Bitcoin and the Banking Crisis

At a time when fractional reserve banking is under the microscope, Bitcoin and alternative assets are booming. In the last week, Bitcoin climbed past $28,000 for the first time since June 2022, and is up 67% in the year to date.

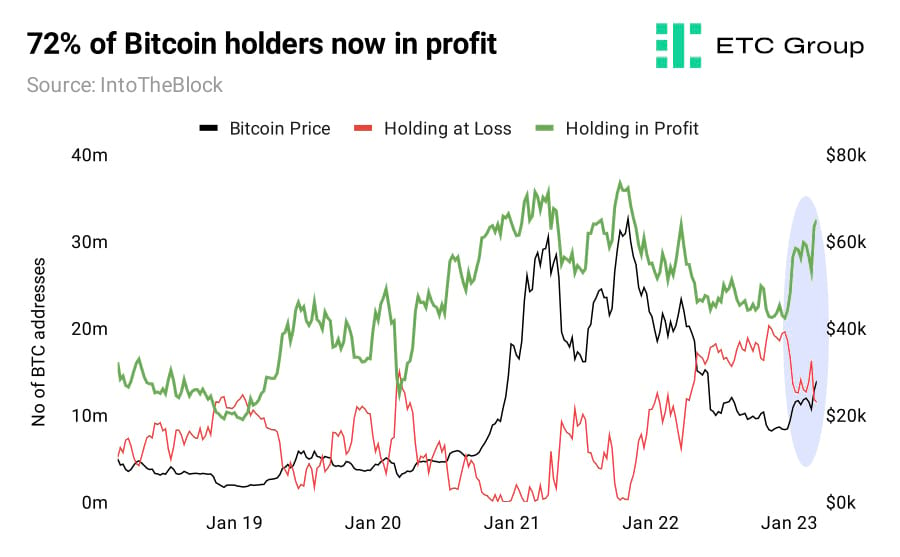

The regime change means that 72% of Bitcoin holders - 32.5 million addresses - are ‘in the money' (holding in profit) at the current price, a huge shift from the start of 2023 where more than 50% of Bitcoin buyers were holding at a loss.

This is the highest point since November 2021.

The worst of the Crypto Winter appears to be in the rear-view mirror, exactly at the point when the US faces its worst banking crisis since 2008 and macro and liquidity concerns threaten to consume global markets.

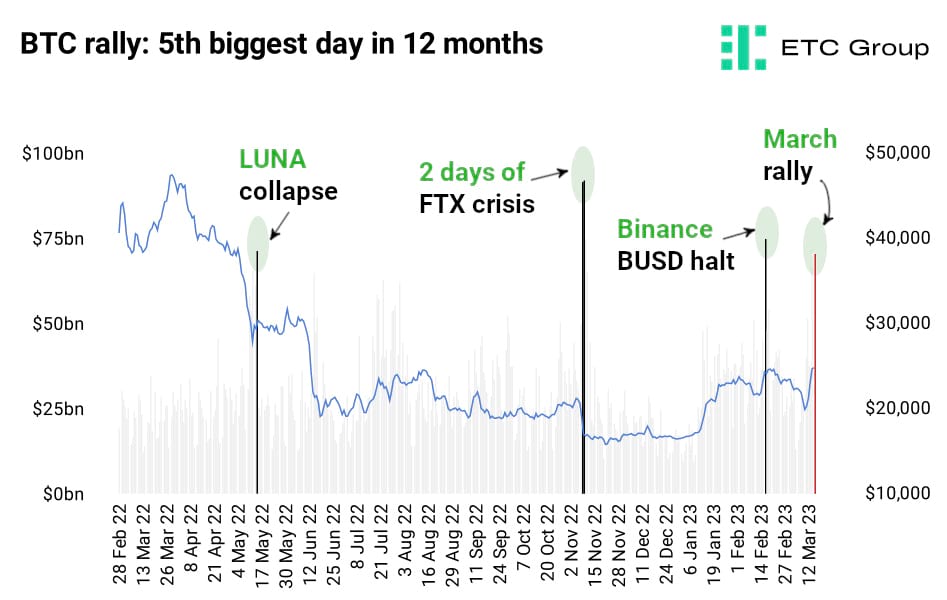

Trading in BTC/USD has rocketed, with 15 March ranking as the fifth largest trading day in the last 12 months. On this day $70.7bn was traded across the major digital asset exchanges.

