Crypto contagion fears ease

Time heals all wounds, so the saying goes. After a very difficult period for holders of all stripes, there are signs that the heaviest selling at these prices is coming to an end. As FTX Head of OTC Jon Cheeseman explained this week:

Sometimes all it takes for markets to turn is not for massive buying to occur but for aggressive selling to end.

Barring a US CPI print way above forecasts of 8.8%, (due on Wednesday 13 July) it appears markets will stabilise as crypto contagion fears lessen.

That's not to say we couldn't see another fall lower: below Bitcoin's current price level in the $19k-$20k area, there remains a large amount of support in the $17k and $13.9k regions. Analysts are watching these levels very closely.

The collapse of several interconnected counterparties in the lending portion of the crypto market had spread shock and risk through the system, with a number of high profile defaults. Contagion was the watchword.

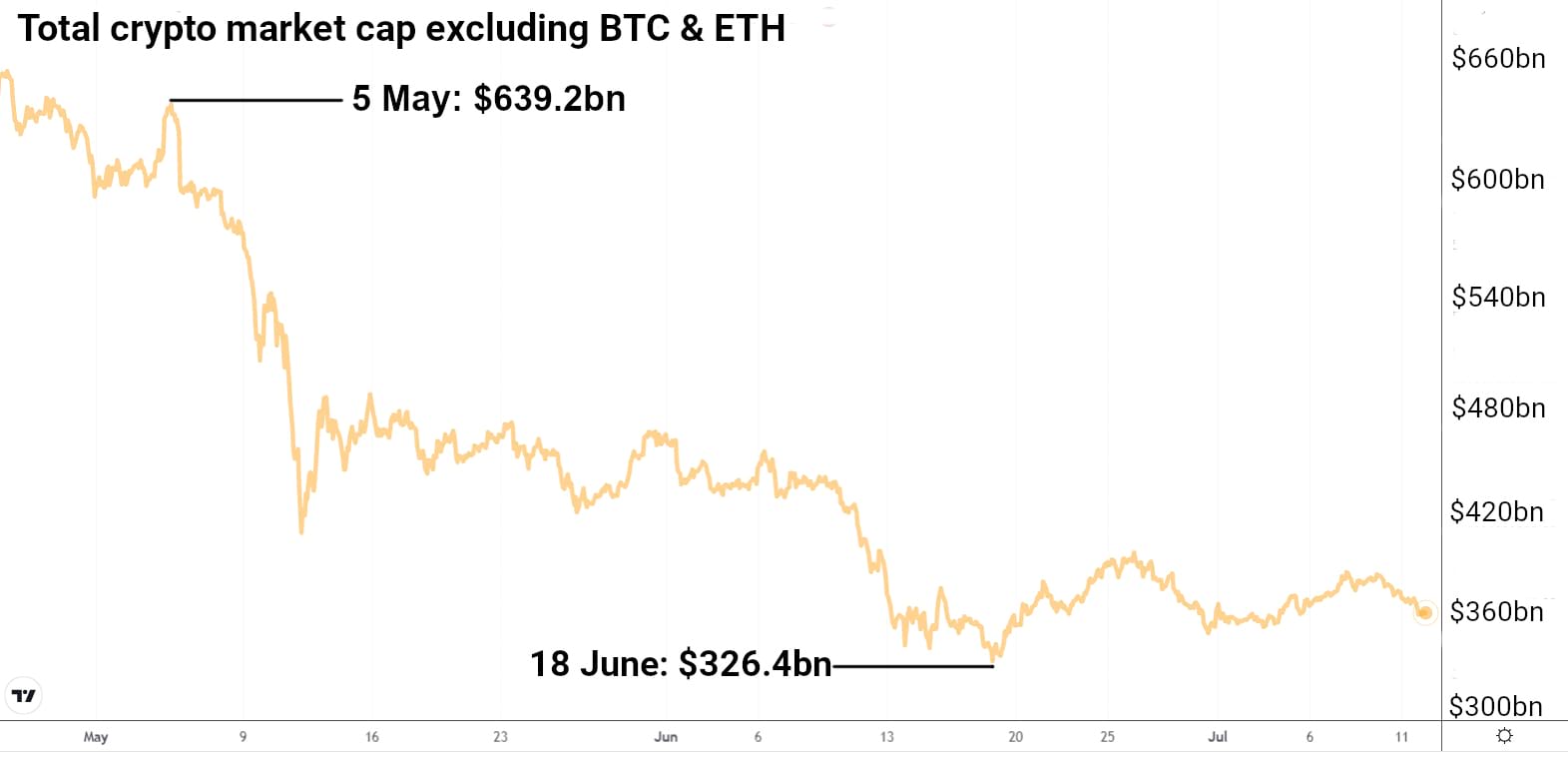

And there is no doubt a spotlight has been shone on a poorly-understood area of the market. Altcoins have taken by far the largest hit of this bear market: the total market cap excluding blue-chips Bitcoin and Ethereum dropping by 48.9% by 18 June.

When crypto institutions are all lending to each other, while still believing they are diversified, it only takes one default to spark a domino effect. First to feel the pain of counterparty failure was lender Celsius, which stopped customers from withdrawing crypto assets from its platform on 13 June due to “extreme market conditions”. Three updates later, the last on 30 June, and Celsius is no closer to telling its customers when it may restart its services.

Singapore-based hedge fund Three Arrows Capital, which had used borrowing to supercharge its crypto bets, filed for bankruptcy protection in the US in early July, having defaulted on a loan worth more than $670m in cash and Bitcoin from Canadian broker Voyager Digital. Voyager has sought protection of its own, meeting with angry investors in its first bankruptcy hearing. Singapore crypto lending startup Vauld is another domino to fall, with a 4 July statement noting customers had withdrawn over $197m from its platform in a month, and by 11 July sought a six-month moratorium to prepare for restructuring.

