Introduction — what is Bitcoin Cash?

Bitcoin Cash (BCH) remains one of the most high-profile cryptocurrencies in the world, four years after its release on 1 August 2017. It began as a fork of the original cryptocurrency, Bitcoin, and in the intervening years has seen global merchant adoption as a cross-border payments protocol promising cheap, fast transactions, with all the security, transparency and tamper-resistent benefits of a world-leading blockchain.

Bitcoin Cash was born just weeks before the first crypto bull run that saw the total capitalisation of all projects on the market reach a then-record $150 billion. At the time of publication, the cryptoasset market cap is again approaching $2 trillion. It is the world’s fourth-largest addressable crypto market in terms of the number of active addresses, according to Thomson Reuters data.

In August 2017 , Bitcoin Cash went straight into the charts at number 4 in the list of the largest cryptocurrencies, with a market cap of $6bn. But while BTC has increased its market cap from $69bn to over $875bn in the last four years, BCH has seen a much more modest 108% increase. This may be one reason why analysts and journalists tend to write about Bitcoin Cash infrequently compared to the parent chain.

It is also worth understanding the history of Bitcoin Cash: the project emerged out of a disagreement between Bitcoin developers as to how the original cryptocurrency should grow, move forward, and become more efficient at processing transactions.

History and Hard Fork

By 2017 many of the original Bitcoin developers were concerned that Bitcoin would not be able to scale effectively and become the global alternative payments network its creator Satoshi Nakamoto intended, if it stuck to its early 1MB blocksize limit.

Supporters of the original chain wanted to keep block sizes at 1MB — less than the amount of information contained on a floppy disk. This was in accordance with what they believed was Satoshi Nakamoto’s original vision, while allowing for anyone to read/write information to the Bitcoin blockchain. However, those who saw Bitcoin as a form of peer to peer cash — as described in the title of the Bitcoin whitepaper: ‘‘Bitcoin: A Peer to Peer Electronic Cash System” — wanted to increase the block size to 2MB, 4MB and eventually 32MB. Neither side could agree, and both had roughly equal hashpower (computing power dedicated to processing transactions). So at block 478,558, the Bitcoin blockchain split into two forks. Everyone who held 1 Bitcoin (BTC) also received 1 Bitcoin Cash (BCH).

Because of this continued blocksize limit, among other technical limitations, the Bitcoin blockchain tops out at a maximum of 7 transactions per second. Bitcoin Cash, by contrast, has scaled to a current level of around 100 transactions per second. There are plans ongoing for this theoretical limit to reach much higher, too.

Now, as then, it remains one of the most-recognised and most-trusted cryptocurrencies.

And as proof that it is not simple name recognition, but rather wide-scale adoption and mainstream usage that affords Bitcoin Cash this place in history, it is worth noting that there are many other Bitcoin forks in existence.

With a market cap of $12.9bn, and a position as the 13th largest cryptoasset, Bitcoin Cash is by far the most successful fork of Bitcoin, at least 220% larger than any other to come to market. Other, later forks, which involve the original Bitcoin blockchain, and remain Proof of Work systems, with some significant alterations to tokenomics, blocksize, privacy protocols and the like, include Bitcoin SV (market cap $3.1bn, 44th largest) Bitcoin Gold (market cap $1.1bn, 81st largest) and Bitcoin Diamond ($525m, 121st largest).

BTC decided in 2017 that its first major scaling solution would be to implement SegWit (Segregated Witness), a code addition which places transaction data outside the block. BTC blocks remain at around 1MB in size, but the network only recognises those that have this appended data.

At the same time, Bitcoin Cash developers moved ahead with a range of upgrades.

And some in the Bitcoin Cash community still see the blockchain as the correct Bitcoin scaling solution, but it has surpassed this limited ambition in the intervening years.

What is a Hard Fork?

In blockchain, a fork is a change of its underlying protocol which means it is a split from its original path which represents a major change (hard fork) or a minor one (soft fork).

A hard fork can occur in any blockchain and leads to permanent chain separation. Token holder of the original blockchain are given tokens on the new chain due to the shared history.

