's the same with Fidelity, which has offered Bitcoin trading to hedge funds and institutional clients since 2018.

The other point is that in terms of market structure, the BNY team has an implicit understanding of how things need to look and must work in traditional venues with large hedge funds and buy-side participants.

Another significant detail is that top leadership at BNY bought into this vision, and were able to explain to different parties exactly how important Bitcoin and Ethereum were to their strategic vision and spent the time and capital necessary to integrate with all the blue-chip service providers in crypto compliance, trade execution and market data.

Banking regulators as a whole are not particularly friendly to digital assets today. In fact, many are overtly hostile - the Basel Committee, for example.

In the US, it's an open secret that the federal regulatory body the FDIC has been discouraging banks from interacting with crypto - both in formal guidance and informally, touting the ‘systemic risk' angle.

But now, much more capital is going to be able to flow into Bitcoin and Ethereum as part of this BNY deal.

Next: MSCI. MSCI is the world's best known index provider - by those in the finance trade, at least. Founded in 1969, the company operates the MSCI World index, which is the gold standard (or Bitcoin standard, if you will) for representing the performance of stocks and shares in developed markets around the world. It covers 85% of the market cap in each country it references.

And so, MSCI has entered the crypto market with avengence. Along with investment bank Goldman Sachs and data provider Coin Metrics (which rivals Glassnode for the finest on-chain data platform out there), MSCI launched a taxonomy to classify digital assets.

One of the major reasons why many asset managers can't interact with crypto beyond Bitcoin and Ethereum is the lack of an agreed way to measure portfolio performance. With this taxonomy, noting where digital assets sit on the risk spectrum, MSCI just gave the industry a huge boost. The significance of this may take some time for this to filter through the market, but new pools of capital entering and new portfolio standards can't be ignored.

All of the above makes an obvious rebuttal for this article from January 2022 which posed the idea of a crypto ‘ice age', where prices stay low for years, and investors lose interest.