Investors who sought to juice their gains by borrowing or lending riskier assets have been hurt the hardest by the mass deleveraging in crypto DeFi markets. But time has passed without more signs of fresh contagion.

It is too early to say at this stage when bullish market intent might resume. Structural tailwinds evidently remain in crypto's favour, and long-term holders continue to buy on weakness. In the short term there is downside risk from macro factors ranging from recession to conflict in Europe. But from a crypto contagion perspective, what were opaque unknowns have now, at least, come into the light.

Grayscale in dead-end SEC lawsuit over Bitcoin ETF

The structure of crypto asset funds, exchange traded products and ETFs is more important than most investors realise. Choosing the wrong investment vehicle can have dramatic effects on any crypto portfolio.

As a case in point: the world's biggest Bitcoin fund manager Grayscale has sued the SEC. Why? For failing to allow it to change the structure of Grayscale Bitcoin Trust (GBTC) to an ETF. From a legal perspective, GBTC is a ‘grantor trust' that operates in the same way as a closed-ended fund. Grayscale can create new shares in GBTC but can't remove them from the market to account for changing supply and demand.

The upshot is: once Bitcoin goes into the Grayscale Bitcoin Trust, it can't come out again. That leaves nearly $14bn, some 690,000 bitcoins locked in GBTC as of July 2022.

The effect is that shares in GBTC have been trading at a discount since 18 February 2021 and crumbled to 31.4% below its Net Asset Value (NAV) as of 8 July 2022, leaving investors rightly agitated. Since launch in 2013, Grayscale has been touting GBTC as the best way for institutions to gain accurate exposure to the price of Bitcoin, making this a poor reflection of its intent.