Benefits of Bitcoin Cash vs Bitcoin

Micro Fees: Data tracker BitcoinFees.cash isolates the current fee to send or receive BCH to a cryptocurrency-enabled wallet in real time, compared to parent blockchain Bitcoin. As of 16 August 2021, fees on the BCH network stand at $0.0035, with a median fee of $0.0015. To send or receive BTC costs $0.60 as per the latest data, with a median fee of $0.39.

Clearly, the ability to send and receive value quickly and at minimal cost — 0.5% of the cost of completing a Bitcoin transaction, given these current numbers — is extremely attractive to users who want to receive the benefits of blockchain payments without having to pay a premium.

Lower energy consumption: Bitcoin has a limited blocksize, and so cannot improve its energy efficiency simply by processing more transactions for the same energy cost. Bitcoin Cash, by contrast, has had its blocksize barrier removed and so is able to scale effectively and increase transaction throughput programmatically. Using statistics sourced via blockchain explorer Blockchair, this overview suggests that Bitcoin Cash uses 97.3% less energy per transaction than Bitcoin.

Adoption and Usage

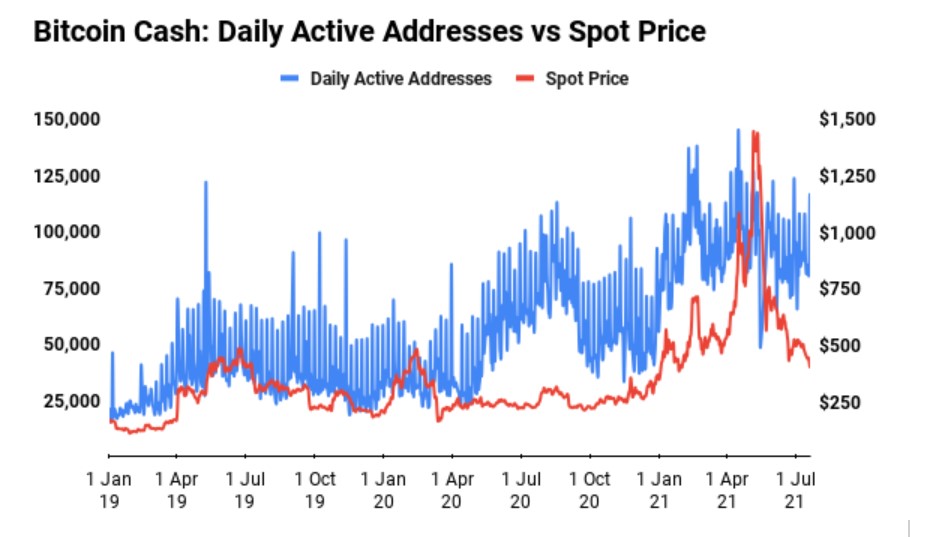

Bitcoin Cash has retained its laser focus on facilitating easy, fast, everyday transactions. And this is starting to pay off. Daily active addresses, a proxy for daily active users, have continued to grow strongly in the past two years and especially in advance of the spot price of BCH, suggesting that adoption and utility have been a frontrunner ahead of market value to date.

When payments giant Paypal crossed the Rubicon to offer US users the ability to buy and sell cryptocurrencies directly from their accounts in November 2020, it chose only four of the best known and most highly-regarded assets: Bitcoin, Ethereum, Litecoin and Bitcoin Cash.

Similarly, the Paypal subsidiary and social payments service Venmo chose the same four cryptoassets when it made the unprecedented decision to open its service for retail customers on 20 April 2021 to buy, sell and hold crypto within its app.

Venmo is now the second-most used financial application in the United States with an estimated 70 million customers in total, and 52 million monthly active users.

October 2020 was a significant turning point for Bitcoin Cash, as it was chosen among only three other cryptocurrencies to form the backbone of Paypal’s crypto strategy. The same move was enacted by the payments service Venmo, putting Bitcoin Cash in reach of millions of new users in the US and across the world. When reports surfaced in July 2021 that e-commerce giant Amazon was ready to begin accepting cryptocurrencies from its 213 million monthly users, only four cryptocurrencies were mentioned: Bitcoin, Ethereum, Cardano and Bitcoin Cash.