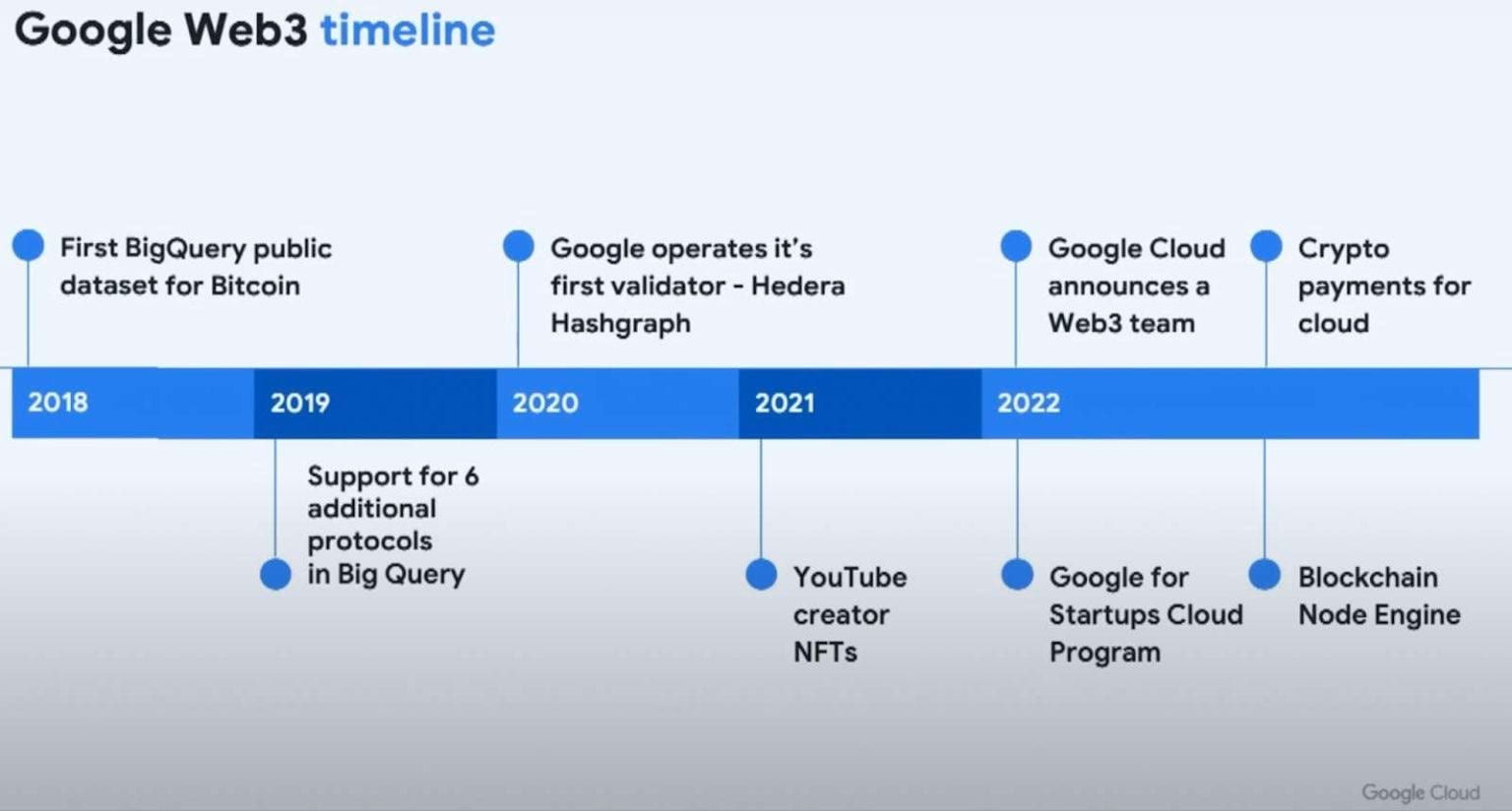

At the time, James Malcolm, the head of forex strategy at UBS questioned: “A lot of people in the technology space seem to be questioning whether or not [crypto tech] is that effective. It begs the question if it was so blatantly next-generation technology, then why aren't a lot of big tech companies all over it? Why isn't Google massively invested?”

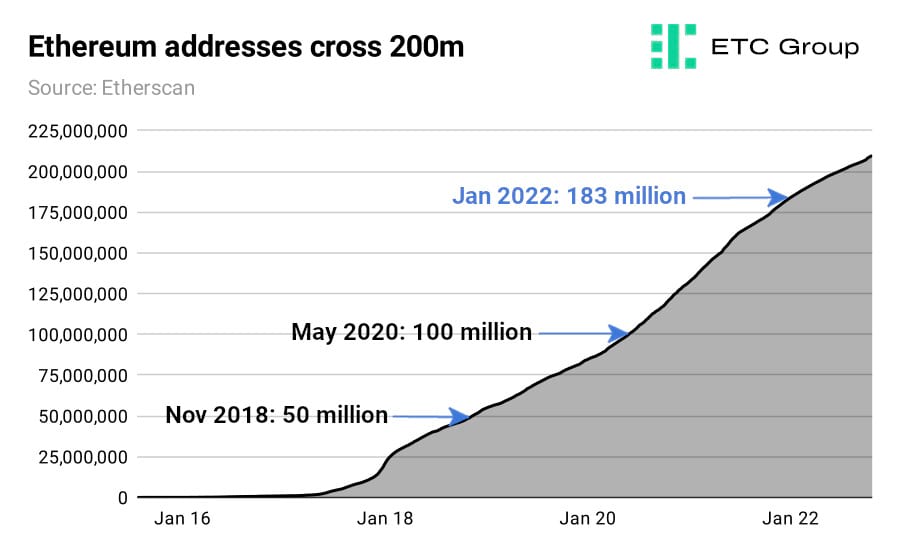

On 28 October, Google announced that its cloud division would start offering node management services for Ethereum validators. At last count there were more than 456,000 validators on the post-Merge Ethereum blockchain. As the below chart shows, there are also now more than 209 million distinct Ethereum addresses, up from 183 million on 1 January 2022. The userbase continues to grow strongly.

Ethereum will be the first blockchain supported by Google Blockchain Node Engine, the company said, “[to] enable developers to provision fully managed Ethereum nodes with secure blockchain access.”

Ethereum's closest competitor followed: in early November, Google announced that it would become a Solana validator, outlining its Web3 credentials ever further.

Google set out a bold statement of intent on 11 October when it announced a partnership with Coinbase to allow Web3 companies to pay in crypto for hosting services.

It is particularly significant that tech and payments giants continue to integrate cryptoasset infrastructure in the middle of a deep price retracement, when the market has shed two-thirds of its value from the $3 trillion all time high. The world's largest companies are not exiting the space in their droves. In fact, quite the opposite.