Only four 24-hour periods exceed this level:

- 14 May 2022: Terra LUNA stablecoin implodes - ($71.5bn)

- 8 November 2022: Reaction to FTX collapse ($91.7bn)

- 9 November 2022: Reaction to FTX collapse ($92.1bn)

- 16 February 2022: Paxos stops minting Binance's BUSD stablecoin ($75.2bn)

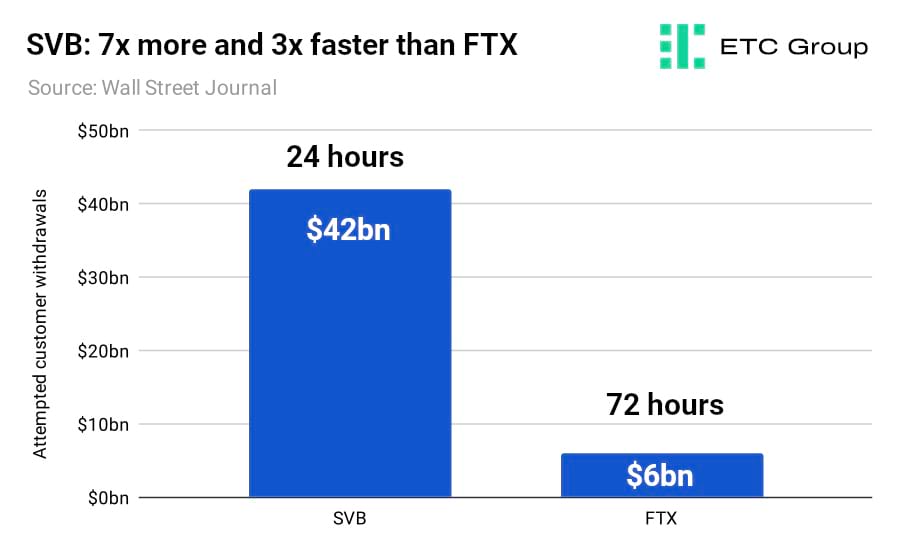

It is worth considering how the scale of the US banking crisis compares to crypto's own.

The run on Silicon Valley Bank was shockingly fast, and investors are right to query how a bank worth $200 a share one evening was worth effectively $0 by market opening the next day.

The SVB crisis was seven times larger and happened three times faster. Customers attempted to withdraw $42bn over the course of 24 hours from Silicon Valley Bank, compared to $6bn over the course of 72 hours from FTX.

Most reading this will know the situation so far. Banks were told that inflation was transitory and so loaded up on long-duration bonds, expecting interest rates to fall. Suddenly SVB was holding 30-year Treasury notes yielding 1.5% when its rivals were getting 4%+. And if Silicon Valley Bank looked for a buyer to purchase those US government bonds? They'd have to take at least a 25% loss.

Commercial banks who have made mistakes or taken duration risks can easily sweep them under the rug in the good times. This is no longer possible with rates at 14-year highs.

Beyond Silvergate, SVB and Signature, Credit Suisse has also failed. This now goes far beyond a tech bank like SVB that made a calamitous but understandable mistake with its duration risk.

Over the weekend of 18-19 March, Swiss banking giant UBS Group agreed a $3.2bn ‘takeunder' deal for its rival Credit Suisse. A takeunder is what it sounds like: the opposite of a takeover; when an offer to buyout a company comes at a price per share lower than its current price. These generally only occur when the seller is in severe financial distress. Shareholders will receive one share of UBS for every 22.48 shares they held in Credit Suisse.

Is BTFP just QE by stealth?

The Federal Reserve has long claimed it has all the tools to combat inflation. It was surprising for many to see, with fears of liquidity drying up, a new emergency policy tool being created and launched: the Bank Term Funding Program (BTFP).