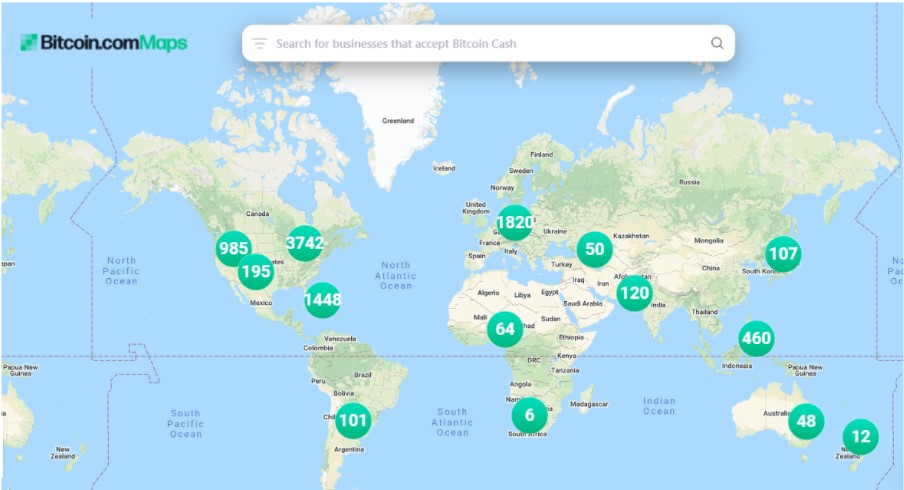

Supporters of Bitcoin Cash have relentlessly promoted the cryptocurrency as an alternative payment mechanism. The results of this campaign are starting to come to fruition. As of February 2020, some 4,300 merchants both on- and offline accepted Bitcoin Cash as an alternative payment mechanism. Various data trackers like AcceptBitcoin.Cash keep a real-time record of the online and brick-and-mortar stores that accept BCH alongside fiat currencies like the US dollar or Japanese Yen, and as of 16 August 2021, over 9,150 merchants across every industry and sector now accept BCH.

The Bitcoin Cash subreddit is one of the largest on social media site Reddit, with 604,000 members, and users regularly update these figures on a weekly basis.

Map.bitcoin.com also tracks adoption in real time, and while almost every country in the world has a venue that accepts BCH, the largest concentrations currently reside in central Europe and on the East coast of the United States. Bear in mind that these datapoints include the server locations of online stores, as well as physical shops and outlets.

One key usage point for Bitcoin Cash, and certainly one that its advocates have promoted since 2017, is as an alternative or replacement for central bank-issued currencies subject to hyperinflation.

As Reuters reported in June 2021, countries such as Zimbabwe and Venezuela whose citizens are hemmed in by hyperinflationary fiat currencies are increasingly turning to worldwide payment networks like Bitcoin Cash. With the prices of food, fuel, medicines and everyday goods and services triggered by an excessive increase in the M1 money supply, people are turning to non-central bank currencies with low fees in order to survive.

As hyperinflation and US sanctions disrupt Venezuela’s economy, cryptocurrency is emerging as a way to provide services handled elsewhere by the traditional banking system. It has become a tool to send remittances, protest wages from inflation and help businesses manage cash flow is a quickly depreciating currency. Brian Ellsworth, Senior Correspondent, Reuters News

While most countries covered by the International Monetary Fund’s 2021 inflation rate Datamapper show inflation rates in the single digits, the worst offenders include Zimbabwe with 99.3% inflation on an annual basis, Sudan at 197% and Venezuela with 5,500% inflation.

Local media sourced figures from the Family Food Basket measure of inflation, showing that the cost of staple foods for the average family of five in Venezuela, using the bolivar, increased more than 18 times in 2020.

It is not always poorly-performing countries that see the largest levels of cryptocurrency adoption, as blockchain research house Chainalysis reported in its 2020 Global Crypto Adoption Index. For example, Vietnam sits 10th amid the countries with the highest adoption, behind the US, Nigeria, South Africa and Russia. Vietnam has witnessed extraordinary economic progress over the past two decades, including slashing its poverty rate from more than 70% to less than 6% since 2020, and according to the World Bank ranks in the top 50 countries by GDP.