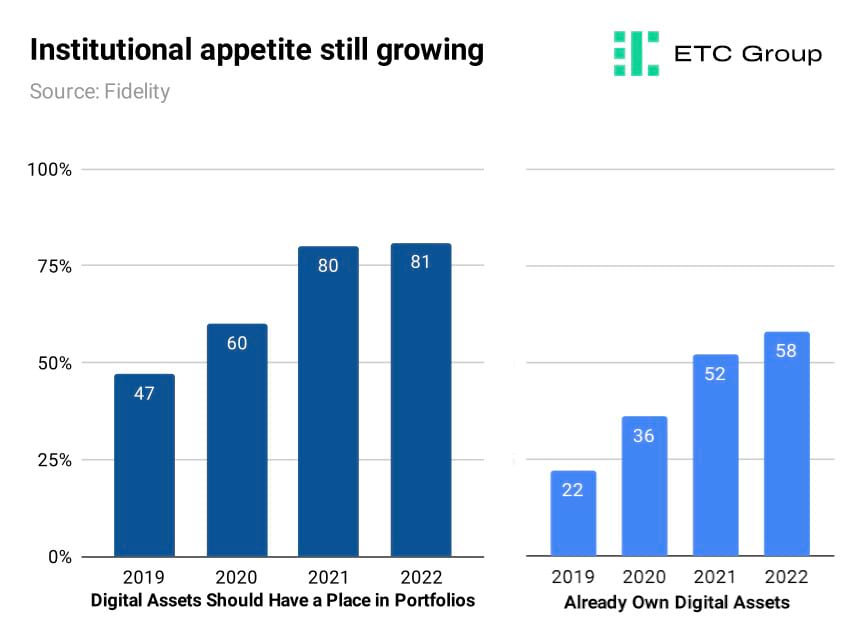

Had just one of these institutional stories landed in our inboxes two years ago, the crypto market would have soared. Now, there is barely a murmur. And that's a good thing. It means that markets are maturing, and fast. Institutions are just an accepted part of the landscape. Additional confirmation, if it was needed, came from Fidelity's annual Institutional Digital Asset Survey, which found no slowdown in appetite for digital assets, even while there remains much growth to come in those who actually hold those assets.

Unsurprisingly there was a geographic split between the US, Asia and Europe. The US, which has thus far failed to put in place any nationwide legislation to support the digital assets industry, was well behind its peers with only 74% of institutions saying digital assets should have a place in investor portfolios, compared to 84% in Asia, and 86% in the leader Europe.

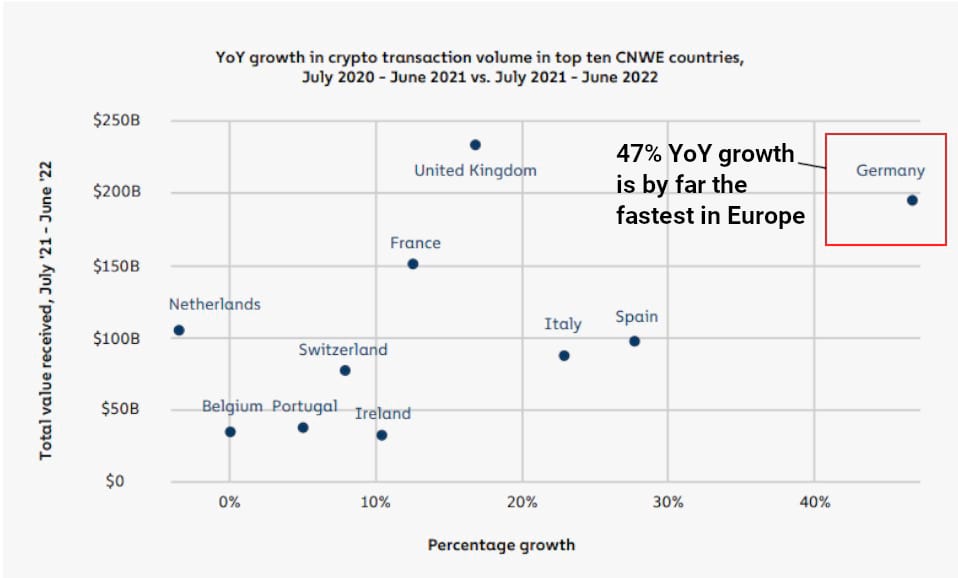

The Chainalysis annual Geography of Cryptocurrency report also arrived in October, showing central, western and eastern Europe as the largest market for digital assets for a second year running.

In fact it has been those jurisdictions that have innovated the fastest, like Germany, with its forward-thinking regulator BaFin, and crypto-friendly tax policies, that have seen the largest influx of transactions. At a 47% year on year growth, Germany saw by far the fastest growth in Europe this year.

To conclude: corporate and institutional adoption and support of cryptoassets kicked into a new gear in October. And it was particularly significant that big moves are being made in the depths of a bear market. Lower spot prices for Bitcoin, Ethereum and the altcoins have not scared off the largest pools of institutional capital: if anything, it has energised them.

Four days after the end of October, JP Morgan executed its first live DeFi trade using a fork of Aave, Uniswap and the Polygon blockchain. It was a momentous day.

JP Morgan traders used the decentralised exchange Uniswap to swap a tokenised version of Singaporean dollars for a tokenised version of Japanese yen.

JP Morgan CEO Jamie Dimon, he of the famous comment: “Bitcoin is worse than tulips,” has long been trying to give to crypto markets with one hand and take away with the other.

This gives crypto market analysts a binary choice: we can either listen to what they say, or watch what they do.

Ethereum Layer 2 Polygon becomes tech, banking, consumer blockchain of choice

Polygon is becoming the blockchain of choice for major tech companies to carry out massive retail launches of new products. Polygon is a Layer 2 blockchain that sits on top of Ethereum, using Ethereum's security and architecture to function, while also allowing for fast transaction confirmations and low fees.

Some major adoption theses played out in October, as Instagram said it would use Polygon to mint and sell NFTs on its platform. During a 19 October panel at TechCrunch Disrupt, Reddit chief product officer Pali Bhat revealed that users of the social media giant had created over 2.5 million wallets to buy NFT avatars that can be used as profile pictures on the platform.