On 19 March, the other major central banks followed suit. In a joint statement the European Central Bank, the Bank of Japan, the Swiss National Bank, the Bank of England and the Bank of Canada said they would “enhance the provision of liquidity” by offering US dollar swaps daily instead of weekly. These operations start on Monday 20 March and will continue “at least until the end of April”, the statement said.

More quantitative easing is always required when central banks run out of ideas in fragile and brittle economies. As a case in point, look at the Bank of England, that while raising interest rates with one hand (quantitative tightening), was forced to step in and buy government bonds (quantitative easing) after the country's pension funds were within hours of collapse.

Three distinct things are happening here:

- Bitcoin's utility as a decentralised, supply-capped store of value has been acquitted, live and in public.

- The moves being made now effectively lock in the near-immediate easing of monetary policy, providing a baseline for a crypto-friendly environment.

- More users will turn to crypto and alternative assets as faith in the US banking plummets

USDC depeg: did DeFi work exactly as intended?

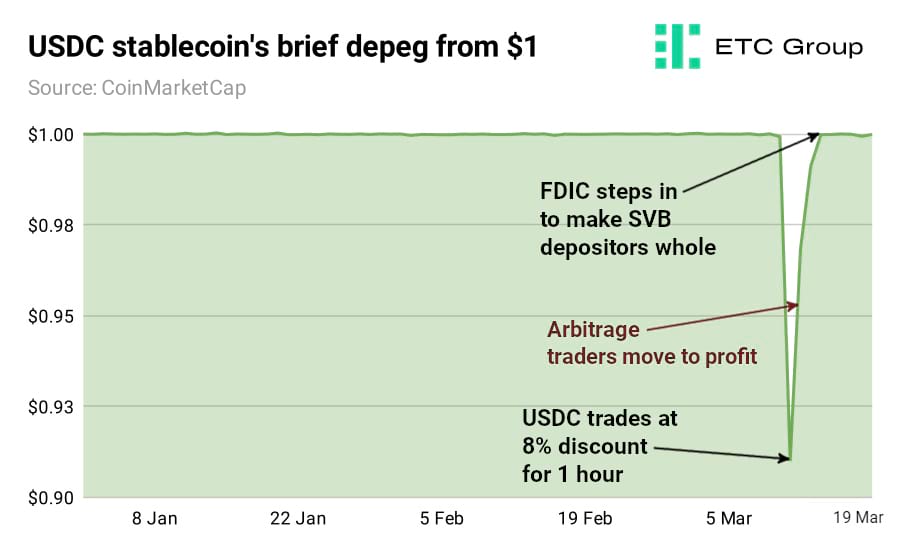

USDC, the second-largest stablecoin in the market, briefly lost its 1:1 peg to the US dollar on 11 March after Circle disclosed that it had $3.3 billion of its cash reserves deposited with Silicon Valley Bank (SVB).

The capital held at SVB represented 8% of Circle's treasury - amounting to $43 billion at the time.

The furore over the failure of SVB, and the contagion it may pose to other Tier 2 banks in America, led Circle to move $5.4 billion of its cash reserves into the custody of BNY Mellon.

The question to consider here is: did DeFi work precisely as intended?

Most stablecoins draw their value from their physical or digital asset reserves and should always have enough of an asset on hand to fully back them up. Any shortfall interferes with the 1:1 ratio that stablecoins are expected to maintain.

As Jim Bianco noted on Laura Shin's Unchained podcast, When USDC depegged from 1 dollar to 88 cents, the moves were “pretty orderly and understandable“.

When the news came out that 8% of the backing of the coin was in Silvergate bank, it traded down to 88 cents for a moment, but levelled out at 92 cents, Bianco notes.

8% of the money was trapped in a bank that Circle couldn't access, so the new peg was (briefly) 92 cents. Hedge funds, spotting an opportunity, were at the time offering to buy startup's deposits for as little as 60 cents on the dollar.