While Bitcoin has clearly proven its store of value credentials, the fact remains that it is not widely transferred as a daily means of exchange. At the same time, populations need stable currencies that are widely adopted and that offer a reliable payment system not subject to volatile price increases and decreases.

As such, Bitcoin is not particularly well suited to fulfill this purpose, given the much higher requirement of money velocity (rate of turnover in the money supply) that citizens demand from their currencies.

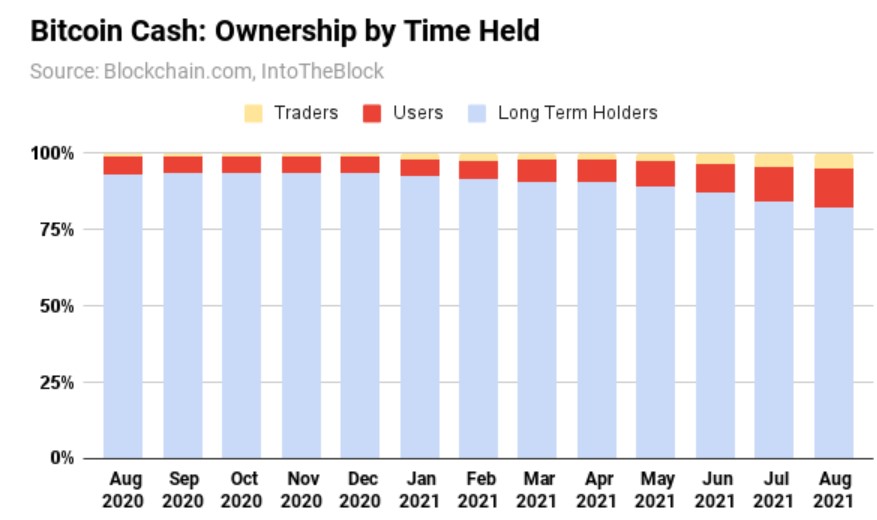

The promise that a focus on adoption and utility would cede the greatest results now appears to be materialising. Ownership by time held is a good metric to display Bitcoin Cash’s widening usage. IntoTheBlock, a data analytics platform run by Blockchain.com, shows how the number of long-term holders has gradually decreased at the expense of users and traders.

Long-term holders are accounted for by showing those addresses that have held on to BCH for one year or more. Users are those addresses that have held BCH for between one and 12 months, while traders are those that only hold BCH coins for less than one month.

And of the approximately 17 million Bitcoin Cash addresses that exist today? Over the period covered, a clear trend has emerged. Long-term holders decreased from 93.2% to 82.2%, while users increased from 5.8% to more than 12.5% of the total ecosystem.

Additionally, March 2021 was the first point in history when BCH user addresses exceeded 1 million, and in the five months to mid-August 2021 has more than doubled to 2.2 million. This would seem a clear indication of the exponential rate of adoption for Bitcoin Cash.

Institutional focus

Bitcoin Cash is available to trade on every major cryptoexchange across the world; the longevity and security of its network remaining its most attractive properties.

While one of the longest-existing cryptocurrencies, with a significant and evidently growing userbase, and deep development bench, Bitcoin Cash has not enjoyed the same attention as Bitcoin or Ethereum as a tradeable asset by institutions.

Why, then with Bitcoin Cash one of the most trusted applications in the crypto world, does it remain relatively underreported on by analysts?

For larger institutions to date, the opportunities to profit from the rise and fall of the Bitcoin Cash price have been rather limited.

Bitcoin Cash derivatives appeared on the market as early as 2018, just 12 months after the hard fork that brought it into the world.

While these BCH derivatives have existed for some years, indicating interest in trading from institutions at the higher risk-appetite end of the scale, such as hedge funds, OTC desks and HNWIs, these financial products come with significant limitations and often with region-locks, given the sometimes 10x-20x leverage allowed, and the lack of correct registration with authorities for the exchanges on which they trade.

For example, crypto derivative specialist FTX offers Bitcoin Cash perpetual futures but they are not available to customers in the US, and the Hong Kong-headquartered exchange’s US arm does not trade crypto derivatives, as of 22 July 2021.

The same is true for Binance, the world’s largest retail cryptoexchange by volume. That business is now under investigation by the US futures watchdog, the CFTC for alleged abuses of futures regulations.

