Nine US Ether futures ETFs go live on the same day

The launch of nine Ether futures ETFs on the same day was a source of great excitement in the US. As expected, speculators tried to front-run the launch.

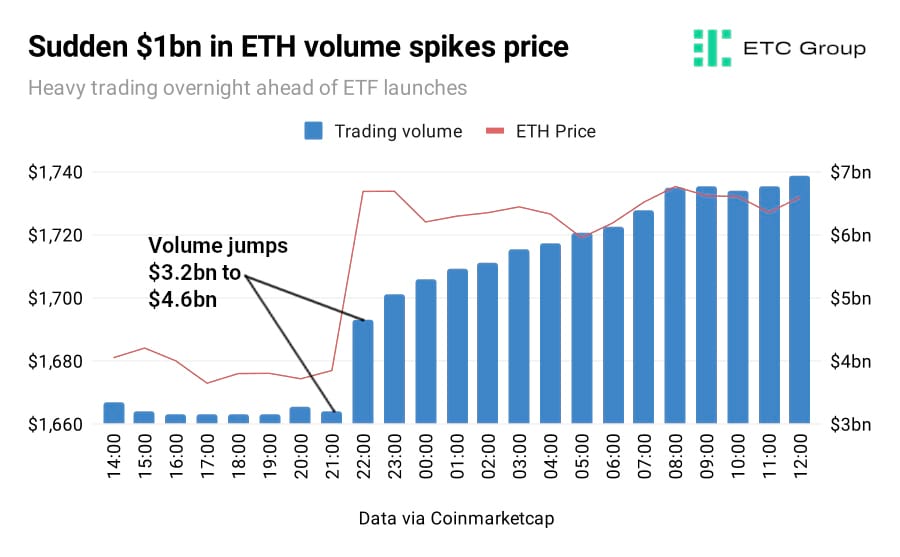

There were signs of heavy trading in Ether overnight on 1 October, suggesting that Asian traders were picking up ETH in large amounts. Between 9pm and 10pm UTC on 1 October, ETH trading volume jumped from $3.2bn to $4.6bn and continued rising, sparking a 5% rise in the price of ETH.

Capital inflows saw open interest for ETH futures on crypto native exchanges jump by $110m and saw Ether move above $1,700.

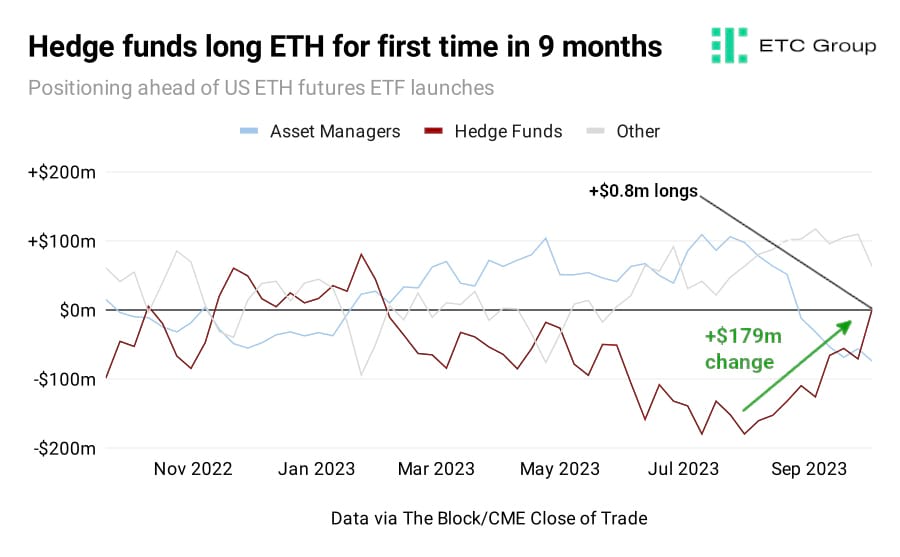

Also marking a change in long-term trends, hedge funds' net positions on CME Ether futures switched long for the first time in nine months. The last time hedge funds were net long was 31 January 2023.

The level of position switching totalled $179m short ETH futures from the low point on 1 August 2023 to $874k long as of 3 October.