The following day, when it was reported that Circle may get 50 cents on the dollar back from the FDIC backing SVB depositors, USDC moved up to 95 or 96 cents. Then on 12 March when the FDIC stepped in offering to make all depositors whole, thereby closing the deficit between circulating USDC and the dollar supply they can be redeemed for, the USDC peg shifted back up to 1 dollar.

Market watchers are now scrutinising the types of failures that come with running a fractional reserve banking system. When everyone suddenly wants their money exactly at the same moment - the definition of a bank run - the system grinds to a halt and collapses.

It is worth noting that the San Francisco commercial bank First Republic is suffering the same fate as SVB. As the Wall Street Journal reported, depositors have withdrawn $70bn from the bank since the collapse of SVB earlier this month.

Fractional-reserve banking is a system of bank management that only holds a fraction of bank deposits, with the remaining funds invested or loaned out to borrowers. The policy was introduced in the US in the 1930s. At the same time, the Federal Deposit Insurance Corporation (FDIC) was created to provide insurance for depositors holding a certain amount - raised to $250,000 in 2008.

Bianco posits DeFi protocols as the full-reserve banking solution to the woes we all now face.

We have had nothing but bank instability for hundreds of years…the fractional reserve banking system has always been broken. We had bank runs in the 17th century, the 18th century, in the 1930s, in 2008. The banking system is always unsound. It is in one of two states: it is either blowing up, or about to blow up.

By contrast, both Aave and Compound are DeFi lending protocols and effectively full-reserve banking systems that allow users to take out loans using cryptocurrency as collateral.

Those who borrow pay interest, and those who deposit receive interest, just like at a bank, but there is no loan manager making decisions based on a person's location, capital stack or credit history. Deposits go into liquidity pools, which the protocol can use to make loans. Risk is managed by auto-liquidating positions where collateral falls below a certain level.

This event has aptly demonstrated the benefits of a decentralised financial system organised around code and collateralisation, as opposed to the risks bankers are forced to take in a system that relies on fractional reserves.

Bitcoin miners boom as fees climb 128%

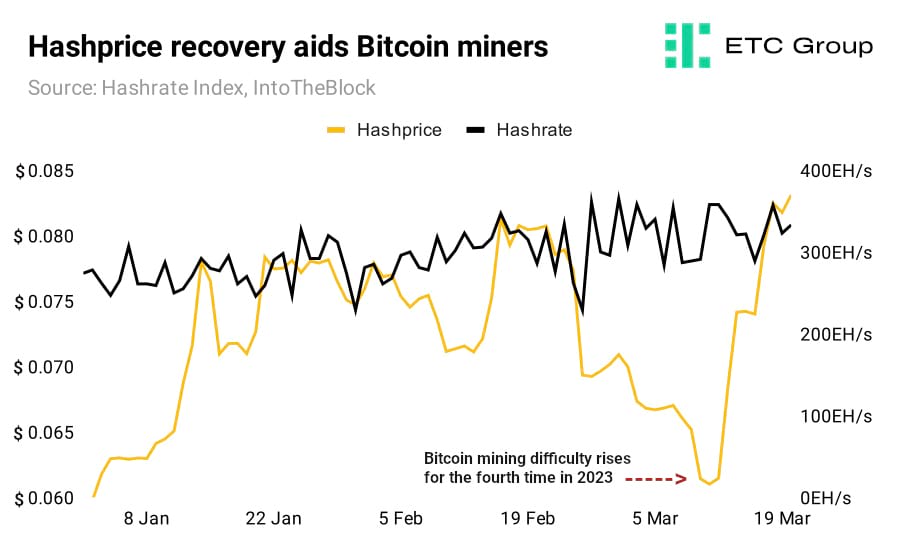

Bitcoin miners are back in profit again after a long, cold Crypto Winter. Miners have been benefiting from meteoric stock price rises, while at the same time making gains from the 40% year-to-date increase in hashprice from $0.059/TH to 0.083/TH.

Hashprice is the money miners can earn for every unit of energy spent on processing blocks of Bitcoin transactions.

At the same time, the price of 1 BTC has risen by 67%, from $16,605 to $28,040, which means mining companies can sell their most prized commodity on much improved profit margins.

