US Crypto Staking Providers Under Fire

The SEC has gone past sabre rattling and taken punitive measures against staking products that it has long maintained qualify as securities.

On 9 February, Kraken announced that it will be hitting the brakes on staking services for its US customers. The exchange reached a $30 million settlement with the US Securities and Exchange Commission (SEC) for failing to register its products as interest-bearing securities.

The San-Francisco based exchange has more than 9 million clients globally with a daily trading volume numbered at $570 million. Kraken continues to offer its suite of staking products – that offer yields of up to 22% – for its non-US customer base.

Staking is a critical operation of the most modern version of blockchains like Ethereum and in decentralised finance (DeFi) markets. The practice rewards users for contributing to the security of a network by lending or locking up their digital assets in return for rewards.

Kraken's settlement with the SEC has sent a chill across the staking service provider industry as it breathes more life into suspicions that the regulatory body won't stop until it sees all staking products within its jurisdiction coming under the purview of the Securities Act of 1933.

Last year, the now bankrupt BlockFi was forced to pay $100 million to the SEC and various US states for not registering crypto lending products as securities.

SEC Chair Gary Gensler has emphasised that the current crop of staking providers do not provide transparency to customers over how they are protecting or using their staked digital assets. He believes the staking ecosystem needs to come under the guard of federal securities law.

There is a feeling among regulators that crypto exchanges may be lending out customer funds or using them as capital for high-risk trading strategies after the exposure of FTX's malpractices.

The shuttering of staking services from centralised providers like Kraken could be a blessing in disguise for decentralised providers such as Lido and Rocketpool. They would benefit from American users moving to their platforms in order to gain interest in digital assets denied on domestic exchanges.

Decentralised platforms are difficult to shut down because they are peer-to-peer interfaces and not run by a single company. This makes it hard to justify that they represent a common enterprise – one of the pillars of the Howey Test that is used by US regulators to determine what qualifies as a security.

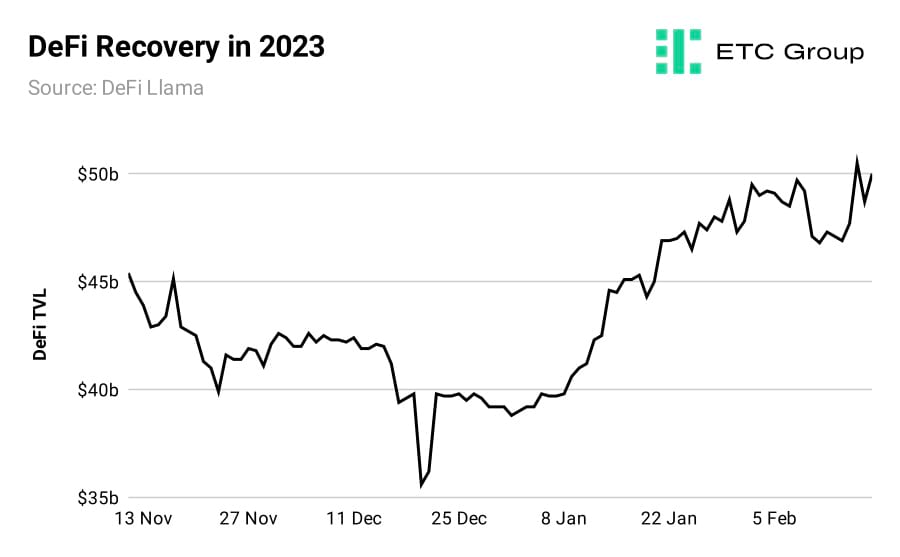

The total value of digital assets locked (TVL) in decentralised protocols has snowballed to $50 billion since the DeFi ecosystem was hit by the demise of FTX. The lion's share of this figure is stored on the Ethereum blockchain that accommodates a range of staking protocols, decentralised exchanges, and yield aggregators.