While ETC Group's head of research Tom Rodgers demystified NFTs in this article the fact remains that the technology has something of an image problem. Perhaps the Reddit-led rebrand to ‘Digital Collectibles' can offer markets a boost in the medium term.

After the success of Starbucks' NFT integration in September, on 19 October Brazilian fintech bank Nubank started using Polygon to release loyalty tokens - Nucoins - to its customers. Nubank went public in a December 2021 IPO at a valuation of $41.5bn, eyeing Latin American growth as its first priority.

The project was “another step ahead in our belief in the transformative power of blockchain technology, going beyond the purchase, sale and maintenance in the Nu app,” said Nucoin general manager Fernando Czapski.

Bitcoin investors overwhelmingly in HODL mode

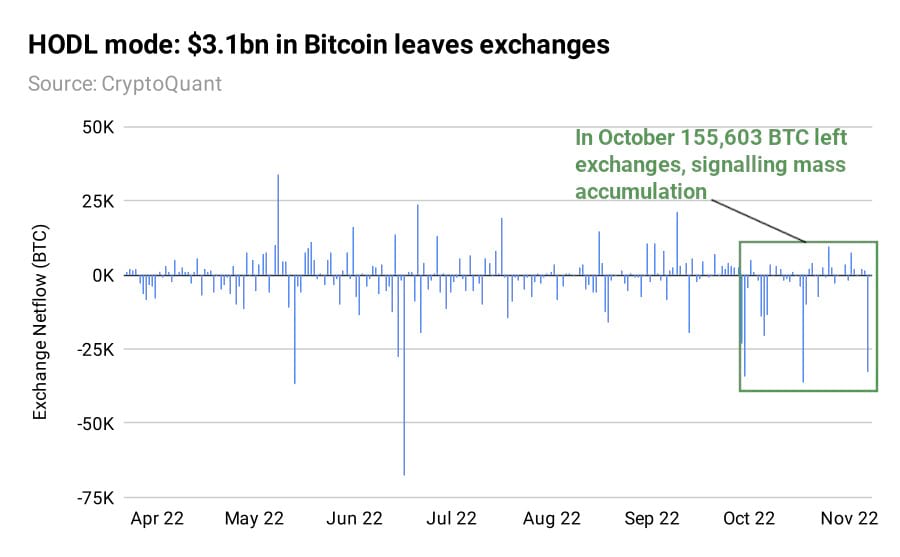

In October, $3.14bn in Bitcoin or 155,603 BTC left exchanges. That suggests a clear trend is in action, with Bitcoin investors overwhelmingly in accumulation and holding mode.

Generally, when crypto exchange netflows are negative, it means that fewer holders are moving coins onto exchanges for selling, and therefore signals that investors are accumulating Bitcoin.

Early signs signal a positive shift in demand. From here? It's not up only. There remain structural concerns. But the dramatic change in tone and support for digital assets from internet and payments giants - to get on the train or get left behind at the station - is notable and should not be quickly dismissed.

3. Macro Signals

A Tale of Two Recessions is coming. It was the best of times, it was the worst of times: and no-one could decide quite which one it would be.

The United Nations warned the Federal Reserve on 3 October that continuing to raise rates aggressively risks plunging the world into global recession.

So is the US central bank willing to crash the stock market to get inflation under control? That's the question on most traders' minds as we barrel towards the end of a terrible year for traditional investors.

US CPI for September was unveiled on 13 October. CPI YoY printed 0.1% higher than expected at 8.2%. Given that the Fed's aggressive rate-raising has clearly not had much of an impact to date, these figures signalled the virtual certainty - later confirmed - of another 75bps rate hike in the 2 November FOMC meeting.

Core CPI (which excludes the prices of petrol, which is based on oil prices, and food, much of which is seasonal), rose 6.6% YoY, greater than the March peak and the fastest growth rate for Core CPI in 40 years.

Analysts at Bank of America reconfigured recent predictions to project a less bad recessionary era in the US than most still fear. Shrugging off recession concerns, the investment bank raised its annual outlook for revenue as resilient consumer spending gave its researchers enough confidence to call a turnaround in the country's fortunes by the middle of 2023.

JP Morgan, however, sees a different narrative playing out. CEO Jamie Dimon told investors that both the US and global economies are facing a “very, very serious” mix of headwinds, that are likely to cause a deep recession by the end of Q2 2023. What is most prominent amid this analysis is that the world is heading for falling GDP growth, but it will not be evenly spread across the board.

Different parts of the world will experience the coming recessionary era differently: certainly Japan with its 48% (!) import cost increase in yen terms seems to be one of the major economies that will be hit the hardest. The strong dollar has butchered many major currencies worldwide, and that will inevitably lead to investors seeking hard assets, and non-inflationary assets like Bitcoin.

The cost of capital is going to remain high until interest rates start to come down. US futures traders are about evenly split on the state of interest rates for the end of 2022 remaining in the 4.5% to 4.75% range.

But as always, the devil is in the details. Chairman Powell's speech noted that the Fed would take into account how far it had already raised rates when considering the central bank's next move.