The CFTC is investigating if the company, which isn’t registered with the agency, permitted US residents to trade derivatives that the regulator polices — Niket Nishant, Reuters, 12 March 2021

The first, of course, was Grayscale’s Bitcoin Cash Trust, which debuted on OTCQX, the venture markets of the US OTC market on 3 January 2018.

With a 2.5% annual charge, the GBTC is one of the more expensive products available today.

Its $171m assets under management make it a compelling investment, but with a minimum investment of $25,000 required to buy shares making this a large commitment.

Thus, larger institutions which require much more stringent capital controls and regulatory adherence, such as asset managers, regional and national pension funds, university endowments and publicly-listed corporations have largely been excluded from BCH futures and derivatives markets. These are precisely the types of organisations that have invested heavily in Bitcoin and Bitcoin derivatives, whether through holding assets as reserves on their balance sheet or directly investing in the market.

Development

The Bitcoin Cash roadmap for development reveals the scale of the ambition at play.

Development has not stopped in the years since the Bitcoin hard fork. In fact, while Bitcoin Cash can claim to be a successful alternative payments mechanism, like Litecoin, there are scores of other utility developments in play that are adding to its practicality, developing tools like smart contracts, prediction markets, and EVM-compatible content.

The size and strength of the BCH development community also helps to keep it relatively stable and secure: nearest competitor Bitcoin SV suffered a 51% attack in August 2021, where hackers managed to reorganise the blocks of transactions that make up a blockchain.

The attack resulted in multiple versions of the Bitcoin SV blockchain being mined concurrently. And as Cointelegraph reported, it was the third-such blockchain reorganisation attack on Bitcoin SV by rogue actors inside three months.

As a reminder, if enough miners can control 51% of the nodes that agree on the correct copy of the blockchain, they can bend the history of transactions to their will. Two options with this power in their hands are to either refuse to confirm legitimate transactions, or to double-spend coins to increase their own personal wealth.

The more miners — and hashing power — there are dedicated to competing for block rewards, the more expensive and less likely it is for a single bad actor to be able to gather 51% of the hashing power and force unwanted changes to the correct copy of the blockchain.

The risks of having only a small number of centralised miners on Proof of Work networks that support transaction confirmations should be plainly obviously: to the extent that it is now theoretically possible (while technically extremely challenging) to carry out these hacking attempts on smaller blockchains with just a few thousand dollars-worth of rented computer hashing power.

Properly decentralised mining operations make for more secure blockchains. And Bitcoin Cash has that. What it also has to contend with, is its ability to wrangle disparate miners distributed globally, all of whom are in the business of making money. Doing this successfully is a combination of the stringent application of game theory, robust blockchain mechanics and appropriate rewards.

In more recent times, Bitcoin Cash developers have expended significant energy in fostering new developments to tweak technicals to improve efficiencies. One example of this would be the switch away from the DAA difficulty adjustment to a newer technology, ASERT (Absolutely Scheduled Exponentially Rising Targets).

In November 2020 ASERT was instituted on Bitcoin Cash, mainly because DAA was seen as unstable and prone to wide oscillations. ASERT keeps transaction confirmation times fast, allows for stable block generation intervals and adds useful tokenomic adjustments, including disincentives for miners to perform malicious actions, like hashrate alterations or timestamp manipulation.

Since Bitcoin Cash was birthed from a disagreement over block sizes and how to successfully scale transaction throughput, it is interesting to note that developments have continued in this vein over recent years. In June 2021, one researcher managed to successfully mine a 1GB block using a Raspberry Pi4, a basic consumer computing system that costs only $70 (£50) . By contrast, the latest ASIC hardware for mining Bitcoin, Bitmain’s Antminer S19 Pro, costs in the region of $8,000 (£5,800). Later developments continue in this mode, attempting to improve decentralisation — and hence the security of the network — by ensuring that anyone with cheap retail hardware can mine Bitcoin Cash, and ensure that nodes are not overly concentrated in the hands of a few rich and powerful players.

It has not yet been proven that Bitcoin Cash actually needs blocksizes this large.