But centralised platforms have come out swinging. Coinbase CEO Brian Armstrong has said that an industry-wide clampdown on staking would be an all too familiar demonstration of ‘regulation by enforcement' and that the San Francisco-headquartered exchange would prove in court that their staking products are not securities.

Staking fees play a substantial role in diversifying the revenues of leading exchanges like Coinbase and Binance. Exchanges stake digital assets on the blockchain on the behalf of customers and take a small commission for their services when rewards are periodically distributed by blockchain networks like Ethereum and Cardano.

Coinbase is one of the largest depositors of staked ETH on Beacon Chain that will begin to be released after Ethereum's Shanghai upgrade planned for March. There is currently over 1 million ETH – worth $1.9 billion – staked via the exchange.

This circles back to the inability of regulators and US legislators to formally demarcate the difference between crypto and traditional financial assets like equities and bonds. The scenes unfolding in the space also show that regulators are unwilling to update the current legal playbook when it comes to securities regulation.

The Decline of BUSD

On 13 February, it was announced that digital assets company Paxos would stop issuing Binance USD (BUSD) stablecoins under the advice of New York state's financial regulator.

The New York State Department of Financial Services (NYDFS) issued the notice in light of ambiguities surrounding Paxos' relationship with Binance and BUSD – a product co-founded by both companies in 2019 and minted on the Ethereum blockchain.

Stablecoins are digital assets on the blockchain that are pegged to the price of fiat currencies like the US Dollar or commodities like gold.

A spokesperson for NYDFS said the notice was owing to Paxos' reluctance to conduct due diligence on Binance customers and stamp out the use of BUSD in money-laundering schemes.

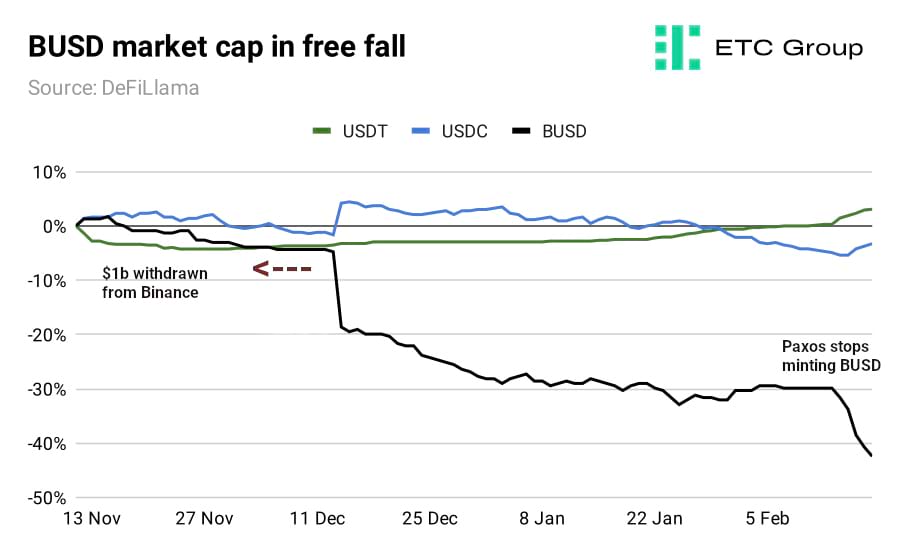

Since the news of the enforcement broke, the market cap of BUSD has shrunk from $16.1 billion to $13 billion. This means the third-largest stablecoin has shed more than 40% of its market cap since the unwinding of FTX last November and lost considerable ground to rival stablecoins USDT and USDC.

On 13-14 December, Binance recorded negative net flows to the tune of $1 billion, equivalent to 6% of the exchange's reserves. The withdrawals were precipitated by concerns over how Binance was safeguarding customer deposits and its inability to adequately show proof of its cryptocurrency reserves.