Their cost of BTC production depends on three variables: the speed of miners' hardware, the Bitcoin network mining difficulty, and electricity prices.

The effects have been immediate. The two largest publicly-traded Bitcoin miners by market cap: Riot (NASDAQ:RIOT) and Marathon Digital (NASDAQ:MARA), have seen their stock prices rocketed by 150% and 130% respectively in the year to date.

The present bear market cycle has resulted in the bankruptcies of big name miners like Core Scientific and Compute North, in addition to debt restructuring plans for other miners that have not been able to keep up with debt repayments.

Over the last 12 months mining companies have struggled to raise funds for operations given rising interest rates, turmoil in the banking sector, and elevated energy prices. Some of the miners that held on mined Bitcoin for the majority of the bear market in 2022 are now starting to cash in so they can fund daily operations.

In light of this, Bitcoin miners are finding it difficult to return to a 100% HODL strategy that acted as their guiding philosophy during the bull market. Hut 8 (NASDAQ: HUT) became one of the last publicly traded miners to yield to pressure after it sold 188 Bitcoins in February.

With Bitcoin's hashrate up 27% since the start of the year from 253 EH/s to an all time high of 322 EH/s, mining difficulty is also more challenging than ever before.

Bitcoin network difficulty refers to how difficult it is for miners to solve block puzzles and gain new Bitcoin as rewards. The harder Bitcoin difficulty is, the harder it is to solve blocks.

Mining difficulty has increased from 35.36 trillion at the start of the year to 43.55 trillion this year – a 23% jump.

Additional revenue sources for Bitcoin's biggest supporters - and its critical source of network security - are also coming as a welcome relief. Bitcoin Ordinals are the blockchain's own version of NFTs and a development previously thought impossible, given Bitcoin's scripting language and the way it handles assets

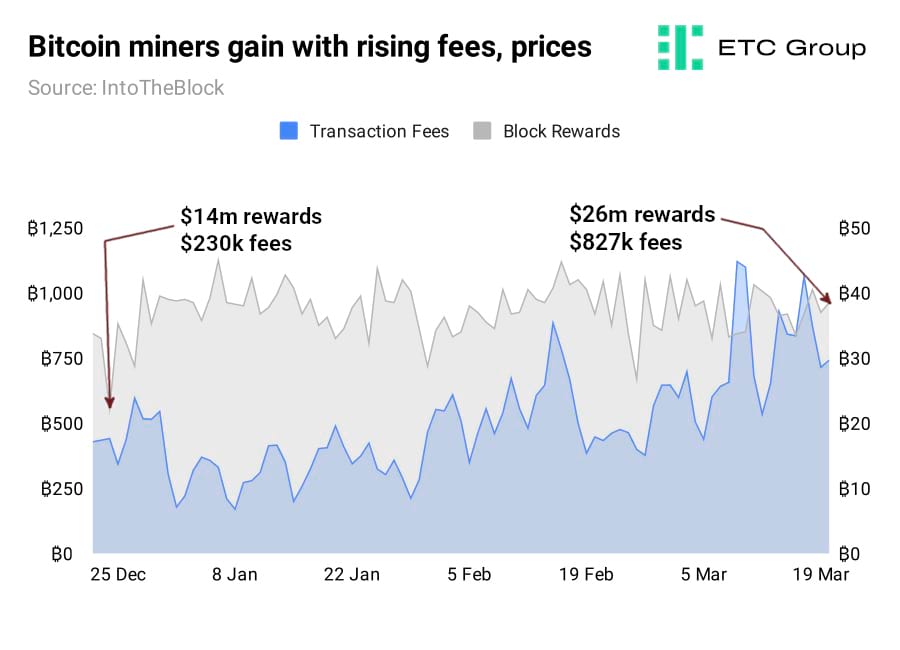

Since their introduction in January, there has been a marked increase in transaction fees paid. As a snapshot, Bitcoin users paid $230,210 to miners in fees as of the end of December, compared to $827,050 on 20 March.