This does however show the blockchain’s ability to scale effectively if the Bitcoin Cash protocol continues its growth. Given that it remains the fourth-most used blockchain in the world, with a robust development community, it is likely that this will be the case.

Smart contracts, DeFi, and NFTs

Just as Ethereum has testnets such as Ropsten and Rinkeby that allow developers to run tests on new features, smart contract code and network upgrades before they go live, so Bitcoin Cash has Testnet4 and Scalenet. These exist to stress-test BCH in advance of major development upgrades. Most decentralised applications, from DeFi to NFTs and many others, will leverage testnets to trial their software and its interactions with existing smart contracts to iron out bugs before the project goes live on the mainnet.

One of the main complaints levelled at older blockchains like Bitcoin and Bitcoin Cash are that they are inherently single-asset, whereas blockchains like Ethereum are inherently multi-asset, able to store, represent and process value of a theoretically unlimited number of coins and tokens through token standards like ERC-20.

So it was with no little measure of excitement that the ability to process smart contracts was introduced in 2019. It has taken a little under two years for applications to catch up to this development.

The strength of the Bitcoin Cash development community is one of its most attractive features. Because the chain forked from Bitcoin in 2017, many of the developers of the original cryptocurrency remain in place at Bitcoin Cash, including Jonathan Toomin, upgrading the blockchain as and when required and offering new insights into how to push the project forward. In order to take Bitcoin Cash into the 2020s in a strong position, these developers have outlined a roadmap of developments

Developers often congregate at BitcoinCashResearch.org, to discuss new options and offer monthly progress reports, but the most useful place to find Bitcoin Cash development upgrades is at CoinDance. This site groups upgrades by whether they are intended to improve scaling, usability, privacy, network operation, security, extensibility or governance, and shows the scores of development upgrades already enacted on Bitcoin Cash, along with the latest proposals.

These range from simple UX improvements like Cash Accounts , a naming system designed to simplify the process of sharing payments information, to CashScript, a fresh programming language based on Ethereum’s Solidity that enables smart contracts on Bitcoin Cash.

One of the most highly-anticipated upgrades, CashTokens, has now been enacted on the blockchain, too. These are a Bitcoin Cash virtual machine-enforced scheme for issuing, validating, and redeeming tokens. They enable on-chain token sales, transferable synthetic assets, decentralized exchanges, and prediction markets on Bitcoin Cash.

And in August 2021 a sidechain called Smartbch successfully launched, with the ability to run EVM-compatible content. Such functionality upgrades could rival anything developed on Ethereum to date.

While to date the number of applications choosing Bitcoin Cash to run their smart contract-based applications is limited, and the popularity of its blockchain nowhere near Ethereum's for interoperability or utility, there are strides being made in that direction.

May 2021 saw a major network upgrade, which will allow greater use of NFTs on the BCH blockchain. Simple Ledger (SLP) resides on the Bitcoin Cash blockchain, and SLP transactions live inside a special output known as OP_RETURN, which after May’s network-wide upgrade is now part of every standard Bitcoin Cash transaction. If one user wants to send another some tokens, she sends a fractional amount of BCH, and the transaction also contains within it the data to transfer the tokens.

DeFi applications on Bitcoin Cash, too, has been limited to date. This may be about to change. In May 2021, Singapore-based General Protocols raised a $3m Series A funding round to develop public DeFi protocols. General Protocols is the company behind Anyhedge, the first such DeFi application to launch on Bitcoin Cash, in December 2020. Partnerships like that with Detoken, the first non-custodial BCH derivatives exchange to launch, could aid this narrative and bring a much wider audience of investors to Bitcoin Cash.

Conclusion

By any metric, Bitcoin Cash has achieved what its supporting developers set out to do. That is, to make the blockchain more efficient at scaling and processing payments quickly. Some of the world’s most talented and forward-thinking programmers remain involved in pushing the Bitcoin Cash network forward.

The historic situation of the original Bitcoin development cadre continuing to work on behalf of Bitcoin Cash means some of the world’s foremost minds in blockchain — and its most experienced technical achievers — are focused on improving the project and this can only be a net benefit for its future. The addition of Scalenet4 and Testnet has clearly improved the testing regime for Bitcoin Cash, as evidenced by the sheer number of improvement proposals that have come to fruition in the last four years, and the state of Bitcoin Cash as a stable payments cryptocurrency used in every corner of the globe.