While Paxos will not be issuing any new BUSD, Binance will still support BUSD trading pairs. The platform doubled down on its native stablecoin last year when it took the unilateral decision to convert USDC, Pax Dollar (USDP), and True USD (TUSD) stablecoin customer holdings into BUSD in an effort to boost its trading volume and market dominance.

But a loss in faith in Binance has crystallised into a loss of faith in the stablecoin bearing its name, Binance USD. This is a big blow for the exchange because customers converting BUSD into alternative stablecoins available on competing exchanges drains Binance of liquidity. According to one estimate, BUSD makes up some 35% of trading volume on the exchange.

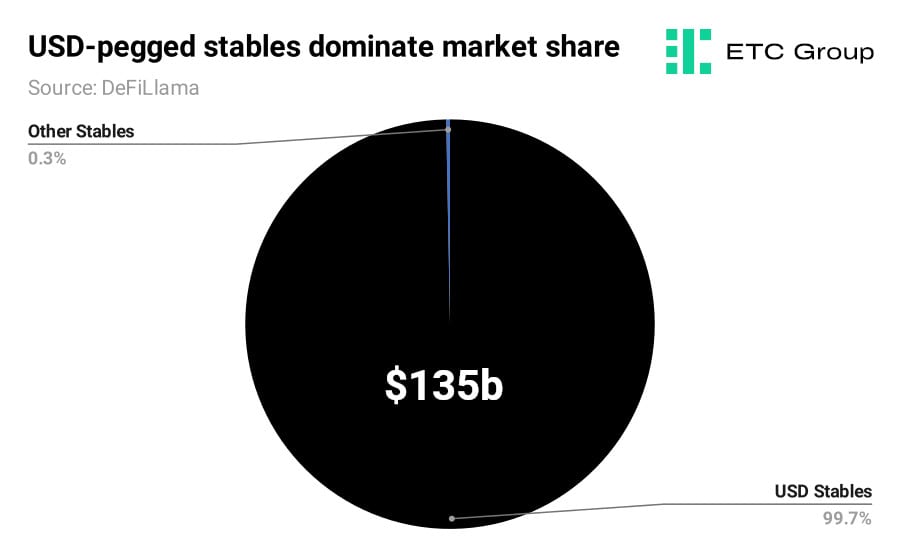

The action against Paxos will make the entire stablecoin industry pause for thought as they consider what ramifications it may hold for the $136 billion market. Paxos has already sounded the alarm that the SEC may take legal action against BUSD for serving as an unregistered security.

A broadened definition of what constitutes a security will not be in the interest of stablecoin issuers – some of which already have a chequered history with U.S. enforcement bodies. In 2021, Tether, the issuer of the world's largest stablecoin USDT, was forced to pay a $41 million fine to the Commodity Futures Trading Commission (CFTC) over misleading claims about the extent to which USDT was collateralized by fiat currencies.

The CEO of Binance, Changpeng Zhao, has asserted that excessive scrutiny of US Dollar-based stablecoins could drive the stablecoin industry offshore and toward pursuing non-dollar alternatives like Euro or Yen-backed stablecoins.

Such a migration could potentially thwart the dominant role played by USD as serving as the dominant fiat currency in which the price of digital assets are denominated. However, such a scenario seems far-fetched given that the Euro stablecoin market cap is only $199 million – 0.15% of the total stablecoin market cap.

From one perspective, regulators are trying to take preventative action to avoid doomsday situations like the one endured last summer after the depegging of Terra's UST. The unravelling of the algorithmic stablecoin caused harm to millions of investors and contributed to the downfall of some of the market's most over-leveraged crypto hedge funds, lenders, and its weakest exchanges.

The SEC finally took legal action against the issuer of UST, Terraform Labs, last week because of its role in mass securities fraud, price manipulation, and investor deception.

It is unlikely that BUSD will be consigned to the same fate as UST. Paxos has been externally audited on a number of occasions and reported holdings amounting to $16 billion on 31 January. Every unit of BUSD is physically backed by Paxos by cash reserves or equivalents and the company is currently meeting all redemption orders.

