Bitcoin dip to $25k has long-term investors seeking entry point

A combination of macro concerns and a period of record low volatility has left Bitcoin in an intriguing position as we head into the third quarter of the year.

BTC had been trading against the US dollar in an extraordinarily tight range for the last two months; sticking between $29k and $30k between 21 June and 15 August. Was this Bitcoin becoming boring, or was there something else going on in the background? A full 8 weeks of basically no price movement in Bitcoin is unheard of: something we as analysts have certainly never seen before.

It came to a head on 17 August, when selloffs in equities and bonds began with macro jitters over China's failure to launch from its post-Covid reopening, spreading to digital assets after a Wall Street Journal report about Elon Musk's SpaceX writing down the value of its Bitcoin by a total of $373m last year. While this was old news, it appears to have contributed to short-term bearishness.

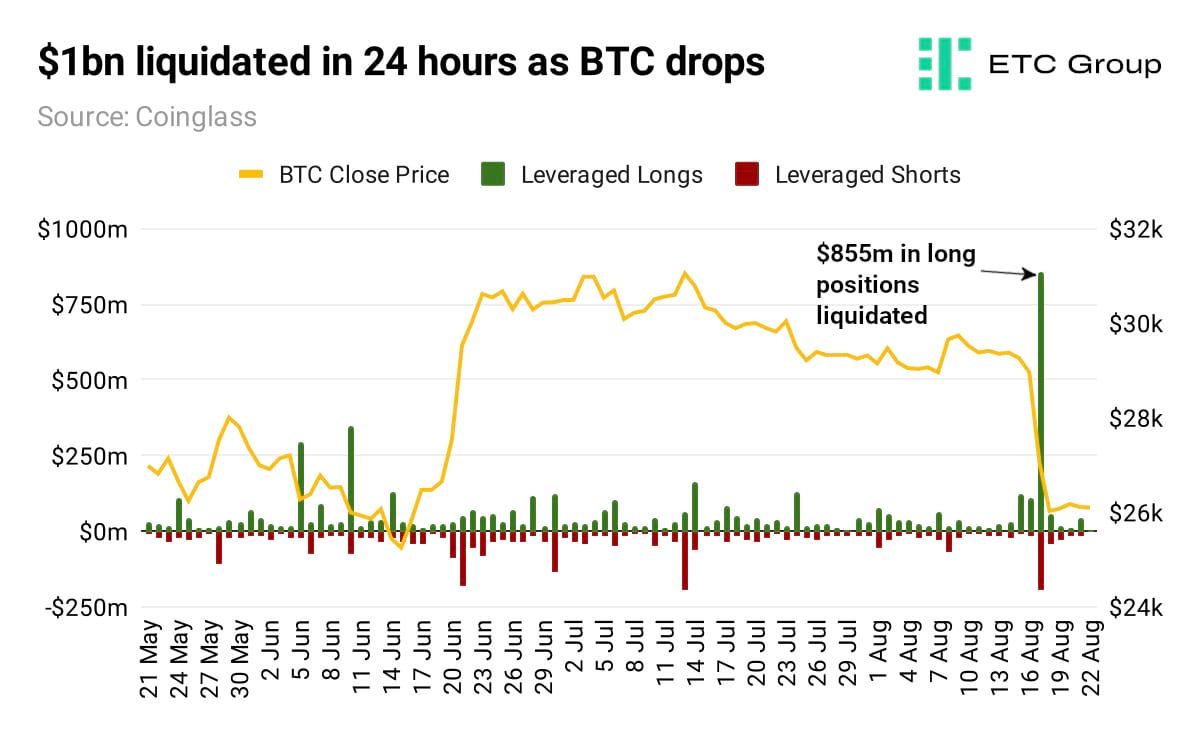

Then came a very large leveraged liquidation event as crypto-native exchanges like Binance and OKEx began auto-liquidating traders' positions. Across the crypto market, traders using leverage were punished as BTC broke down below key technical levels, with $1.04bn in both long and short positions liquidated across 24 hours.

According to futures and options data provider Coinglass, this represented an increase of 580% on the previous day.