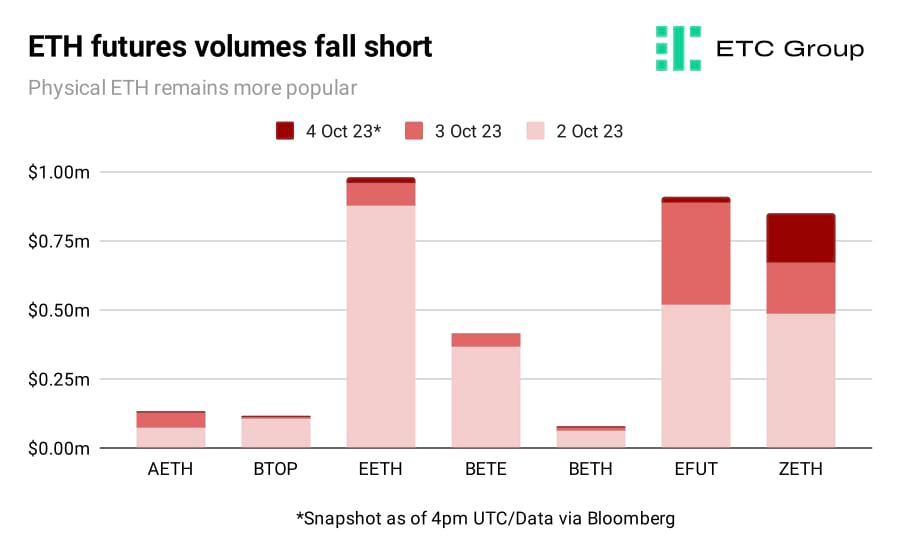

While the ETH futures ETF trading volumes were around average for a standard ETF launch, they did not live up to the first Bitcoin futures ETF in the States, ProShares' BITO, which notably traded more than $1bn in its first day. That, of course, launched at the height of the last bull market, in October 2021, when Bitcoin sat at around $60,000.

As Coindesk reported:

Among the more popular of the new ETFs, Van Eck's Ethereum Strategy ETF (EFUT) traded just shy of 25,000 shares at a price roughly averaging $17 per share for a total dollar volume of just $425,000.

After the launch on 2 October, Bloomberg trade data also showed a clear preference for physical ETH ETPs like ETC Group Physical Ethereum ETP (ZETH).

ETC Group's physically-backed spot Ether ETP (ZETH), which launched in March 2021, has an average weekly trading volume of $1.67m, despite not enjoying the same fanfare as this clutch of American products. It could be, then, that investors are simply not as interested in derivatives-based exchange traded products as their physically-backed counterparts.

In general, futures-based ETPs and ETFs face additional drags (including the cost of continually rolling over futures contracts), and do not track the price of underlying assets as closely as physically-backed products.

One could suggest that the lack of action is down to the fact that crypto markets are currently bearish-to-neutral from a sentiment perspective.

But issuers were feeling more confident that spot Bitcoin ETFs could now be approved, with Van Eck CEO Jan van Eck telling CNBC:

It looks like early in 2024 we will probably see a spot product,

and Bitwise CIO Matt Hougan adding:

I expect we'll see a spot Bitcoin ETF this calendar year.

While SEC chairman Gary Gensler has repeatedly denied or delayed every attempt by asset managers to launch a US-based spot Bitcoin ETF, the tide appears to be turning in this regard. In a recent five-hour grilling at the hands of the US Financial Services Committee Rep Andy Barr launched a particularly savage attack, accusing Gensler of being like the “Tonya Harding of securities regulation because you are kneecapping US capital markets.”

Regulatory certainty or approvals of any kind tend to be a risk-reduction indicator for crypto markets, while at the same time offering an upwards turn in sentiment.

Altcoin season returns? ETH & BTC related assets jump in risk/reward plays

Altcoin season is a crypto market cycle generally noted to return when fundamentals of the top two digital assets start to swing in a positive direction, while sentiment also improves more broadly. At this point, speculation and trading volume returns to crypto markets as investors and traders seek larger gains further out on the risk/reward curve.