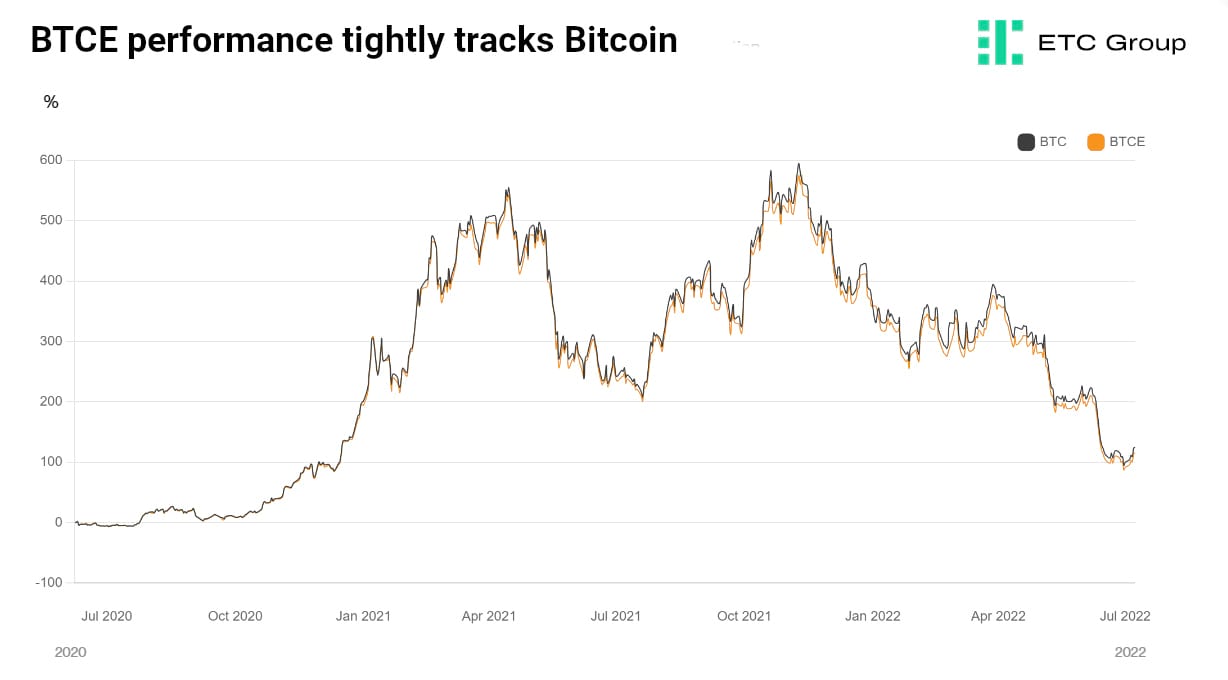

ETPs like BTCE – ETC Group Physical Bitcoin, by contrast, trade in the same way as stocks on national securities exchanges. Their built-in create-redeem function allows them to trade very close to the price of Bitcoin.

When GBTC traded at a healthy premium to NAV between around 2014 and 2021, a simple trade that was extremely attractive to accredited investors was to create GBTC shares by buying at the NAV, then selling those shares on the open market for 10% to 30% gain. That trade is now long gone, with such a sharp discount in GBTC now in evidence.

The SEC has outright rejected every US spot Bitcoin ETF that has landed on its desk in the last decade, a brick wall that has applied to everyone from crypto natives like the Winklevoss twins to massive asset managers like Fidelity, VanEck and WisdomTree.

A ruling is likely in the next 12 months. Grayscale CEO Michael Sonnenshein should not hold his breath.

Europe agrees landmark MiCA crypto legislation

The battle for which continent can legislate first on crypto has come to a head, with Europe pushing through its landmark Markets in Crypto Assets (MiCA) legislation on 30 June 2022. Rules on everything from stablecoins to wallets and trading venues are now expected to come into force across the EU in 2023.

The European Commission came forward with MiCA in September 2020 in a bid to close the gaping hole at the centre of Europe's crypto financial services regulation. While each of the 27 member-states may have their own policies on how to treat crypto, they vary drastically in scope and scale.

Key Takeaways from MiCA

- More redress for users: Crypto asset service providers become liable for losing investor crypto through hacks or insecurity.

- Market participants have to declare their environmental and climate footprint

- Stablecoin issuers effectively become banks. Issuers such as Tether (USDT), Circle (USDC) or the Euro-backed stablecoin Stasis (EURS) will be required to build up liquid reserves in a 1:1 ratio, and will come under European Banking Authority oversight. Every stablecoin holder will be offered a claim to the relevant fiat asset at any time and free of charge. Limits placed on new stablecoins “to preserve [EU] monetary sovereignty”

- NFTs will be regulated separately

Bruno Le Maire, France's Minister for the Economy, claimed MiCA would “put an end to the crypto wild west”, while protecting Europeans invested in the asset class. Policymakers would remain “innovation-friendly to maintain the EU's attractiveness”. This recognises quite strongly that crypto assets have become a key part of the macro mix, alongside commodities, bonds and equities.