$855.31m in leveraged long positions, and $194.18m in leveraged short positions were also liquidated across top exchanges. At 48.3% of the total, Bitcoin trades were the largest contributor to these losses. Ethereum, at 29.6%, XRP at 2.4% and Litecoin at 1.8% were the next three largest.

Crypto-native exchanges allow retail traders to borrow money to trade with increased leverage, amplifying their gains on one hand, but exacerbating their losses if the market moves against them.

Spot Bitcoin fell as low as $25,409 before retracing back to retake $26k as investors with dry powder on hand swooped in to buy the dip.

Elsewhere, given the record fast pace of interest rate rises, fixed income in US treasuries and other government bonds have been a great place for investors to hide and simply collect their “risk-free” 3%-4% yields.

However, we believe that Bitcoin will become the release valve where investors will flee in times of trouble, taking market share from gold (which has gained 53% in the last five years compared to Bitcoin's 252%), but also from fixed income and longer-dated treasuries.

Bitcoin is not there yet: it will require a market cap in excess of $1 trillion in order to soak up the liquidity coming in from fixed income, but this is the obvious direction of travel.

We may even get there sooner than we think.

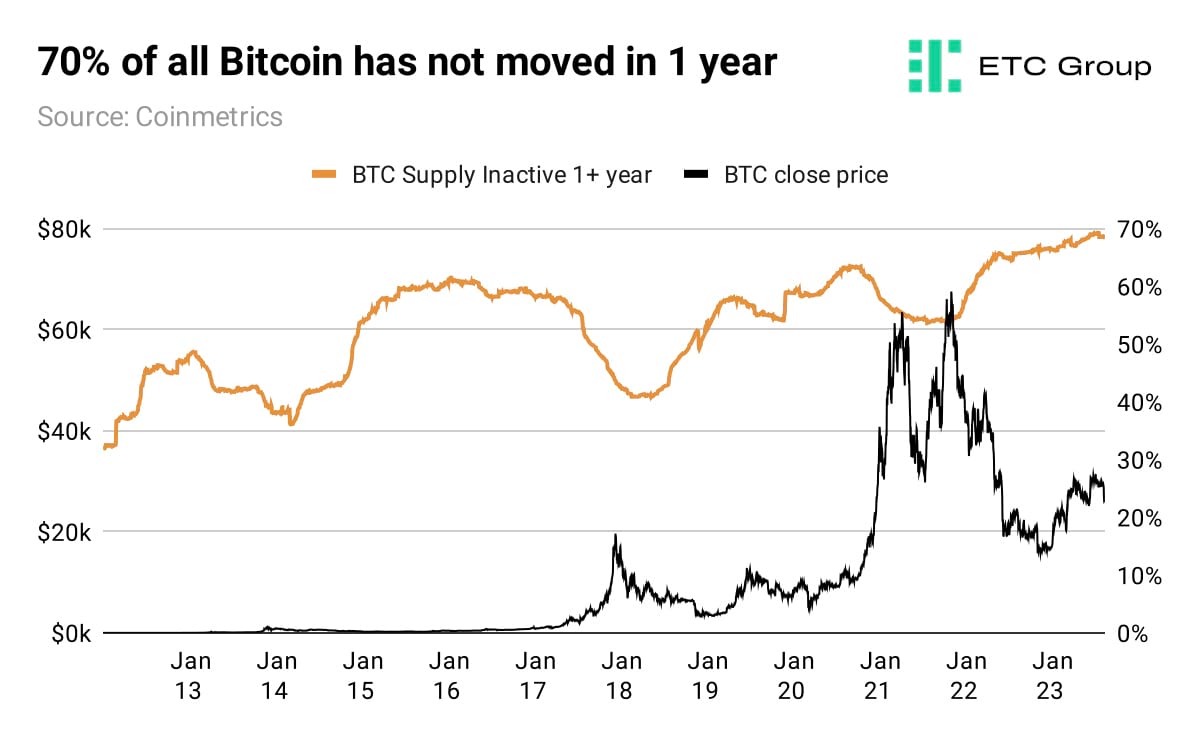

On a longer time frame, early movers and Bitcoin HODLers have clearly set out their stall already. 70% of Bitcoin's circulating supply has not moved in 1 year, and over 50% has not moved in two years.