And certainly, as has been proven over the past decade, many hundreds of cryptocurrencies can exist and thrive concurrently, and it is not a zero-sum game where Bitcoin’s net gains are tantamount to a loss in the overall value of the Bitcoin Cash network. The competition appears to be more accurately replicated with a cryptocurrency payments network like Litecoin (LTC), another long-established blockchain that has also achieved 100% uptime over the course of its history that is also seeing increased merchant and user adoption.

That said, valuing Bitcoin Cash remains a difficult proposition given the scale of the challenges ahead. The wider public is not well versed in the technical considerations of hard forks in general, nor what these mean for the stability and longevity of a particular blockchain.

And while current-use test networks for Bitcoin Cash have been able to prove the security and reliability of 256MB blocks — and the theoretical scaling possibilities of blocks up to 1GB and beyond, there remains large amounts of space to fill even in Bitcoin Cash blocks of the current size of 32MB.

Regulatory considerations to date, for example the cryptocurrency frameworks in development in the US Congress, remain devoted either to the original cryptocurrency Bitcoin, as the widest-recognised asset among all cryptocurrencies, or to the asset class in general. That leaves Bitcoin Cash vulnerable to the ever-changing definitions of regulatory bodies, and its future not necessarily entirely in its own hands.

The overall Bitcoin Cash narrative may have suffered to a degree from its developers’ relentless focus on how much better it is as a payments network than Bitcoin. Bitcoin Cash forked from Bitcoin to pursue a more user-friendly, inexpensive roadmap for payments. It has certainly been successful in that regard, by any metric one cares to peruse. The more interesting outlook would focus on how markets respond to a Bitcoin Cash that can produce smart contracts, use new programming languages to rival Ethereum’s Solidity, and expand the ability to programme prediction markets, NFTs and DeFi on Bitcoin Cash. One could say the future looks particularly bright.

AVIS IMPORTANT :

Cet article ne constitue ni un conseil en investissement ni une offre ou une sollicitation d'achat de produits financiers. Cet article est uniquement à des fins d'information générale, et il n'y a aucune assurance ou garantie explicite ou implicite quant à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Il est recommandé de ne pas se fier à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Veuillez noter que cet article n'est ni un conseil en investissement ni une offre ou une sollicitation d'acquérir des produits financiers ou des cryptomonnaies.

AVANT D'INVESTIR DANS LES CRYPTO ETP, LES INVESTISSEURS POTENTIELS DEVRAIENT PRENDRE EN COMPTE CE QUI SUIT :

Les investisseurs potentiels devraient rechercher des conseils indépendants et prendre en compte les informations pertinentes contenues dans le prospectus de base et les conditions finales des ETP, en particulier les facteurs de risque mentionnés dans ceux-ci. Le capital investi est à risque, et des pertes jusqu'à concurrence du montant investi sont possibles. Le produit est soumis à un risque intrinsèque de contrepartie à l'égard de l'émetteur des ETP et peut subir des pertes jusqu'à une perte totale si l'émetteur ne respecte pas ses obligations contractuelles. La structure juridique des ETP est équivalente à celle d'une dette. Les ETP sont traités comme d'autres instruments financiers.

À propos de ETC Group

ETC Group développe des instruments financiers innovants adossés à des actifs numériques, notamment l'ETC Group Physical Bitcoin (BTCE) et l'ETC Group Physical Ethereum (ZETH), qui sont cotés sur des échanges européens, comme le XETRA, Euronext, SIX, AQUIS UK et Wiener Börse.

ETC Group a lancé le premier produit négocié en bourse (exchange traded product- ETP) Bitcoin à compensation centralisée au monde en juin 2020 sur la Deutsche Börse XETRA, la plus grande plateforme de cotation d'ETF d'Europe.

ETC Group travaille en permanence à l'élargissement de sa gamme d'ETPs garantis par des crypto-monnaies, de qualité institutionnelle, offrant aux investisseurs la possibilité de s'exposer au Bitcoin, à l'Ethereum, au Cardano, au Solana et à d'autres actifs numériques populaires sur les principales bourses européennes.