It's not surprising to see stablecoins first on the slate for regulation. These coins are the liquidity backbone of the retail market. As digital assets pegged to fiat currencies like the US dollar, they help traders gain access to markets and enhance liquidity. Coins maintain their pegs in different ways, with the most controversial being algorithmic and relying on arbitrage, while the most prominent like Tether and USDC hold equivalent assets in reserve.

Still, the political language on crypto assets has altered dramatically over the past five years. Look back to the last crypto bear market in late 2017 to late 2018, when Bitcoin fell 80% from a $19,100 peak to less than $4,000. The head of the bank for international settlements said crypto was “a bubble, a Ponzi scheme and an environmental disaster”.

Now the European focus is on offering investors more protection while crucially allowing for crypto innovation and global competitiveness. This argument has been hard won.

Bitcoin miners sell up: which will win from Crypto Winter?

Bitcoin miners are facing a cascade of pressures: the depressed price of BTC, rising energy prices, and creditors clawing for loan repayments. This has led to some of the biggest mining companies in the world tucking into their Bitcoin reserves and downsizing operations so they can stay afloat.

Last week, Core Scientific ( NASDAQ:CORZ ), one of the world's largest public miners, reported that it had sold 7,202 BTC in June for roughly $167 million. This represented almost 80% of Core Scientific's Bitcoin treasury and was critical for the company to raise capital, retire debit, and keep pace with deepening operational costs.

Compass Mining is another name caught up in the liquidity drain being felt across the sector. Earlier this month, the company enforced a round of layoffs and employee pay cuts. Compass Mining disclosed that it would be cutting its staff by 15% and slashing up to 50% of their highest-paid executives' salaries.

These developments came shortly after news broke out toward the back end of June that the company had failed to pay utility bills for one of its mining facilities in Maine. The cash crunch demonstrated by this delinquency also led to the CEO and CFO of Compass Mining tendering their resignations.

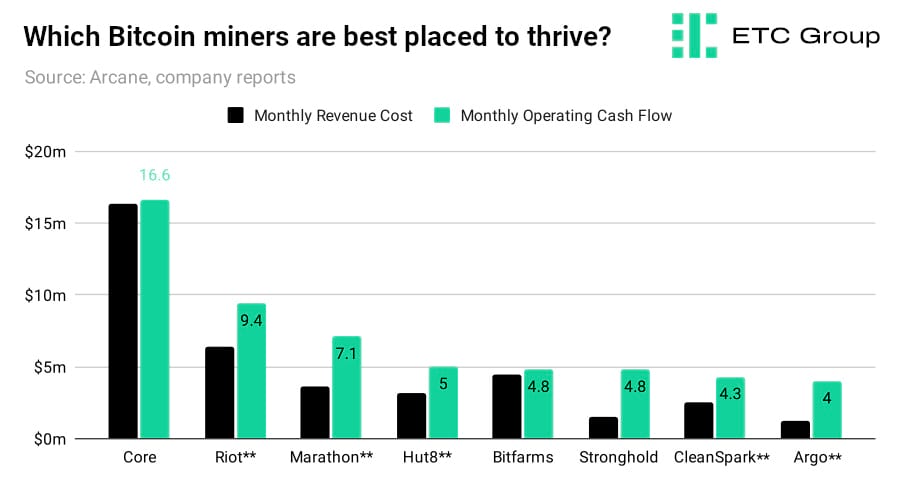

Miners like Marathon Digital ( NASDAQ: MARA ) and Riot Blockchain ( NASDAQ: RIOT ) have risen to positions of strength during this bear cycle by largely maintaining their Bitcoin reserves and operating cash flows in relation to some of their competitors.

Both miners are primary holdings within ETC Group's KOIN ETF that provides exposure to publicly traded companies participating in the cryptoasset sector. In its latest press release, Marathon reiterated that it had not sold a single Bitcoin since October 2020 and presently holds around 10,055 BTC – making it the largely publicly-listed mining company in the world. Riot is also adding to its Bitcoin balance sheet on a monthly basis with the company boasting 6,654 BTC according to a recent investor update.

However, neither of these companies has been immune to the slings and arrows of fortune. Marathon has suffered equipment damage from summer storms in Montana, while Riot has been selling most of the Bitcoin it has been generating. From the 421 BTC mined by Riot in June, it sold 300 in order to preserve a steady cash flow.