This latter cohort could have sold and taken profits at any point up to the BTC all time high of $67k in November 2021, or indeed at any point all the way down to where we are now at $26k. So, what does this tell us? That these investors are holding out for a sell price much higher than $67k.

This is significant as it tells us there is a very strong floor in ownership. We believe this chimes with the trend of crypto investors seeing trouble brewing in the banking sector and are at the same time seeing their cash dued through inflation and the mixed messaging efforts of central banks.

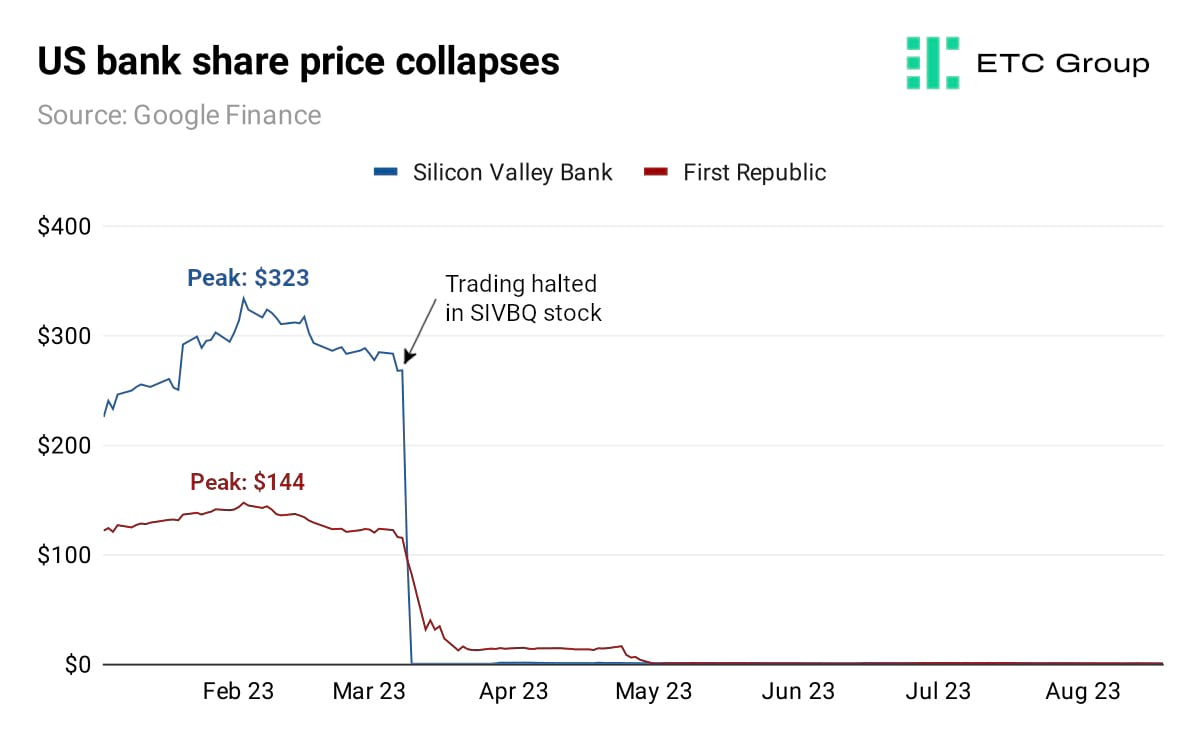

Despite a concerted effort to cut off banking access to Bitcoin in the US, the Federal Reserve has watched while banks have failed and Bitcoin has marched on regardless, with some investors treating the cryptocurrency as a release valve, or hedge against calamity in the banking sector.

After the collapse of the $212bn Silicon Valley Bank in March, and First Republic Bank, which had its assets seized by the FDIC in May, market observers have been eagerly watching to see if there were more dominos to fall.

The first signal of an extended banking downturn came on 8 August, when ratings agency Moody's downgraded the credit ratings of 10 US banks, as well as putting a host of larger names on notice. S&P followed soon after, cutting the credit ratings of small and mid-sized US banks citing ‘tough operating conditions'. In a note, the S&P said the 500 basis point rise in interest rates by the Fed was fuelling liquidity concerns.

Over time, and as adoption grows and available supply diminishes further, we expect Bitcoin to become ever more a channel to which investors flee in times of trouble.