“In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments,” Powell said.

Signals that the Federal Reserve could start to ease off on interest rate rises from December, perhaps with a 50bps rise instead of the 75bps that has become the standard, would light a fire under risk assets like stocks and crypto.

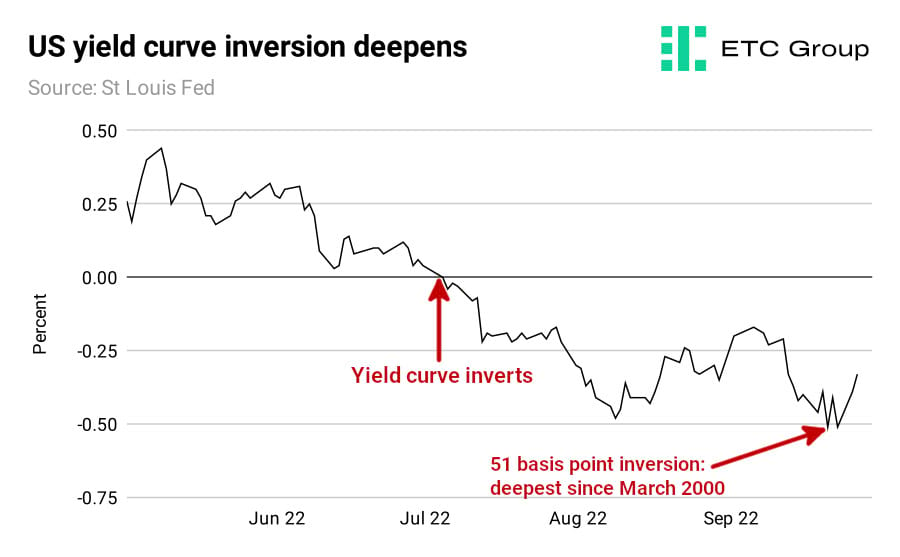

On the other hand, the US 3 month to 10 year yield curve has now inverted, and this signal has never not preceded a recession.

We have talked quite a lot in previous issues about the US Treasury market and the 2 year to 10 year yield curve. When macro analysts look at the US yield curve inversion, they look for two metrics to figure out how bad a recession could be: depth and duration. For duration: the 2 year to 10 year yield curve is now more than 120 days inverted. For depth: at a low of 51 basis points we have to go all the way back to 1981, 41 years ago, to find an inversion deeper than this.

One other point to make: crypto companies are laying off staff, that is true. But then so are tech giants, and to point to the crypto industry alone as an exemplar of worsening sentiment is flat out wrong. Twitter laid off 50% of its workforce, Intel cut its headcount by 20%, Apple and Amazon have implemented a hiring freeze, and there are many more.

For a final indication of how strange and strained the global economic system is at the moment, we need only look at one story.

You may have heard of Ben Bernanke, the Chairman of the Federal Reserve who presided over the mortgage-backed securities crisis that laid the foundations of the 2007-2009 Great Financial Crisis. The man who stated in March 2007 that “subprime is contained”. He just won the Nobel Prize in Economics for his research into banks and financial crises. Hence the widespread distrust of mainstream economic policies, and the very reason Bitcoin exists.

Economic policy is starting to coalesce around the idea that risks in general are tilting away from inflation and towards defaults as government and corporate borrowing becomes more expensive due to interest rate rises.

4. Regulatory Signals

Accounting change makes it much easier for US companies to hold Bitcoin

One US regulatory move that has almost entirely flown more under the radar - but is incredibly important - is the news that the Financial Accounting Standards Board (FASB) has agreed to make fair value the primary accounting method for measuring cryptoassets.

This means it just became a lot more simple for US public companies to hold Bitcoin and other cryptoassets on their balance sheets.

Currently crypto purchases must appear on company balance sheets as intangible assets.

That means that if the price of Bitcoin falls, accountants must mark down its value. If the price of Bitcoin rises again? It can't be marked back up . That leaves many businesses with an official hole in their accounts - a difficult state of affairs to justify.

These kinds of accounting rules seriously discourage any company from putting Bitcoin or any other kind of crypto on a balance sheet, because they force businesses to take a writedown in the asset's value, and do not allow them to write it back up.

In a Youtube video covering the 12 October decision meeting, FASB board member Christine Botosan said: “Given how these assets generate huge cash flows, I strongly feel that fair value is in fact the right measurement basis, and it better captures the economics of this type of asset.”

The FASB had a totally incorrect view that Bitcoin was difficult to ‘mark to market', a term which means adjusting the value of an asset that fluctuates over time.

Most firms tend to use the CME Bitcoin Reference Rate and CME Ether Reference Rate which take an aggregated snapshot of the price of BTC and ETH on major spot exchanges including Coinbase, Gemini, Bitstamp and Kraken. Both are published at 4pm London time every day. More recent developments mean market data firms like Coin Metrics can offer a 24/7 reference rate.

It's notable that it was the Canadian arm - and not the US branch - of KPMG that came out and put Bitcoin and Ethereum on its balance sheet in February 2022.