It will be the risk management strategies of mining companies that will determine whether they lose, hold, or gain ground during this industry shake up.

Markets

The cryptoasset market has witnessed a broad downturn in July to date.

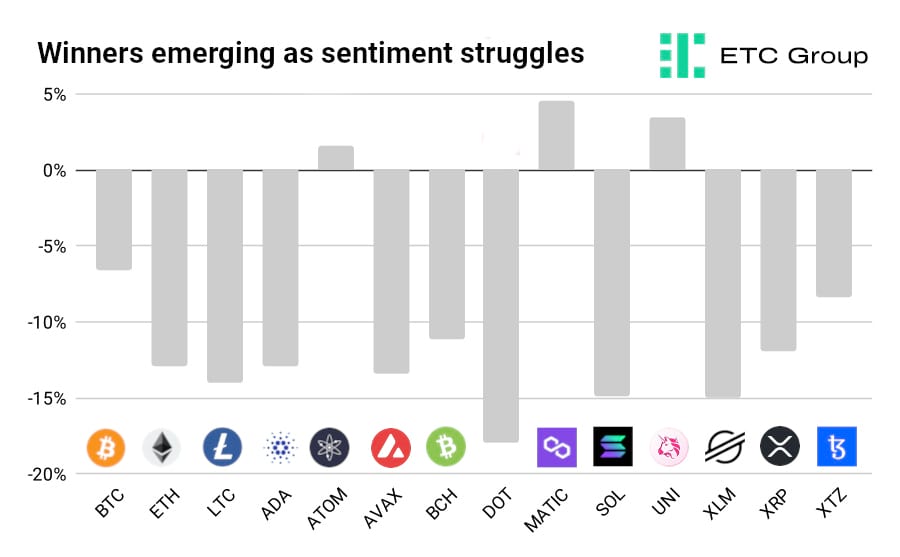

Bitcoin has dipped below its $20,000 support, while Ethereum is holding the line at $1,050. But Bitcoin's dominance over Ethereum strengthened during the first weeks of July. The former has shed 6.5% of its value against the latter's depreciation of 12.9%.

Altcoin investors have found some relief in Polygon (MATIC) and Uniswap (UNI) as the two cryptoassets have built on the momentum they displayed during the tail end of last month.

A number of projects from the defunct Terra blockchain are lining up to join – or have already migrated – to the Polygon network. Meanwhile, trading volumes on decentralised exchange Uniswap remain largely unaffected by the overall market correction.

Other altcoins have felt the pain of liquidity being pulled away from the market. Gains that Solana (SOL) had made during the second half of June faded away in July. The price of the Ethereum challenger has fallen by 14.9% and is stationed around the $33 range.

Smart contract platform Polkadot (DOT) suffered the highest losses since the month began, falling 17.9% since 28 June. Bitcoin Cash (BCH) too is in a challenging period, with the Proof of Work cryptocurrency dipping below $100 for the first time since December 2018.

AVIS IMPORTANT :

Cet article ne constitue ni un conseil en investissement ni une offre ou une sollicitation d'achat de produits financiers. Cet article est uniquement à des fins d'information générale, et il n'y a aucune assurance ou garantie explicite ou implicite quant à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Il est recommandé de ne pas se fier à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Veuillez noter que cet article n'est ni un conseil en investissement ni une offre ou une sollicitation d'acquérir des produits financiers ou des cryptomonnaies.

AVANT D'INVESTIR DANS LES CRYPTO ETP, LES INVESTISSEURS POTENTIELS DEVRAIENT PRENDRE EN COMPTE CE QUI SUIT :

Les investisseurs potentiels devraient rechercher des conseils indépendants et prendre en compte les informations pertinentes contenues dans le prospectus de base et les conditions finales des ETP, en particulier les facteurs de risque mentionnés dans ceux-ci. Le capital investi est à risque, et des pertes jusqu'à concurrence du montant investi sont possibles. Le produit est soumis à un risque intrinsèque de contrepartie à l'égard de l'émetteur des ETP et peut subir des pertes jusqu'à une perte totale si l'émetteur ne respecte pas ses obligations contractuelles. La structure juridique des ETP est équivalente à celle d'une dette. Les ETP sont traités comme d'autres instruments financiers.