More Austrians own Bitcoin than have a company pension - JP Morgan

A study by the Austrian division of JP Morgan's asset management arm has found that more Austrians own Bitcoin than have a company pension. The data was sourced from a survey of more than 1,000 men and women in Austria released on 20 August 2023.

Finanzbarometer Österreich 2023 found that 14% of Austrians were invested in cryptocurrencies, compared to 11% who said they owned bonds, while just 10% noted they were invested in a company pension.

The JP Morgan survey also found widespread dissatisfaction that drastically increased interest rates across the EU had made loans and mortgages much more expensive to service, but had not yet trickled down to bank offerings nor improved the return on cash for savers.

The European Central Bank had held interest rates in the euro area at or near zero for six years between 2016 and 2022, before moving rates 425 basis points higher in a single year. This makes the quantitative tightening over the last 12 months the fastest in European economic history.

Previous qualitative studies focused on Austria have found that crypto ownership tends to skew towards young people who have grown up online - so-called digital natives - rather than those born before the invention of the internet.

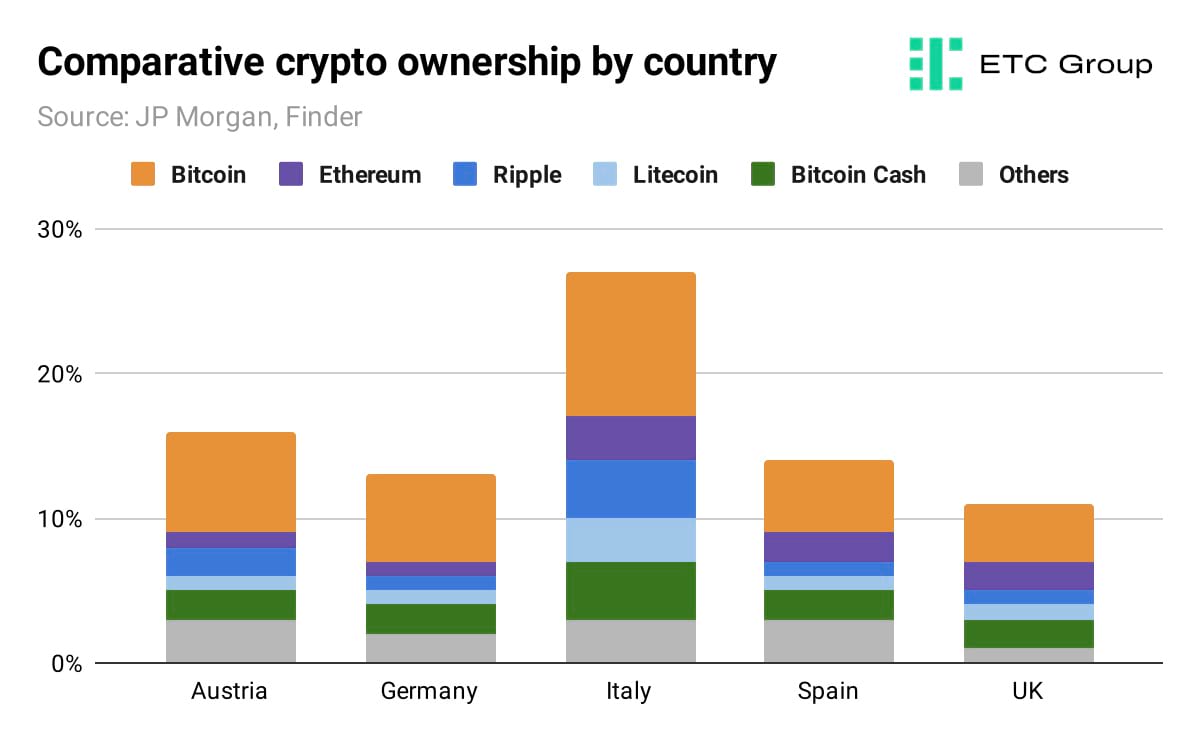

JP Morgan's study also chimes with a global 2022 survey of 42,000 investors by comparison provider Finder, which concluded that 14% of Austrians owned cryptocurrencies in one form or another.