Stablecoin legislation must be a top priority for Congress and administrators in 2023. The UK and EU are far ahead in this respect and have already addressed many of the nuances of stablecoins through draft frameworks set to be put into action this year.

Stablecoins are an important innovation because they are easy to access for anyone with an internet connection and can be moved across borders almost instantly at a fraction of the cost banks would charge. In economies facing hyper-infaltion, stablecoins can act as a safe haven for investors looking to escape currency debasement or a shortage of U.S. dollar reserves.

The Case for 5% Bitcoin: Portfolio Boost

Bitcoin is increasingly becoming a popular option for investors looking to diversify buy and hold portfolios.

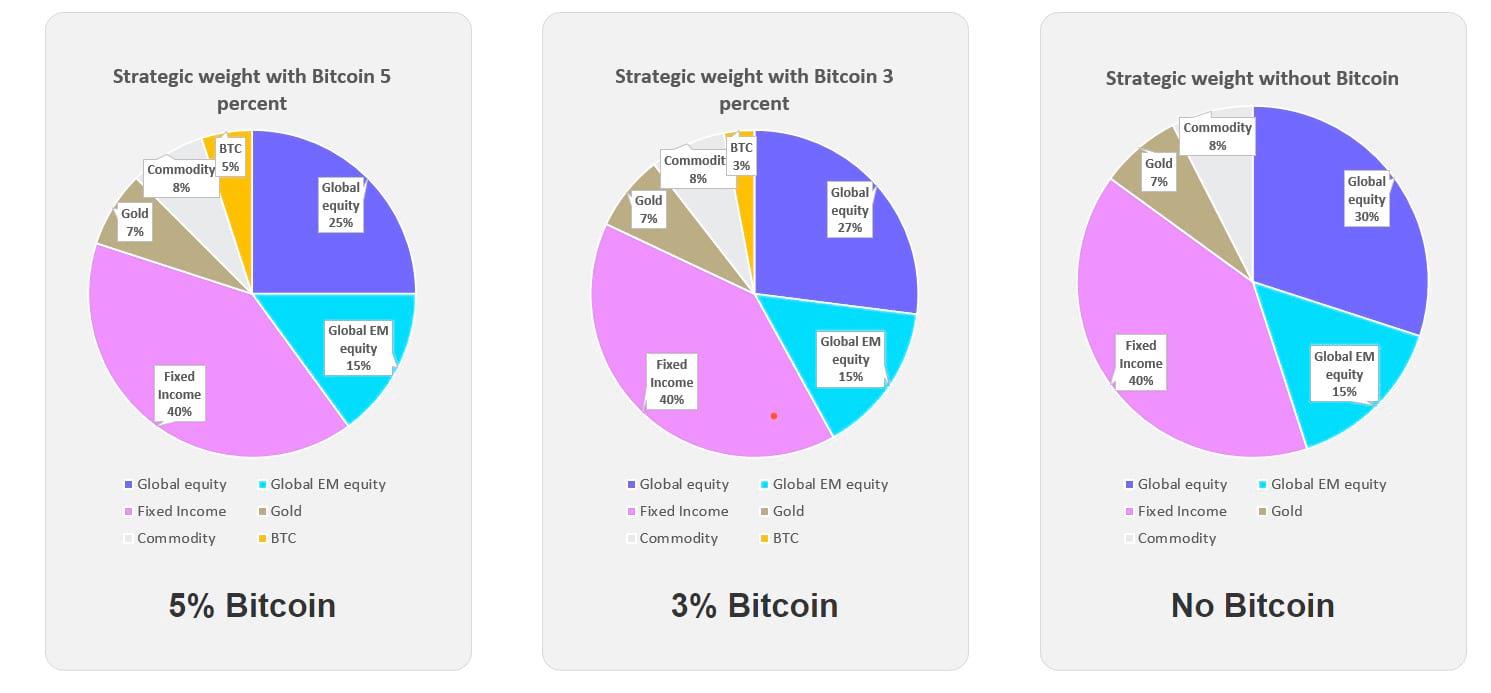

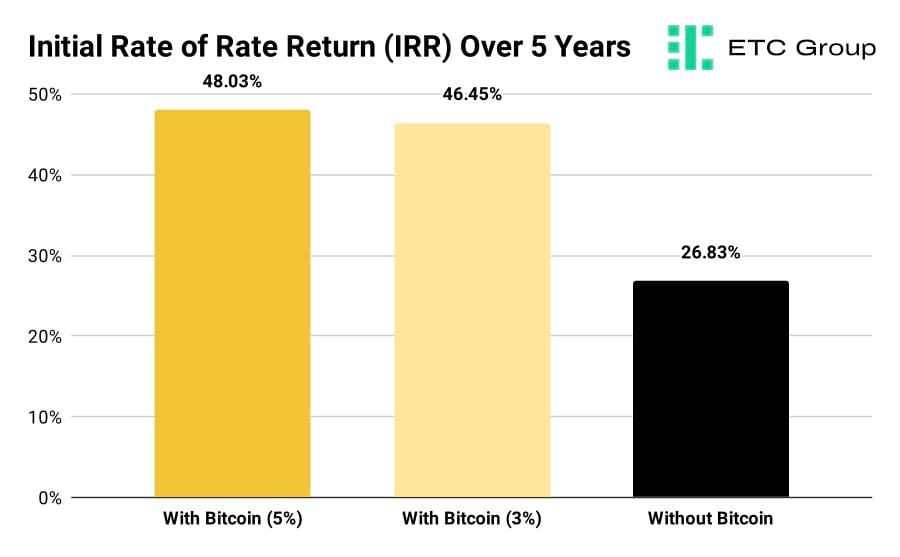

With this in mind, ETC Group simulated the performance of adding Bitcoin to traditional 60/40 portfolios with a starting investment of €100,000 over the past five years.

Outside Bitcoin, the model portfolios consist of ETFs and ETCs with exposure to risk assets like equities, commodities, and gold alongside risk managers like Euro government bonds of mixed maturities.

The daily average price of Bitcoin and accumulating ETFs – underpinned by shares, commodities, and bonds – are taken into account from 2 January 2018 to 2 January 2023. The costs for Bitcoin allocation are neglected due to the minor influence on total returns.