Coinbase, Blockchain Association join landmark Ripple vs SEC lawsuit

Coinbase doesn't even offer XRP to trade on its platform, and yet the largest US digital asset exchange has officially joined with Ripple to fight its suit against the SEC. Trade advocacy body The Blockchain Association made the same move in a joint announcement on the final day of October.

The tone is clear: both Coinbase and the industry body think that Ripple is going to win against the US regulator, and both want to be seen on the right side of history.

The SEC has been pursuing Ripple for over two years over what it says was the company fraudulently raising funds through the sale of XRP as an “unregistered security”. Ripple's defence is largely based around the argument that if Ethereum was not considered a security in 2018, XRP should not be treated as one today.

On 21 October, Ripple Labs was authorised by the Southern District Court of New York to access internal SEC documents relating to a speech made by William Hinman, former Director of the SEC's Division of Corporation Finance, in 2018. In the speech, Hinman had intimated that Ethereum should not be considered a security by the SEC because it is “sufficiently decentralised”.

Traders viewed the decision to release the Hinman documents as a small victory for Ripple with the price of XRP, the sixth-largest cryptocurrency, jumping by 7% on the back of the news. The outcome of the lawsuit is of significance for the wider cryptoassset industry, as it may establish a benchmark for whether digital assets should be treated as securities or commodities.

Europe shifts on landmark MiCA text

It will be at least two years before Europe's world-leading regulatory structures for crypto will be introduced in 2024 but the fact that the 27-member bloc has even got this far was major headline news in October.

At least one member state is unhappy with the language, but there remains much negotiation to come yet. The difficulty researchers and policymakers have is in navigating a 27-country decision-making system. The EU's General Secretariat Jeppe Tranholm-Mikkelsen also put forward a controversial section of text outlining a potential €200m trading activity cap for non-euro stablecoins, that critics insist would cripple Europe's current leadership in crypto.

Tranholm-Mikkelsen wrote on 6 October: “If widely used as a means of exchange within a single currency area, issuers should be required to reduce the level of activity. An asset-referenced token should be considered to be widely used as a means of exchange when number and value of transactions per day associated to uses as means of exchange is higher than 1 000 000 and EUR 200 million respectively, within a single currency area.”

A final vote on the text of the bill has since been delayed until February 2023.

5. On-Chain Signals

Bitcoin

Liquidity demand: Exchange flows

Bitcoin exchange inflows dropped significantly in October, by as much as 59% compared to September, signalling that fewer traders were moving coins into selling positions. Bullish Bitcoin

Futures activity

Bitcoin futures trading volume fell to $880bn from September's uptick with only CME seeing larger volume across the exchanges. Bearish Bitcoin

HODLer behaviour

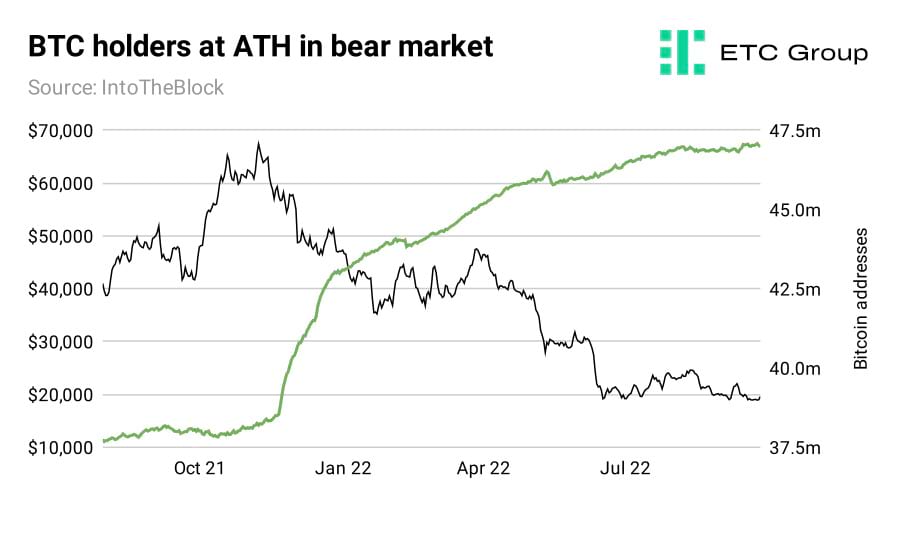

The number of Bitcoin holders continues to breach all time highs, with September's 47 million surpassed in October by another 300,000. Short term traders (defined as those holding BTC for 1 month or less) have dropped 6% while Long term holders (defined as those holding BTC for 1 year or more, climbed another 2% this month. Bullish Bitcoin

Institutional demand

Institutional demand for BTC as measured by global crypto ETP inflows remained flat in October. Neutral Bitcoin

P&L of investors

Bitcoin Net Unrealised Profit and Loss is near its lowest ever point, suggesting material upside for new or existing investors adding at these levels. Bullish Bitcoin