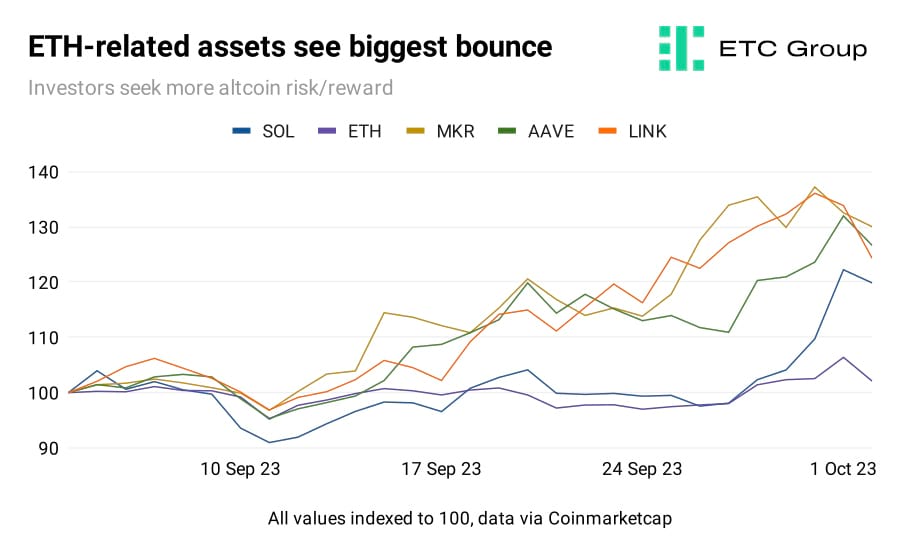

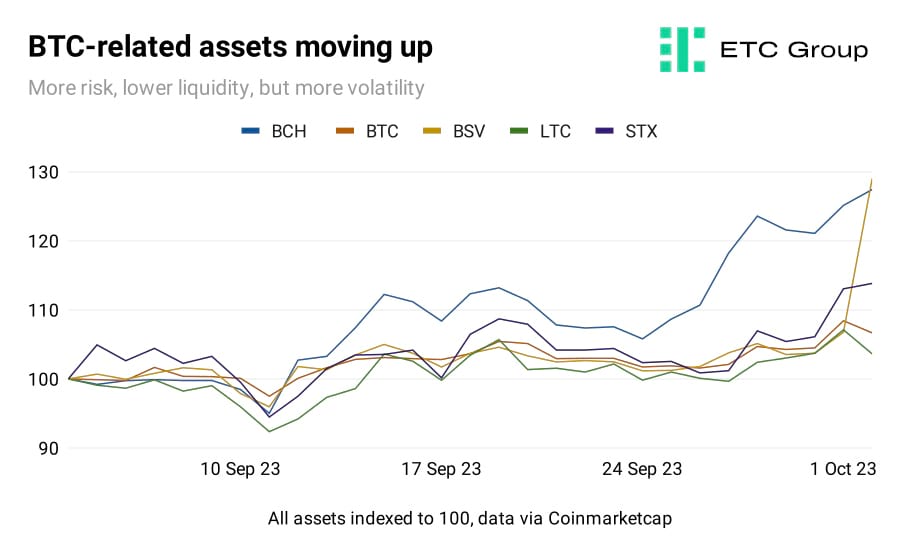

As we will see, while ETH and BTC are both slightly higher in the last month, it is related assets and rival chains which are seeing the largest gains over and above the two blue-chip cryptos.

Indexing each asset's relative price rises allows us to show how far each has moved against one another.

Ethereum-related digital assets enjoyed large upswings over the past month in the lead up to the launch of nine Ether-based futures ETFs in the US. The implication here is that more institutional capital will now be able to flow into Ethereum's broad ecosystem of financial apps and markets.

For ETH-related assets, the largest gainers include rival Layer 1 chain Solana; price oracle Chainlink (LINK), which is an ERC-20 token; the DAI stablecoin issuer Maker (MKR); and the DeFi lending protocol Aave (AAVE), the latter two of which have their largest markets on the Ethereum blockchain.

But the trend has not been limited to Ethereum, which suggests the very beginnings of a new altcoin season could be upon us.

Bitcoin has fewer altcoin proxies in the market due to its lack of associated markets, tokens, and smart contract development, but the same thing appears to be happening here, too.

Bitcoin Cash (BCH), the Bitcoin fork focused on faster block times to allow the chain to scale to be a cross-border payments mechanism (instead of Bitcoin's digital gold-like store of value) has enjoyed a near 30% rise in the last 30 days.

Stacks (STX), a protocol designed to implement smart contract tooling on the Bitcoin blockchain, has also historically shifted higher when markets reprice Bitcoin upwards.

This suggests that investors see green shoots of positivity amid the last two years of a bear market, and are starting to place their bets on lesser-traded, more volatile digital asset proxies.

And the relative lack of movement in the larger-cap Bitcoin-related assets like Litecoin would seem to support this argument.