This compared with 11% of Germans and 8% of UK investors. Bitcoin was by far the largest asset owned in Austria, followed by Ripple, Bitcoin Cash, Ethereum and Litecoin. The largest cryptocurrency ownership in Europe was discovered in Italy, where over 21% of respondents reported owning the assets.

The survey found that the largest cohort of owners in Austria were in the 18-24 age bracket. It was a similar story in Spain and Belgium, where the largest proportion of cryptocurrency owners were under 25 years old. The same was not true in Norway, where the average age of Bitcoin holders was over 45 years old.

The level of Bitcoin ownership is perhaps not surprising, given Austria's large fintech sector.

Crypto-specific platforms like transaction monitoring software firm Blockpit, data provider Liquidary and trading venue Coinpanion have become some of the country's leading blockchain businesses.

Austria has in the past taken a somewhat laissez-faire approach to regulating cryptoassets, but efforts by its regulators have been superseded by the landmark Markets in Crypto Assets (MiCA) regulation that passed in April this year.

In the immediate aftermath of this regulatory clarity, it was one of Europe's most traditional banks which put its head above the parapet.

On 20 April Raiffeisenlandesbank NÖ-Wien (RLB) announced plans for a retail investment offering with Vienna-based cryptocurrency exchange Bitpanda: a white-labelled app to include cryptocurrencies, stocks, ETFs, precious metals and commodities.

RLB said it wanted to allow investors the ability to take part from as little as one euro, citing a study showing almost a third of 20 to 39-year olds use platforms like Bitpanda's exchange.

Investigating Coinbase: Diversify, win futures, beat Binance

If ever there was a bellwether stock in crypto it is surely Coinbase (NASDAQ:COIN). When the San Francisco exchange debuted via direct listing on the Nasdaq in April 2021, it was the event of the year: the first major cryptocurrency company to list its shares on a US stock exchange and a signal that crypto had blown past the early adopters to find a new and diversified investor base.

By October 2021, Citigroup had initiated coverage of COIN with a rosy $415-a-share price target, citing Coinbase as “crypto's general store”, providing a one-stop-shop with all of the services this new class of digital asset investors required.

But a deep bear market kicked off 12 months after listing, in May 2022, with the collapse of the algorithmic stablecoin experiment TerraUSD and its sister coin LUNA.

It has been a tough road back to prominence for Coinbase and its share price, but cutting 950 staff and making a swathe of recent moves to diversify its revenue base has analysts eyeing better times ahead. And increased regulatory attention on Binance - by far the world's largest retail trading platform for cryptocurrencies - means Coinbase CEO Brian Armstrong now has his opposite number CZ Zhao firmly in his sights.