Average fees paid to miners have climbed 128% from 12.97BTC in January to 29.7BTC in March, ETC Group analysis shows.

The introduction of NFT-like assets on Bitcoin has not only enthused a new wave of developers but has also brought forward an enticing new revenue stream to miners.

Data from Dune Analytics shows that more than 550,000 Ordinals have been created as of 21 March 2023, producing more than $3m in new revenue for Bitcoin miners.

Markets

Over the last two weeks crypto markets have witnessed massive increases in trading volume, soaring interest from retail traders and a new-found appreciation for assets with a pre-determined supply limit that cannot be printed en mass when their underlying system runs into trouble.

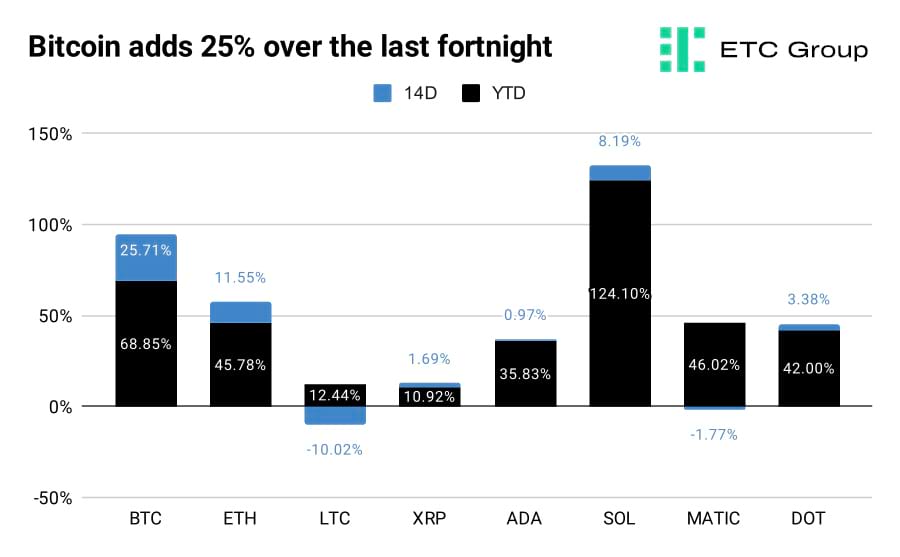

As such, Bitcoin continued its sharp rally, gaining 25.7% across the fortnight to end at £27.9k.

Ethereum too has its own bullish elements unfolding, with unstaking rewards from the Beacon Chain set to be released to holders on April 12 with the Shanghai hard fork. ETH climbed 11.5% from $1,560 to $1,740.

Altcoins have not risen by the same amount as the top two blue-chip cryptoassets; that capital rotation may take a little time to work through, as markets digest the extent of the potential contagion in US banking.

AVIS IMPORTANT :

Cet article ne constitue ni un conseil en investissement ni une offre ou une sollicitation d'achat de produits financiers. Cet article est uniquement à des fins d'information générale, et il n'y a aucune assurance ou garantie explicite ou implicite quant à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Il est recommandé de ne pas se fier à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Veuillez noter que cet article n'est ni un conseil en investissement ni une offre ou une sollicitation d'acquérir des produits financiers ou des cryptomonnaies.

AVANT D'INVESTIR DANS LES CRYPTO ETP, LES INVESTISSEURS POTENTIELS DEVRAIENT PRENDRE EN COMPTE CE QUI SUIT :

Les investisseurs potentiels devraient rechercher des conseils indépendants et prendre en compte les informations pertinentes contenues dans le prospectus de base et les conditions finales des ETP, en particulier les facteurs de risque mentionnés dans ceux-ci. Le capital investi est à risque, et des pertes jusqu'à concurrence du montant investi sont possibles. Le produit est soumis à un risque intrinsèque de contrepartie à l'égard de l'émetteur des ETP et peut subir des pertes jusqu'à une perte totale si l'émetteur ne respecte pas ses obligations contractuelles. La structure juridique des ETP est équivalente à celle d'une dette. Les ETP sont traités comme d'autres instruments financiers.