ETC Group found that a mere 5% allocation of Bitcoin to the constructed portfolio would have seen an initial €100,000 grow to €148,000 – a return of 48% within five years before taxes.

Meanwhile, the difference in returns seen from a 3% Bitcoin weighting is only marginal with the value of the portfolio reaching €146,400.

However, the gap between a portfolio with 5% Bitcoin and one without any whatsoever is stark, with the former generating a return 21 percentage points greater.

Bitcoin's performance over the last half-decade was comparable to the performance of other asset classes because momentous bull runs were offset by precipitous drawdowns. Portfolio returns can largely be attributed to annual rebalancing and profit taking in the model.

Since the time series tests the performance of digital assets integrated into classical 60/40 portfolios over the last five years, Bitcoin was the clear choice. A number of other cryptocurrencies were not mature enough to provide historical price data and, if they were, their limited distribution made them less representative of the wider market.

For future results, a basket of multiple cryptocurrencies can be considered as the cryptocurrency market is maturing.

The results of this analysis will resonate with buy and hold portfolios that absorbed varying amounts of Bitcoin early on and implemented routine rebalancing.

ETC Group's portfolio model is only indicative of past performance. It does not imply that there is any guarantee of mirroring these returns in the future given Bitcoin's volatility, macro-economic pressures, and black swan events that influence the trajectory of other asset classes.