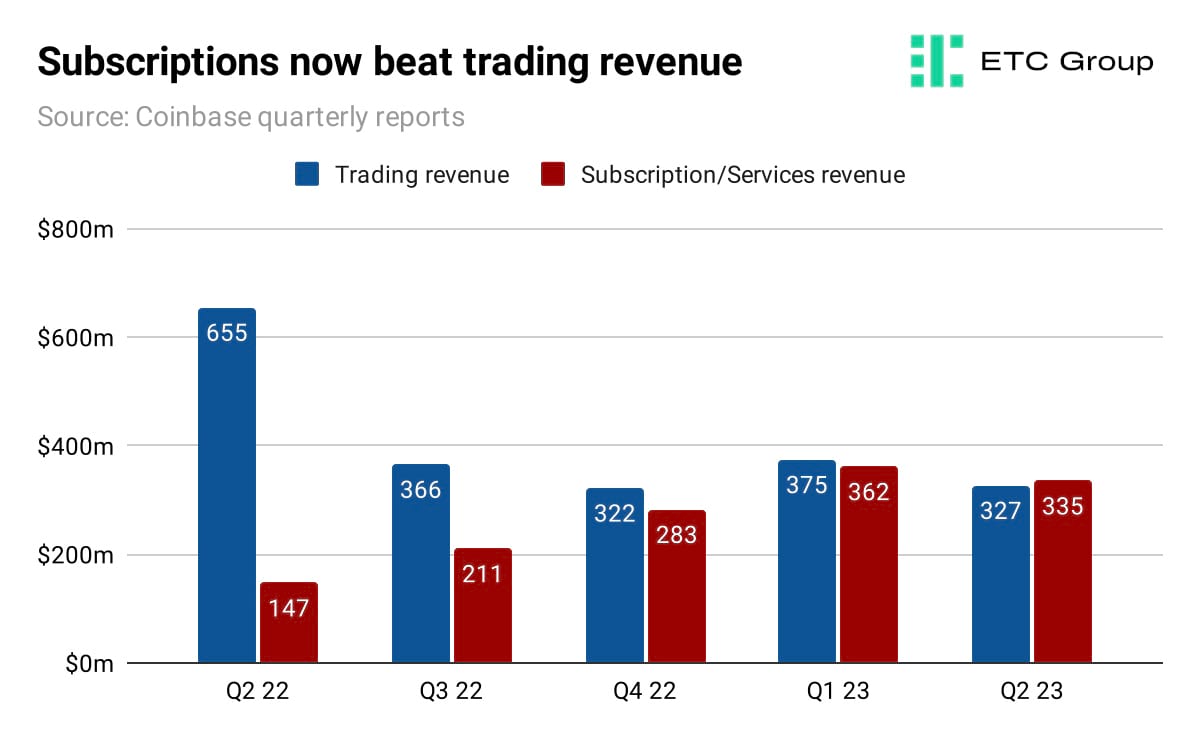

As reported in its Q2 2023 results on 3 August, subscriptions and services on the Coinbase platform outpaced revenue from trading for the first time.

These included staking rewards on the Ethereum blockchain, its Prime brokerage services and Coinbase One, which allows fee-free trading for a monthly subscription fee.

Trading volumes and therefore revenues are extremely cyclical (i.e. they are higher in bull markets and lower in bear markets), so more regular subscription income was exactly the kind of move that Wall Street was looking for.

More recently, Coinbase International, its non-US arm, has seen volumes pick up with $280m of trades recorded across a 24-hour period.

Add a 14 August official launch in Canada - along with banking payment rail support from Interac - and the 16 August regulatory win from the National Futures Association to offer Bitcoin and Ethereum futures trading in the US, and Coinbase's future starts to look a lot substantially better.

There are also notable acquisitions going on in the background. In March, Coinbase bought out noted investment firm One River Asset Management, which had $150m in Ethereum and Bitcoin on its books. In the last couple of days, Coinbase Global took an as-yet-undisclosed equity stake in the USDC stablecoin issuer Circle. USDC has lost substantial market share to its nearest rival USDT in recent months, and has had to contend with Paypal entering the stablecoin market with PYUSD, as reported in previous Crypto Minutes.

The final piece of the puzzle, in terms of regulatory acceptance, could come in the form of the spot Bitcoin ETFs from BlackRock et al, now working their way through the American system. Coinbase shares jumped 12% on the day the company was named as surveillance sharing partner for Cboe's BZX Exchange in five of its spot Bitcoin ETF applications.

AVIS IMPORTANT :

Cet article ne constitue ni un conseil en investissement ni une offre ou une sollicitation d'achat de produits financiers. Cet article est uniquement à des fins d'information générale, et il n'y a aucune assurance ou garantie explicite ou implicite quant à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Il est recommandé de ne pas se fier à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Veuillez noter que cet article n'est ni un conseil en investissement ni une offre ou une sollicitation d'acquérir des produits financiers ou des cryptomonnaies.

AVANT D'INVESTIR DANS LES CRYPTO ETP, LES INVESTISSEURS POTENTIELS DEVRAIENT PRENDRE EN COMPTE CE QUI SUIT :

Les investisseurs potentiels devraient rechercher des conseils indépendants et prendre en compte les informations pertinentes contenues dans le prospectus de base et les conditions finales des ETP, en particulier les facteurs de risque mentionnés dans ceux-ci. Le capital investi est à risque, et des pertes jusqu'à concurrence du montant investi sont possibles. Le produit est soumis à un risque intrinsèque de contrepartie à l'égard de l'émetteur des ETP et peut subir des pertes jusqu'à une perte totale si l'émetteur ne respecte pas ses obligations contractuelles. La structure juridique des ETP est équivalente à celle d'une dette. Les ETP sont traités comme d'autres instruments financiers.