Investors may, of course, prefer to keep an eye on ETC Group's crypto basket product DA20 , which tracks the prices of the top 20 assets by market cap. While there are notable opportunities in small-cap altcoins in bullish markets, these bring with them dramatically increased concentration and liquidity risks.

Crypto the bright spot amid macro doom and gloom

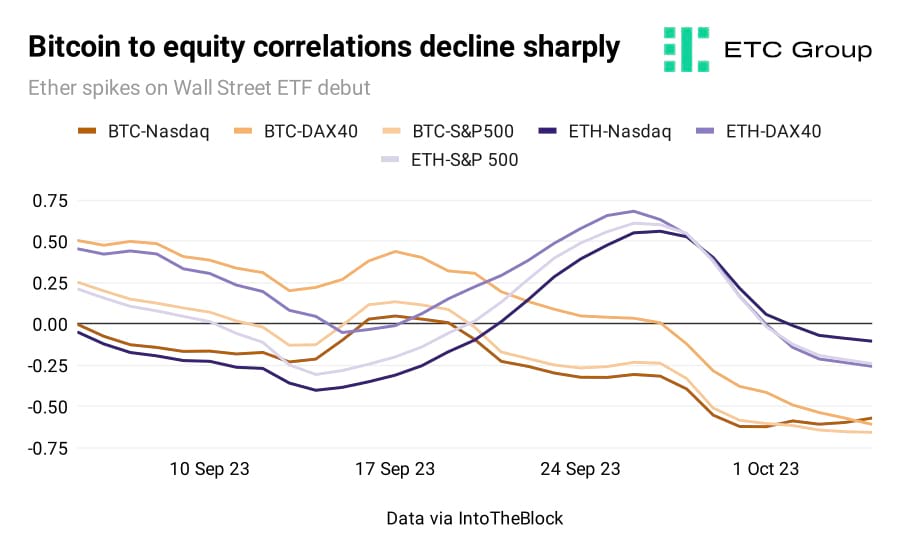

Crypto correlations with equities have plummeted in recent months, shining a spotlight on how these assets could be used to diversify portfolios, and even as hedges against wider market malaise.

China's failed re-opening and property market woes, along with other considerations such as the troubling performance of the yuan and Indian rupee against a very strong US dollar, give us a set of weak macro data posing increased headwinds for traditional portfolios.

Suggestions of higher-for-longer central bank interest rates in the US, Europe and the UK also put the brakes on any equity market rallies.

And we have seen the outcome of such moves in the correlation coefficients for Bitcoin and Ethereum.

Ether's Wall Street debut pushed correlations with equity indices higher, before returning to type as of the start of October at below zero. Bitcoin has seen its correlations with tech stocks, US equities and Euro-area equities decline sharply in recent months, ending the most recent sessions with the Nasdaq 100, S&P 500 and DAX 40 all below minus 0.5.

30-day correlations show how assets tend to move in relation to one another.

A correlation near zero implies no directional cohesiveness, while figures closer to -1 show that Bitcoin/Ethereum and the asset or index in question tend to move in opposite directions.

On longer timeframes, both Bitcoin and Ether are much less correlated than is traditionally supposed.

AVIS IMPORTANT :

Cet article ne constitue ni un conseil en investissement ni une offre ou une sollicitation d'achat de produits financiers. Cet article est uniquement à des fins d'information générale, et il n'y a aucune assurance ou garantie explicite ou implicite quant à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Il est recommandé de ne pas se fier à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Veuillez noter que cet article n'est ni un conseil en investissement ni une offre ou une sollicitation d'acquérir des produits financiers ou des cryptomonnaies.

AVANT D'INVESTIR DANS LES CRYPTO ETP, LES INVESTISSEURS POTENTIELS DEVRAIENT PRENDRE EN COMPTE CE QUI SUIT :

Les investisseurs potentiels devraient rechercher des conseils indépendants et prendre en compte les informations pertinentes contenues dans le prospectus de base et les conditions finales des ETP, en particulier les facteurs de risque mentionnés dans ceux-ci. Le capital investi est à risque, et des pertes jusqu'à concurrence du montant investi sont possibles. Le produit est soumis à un risque intrinsèque de contrepartie à l'égard de l'émetteur des ETP et peut subir des pertes jusqu'à une perte totale si l'émetteur ne respecte pas ses obligations contractuelles. La structure juridique des ETP est équivalente à celle d'une dette. Les ETP sont traités comme d'autres instruments financiers.