Ethereum

Liquidity demand: Exchange flows

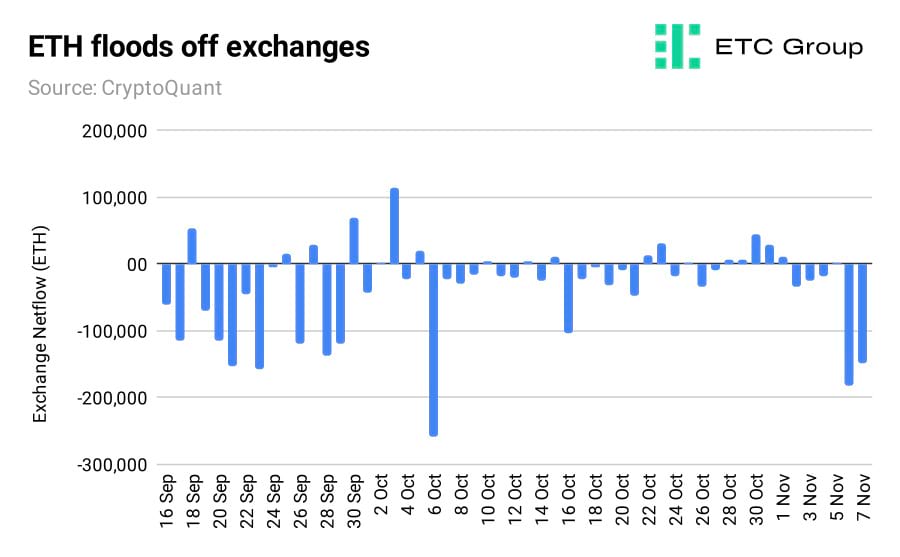

Ethereum exchange outflows (which signals more holding and lower buying pressure) clearly outpaced inflows in October, despite large inflows around the time of the Merge in mid-September. Bullish Ethereum

Futures activity

Lower volatility contributed to a drop in Ethereum futures trading volume, commensurate with the types of volumes seen during the low-vol period in March and April. Bearish Ethereum

HODLer behaviour

Enabling staking with Proof of Stake Ethereum saw the number of addresses holding ETH for 1+ year rise in October to its highest ever point at 52 million. Bullish Ethereum

Institutional demand

Institutional demand for ETH as measured by crypto ETPs remained flat in October. Neutral Ethereum

6. Altcoin Brief

Investors are still betting big on smart contract blockchains, many of which are demonstrating strong support from institutions and retail communities even with token prices well below their November 2021 peak.

Polygon ups scaling potential

Polygon introduced its public testnet for zkEVM (zero-knowledge Ethereum Virtual Machine) rollups on 10 October. ZK-rollups are scaling solutions that improve a blockchain's performance by bundling together collections of transactions into a single block in order to cut gas fees and bolster TPS.

Polygon's public testnet will let developers deploy zk-rollups in decentralised applications. The rollups are Ethereum-compatible which means all Ethereum and Polygon dApps and protocols will interact seamlessly with it.

Avalanche leans hard into gaming

Avalanche is making moves to distinguish itself as a powerhouse for blockchain gaming.

Ava Labs, the company behind the Avalanche blockchain, entered a strategic partnership with BLRD, a subsidiary of Japanese gaming house GREE, on 27 October. GREE has 30 million active users across all its games and works alongside companies like Sega and Konami. GREE presently supports Avalanche's gaming subnets by running more than a dozen network validators.

Its new partnership has been formed to accelerate BLRD's involvement in the sector as the Japanese company targets 2023 for the release of its first Web 3.0 game.

Solana to eat Uber's lunch with stablecoins

Solana is becoming an ecosystem for a number of innovative projects including decentralised data sharing, mapping, and now Uber-style ride sharing. Teleport, a decentralised ride sharing platform is expected to be piloted at Solana's Breakpoint event in November.

The developers of Teleport, the Decentralised Engineering Corporation (DEC), raised $9 million in a seed round co-led by Foundation Capital and Road Capital in October. The capital will go toward maturing Teleport's customer services. Drivers will have the option to be paid in the US dollar-backed stablecoin USDC or via regular bank accounts.

7. Into the Metaverse

On 22 October payments giant Visa registered a series of trademarks for its own Bitcoin wallet and a slew of NFT and metaverse-related tech. One excerpt from the US Patent Office applications reads: “online non-downloadable software for management of digital transactions; non-downloadable virtual goods, namely a collectible series of non-fungible tokens; online non-downloadable software for us as a cryptocurrency wallet.”

More retail Metaverse news landed in October as FIFA launched its own Virtual World in Roblox ahead of the Qatar 2022 World Cup, but most investor focus was contained to Mark Zuckerberg's pivot into the space.

Meta's latest earnings report shows that the company's Metaverse division, Reality Labs, has lost $9.4 billion in the first three quarters of this year. Reality Labs is responsible for developing the virtual and augmented reality (AR) technology that will support the Metaverse in the years to come.

Meta stock plunged by 24% in response to its second straight quarterly decline; the lowest its shares have been since 2015. But Zuckerberg remains adamant on his company's foray into building infrastructure to support the Metaverse and has repeatedly reminded investors that patience is paramount.