Markets

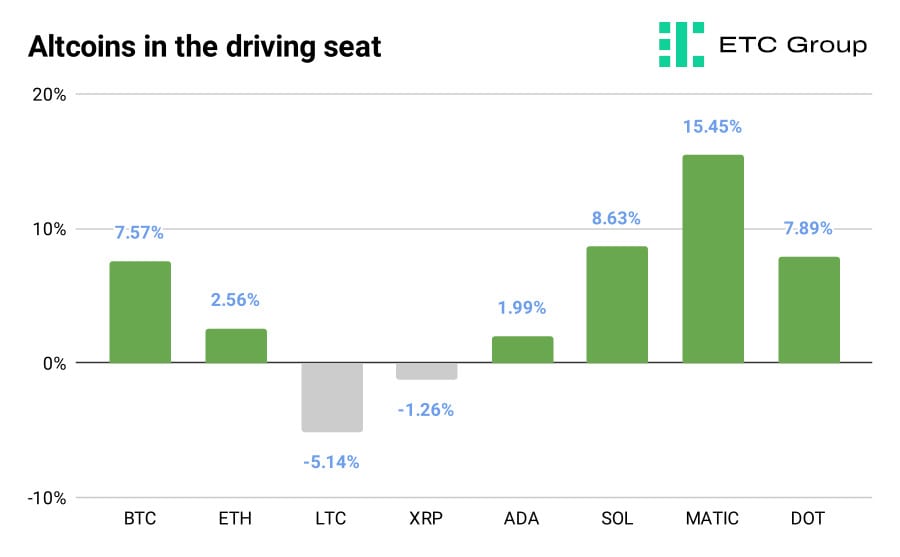

Bitcoin has had a strong performance over the last fortnight and risen to $24,700. But it has been unable to consolidate above the $25,000 resistance zone in spite of repeated attempts by bulls to mount a breakthrough.

The market dominance of Bitcoin stands at 42% – a level it hasn't occupied since July 2022.

Ethereum has had a less meteoric rise, with the digital asset now trading hands at $1,680. Ethereum has been deflationary since 16 January, and its total supply has reduced by 31,000 ETH since last September's historic Merge network upgrade.

Ethereum sidechain Polygon (MATIC) has seen its price soar by 40% in the last month to $1.4. The scaling solution recently revealed that its zkEVM beta network will go live in March. This will make it easier for Ethereum developers to transfer code and build on Polygon without having to use a new programming language.

Solana (SOL) and Polkadot (DOT) have followed suit with both smart contract platforms posting gains of 8%. SOL trading volumes were bolstered by news that Helium, a peer-to-peer hotspot network, will be shifting to the Solana blockchain next month. The Helium community voted to shut down its own blockchain and relocate to Solana last year.

AVIS IMPORTANT :

Cet article ne constitue ni un conseil en investissement ni une offre ou une sollicitation d'achat de produits financiers. Cet article est uniquement à des fins d'information générale, et il n'y a aucune assurance ou garantie explicite ou implicite quant à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Il est recommandé de ne pas se fier à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Veuillez noter que cet article n'est ni un conseil en investissement ni une offre ou une sollicitation d'acquérir des produits financiers ou des cryptomonnaies.

AVANT D'INVESTIR DANS LES CRYPTO ETP, LES INVESTISSEURS POTENTIELS DEVRAIENT PRENDRE EN COMPTE CE QUI SUIT :

Les investisseurs potentiels devraient rechercher des conseils indépendants et prendre en compte les informations pertinentes contenues dans le prospectus de base et les conditions finales des ETP, en particulier les facteurs de risque mentionnés dans ceux-ci. Le capital investi est à risque, et des pertes jusqu'à concurrence du montant investi sont possibles. Le produit est soumis à un risque intrinsèque de contrepartie à l'égard de l'émetteur des ETP et peut subir des pertes jusqu'à une perte totale si l'émetteur ne respecte pas ses obligations contractuelles. La structure juridique des ETP est équivalente à celle d'une dette. Les ETP sont traités comme d'autres instruments financiers.