The banking sector is not shying away, either. UBS and Julius Baer made moves to shift their wealth management advice from “oak-panelled boardrooms to virtual reality” in October, the Financial Times reported.

And some industry participants creating the machinery to support the nascent space are already reaping profits from their endeavours.

The share price of PTC, an American software company focused on industrial uses for augmented reality (AR) in supply-chain manufacturing, has demonstrated remarkable resilience against the macro climate that has seen tech companies and the wider equity market plummet this year.

In its last earnings report, PTC gained $508 million in revenue, a 6% increase YoY. PTC has committed part of its operations to creating enterprise grade AR solutions with a view to boosting workplace efficiency by merging physical environments with instructive virtual habitats.

Regulators are also embracing virtual worlds with open arms. The global law enforcement agency Interpol made a clear statement of intent by launching its own Metaverse in October. The first purpose of this portal is to serve as an immersive training ground for forensic investigation courses and to advance interaction with other law enforcement agencies around the globe through the use of digital avatars.

Meanwhile, the Norwegian government has also dipped its toes into the Metaverse while partnering with the consulting firm Ernst and Young (EY) to open a tax office in Decentraland. The decision is part of an effort to educate younger audiences about taxes related to DeFi and NFTs.

8. Outlook

- The FTX situation caught the market by surprise, and engenders a new potentially bearish phase in crypto that many market-watchers hoped was a thing of the past.

- As expected, crypto markets traded largely sideways in October. Across the month there were some very positive signs for markets in the medium term: mass corporate and institutional adoption and this could form the next bullish narrative.

- Regulation and transparency will be key for markets until the end of 2022 and beyond. Certainly crypto companies that make a virtue of being whiter-than-white in terms of not lending customer assets will be the early winners.

- The narrative of Bitcoin as the ultimate supply-limited asset is starting to regain pace, given that central banks continue to raise rates across the board, and higher rates are expected to persist well into 2023.

- With the recent FTX/Binance situation, regulators will be on notice watching for any impropriety. Customers will pull assets off exchanges in their droves.

- History is repeating itself in Bitcoin with large levels of bear market accumulation; not only long-term holders, but the smaller retail holders are now increasing their Bitcoin exposure. This looks to be particularly positive in the medium term and the pattern validates Bitcoin's store of value/digital gold thesis. In addition: in the last five years, gold has appreciated 33% while Bitcoin has appreciated 225%.

- Bitcoin remains well undervalued from a technical perspective, with valuation metrics like Net Unrealised Profit and Loss notably flashing BTC in a position where long-term average-in buys have been historically profitable. HODLer behaviour across BTC and ETH remains at all time highs, despite the bear market prices, suggesting that investors are generally willing to buy low and hold out for better times ahead.

Our latest research

ETC Group Research In The Press

ETC Group's research team is regularly quoted in high profile digital asset and traditional media venues. Below is a selection of the highlights and features this month.

Cboe Digital to Launch Margin-Based Crypto Futures (20 October 2022) - Markets Media

Head of Research Tom Rodgers is quoted on his views on BNY Mellon starting institutional custody of Bitcoin and Ethereum, specifically that it will unlock massive buy-side participation in crypto markets.

Metaverse Deep Dive (22 October 2022) Milano Finanza

Head of Research Tom Rodgers contributes to the Italian publication Milano Finanza for an article on the development of the metaverse. The piece is syndicated to ADVFN, MF Dow Jones and TGcom24.

Connect with and Follow us

Linkedin: ETC Group

Linkedin: Tom Rodgers, Head of Research

Linkedin: Hanut Singh, Research Analyst

Twitter: ETC Group

Twitter: ETC Group Research

AVIS IMPORTANT :

Cet article ne constitue ni un conseil en investissement ni une offre ou une sollicitation d'achat de produits financiers. Cet article est uniquement à des fins d'information générale, et il n'y a aucune assurance ou garantie explicite ou implicite quant à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Il est recommandé de ne pas se fier à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Veuillez noter que cet article n'est ni un conseil en investissement ni une offre ou une sollicitation d'acquérir des produits financiers ou des cryptomonnaies.

AVANT D'INVESTIR DANS LES CRYPTO ETP, LES INVESTISSEURS POTENTIELS DEVRAIENT PRENDRE EN COMPTE CE QUI SUIT :

Les investisseurs potentiels devraient rechercher des conseils indépendants et prendre en compte les informations pertinentes contenues dans le prospectus de base et les conditions finales des ETP, en particulier les facteurs de risque mentionnés dans ceux-ci. Le capital investi est à risque, et des pertes jusqu'à concurrence du montant investi sont possibles. Le produit est soumis à un risque intrinsèque de contrepartie à l'égard de l'émetteur des ETP et peut subir des pertes jusqu'à une perte totale si l'émetteur ne respecte pas ses obligations contractuelles. La structure juridique des ETP est équivalente à celle d'une dette. Les ETP sont traités comme d'autres instruments financiers.